Is XTB Good for Day Trading? My Honest Experience

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Is XTB Good for Day Trading?

Yes. XTB continues to be a strong option for day trading in 2026, delivering tight spreads, rapid execution, and feature-rich desktop and mobile platforms. With over 100 technical indicators, real-time alerts, and robust risk management tools, it’s built for intraday strategies. FCA regulation and segregated client funds add an extra layer of security for UK traders.

Why Consider XTB for Day Trading?

XTB is a strong choice because it combines speed, reliability, and low-cost trading with advanced tools. Traders benefit from millisecond-level execution, customizable technical indicators, real-time alerts, and responsive mobile/desktop platforms. These features allow UK day traders to implement intraday strategies efficiently and manage risk effectively.

What Makes XTB a Popular Choice Among Active Traders?

Its popularity comes from wide market access, competitive spreads, high liquidity, and responsive support. Traders can access forex, commodities, indices, and ETFs, while using advanced charting and analysis tools to react quickly to market changes.

XTB Overview

XTB is a trusted global broker that offers a robust trading experience across crypto, forex, indices, and more—all through its award-winning xStation platform. While XTB only supports crypto CFDs (not actual asset ownership), it delivers competitive spreads, fast execution, and a suite of educational tools that make it a top choice for UK traders looking to gain exposure to crypto markets alongside traditional instruments. With no minimum deposit and a strong FCA regulatory framework, XTB is ideal for those who value flexibility, speed, and learning support in their trading journey.

- Minimum Deposit: £0 (start trading with any amount)

- Access crypto CFDs with tight spreads and fast execution

- FCA regulated and fully compliant with UK trading standards

- xStation 5 platform offers powerful tools and market insights

- Great for traders who want a low-barrier, all-in-one CFD platform

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How Does XTB Perform for Day Trading?

XTB performs strongly for day trading due to its fast, reliable trade execution, low spreads, and advanced analytical tools. Both mobile and desktop platforms maintain high uptime and responsive interfaces, making it possible for traders to enter and exit positions efficiently in volatile market conditions.

How Fast and Reliable is Trade Execution on xStation?

Trades are executed in milliseconds with minimal latency, ensuring accuracy on entry and exit points. Platform reliability remains high even during volatile periods, which is essential for intraday trading.

How Competitive Are Spreads and Fees for Intraday Trading?

XTB offers tight spreads on major forex pairs and indices, low CFD fees, and transparent overnight financing. Volume discounts apply to frequent traders, making intraday trading cost-efficient relative to other UK brokers.

| Feature | Details |

|---|---|

| Average Forex Spread (EUR/USD) | 0.9 pips |

| Average Forex Spread (GBP/USD) | 1.4 pips |

| Average Forex Spread (AUD/USD) | 1.3 pips |

| CFD Fees | 0% commission on CFDs* (excluding Equity CFDs and ETFs) |

| Overnight Financing Rates (Forex) | Approximately -0.00342% to -0.00359% per day (e.g., GBP/USD) |

| Overnight Financing Rates (Indices) | Approximately -0.006752% to -0.009962% per day (e.g., DE40) |

| Volume Discounts | Available for high-volume traders; eligibility criteria apply |

*Free for ETF and real shares and 0.2% fee for transactions above EUR 100000.

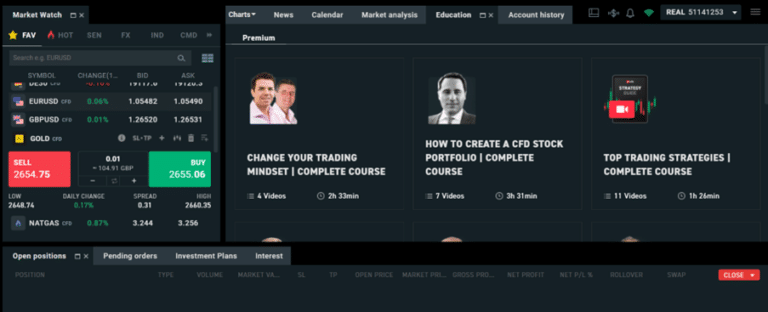

What Tools and Indicators Does xStation Provide for Day Traders?

xStation provides 100+ technical indicators, pattern recognition tools, customizable watchlists, and alerts. Traders can use moving averages, RSI, Bollinger Bands, and automated notifications to identify entry and exit points, improving efficiency and decision-making for intraday trades.

What Challenges Might I Face Day Trading with XTB?

While XTB is fast and reliable, day trading carries challenges. Professionals need advanced features like multi-chart layouts, automated alerts, and leverage controls. Fees, overnight financing, and spreads can impact high-frequency strategies, so understanding cost structures and managing risk is essential for consistent performance.

Are Advanced Day Trading Features Adequate for Professionals?

xStation provides advanced charts, over 100 technical indicators, customizable watchlists, and automation tools. Professional traders can implement intraday strategies, scalping, and hedging efficiently. However, extreme volatility or market gaps may require additional tools not native to the platform.

How Do Fees and Overnight Costs Impact High-Frequency Trading?

Active traders must account for spreads, overnight financing, and occasional commissions. These costs can accumulate quickly in high-volume day trading. Monitoring leverage, using stop-losses, and planning trades strategically helps minimize the impact of fees on profitability.

XTB Day Trading Costs vs Competitors

| Platform | Average Forex Spread | CFD Fees | Overnight Financing | Volume Discounts |

|---|---|---|---|---|

| XTB | 0.3%-0.5% | Variable | Yes | Yes |

| IG | 0.4%-0.6% | Variable | Yes | Yes |

| CMC Markets | 0.3%-0.5% | Variable | Yes | Yes |

| Pepperstone | 0.1%-0.4% | Variable | Yes | Yes |

How Does XTB Compare to Other UK Day Trading Platforms?

XTB competes strongly with other UK brokers thanks to low spreads, fast execution, and comprehensive tools. While IG and CMC Markets also offer reliable platforms, XTB excels in mobile responsiveness and ease of use for intraday strategies. Traders must match platform features to their trading style.

What Advantages Does XTB Offer Over Competitors?

XTB provides millisecond-level execution, responsive desktop and mobile platforms, advanced indicators, and custom alerts. Copy trading and demo accounts further support traders of all skill levels. Tight spreads and high liquidity make intraday strategies cost-efficient and reliable.

Where Might Other Platforms Be More Suitable for Certain Traders?

IG and CMC Markets may suit institutional traders needing ultra-high leverage or direct market access. Pepperstone’s very low spreads may favor scalpers. Traders prioritizing specialized instruments or particular order types should compare each platform’s offerings.

Feature Comparison – XTB vs Other Brokers

| Platform | Execution Speed | Mobile App | Charts & Indicators | Spreads |

|---|---|---|---|---|

| XTB | Fast (millisecond) | Excellent | 100+ Technical Tools | 0.3%-0.5% |

| IG | Fast | Good | Advanced | 0.4%-0.6% |

| CMC Markets | Fast | Good | Professional Charts | 0.3%-0.5% |

| Pepperstone | Very Fast | Excellent | Basic Tools | 0.1%-0.4% |

How Can I Maximise Day Trading Success on XTB?

Success depends on speed, cost awareness, and informed analysis. Using xStation’s fast execution and automation tools reduces reaction time. Monitoring fees and spreads ensures trades remain profitable. Alerts, technical analysis, and market research help identify entry and exit points for consistent intraday performance.

How Should I Use xStation’s Speed and Automation Tools?

Automated alerts and one-click order execution help traders react instantly. Multi-chart layouts and custom watchlists enable monitoring multiple markets simultaneously. Using built-in tools efficiently reduces missed opportunities and allows better timing of entry and exit points.

How Can I Monitor and Minimise Costs Effectively?

Track spreads, overnight financing, and leverage. Plan trades to avoid unnecessary overnight exposure. High-volume traders should monitor fee structures and consider volume discounts. Managing leverage and risk helps preserve capital while reducing trading costs.

How Do I Use Market Analysis and Alerts to Improve Trades?

Technical indicators, pattern recognition, and real-time alerts allow traders to respond to price changes immediately. Economic news and calendar events integrated into xStation help anticipate volatility. Combining analysis with alerts increases the likelihood of timely and profitable trades.

Should I Use XTB for Day Trading?

XTB remains a top contender for UK day traders in 2026, offering low-cost spreads, lightning-fast execution, and powerful charting capabilities. It’s particularly well-suited for active traders, scalpers, and those running intraday forex or CFD strategies. If you’re new to day trading, the demo account is a smart starting point to get comfortable with the platform before committing real capital.

Who Benefits Most from Day Trading on XTB?

Experienced UK traders who demand fast execution and responsive platforms will get the most out of XTB. Those who rely on technical indicators, trade across multiple markets, or run intraday strategies are well catered for. Beginners can also find value here—starting with the demo account is a sensible first step—though high-frequency scalpers and professionals stand to gain the most from XTB’s speed and toolset.

Featured Broker

- Easy Account Set Up

- Interest On Univested Funds

- Educational Tools

- Easy To Use Platform

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

Is XTB suitable for day trading?

Yes, XTB is well-suited for day trading. It offers fast trade execution, competitive spreads, and a user-friendly platform, making it ideal for active traders.

What are the fees associated with day trading on XTB?

XTB operates on a spread-only model for standard accounts, meaning there are no commissions on trades. Spreads are competitive, especially on major forex pairs. However, overnight fees (swaps) apply if positions are held overnight.

Does XTB offer tools beneficial for day traders?

Yes, XTB’s xStation platform provides advanced charting tools, one-click trading, and real-time market analysis, all of which are advantageous for day traders.

How does XTB's execution speed compare to other brokers?

XTB is known for its fast execution speeds, which are crucial for day traders looking to capitalize on short-term market movements.

Are there any challenges for day traders using XTB?

While XTB offers many benefits, some traders may find limitations in accessing certain niche markets or integrating third-party tools. Additionally, overnight fees can impact profits if positions are not closed by the end of the trading day.