XTB Free Stock Offer UK 2026 – Get 1 Free Rolls Royce Share

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

December Update: Offer Expired!

The XTB Free Rolls-Royce Stock promotion ended on 30 November 2025 and is no longer available to new customers.

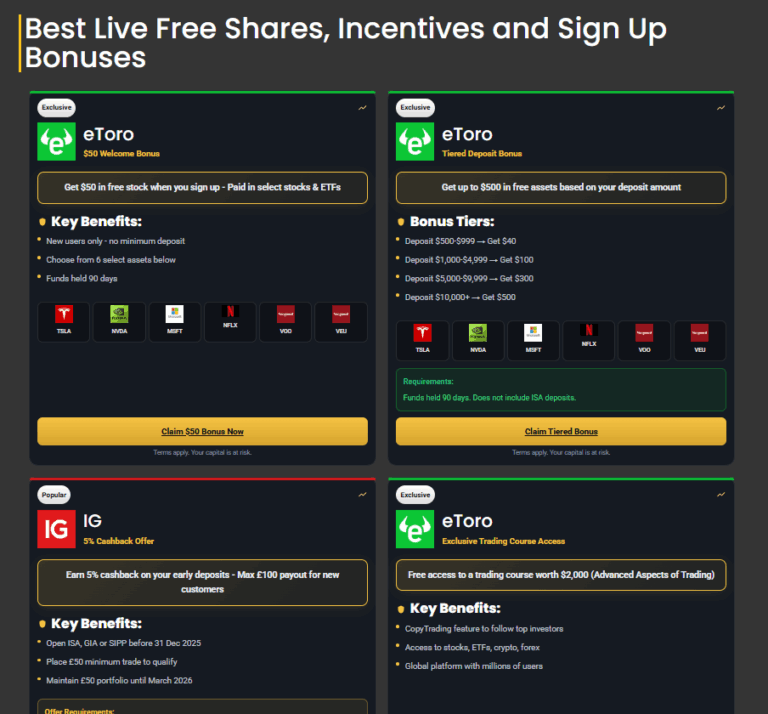

Looking for active promotions? Visit our Live Deals page where we maintain an up-to-date list of the best bonuses, free share offers, and sign-up incentives across investing, trading, and crypto platforms in the UK.

Quick Answer: How Do I Get a Free Stock with XTB?

Open and verify a new XTB account from 13 October 2025 to 30 November 2025 (UK only), accept the Free Stock promotion during signup, and make your first deposit. Within three business days of your deposit being credited, one Rolls-Royce (LSE: RR.) share will be added to your portfolio, and you’ll receive an email confirmation. Limited availability. T&Cs apply. Your capital is at risk.

XTB

Free Rolls-Royce Share Offer (UK)

Get 1 free Rolls-Royce (LSE: RR.) share when you open a new XTB UK account and make your first deposit between 13 Oct and 30 Nov 2025.

Key Benefits:

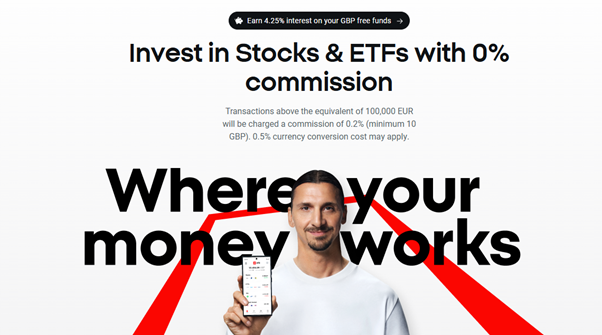

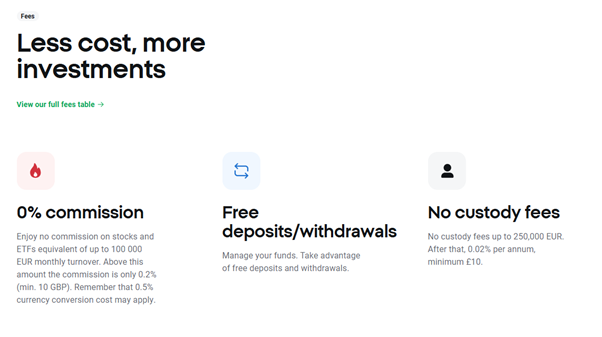

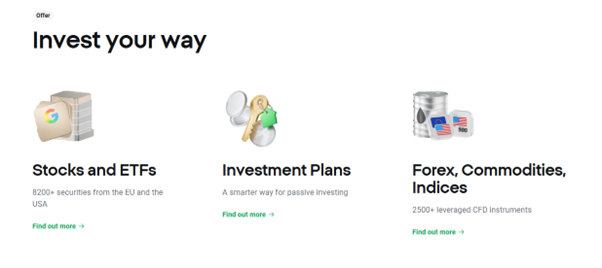

- 0% commission on stocks & ETFs (up to €100k/month)

- Over 10,000 instruments to trade globally

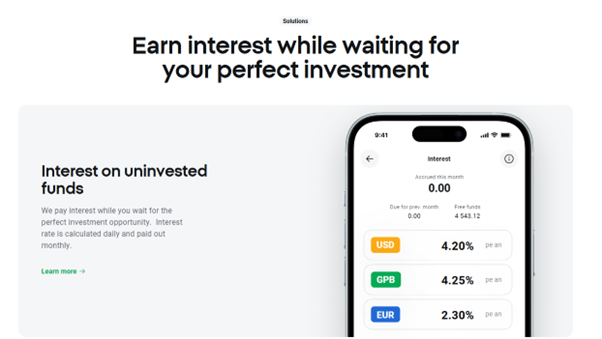

- Earn up to 4.25% interest on uninvested GBP funds

- Free education section and responsive 24/5 support

Your capital is at risk. The value of your investments may fluctuate. Limited availability. T&Cs apply.

What is the XTB Free Stock Offer?

When does the XTB promotion run?

What free stock can you get with XTB?

Who is eligible to claim the offer?

How Do You Claim a Free Share with XTB?

Step 1 – Register an account with XTB

Visit XTB’s official website or download its mobile app, then start the account registration process. You’ll need to provide personal information including your name, email address, and phone number. The process is simple, beginner-friendly, and typically only takes a few minutes to complete.

Step 2 – Accept the promotional conditions

During the sign-up process, XTB will present the option to opt-in to the “Free Stock” campaign. To qualify, you must accept these conditions. If you skip this step, you won’t be eligible for the Rolls Royce share, even after making a deposit.

Step 3 – Complete account verification

XTB follows FCA compliance standards by requiring ID and address checks. You’ll upload documents such as a passport or driving licence and proof of address like a utility bill. Once approved, your account becomes fully active, enabling you to deposit funds and receive rewards.

Step 4 – Make your first deposit

No strict minimum deposit applies. Unlike some brokers, XTB’s promotion qualifies clients after any initial deposit. This inclusive policy lowers the barrier to entry, making it attractive for beginners who want to try investing with a small starting amount before committing larger sums.

Step 5 – Receive your free Uber stock

Do You Need a Promo Code for XTB’s Free Stock Offer?

Is a referral or promo code required to claim the free Uber share?

How do I make sure I qualify for the offer?

Why Choose XTB for Investing in 2025?

XTB appeals to both beginners and experienced investors by offering commission-free share trading up to €100k turnover, access to global markets, and an intuitive, multi-asset platform. Combined with a low deposit threshold and FCA regulation, it stands out as one of the most accessible and trusted broker options in 2025.

Is XTB beginner-friendly for new investors?

Yes, XTB is designed with beginners in mind. The platform is intuitive, offering educational materials, video tutorials, and regular webinars. Its no-minimum-deposit structure and user-friendly mobile app make it easy for first-time investors to start building confidence without a large financial commitment upfront.

Does XTB charge commission on shares and ETFs?

No commission is charged on share and ETF trades up to €100,000 in monthly turnover. This pricing model allows beginners and regular investors to keep costs low. Beyond the threshold, competitive fees apply, but most retail clients rarely exceed this generous allowance.

What extra benefits does XTB offer UK clients?

XTB delivers multiple perks beyond the promotion: commission-free investing, global market access, and minimum investments starting from just $10. UK users also benefit from up to 4.25% interest on idle GBP funds, responsive 24/5 customer support, free learning resources, and instant deposits/withdrawals.

Is the XTB Free Stock Offer Secure?

Yes. XTB is FCA-regulated, meaning it follows strict UK financial rules. Eligible client assets are protected under the FSCS scheme. The broker also applies modern security measures like two-factor authentication, ensuring that participation in the free stock offer remains safe and reliable.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

What Stock Do You Receive from XTB?

Can you sell your Rolls Royce share straight away?

Yes — once the Rolls-Royce share is credited to your account, you’re free to sell it at any time. There are no lock-in periods or holding requirements tied to the promotion, so you can choose to hold, sell, or trade the share according to your personal investment strategy.

Could the stock allocation run out before November 30th?

Final Thoughts – Is the XTB Free Stock Offer Worth It?

Yes, the promotion is a strong entry point for beginners. The transparent Rolls-Royce share reward removes uncertainty, while XTB’s platform features—commission-free investing, educational resources, and strong regulation—add long-term value. For new UK clients, it’s a compelling, low-barrier way to begin investing.

Featured Broker

- Easy Account Set Up

- Interest On Univested Funds

- Educational Tools

- Easy To Use Platform

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

Can I sell my free Rolls-Royce share after receiving it?

Yes. Once the Rolls-Royce share is credited to your account, you can hold, sell, or trade it at any time based on your investment preferences. There are no restrictions or lock-in periods tied to the offer.

Do I owe tax on the free stock?

You may be subject to tax on the value of the free share you receive. XTB does not provide tax advice, so please check with a qualified tax professional or HMRC for guidance based on your personal circumstances.

How long does XTB account approval usually take?

Account verification and approval are typically completed within one to two business days once all required documents are provided. You’ll receive a confirmation email once your account is active and ready to use.

What happens if I don’t deposit before 30 November 2025?

To qualify, your deposit must be made before the campaign ends on 30 November 2025. If you register but fail to deposit before this date—or if the allocation runs out—you will not receive the free Rolls-Royce share.