Best Broker for CFD Hedging - in the UK for 2026

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead, Thomas Drury (Chartered ACII), Dom Farnell — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Some links earn commission at no cost to you. This doesn't affect our ratings.

Contact: info@theinvestorscentre.co.uk

Hedging with CFDs protects existing positions without forcing you to sell. You keep your shares, avoid triggering capital gains tax, and use a CFD position to offset potential losses. But brokers handle hedging differently—some net opposing positions automatically, others keep both sides open. Some offer guaranteed stops that execute through gaps, others don’t. These differences determine whether your hedge actually works when you need it.

We reviewed six FCA-regulated brokers specifically for their hedging capabilities: how they handle opposing positions, what risk tools they offer, and what it costs to maintain a protective position over days or weeks.

What Is the Best Broker for CFD Hedging in the UK?

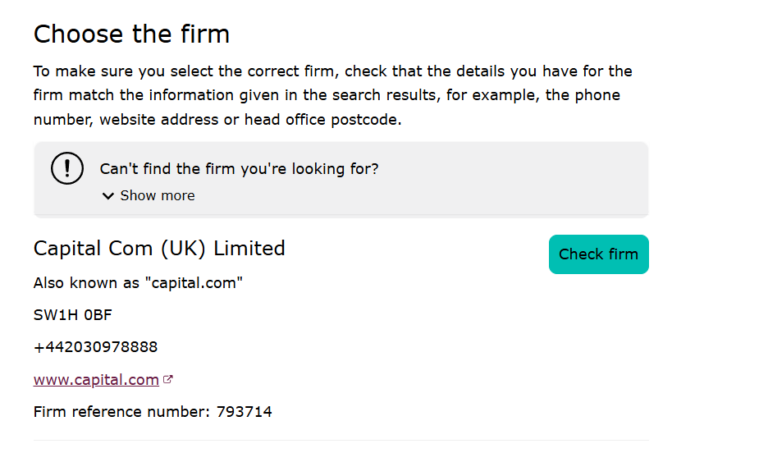

Capital.com is the best broker for CFD hedging in the UK for 2026—the dedicated hedging mode keeps long and short positions visibly separate, guaranteed stop-loss orders provide gap protection when needed, and no commission* keeps hedging costs low over time. The platform clearly labels each hedged position with its own entry price, margin, and P&L.

CMC Markets offers guaranteed stop-loss orders across most CFD markets with full premium refunds if the GSLO isn’t triggered. IG provides the most flexibility with CFDs, spread bets, options, and futures all accessible from one account.

*other fees may apply.

Capital.com

CFD Hedging Score: 4.8/5

60% of Retail CFD Accounts Lose Money

CMC Markets

CFD Hedging Score: 4.75/5

64% of retail CFD accounts lose money.

How Do These CFD Hedging Brokers Compare?

| Rank | Broker | Best For | Key Hedging Feature | FCA FRN |

|---|---|---|---|---|

| 1 | Capital.com | Overall CFD hedging | Dedicated hedging mode + GSLOs | 793714 |

| 2 | CMC Markets | Gap protection | Guaranteed stop-losses (full refund if not triggered) | 173730 |

| 3 | IG | Multi-asset hedging | Force open + options access | 195355 |

| 4 | Pepperstone | Capital efficiency | Margin on largest leg only | 684312 |

| 5 | Saxo | Portfolio hedging | Options + multi-asset view | 551422 |

| 6 | City Index | Tax-efficient hedging | Spread betting + GSLOs | 446717 |

What Should You Look For in a CFD Hedging Broker?

Hedging requires different broker capabilities than speculative trading. Before comparing platforms, understand what actually matters.

Hedging mode: Can you hold both long and short positions on the same instrument simultaneously? Some brokers automatically net opposing trades—opening a short closes your long. For hedging, you need both sides to remain open as separate positions.

Guaranteed stop-losses: Standard stops can slip if prices gap overnight. Guaranteed stop-loss orders (GSLOs) execute at your specified price regardless of gaps—essential for hedges held through volatile events. Available at Capital.com, CMC Markets, IG, and City Index for a premium.

Margin treatment: Most brokers require margin on both sides of a hedged position. Pepperstone calculates margin on the “largest leg” only—a fully hedged position needs margin on one side, not both. This frees capital.

Overnight financing: Hedges often stay open for days or weeks. Daily financing charges accumulate. Lower overnight rates mean cheaper long-term protection.

Platform compatibility: If you use automated hedging strategies via Expert Advisors, you need MT4/MT5 support. Pepperstone and IG offer this; Capital.com connects via TradingView but not MT4/MT5 directly.

Which CFD Broker Has the Best Hedging Features?

The table below compares hedging-specific features. Note that “hedging mode” means the ability to hold opposing positions simultaneously without automatic netting.

| Broker | Hedging Mode | Guaranteed Stops | Margin Treatment | Overnight Rate/Year | Platforms |

|---|---|---|---|---|---|

| Capital.com | ✓ Dedicated toggle | ✓ GSLO | Standard | Benchmark + 4% | Proprietary, TradingView |

| CMC Markets | ✓ | ✓ GSLO | Standard | Benchmark + 2.5% | Next Gen, MT4 |

| IG | ✓ Force open | ✓ | Standard | Benchmark + 2.5-3% (entity dependent) | Proprietary, MT4, ProRealTime |

| Pepperstone | ✓ | ✗ | Largest leg only | Tom-next/Benchmark +2.5-3% | MT4, MT5, cTrader, TradingView |

| Saxo | ✓ | ✗ | Portfolio-based | Benchmark + 3.5% (Classic) | SaxoTraderGO, SaxoTraderPRO |

| City Index | ✓ | ✓ GSLO | Standard | Benchmark + 2.5% | Proprietary, MT4 |

Reading this table:

- Dedicated toggle/Force open: Explicit setting to enable hedging (clearer than default behaviour)

- GSLO: Guaranteed stop-loss orders available for premium

- Largest leg only: Margin calculated on bigger position only (Pepperstone advantage)

- Benchmark: Typically SONIA for GBP instruments

Here Are The Top 6 CFD Hedging Brokers Reviewed

Each review focuses on hedging-specific capabilities: how the broker handles opposing positions, what risk tools it offers, and what hedging costs over time.

- Capital.com – Best Overall for CFD Hedging

- CMC Markets – Best for Gap Protection

- IG – Best for Multi-Asset Hedging

- Pepperstone – Best for Capital-Efficient Hedging

- Saxo – Best for Portfolio-Level Hedging

- City Index – Best for Tax-Efficient Hedging

Pros & Cons

- Widest commodity range on this list—gold to orange juice to lean hogs

- AI risk alerts that flag potentially high-risk trades

- No commission*—costs sit entirely in the spread

- Clean interface that doesn’t overwhelm new traders

- MT4 and TradingView integration for those who want third-party platforms

- Can’t trade actual commodity futures—CFDs only

- Charting tools are decent but not CMC-level

- No cTrader for automated strategy runners who prefer that platform

How Does Capital.com Handle Hedged Positions?

Capital.com offers a dedicated hedging mode toggle in account settings (Account → My Accounts → Trade Options → Hedging Mode). Once enabled, opening an opposite position creates a separate trade rather than closing your existing one. Each position displays independently with its own entry price, margin requirement, and profit/loss calculation. Built-in margin alerts help you monitor exposure levels, and the platform displays overnight financing costs on the order ticket before you confirm any trade.

What Risk Protection Tools Does Capital.com Offer?

Guaranteed stop-loss orders (GSLOs) are available and execute at your specified price regardless of market gaps or slippage. The GSLO fee is only charged if triggered, calculated as a percentage of the position’s open value. Standard stop-losses, trailing stops, and take-profit orders are also available on all positions. Negative balance protection ensures retail accounts cannot lose more than deposited.

What Does Hedging Cost at Capital.com?

No commission on any trades*—costs sit entirely in the spread. Forex spreads from 0.6 pips, index spreads from 0.4 points. GSLO premiums vary by instrument and are displayed on the deal ticket before you place the order. Overnight funding charges apply to positions held past market close: benchmark rate (e.g., SONIA) plus 4% for long positions. The overnight charge displays on the order ticket before confirmation, allowing you to calculate multi-day costs in advance.

Ideal Hedging Scenario

Capital.com suits traders who want clear, intuitive hedging with low ongoing costs. The dedicated hedging mode makes it obvious what you’re doing, and guaranteed stops provide gap protection when needed. Best for discretionary hedgers who value simplicity and transparent pricing.

*other fees may apply.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Next Generation platform has serious charting depth (115+ indicators)

- Competitive gold spreads from 0.3 points

- Commodity indices let you trade entire sectors in one position

- Pattern recognition that’s actually useful, not just decorative

- Panel-based interface has a steeper learning curve than competitors

- £10/month inactivity fee after 12 months

- Not ideal for traders who want simplicity over depth

How Does CMC Markets Handle Hedged Positions?

CMC Markets allows simultaneous long and short positions on the same instrument. Both positions appear separately in the Positions panel without automatic netting. The Next Generation platform includes correlation matrices and sector analysis tools useful for identifying effective hedge candidates across related instruments.

What Risk Protection Tools Does CMC Markets Offer?

Guaranteed stop-loss orders (GSLOs) execute at your specified price regardless of market gaps or slippage. Available on most CFD markets for a premium charge displayed before order confirmation. The full premium is refunded if the GSLO is not triggered—whether you close manually, hit take-profit, or cancel the order. Standard stops, trailing stops, and take-profit orders also available.

What Does Hedging Cost at CMC Markets?

No commission on CFDs or spread bets*—costs in the spread. Index spreads from 0.3 points, forex from 0.7 pips. GSLO premiums vary by instrument and volatility. Overnight financing at benchmark rate plus 2.5%. The platform displays projected overnight costs before you confirm the order.

Ideal Hedging Scenario

CMC Markets suits traders who need certainty about maximum loss. If your hedge must execute at a specific level through earnings, elections, or central bank decisions—even if prices gap 100 points overnight—GSLOs provide that guarantee. The full refund policy if not triggered makes this protection more attractive for hedges that may not be needed.

*other fees may apply.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros & Cons

- More ways to trade commodities than any competitor—CFDs, spread bets, futures, options, ETFs

- Weekend gold trading when other brokers are closed

- ProRealTime charting included at no extra cost for active traders

- 50 years in business, publicly listed, properly capitalised

- Spreads run slightly wider than specialist low-cost brokers

- Platform depth can overwhelm if you just want simple trades

- £12/month inactivity fee after 24 months

How Does IG Handle Hedged Positions?

IG’s “force open” setting allows simultaneous long and short positions on the same instrument. Toggle this in platform settings to prevent automatic netting. Positions display separately with individual P&L tracking. If you hold shares in an IG ISA or share dealing account, you can hedge that exposure with CFDs without transferring assets between platforms—everything visible in one ecosystem.

What Risk Protection Tools Does IG Offer?

Guaranteed stops available for premium on most markets. Standard stops, trailing stops, and limit orders included. Options contracts available for defined-risk hedging strategies where maximum loss equals the premium paid. The platform shows a preview of resulting positions when placing hedged orders, making it easier to see net exposure.

What Does Hedging Cost at IG?

Spread betting: no commission*, costs in spread. CFDs: variable commission on shares, no commission* on indices/forex. Overnight financing at benchmark rate plus 2.5-3% (entity dependent) for long positions. Guaranteed stop premiums vary by market. Weekend holding costs apply to positions held over Saturday/Sunday.

Ideal Hedging Scenario

IG suits traders who need flexibility in hedge construction. CFDs for straightforward protection, spread bets for tax efficiency (profits typically avoid CGT), options for defined-risk strategies. If you might need different hedge types at different times, IG handles all of them from one account.

*other fees may apply.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Raw spreads from 0.05 points on gold (plus commission)

- MT4, MT5, cTrader, TradingView—platform choice most brokers can’t match

- No inactivity fees

- Commission on Razor account adds to costs for small positions

- Commodity range is narrower than IG or CMC

- No proprietary beginner platform—you’re using MT4/5 or cTrader

How Does Pepperstone Handle Hedged Positions?

Pepperstone allows hedging across all platforms: MT4, MT5, cTrader, and TradingView. No FIFO (First In First Out) rules—you can close either leg of a hedge in any order. The “net off” feature lets you close hedged positions directly against each other. Critically, margin is calculated on the “largest leg” only—a fully hedged position requires margin on one side, not both.

What Risk Protection Tools Does Pepperstone Offer?

Standard stop-losses, trailing stops, and take-profit orders. No guaranteed stop-loss orders available—if prices gap, stops may slip. The platform advantage is execution speed and the ability to run automated hedging strategies via Expert Advisors on MT4/MT5.

What Does Hedging Cost at Pepperstone?

Razor account: spreads from 0.0 pips plus £2.25 commission per lot per side. Standard account: spreads from 1.0 pip, no commission*. Overnight swap rates calculated using tom-next or benchmark rate plus 2.5-3%, varying by instrument and displayed in the platform. No deposit, withdrawal, or inactivity fees—useful for hedges that may sit dormant between active management.

Ideal Hedging Scenario

Pepperstone suits traders who want to minimise capital tied up in margin. The largest-leg calculation means your hedge doesn’t double margin requirements. Also ideal for automated hedging strategies via MT4/MT5 Expert Advisors. Less suitable if you need guaranteed stops for gap protection.

*other fees may apply.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Actual exchange-traded commodity futures—not just CFDs mimicking them

- Commodity options for hedging or directional strategies

- Institutional-grade SaxoTrader platform

- Multi-asset capability if you manage broader portfolios

- Best pricing requires higher account tiers

- Platform complexity assumes existing trading experience

- More firepower than most retail traders need

How Does Saxo Handle Hedged Positions?

Saxo allows opposing positions on the same instrument. The SaxoTraderGO platform displays your entire portfolio—stocks, ETFs, bonds, CFDs, options, futures—in a single view. This makes it easier to assess total exposure across asset classes and identify what needs hedging. Net exposure calculations show your overall directional risk.

What Risk Protection Tools Does Saxo Offer?

Options and futures available alongside CFDs for sophisticated hedge structures. Options provide defined-risk hedging where maximum loss equals the premium paid. No guaranteed stop-loss orders on CFDs, but the ability to use options compensates for traders who want capped downside. Standard stops and limits available.

What Does Hedging Cost at Saxo?

CFD overnight financing at benchmark rate plus 3.5% markup for Classic tier accounts (lower for Platinum and VIP). Short positions on single stock CFDs incur borrowing fees (minimum 0.5%). Options and futures have separate fee structures. Tiered pricing rewards volume—frequent hedgers pay progressively less.

Ideal Hedging Scenario

Saxo suits sophisticated traders managing multi-asset portfolios who need complete visibility of overall exposure. The ability to hedge with options (defined risk) or futures (no daily financing) adds flexibility that pure CFD brokers can’t match. Higher costs and complexity make it less suitable for simple hedges.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros & Cons

- Copy trading lets you follow experienced commodity traders automatically

- Genuinely intuitive interface—the easiest platform on this list

- Social sentiment data on commodities

- 25+ commodities with straightforward access

- Spreads are meaningfully wider—45 pips on gold

- $5 withdrawal fee adds friction

- $10/month inactivity fee after 12 months

How Does City Index Handle Hedged Positions?

City Index allows simultaneous opposing positions without automatic netting. Both spread bets and CFDs support hedging. Positions display separately for clear tracking. Part of StoneX Group (NASDAQ-listed), providing institutional backing and stability.

What Risk Protection Tools Does City Index Offer?

Guaranteed stop-loss orders available for premium on most markets—protection against gaps. Standard stops, trailing stops, and take-profit orders included. 13,500+ markets provide flexibility for cross-asset hedging strategies.

What Does Hedging Cost at City Index?

Spread betting: no commission*, costs in spread. Overnight financing at benchmark rate plus 2.5% for long positions (minus 2.5% for shorts, though low base rates may still result in a charge). GSLO premiums vary by instrument. No commission on spread bets.

Ideal Hedging Scenario

City Index suits UK traders who want tax-efficient hedging. Spread betting profits typically avoid Capital Gains Tax, which matters if the hedge itself is profitable. Combined with guaranteed stops for gap protection, this makes City Index attractive for hedging profitable portfolios where CGT would otherwise apply.

*other fees may apply.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Are These CFD Hedging Brokers Safe and Regulated?

All six brokers are FCA-authorised with identical core protections for UK retail clients:

| Protection | What It Means |

|---|---|

| FCA Regulation | Each broker is authorised by the Financial Conduct Authority—verify on register.fca.org.uk |

| Segregated Funds | Client money held separately from company funds |

| FSCS Protection | Up to £120,000 covered per person if the broker fails |

| Negative Balance Protection | Retail accounts can't lose more than deposited |

Additional credibility factors:

- IG and CMC Markets are publicly listed on the London Stock Exchange

- Saxo is backed by Saxo Bank A/S, a Danish-regulated bank

- City Index is part of StoneX Group, a NASDAQ-listed company

- Pepperstone holds dual FCA and ASIC (Australia) regulation

Important Note: Regulation protects against broker failure, not trading losses. Hedging reduces but doesn’t eliminate market risk.

What Does It Actually Cost to Maintain a CFD Hedge?

Hedging isn’t free. Here’s a realistic cost breakdown for maintaining a hedge over time.

What affects hedging cost:

- Spread width: Lower spreads = cheaper entry/exit

- Overnight rate: Lower financing = cheaper long-term holds

- Commission: Adds to cost on each leg (Pepperstone Razor, Saxo)

- GSLO premium: Additional cost for guaranteed execution (Capital.com, CMC, IG, City Index)

Cost-saving strategies:

- Use spread bets where possible (no commission at most brokers)

- Close hedges when risk passes rather than holding indefinitely

- Compare overnight rates—they vary significantly between brokers

- Consider futures for multi-week hedges (financing built into spread, no daily charge)

How Does CFD Hedging Actually Work?

CFD hedging involves opening a position designed to profit when your existing exposure loses value.

Direct hedge example: You own £20,000 in Barclays shares. Earnings are next week, and you’re worried about a drop. You short £20,000 of Barclays via CFD. If shares fall 10%, you lose £2,000 on shares but gain approximately £2,000 on the CFD (minus costs). Net result: protected.

Proxy hedge example: You own a portfolio of UK financial stocks. Rather than hedging each individually, you short the FTSE 350 Banks index via CFD. If the sector falls, your index short gains value, offsetting portfolio losses. Less precise than direct hedging, but simpler to manage.

Partial hedge: You don’t have to hedge 100%. A 50% hedge reduces volatility while maintaining some upside participation. Many hedgers prefer partial coverage to balance protection with opportunity.

When Does CFD Hedging Make Sense?

Hedging adds cost and complexity. It makes sense in specific situations:

Managing the risks:

- Use stop-losses. Always.

- Size positions so a single loss doesn’t cripple your account—1-2% risk per trade is a common guideline

- Understand overnight costs before holding positions for days

- Start with a demo account if commodity markets are new to you

Final Thoughts

Capital.com offers the clearest hedging implementation for most UK traders—dedicated mode toggle, visible position separation, guaranteed stop-loss orders for gap protection, and no commission* to erode hedge value over time. CMC Markets provides guaranteed stops with full premium refunds if not triggered. Pepperstone’s margin-on-largest-leg calculation makes hedging more capital-efficient. IG offers the most flexibility with CFDs, spread bets, options, and futures from one account.

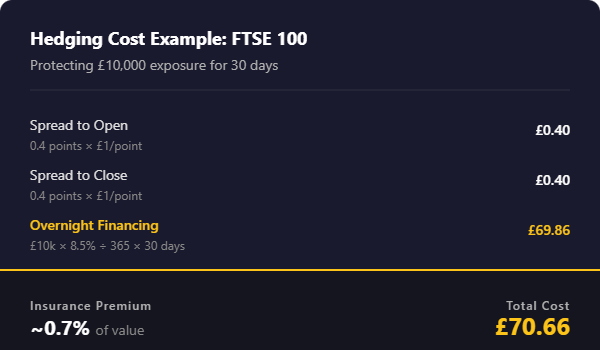

Hedging protects existing positions but adds cost. A 30-day hedge on £10,000 costs approximately £70.66 in spread and financing—roughly 0.7% of protected value. Worth it for genuine risk reduction; expensive if used without clear purpose. Match your hedging need to the broker that handles it best.

*other fees may apply.

Trade with Capital.com

Access 5,000+ CFD Markets

- ✓ 0% Commission (Other fees apply)

- ✓ 0.014s Avg. Execution Speed

- ✓ Seamless TradingView Integration

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

FAQs

FAQ 1: What is hedging mode on a CFD broker?

Hedging mode allows you to hold both long and short positions on the same instrument simultaneously without automatic netting. Without hedging mode enabled, opening a sell position closes your existing buy position. Capital.com offers a dedicated hedging mode toggle in account settings, while IG uses a “force open” function to achieve the same result. Pepperstone enables hedging by default across MT4, MT5, and cTrader.

FAQ 2: How much does it cost to hedge with CFDs?

A typical 30-day CFD hedge on £10,000 of exposure costs approximately £70.66—around 0.7% of the protected value. This breaks down into spread costs (£0.40–£1 to open and close) plus overnight financing (benchmark rate plus 2–3.5% annually, charged daily). Pepperstone and Capital.com offer the lowest overnight rates, while Saxo’s Classic tier charges benchmark plus 3.5%.

FAQ 3: What is a guaranteed stop-loss order (GSLO) for hedging?

A guaranteed stop-loss order executes at your exact specified price regardless of market gaps or slippage—essential for hedges held through volatile events like earnings or elections. Standard stops can slip if prices gap overnight. Capital.com, CMC Markets, IG, and City Index offer GSLOs for a premium. CMC Markets refunds the full GSLO premium if it isn’t triggered, making it cost-effective for precautionary hedges.

FAQ 4: Do I need margin on both sides of a hedged position?

Most brokers require margin on both the long and short leg of a hedged position. Pepperstone is the exception—margin is calculated on the “largest leg” only, meaning a fully hedged position requires margin on one side, not both. This frees up capital for other trades or reduces the total deposit needed to maintain your hedge.

FAQ 5: Is CFD hedging tax-free in the UK?

CFD profits and losses are subject to Capital Gains Tax in the UK. However, spread betting profits are typically tax-free as HMRC classifies them as gambling. For tax-efficient hedging, Capital.com, City Index and IG offer spread betting alongside CFDs—if your hedge is profitable, you keep the gains without CGT liability. Tax treatment depends on individual circumstances, so consult a tax professional if hedging forms a significant part of your strategy.

References

Broker Websites (Primary Sources):

- Capital.com UK: capital.com/en-gb – FRN 793714, hedging mode, GSLO documentation

- CMC Markets UK: cmcmarkets.com/en-gb – FRN 173730, GSLO refund policy

- IG UK: ig.com/uk – FRN 195355, force open feature, options

- Pepperstone UK: pepperstone.com/en-gb – FRN 684312, margin policy, hedging FAQ

- Saxo UK: home.saxo/en-gb – FRN 551422, CFD financing rates

- City Index UK: cityindex.com/en-uk – FRN 446717, overnight funding

Regulatory Sources:

- FCA Financial Services Register: register.fca.org.uk – Broker authorisation verification

- FSCS Deposit Protection: fscs.org.uk – £120,000 limit from 1 December 2025

Hedging features and costs verified from broker websites and help documentation, January 2026. Overnight financing rates are variable and depend on prevailing benchmark rates. All brokers verified on FCA register.