Best CFD Brokers for Professional Traders - in the UK 2026

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

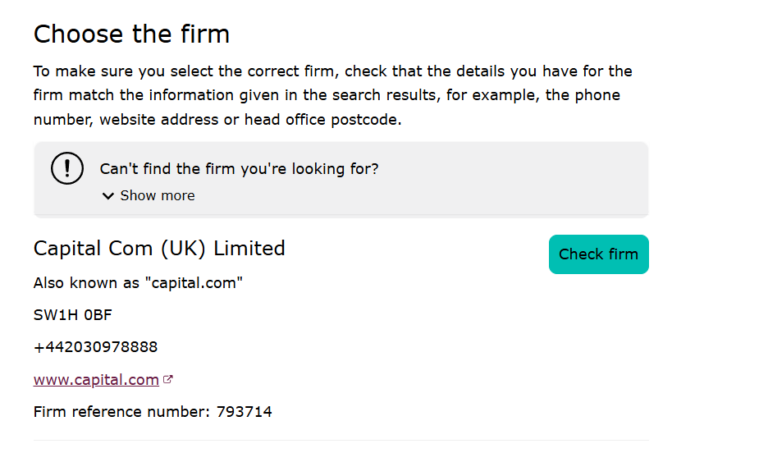

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead, Thomas Drury (Chartered ACII), Dom Farnell — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Some links earn commission at no cost to you. This doesn't affect our ratings.

Contact: info@theinvestorscentre.co.uk

What Is the Best CFD Broker for Professional Traders in the UK?

Capital.com is the best CFD broker for professional traders in the UK for 2026—professional accounts unlock leverage up to 500:1 on forex, indices and commodities, a dedicated account manager provides direct support, and joining bonuses of up to £10,000 reward experienced traders who qualify. The platform maintains commission-free* CFD trading even at professional tier, keeping costs predictable as position sizes increase.

Professional trader status removes the ESMA leverage caps that restrict retail clients to 30:1 on major forex pairs. For traders who meet the eligibility criteria, this means significantly lower margin requirements and the ability to deploy capital more efficiently across multiple positions. However, upgrading also means giving up certain regulatory protections—a trade-off that requires careful consideration.

*other fees may apply.

Who are these professional accounts for?

| Rank | Broker | Best For | Pro Leverage (FX) | Min Deposit | FCA Regulated |

|---|---|---|---|---|---|

| 1 | Capital.com | Overall Value | Up to 500:1 | £20 | ✓ FRN 793714 |

| 2 | IG | Range & Experience | Up to 222:1 | £250 | ✓ FRN 195355 |

| 3 | Saxo | Multi-Asset Professionals | Up to 66:1 | £500 | ✓ FRN 551422 |

Who Qualifies as a Professional Trader in the UK?

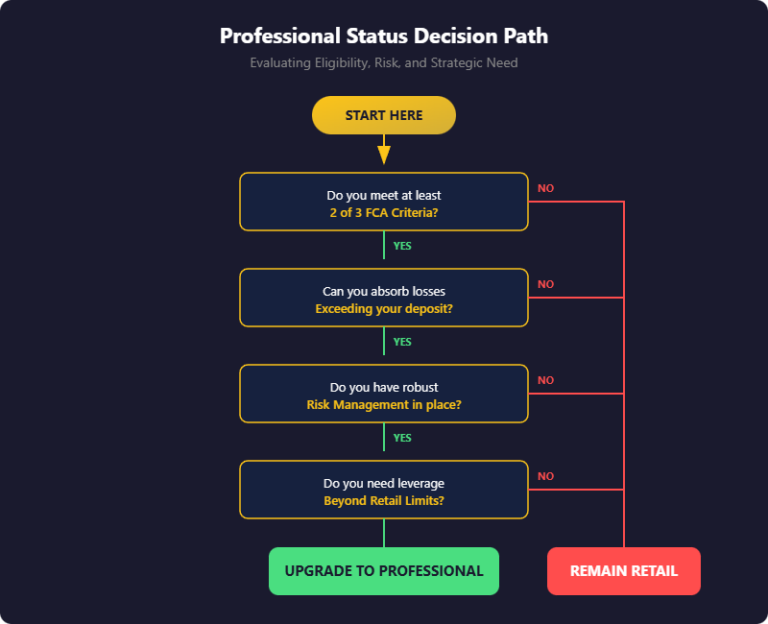

To qualify as an elective professional client with any FCA-regulated broker, you must meet at least two of three criteria set by the regulator. These requirements exist because professional status removes protections designed for less experienced traders.

| Criterion | Requirement | Evidence Needed |

|---|---|---|

| Trading Activity | Average of 10 significant-size transactions per quarter over the past four quarters | Trading statements from current and previous brokers |

| Portfolio Size | Financial instrument portfolio exceeding €500,000 (including cash deposits) | Bank statements, brokerage statements |

| Professional Experience | Worked in financial services for at least one year in a role requiring derivatives knowledge | Employment records, professional qualifications |

Note: Meeting just one criterion is not sufficient—you must satisfy at least two. Brokers will request documentation to verify your claims before upgrading your account status.

What Do You Gain and Lose as a Professional Trader?

Upgrading to professional status involves a genuine trade-off between increased trading flexibility and reduced regulatory protection. Understanding both sides is essential before applying.

What Professional Traders Gain

| Benefit | How It Helps |

|---|---|

| Higher Leverage | Access leverage up to 500:1 on forex (vs 30:1 retail cap), reducing margin requirements |

| Lower Margin Rates | Hold larger positions with less capital tied up |

| No Product Restrictions | Trade instruments restricted for retail clients in some jurisdictions |

| Sophisticated Communication | Brokers assume existing knowledge, reducing generic risk warnings |

| Volume-Based Benefits | Many brokers offer rebates, tighter spreads, or dedicated support for professionals |

What Professional Traders Lose

| Protection Lost | What It Means |

|---|---|

| Negative Balance Protection | Your account can go below zero—you may owe money beyond your deposit |

| Financial Ombudsman Access | You may lose the right to escalate complaints to the FOS |

| Best Execution Priority | Price may not be the primary factor in order execution |

| Standardised Risk Warnings | Fewer prompts about leverage risks on platforms and communications |

Important: The loss of negative balance protection is the most significant change. During extreme market volatility—such as the 2015 Swiss franc event—accounts without this protection can accumulate losses exceeding deposited funds. Professional traders accept responsibility for monitoring positions and managing this risk themselves.

How Do These Professional Trading Accounts Compare?

What Professional Traders Gain

| Feature | Capital.com | IG | Saxo |

|---|---|---|---|

| Pro Leverage (FX) | Up to 500:1 | Up to 222:1 | Up to 66:1 |

| Pro Leverage (Indices) | Up to 500:1 | Up to 222:1 | Up to 40:1 |

| Pro Leverage (Shares) | Up to 33:1 | Up to 20:1 | Up to 10:1 |

| Commission Model | Commission-free (spread only) | Commission-free CFDs | Commission-free CFDs |

| Joining Bonus | Up to £10,000 | Up to £5,000 (referrals) | None advertised |

| Dedicated Manager | ✓ Yes | ✓ Yes (Select tier) | ✓ Yes (Platinum/VIP) |

| Volume Rebates | ✓ Cash rebates | ✓ Volume-based rebates | ✓ Tiered pricing |

| Portfolio Margin | ✗ Standard margin | ✗ Standard margin | ✓ Portfolio-based margin |

| Use Shares as Collateral | ✗ No | ✗ No | ✓ Yes |

| Platforms | Proprietary, MT4, TradingView | Proprietary, MT4, ProRealTime, L2 Dealer | SaxoTraderGO, SaxoTraderPRO |

| Instruments | 3,000+ | 17,000+ | 70,000+ |

| Years Operating | Since 2016 | Since 1974 | Since 1992 |

Here Are The Top 3 CFD Brokers for Professional Traders Reviewed

- Capital.com – Best Overall for Professional CFD Traders

- IG – Best for Range and Established Infrastructure

- Saxo – Best for Multi-Asset Portfolio Professionals

Capital.com Expert Overview

Capital.com offers professional traders the highest leverage among major UK brokers—up to 500:1 on forex, indices, and commodities—combined with commission-free trading that keeps costs low regardless of position frequency.

Pros & Cons

- Highest leverage available—up to 500:1 on forex, indices, and commodities

- Commission-free* trading on all CFDs

- Up to £10,000 joining bonus for qualifying professionals

- Dedicated account manager and volume-based cash rebates

- Cannot use shares as collateral

- Smaller instrument range (3,000+) than competitors

*other fees may apply.

How Do You Upgrade to Professional Status at Capital.com?

The application process begins in your account settings. Navigate to Account → My Accounts → Professional Status and complete the eligibility questionnaire. Capital.com requires documentation proving you meet at least two of the three FCA criteria. Approval typically takes one to two business days once documents are submitted.

What Leverage and Margin Do Professional Traders Get?

Professional accounts at Capital.com unlock leverage of up to 500:1 on major forex pairs, major indices, and commodities. Share CFDs offer leverage up to 33:1. This compares to the retail caps of 30:1 on major forex and 5:1 on shares.

| Asset Class | Retail Leverage | Professional Leverage |

|---|---|---|

| Major Forex | 30:01:00 | Up to 500:1 |

| Minor Forex | 20:01 | Up to 200:1 |

| Major Indices | 20:01 | Up to 500:1 |

| Commodities | 10:01 | Up to 500:1 |

| Shares | 05:01 | Up to 33:1 |

What Professional-Exclusive Benefits Does Capital.com Offer?

Professional clients receive a dedicated account manager for direct support, cash rebates based on trading volume, and access to exclusive webinars and market analysis. New professional clients can earn up to £10,000 in joining bonuses upon meeting minimum trading volume thresholds—£1,000 at Tier 1 and a further £9,000 at Tier 2.

Best For

High-frequency forex and index traders who want maximum leverage with minimal trading costs. The combination of 500:1 leverage and commission-free execution suits scalping and day trading strategies where margin efficiency and tight spreads matter most.

*other fees may apply.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

IG Expert Overview

IG combines professional trading accounts with 50 years of operational experience and access to over 17,000 instruments. The platform’s L2 Dealer provides direct market access for professionals who need order book visibility.

Pros & Cons

- 50 years operational experience, LSE-listed

- 17,000+ instruments available

- L2 Dealer for direct market access

- Professional margin rates drop over 90%

- Lower leverage than Capital.com (222:1 max)

- £250 minimum deposit

- Dedicated manager requires Select tier

How Do You Upgrade to Professional Status at IG?

Log into My IG and select Settings → Client and Account Status. If you meet the eligibility criteria, the option to apply for professional status appears automatically. IG reviews applications within two hours in most cases and will request supporting documentation to verify your trading history or portfolio size.

What Leverage and Margin Do Professional Traders Get?

IG offers professional leverage up to 222:1 on major forex pairs, with significant margin reductions across other asset classes. The margin rate on FTSE 100 positions drops from 5% for retail clients to 0.45% for professionals—a reduction of over 90%.

| Asset Class | Retail Margin | Professional Margin |

|---|---|---|

| FTSE 100 | 5% | 0.45% |

| Major Forex | 3.33% | ~0.45% |

| Gold | 5% | ~0.45% |

What Professional-Exclusive Benefits Does IG Offer?

Professional clients can negotiate bespoke margin call levels to improve capital efficiency. Volume-based rebates reward active traders, and the absence of custody fees on share dealing accounts benefits those holding positions longer-term. IG’s ProRealTime and L2 Dealer platforms provide Level 2 market data and advanced order types suited to professional execution requirements.

Best For

Multi-asset professionals who need extensive instrument coverage and proven infrastructure. IG’s 50-year track record, LSE-listed parent company, and access to 17,000+ instruments suit traders who prioritise stability and range over maximum leverage.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Saxo Expert Overview

Saxo operates as a licensed bank rather than a pure broker, offering professional traders portfolio-based margin models and the ability to use existing shareholdings as collateral for CFD positions.

Pros & Cons

- Portfolio-based margin reduces total requirements

- Use existing shares as collateral

- 70,000+ instruments—largest range

- Licensed bank status

- Lowest leverage of the three (66:1 max)

- Stricter documentation requirements

- Best pricing requires £200,000+ account balance

How Do You Upgrade to Professional Status at Saxo?

Saxo applies stricter documentation requirements than most brokers. Beyond meeting two of three FCA criteria, Saxo specifies minimum transaction sizes: €100,000 notional on forex, €50,000 on indices, or €10,000 on single-stock CFDs. Contact Saxo directly or apply through your account dashboard, providing trading statements that demonstrate qualifying activity.

What Leverage and Margin Do Professional Traders Get?

Professional leverage at Saxo reaches 66:1 on major forex pairs—lower than Capital.com or IG but offset by Saxo’s portfolio-based margin model. This model calculates margin across your entire portfolio rather than position-by-position, potentially reducing total margin requirements when positions hedge each other.

| Feature | Standard Margin | Portfolio-Based Margin |

|---|---|---|

| Calculation | Per-position | Whole portfolio |

| Hedged Positions | Full margin both sides | Net exposure margin |

| Offset Recognition | None | Correlated positions offset |

What Professional-Exclusive Benefits Does Saxo Offer?

Saxo allows professional clients to use a percentage of their shareholdings as collateral for margin trading—a feature uncommon among retail-focused brokers. Tiered account levels (Classic, Platinum at £200,000, VIP at £1,000,000) unlock progressively tighter spreads and dedicated relationship managers. The SaxoTraderPRO platform offers institutional-grade tools including algorithmic order types and multi-monitor workspace layouts.

Best For

Sophisticated traders managing diversified portfolios across asset classes. Saxo’s bank status, portfolio margin, and 70,000+ instruments suit professionals who trade equities, bonds, options, and futures alongside CFDs and want consolidated margin treatment.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Are These Professional Trading Accounts Safe and Regulated?

All three brokers hold full FCA authorisation and segregate client funds from company assets. However, professional status changes your compensation coverage.

| Broker | FCA FRN | FSCS Protection | Segregated Funds | Negative Balance Protection |

|---|---|---|---|---|

| Capital.com | 793714 | Up to £85,000 (investments) | ✓ Yes | ✗ No (professional) |

| IG | 195355 | Up to £85,000 (investments) | ✓ Yes | ✗ No (professional) |

| Saxo | 551422 | Up to £85,000 (investments) | ✓ Yes | ✗ No (professional) |

Important: Professional clients retain FSCS protection for eligible investments (up to £85,000) but lose negative balance protection. This means losses can exceed your deposited funds during extreme market events. The FSCS deposit protection limit of £120,000 applies to cash held with authorised banks—check with each broker how client money is held.

68% of retail investor accounts lose money when trading spread bets and CFDs with IG. 60% lose money with Capital.com. 57% lose money with Saxo. Professional accounts carry additional risks due to higher leverage and the absence of negative balance protection.

What Are the Margin Differences Between Retail and Professional Accounts?

The practical impact of professional status shows most clearly in margin requirements. Here’s how a £100,000 forex position compares:

| Account Type | Leverage | Margin Required | Capital Freed |

|---|---|---|---|

| Retail (30:1) | 30:01:00 | £3,333 | — |

| Professional (Capital.com 500:1) | 500:01:00 | £200 | £3,133 |

| Professional (IG 222:1) | 222:01:00 | £450 | £2,883 |

| Professional (Saxo 66:1) | 66:01:00 | £1,515 | £1,818 |

This freed capital can be deployed across additional positions or held as buffer against drawdowns. However, higher leverage also means the same market move produces proportionally larger profits or losses relative to your margin.

When Should You Consider Upgrading to Professional Status?

Professional accounts suit traders who genuinely need the additional leverage and understand the risks involved. Consider upgrading if:

You should consider professional status if:

- You meet at least two of the three eligibility criteria

- You have robust risk management systems in place

- You understand and can absorb potential losses exceeding your deposit

- You need margin efficiency to execute your trading strategy

- You have sufficient capital to withstand drawdowns at higher leverage

You should remain retail if:

- You only meet one eligibility criterion

- You rely on negative balance protection as a safety net

- You’re uncertain about managing positions at higher leverage

- Your trading strategy works within retail margin limits

- You value the additional regulatory protections

Final Thoughts

Capital.com offers professional traders the strongest combination of high leverage (up to 500:1), commission-free* execution, and tangible joining incentives (up to £10,000). For forex and index traders who prioritise margin efficiency and low costs, it represents the best overall value among UK professional trading accounts.

IG provides unmatched instrument coverage and five decades of operational stability, making it the choice for professionals who need access to 17,000+ markets and value established infrastructure. Saxo suits multi-asset professionals who benefit from portfolio-based margin and the ability to use existing investments as collateral.

Before upgrading, ensure you genuinely meet the eligibility requirements and understand the trade-offs—particularly the loss of negative balance protection. Professional status is designed for experienced traders who can manage the additional risks that come with higher leverage.

*other fees may apply.

Trade with Capital.com

Access 5,000+ CFD Markets

- ✓ 0% Commission (Other fees apply)

- ✓ 0.014s Avg. Execution Speed

- ✓ Seamless TradingView Integration

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

FAQs

FAQ 1: How do you qualify for a professional trading account in the UK?

To qualify as an elective professional client, you must meet at least two of three FCA criteria: average of 10 significant-size transactions per quarter over the past year, a financial portfolio exceeding €500,000 (including cash), or at least one year working in financial services in a derivatives-related role. Brokers require documentation to verify your claims—trading statements, bank statements, or employment records depending on which criteria you’re using.

FAQ 2: What protections do you lose with a professional trading account?

Professional traders lose negative balance protection, meaning your account can go below zero and you may owe money beyond your deposit. You may also lose access to the Financial Ombudsman Service for complaints, best execution priority where price is the primary factor, and standardised risk warnings. The loss of negative balance protection is the most significant—during events like the 2015 Swiss franc crash, accounts without this protection accumulated losses exceeding deposited funds.

FAQ 3: How much margin do professional accounts save compared to retail?

Professional status dramatically reduces margin requirements. On a £100,000 forex position, retail accounts at 30:1 leverage require £3,333 margin. Professional accounts at Capital.com (500:1) require just £200—freeing £3,133. IG’s 222:1 leverage requires £450, while Saxo’s 66:1 requires £1,515. This freed capital can fund additional positions or act as a buffer against drawdowns.

FAQ 4: Which UK broker offers the highest leverage for professional traders?

Capital.com offers the highest professional leverage among major UK brokers—up to 500:1 on forex, indices, and commodities, and up to 33:1 on shares. IG provides up to 222:1 on forex and indices. Saxo offers the lowest at 66:1 on forex, though this is offset by portfolio-based margin that calculates requirements across your whole portfolio rather than per-position.

FAQ 5: Can you switch back to a retail account after upgrading to professional?

Yes. Professional status is not permanent—you can request to revert to retail status at any time by contacting your broker. This reinstates negative balance protection, Financial Ombudsman access, and other retail safeguards, but also reapplies ESMA leverage caps (30:1 on major forex, 5:1 on shares). Some traders switch back after completing specific high-leverage strategies or if their risk tolerance changes.

References

Broker Websites (Primary Sources):

- Capital.com UK Professional: capital.com/en-gb/professional – FRN 793714, leverage details, eligibility criteria

- IG UK Professional: ig.com/uk/professional – FRN 195355, margin rates, qualification process

- Saxo UK Professional: home.saxo/en-gb/accounts/pro – FRN 551422, portfolio margin, collateral features

Regulatory Sources:

- FCA Financial Services Register: register.fca.org.uk – Broker authorisation verification

- FSCS Investment Protection: fscs.org.uk/what-we-cover/investments – £85,000 investment compensation limit

- ESMA CFD Measures: Leverage restrictions for retail clients under product intervention powers

Professional account features, leverage limits, and eligibility requirements verified from broker websites, January 2026. Leverage rates are maximum levels and may vary by specific instrument. Professional clients lose certain regulatory protections including negative balance protection.