How Does Spread Betting Work? The Complete UK Guide

Spread betting lets you speculate on financial markets without owning anything — but leverage cuts both ways. This guide walks through the mechanics in plain English, shows you exactly how profits and losses are calculated with real GBP figures, and explains the costs most brokers gloss over. No fluff, no sales pitch — just what you need to know before risking real money.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

What I Wish Someone Had Told Me Before My First Spread Bet

I placed my first spread bet in 2011 on the FTSE 100. I had £500 in my account, bet £2 per point, and watched the index drop 80 points in an afternoon. That was £160 gone — 32% of my account — in about three hours. Nobody had explained to me what leverage actually meant in practice. This guide exists so you don't learn the same way I did.

What is spread betting?

Spread betting is a way to speculate on financial markets without owning anything. You're not buying shares, currency, or gold. You're entering a contract with a broker — a bet on whether a price will rise or fall. Your profit or loss depends on how far the market moves, multiplied by your stake per point.

It's unique to the UK and Ireland. The product doesn't exist in the US or most of Europe because regulators there classify it differently. Here, HMRC treats it as gambling rather than investing, which creates the tax advantages you've probably heard about — but also some limitations I'll cover later.

How do spread betting prices work?

When you open a spread betting platform, you'll see two prices for every market. Take the FTSE 100: you might see 7,500 on the left and 7,502 on the right.

The left number is the sell price (what you'd get if you bet the market will fall). The right is the buy price (what you'd pay if you bet it will rise). The gap between them — two points in this case — is the spread. That's how the broker makes money, and it's your cost of entry.

If you think the FTSE will rise, you "buy" at 7,502. You choose your stake — say, £10 per point. If the index climbs to 7,550 and you close the trade:

7,550 − 7,502 = 48 points in your favour

48 points × £10 = £480 profit

If it drops to 7,450 instead:

7,502 − 7,450 = 52 points against you

52 points × £10 = £520 loss

Notice the loss is larger than the gain for a similar-sized move. That's the spread working against you — you bought at 7,502, not 7,500, so you started two points in the hole.

Do you own the underlying asset?

No. This is where spread betting differs from buying shares through a stockbroker. When you spread bet on Vodafone, you don't own Vodafone shares. There's no entry on a share register, no dividend rights (though most brokers adjust for dividends), no shareholder voting.

The position exists only between you and the spread betting firm. It's a derivative — the price tracks the underlying market, but you're not participating in it directly.

This matters for two reasons. First, it's why profits are currently exempt from Capital Gains Tax — you haven't disposed of an asset because you never owned one. Second, it's why losses can't be offset against gains elsewhere in your portfolio. HMRC doesn't recognise spread betting losses as capital losses. The tax treatment is more nuanced than the "tax-free" marketing suggests.

How Does Leverage Work in Spread Betting?

Leverage is why spread betting can make — or destroy — an account quickly. You don't pay the full value of your position upfront. Instead, you deposit a fraction called margin.

Say you want to bet £10 per point on the FTSE 100 at 7,500. The full position value is £75,000 (7,500 × £10). But FCA rules require only 5% margin on major indices, so you need £3,750 in your account to open this trade.

That's 20:1 leverage. You're controlling £75,000 with £3,750.

Here's where it gets dangerous. Your profit or loss is calculated on the full £75,000, not your £3,750 deposit. A 1% move in the FTSE — just 75 points — means £750 either way. That's a 20% swing on your deposited capital from a 1% market move.

What is margin in spread betting?

Two types matter:

Deposit margin is what you need to open a position. The FCA sets minimums: 5% for major indices, 3.33% for major forex pairs, 10% for commodities, 20% for individual shares. Your broker may require more.

Maintenance margin is what you need to keep the position open. If your account equity drops below this level, you're in trouble.

Different asset classes carry different margin requirements because they carry different risks. A single stock can gap 20% overnight on an earnings miss. The FTSE 100 rarely moves more than 2-3% in a day. The margin reflects that.

What happens if I get a margin call?

When your equity falls below the maintenance requirement — typically 100% of margin — your broker sends a margin call. This is a warning: deposit more funds or reduce your position, or we'll do it for you.

If you ignore it and equity drops further — often to 50% of the margin requirement — the broker closes your positions automatically. You don't get a choice. They'll liquidate at the next available price, which in a fast market might be significantly worse than you'd hoped.

I've been margin called twice. Both times it happened faster than I expected. Markets don't wait for you to check your phone.

Can you lose more than your deposit?

For retail clients with FCA-regulated brokers, no. Negative balance protection means your account can't go below zero. If the market gaps through your stop loss and your position closes at a worse price than your account can cover, the broker absorbs the difference.

This protection doesn't exist for professional clients. If you apply for a professional account to access higher leverage, you're giving up this safety net. You can genuinely owe money.

It also doesn't mean you can't lose your entire deposit. You absolutely can. Negative balance protection stops you owing more — it doesn't stop you losing everything you put in.

Understanding how leverage amplifies risk is essential before risking real money. This is why most experienced traders recommend you practise with a demo account first.

How Much Does It Cost to Hold a Spread Bet Overnight?

This is the cost most beginners overlook. If you hold a position past 10pm UK time, you'll pay overnight funding — sometimes called a "swap" or "financing charge."

The calculation varies by broker, but it typically works like this: your position value × (SONIA + broker markup) ÷ 365.

Let's say you're long £10 per point on the FTSE at 7,500. That's a £75,000 position. If SONIA is 4.5% and your broker adds 2.5%, you're paying 7% annually — or about £14.38 per night.

This is why spread betting suits short-term traders. If you're planning to hold for weeks or months, ask your broker about futures contracts instead. Futures have wider spreads but no daily funding — often cheaper for anything beyond two to three weeks.

Is Spread Betting Actually Tax-Free?

For most retail traders, yes — profits are exempt from Capital Gains Tax and Stamp Duty. But there are exceptions.

If spread betting is your primary source of income, HMRC may classify you as a professional trader. At that point, profits become taxable as income. There's no hard threshold — it's a judgement based on frequency, sophistication, and whether you have other employment.

Trading through a limited company also changes things. The company pays Corporation Tax on profits regardless of whether they came from spread betting.

And remember: because spread betting is classified as gambling, losses aren't recognised as capital losses. You can't offset them against gains from share dealing or other investments.

Why Do Most Spread Bettors Lose Money?

The FCA requires brokers to publish the percentage of retail accounts that lose money. Most report figures between 68% and 74%. That's not a typo — roughly seven in ten accounts end up in the red.

Why? Three structural reasons:

The spread is a headwind. Every trade starts at a loss. You need the market to move beyond the spread just to break even.

Overnight funding compounds. Hold positions for days or weeks and these charges quietly erode your account.

Leverage amplifies mistakes. A 2% market move can wipe out 40% of your capital. Beginners underestimate how quickly this happens.

None of this means spread betting can't be profitable. But it does mean the deck is tilted against casual traders. If you're serious about this, learn day trading fundamentals properly before risking real money. And when you're ready to trade live, we've compared the top spread betting platforms to help you find one that suits your style.

FAQs

Can you lose more than your deposit with spread betting?

Not if you're a retail client with an FCA-regulated broker. Negative balance protection ensures your account can't go below zero. This has been mandatory since the FCA adopted ESMA's intervention measures permanently in August 2019. Professional accounts don't have this protection — losses can exceed deposits.

What's the minimum amount needed to start spread betting?

Most brokers have no formal minimum, but realistically you need enough to meet margin requirements and survive a few losing trades. Starting with less than £500 makes position sizing very difficult. Many traders begin with £1,000–£2,000 to give themselves room for error while learning.

Is spread betting suitable for beginners?

It can be, but only with proper education and risk management. The leverage makes it unforgiving of mistakes. Start with a demo account, trade small when you go live, and never risk money you can't afford to lose. Most successful traders spent months on demo before committing real capital.

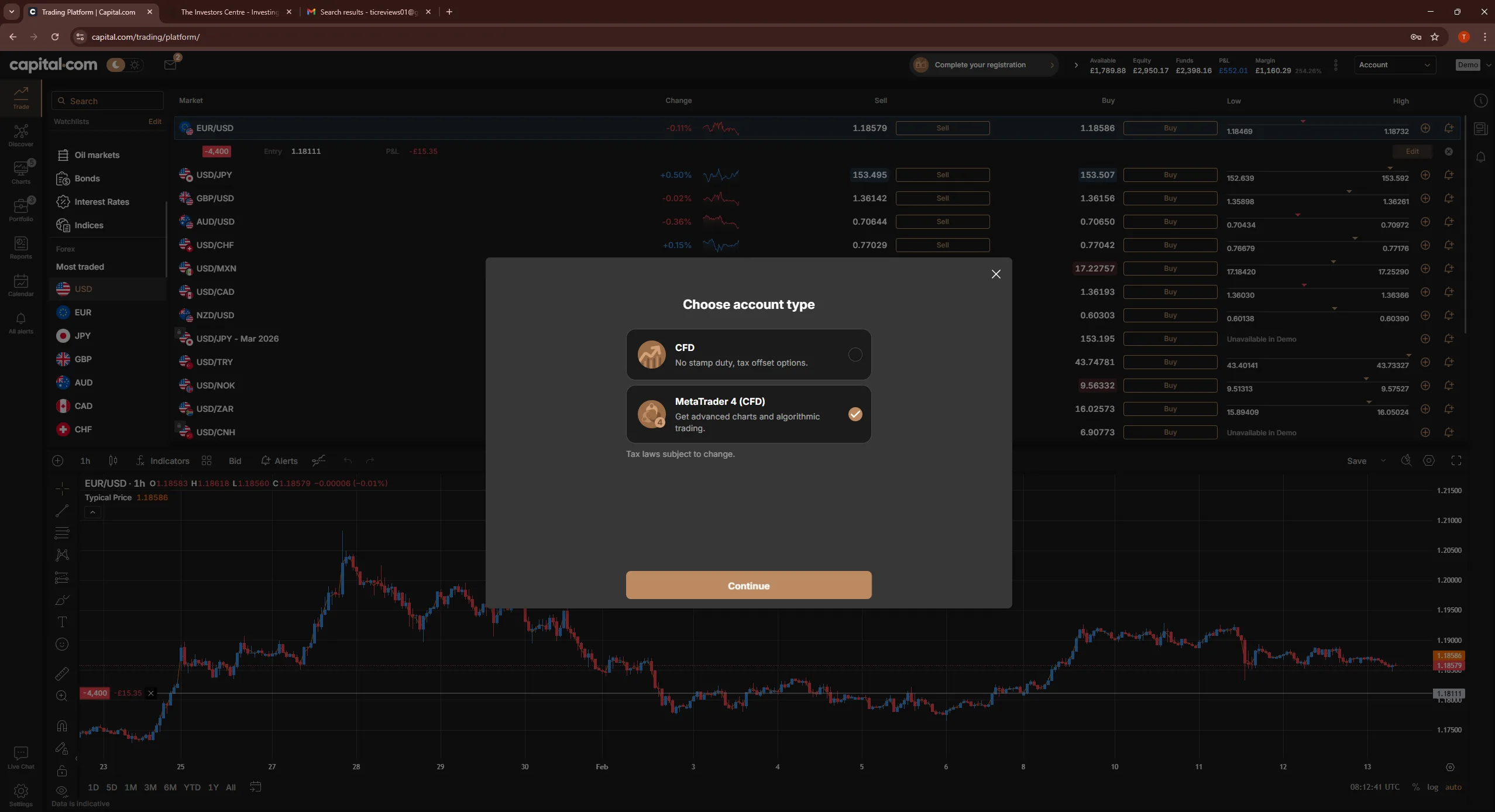

How is spread betting different from CFD trading?

Both are leveraged derivatives, but spread betting is tax-free for UK retail traders while CFD profits are subject to Capital Gains Tax. Spread bets are priced in £ per point; CFDs are priced in contracts. The mechanics are similar — the tax treatment is the key difference. We've written a full comparison of spread betting vs CFDs if you want the detail.

Is spread betting really tax-free in the UK?

For most UK retail traders, yes. HMRC's Capital Gains Manual (CG56100) confirms that no chargeable gains or allowable losses arise from spread betting because no asset is acquired or disposed of. The main exception is if HMRC determines your spread betting constitutes a trade — essentially, if it's your full-time business. In practice, the vast majority of individual spread bettors pay nothing.

References

- HMRC Capital Gains Manual CG56100: Spread Betting — Confirms no chargeable gains or allowable losses arise from spread betting.

- HMRC Business Income Manual BIM22017: Gambling — Clarifies when systematic spread betting may constitute a trade for tax purposes.

- FCA PS19/18: Restricting contract for difference products — Full text of the FCA's permanent leverage caps, margin close-out rules, and negative balance protection requirements.

- Bank of England: SONIA Benchmark — The Sterling Overnight Index Average, the benchmark rate used to calculate overnight financing charges.

- ESMA: Product Intervention Measures — The European Securities and Markets Authority's original intervention measures on CFDs and spread bets, which the FCA adopted permanently.

- FCA: CFD and Spread Betting Performance Data — Aggregated data showing the percentage of retail accounts that lose money across regulated providers.