How to Short a Currency: Step-by-Step Guide for Forex Traders

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are ETF's and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Disclaimers

The information provided in this article is for educational purposes only and does not constitute financial advice. Cryptocurrency trading involves a high risk and may not be suitable for everyone.

Affiliate Disclaimer: This article contains affiliate links. If you make a purchase or sign up through these links, we may receive a commission at no additional cost to you. This helps support our content and keep this site running. We only recommend products and services that we have personally used and believe will add value to our readers.

Quick Answer: To Short a Currency, you’ll need to…

To short a currency, choose a currency pair, analyses market conditions, and open a sell position through your trading platform. You profit if the base currency weakens against the quote currency. Use stop-loss orders and risk management tools to protect your capital.

Shorting currency, or betting that a currency will lose value, is a strategy used by traders to capitalize on market downturns or economic instability. Whether you’re a beginner trying to grasp the fundamentals or an experienced trader looking for more nuanced strategies, this guide will walk you through the entire process of shorting currencies in the forex market. Along the way, I’ll share personal anecdotes from my own trading experience, giving you real-world insights into this exciting but risky strategy.

Featured Platform

Plus 500 - Best for traders seeking leveraged instruments.

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- CFD's

- 20 Million + Users

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is Short Selling in Forex?

Short selling, or “shorting,” in forex is the practice of selling a currency that you don’t own with the expectation that its value will decrease, allowing you to buy it back at a lower price and pocket the difference as profit.

In the forex market, currencies are traded in pairs, meaning when you short one currency, you are simultaneously “long” on the other.

This concept is essential in understanding the dynamics of forex trading, as currency prices fluctuate constantly based on economic factors, geopolitical events, and market sentiment.

Many traders short currencies when they anticipate political instability, economic downturns, or interest rate cuts, which may lead to the devaluation of a specific currency.

How Does Currency Shorting Work?

Shorting currency can be a bit tricky at first glance, but once you understand the mechanics, it becomes much clearer. Here’s how the process typically works:

- Identify a Currency Pair: In forex, currencies are traded in pairs. When shorting, you bet that the base currency (the first currency in the pair) will depreciate against the quote currency (the second currency). For example, if you’re shorting GBP/USD, you’re betting that the British pound will fall in value relative to the US dollar.

- Sell the Base Currency: When you short a currency, you’re essentially borrowing the base currency to sell at the current market rate. This sale happens automatically on most trading platforms.

- Wait for Depreciation: After selling the base currency, you wait for its value to decrease. This is where strategy, market analysis, and timing come into play. You need to be confident that the currency will fall, or else you risk losing money.

- Buy Back the Currency at a Lower Price: Once the value drops, you buy back the base currency at the lower price, closing the trade. The difference between the selling price and the repurchase price is your profit (or loss if the currency increases in value).

Here’s a quick table that summarizes the steps:

| Step | Action |

|---|---|

| 1. Identify a Currency Pair | Choose a pair where you expect the base currency to fall |

| 2. Sell the Base Currency | Sell the base currency at the current market rate |

| 3. Wait for Depreciation | Monitor the market and wait for the base currency to fall |

| 4. Buy Back the Currency | Repurchase the base currency at a lower price |

Personal Anecdote:

One of the first successful currency shorts I made was during a period of political uncertainty in the UK, just before the 2016 Brexit vote. The pound was fluctuating wildly, and based on the market sentiment and news analysis, I decided to short GBP/USD. Within days of the vote, the pound dropped sharply, and the profits I made were substantial. However, the experience taught me a vital lesson: shorting is not without risks. Had the vote gone the other way, the pound could have surged, and my loss would have been equally significant.

Step-by-Step Guide to Shorting Currency

To successfully short a currency, it’s important to follow a structured approach. This section will guide you through the critical steps involved, from researching the right currency pairs to managing your risk effectively.

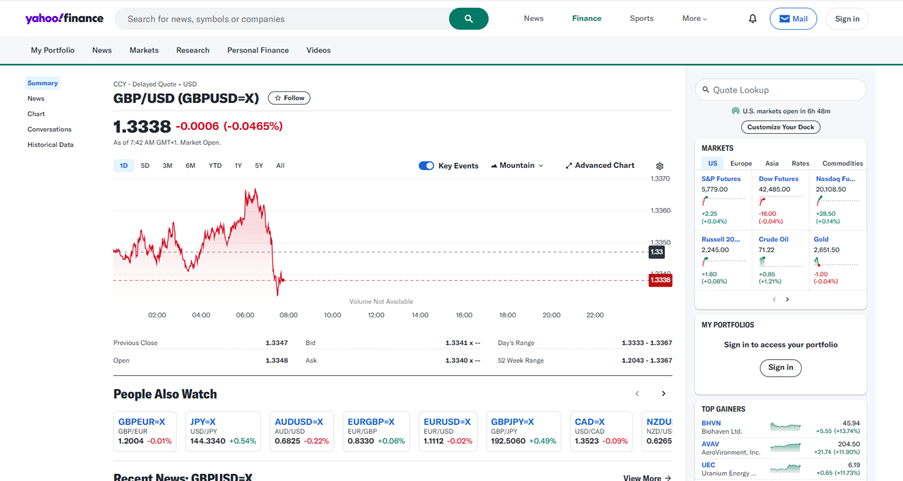

Step 1 – Research Currency Pairs

The first and arguably most important step in shorting a currency is selecting the right currency pair. Each pair represents a unique economic relationship between two countries, and understanding the market forces at play is crucial.

Start with Major Pairs: As a beginner, it’s wise to start with major currency pairs like EUR/USD, GBP/USD, or USD/JPY. These pairs are highly liquid, meaning there’s a lot of activity, which helps you enter and exit trades with ease.

Look at Economic Indicators: Focus on factors like interest rates, inflation, and GDP growth. These metrics provide clues about the health of a currency’s economy. For example, if a country’s central bank is cutting interest rates, it could signal weakness, making it a good candidate for shorting.

Consider Political Stability: Political events, like elections or policy changes, often lead to significant currency fluctuations. This was evident during the Brexit referendum when the pound dropped significantly due to market uncertainty.

Step 2 – Perform Technical and Fundamental Analysis

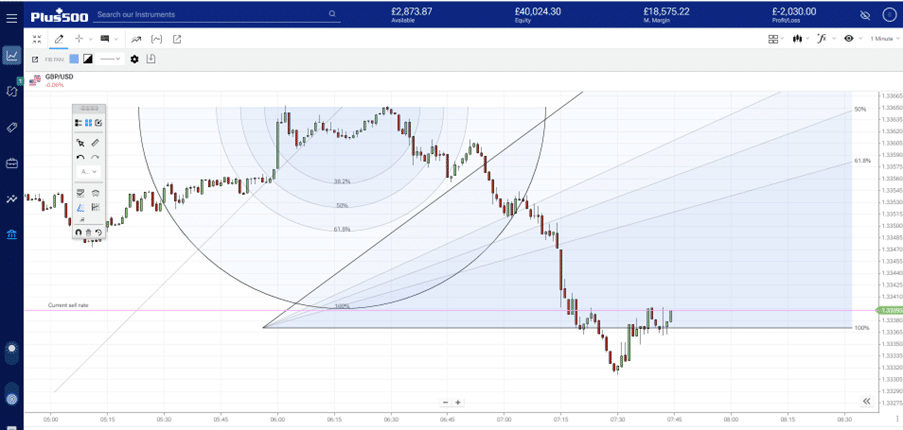

Once you’ve selected a currency pair, the next step is to analyse the market. Both technical and fundamental analysis are key components of this process.

Technical Analysis: This involves analysing historical price data and using charts to predict future movements. Tools like moving averages, Bollinger Bands, and trend lines can help you identify when a currency is overbought or oversold. For example, if a currency pair consistently hits resistance levels and fails to break through, it could be a signal to go short.

Fundamental Analysis: This involves looking at economic reports, news, and financial data to evaluate the strength of a currency. If you believe a country’s economy is heading for a downturn, that currency may lose value, making it a good candidate for shorting.

Table: Key Technical and Fundamental Analysis Tools

Analysis Type | Key Tools | What to Look For |

Technical | Moving Averages, RSI, Fibonacci Retracement | Trends and overbought/oversold conditions |

Fundamental | GDP Growth, Inflation Rates, Central Bank Policies | Economic weakness or strength that might impact currency value |

Step 3 – Choose a Trading Strategy

There are different ways to short a currency, depending on your risk appetite and trading style. The most common methods are spread betting and CFDs (Contracts for Difference).

Spread Betting: In spread betting, you speculate on the direction of a currency pair without actually owning the underlying asset. Your profit or loss depends on how far the market moves in your favor or against you. Spread betting is popular in the UK due to its tax-free profits for individual traders.

CFDs: With CFDs, you enter into a contract to exchange the difference in the currency’s price from when you open the trade to when you close it. CFDs allow you to use leverage, which can amplify both profits and losses.

Step 4 – Open a Forex Trading Account

Plus 500

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- CFD's

- 20 Million + Users

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

To execute short trades, you’ll need a trading account with a forex broker that offers the ability to short currency pairs. Here’s how to get started:

Step-by-Step to Opening an Account:

- Choose a Broker: Research and select a broker that offers the Forex trading instruments you’re interested in. Ensure the broker offers the necessary tools and leverage options for shorting forex.

Look for brokers regulated by reputable authorities like the FCA or SEC. Look for low spreads, good leverage options, and a user-friendly trading platform. Platforms like Plus 500, IG or eToro. - Register an Account: Sign up with your personal details. You’ll need to provide identification and proof of address.

- Verify Your Identity: Most brokers require ID verification to comply with regulations. This is typically done by uploading a scanned copy of your ID and a utility bill or bank statement.

- Fund Your Account: Deposit the minimum trading capital into your account using your preferred payment method (bank transfer, credit card, etc.).

- Start Trading: Once funded, you can start trading. Many brokers also offer demo accounts to practice without risking real money.

Demo Accounts: Why They Matter

Before diving in with real money, using a demo account is highly recommended. Demo accounts allow you to practice trading in a simulated environment with virtual funds. This helps you:

- Test your strategies without financial risk.

- Get comfortable with the trading platform’s interface.

- Learn how different markets react in real-time.

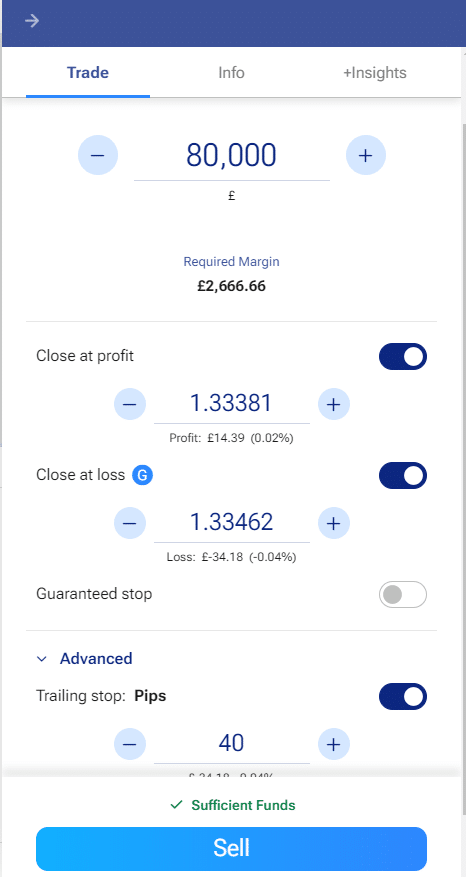

Risk Management Tools and Leverage

Risk management is vital in any trading strategy, but even more so when shorting currencies because potential losses can be unlimited if the currency appreciates instead of depreciating.

Leverage: Forex trading often involves leverage, which allows you to control larger positions with a smaller capital investment. While this can magnify gains, it also increases the risk of substantial losses. Always be cautious with the amount of leverage you use.

Stop-Loss Orders: A stop-loss order automatically closes your position if the market moves against you by a specified amount. This prevents larger losses than you’re prepared to take.

Position Sizing: Always risk a small percentage of your capital on any single trade—usually no more than 1-2%—to ensure that one bad trade doesn’t wipe out your account.

Trailing Stops: These automatically adjust your stop-loss level as the market moves in your favor, locking in profits while protecting your position against a sudden reversal.

Table: Risk Management Tools

Tool | Purpose |

Leverage | Amplifies exposure but increases potential loss |

Stop-Loss Orders | Limits potential losses by closing positions automatically |

Position Sizing | Helps control risk by managing the amount invested in each trade |

Example of Risk Management:

Suppose you short GBP/USD at 1.3330 with a 40-pip trailing stop. If GBP/USD drops to 1.3290, your stop-loss will automatically shift to 1.3310, locking in 20 pips of profit, while still allowing you to benefit from further downward movement.

Real-World Examples of Shorting Currency

Sometimes the best way to understand a concept is through real-world examples. Below, we’ll look at two iconic moments in currency shorting history that showcase how this strategy works in practice.

Shorting the Pound Before Brexit

The 2016 Brexit referendum was a prime example of how political events can lead to massive fluctuations in currency markets. As the UK moved closer to the referendum date, uncertainty around its future in the European Union caused the pound to wobble.

Traders who anticipated that the vote would lead to the UK leaving the EU, and thus a sharp devaluation of the pound, made huge profits. One such example is George Soros, who famously shorted the pound prior to the vote.

- Scenario: In June 2016, GBP/USD was trading around 1.48, but following the referendum, it plummeted to 1.32 within a week.

- Potential Trade: If a trader had shorted GBP/USD at 1.48, expecting the pound to fall, they would have profited significantly as the pound dropped by around 1,600 pips in a very short time.

Andy Krieger and the New Zealand Dollar

One of the most legendary examples of shorting currency is Andy Krieger’s famous bet against the New Zealand dollar (NZD) in 1987. Krieger, a trader at Banker’s Trust, recognized that the NZD was significantly overvalued following the global stock market crash of “Black Monday.”

- Scenario: Krieger used aggressive shorting techniques to sell NZD to the point that his position was so large it exceeded the money supply of New Zealand. The pressure Krieger put on the NZD caused it to collapse rapidly, and he made his company hundreds of millions of dollars in profit.

- Takeaway: Krieger’s trade shows the importance of recognizing when a currency is overbought and ripe for shorting. It also demonstrates the power of market sentiment and how traders can influence currency prices.

Advanced Strategies for Shorting Currency

Once you’ve mastered the basics of shorting currency, it’s time to dive into more advanced strategies that can help maximize your gains and manage risks in different market conditions. Here are two key approaches: scalping and high-frequency trading and hedging risks with options and futures.

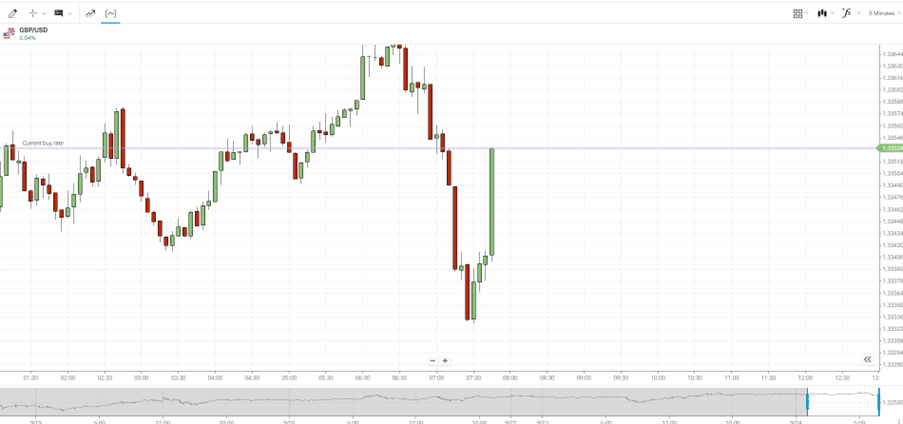

Scalping and High-Frequency Trading

Scalping is a strategy where traders aim to profit from small price movements over short periods. This can involve opening and closing multiple positions within minutes, sometimes even seconds. Scalpers rely on quick trades to accumulate incremental profits, which can add up over time.

- How It Works: Scalping requires constant monitoring of the market, as trades are usually made on minor price fluctuations. Traders often use technical indicators such as moving averages, Bollinger Bands, or RSI (Relative Strength Index) to identify entry and exit points.

- Currency Pair Selection: Scalping works best with highly liquid currency pairs, such as EUR/USD or GBP/USD, because liquidity ensures smaller spreads and more frequent price movements.

High-frequency trading (HFT) is an automated version of scalping that uses sophisticated algorithms to execute hundreds or thousands of trades in milliseconds. While HFT is typically used by institutional traders, individual traders can use automated systems or trading bots to take advantage of this approach.

- My Experience: When I first experimented with scalping, I found it to be a highly intense strategy that required discipline and focus. One of the biggest challenges was managing emotions, as rapid trades can tempt you to take unnecessary risks. However, the small, consistent gains were rewarding when combined with a solid exit strategy.

What are the Pros and Cons to Scalping

- Quick profits from small price movements

- Reduced exposure to market changes

- High liquidity pairs offer frequent opportunities

- Requires constant attention to the market

- Transaction costs can add up with frequent trades

- Emotionally demanding and can lead to burnout

Hedging Risks with Options and Futures

Hedging is an advanced strategy used to protect against potential losses. In the context of forex trading, hedging involves using options or futures contracts to offset the risks of shorting currency.

Options: Options give you the right (but not the obligation) to buy or sell a currency at a specific price before a set expiration date. When shorting a currency, you can buy a put option to sell the currency at a higher price if the market doesn’t move in your favour.

For example, if you’re shorting EUR/USD and the euro starts to gain strength unexpectedly, holding a put option on the euro can limit your losses.

Futures: Futures contracts obligate you to buy or sell a currency at a predetermined price on a specific future date. This allows traders to lock in profits or hedge against unfavourable price movements. If you short a currency, you can use futures to guarantee the purchase price at a later date, reducing the risk of market volatility.

My Experience: Using futures to hedge short positions has helped me protect against market swings, especially during times of major political or economic events. One time, I shorted GBP/USD, but political news in the UK sent the pound unexpectedly higher. Fortunately, my futures contract mitigated a potential large loss.

Table: Hedging with Options vs. Futures

Hedging Tool | How It Works | Best Use Case |

Options | Right (not obligation) to buy/sell at a set price | Flexibility in uncertain markets |

Futures | Obligation to buy/sell at a set price | Lock in prices during volatile market period

|

Conclusion and Takeaways

Shorting currency can be a highly rewarding strategy when executed with proper planning, analysis, and risk management. Whether you are using spread betting, CFDs, or another method, understanding the mechanics of the forex market and staying informed about economic events is crucial to success. Here are the key takeaways:

Research and Analysis: Always conduct thorough research on currency pairs and apply both technical and fundamental analysis to identify the best shorting opportunities.

Choose the Right Strategy: Select a trading strategy that fits your risk tolerance and trading goals, whether it’s spread betting, CFDs, or another method.

Risk Management: Use tools like stop-loss orders, trailing stops, and position sizing to protect your capital, especially when trading with leverage.

Stay Informed: Keep an eye on global economic trends, central bank policies, and geopolitical events, all of which can impact currency values and your short positions.

By following these steps and continuously learning, you can improve your skills in shorting currency while mitigating risks. Remember, success in forex trading is as much about protecting your capital as it is about making profits.

Ready to start trading? Open a live account or try out a demo to build confidence and test your strategies in a risk-free environment.

Plus 500 - Best for traders seeking leveraged instruments.

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- CFD's

- 20 Million + Users

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQ

How Much Money Can You Lose Shorting Currency?

When shorting currency, your potential losses are theoretically unlimited, as a currency can rise indefinitely. If the market moves against your position, losses can quickly accumulate, especially when using leverage. Always use stop-loss orders and risk management tools to limit potential losses.

Can I Short Currency Without Leverage?

Yes, you can short currency without leverage, but it requires more capital. Without leverage, your potential profits and losses are directly tied to the amount invested. While this reduces risk, it also limits the size of your returns compared to leveraged trades.

How Do Interest Rates Affect Currency Shorts?

Higher interest rates strengthen a currency, while lower rates weaken it. If a central bank raises rates, the currency may appreciate, negatively impacting short positions. Conversely, rate cuts can cause a currency to decline, benefiting short positions. Monitoring central bank policies is crucial when shorting currencies.

References

Investor.gov – Foreign Currency Exchange (Forex) Trading for Individual Investors

https://www.investor.gov/introduction-investing/investing-basics/investment-products/foreign-currency-exchange-forex-trading-individual-investorsCFTC – Customer Advisory: Eight Things You Should Know Before Trading Forex

https://www.cftc.gov/LearnAndProtect/AdvisoriesAndArticles/forexadvisory.htmlCFTC – Foreign Currency Trading

https://www.cftc.gov/IndustryOversight/Intermediaries/ForeignCurrencyTrading/index.htmSEC – Foreign Currency Transactions

https://www.sec.gov/oiea/investor-alerts-bulletins/ib_forex.htmlInvestor.gov – Understanding Forex Trading Risks

https://www.investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletins/investor-bulletin-foreign-currency

Related Blogs

Start Your Trading Journey Today with Plus500

81% of retail CFD accounts lose money.