What Is Leverage in Trading? The Maths, the Risks, and What the FCA Limits Actually Mean

Leverage lets you control positions worth far more than your deposit — but the maths cuts both ways. This guide walks through full GBP worked examples, explains every FCA leverage cap by asset class, and covers the overnight costs and margin call mechanics that most guides gloss over.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

How Leverage Actually Works (and Why Most Explanations Get It Wrong)

Leverage is the reason a trader with £500 can open a position worth £15,000. It's also the reason that same trader can lose their entire deposit before lunch.

I've watched it happen — not to anonymous forum users, but to people I've spoken with directly. They open an account, see "30:1 leverage" listed next to GBP/USD, and assume it's a feature designed to help them. In a sense it is. But it's a feature that works identically in both directions, and most beginners don't run the numbers until it's too late.

Here's the core of it. When you trade with leverage, your broker lends you the difference between what you deposit and the full size of your position. Your deposit — called margin — acts as collateral. If you put down £500 and trade at 30:1, you're controlling a position worth £15,000. Your broker is fronting the other £14,500. You don't receive that money. You can't withdraw it. But your profit or loss is calculated on the full £15,000 as though it were yours.

That's the mechanic that catches people. A 1% move on a £15,000 position is £150. On a £500 account, that's a 30% swing — in either direction. Without leverage, that same £500 exposed to a 1% move would gain or lose £5. Leverage didn't change the market. It changed what the market does to your account.

The formula is straightforward:

Leverage Ratio = Total Position Size ÷ Margin Deposited

So 30:1 means you need 3.33% of the position's value as margin. 20:1 means 5%. 5:1 means 20%. The higher the ratio, the less capital you need upfront — and the faster your account moves.

In the UK, the Financial Conduct Authority caps leverage for retail traders. You won't find 100:1 or 500:1 at any FCA-regulated broker, no matter what offshore firms might advertise on social media. The FCA introduced permanent restrictions in August 2019 after years of data showing that higher leverage was directly linked to larger retail losses. Those limits aren't arbitrary — they're calibrated to the volatility of each asset class, and they exist because the regulator's own analysis showed that uncapped leverage was causing measurable financial harm to hundreds of thousands of UK consumers every year.

I'll break down the exact limits, the maths behind a real GBP/USD trade from entry to margin call, and the overnight costs that quietly eat into leveraged positions — all with specific figures rather than vague warnings. If you're already getting started with day trading or considering forex, understanding leverage isn't optional. It's the single most important concept standing between a funded account and a blown one.

Most guides tell you leverage "magnifies gains and losses" and leave it there. That sentence is technically correct and practically useless. What matters is knowing exactly how many pips it takes to wipe your margin, what your broker does when it happens, and how to size your positions so it doesn't.

FCA Leverage Limits for UK Retail Traders — the Full Breakdown

The FCA doesn't let retail traders choose their own leverage. Since August 2019, every FCA-regulated broker must cap leverage based on the asset you're trading.

| Asset Class | Max Leverage | Margin Required | £100 Controls |

|---|---|---|---|

| Major forex pairs EUR/USD · GBP/USD · USD/JPY · USD/CHF |

30 : 1 | 3.33% | £3,000 |

| Minor forex · Gold · Major indices EUR/GBP · XAU/USD · FTSE 100 · S&P 500 |

20 : 1 | 5% | £2,000 |

| Other commodities · Minor indices Crude oil · Silver · Natural gas |

10 : 1 | 10% | £1,000 |

| Individual shares Tesla · Apple · Shell · Barclays |

5 : 1 | 20% | £500 |

| Cryptocurrency CFDs Bitcoin · Ethereum · All crypto derivatives |

BANNED (retail) | N/A | Not available |

These numbers weren't picked at random. The FCA's policy statement PS19/18 laid out the evidence: at higher leverage ratios, retail clients weren't just losing more often — they were losing more money per trade. The regulator's own analysis found that its leverage restrictions and negative balance protection prevent nearly 400,000 people per year from risking more than their original stake, providing between £267m and £451m of annual consumer protection. That's not a theoretical benefit. That's measured harm that isn't happening because the caps exist.

Negative balance protection is the other piece. Under FCA rules, your account cannot go below zero. If a market gaps through your stop-loss overnight — say sterling drops 3% on unexpected political news — your broker absorbs the loss beyond your deposited funds. Before these rules, traders routinely owed their brokers money after flash crashes. The Swiss franc event in January 2015 left retail traders across Europe owing millions to brokers who'd offered 200:1 and 400:1 leverage.

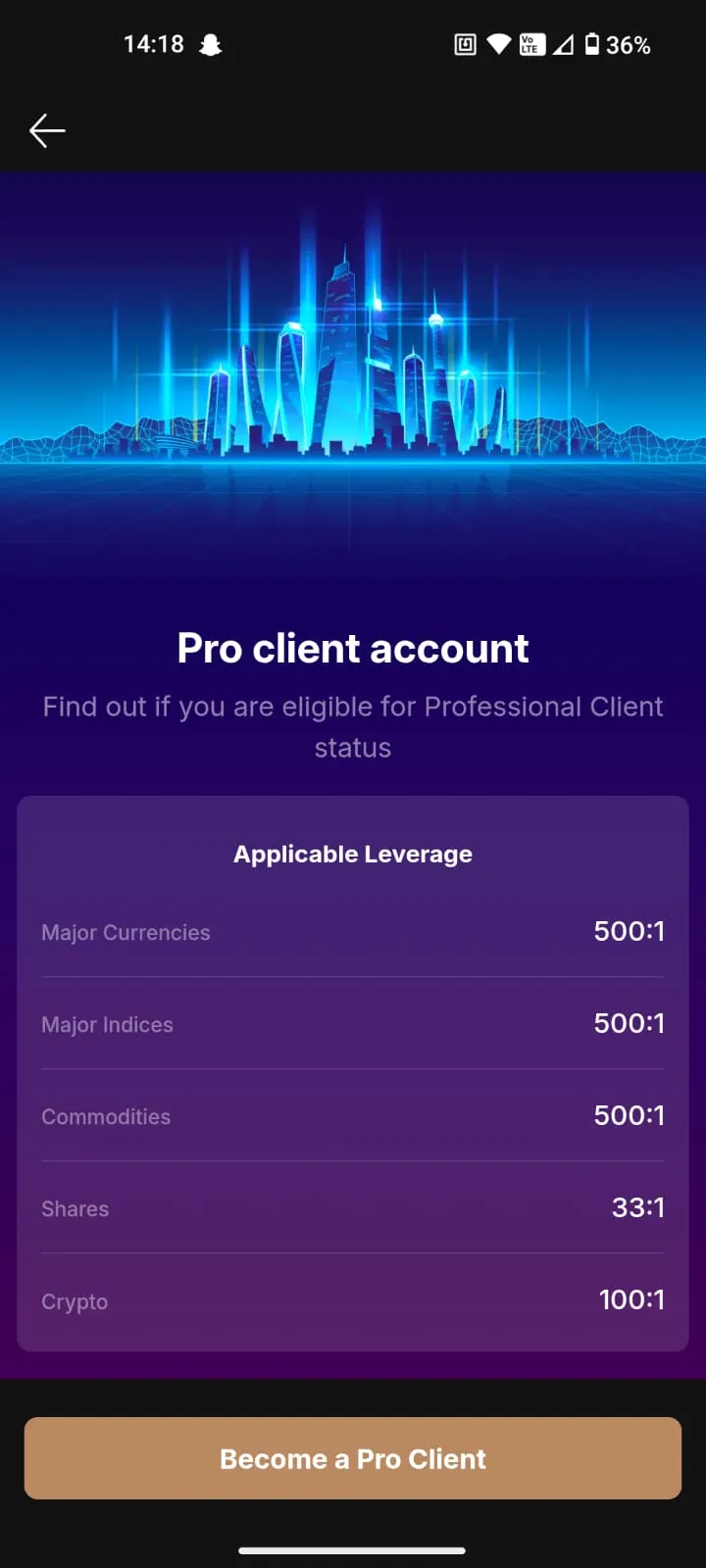

Some brokers will push you toward a professional account, which removes the leverage cap entirely. The FCA has specifically warned against this. Professional classification strips your negative balance protection, removes the standardised risk warnings, and takes you outside the 50% margin close-out rule. You might get 200:1 leverage, but you also lose every safety net that exists precisely because retail traders kept blowing up at those ratios.

A £500 GBP/USD Trade — Worked Example From Open to Margin Call

Here's where it gets concrete. You deposit £500 into an FCA-regulated account and decide to trade GBP/USD at 30:1 leverage.

Your maximum position size: £500 × 30 = £15,000 exposure. At a GBP/USD rate of roughly 1.2600, that's approximately $18,900 — just under two mini lots.

If you understand what a pip is worth, you'll know that on a position this size, each pip movement is worth roughly £1.19.

| Scenario | Pip Move | P&L | Account Effect |

|---|---|---|---|

| Trade goes right | +50 pips | +£59.50 | +11.9% return from a <0.4% move |

| Trade goes wrong | −50 pips | −£59.50 | −11.9% loss from the same move |

| Margin call zone | −210 pips | −£250 | 50% close-out — broker auto-liquidates |

Now here's what most guides skip. Your broker doesn't wait for your account to hit zero. Under FCA rules, when your equity drops to 50% of your required margin, your broker closes your position automatically. On this trade, your margin requirement is £500 (the full deposit). The 50% close-out triggers when your equity falls to £250 — meaning you've lost £250 of your £500.

At £1.19 per pip, it takes roughly 210 pips to hit that close-out level. On GBP/USD, a 210-pip move can happen inside a single volatile session — an unexpected Bank of England decision, a US non-farm payrolls shock, or a geopolitical headline outside market hours.

If you opened this same trade using lower leverage — say 10:1 instead of 30:1 — your position would be £5,000 instead of £15,000. Each pip would be worth roughly £0.40. A 210-pip adverse move would cost you £84 instead of £250. Same market, same account, completely different outcome. That's why practising with a demo account before committing real capital isn't just sensible advice — it's the only rational way to learn how leverage behaves under pressure.

The Hidden Cost Nobody Mentions — Overnight Financing in GBP

Every leveraged position held past the end of the trading day incurs an overnight financing charge. Your broker lent you money; they charge interest on it.

The standard formula across most UK brokers is SONIA (the Sterling Overnight Index Average) plus a markup — typically 2.5% to 3% annually for long positions. On a £15,000 leveraged position with a combined rate of roughly 7.5% per annum, the daily charge works out to approximately:

£15,000 × 7.5% ÷ 365 = £3.08 per day

That's £21.58 per week. £92.47 per month. On a £500 account, holding a fully leveraged position for a month costs you roughly 18.5% of your account in financing alone — before the market moves a single pip.

This is the silent killer for beginners who open leveraged forex positions and hold them for days or weeks, treating them like investments. They aren't investments. They're leveraged derivatives with a daily cost of carry. If your position isn't moving meaningfully in your favour, the overnight charges are draining your equity while you wait.

The cost differs between spread betting and CFD accounts. Both use leverage identically, but the financing calculation may vary slightly by broker. More importantly, the tax treatment is different — spread betting profits are currently tax-free in the UK, while CFD profits fall under Capital Gains Tax. If you're weighing up which structure to use for leveraged trading, that distinction matters. We've covered this in detail in our spread betting vs CFDs comparison.

How to Choose the Right Leverage for Your Account Size

Maximum leverage and appropriate leverage are rarely the same number. The FCA allows 30:1 on major forex pairs. That doesn't mean you should use it.

The decision starts with a question most beginners never ask: how much of my account am I willing to lose on a single trade? Professional risk management convention puts this at 1-2% per trade. On a £2,000 account, that's £20 to £40 of acceptable loss.

Work backwards from there. If your stop-loss on a GBP/USD trade is 40 pips, and you're risking £40 maximum, your position size should be roughly £1 per pip — which translates to a position of approximately £10,000. That's 5:1 effective leverage on a £2,000 account. Not 30:1. Not even close.

The trap is thinking in ratios rather than pounds. A beginner with £1,000 who uses 30:1 leverage controls £30,000 of market exposure. A 1% adverse move — completely routine on any given Tuesday — costs them £300. That's 30% of their account gone from a move that barely registers on a chart. Run that scenario twice in a week and the account is functionally dead.

I'd rather see someone trade at 3:1 or 5:1 leverage and stay in the market for six months than watch them use 30:1 and blow their account in a fortnight. Survival beats performance every time when you're learning. The traders who eventually become profitable are the ones who lasted long enough to develop an edge — not the ones who swung for maximum exposure on day one.

If you're building a day trading strategy or considering your first live forex trade through an FCA-regulated broker, start with leverage well below the cap. You can always increase it later when your risk management is tested and your position sizing is second nature.

Common Leverage Mistakes That Blow Accounts

Using maximum leverage on every trade. This is the default for most beginners because brokers set the maximum automatically. Change it. Manually reduce your position size so your effective leverage matches your risk tolerance, not your broker's ceiling.

Ignoring correlation. Going long on EUR/USD and GBP/USD simultaneously at full leverage isn't two separate trades — it's one oversized bet that the dollar weakens. If the dollar strengthens, both positions lose in tandem and your margin evaporates twice as fast.

Holding leveraged positions over weekends. Markets can gap significantly between Friday's close and Monday's open. Your stop-loss doesn't protect you during a gap. On high leverage, a 100-pip weekend gap on forex can do serious damage to a small account.

Treating leverage as free money. It isn't. Every penny of that borrowed exposure carries an overnight cost, and every pip of adverse movement hits your equity harder than it would on an unleveraged trade. The market doesn't know or care what leverage you're using. Your account balance does.

FAQs

Can you lose more than your deposit when trading with leverage in the UK?

Not if you're trading with an FCA-regulated broker. Negative balance protection has been mandatory since August 2019. Your account can't go below zero. This protection doesn't apply if you hold a professional trading account or trade through an offshore broker outside FCA jurisdiction.

What leverage should a beginner use?

Far less than the maximum. Most experienced traders recommend effective leverage of between 2:1 and 5:1 for anyone in their first year of live trading. The FCA cap of 30:1 on major forex is a ceiling, not a target. Starting low gives you room to survive losing streaks while you develop consistency.

Is leverage the same as margin?

They're connected but different. Leverage is the ratio of your total position to your deposited capital — it describes how much exposure you're getting. Margin is the actual cash you put down to open the trade. A 30:1 leverage ratio means you need 3.33% margin. One describes the multiplier, the other describes the deposit.

Does leverage cost money?

Yes. Any leveraged position held overnight incurs a financing charge — your broker charges interest on the borrowed capital. On long positions, this is typically SONIA plus 2.5-3% at most UK brokers. The charge is small per day but compounds meaningfully over weeks. This is why leveraged trading suits short-term strategies rather than buy-and-hold.

Can you trade without leverage?

Yes. You can buy shares outright through an investment account or ISA with no leverage at all — a 1:1 ratio. Some brokers also let you set leverage to 1:1 on CFD and spread betting accounts, though this removes most of the capital efficiency that makes those products useful. If leverage makes you uncomfortable, unleveraged investing through a stocks and shares ISA is a perfectly valid approach. We've compared the top platforms if you want to explore that route.

References

- FCA PS19/18: Restricting contract for difference products sold to retail clients — Full text of the FCA's permanent CFD and spread betting restrictions, including leverage caps, the 50% margin close-out rule, and negative balance protection.

- FCA Press Release: Permanent restrictions on CFDs and CFD-like options (1 July 2019) — Summary of the rules effective 1 August 2019.

- FCA: Warns investors in CFDs risk losing out on protections (October 2025) — Source for the £267m–£451m annual consumer protection figure and 400,000 retail clients protected.

- HMRC: Spread Betting Tax Treatment (BIM22017) — HMRC guidance on the tax treatment of spread betting profits and losses.

- Bank of England: SONIA Benchmark — Official source for the Sterling Overnight Index Average used to calculate overnight financing charges.