How to Buy Crypto on Uphold in the UK (2026)

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: To buy Crypto on Uphold, you’ll need to…

You can buy crypto on Uphold by creating an account, completing identity verification, selecting a cryptocurrency such as Bitcoin, choosing a payment method (like a bank transfer or debit card), and confirming the transaction. The process is designed to be beginner-friendly, FCA-compliant for UK users, and usually takes less than 10 minutes to complete.

Author Comments

I’ve used Uphold since 2020, and what stands out is its simplicity. You can buy crypto with GBP in minutes — no jargon, no hidden fees. While not the cheapest, it’s one of the most accessible ways for UK investors to start their crypto journey. – Thomas Drury

Quick Guide

| Step | Action | Description |

|---|---|---|

| 1 | Sign Up | Visit Uphold.com or download the app, then create an account with your email and ID verification. |

| 2 | Deposit GBP | Fund your account using Open Banking or debit card (bank transfers are free). |

| 3 | Choose a Crypto | Pick from 260+ coins — e.g. Bitcoin, Ethereum, or XRP. |

| 4 | Enter Amount | Type the GBP amount you want to invest; Uphold shows live pricing and spreads. |

| 5 | Confirm Trade | Review, preview, and confirm. Your crypto appears instantly in your wallet. |

Uphold Overview

Uphold lets UK users buy, sell, and hold over 260 cryptocurrencies through a user-friendly app or browser dashboard. This step-by-step guide explains how to set up your account, fund it with GBP or crypto, and complete your first Uphold crypto purchase quickly and securely.

- Minimum Deposit: No fixed minimum (trade from as little as £1 / $1)

- Buy, sell, and swap Bitcoin, Ethereum, and over 250 assets including stocks and metals

- Regulated in the US and serving over 10 million users globally

- Intuitive app and desktop platform with integrated multi-asset wallets

- Great for investors looking to diversify across crypto, stocks, and precious metals easily

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Step-by-Step Guide to Buying Crypto on Uphold

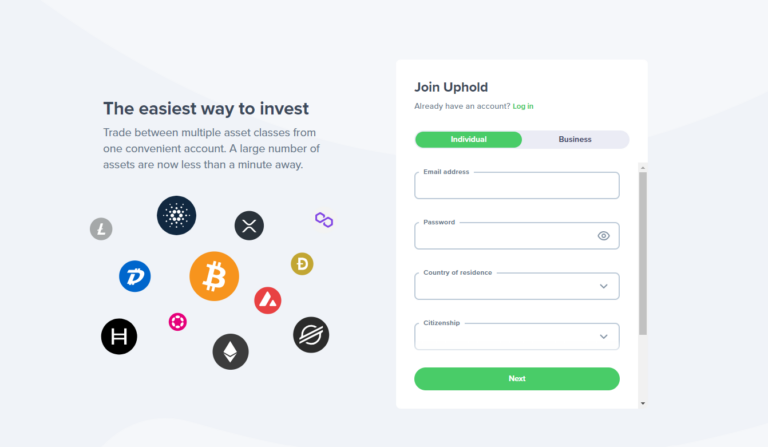

Step 1: Log in or Sign Up to Your Uphold Account

To buy crypto, visit Uphold.com or download the app. Click “Sign Up” and enter your name, email, and password. UK users must verify their identity by submitting photo ID and a selfie. Once verified, log in using secure two-factor authentication to access your dashboard.

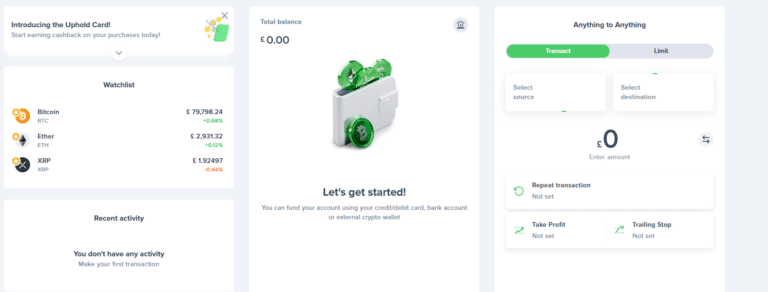

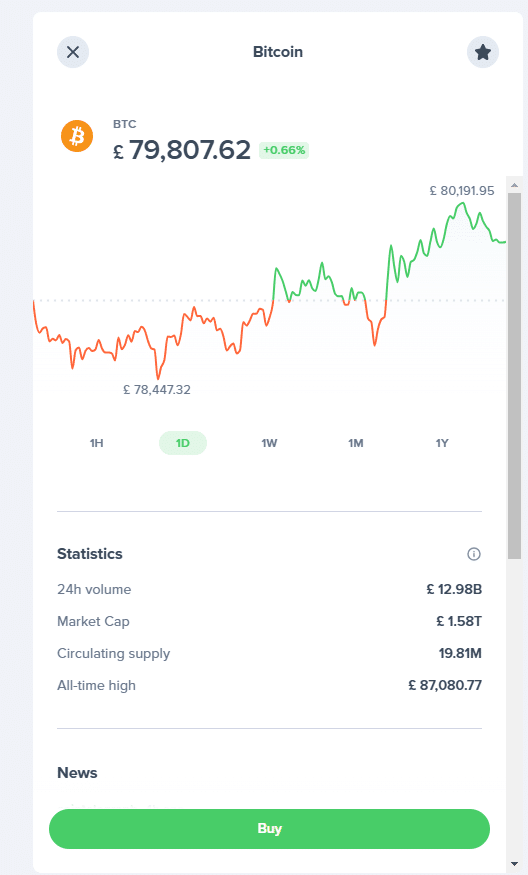

Step 2: Choose the Cryptocurrency You Want to Buy

Navigate to “Transact” and search or browse for your preferred crypto—like Bitcoin, Ethereum, or XRP. Uphold supports 260+ assets. Select the coin, and the platform will display the live rate, asset chart, and purchase options. Choose the one you want to buy.

Step 3: Select Your Funding Method (GBP or Crypto)

Select your funding source: UK bank transfer (via Open Banking), debit card, or existing crypto balance. Uphold allows direct GBP-to-crypto purchases. Crypto deposits are also supported. Each method shows expected costs, and all options are FCA-compliant for UK users.

Step 4: Enter the Amount and Review the Order

Input the amount in GBP or crypto. Uphold auto-calculates the equivalent based on current pricing, including spread-based fees. You’ll see the full cost breakdown, asset details, and final conversion rate. Carefully review everything before proceeding. No advanced order types like limits are available.

Step 5: Confirm the Purchase and Monitor Holdings

Click “Preview Trade,” then confirm the transaction. Your crypto appears instantly in your Uphold portfolio. From the dashboard, you can monitor price changes, set recurring buys, convert to other assets, or withdraw. All crypto is stored in Uphold’s custodial wallet with 24/7 access.

What Are Some Additional Tips for Using Uphold?

What Is Uphold and How Does It Work?

Uphold is not just a Crypto Exchange, it is a multi-asset trading platform that supports crypto, precious metals, and fiat currencies. It lets users buy, sell, convert, and withdraw assets instantly. Uphold’s “anything-to-anything” system allows seamless conversions, such as GBP to Bitcoin or gold to Ethereum, all within one interface.

How User Friendly Is Uphold?

Uphold is designed for simplicity. Its interface is clean, fast, and mobile-optimized. Users can buy crypto in a few taps, view portfolio charts, and automate recurring purchases. Both new and experienced traders find it intuitive, with clearly labeled tabs and minimal distractions.

Is Uphold a Regulated Platform?

Yes. Uphold is registered with the UK Financial Conduct Authority (FCA) for anti-money laundering compliance. It also meets global regulatory standards and maintains full transparency through real-time proof-of-reserves. All UK activity is governed by local financial regulations and consumer protection rules.

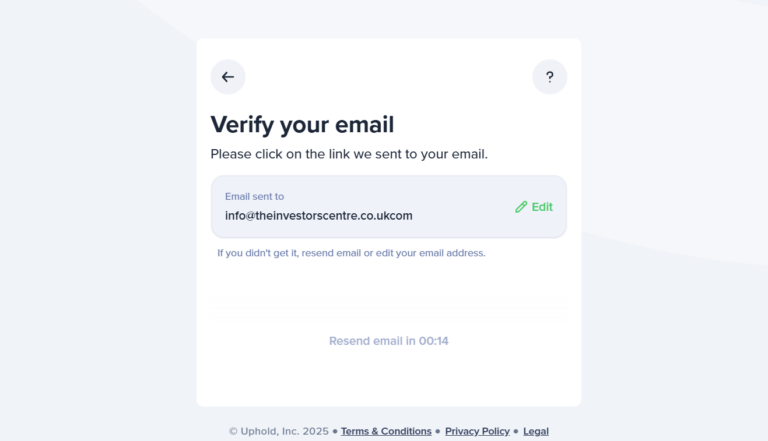

How Do You Create an Uphold Account?

Go to Uphold.com or download the app, then click “Sign Up.” Enter your name, email, and password. You’ll receive a confirmation email. Once verified, you can log in and complete identity verification. The process is streamlined and typically takes under five minutes to complete.

What Details Are Required to Sign Up?

To create an account, you’ll need your full legal name, a valid email address, a mobile number, and proof of identity. UK users must submit a government-issued ID (passport or driver’s licence) and a real-time selfie to comply with Know Your Customer (KYC) rules.

Is Identity Verification Required to Buy Crypto?

Yes. Uphold requires all users to complete identity verification before buying, selling, or withdrawing crypto. This includes submitting ID documents and a selfie. It ensures compliance with FCA anti-money laundering laws and helps protect your account from unauthorised access or fraudulent use.

How Long Does Account Approval Take?

In most cases, account verification is completed within minutes. Users are prompted to upload ID and a selfie during sign-up. Once submitted, Uphold’s system processes the data quickly. Delays may occur during peak demand but typically resolve within 24 hours.

What Deposit Methods Does Uphold Support in the UK?

UK users can deposit funds via Open Banking (bank transfer), debit card, or crypto transfer. Bank transfers are free and processed quickly during business hours. Debit card payments are instant but include a small fee. Uphold also accepts supported crypto deposits from external wallets.

| Deposit Method | Fee | Processing Time | Notes |

|---|---|---|---|

| Open Banking (Bank Transfer) | Free | Fast during business hours | Best option for GBP deposits |

| Debit Card | 2.49% fee | Instant | Convenient but higher cost |

| Crypto Transfer | Network fees apply | Varies by blockchain | Supports Bitcoin Ethereum and others |

Can I Send Crypto from Uphold to Another Wallet?

Yes. Uphold allows crypto withdrawals to external wallets for all supported assets. Navigate to your portfolio, select the asset, and click “Send.” Enter the destination wallet address, verify the transaction, and Uphold will process the withdrawal, typically within minutes after blockchain confirmation.

| Feature | Details | Fees | Notes |

|---|---|---|---|

| Withdraw Crypto to External Wallets | Supported for all assets | Network fees only | Typically processed within minutes after confirmation |

| Withdraw GBP to UK Bank Account | Supported via bank transfer | Free | Processed via Open Banking |

| Custody Type | Custodial | N/A | Uphold holds crypto in secure wallets private keys managed by Uphold |

What Are the Fees and Costs for Buying Crypto on Uphold?

| Action | Fee |

|---|---|

| GBP Deposit (Bank Transfer) | Free |

| GBP Deposit (Debit Card) | ~2.49% |

| Crypto Deposit | Free (network fee may apply) |

| Crypto Withdrawal | Network fee only |

| GBP Withdrawal (UK Bank) | Free |

| Trading Fee | 0% commission (spread-based) |

| Spread on Major Cryptos | ~0.8%–1.2% (can vary) |

How Does Uphold’s Spread-Based Pricing Work?

Uphold doesn’t charge direct trading fees. Instead, it builds a spread into the price — the difference between buy and sell rates. For major assets like Bitcoin or Ethereum, this spread typically ranges between 0.8% and 1.2%, though it may be higher during market volatility.

Are There Hidden Fees Beyond the Spread?

No. Uphold is transparent about its pricing. Aside from spreads and standard blockchain network fees on crypto withdrawals, there are no hidden platform charges. You’ll see the final cost before confirming any trade, deposit, or withdrawal. Uphold does not charge inactivity or custody fees.

How Do Uphold’s Fees Compare to Coinbase or Kraken?

Uphold’s spread-based pricing is higher than Krakens low spot fees but simpler. It’s often cheaper than Coinbase’s instant buy fees, especially for small purchases. Uphold also avoids separate trading and deposit fees, making it appealing for beginners prioritising convenience over lowest-cost execution.

Final Thoughts

Read our full Uphold review here for a detailed look at features, fees, and platform comparisons.

Buy, trade, and diversify effortlessly

- Invest from £1

- Auto-pilot recurring buys

- Trade crypto, stocks & metals

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

FAQs

Is Uphold Good to Buy Crypto?

Yes. Uphold is simple, beginner-friendly, and offers access to 260+ assets. It supports fast GBP deposits, clear fees, and a trusted security model. While spreads are higher than some exchanges, it’s a reliable option for users prioritizing ease and transparency over low spot fees.

Is Uphold Available in the UK?

Yes. Uphold is fully available in the UK and supports GBP funding via Open Banking and debit cards. It’s registered with the Financial Conduct Authority (FCA) for anti-money laundering compliance, making it a safe and legal choice for UK-based crypto investors.

How Much Does Uphold Charge to Buy Crypto?

Uphold does not charge commission. Instead, it includes a spread of about 0.8%–1.2% on major cryptos. GBP bank deposits and withdrawals are free, while card deposits incur a ~2.49% fee. Crypto withdrawals are subject to standard blockchain network fees only.

Is Uphold Better Than Coinbase?

Uphold is easier to use and has simpler fee structures for small trades. Coinbase offers more trading tools but charges higher fees for instant buys. For UK beginners seeking low-friction access to crypto with strong transparency, Uphold may be the more appealing choice.

References

https://www.fca.org.uk/consumers/cryptoassets

https://uk.trustpilot.com/review/uphold.com

https://www.theguardian.com/technology/cryptocurrency