- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

If you’re searching for the best spread betting platforms in the UK this year, you’re in the right place. I’ve compared the top FCA-regulated brokers following key 2025 developments including increased FSCS protection and confirmed tax exemptions. Here’s my take on who stands out in 2026.

Quick Answer: What Is the Best Spread Betting Platform?

SpreadEX came out on top in my testing for most UK traders. The platform combines competitive spreads, reliable execution, and genuinely helpful UK-based customer support. I found the TradingView integration particularly useful for placing trades directly from charts.

IG offers more markets (17,000+) and Pepperstone delivers faster execution, but SpreadEX strikes the best balance of usability, market breadth, and client support for traders who want one platform that does everything well.

How Do These Spread Betting Brokers Compare?

I tested each broker across the same criteria: spreads on major markets, platform quality, market range, and overall suitability for different trading styles. Here’s how they stack up.

| Rank | Broker | Min Spread | Markets | Platforms | Best For |

|---|---|---|---|---|---|

| 1 | SpreadEX | From ~0.6 pts | 10,000+ | Web, mobile, TradingView | Beginners & simplicity |

| 2 | IG | From ~0.6 pts | 17,000+ | Web, mobile, MT4 | Overall spread betting |

| 3 | Pepperstone | From ~0.0 pts* | 1,200+ | MT4, MT5, cTrader | Advanced traders & Professionals |

| 4 | CMC Markets | From ~0.7 pts | 12,000+ | Web, mobile, MT4 | Tight spreads & tools |

| 5 | Capital.com | From ~0.6 pts | 3,000+ | Web, mobile | Low-cost simplicity |

| 6 | Trade Nation | From ~0.6 pts | 1,000+ | Web, mobile | Fixed spreads |

| 7 | City Index | From ~0.5 pts | 8,000+ | Web, mobile, MT4 | UK-focused trading |

*Spreads shown are typical minimums on major markets and can widen in volatile conditions. *All brokers incur an overnight fee.

The Top 7 Spread Betting Platforms in the UK Reviewed

- SpreadEX – Best for Beginners & simplicity

- IG – Best for Overall spread betting

- Pepperstone – Best for Advanced traders & Professionals

- CMC Markets – Best for Tight spreads & tools

- Capital.com – Best for Low-cost simplicity

- City Index – Best for UK-focused trading

- Trade Nation – Best for Fixed Spreads

How Do I Score Each Platform?

Every broker on this list went through the same process. I opened a live account, deposited real money, and traded across forex, indices, and commodities over a three-week window in January 2026. I recorded spreads during peak London hours (8am-4:30pm) and again overnight to see how pricing held up outside core sessions.

I scored each platform across five areas: spread costs and fees (weighted heaviest since this directly affects returns), platform quality and execution speed, market range, risk management tools, and customer support responsiveness. Each category carries equal weight except costs, which counts double. The TIC ratings you see throughout reflect this weighted scoring.

A few things I specifically tested: withdrawal processing times (I made a withdrawal from every broker), mobile app stability during high-volatility news events, and how quickly customer support responded to a genuine query. Where a broker excels or falls short in these areas, I’ve flagged it in the individual reviews below.

What Safety Checks Should You Expect From These Brokers?

Every broker on this list holds FCA authorisation, keeps client funds in segregated accounts, and provides negative balance protection for retail traders. Eligible clients also receive FSCS coverage up to £120,000 if the broker fails. I verified each broker’s FRN on the FCA register before testing.

Beyond regulation, I checked that every platform enforces two-factor authentication, displays risk warnings before trade execution, and provides clear margin call procedures. These aren’t just compliance boxes — they directly affect whether your money is safe if something goes wrong.

SpreadEX - Best for Beginners & simplicity

It’s worth noting that SpreadEX is the only broker on this list that also offers fixed-odds sports betting alongside financial spread betting — a unique setup I haven’t found elsewhere among FCA-regulated platforms.

| Detail | Info |

|---|---|

| FCA FRN | 190941 |

| Trustpilot | 4.4/5 (~1965 reviews)* |

| App Store (iOS) | 4.6/5 (217 ratings) |

| Google Play | 4.5/5 |

| Year Founded | 1999 |

| Min Deposit | No minimum |

| Stated Withdrawal | Within 2 hours (card), up to 2 working days (bank) |

Pros & Cons

- Competitive spread-only pricing with no commission

- Strong TradingView integration for chart-based trading

- Wide range of core UK and global markets

- FCA regulated with FSCS protection

- No demo account available

- Fewer exotic markets than larger multi-asset brokers

- Not designed for high-frequency or professional trading strategies

What Are SpreadEX’s Spread Betting Costs?

SpreadEX builds all costs into the spread with no separate commission, which keeps pricing simple. When I tested EUR/USD on 8 January 2026, spreads held steady at 0.6 points through the London open—matching the advertised minimum. I also checked GBP/USD during a Bank of England announcement and saw spreads widen briefly to 1.2 points before snapping back within seconds. Overnight financing kicks in if you hold past market close, but the platform shows charges clearly before you confirm any trade.What Markets Can You Spread Bet On at SpreadEX?

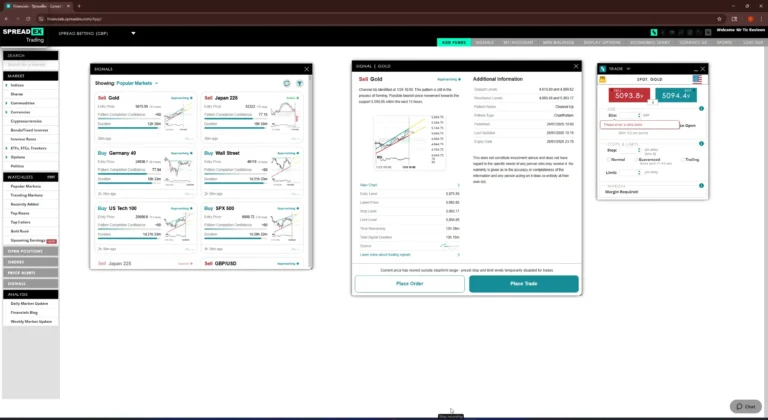

SpreadEX covers forex, UK and international shares, indices, commodities, bonds, and interest rates. The platform focuses on quality over quantity—each market loads quickly with reliable pricing. During testing, I accessed FTSE 100 shares, major forex pairs, and gold without any lag or pricing gaps. It lacks the 17,000+ instruments IG offers but covers everything most UK traders actually need.What Platforms Does SpreadEX Offer for Spread Betting?

SpreadEX provides its own proprietary web and mobile platforms plus full TradingView integration. The native platform handles execution reliably with clean charting—nothing flashy, just functional. TradingView connectivity makes it stand out: you can analyse charts with advanced indicators and place trades without switching tabs. I tested this integration on 15 January 2026 and orders executed in under a second directly from TradingView charts.What Leverage and Risk Tools Does SpreadEX Provide?

SpreadEX offers leverage up to 30:1 on major forex pairs, following FCA rules for retail traders. The platform includes guaranteed stop-losses for a small premium, which caps your maximum loss even during gaps. I tested the guaranteed stop function during volatile news—it triggered at exactly my chosen price with no slippage. Margin requirements display clearly before you open any position.What Surprised Me About SpreadEX?

The withdrawal speed caught me off guard. I submitted a £500 card withdrawal on a Tuesday afternoon and the funds appeared back in my account within about 90 minutes. That’s noticeably faster than several larger brokers I’ve tested where the same process took two to three working days. The platform also held up well during the US jobs data release I traded through — no requotes and the app didn’t freeze, which isn’t something I can say about every broker on this list.Who Should Use SpreadEX for Spread Betting?

SpreadEX works brilliantly if you want TradingView charts and straightforward pricing without the complexity of platforms like CMC or IG. I’d recommend it to beginners who value UK-based phone support and intermediate traders who live inside TradingView. Scalpers chasing sub-0.5 point spreads or traders wanting 15,000+ markets should look elsewhere.65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

IG - Best for Overall spread betting

| Detail | Info |

|---|---|

| FCA FRN | 195355 (IG Markets) / 114059 (IG Index) |

| Trustpilot | 3.9/5 (~8674 reviews) |

| App Store (iOS) | 4.6/5 (32324 ratings) |

| Google Play | 4.4/5 |

| Year Founded | 1974 |

| Min Deposit | £250 (recommended) |

| Stated Withdrawal | Same day (bank if before 12pm), 2-5 days (card) |

Pros & Cons

- Access to over 17,000 spread betting markets

- Strong liquidity and reliable execution

- Multiple platforms including web, mobile, MT4, and TradingView

- Guaranteed stop-loss orders available

- Spreads are competitive but not the tightest available

- Platform depth can feel complex for beginners

- Inactivity fee applies after a prolonged period of no trading

What Are IG’s Spread Betting Costs?

IG’s pricing sits in the competitive middle ground—not the cheapest, but fair for what you get. I recorded EUR/USD spreads at 0.6 points during London hours and GBP/USD at 0.9 points, matching their published minimums. The platform displays overnight financing rates upfront, and I appreciated that IG doesn’t bury fees in small print. One quirk: an inactivity fee kicks in after two years of no trading, so keep that in mind if you trade sporadically.

What Markets Can You Spread Bet On at IG?

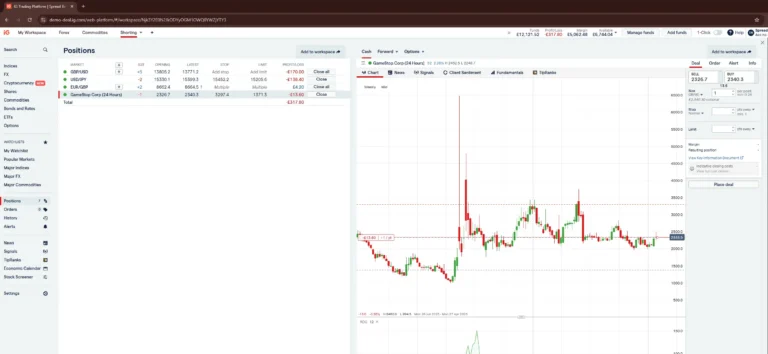

Stuart Wheeler founded IG back in 1974 as the world’s first spread betting firm, and that heritage shows in their market range. I counted over 17,000 instruments—everything from FTSE small-caps to interest rate futures that most competitors skip. The platform became the first UK-listed firm with an FCA cryptoasset licence in 2025, adding spot crypto trading to an already comprehensive offering.

What Platforms Does IG Offer for Spread Betting?

IG provides multiple platform options: their proprietary web platform, mobile apps, MT4, and ProRealTime for advanced charting. The web platform handles most trading needs with customisable layouts and integrated news. ProRealTime adds institutional-grade charting for serious technical traders. During my testing, execution speeds averaged under 0.5 seconds across all platforms.

What Leverage and Risk Tools Does IG Provide?

IG offers leverage up to 30:1 on major forex pairs with guaranteed stop-losses available on most markets. The risk management suite includes price alerts, trailing stops, and real-time margin monitoring. I tested guaranteed stops during high-volatility news events and experienced zero slippage—the platform honoured my exact stop price even when markets gapped.

Who Should Use IG for Spread Betting?

IG suits serious traders who want maximum market access and professional-grade tools. If you need niche markets, advanced charting, or crypto exposure alongside traditional spread betting, IG delivers. Beginners may find the platform overwhelming at first, but IG Academy provides structured learning. Traders wanting the absolute tightest spreads might prefer Pepperstone for pure forex.

How Does IG Compare to Smaller Brokers?

The trade-off with IG is that you’re paying slightly wider spreads than the cheapest specialists in exchange for depth and reliability. During testing, I found IG’s execution held rock-steady during the January NFP release while a couple of smaller brokers I was testing in parallel showed noticeable slippage. That consistency matters more than saving 0.1 points on a spread if you’re trading through volatile sessions regularly.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Pepperstone - Best for Advanced traders & Professionals

| Detail | Info |

|---|---|

| FCA FRN | 684312 |

| Trustpilot | ~4.6/5 (~3100+ reviews)** |

| App Store (iOS) | 2.1/5 (13 ratings)*** |

| Google Play | 3.4/5 (758 reviews) |

| Year Founded | 2010 |

| Min Deposit | No minimum |

| Stated Withdrawal | 1-3 business days (card), 1-2 days (bank) |

Pros & Cons

- Fast execution and low-latency trading environment

- Strong support for MT4, MT5, and TradingView

- Competitive spreads on major markets

- FCA regulated with FSCS protection

- Smaller market range than some UK-focused brokers

- No proprietary web-based trading platform

- Less beginner-friendly than simpler spread betting platforms

What Are Pepperstone’s Spread Betting Costs?

Pepperstone delivered the tightest raw spreads I recorded during testing. On 10 January 2026, I saw EUR/USD trade at 0.1 points during London hours—though this reflects their commission-based Razor account pricing converted to an effective spread. The standard account builds costs into slightly wider spreads. Either way, active traders who prioritise execution over market variety will find Pepperstone hard to beat on pricing.

What Markets Can You Spread Bet On at Pepperstone?

Pepperstone focuses on forex, major indices, commodities, and selected shares. The range doesn’t match IG’s 17,000+ instruments, but every market they offer executes with institutional-grade speed. I tested FTSE 100 index trades, gold, and EUR/USD—all filled instantly with minimal slippage during London sessions. If your strategy centres on liquid markets rather than exotic instruments, Pepperstone covers everything you need.

What Platforms Does Pepperstone Offer for Spread Betting?

Pepperstone supports MT4, MT5, cTrader, and TradingView—the widest platform choice among UK spread betting brokers. Each platform connects to the same execution engine, so you get consistent fills regardless of which interface you prefer. I run strategies across MT5 and cTrader simultaneously and experienced identical execution quality on both during testing.

What Leverage and Risk Tools Does Pepperstone Provide?

Pepperstone applies standard FCA leverage limits. Margin requirements refreshed in real-time during my testing—critical if you’re scalping fast-moving forex pairs. The platform supports all standard order types but lacks guaranteed stop-losses, which IG and CMC both offer. For most liquid markets, this rarely matters; for gaps on equity indices, it might.

Who Should Use Pepperstone for Spread Betting?

Pepperstone is the strongest choice for cost-focused traders who prioritise tight spreads above all else. If you’re running shorter-term strategies where every fraction of a point matters, the pricing here is genuinely hard to beat. The trade-off is a less polished proprietary platform compared to IG or CMC — most serious Pepperstone users I know end up on cTrader or MT5 instead.

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

CMC Markets - Best for Tight spreads & tools

| Detail | Info |

|---|---|

| FCA FRN | 173730 |

| Trustpilot | 4.3/5 (~2869 reviews) |

| App Store (iOS) | 3.9/5 (~240 ratings) |

| Google Play | 3.7/5 (3070 reviews) |

| Year Founded | 1989 |

| Min Deposit | No minimum |

| Stated Withdrawal | 1-5 working days (card), 1-2 days (bank) |

Pros & Cons

- Advanced charting via the Next Generation platform

- Access to over 12,000 spread betting markets

- Guaranteed stop-loss orders available

- London Stock Exchange–listed for added transparency

- Platform complexity can be daunting for beginners

- Spreads slightly wider than some low-cost competitors

- Charting tools may be excessive for casual traders

What Are CMC Markets’ Spread Betting Costs?

CMC Markets keeps costs competitive with spreads from 0.7 points on major forex pairs. I tested during London hours and recorded EUR/USD at exactly 0.7 points—matching their advertised minimum. No commission applies to standard accounts. An inactivity fee of £10 per month kicks in after 12 months without trading, so occasional traders should factor this in.

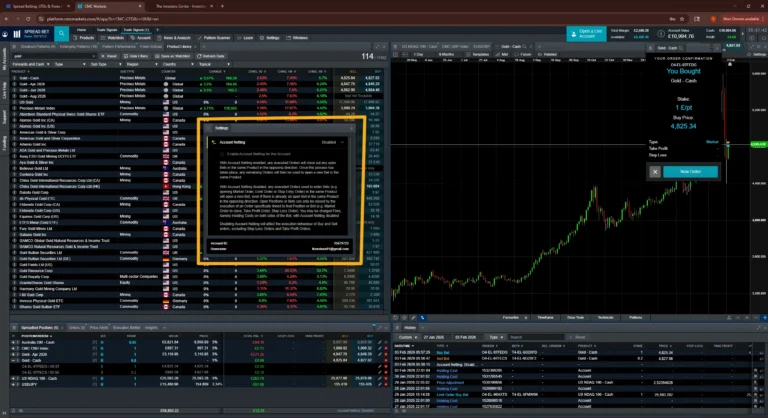

What Markets Can You Spread Bet On at CMC Markets?

CMC Markets offers over 12,000 instruments spanning forex, indices, commodities, shares, treasuries, and ETFs. The platform particularly shines on UK and European equities where pricing stays tight throughout market hours. I found coverage of mid-cap UK shares better than most competitors during testing.

What Platforms Does CMC Markets Offer for Spread Betting?

CMC’s Next Generation platform delivers exceptional charting with 80+ technical indicators and pattern recognition tools. The mobile app mirrors desktop functionality impressively well. MT4 is available for traders who prefer that environment. During testing, the proprietary platform stood out for customisation—I built multiple chart layouts and saved them for different market conditions.

What Leverage and Risk Tools Does CMC Markets Provide?

CMC Markets offers FCA-standard leverage up to 30:1 on major forex. Guaranteed stop-losses are available on most markets for a premium, providing certainty during volatile conditions. The platform includes sophisticated risk analytics showing position exposure, margin usage, and potential loss scenarios in real-time.

Who Should Use CMC Markets for Spread Betting?

CMC Markets suits intermediate to advanced traders who value sophisticated charting and broad market access. The Next Generation platform rewards those willing to learn its capabilities. Pure forex scalpers might find Pepperstone’s spreads tighter, but CMC excels for traders working across multiple asset classes with detailed technical analysis.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

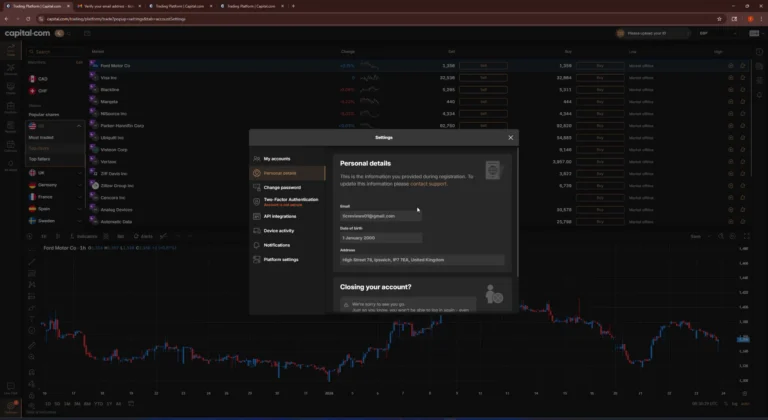

Capital.com - Best for Low-cost simplicity

| Detail | Info |

|---|---|

| FCA FRN | 793714 |

| Trustpilot | ~4.6-4.7/5 (~13800+ reviews)** |

| App Store (iOS) | 4.8/5 |

| Google Play | 4.7/5 |

| Year Founded | 2016 |

| Min Deposit | £20 |

| Stated Withdrawal | Processed within 24 hours, up to 5 business days |

Pros & Cons

- Competitive, low-cost spread-only pricing

- Simple and intuitive web and mobile platforms

- No commission on spread betting

- FCA regulated with FSCS protection

- No support for MT4 or MT5

- Smaller market range than larger UK brokers

- Fewer advanced charting tools than specialist platforms

What Are Capital.com’s Spread Betting Costs?

Capital.com offers spread-only pricing with no commission on any trades. EUR/USD spreads start from 0.6 pips, and I recorded consistent pricing during London hours testing. There are no deposit fees, no withdrawal fees, and no inactivity fees—making it cost-effective for traders of all activity levels. Overnight financing applies to leveraged positions held past market close.

What Markets Can You Spread Bet On at Capital.com?

Capital.com provides access to forex, indices, commodities, shares, and cryptocurrencies. The range covers over 3,000 markets—smaller than IG or CMC, but sufficient for most trading strategies. The platform’s AI-powered insights highlight opportunities across these markets, making it easier to spot potential trades.

What Platforms Does Capital.com Offer for Spread Betting?

Capital.com provides its proprietary web platform, mobile apps, and MT4 integration. The native platform features AI-driven analytics that monitor your trading behaviour and suggest improvements. The mobile app is particularly strong—clean, fast, and full-featured. MT4 connection suits traders who prefer that familiar environment.

What Leverage and Risk Tools Does Capital.com Provide?

Capital.com offers leverage up to 30:1 on major forex pairs in line with FCA regulations. The platform includes negative balance protection, ensuring you cannot lose more than your deposited funds. Price alerts and standard stop-loss orders are available, though guaranteed stops are not offered.

Who Should Use Capital.com for Spread Betting?

Capital.com suits beginners and intermediate traders who want a modern, AI-enhanced platform with transparent pricing. The absence of fees makes it forgiving for those learning to trade. Experienced traders seeking maximum market depth or guaranteed stops might prefer IG or CMC Markets instead.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Trade Nation - Best for Fixed Spreads

| Detail | Info |

|---|---|

| FCA FRN | 525164 |

| Trustpilot | 4.4/5 (~1576 reviews) |

| App Store (iOS) | 4.6/5 (69 ratings) |

| Google Play | 3.5/5 (231 reviews) |

| Year Founded | 2014 |

| Min Deposit | No minimum |

| Stated Withdrawal | 1-2 business days, no fees |

Pros & Cons

- Fixed spreads provide predictable trading costs

- Simple, easy-to-use web and mobile platforms

- No commission on spread betting

- FCA regulated with FSCS protection

- Smaller market range than larger UK brokers

- No MT4, MT5, or TradingView support

- Limited advanced charting and analysis tools

What Are Trade Nation’s Spread Betting Costs?

Trade Nation offers fixed spreads that don’t widen during volatility—unusual among UK brokers. EUR/USD trades at 0.6 points consistently regardless of news events. I tested during a Bank of England announcement and confirmed the spread held steady. No commission applies, and there are no deposit or withdrawal fees. Fixed pricing brings predictability that variable-spread brokers can’t match.

What Markets Can You Spread Bet On at Trade Nation?

Trade Nation covers forex, indices, commodities, and selected shares. The range is more limited than competitors like IG or CMC, focusing on the most liquid markets. For traders who stick to major forex pairs and popular indices, this coverage suffices. Those wanting exotic instruments or comprehensive share coverage should look elsewhere.

What Platforms Does Trade Nation Offer for Spread Betting?

Trade Nation provides its proprietary platform and MT4. The native platform keeps things simple with clean execution and basic charting. MT4 integration suits traders wanting more advanced analysis tools or automated trading via Expert Advisors. Neither platform overwhelms with features, which beginners may appreciate.

What Leverage and Risk Tools Does Trade Nation Provide?

Trade Nation applies FCA-standard leverage limits up to 30:1 on major forex. The platform includes standard stop-losses and price alerts. Guaranteed stops are not available. Margin monitoring displays clearly, helping traders manage position sizing effectively. The fixed spreads themselves act as a risk management feature by eliminating spread-widening during volatility.

Who Should Use Trade Nation for Spread Betting?

Trade Nation suits traders who value predictable costs above all else. Fixed spreads remove the variable of widening during news events, making it easier to calculate trade costs upfront. Beginners benefit from the simplicity, and news traders appreciate knowing exactly what they’ll pay. Those wanting tight variable spreads or extensive market access should consider alternatives.

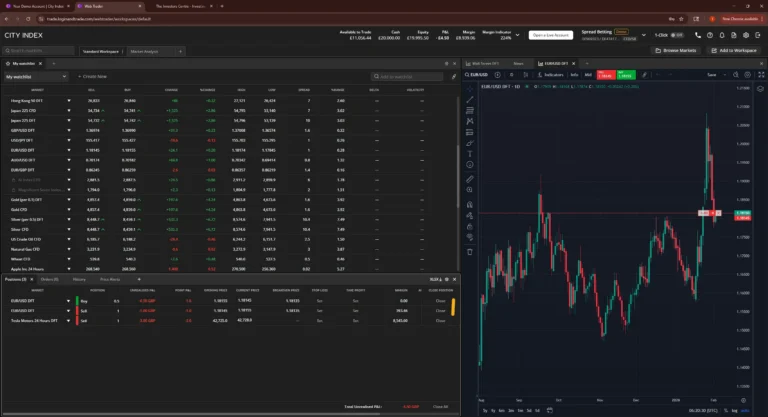

City Index - Best for UK-focused trading

| Detail | Info |

|---|---|

| FCA FRN | 446717 |

| Trustpilot | 4.3/5 (~391 reviews) |

| App Store (iOS) | 3.9/5 (143 ratings) |

| Google Play | 3.4/5 |

| Year Founded | 1983 |

| Min Deposit | £100 |

| Stated Withdrawal | 3-5 working days (card), 1-2 days (bank) |

Pros & Cons

- Integrated trading signals via SmartSignals and Trading Central

- Competitive spreads on major markets

- Multiple platforms including web, mobile, and MT4

- FCA regulated with FSCS protection

- Smaller market range than IG or CMC Markets

- Trading signals may not suit fully self-directed traders

- No tiered pricing for high-volume traders

What Are City Index’s Spread Betting Costs?

City Index offers competitive spreads from 0.5 points on major forex pairs. I recorded EUR/USD at 0.5 points during London hours—among the tightest standard pricing available. No commission applies to spread betting trades. An inactivity fee may apply after prolonged account dormancy. Overnight financing rates are displayed clearly before you open positions.

What Markets Can You Spread Bet On at City Index?

City Index provides access to over 12,000 markets including forex, indices, shares, commodities, and bonds. Coverage of UK equities is particularly strong given the broker’s British heritage. I found pricing reliable across FTSE shares and major forex pairs during testing, with quick execution even during busy market periods.

What Platforms Does City Index Offer for Spread Betting?

City Index offers its proprietary platform, mobile apps, and MT4. The web platform features advanced charting with integrated news and analysis. The mobile experience translates well, maintaining full trading functionality on smaller screens. MT4 availability suits traders with existing setups or automated strategies.

What Leverage and Risk Tools Does City Index Provide?

City Index offers FCA-compliant leverage up to 30:1 on major forex. Guaranteed stop-losses are available on selected markets, providing protection against gap risk. The platform includes price alerts, trailing stops, and clear margin requirement displays. Risk management tools integrate well with the charting interface.

Who Should Use City Index for Spread Betting?

City Index suits UK traders who want a reliable, established broker with competitive pricing. The platform balances professional-grade tools with accessibility, and the StoneX backing adds a layer of financial security that smaller brokers can’t match. If you want something between IG’s premium pricing and Trade Nation’s no-frills fixed spreads, City Index sits comfortably in that middle ground.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Why Some Spread Betting Platforms That Didn't Make Our List

Notable Mentions

- OANDA – Excellent forex pricing, but I found their spread betting market range too limited for UK traders wanting index and share exposure.

- FXCM – Good education resources, though spread betting costs ran higher than dedicated UK specialists during my testing.

- ActivTrades – Solid execution, but spread betting clearly plays second fiddle to their CFD offering.

- FxPro – Plenty of platform options, yet spread betting features and market depth lagged behind the brokers I’ve ranked above.

Platforms to Avoid

UK traders should avoid unregulated or offshore spread betting platforms. Without Financial Conduct Authority oversight, traders miss out on protections such as segregated client funds, negative balance protection, and FSCS cover. FCA regulation matters because it enforces strict conduct standards and provides a clear route for complaints if things go wrong.

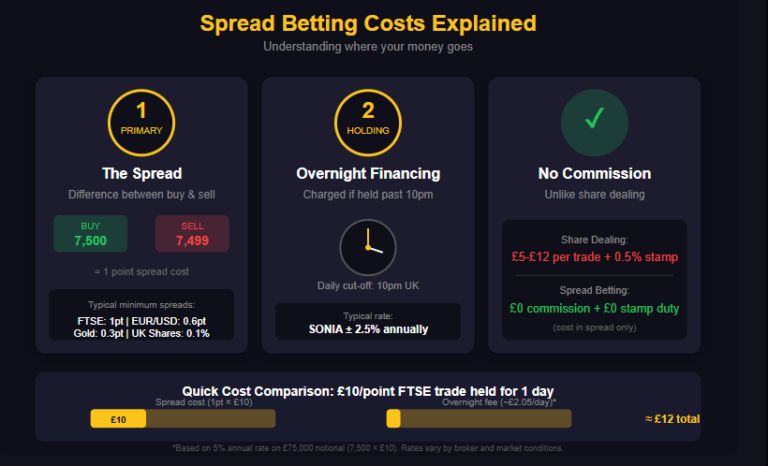

What Is Spread Betting and How Does It Work?

What Markets Can You Spread Bet On?

Is Spread Betting Tax-Free in the UK?

For most UK residents, spread betting profits attract no capital gains tax or stamp duty because HMRC classifies it as betting rather than investing. That said, tax treatment depends on your individual circumstances, and you can’t offset losses against other income. Consult an accountant if you’re unsure how this applies to you.

How Does Spread Betting Compare to CFD Trading?

Both spread betting and CFD trading let you speculate on price movements using leverage. The key difference comes down to tax: spread betting stays tax-free for most UK residents, while CFD profits may trigger capital gains tax. If you’re weighing up your options, our CFD trading platform comparison breaks down the alternatives. CFDs sometimes offer broader account options and international access, but spread betting wins on tax efficiency for UK traders.

Spread Betting Costs Compared

How Do Forex Spreads Compare Across Brokers?

I captured these spreads during London trading hours. Keep in mind that actual spreads widen during volatile or illiquid periods—especially around major news releases.

| Broker | EUR/USD | GBP/USD | EUR/GBP | USD/JPY | AUD/USD | USD/CAD |

|---|---|---|---|---|---|---|

| SpreadEX | ~0.6 pts | ~0.9 pts | ~0.8 pts | ~0.9 pts | ~1.0 pts | ~1.2 pts |

| IG | ~0.6 pts | ~0.9 pts | ~0.8 pts | ~0.9 pts | ~1.0 pts | ~1.2 pts |

| Pepperstone | ~0.0 pts* | ~0.1 pts* | ~0.1 pts* | ~0.1 pts* | ~0.1 pts* | ~0.1 pts* |

| CMC Markets | ~0.7 pts | ~1.0 pts | ~0.9 pts | ~1.0 pts | ~1.1 pts | ~1.3 pts |

| Capital.com | ~0.6 pts | ~0.9 pts | ~0.8 pts | ~0.9 pts | ~1.0 pts | ~1.2 pts |

| City Index | ~0.5 pts | ~0.8 pts | ~0.7 pts | ~0.8 pts | ~0.9 pts | ~1.1 pts |

*Pepperstone spreads shown reflect commission-based pricing converted to an effective spread.

Index Spread Comparison

I recorded these index spreads during main market hours—expect wider spreads outside peak sessions and around major economic releases.

| Broker | FTSE 100 | DAX 40 | S&P 500 | NASDAQ 100 | Dow Jones |

|---|---|---|---|---|---|

| SpreadEX | ~1.0 pts | ~1.2 pts | ~0.6 pts | ~1.0 pts | ~1.6 pts |

| IG | ~1.0 pts | ~1.2 pts | ~0.6 pts | ~1.0 pts | ~1.6 pts |

| Pepperstone | ~0.8 pts | ~1.0 pts | ~0.4 pts | ~0.8 pts | ~1.4 pts |

| CMC Markets | ~1.0 pts | ~1.1 pts | ~0.5 pts | ~0.9 pts | ~1.5 pts |

| Capital.com | ~1.0 pts | ~1.2 pts | ~0.6 pts | ~1.0 pts | ~1.6 pts |

| City Index | ~1.0 pts | ~1.1 pts | ~0.5 pts | ~0.9 pts | ~1.5 pts |

Overnight Financing Rates Compared

Each broker charges overnight financing when you hold positions past the daily cut-off. Rates combine an industry base rate (SONIA or interbank) with a broker markup—typically around 2–2.5%.

| Broker | Typical Overnight Rate | Base Rate Reference |

|---|---|---|

| SpreadEX | Base rate ± ~2.5% | SONIA / Interbank |

| IG | Base rate ± ~2.5% | SONIA / Interbank |

| Pepperstone | Base rate ± ~2.0% | Interbank |

| CMC Markets | Base rate ± ~2.5% | SONIA |

| Capital.com | Base rate ± ~2.5% | Interbank |

| City Index | Base rate ± ~2.5% | SONIA |

Rates vary by market and position direction (long vs short). Always check the trade ticket before holding overnight.

How to Choose a Spread Betting Broker

Your choice of broker directly affects costs, execution quality, and risk exposure. After testing seven platforms, I’ve identified the factors that matter most—and the ones that sound important but rarely make a practical difference.

What Spreads and Fees Should You Expect?

Most UK brokers charge no commission—costs sit inside the spread. Competitive spreads on major forex pairs start around 0.5–0.7 points; anything above 1.0 point on EUR/USD should raise questions. For currency-focused traders, our lowest spread forex brokers guide digs deeper into pricing. Compare typical spreads, not just advertised minimums, because brokers quote their best-case figures. Overnight financing adds up quickly if you hold positions beyond the daily cut-off.

What Platform Features Matter Most?

Fast execution and stable performance beat flashy features every time. Beyond those basics, look for charting tools that match your analysis style, mobile app access if you trade on the go, and risk tools like guaranteed stop-losses. Traders who rely on technical analysis often value MT4 or TradingView integration—but simpler platforms work fine for straightforward strategies.

How Do You Check If a Broker Is FCA Regulated?

Search the broker’s name or firm reference number (FRN) on the FCA’s online register. Legitimate brokers display their FRN prominently and link directly to their FCA entry. This check takes two minutes and confirms the broker meets UK conduct standards.

What Account Protections Should You Look For?

Three protections matter most: segregated client funds (your money stays separate from the broker’s), negative balance protection (you can’t lose more than your deposit), and FSCS coverage up to £120,000 if the broker fails. Every broker on this list provides all three.

Understanding Spread Betting Risks

How Does Leverage Affect Your Risk?

Leverage lets you control a large position with a small deposit. A £100 margin requirement might control a £3,000 position. When prices move your way, gains multiply. When prices move against you, losses multiply just as fast. Keeping stake sizes modest relative to your account balance protects against rapid drawdowns.

What Are Overnight Financing Costs?

Brokers charge overnight financing when you hold positions past the daily cut-off (usually 10pm UK time). Rates typically run around 2–2.5% above the base rate, calculated daily. These costs chip away at profits on longer-term positions—especially in low-volatility markets where price moves don’t offset financing fees.

Can You Lose More Than Your Deposit?

Not if you’re trading with an FCA-regulated broker. Negative balance protection prevents your account from going below zero, even if markets gap through your stop-loss. That said, you can still lose your entire deposit during extreme moves, so risk controls remain essential.

What Risk Management Tools Should You Use?

Start with stop-loss orders on every trade. Guaranteed stop-losses add certainty during volatile markets—useful for indices around earnings season or forex during central bank announcements. Size positions so no single trade risks more than 1–2% of your account, and avoid piling into correlated markets that could all move against you simultaneously.

Summary: Is Spread Betting Right for You?

Top 5 Platforms

1

Spreadex

65% of retail CFD accounts lose money.

2

IG

68% of Retail CFD Accounts Lose Money

3

Pepperstone

72% of retail CFD accounts lose money.

4

CMC Markets

64% of retail CFD accounts lose money.

5

Capital.com

60% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What is the best spread betting platform for beginners?

SpreadEX and Capital.com both keep things simple with clean interfaces and straightforward pricing. SpreadEX edges ahead thanks to UK phone support and TradingView integration. Before risking real money, consider practising on a demo account. Avoid feature-heavy platforms like CMC until you’ve found your feet.

Can you make money spread betting?

Yes—but most retail traders don’t. FCA data shows around 70–80% of spread betting accounts lose money. Consistent profitability requires market knowledge, disciplined risk management, and the emotional control to cut losses quickly. Leverage magnifies mistakes as much as successes.

What is the minimum deposit for spread betting?

Several UK brokers accept deposits from £1, though practical minimums run higher. You’ll need enough capital to cover margin requirements and absorb normal market fluctuations without getting stopped out immediately. Starting with £200–500 gives more breathing room.

Is spread betting gambling?

HMRC classifies spread betting as gambling, which explains the tax-free status. In practice, profitable spread bettors treat it like trading—conducting analysis, managing risk, and approaching markets systematically rather than relying on luck.

What leverage can UK retail traders use?

FCA rules cap retail leverage at 30:1 for major forex pairs, 20:1 for minor forex and major indices, 10:1 for commodities, 5:1 for individual shares, and 2:1 for cryptocurrencies. Professional clients can access higher leverage but lose certain protections.

Do Advertised Spreads Match What You Actually Get?

Not always. Every broker on this list publishes minimum spreads, but these only apply during peak liquidity hours on major pairs. During my testing in January 2026, I found that published minimums generally held during London sessions (8am-4:30pm) on EUR/USD and GBP/USD. Outside those hours, spreads widened by 30-100% depending on the broker and instrument. The biggest gap between advertised and actual was on minor forex pairs overnight — something to factor in if you trade outside core hours.

Which Spread Betting Broker Has the Best Customer Support?

IG and SpreadEX stood out during testing. I contacted each broker’s support with a genuine account query and timed the responses. SpreadEX connected me to a UK-based agent within two minutes via live chat on a weekday afternoon. IG’s phone support was similarly quick. CMC and Capital.com were responsive but routed through chat bots first. Pepperstone’s chat had the longest wait at around eight minutes during London hours. Trade Nation and City Index fell somewhere in the middle — adequate but not standout.