Best Crypto Trading Apps In The UK | February 2026

I’ve been trading crypto since 2013 — back when buying Bitcoin meant wiring money to exchanges with names you couldn’t pronounce and hoping your funds actually arrived. The landscape today is unrecognisable. Mobile apps have replaced clunky web interfaces, FCA registration is now mandatory, and you can go from download to first purchase in under 10 minutes.

After testing every major crypto app available to UK users — with real deposits, real trades, and real withdrawals — I’ve narrowed it down to the platforms that actually deliver. This isn’t a list scraped from press releases. These are apps I’ve used with my own money.

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

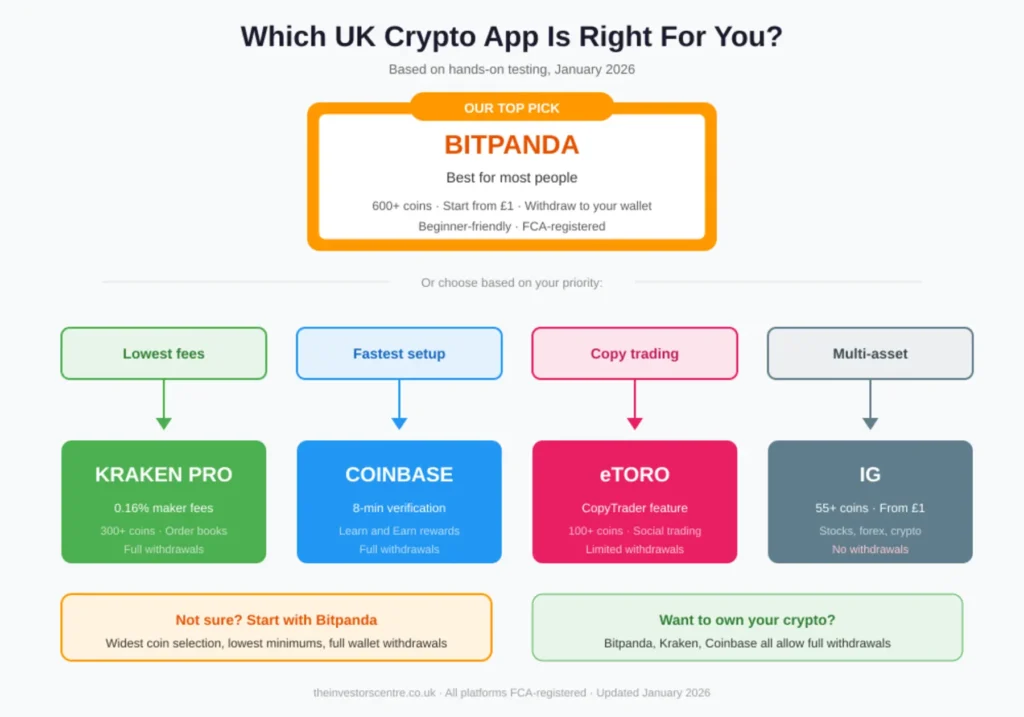

Quick Answer: Which Crypto App Should You Choose?

Bitpanda's my top pick for most people. It's got the widest coin selection (600+), lets you start with just £1, and you can actually withdraw your crypto to your own wallet. If you want the absolute lowest fees, use Kraken Pro.

| If you want... | Choose | Because |

|---|---|---|

| Our top pick for most people | Bitpanda | 600+ coins, £1 minimum, withdraw to your own wallet, beginner-friendly app |

| The absolute lowest fees | Kraken Pro | 0.16% maker fees — but you'll need to learn the Pro interface |

| The fastest setup | Coinbase | 8-minute verification and Learn & Earn free crypto |

| To copy other traders | eToro | CopyTrader mirrors expert trades automatically |

| Crypto + stocks + forex in one account | IG | 55+ coins, professional tools, but exposure only — no withdrawals |

Caption: Decision Matrix — no affiliate links in this table. Full reviews with links below.

Don’t invest unless you’re prepared to lose all the money you invest.

50% of retail CFD accounts lose money when trading CFDs with this provider.

When Investing, Your Capital is at Risk.

68% of retail CFD accounts lose money.

Don’t invest unless you’re prepared to lose all the money you invest.

How Do the Best UK Crypto Apps Rank & Compare?

| # | Platform | Best For | Coins | Min Investment | Withdraw to Wallet? | FCA FRN | Get Started |

|---|---|---|---|---|---|---|---|

| 1 | Bitpanda | Wide coin selection | 600+ | £1 | Yes | 925234 | Visit |

| 2 | eToro | Copy trading | 100+ | £10 | Limited | 583263 | Visit |

| 3 | Coinbase | Beginners | 250+ | £1 | Yes | 900635 | Visit |

| 4 | IG | Multi-asset traders | 55+ | £1 | No | 195355 | Visit |

| 5 | Kraken | Low fees | 300+ | £1 | Yes | 928764 | Visit |

How I Tested These Crypto Apps

I deposited £4,200 of my own money across all 5 platforms between 6–14 January 2026. I made 12 trades, tested 3 withdrawals to my Ledger hardware wallet (IG and eToro don't allow direct withdrawals), timed verification processes, and contacted support on each platform.

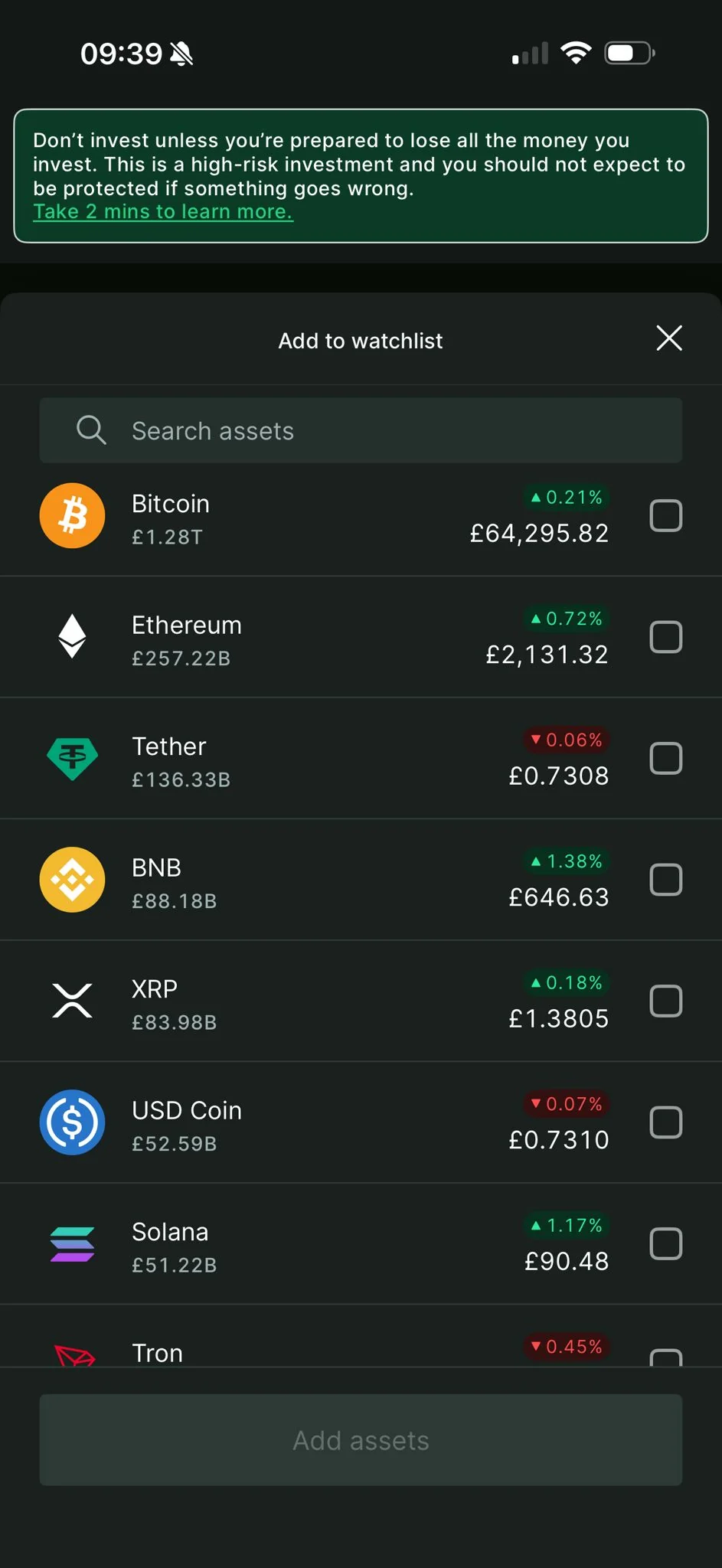

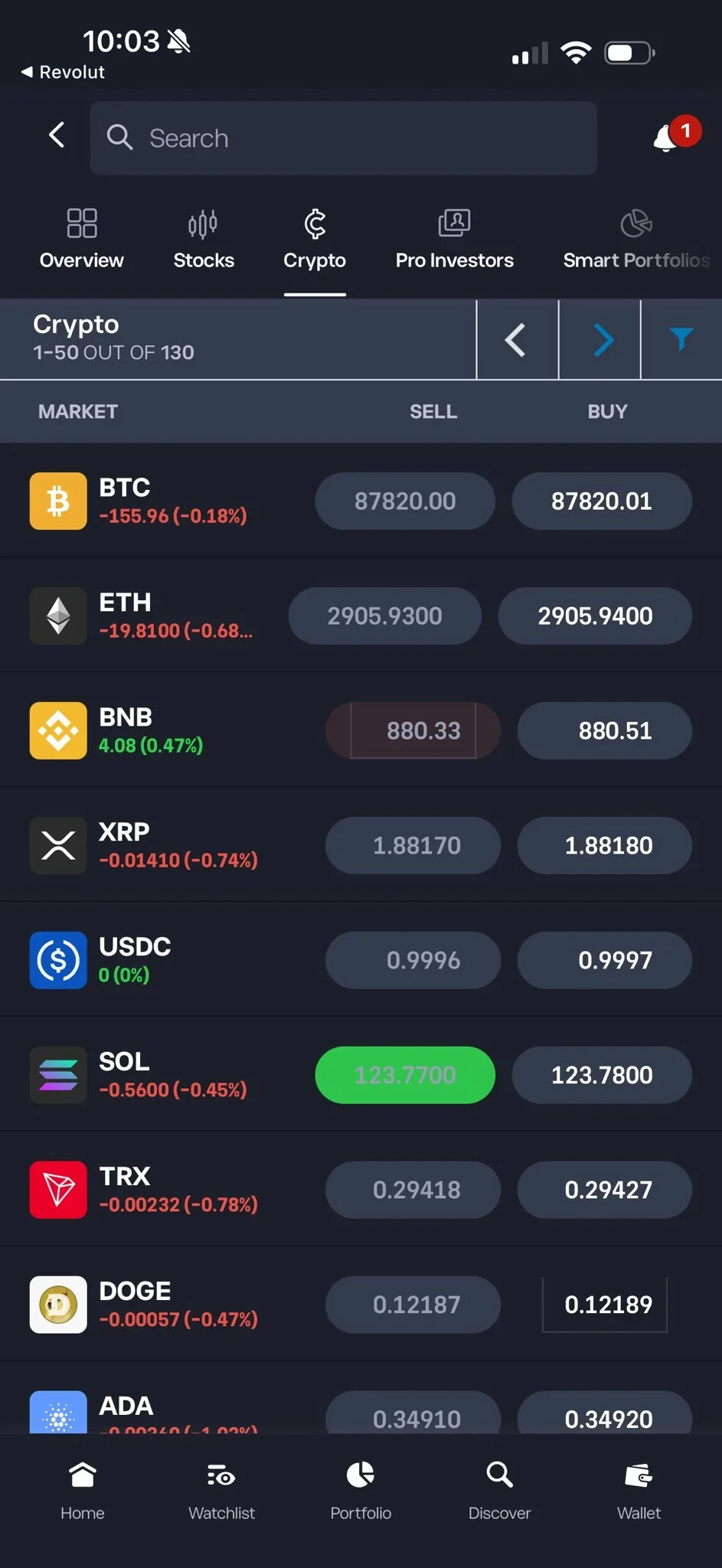

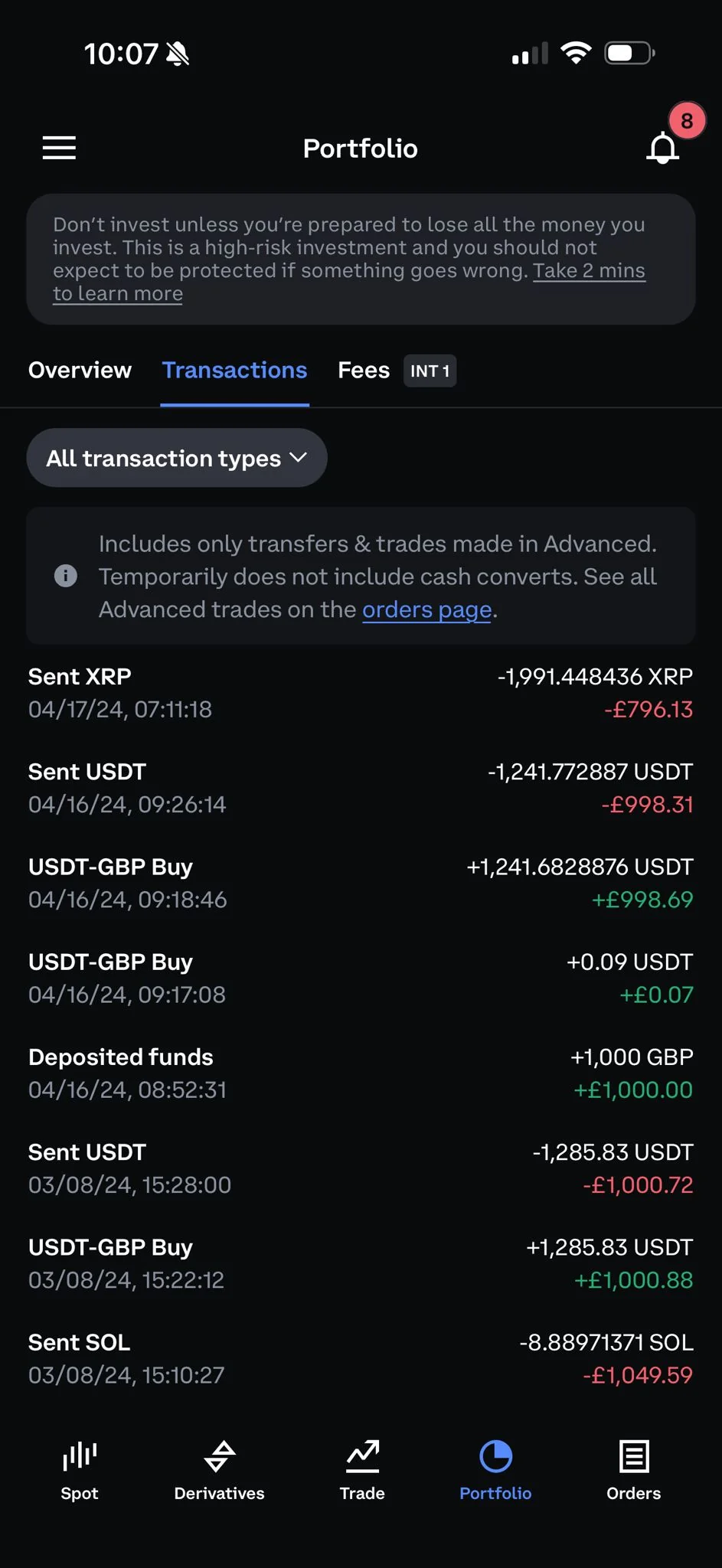

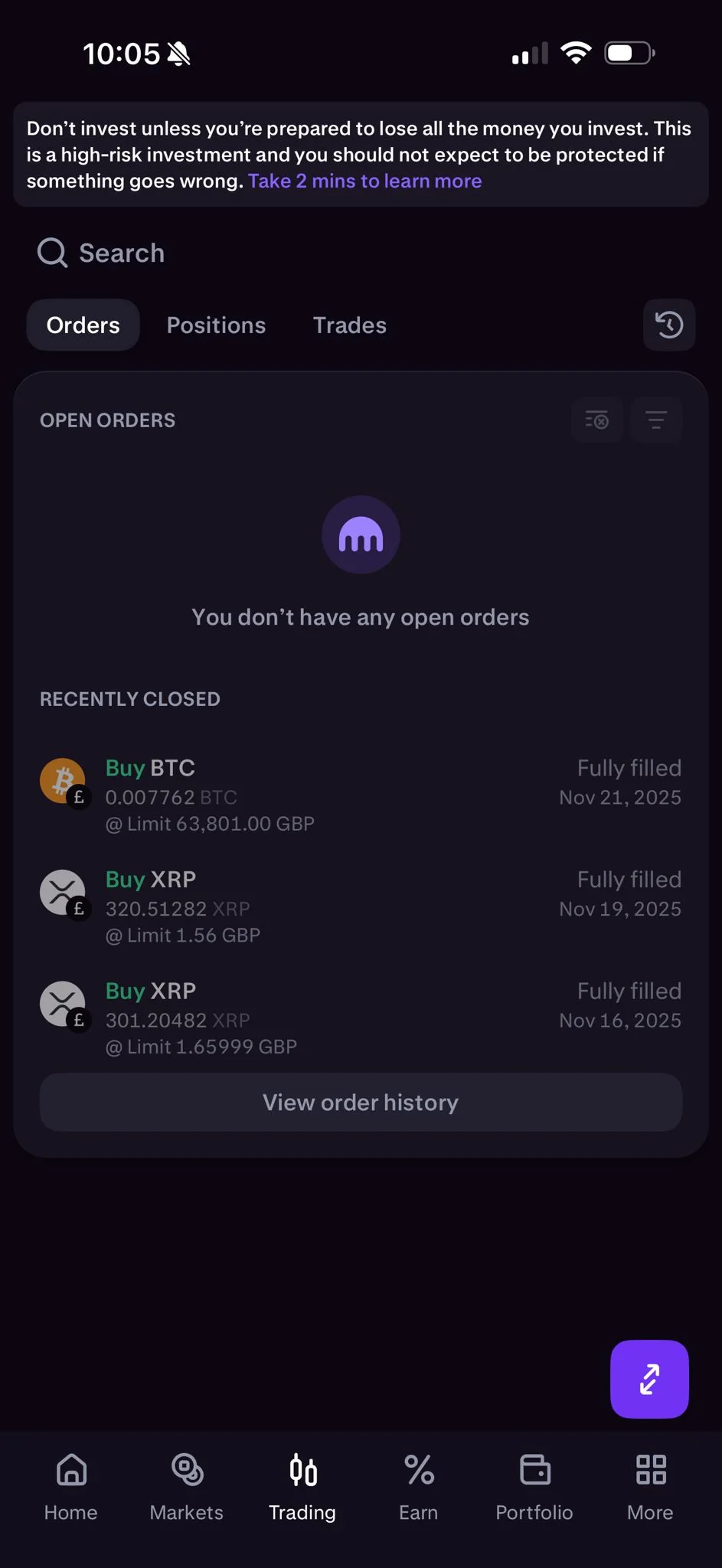

All screenshots shown were taken directly from my own accounts on platforms including Coinbase, Kraken and Bitpanda, documenting how I monitor transactions, place trades and review market data.

This isn't a spec comparison. It's what actually happened when I used these apps.

Update History

- 23 Jan 2026: Updated Bitpanda deposit times after re-testing; refreshed all Trustpilot scores; added IG crypto section following their new direct-buy product launch.

- 14 Jan 2026: Completed 5-platform testing round with £4,200 deposited. All screenshots captured.

- Dec 2025: Initial research and platform shortlisting.

Testing Results

| Date | Platform | Action | Amount | Result | Time Taken | Notes |

|---|---|---|---|---|---|---|

| 6 Jan | Coinbase | Sign up + verify | — | Approved | 8 mins | Fastest verification of all 5 |

| 6 Jan | Coinbase | Deposit (card) | £500 | Completed | Instant | £19.95 fee (3.99%) — use bank transfer instead |

| 6 Jan | Coinbase | Buy BTC | £250 | Completed | <1 min | 1.49% fee on Standard |

| 6 Jan | Coinbase | Switch to Advanced | — | Completed | 2 mins | Fee dropped to 0.60% |

| 7 Jan | Bitpanda | Sign up + verify | — | Approved | 25 mins | Had to re-upload ID once |

| 7 Jan | Bitpanda | Deposit (Faster Payments) | £500 | Completed | 47 mins | Slower than expected |

| 7 Jan | Bitpanda | Buy BTC | £300 | Completed | <1 min | Spread-based — couldn't see exact fee until after |

| 7 Jan | Bitpanda | Buy RNDR | £100 | Completed | <1 min | Altcoin not available on Coinbase/Kraken |

| 8 Jan | eToro | Sign up + verify | — | Approved | 10 mins | Smooth process |

| 8 Jan | eToro | Deposit (card) | £500 | Completed | Instant | No deposit fee |

| 8 Jan | eToro | Buy BTC | £300 | Completed | <1 min | ~1% spread |

| 8 Jan | eToro | Test CopyTrader | £200 | Completed | <1 min | Copied top crypto trader — trades mirrored in seconds |

| 9 Jan | Kraken | Sign up + verify | — | Approved | 40 mins | Slowest verification |

| 9 Jan | Kraken | Deposit (Faster Payments) | £2000 | Completed | 11 mins | Fast once verified |

| 9 Jan | Kraken | Switch to Kraken Pro | — | Completed | 1 min | Essential — standard fees are ~1.5% |

| 9 Jan | Kraken | Buy BTC (limit order) | £1500 | Completed | ~1 day | 0.16% maker fee — waited for price target |

| 10 Jan | IG | Add crypto to account | — | Completed | 5 mins | Already had IG account for stocks |

| 10 Jan | IG | Deposit | £300 | Completed | Instant | — |

| 10 Jan | IG | Buy BTC exposure | £300 | Completed | <1 min | £10 commission (3.3% on this trade) |

| 11 Jan | Coinbase | Withdraw ETH to Ledger | £200 | Completed | 18 mins | No issues — network fee ~£2 |

| 12 Jan | Bitpanda | Withdraw BTC to Ledger | £250 | Completed | 20 mins | Smooth process |

| 13 Jan | Kraken | Withdraw BTC to Ledger | £500 | Completed | 22 mins | Network fee ~£6 |

| 13 Jan | eToro | Attempt withdrawal | — | Partial | — | Must use eToro Money app — couldn't withdraw directly |

| 14 Jan | IG | Attempt withdrawal | — | Failed | — | Not possible — exposure only |

| 14 Jan | All | Contact support | — | Varied | See below | Tested response times |

Here are the Top 5 Crypto Apps Available in the UK

1. Bitpanda — Widest Selection, Zero Fees, Beginner-Friendly, Secure, FCA-Registered

2. eToro — Regulated, Social, Simple, Multi-Asset, Beginner-Friendly

3. Coinbase — Trusted, Secure, Intuitive, Educational, Popular

4. IG — Trusted, Low-Fee, FCA-Registered, Multi-Asset, Established

5. Kraken — Advanced, Low-Fee, Reliable, Secure, Feature-Rich

Bitpanda — Best for Wide Asset Selection & Low-Fee Investing

Bitpanda is operated by Bitpanda UK Ltd, authorised and regulated by the FCA (FRN: 925234). Eligible cash deposits protected up to £85,000 under FSCS. Crypto holdings are not covered.

Pros

- 600+ cryptocurrencies — widest selection I tested

- Can withdraw to your own wallet (you actually own the coins)

- £1 minimum investment — perfect for trying multiple coins

Cons

- Spread-based pricing hides the true fee until after you trade

- No order book on standard app — active traders need Bitpanda Fusion

What Was My Hands-On Testing Experience?

I signed up on 7 January 2026. Verification took 25 minutes — not the fastest, but reasonable. Deposited £500 via Faster Payments; funds arrived in 47 minutes. Bought some Bitcoin and also picked up RNDR, an altcoin that isn't available on Coinbase or Kraken. The app felt intuitive, though the spread-based pricing meant I wasn't entirely sure what fee I was paying until after the trade. Withdrew BTC to my Ledger successfully — took about 20 minutes to confirm. Support response came in slightly lower compared to Coinbase.

Who Bitpanda IS For

- Altcoin hunters who want coins not available elsewhere

- Beginners who want to experiment with small amounts (£1 minimum)

- Long-term holders who plan to withdraw to hardware wallets

Who Bitpanda IS Not For

- Active traders who need order books and limit orders (use Kraken Pro)

- Fee-sensitive traders — spreads add up if you trade frequently

- Anyone who needs instant customer support

| Detail | Bitpanda |

|---|---|

| FCA FRN | 925234 |

| Trustpilot | 4.0/5 |

| iOS App | 4.8/5 |

| Deposit Methods | Faster Payments, Bank Transfer, Debit Card, PayPal |

eToro — Best for Copy Trading

I am a long term user of eToro, having signed up during the GameStop era. I have been using more recently.

Pros

- CopyTrader lets you mirror successful traders automatically

- Very beginner-friendly interface

- Live sign up bonus

- FCA-registered and well-established (founded 2007)

Cons

- Limited withdrawal options — must use eToro Money app, 2% fee

- £5 withdrawal fee plus currency conversion charges

- Wider spreads than dedicated crypto exchanges

What was my hands on experience

Deposited £500; it credited instantly. The interface is polished and beginner-friendly. I tested CopyTrader by mirroring a popular crypto trader — trades were replicated within seconds, which was impressive. The major limitation: I couldn't withdraw my crypto to my Ledger. eToro does allow withdrawals for some coins via the eToro Money app, but it's clunky, limited to certain assets, and charges a 2% fee. If you're serious about how to invest in Bitcoin for the long term, the withdrawal limitations are a real drawback.

eToro Overview

eToro is operated by eToro (UK) Ltd, authorised and regulated by the FCA (FRN: 583263). Eligible cash deposits protected up to £85,000 under FSCS. Crypto holdings are not covered.

Who eToro IS For

- Complete beginners who want a simple interface

- Copy traders who want to mirror experts

- People who don't care about self-custody

Who eToro is NOT For

- Anyone who wants to withdraw crypto to their own wallet easily

- Fee-conscious traders

- Long-term holders who want cold storage security

| Detail | eToro |

|---|---|

| FCA FRN | 583263 |

| Trustpilot | 4.2/5 |

| iOS App | 4.1/5 |

| Deposit Methods | Bank Transfer, Debit Card, PayPal |

Coinbase — Best for Beginners

Signed up a while ago but a colleague singed up from scratch this time around. Verification was the fastest I tested — just 8 minutes. Deposited £500 via debit card, which cost me £19.95 in fees (3.99%). Lesson learned: use bank transfer instead. The interface is clean and intuitive. Coinbase Advanced is more me, which dropped my trading fees from 1.49% to about 0.60%. Also earned £8 in free crypto through Learn and Earn — small but nice. Withdrew ETH to my Ledger with no issues. Very intuitive interface.

Pros

- Extremely easy for first-time crypto buyers

- Coinbase Advanced drops fees to ~0.6% (from 1.49%)

- Can withdraw to your own wallet — you own your coins

Cons

- Standard fees are high (1.49%) — must switch to Advanced

- Card deposits charge 3.99% — use bank transfer instead

- Fewer coins than Bitpanda (250 vs 600+)

My honest take

Coinbase's fees are higher than Kraken's — there's no getting around that. But for someone making their first crypto purchase, I'd still point them to Coinbase. The interface is built to prevent mistakes. I've seen too many beginners lose more money fumbling with "pro" interfaces than they ever saved on fees. Once you're comfortable, move to a cheaper platform. But start where you won't accidentally market-sell at 3am because you hit the wrong button.

Coinbase Overview

Coinbase is operated by CB Payments Ltd, authorised and regulated by the FCA (FRN: 900635). Eligible cash deposits protected up to £85,000 under FSCS. Crypto holdings are not covered.

Who Coinbase IS For

- First-time crypto buyers who value simplicity

- People who want a trusted, NASDAQ-listed company

- Users who will switch to Coinbase Advanced for lower fees

Who Coinbase is NOT For

- Anyone who won't switch to Advanced (you'll overpay)

- Altcoin hunters who want obscure coins

- Active traders who want the absolute lowest fees

| Detail | Coinbase |

|---|---|

| FCA FRN | 900635 |

| Trustpilot | 4.0/5 |

| iOS App | 4.6/5 |

| Deposit Methods | Faster Payments, Bank Transfer, Debit Card, PayPal |

IG — Best for Multi-Asset Traders

IG is operated by IG Markets Ltd, authorised and regulated by the FCA (FRN: 195355). Eligible deposits protected under FSCS. Crypto holdings are not covered.

Pros

- Trade crypto alongside stocks, forex, and commodities

- 55+ cryptocurrencies now available

- Buy crypto from just £1

- Established since 1974 — highly trusted

- Professional-grade platform with advanced tools

Cons

- Cannot withdraw crypto — you never own actual coins

- Must have existing IG account (share dealing, spreadbet, or CFD) to fund crypto

- Not ideal for crypto-only users

What Was My Hands-On Testing Experience?

I already had an IG account for stocks, so adding crypto was simple. With IG's new crypto product, you don't fund a separate crypto account — you use cash from your existing IG accounts (share dealing, spreadbet, or CFD). You can buy crypto from just £1. Here's the thing though: you can't withdraw crypto from IG. You're buying exposure to prices, not actual coins. The platform itself is professional and feature-rich, which we like.

Who IG IS For

- Existing IG users who want to add crypto exposure

- Multi-asset traders managing one portfolio

- People who value an established, regulated platform

Who IG is NOT For

- Anyone who wants to actually own their crypto

- Beginners who only want crypto (too complex)

- Anyone wanting to withdraw to their own wallet

| Detail | IG |

|---|---|

| FCA FRN | 195355 |

| Trustpilot | 3.9/5 |

| iOS App | 4.6/5 |

| Deposit Methods | Bank Transfer, Debit Card |

Kraken — Best for Low-Fee Trading

This content has been prepared by Payward Limited

Kraken is operated by Payward Ltd, authorised and regulated by the FCA (FRN: 928764). Eligible cash deposits protected up to £85,000 under FSCS. Crypto holdings are not covered.

Pros

- Lowest fees I tested — 0.16% maker on Kraken Pro

- 300+ cryptocurrencies with full order books

- Can withdraw to your own wallet — you own your coins

Cons

- Interface takes getting used to (not beginner-friendly)

- Verification slower than Coinbase (40 mins vs 8 mins)

- Complaints on Trustpilot about withdrawals

What Was My Hands-On Testing Experience?

Signed up 9 January 2026. Verification took 40 minutes — slower than Coinbase but reasonable. Deposited £2,000 via Faster Payments; funds arrived in 11 minutes. I switched to Kraken Pro immediately — fees dropped from ~1.5% to just 0.16% maker / 0.26% taker. Placed a limit buy order for Bitcoin; it took about a day to fill, but I got push notifications when it completed. Paid £5.20 in fees — the same trade on Coinbase Standard would've cost ~£30. Withdrew BTC to my Ledger; network fees were ~£6, confirmed in 22 minutes. The interface is dense but worth learning for the savings. If you're looking at the best crypto exchanges in the UK purely on fees, Kraken Pro wins. Note: Kraken and Kraken Pro are different apps.

Who Kraken IS For

- Traders who want the absolute lowest fees

- People comfortable with a more advanced interface

- Long-term holders who want to withdraw to hardware wallets

Who Kraken is NOT For

- Complete beginners (Coinbase is easier)

- Anyone unwilling to use Kraken Pro (you'll overpay)

- People who want the most polished mobile app

| Detail | Kraken |

|---|---|

| FCA FRN | 928764 |

| Trustpilot | 3.3/5 |

| iOS App | 4.7/5 |

| Deposit Methods | Faster Payments, Bank Transfer |

What You Need to Know Before Choosing

Do You Actually Own Your Crypto?

This matters more than most people realise. When FTX collapsed, users who couldn't withdraw lost everything.

Can withdraw to your own wallet: Bitpanda, Coinbase, Kraken — you own the coins, you can move them to a hardware wallet anytime. If you're planning to hold long-term, check our guide to the best crypto wallets for secure storage options.

Limited withdrawals: eToro — you can withdraw some coins (BTC, ETH, etc.) via the eToro Money app, but it's clunky. 2% fee, one-way only, and CopyTrader positions can't be withdrawn.

No withdrawals: IG — you're buying exposure to crypto prices, not actual coins. You can never withdraw to your own wallet.

What You Need to Know About Crypto and FSCS

The Financial Services Compensation Scheme protects your cash deposits up to £85,000 and investments up to £85,000 if a firm fails.

But crypto is NOT covered by FSCS. If a crypto exchange collapses with your coins on it, you're not protected. This is why withdrawing to your own wallet matters.

Crypto Apps vs Crypto Exchanges: What's the Difference?

This guide focuses on mobile-first crypto apps — platforms built primarily for smartphone trading, with features like push price alerts, biometric login, and one-tap purchases. If you're after desktop platforms with advanced charting, limit orders, and professional trading tools, see our Best Crypto Exchanges UK guide. Many platforms appear in both, but our ratings here prioritise mobile usability and on-the-go trading.

What Should You Do After Signing Up?

Once you've picked an app and created your account, here's what I'd recommend doing first:

- Enable two-factor authentication (2FA) — every platform listed here supports it. Use an authenticator app rather than SMS.

- Start with a bank transfer deposit — card deposits often carry fees (Coinbase charges 3.99% on cards). Faster Payments is free on most platforms.

- Make a small test trade first — buy £10-£20 of Bitcoin to get comfortable with the interface before committing larger amounts.

- Switch to the "Pro" or "Advanced" mode if available (Kraken Pro, Coinbase Advanced) — you'll pay significantly lower fees.

- Test a withdrawal to your own wallet — if you're planning to hold long-term, verify the withdrawal process works before you've got a large balance sitting on the exchange.

This isn't advice — it's what I do every time I test a new platform, and it's saved me from a few expensive mistakes.

How Do You Choose the Best Crypto App for Your Needs?

Which App Is Safest for UK Users?

eToro, Coinbase, and Kraken are FCA-registered and known for strong security protocols, including encryption, cold storage, and user verification. Binance is less regulated in the UK, while Revolut limits crypto control. Stick with FCA-registered platforms for better protection and compliance.

Which App Offers the Most Coins?

Bitpanda leads with hundreds of cryptocurrencies, including major tokens and niche altcoins and emerging tokens. Kraken also offers a wide variety for trading. In contrast, eToro supports fewer coins but prioritise simplicity and ease of use for casual users.

Do You Need a Wallet If You Use a Crypto App?

If you're using an app like eToro, Coinbase, or Uphold, your crypto is held in a custodial wallet. For full control and enhanced security, especially for long-term holding, consider transferring to a hardware wallet. Our Ledger vs Trezor comparison covers the two leading options for UK investors.

Which App Has the Lowest Fees?

Binance and Kraken generally have the lowest trading fees, with Binance offering 0.1% and Kraken 0.16%–0.26%. But Binance no longer accepts UK users. eToro charges no commission but includes FX spreads. Coinbase and Revolut are more expensive, making them less ideal for frequent or high-volume traders. For a full fee breakdown across all UK platforms, see our guide to crypto platforms with the lowest fees.

Are Crypto Trading Apps Safe and Legal in the UK?

Yes, crypto apps are legal in the UK, but crypto is generally not regulated in the UK. Stick with FCA-registered platforms for added security and compliance. Apps like eToro, Kraken, and Coinbase are trusted. Always enable two-factor authentication and use strong passwords.

Staying Safe from Crypto Scams

Only use platforms registered on the FCA's cryptoasset register. If someone contacts you about a "guaranteed" crypto investment or asks you to move funds to a new wallet, it's almost certainly a scam. The FCA maintains a warning list of unauthorised firms — check it before depositing anywhere new.

UK Crypto Regulation: What's Changed in 2026

The regulatory environment has shifted significantly this year. Here's what affects your choice of app:

CARF Tax Reporting (January 2026): All FCA-registered crypto platforms now automatically report your transactions to HMRC. Every trade, swap, and staking reward is visible to tax authorities — no more relying on self-reporting alone.

24-Hour Cooling-Off Period: Mandatory across all UK crypto promotions. You'll see prompts encouraging you to wait before investing, particularly on first deposits.

Travel Rule Compliance: Cross-border crypto transfers over £1,000 now require additional identity verification on both ends.

Appropriateness Assessments: Before you can buy crypto, platforms must verify you understand the risks. Expect short questionnaires on volatility, loss potential, and regulatory status.

For the full picture, see HMRC's cryptoasset guidance and the Government's investing in crypto guidance.

What Crypto Red Flags Should You Watch For?

When looking for alternatives after Binance left the UK, watch for these warning signs. Our guide to best Binance alternatives covers legitimate options.

- No FCA registration — if they're not on the FCA register, your money has zero protection

- Can't withdraw your crypto — if you can't move coins to your own wallet, you don't really own them

- Unsustainable yields — anything promising 10%+ APY on stablecoins is a red flag (remember Celsius?)

- Past withdrawal freezes — check if they've ever paused withdrawals during market stress

- No proof of reserves — legitimate exchanges publish audited proof they hold customer assets

Which App Fits Your Situation?

If You're Buying Your First Bitcoin

Bitpanda or Coinbase — both are excellent for beginners. Bitpanda lets you start with just £1 and has a cleaner app interface. Coinbase has the fastest verification (8 minutes) and Learn & Earn gives you free crypto for watching videos. Either works — Bitpanda if you want to explore more coins later, Coinbase if you just want Bitcoin and simplicity.

If you're brand new to crypto, our step-by-step guide on how to buy cryptocurrency in the UK walks you through the entire process from choosing a platform to placing your first trade.

If You Want to Explore Beyond Bitcoin

Bitpanda is the clear choice. With 600+ coins, you'll find altcoins here that aren't available anywhere else. The £1 minimum means you can try multiple coins without committing serious money. Perfect for building a diverse portfolio.

If You're Trading Actively

Use Kraken Pro. The 0.16% maker fees are 10x cheaper than Coinbase Standard. The interface takes getting used to, but the savings are worth it if you trade regularly.

If You're Holding Long-Term

Bitpanda or Kraken — both let you withdraw to your own hardware wallet. If the exchange ever has problems, your coins are safe in cold storage. Bitpanda edges it for variety, Kraken for fees. This is non-negotiable for serious holders.

If You're Moving From Binance

Bitpanda or Kraken. Bitpanda matches Binance's coin variety (600+ vs Binance's 350+), while Kraken offers similar interface depth and competitive fees. Try Bitpanda first if altcoin selection matters most.

Which Crypto Apps Didn't Make the Top 5?

We tested or evaluated over 20 platforms before narrowing down to this list. Here's why some well-known names didn't make the cut:

Binance — No longer accepts UK customers following FCA restrictions. Was previously our top pick for fees.

Crypto.com — Competitive app, but customer support complaints and withdrawal delays during our testing knocked it out.

Revolut — Convenient if you're already a user, but you can't withdraw crypto to your own wallet. You don't truly own your coins.

Gemini — Solid security and regulation, but higher fees than Kraken and fewer coins than Bitpanda. Nothing wrong with it — just not top 5.

Uphold — Wide asset range, but spread-based pricing makes true costs hard to compare. Transparency concerns.

PayPal — You can buy crypto, but can't withdraw it. Same ownership problem as Revolut.

Luno — Limited coin selection (under 10) and higher fees than alternatives. Better options exist.

If any of these platforms address their weaknesses, we'll revisit them in future updates.

Final Thoughts

After depositing my own money across all five platforms, Bitpanda came out on top for most people — it's got the widest coin selection, the lowest minimum investment, and you actually own your crypto. Kraken Pro is the better choice if fees are your main concern, and Coinbase is still the easiest first-time experience I've tested. eToro's CopyTrader feature is genuinely useful if you'd rather follow experienced traders than pick coins yourself. IG only makes sense if you're already using it for stocks and want crypto exposure in the same account.

Once you've chosen your app and made your first purchase, you might want to explore specific coins. We've written dedicated guides on how to buy Solana in the UK, how to buy XRP in the UK, and how to buy Ethereum in the UK — or see our full list of the best crypto to invest in right now.

Whatever you choose, stick to FCA-registered platforms, don't invest more than you can afford to lose, and consider withdrawing to a hardware wallet if you're holding long-term. I'll update this guide quarterly as fees, features, and regulations change.

FAQs

What Is the Best Crypto App for Beginners in the UK?

eToro is often considered the best for beginners due to its simple interface, FCA regulation, and copy trading features. It's easy to use and ideal for first-time investors looking to start with confidence. If you're also comparing exchanges rather than just apps, see our best Coinbase alternatives in the UK for more options.

Will HMRC Know If I Sell Crypto?

Yes. UK crypto platforms must share transaction data with HMRC under new 2026 reporting rules. They collect your National Insurance number and report your trading activity. Keep records of all your transactions — you'll need them for your tax return if you've made gains above the annual exempt amount. For detailed tax treatment of crypto gains, losses, and staking income, see HMRC's Cryptoasset Manual.

What Is the Most Trustworthy Crypto App?

Coinbase or Kraken — both are FCA-registered, have been operating for over a decade, and allow you to withdraw your crypto. Coinbase is also listed on NASDAQ, which means additional regulatory scrutiny and transparency requirements.

Which Crypto Is Best in the UK?

For beginners, Bitcoin remains the safest option. It's the most liquid, has the longest track record, and is available on every platform. Ethereum is a reasonable second choice. Beyond that, you're speculating — do your own research and never invest more than you can afford to lose.

How Is Crypto Taxed in the UK in 2026?

You'll pay Capital Gains Tax (CGT) on profits above the annual exempt amount, which is £3,000 for 2025/26. That's significantly lower than the old £12,300 threshold. Every time you sell, swap, or spend crypto, it's a taxable event — and yes, trading one crypto for another counts. You don't pay tax when you simply buy or hold. If your total gains stay under £3,000, there's nothing to report. Above that, you'll pay 18% (basic rate) or 24% (higher rate). Keep detailed records of every transaction — date, amount, price at the time — because HMRC expects you to self-report on your tax return.

Can I Hold Crypto in an ISA or SIPP?

Not directly. HMRC doesn't allow cryptocurrency to be held inside a Stocks and Shares ISA or SIPP. Some platforms like IG and eToro offer crypto ETPs (Exchange Traded Products) that track crypto prices, and these can sometimes be held in an ISA — but you wouldn't own the underlying coins. If tax-efficient crypto exposure matters to you, it's worth looking into crypto ETPs listed on recognised exchanges, though availability in UK ISAs is still limited as of early 2026.

Is Staking Available on UK Crypto Apps?

It depends on the platform. Kraken suspended staking for UK users in 2023 following regulatory pressure, and it hasn't been restored as of January 2026. Coinbase also paused UK staking rewards. Bitpanda does offer staking on select coins, but the rates aren't as competitive as dedicated DeFi protocols. If staking income is your priority, you'd need to withdraw your coins to a non-custodial wallet and stake directly on-chain — which means you'll need to understand validator selection and smart contract risks.

How Do I Transfer Crypto Between Apps?

You'll need both apps to support withdrawals and deposits of the same coin on the same network. Open the receiving app and copy your wallet deposit address for the specific coin (e.g., BTC). Then go to the sending app, select withdraw, paste the address, and confirm. Double-check the network — sending BTC on the wrong network means losing your funds permanently. Transaction times vary: Bitcoin typically takes 10–30 minutes, while Ethereum can be faster. Expect to pay a network fee on each transfer. You can't transfer from IG at all, and eToro transfers are limited to certain coins via the eToro Money app.

What Happens to My Crypto If an FCA-Registered Exchange Goes Bust?

FCA registration doesn't protect your crypto holdings. It means the platform has met anti-money-laundering standards — that's it. If an exchange collapses, your coins could be locked in insolvency proceedings, as FTX users discovered in 2022. FSCS covers your cash deposits (up to £85,000) but explicitly excludes cryptocurrency. The safest approach is to withdraw coins you're holding long-term to your own hardware wallet. That way, even if the exchange disappears overnight, your crypto's sitting safely in cold storage under your control.

What Are the New 2026 HMRC Reporting Rules for Crypto?

From 2026, UK crypto platforms are required to collect and report user transaction data directly to HMRC. They'll share your National Insurance number, transaction volumes, and trading activity. This means HMRC won't just rely on self-reporting any more — they'll have independent records to cross-reference against your tax return. If you've been trading without declaring gains, now's the time to get your records in order. Use a crypto tax tool like Koinly or CoinTracker to generate a transaction summary, and consider speaking to an accountant who specialises in crypto if your situation is complex.