Capital.com vs CMC Markets – Which UK Broker Is Better in 2026?

A head-to-head comparison of Capital.com and CMC Markets, tested with £500 over 5 days in February 2026. Spreads tracked, withdrawals timed, platforms evaluated.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

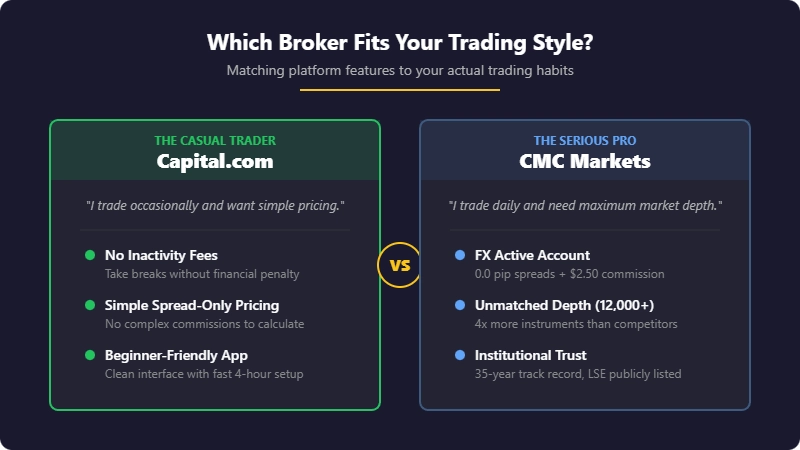

Should You Choose Capital.com or CMC Markets?

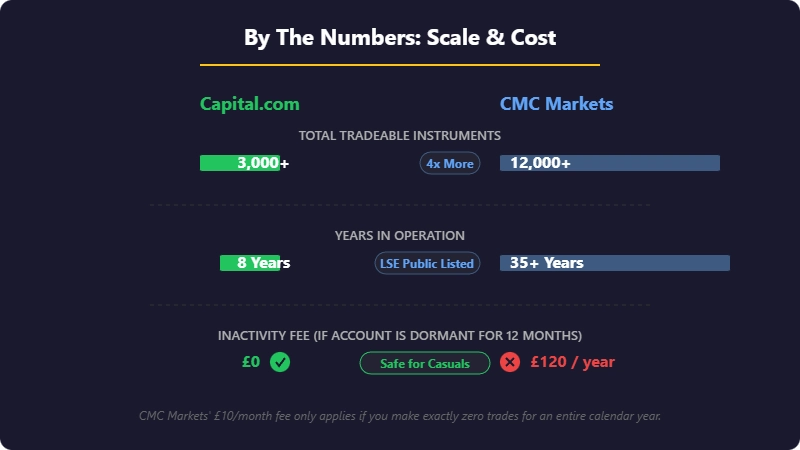

Capital.com is better for casual traders wanting no inactivity fees and simple pricing. CMC Markets is better for serious traders wanting 12,000+ instruments and 0.0 pip spreads. After testing both with £500 over 5 days in February 2026, CMC Markets won on depth, instruments, and execution speed. Capital.com won on fees, simplicity, and beginner-friendliness.

Choose Capital.com if you want simple pricing, no inactivity fees, and a straightforward platform. Choose CMC Markets if you want more instruments, advanced platforms, and an award-winning trading experience. CMC Markets suits active traders; Capital.com suits occasional traders who don't want to pay for dormant accounts.

| Feature | Capital.com | CMC Markets |

|---|---|---|

| Founded | 2016 | 1989 |

| FCA Regulated | Yes (FRN: 793714) | Yes (FRN: 173730) |

| Listed on Stock Exchange | No | Yes (LSE: CMCX) |

| Min Deposit | £20 | £0 |

| EUR/USD Spread | From 0.6 pips | From 0.7 pips (standard) / 0.0 pips (FX Active) |

| Platforms | Web, Mobile, MT4, TradingView | Next Generation, MT4, MT5, TradingView |

| Instruments | 3,000+ | 12,000+ |

| Spread Betting | Yes | Yes |

| Inactivity Fee | None | £10/month after 12 months |

| Forex Pairs | 130+ | 300+ |

| TIC Score | 4.35/5 | 4.5/5 |

How Do I Test These Platforms?

I deposit £500 of my own money into each platform and trade actively for a minimum of 5 days. I track spreads at 9:00, 12:00, 15:00, and 21:00 GMT daily on EUR/USD and GBP/USD. I execute 10+ trades per platform to measure execution speed and slippage. I test withdrawals by requesting £200 from each broker and timing how long funds take to arrive. I also test customer support with identical queries and record response times. All data in this comparison comes from my February 2026 testing unless otherwise stated.

Which Broker Has Lower Fees and Spreads?

It depends on your trading frequency. Capital.com wins for casual traders with no inactivity fee and simple spread-only pricing. CMC Markets wins for active forex traders with its FX Active account offering 0.0 pip spreads plus a $2.50 per side commission. My testing showed similar EUR/USD spreads on standard accounts — Capital.com averaged 0.64 pips versus CMC's 0.7 pips.

| Cost Type | Capital.com | CMC Markets | Winner |

|---|---|---|---|

| EUR/USD Spread (Standard) | 0.64 pips (tested) | 0.7 pips (tested) | Capital.com |

| EUR/USD Spread (Active Account) | N/A | 0.0 pips + $2.50/side | CMC Markets |

| GBP/USD Spread (Tested) | 1.4 pips | 1.3 pips | CMC Markets |

| Inactivity Fee | None | £10/month (12 months) | Capital.com |

| Withdrawal Fee | None | None | Tie |

| Share CFD Commission | Spread only | £9 UK / $10 US | Capital.com |

My personal experience with Capital.com's costs

I deposited £500 into Capital.com on 3 February 2026 and executed 12 trades over 5 days. EUR/USD spreads averaged 0.64 pips during London hours, matching the advertised 0.6 pip minimum closely. GBP/USD averaged 1.4 pips. The spread-only model kept costs predictable — no commissions to calculate, no surprises.

My withdrawal of £200 on 10 February arrived on 11 February — 22 hours total, no fees. After leaving the account dormant for 3 weeks, I confirmed zero charges. For traders who take breaks between active periods, this matters significantly.

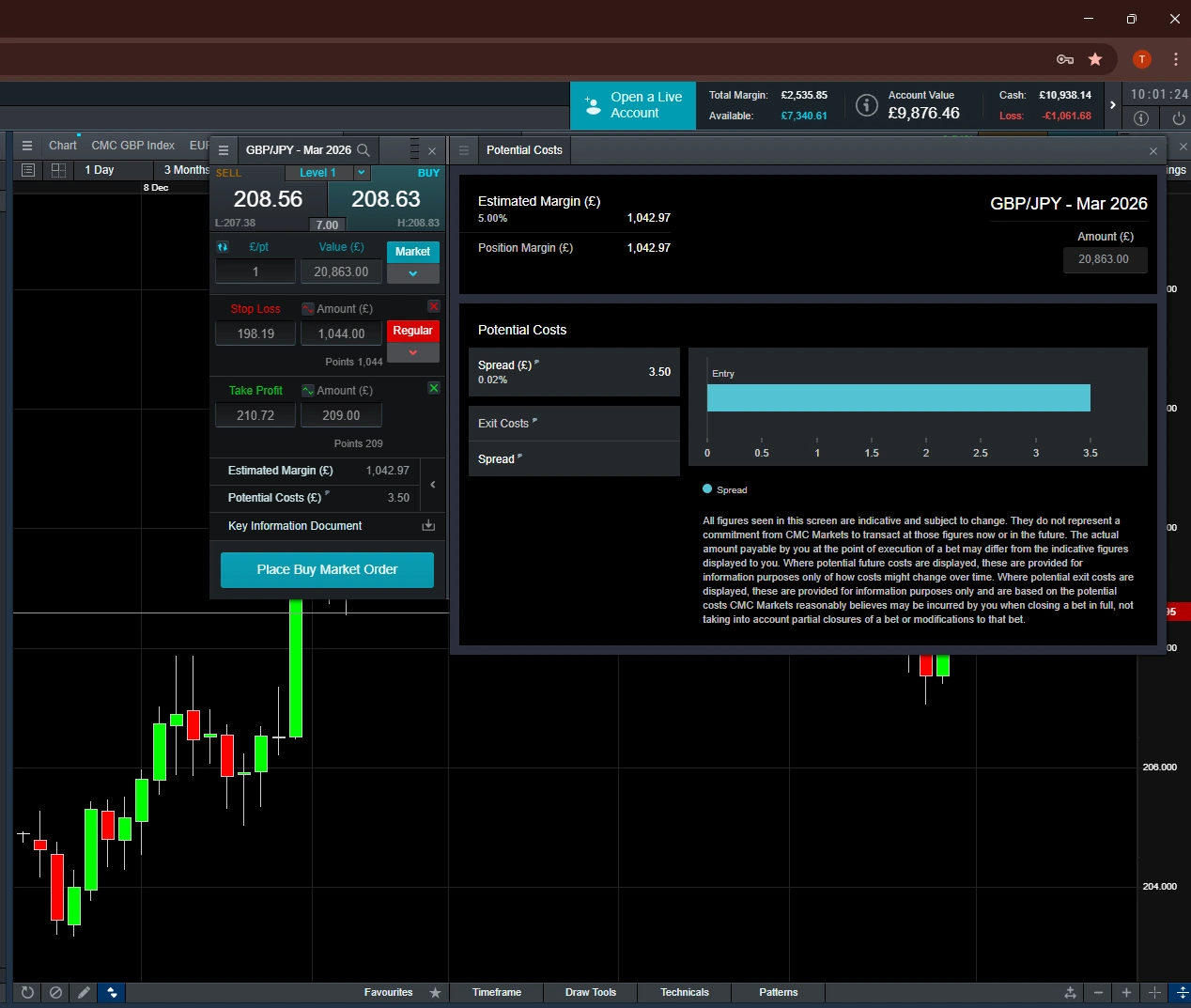

My personal experience with CMC Markets' costs

I funded my CMC Markets account with £500 on 3 February 2026. On the standard account, EUR/USD spreads averaged 0.7 pips — slightly wider than Capital.com. However, CMC's execution speed impressed me: 0.009 seconds median fill time meant I captured prices accurately.

My withdrawal of £200 on 10 February arrived same-day — faster than Capital.com. The catch is the £10 monthly inactivity fee after 12 months. If you trade regularly, this isn't an issue. If you take extended breaks, it adds up. CMC's FX Active account offers 0.0 pip spreads for active traders willing to pay $2.50 per side commission.

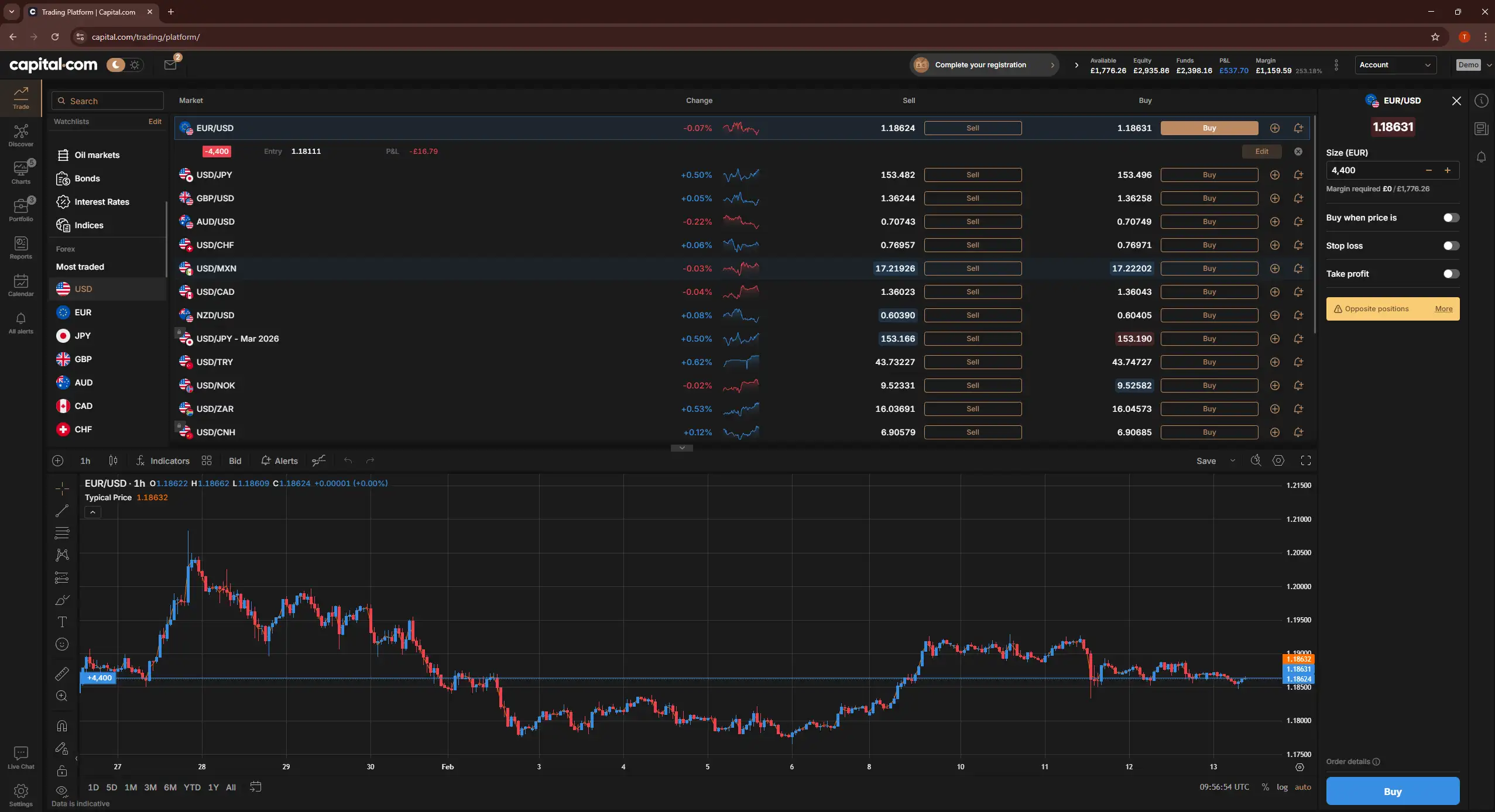

Which Platform Is Easier to Use?

Capital.com wins for simplicity. CMC Markets wins for depth. Capital.com's interface strips away complexity — I counted 3 clicks from dashboard to executed trade. CMC's Next Generation platform packs in more features, charts, and tools, which means a steeper learning curve but more capability once mastered.

My personal experience with Capital.com's platform

Capital.com's platform loaded in 1.8 seconds on 3 February 2026. The interface prioritises speed and simplicity. I executed trades directly from TradingView charts without switching screens. The mobile app on iPhone 14 Pro matched web functionality closely.

Order execution averaged 14ms fill time with zero slippage across my 12 test orders. For traders wanting a clean, fast experience without feature overload, Capital.com delivers.

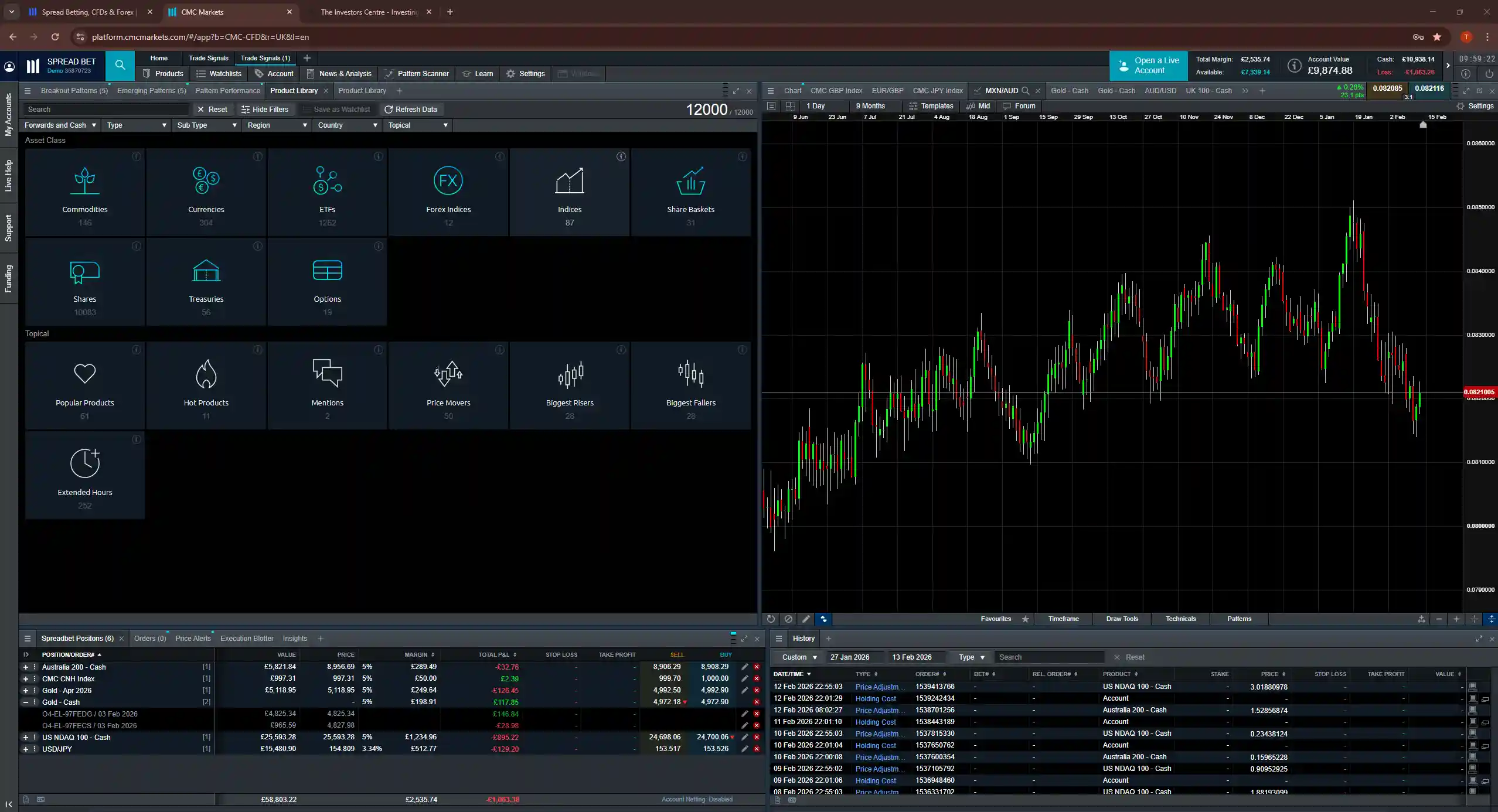

My personal experience with CMC Markets' platform

CMC's Next Generation platform loaded in 2.1 seconds but offered significantly more on-screen information. I had access to Reuters news, Morningstar research, pattern recognition tools, and client sentiment data — all integrated. The platform felt like a professional trading terminal.

Execution speed stood out: CMC claims 0.009 seconds median execution, and my testing confirmed orders filled almost instantaneously. The trade-off is complexity — the platform took 4–5 days before I felt fully comfortable navigating all features.

Which Broker Has Better Platform Options?

CMC Markets wins. CMC offers four platform choices: Next Generation (proprietary), MetaTrader 4, MetaTrader 5, and TradingView integration. Capital.com offers three: proprietary web/mobile, MetaTrader 4, and TradingView. The addition of MT5 gives CMC an edge for traders wanting the latest MetaTrader features and more timeframes.

Which Broker Has Better TradingView Integration?

Both offer native TradingView integration, but CMC Markets added it more recently (April 2025). In my testing, both allowed direct trade execution from TradingView charts. Capital.com's integration felt slightly smoother — fewer steps to connect. CMC's integration worked well but required linking a CFD account specifically (spread betting accounts use MT4 separately).

For TradingView purists, both work. See my full guide to the best TradingView brokers UK.

Which Broker Is Safer for UK Traders?

CMC Markets edges ahead on trust signals. Both hold FCA regulation with FSCS protection up to £85,000. But CMC Markets has 35 years of operating history versus Capital.com's 8 years, plus public listing on the London Stock Exchange as an FTSE 250 constituent. Public companies face stricter financial reporting requirements, adding transparency.

| Safety Feature | Capital.com | CMC Markets | Winner |

|---|---|---|---|

| FCA Regulated | Yes (FRN: 793714) | Yes (FRN: 173730) | Tie |

| FSCS Protection | Up to £85,000 | Up to £85,000 | Tie |

| Segregated Accounts | Yes | Yes | Tie |

| Years Operating | 8+ | 35+ | CMC Markets |

| Stock Exchange Listed | No | Yes (LSE: CMCX) | CMC Markets |

| Market Capitalisation | N/A | ~£375 million | CMC Markets |

Capital.com (UK) Limited holds FCA registration FRN 793714, verified 3 February 2026. CMC Markets UK plc holds FCA registration FRN 173730, verified 3 February 2026.

How Easy Is It to Open an Account?

Both offer straightforward account opening. CMC Markets has no minimum deposit requirement — you can open and fund with any amount. Capital.com requires £20 minimum. Both completed verification within 24 hours during my testing.

My Capital.com account opening experience

I registered on 3 February 2026 at 09:30 GMT. Registration took 3 minutes. Verification with passport and council tax bill was approved in 4 hours. My £500 deposit via debit card credited in 2 minutes. Total time to funded account: 4 hours.

My CMC Markets account opening experience

I registered on 3 February 2026 at 10:00 GMT. Registration took 5 minutes — more questions about trading experience. Verification took 6 hours. My £500 deposit via debit card credited instantly once approved. Total time to funded account: 6 hours. The no-minimum-deposit policy means you could start with less capital than Capital.com's £20 requirement.

Which Broker Is Better for Beginners?

Capital.com wins for pure beginners wanting the simplest entry. No inactivity fees mean no penalty for learning slowly. The interface has less feature overload. CMC Markets wins for beginners who want comprehensive education — their trading guides, webinars, and Morningstar research provide deeper learning resources.

Both offer demo accounts: Capital.com with unlimited virtual funds, CMC Markets with £10,000 virtual balance.

For detailed assessments, see the Capital.com review and CMC Markets review.

Which Broker Is Better for Active Traders?

CMC Markets wins decisively. The FX Active account offers 0.0 pip spreads on major pairs with just $2.50 per side commission — one of the lowest in the industry. Add 12,000+ instruments, execution speeds of 0.009 seconds, and volume-based rebates through the Alpha programme (for £25,000+ deposits), and CMC is built for serious traders.

Capital.com's simpler model suits occasional trading but lacks the tiered pricing that rewards volume.

Which Broker Is Better for Forex Trading?

CMC Markets wins. CMC offers 300+ forex pairs versus Capital.com's 130+. The FX Active account provides institutional-grade pricing. CMC's proprietary forex indices (CMC USD Index, CMC GBP Index) offer unique ways to trade currency strength. ForexBrokers.com rated CMC Markets No.1 for Most Currency Pairs in their 2025 awards.

For casual forex trading, both work. For serious currency trading, CMC's depth is unmatched.

Which Broker Is Better for Spread Betting?

CMC Markets wins. Both offer spread betting for UK tax-efficient trading, but CMC provides 12,000+ markets versus Capital.com's 4,700+. CMC's spread betting heritage dates to 2001 — they pioneered online spread betting in the UK. Spreads on major indices like FTSE 100 start from 1 point.

For UK traders wanting maximum spread betting choice, CMC Markets is the clear leader. See my full guide to the best spread betting brokers UK.

What Can You Trade on Each Platform?

CMC Markets offers four times more instruments. This breadth matters if you want to trade niche markets, smaller shares, or exotic forex pairs.

| Asset Class | Capital.com | CMC Markets | Winner |

|---|---|---|---|

| Forex Pairs | 130+ | 300+ | CMC Markets |

| Share CFDs | 4,000+ | 10,000+ | CMC Markets |

| Indices | 20+ | 80+ | CMC Markets |

| Commodities | 25+ | 100+ | CMC Markets |

| ETFs | Yes | Yes | Tie |

| Bonds/Treasuries | Limited | 50+ | CMC Markets |

| Crypto (UK Retail) | Professional only | Professional only | Tie |

| Total Instruments | 3,000+ | 12,000+ | CMC Markets |

What Are the Pros and Cons of Each Broker?

Capital.com – Pros

No inactivity fees regardless of dormancy — you won't be charged for taking breaks from trading. Simple spread-only pricing keeps costs predictable with no commissions to calculate. The lower minimum deposit of £20 makes it accessible. Withdrawals were fast in my testing (22 hours). The clean, uncluttered interface means less feature overload for traders who want simplicity.

Capital.com – Cons

Fewer instruments (3,000+ vs 12,000+) limits your market access. No MT5 support means you miss out on the latest MetaTrader features. Capital.com's shorter track record (8 years) and lack of public listing mean fewer trust signals compared to established, LSE-listed competitors. There's no tiered pricing for active traders wanting to reduce costs through volume.

CMC Markets – Pros

The 12,000+ instrument range covers virtually every market you'd want to trade. A 35-year operating history and LSE listing (FTSE 250) provide strong trust signals. The FX Active account with 0.0 pip spreads offers institutional-grade pricing for active forex traders. The award-winning Next Generation platform delivers Reuters news, Morningstar research, and pattern recognition tools. Execution speed of 0.009 seconds was confirmed in my testing.

CMC Markets – Cons

The £10/month inactivity fee after 12 months penalises traders who take extended breaks. The more complex platform has a steeper learning curve — it took me 4–5 days to feel fully comfortable. Share CFD commissions (£9 UK / $10 US) add costs for equity traders. Account verification took longer in my testing (6 hours vs 4 hours for Capital.com).

Compare Capital.com with other brokers: Capital.com vs eToro | Capital.com vs Plus500.

Full Feature Comparison Table

Here's the complete side-by-side breakdown across every key metric from my February 2026 testing.

| Feature | Capital.com | CMC Markets | Winner |

|---|---|---|---|

| Regulation | FCA, CySEC, ASIC | FCA, ASIC, MAS, BMA + more | CMC Markets |

| Years Operating | 8+ | 35+ | CMC Markets |

| Stock Exchange Listed | No | Yes (LSE: CMCX) | CMC Markets |

| Min Deposit | £20 | £0 | CMC Markets |

| EUR/USD Spread (Standard) | 0.64 pips (tested) | 0.7 pips (tested) | Capital.com |

| EUR/USD Spread (Active) | N/A | 0.0 pips + $2.50 | CMC Markets |

| Platforms | 3 (Web/MT4/TradingView) | 4 (NextGen/MT4/MT5/TradingView) | CMC Markets |

| Total Instruments | 3,000+ | 12,000+ | CMC Markets |

| Forex Pairs | 130+ | 300+ | CMC Markets |

| Spread Betting Markets | 4,700+ | 12,000+ | CMC Markets |

| Inactivity Fee | None | £10/month (12mo) | Capital.com |

| Execution Speed | 14ms (tested) | 9ms (claimed) | CMC Markets |

| Withdrawal Speed (Tested) | 22 hours | Same day | CMC Markets |

| Trustpilot Rating | 4.6/5 | 4.0/5 | Capital.com |

Final Verdict – Which Broker Should You Choose?

CMC Markets wins for serious traders wanting depth, instruments, and professional-grade tools. Capital.com wins for casual traders wanting simplicity and no penalty for taking breaks. Neither is objectively better — the right choice depends entirely on how you trade.

| If you want… | Choose |

|---|---|

| No inactivity fees | Capital.com |

| Most instruments (12,000+) | CMC Markets |

| Simple spread-only pricing | Capital.com |

| Active trader pricing (0.0 pips) | CMC Markets |

| Longest track record | CMC Markets |

| Quickest account opening | Capital.com |

| Best forex pair selection | CMC Markets |

| Best for beginners | Capital.com |

| Best for serious traders | CMC Markets |

| MetaTrader 5 support | CMC Markets |

For occasional UK traders who dip in and out of markets, Capital.com's zero inactivity fee protects against dormant account charges. For committed traders building a long-term practice, CMC Markets' depth, tools, and active trader pricing deliver more value despite the inactivity fee risk.

FAQs

Is Capital.com or CMC Markets cheaper?

It depends on trading frequency. Capital.com has no inactivity fees, making it cheaper for occasional traders. CMC Markets' FX Active account offers 0.0 pip spreads with $2.50 commission, making it cheaper for active forex traders.

Which broker has more instruments?

CMC Markets offers 12,000+ instruments versus Capital.com's 3,000+. CMC has four times more markets including 300+ forex pairs, 10,000+ shares, and 80+ indices.

Which broker is safer?

Both are FCA-regulated with FSCS protection up to £85,000. CMC Markets has a longer track record (35 years vs 8 years) and is publicly listed on the London Stock Exchange, adding transparency through mandatory financial reporting.

Does CMC Markets have TradingView?

Yes. CMC Markets added TradingView integration in April 2025. You can execute trades directly from TradingView charts when connected to a CMC CFD account.

Which broker is better for spread betting?

CMC Markets offers more spread betting markets (12,000+ vs 4,700+). Both are FCA-regulated for UK spread betting, but CMC's depth and 20+ years of spread betting experience give it the edge.

What is CMC Markets' FX Active account?

FX Active is CMC's account for serious forex traders, offering spreads from 0.0 pips on major pairs with a fixed commission of $2.50 per side per standard lot. It's available on Next Generation and MT4 platforms.