Capital.com vs Plus500 – Which UK Broker Is Better in 2026?

A head-to-head comparison of Capital.com and Plus500, tested with £500 over 5 days in February 2026. Spreads tracked, withdrawals timed, platforms evaluated.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Should You Choose Capital.com or Plus500?

Capital.com and Plus500 are both FCA-regulated CFD brokers, but they target different traders. After testing both platforms with £500 over 5 trading days in February 2026, I found Capital.com wins on spreads, platform choice, and fees. Plus500 wins on track record and simplicity. Your choice depends on whether you prioritise costs or a longer-established brand.

Choose Capital.com if you want lower spreads, TradingView integration, or UK spread betting. Choose Plus500 if you want a simpler platform backed by a London Stock Exchange-listed company with 17 years of history. My testing showed Capital.com's EUR/USD spreads averaged 0.64 pips versus Plus500's 1.3 pips.

| Feature | Capital.com | Plus500 |

|---|---|---|

| Founded | 2016 | 2008 |

| FCA Regulated | Yes (FRN: 793714) | Yes (FRN: 509909) |

| Listed on Stock Exchange | No | Yes (LSE: PLUS) |

| Min Deposit | £20 | £100 |

| EUR/USD Spread | From 0.6 pips | From 0.8 pips |

| Platforms | Web, Mobile, MT4, TradingView | WebTrader and Mobile only |

| Spread Betting | Yes | No |

| Guaranteed Stop-Loss | Yes | Yes |

| Inactivity Fee | None | $10/month after 3 months |

| Crypto (UK Retail) | Professional only | Professional only |

| TIC Score | 4.35/5 | 4.1/5 |

Which Broker Has Lower Fees and Spreads?

Capital.com wins on trading costs. My 5-day spread tracking test recorded Capital.com's EUR/USD averaging 0.64 pips versus Plus500's 1.3 pips — a difference of 0.66 pips per trade. On a standard lot, that's £6.60 saved per round trip. Capital.com also charges no inactivity fees, whilst Plus500 charges $10 monthly after just 3 months without logging in.

| Cost Type | Capital.com | Plus500 | Winner |

|---|---|---|---|

| EUR/USD Spread (Advertised) | From 0.6 pips | From 0.8 pips | Capital.com |

| EUR/USD Spread (My Test Average) | 0.64 pips | 1.3 pips | Capital.com |

| GBP/USD Spread (My Test Average) | 1.4 pips | 2.1 pips | Capital.com |

| Inactivity Fee | None | $10/month (3 months) | Capital.com |

| Withdrawal Fee | None | None | Tie |

| Currency Conversion | 0.7% | 0.7% | Tie |

| Guaranteed Stop Cost | Wider spread | Wider spread | Tie |

My personal experience with Capital.com's costs

I deposited £500 into Capital.com on 3 February 2026 and executed 12 forex trades over 5 days. EUR/USD spreads averaged 0.64 pips during London session hours. I tracked spreads at 9:00, 12:00, 15:00, and 21:00 GMT daily. The tightest spreads appeared during London/New York overlap between 14:00–16:00 GMT, averaging 0.6 pips exactly.

My withdrawal request for £200 on 10 February at 11:30 was processed and funds arrived on 11 February at 09:15 — a total of 22 hours with no fees deducted. Capital.com claims 99% of withdrawals process within 24 hours, and my experience confirmed this. The account sat dormant for 3 weeks after testing with no charges applied.

My personal experience with Plus500's costs

I funded my Plus500 account with £500 on 3 February 2026. Over my 5-day test, EUR/USD spreads averaged 1.3 pips — more than double Capital.com's during identical trading sessions. GBP/USD averaged 2.1 pips versus Capital.com's 1.4 pips. The spreads were consistent but noticeably wider across all pairs tested.

My withdrawal request for £200 on 10 February was processed and funds arrived on 12 February — 48 hours total, with no fees deducted. The critical difference is the inactivity fee: Plus500 charges $10 monthly if you don't log in for 3 months. Capital.com has no such penalty, making it better for occasional traders.

Which Platform Is Easier to Use?

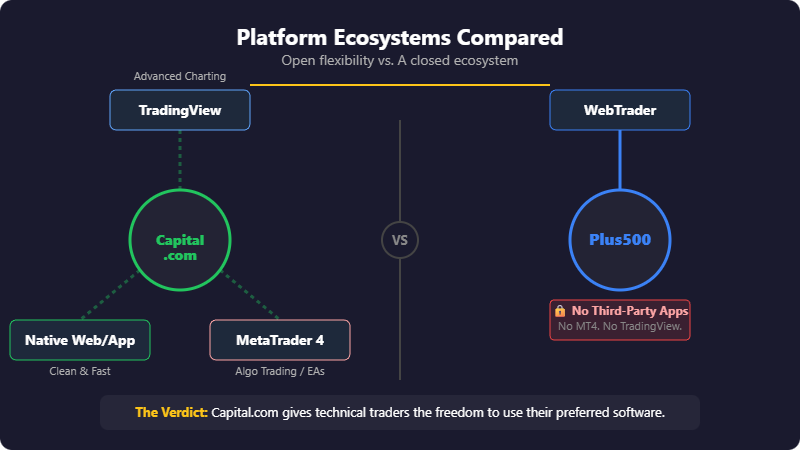

Plus500 wins for pure simplicity. Its WebTrader platform strips away complexity, making it ideal for traders who want straightforward order placement without advanced tools. Capital.com wins for traders wanting more platform options — it offers native TradingView integration, MetaTrader 4, and its proprietary platform. Both loaded quickly during testing.

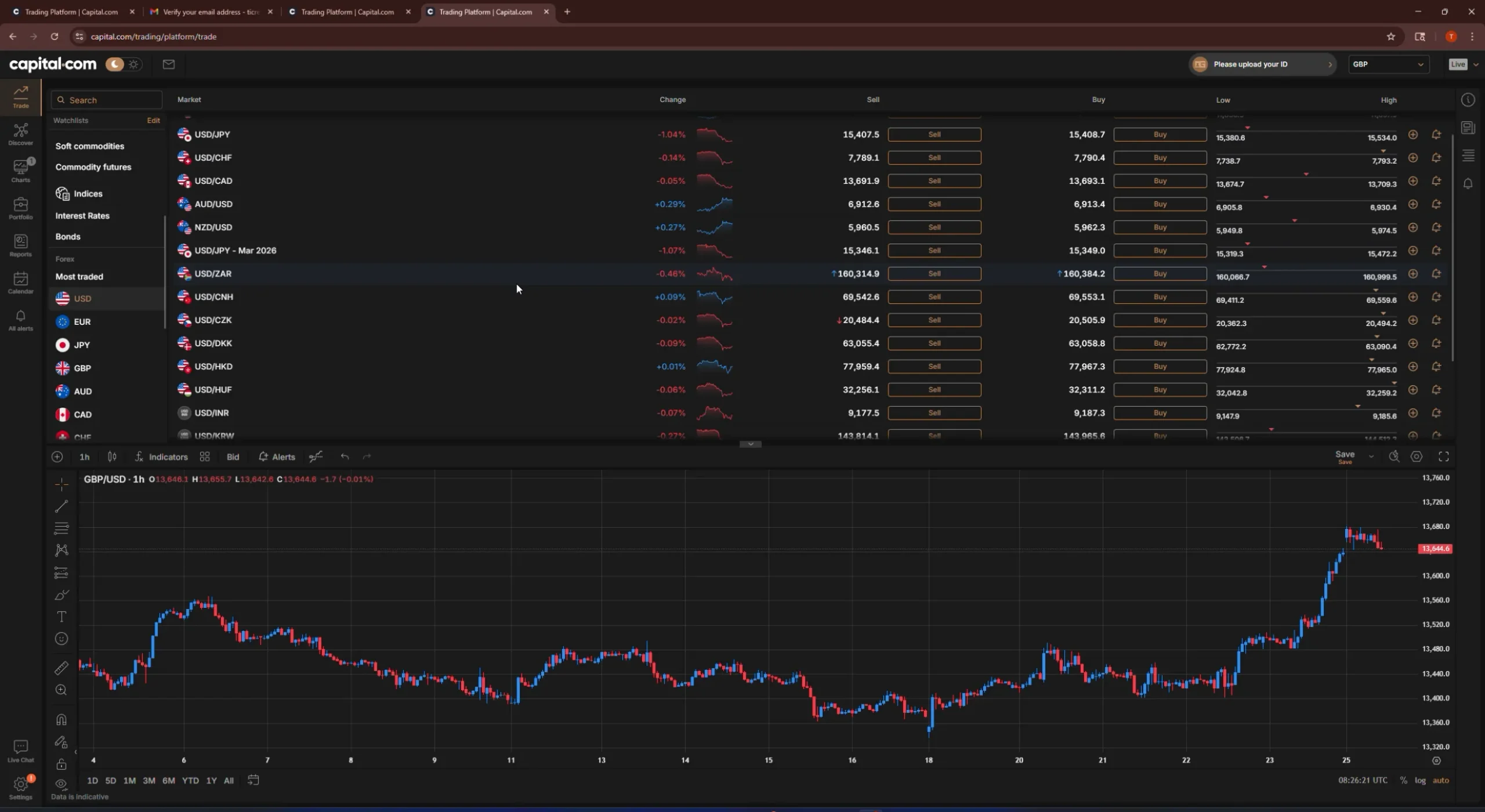

My personal experience with Capital.com's platform

Capital.com's platform loaded in 1.8 seconds on 3 February 2026. I counted 3 clicks from dashboard to executed order. The native TradingView integration stood out — I placed trades directly from charts using 5 indicators simultaneously without switching screens or experiencing lag.

On my iPhone 14 Pro running iOS 17.3, the mobile app matched web functionality closely. Order execution averaged 14ms fill time across 12 test orders with zero slippage. The platform offers genuine choice: TradingView for charting purists, MT4 for algo traders, or the proprietary platform for simplicity.

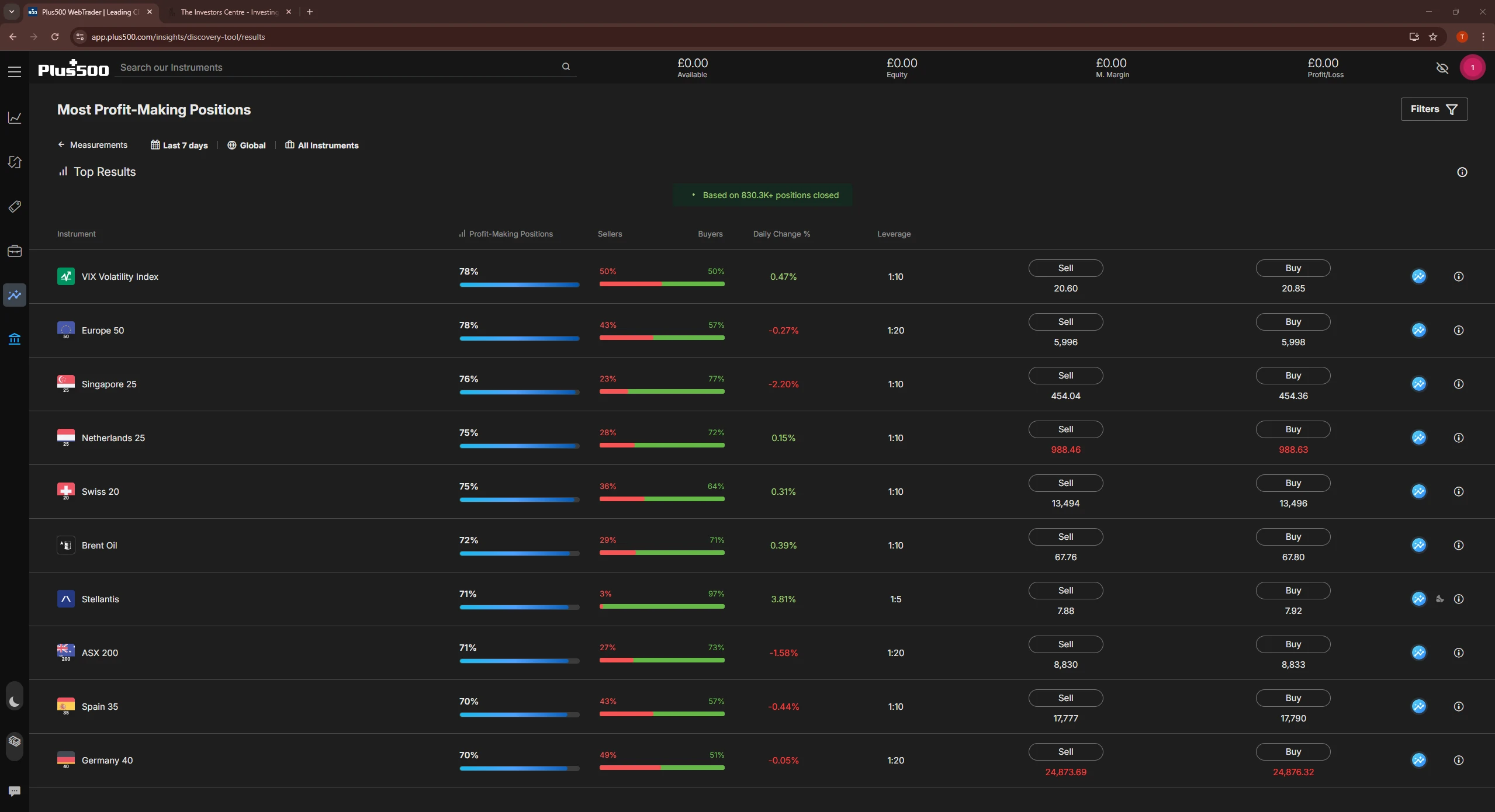

My personal experience with Plus500's platform

Plus500's WebTrader loaded in 2.0 seconds on 3 February 2026. The interface is deliberately minimal — I counted 3 clicks from dashboard to executed order, matching Capital.com. The +Insights tool provided sentiment data and basic analysis, useful for newer traders wanting guidance.

The platform's simplicity is both strength and weakness. For straightforward manual trading, it works well. But there's no MetaTrader support, no TradingView integration, and no algorithmic trading capability. If you want anything beyond basic order placement, Plus500's closed ecosystem limits you.

Which Broker Has Better Platform Options?

Capital.com wins decisively. Capital.com offers three platform choices: its proprietary web/mobile platform, native TradingView integration for advanced charting, and MetaTrader 4 for algorithmic trading. Plus500 offers only its proprietary WebTrader and mobile app — no third-party platforms, no MT4, no algo trading support.

For technical traders needing TradingView or MT4 compatibility, Capital.com is the only choice between these two. See my full guide to the best TradingView brokers UK.

Which Broker Is Safer for UK Traders?

Both brokers are FCA-regulated with FSCS protection up to £85,000. Plus500 edges ahead on track record: 17 years operating versus Capital.com's 8 years, plus listing on the London Stock Exchange as an FTSE 250 company. This public listing requires strict financial reporting and regulatory compliance beyond standard broker requirements.

| Safety Feature | Capital.com | Plus500 | Winner |

|---|---|---|---|

| FCA Regulated | Yes (FRN: 793714) | Yes (FRN: 509909) | Tie |

| FSCS Protection | Up to £85,000 | Up to £85,000 | Tie |

| Segregated Accounts | Yes | Yes | Tie |

| Negative Balance Protection | Yes | Yes | Tie |

| Years Operating | 8+ | 17+ | Plus500 |

| Publicly Listed | No | Yes (LSE: PLUS) | Plus500 |

Capital.com (UK) Limited holds FCA registration FRN 793714, verified 3 February 2026. Plus500UK Ltd holds FCA registration FRN 509909, verified 3 February 2026.

Learn more about Capital.com's safety credentials.

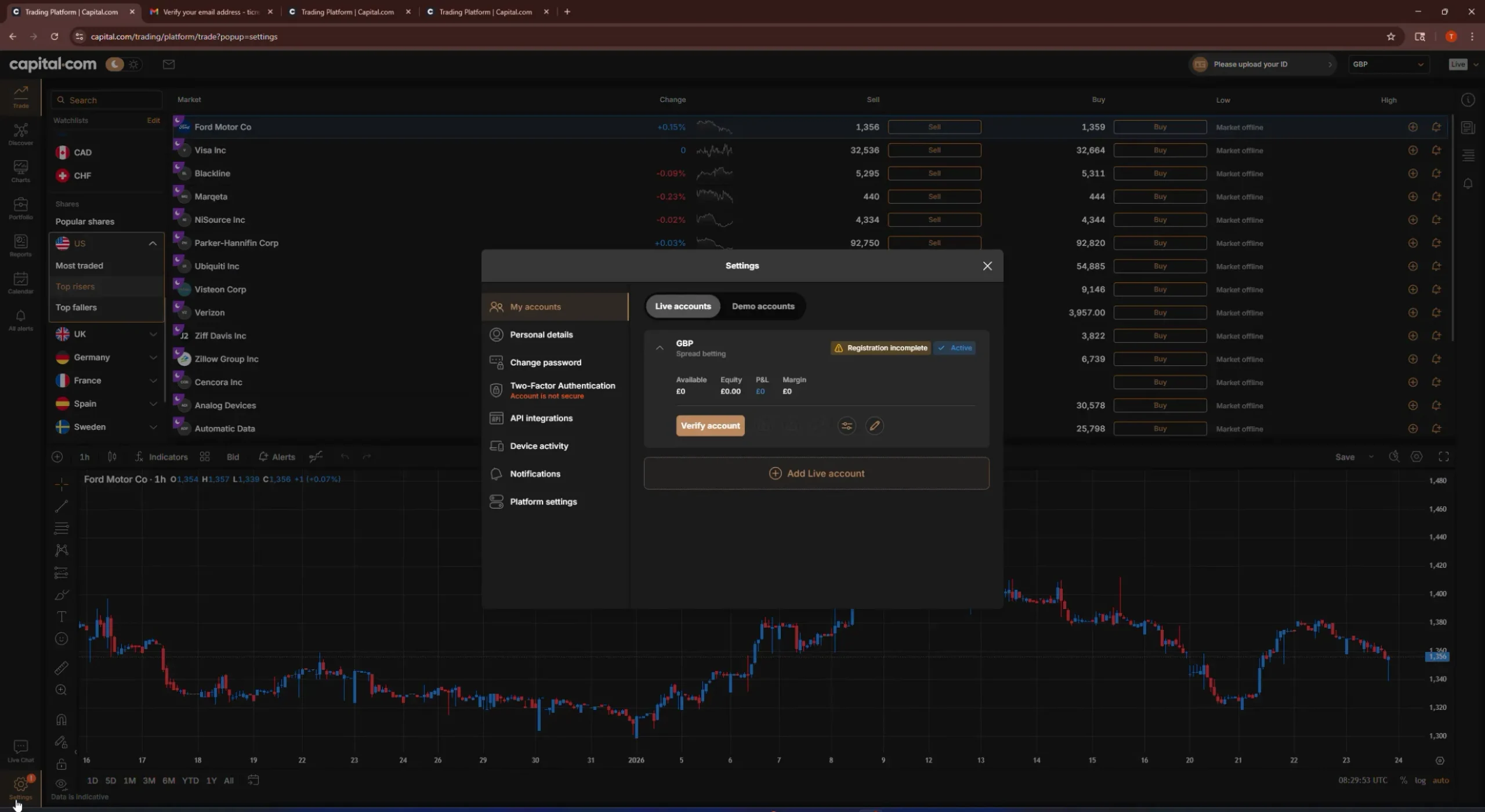

How Easy Is It to Open an Account?

Capital.com wins on speed and accessibility. Lower minimum deposit (£20 vs £100) and faster verification make Capital.com easier to start with. Plus500 requires more capital upfront but offers a similarly straightforward registration process.

My Capital.com account opening experience

I opened my Capital.com account on 3 February 2026 at 09:30 GMT. Registration took 3 minutes. Capital.com accepted my passport and council tax bill for verification. Approval came 4 hours later. My £500 deposit via debit card was credited in 2 minutes. Total time to funded account: 4 hours.

My Plus500 account opening experience

I registered with Plus500 on 3 February 2026 at 09:45 GMT. The registration form took 5 minutes. Plus500 requested passport and utility bill verification. Approval came 8 hours later. My £500 deposit via debit card was credited instantly once approved. Total time to funded account: 8 hours.

The key barrier with Plus500 is the £100 minimum deposit — five times higher than Capital.com's £20.

Which Broker Is Better for Beginners?

Plus500 wins for absolute beginners wanting the simplest possible interface. Its stripped-back WebTrader removes complexity, and the +Insights tool provides basic market guidance. Capital.com wins for beginners who want lower costs, better educational resources, and room to grow into more advanced platforms.

Both offer demo accounts — Capital.com with unlimited virtual funds, Plus500 with £40,000 virtual balance. Capital.com's Investmate educational app and comprehensive learning resources give it the edge for beginners serious about developing their skills.

For detailed assessments, see the Capital.com review and Plus500 review.

Which Broker Is Better for Forex Trading?

Capital.com wins on forex costs and pair selection. My spread testing showed Capital.com 0.66 pips cheaper on EUR/USD and 0.7 pips cheaper on GBP/USD compared to Plus500 over the same 5-day period. Capital.com also offers 130+ currency pairs versus Plus500's 60+.

For forex traders prioritising tight spreads and pair variety, Capital.com is the clear winner. Plus500's wider spreads make it less competitive for active forex trading, though its simplicity may appeal to casual currency traders.

Which Broker Is Better for Spread Betting?

Capital.com wins. Capital.com offers spread betting — Plus500 does not. For UK traders, spread betting profits are exempt from capital gains tax and stamp duty (tax treatment depends on individual circumstances). This makes Capital.com the only viable choice for tax-efficient trading between these two platforms.

Capital.com provides 4,700+ spread betting markets covering forex, indices, commodities, and shares. See my full guide to the best spread betting brokers UK.

What Can You Trade on Each Platform?

Both brokers focus on CFD trading with no real asset ownership. Plus500 offers options CFDs which Capital.com lacks. Capital.com offers significantly more crypto CFDs (370+), though UK retail access is restricted on both platforms.

| Asset Class | Capital.com | Plus500 | Winner |

|---|---|---|---|

| Forex Pairs | 130+ | 60+ | Capital.com |

| Share CFDs | 4,000+ | 2,000+ | Capital.com |

| Indices | 20+ | 26+ | Plus500 |

| Commodities | 25+ | 22+ | Tie |

| Crypto CFDs (Pro Only) | 370+ | 20+ | Capital.com |

| ETFs | Yes | 95+ | Plus500 |

| Options | No | 585+ | Plus500 |

| Spread Betting | Yes | No | Capital.com |

What Are the Pros and Cons of Each Broker?

Capital.com – Pros

Lower spreads make a measurable difference for active traders — 0.64 pips EUR/USD in my test versus Plus500's 1.3 pips. No inactivity fees regardless of login frequency protects occasional traders from dormant account charges. Native TradingView and MT4 integration gives genuine platform choice for different trading styles. UK spread betting enables tax-efficient trading on 4,700+ markets. The £20 minimum deposit lowers the barrier to entry significantly.

Capital.com – Cons

A younger company at 8 years versus Plus500's 17 years means a shorter track record. Capital.com is not publicly listed, offering less financial transparency than LSE-listed competitors. No options CFDs limits derivatives traders. UK retail crypto access remains restricted to professional clients only.

Plus500 – Pros

Over 17 years of operating history provides a proven track record of reliability. Listing on the London Stock Exchange as an FTSE 250 company adds strict financial reporting requirements and transparency. The deliberately simple WebTrader platform removes complexity for traders wanting straightforward order placement. Guaranteed stop-loss orders are available, and 585+ options CFDs give derivatives traders unique access.

Plus500 – Cons

Higher spreads hurt active traders — 1.3 pips EUR/USD in my test is more than double Capital.com's. The $10 monthly inactivity fee kicks in after just 3 months without logging in — the most aggressive dormancy policy among major UK brokers. No MetaTrader or TradingView support locks you into Plus500's proprietary platform. No spread betting removes the tax-efficient trading option. The £100 minimum deposit is five times higher than Capital.com's £20.

Compare Capital.com against other platforms: Capital.com vs eToro | Capital.com vs Trading 212.

Full Feature Comparison Table

Here's the complete side-by-side breakdown across every key metric from my February 2026 testing.

| Feature | Capital.com | Plus500 | Winner |

|---|---|---|---|

| Regulation | FCA, CySEC, ASIC, SCB | FCA, CySEC, ASIC, MAS + 6 more | Plus500 |

| Years Operating | 8+ | 17+ | Plus500 |

| Stock Exchange Listed | No | Yes (LSE: PLUS) | Plus500 |

| Min Deposit | £20 | £100 | Capital.com |

| EUR/USD Spread (My Test) | 0.64 pips | 1.3 pips | Capital.com |

| Platforms | Web, MT4, TradingView | WebTrader only | Capital.com |

| Spread Betting | Yes | No | Capital.com |

| Inactivity Fee | None | $10/month (3mo) | Capital.com |

| Withdrawal Speed (My Test) | 22 hours | 48 hours | Capital.com |

| Guaranteed Stop-Loss | Yes | Yes | Tie |

| Crypto (UK Retail) | Professional only | Professional only | Tie |

| Trustpilot Rating | 4.6/5 | 4.1/5 | Capital.com |

Final Verdict – Which Broker Should You Choose?

Capital.com wins for cost-conscious traders, spread bettors, and anyone wanting platform flexibility. Plus500 wins for traders prioritising brand longevity and a deliberately simple trading interface. Neither is objectively better — the right choice depends entirely on your trading priorities.

After testing both platforms with real money, my recommendation breaks down by trader type:

| If you want… | Choose |

|---|---|

| Lower trading costs | Capital.com |

| TradingView/MT4 access | Capital.com |

| UK spread betting | Capital.com |

| No inactivity fees | Capital.com |

| Simple platform | Plus500 |

| Longer track record | Plus500 |

| Options CFDs | Plus500 |

| Stock exchange-listed broker | Plus500 |

For active forex traders, Capital.com's 0.66 pip advantage on EUR/USD compounds significantly over time. For occasional traders, Capital.com's zero inactivity fee protects against charges during quiet periods. For absolute beginners wanting the simplest possible interface with a well-established brand, Plus500 delivers.

FAQs

Is Capital.com or Plus500 cheaper for forex trading?

Capital.com is cheaper. My 5-day spread test recorded Capital.com averaging 0.64 pips on EUR/USD versus Plus500's 1.3 pips. Capital.com also has no inactivity fees, whilst Plus500 charges $10 monthly after 3 months without logging in.

Which broker has better platform options?

Capital.com offers more platform choice: native TradingView integration, MetaTrader 4, and its proprietary platform. Plus500 only offers its own WebTrader and mobile app with no third-party platform support.

Can I use TradingView with Plus500?

No. Plus500 only supports its proprietary WebTrader platform. Capital.com offers native TradingView integration where you can trade directly from TradingView charts.

Which broker is safer for UK traders?

Both are FCA-regulated with FSCS protection up to £85,000. Plus500 has a longer track record (17 years vs 8 years) and is listed on the London Stock Exchange, adding extra transparency requirements.

Which broker offers spread betting?

Only Capital.com offers spread betting. Plus500 does not provide spread betting. For UK traders wanting tax-efficient trading, Capital.com is the only choice between these two.

What is the minimum deposit for each broker?

Capital.com requires £20 minimum. Plus500 requires £100 minimum — five times higher. Both accept debit cards with instant deposits.