Is Pepperstone Good for Spread Betting in 2025?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is Pepperstone Worth Using for Spread Betting?

Yes — Pepperstone is an excellent choice for spread betting, particularly if you're focused on forex. It's FCA-regulated, offers some of the tightest spreads in the UK, and gives you access to professional-grade platforms like MT4, MT5, and cTrader. If you're an active trader who values low costs and fast execution, Pepperstone delivers.

Top Rated

Top Rated

Fast-execution spread betting and CFD broker trusted by serious traders. Raw spreads from 0.0 pips and support for MT4, MT5, cTrader and TradingView.

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Pepperstone Spread Betting – Quick Overview

| Feature | Details | Verdict |

|---|---|---|

| Regulation | FCA (UK) | ✓ |

| Tax Status | Tax-free profits* | ✓ |

| Markets Available | 1,200+ | ✓ |

| Minimum Stake | From £0.10/point | ✓ |

| Platform Options | MT4, MT5, cTrader, TradingView | ✓ |

| Demo Account | Yes, unlimited | ✓ |

*Tax treatment depends on individual circumstances and may change.

What Makes Pepperstone Stand Out for Spread Betting?

Pepperstone has built its reputation on tight spreads and fast execution. Originally an Australian broker, it now has a strong UK presence with full FCA regulation. It's designed for traders who want professional tools without the premium price tag.

How Tight Are Pepperstone's Spreads?

Very tight. On the Razor account, spreads start from 0.0 pips on major forex pairs like EUR/USD. Even on the Standard account, you're looking at spreads from around 1.0 pip. For active forex traders, this can translate into meaningful savings over time compared to wider-spread brokers.

What Platforms Can You Use?

Pepperstone offers more platform choice than most UK brokers. You can trade via MetaTrader 4, MetaTrader 5, cTrader, or TradingView. Each has its strengths — MT4 for reliability, MT5 for more features, cTrader for advanced charting, and TradingView for its social trading community.

How Do Pepperstone's Spread Betting Costs Compare?

Pepperstone offers two account types with different cost structures. Both are competitive, but your best choice depends on how frequently you trade and what markets you focus on.

What's the Difference Between Standard and Razor Accounts?

The Standard account has spreads from 1.0 pip with no commission — simple and predictable. The Razor account offers raw spreads from 0.0 pips but charges a commission of £2.25 per lot per side. For high-volume forex traders, Razor usually works out cheaper despite the commission.

Are There Any Hidden Fees?

No. Pepperstone doesn't charge deposit or withdrawal fees, and there's no inactivity fee if you stop trading for a while. Overnight funding applies if you hold positions past market close, which is standard across all spread betting providers. The fee structure is refreshingly transparent.

Pepperstone Spread Betting Costs vs Competitors

| Broker | EUR/USD Spread | FTSE 100 Spread | Commission | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone (Razor) | 0.0–0.3 pips | 1 pt | £2.25/lot | None |

| IG | 0.6 pips | 1 pt | None | £12/month (after 24 months) |

| CMC Markets | 0.7 pips | 1 pt | None | £10/month (after 12 months) |

| City Index | 0.5 pips | 1 pt | None | £12/month (after 12 months) |

Is Pepperstone's Platform Easy to Use for Spread Betting?

Pepperstone doesn't have its own proprietary platform — instead, it offers access to established third-party platforms. This gives you flexibility but means the experience varies depending on which platform you choose.

Which Platform Is Best for Beginners?

TradingView is probably the most beginner-friendly option, with an intuitive interface and strong community features. MT5 is also a solid choice if you want something widely supported with plenty of tutorials available online. MT4 works well but feels slightly dated compared to newer alternatives.

Is Pepperstone Good for Advanced Traders?

Yes — this is where Pepperstone really shines. cTrader offers advanced charting, Level II pricing, and excellent tools for algorithmic trading. Execution speeds are fast, and the raw spread Razor account is built for scalpers and high-frequency traders who need every pip to count. For a full comparison of platforms geared towards experienced traders, see our ranked guide to the best professional spread betting platforms.

What Markets Can You Spread Bet on with Pepperstone?

Pepperstone covers over 1,200 markets, though its offering is weighted heavily towards forex. If currency trading is your focus, you'll find everything you need. Other asset classes are available but more limited.

Is Pepperstone Best for Forex Spread Betting?

Absolutely. Pepperstone offers 60+ forex pairs with some of the tightest spreads available in the UK. Major pairs like EUR/USD, GBP/USD, and USD/JPY are where Pepperstone excels. If forex is your primary market, it's hard to find a better combination of cost and execution quality.

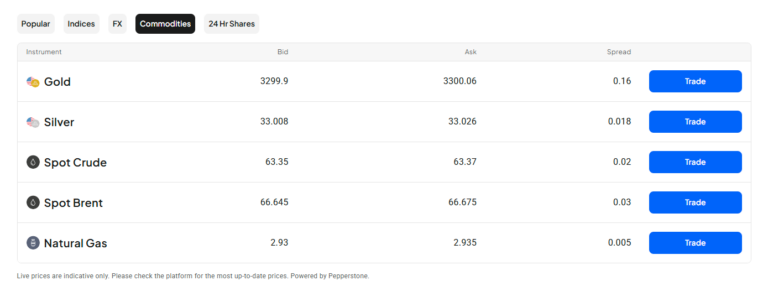

What About Indices, Shares, and Commodities?

Pepperstone covers major indices like the FTSE 100, DAX, and S&P 500, plus popular commodities including gold and oil. Share CFDs are available but the range is smaller than brokers like IG or CMC Markets. If you want extensive share coverage, Pepperstone may feel limited.

Does Pepperstone Offer the Right Risk Management Tools?

Pepperstone provides standard risk management features you'd expect from an FCA-regulated broker. However, there's one notable gap compared to some competitors.

Are Guaranteed Stop-Losses Available?

No. Pepperstone doesn't offer guaranteed stop-losses, which means your stop could be subject to slippage during volatile markets. If guaranteed stops are important to you — particularly for trading around major news events — this is a limitation worth considering.

How Does Negative Balance Protection Work?

As an FCA-regulated broker, Pepperstone provides negative balance protection for all retail clients. This means you can't lose more than the funds in your account, even if markets gap sharply against your position. It's a mandatory protection that adds peace of mind.

Where Does Pepperstone Fall Short for Spread Betting?

Pepperstone is excellent for forex-focused traders, but it's not the best fit for everyone. There are a few areas where competitors offer more.

Is the Market Range Limited?

Compared to IG's 17,000+ markets, Pepperstone's 1,200 feels more focused. You won't find the same breadth of individual shares or niche markets. If you want to spread bet across a wide variety of assets beyond forex and major indices, other brokers offer more choice.

No Guaranteed Stop-Losses?

This is a genuine drawback for risk-conscious traders. Without guaranteed stops, there's always a chance of slippage in fast-moving markets. For most day-to-day trading it's not an issue, but it's something to factor in if you trade volatile instruments or hold positions through major announcements.

Who Is Pepperstone's Spread Betting Best Suited For?

Pepperstone is ideal for active forex traders who prioritise tight spreads and fast execution. It suits scalpers, day traders, and anyone who values platform flexibility over a single polished proprietary interface. It's less suited for beginners wanting simplicity, or traders who need extensive share markets and guaranteed stop-losses.

Final Verdict – Should You Use Pepperstone for Spread Betting?

Pepperstone is one of the best spread betting brokers for forex-focused traders in the UK. Its combination of raw spreads, no inactivity fees, and professional-grade platforms makes it a standout choice for active traders. The lack of guaranteed stop-losses and a smaller market range are the main trade-offs.

If tight spreads and execution speed matter more to you than market breadth, Pepperstone is hard to beat. For a full breakdown of the platform, see our complete Pepperstone review.

FAQs

Is spread betting with Pepperstone tax-free?

Yes. Spread betting profits are currently free from capital gains tax and stamp duty for UK residents. However, tax treatment depends on individual circumstances and could change in the future.

What's the minimum stake for spread betting on Pepperstone?

Pepperstone allows stakes as low as £0.10 per point on certain markets. This makes it accessible if you want to start small or test strategies with minimal risk.

Does Pepperstone offer a demo account?

Yes. Pepperstone provides a free demo account with virtual funds. You can practise on MT4, MT5, cTrader, or TradingView before committing real money.

Is Pepperstone good for beginners?

It can be, but there's a learning curve. Pepperstone's platforms are powerful but not as intuitive as some beginner-focused brokers. If you're willing to invest time learning MT5 or TradingView, it's a solid option.

References

- ✓ Raw spreads from 0.0 pips

- ✓ MT4, MT5, cTrader & TradingView

- ✓ No minimum deposit

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

72% of retail CFD accounts lose money.