- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Is OKX a Good Crypto Exchange in 2025?

OKX offers strong trading tools, low fees, and deep liquidity, but it’s not the best choice for UK users. The lack of FCA registration and complex interface make it less beginner-friendly. While reliable, better options exist — like Bitpanda, Coinbase, and eToro.

Author’s Comments

After testing OKX for several weeks, I found it efficient but overwhelming. It’s clearly designed for traders who already understand crypto markets. The app performs well, yet beginners may find its features confusing. Personally, I’d recommend simpler, regulated alternatives for UK investors. – Thomas Drury

Summary Table: OKX Overall Rating (2025)

| Category | Rating | Verdict |

|---|---|---|

| Ease of Use | 3.6/5 | Clean layout but overly complex |

| Fees | 4.3/5 | Low trading fees with volume discounts |

| Safety | 4.0/5 | Good protection but lacks UK regulation |

| Features | 4.2/5 | Excellent range for advanced traders |

| UK Access | 3.0/5 | Limited support and no FCA oversight |

| Overall | 3.4/5 | Solid platform, but better choices exist for most users |

What Is OKX and How Does It Work?

Founded in 2017, OKX is a global crypto exchange offering spot, futures, and DeFi trading to millions of users. It’s known for advanced tools and competitive fees but operates offshore, meaning it isn’t FCA-registered — limiting its appeal for UK-based investors.

How Popular Is OKX Worldwide?

OKX ranks among the top five global exchanges by trading volume, handling billions in daily trades. It’s trusted by over 50 million users across 180 countries. However, despite its popularity, UK access remains restricted compared to regulated competitors like Coinbase and eToro.

What Was My First Impression of OKX?

My first impression of OKX was that it’s sleek but designed for experienced traders. The platform loads quickly, offers detailed charts, and feels professional — yet the sheer number of features can overwhelm newcomers looking for a simple start in crypto.

How Easy Is It to Sign Up on OKX?

The signup process is quick and efficient. You can register with an email, verify ID, and start exploring within minutes. KYC approval usually takes under ten minutes, though some UK users may experience delays due to regional verification policies.

Is the OKX Interface Beginner-Friendly?

While visually modern, OKX isn’t ideal for beginners. The dashboard presents complex charts, margin options, and derivatives front and centre. It’s intuitive once learned, but not immediately clear — unlike streamlined apps such as Crypto.com or Bitpanda.

How Simple Is It to Deposit and Start Trading?

Depositing crypto is instant, but fiat deposits via GBP remain limited. Bank transfers are unavailable for most UK users, meaning you’ll likely buy crypto elsewhere first. Once funded, trades execute smoothly with competitive spreads and deep market liquidity.

Comparison Table: Account Setup Features

| Feature | OKX | Binance | Crypto.com |

|---|---|---|---|

| KYC Verification Time | 10 mins | 15 mins | 24 hrs |

| GBP Deposits | Limited | Partial | Full |

| Ease of Use | Moderate | Complex | Easy |

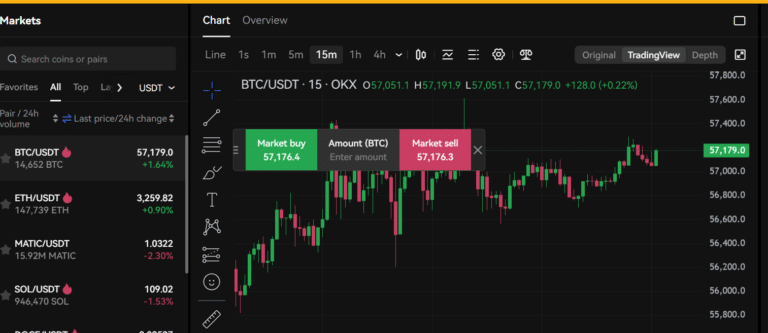

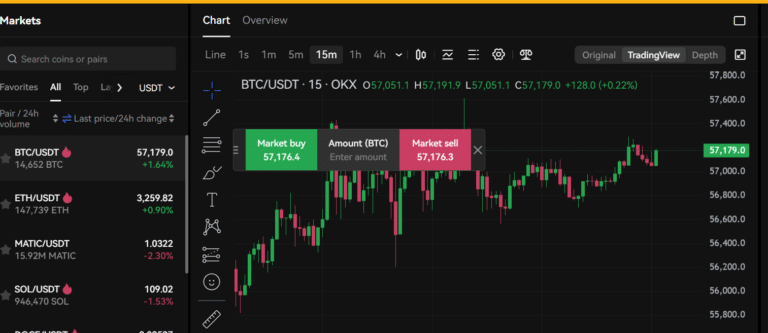

What Is It Like Trading on OKX?

Trading on OKX feels powerful yet complex. The exchange offers deep liquidity and advanced order types, catering to serious traders. However, beginners may find the array of charts, metrics, and options overwhelming without prior experience or guidance.

What Trading Options Does OKX Offer?

OKX provides a broad range of trading products, including spot, futures, and options markets, alongside staking and DeFi features. It even supports NFTs through its marketplace. This variety is impressive but can intimidate newcomers seeking simpler buy-and-hold investing.

How Competitive Are OKX’s Fees and Spreads?

Fees are among the lowest on the market, with spot trades starting at 0.08% for both makers and takers. High-volume traders or OKB token holders receive further discounts. Spreads are tight on the exchange but can vary during volatile market periods.

What Advanced Trading Tools Are Available?

OKX includes sophisticated features like TradingView charts, API access, copy trading, and automated strategies. These tools appeal to professionals managing complex portfolios, though they’re not essential for most everyday investors or beginners.

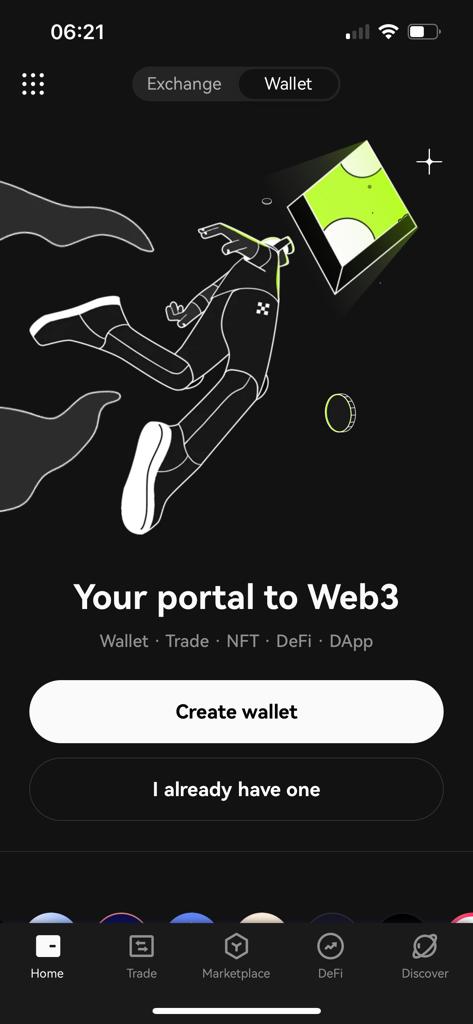

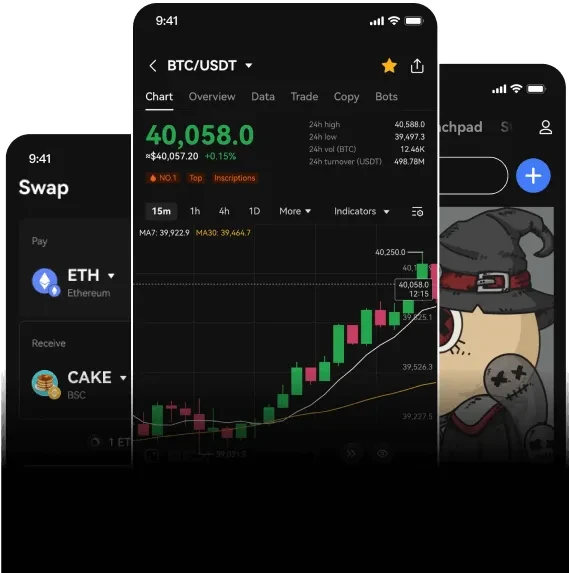

How Does the Mobile App Perform?

The OKX app is fast, stable, and well-designed. It replicates the desktop experience efficiently, offering access to charts, wallets, and trading pairs. However, it’s not particularly beginner-friendly — less intuitive than apps like Crypto.com or Coinbase.

Fee Comparison Table: OKX vs Competitors

| Platform | Spot Fee | Futures Fee | Mobile App Rating |

|---|---|---|---|

| OKX | 0.08% | 0.02% | 4.5/5 |

| Binance | 0.10% | 0.04% | 4.3/5 |

| Bybit | 0.10% | 0.01% | 4.4/5 |

How Beginner-Friendly Is the Earning Experience?

OKX offers multiple ways to earn passive income, including staking, savings, and DeFi products. However, while the earning potential is strong, the platform isn’t tailored to beginners — explanations are minimal, and some products carry higher risks than they appear.

How Beginner-Friendly Is the Earning Experience?

The “Earn” section is cleanly organised, but understanding each product requires research. Yields vary widely, and some options, like Dual Investment, involve risk exposure to market volatility. Beginners might prefer simpler, clearer options from exchanges like Crypto.com or Bitpanda.

Earning Options Summary Table

| Feature | Available | Typical Yield | Difficulty |

|---|---|---|---|

| Staking | Yes | 3–10% | Easy |

| DeFi Earn | Yes | 4–15% | Moderate |

| Dual Investment | Yes | 8–25% | Advanced |

What Could Be Better About OKX? (My Frustrations)

While OKX performs well technically, it’s not the most user-friendly exchange. The interface and advanced tools are geared toward experienced traders. Combined with limited UK support, it can leave beginners feeling lost or unsupported during their first crypto experience.

Is the Interface Too Complex for New Users?

Yes. The interface is feature-heavy, showing charts, futures, and order books right away. Beginners may struggle to locate basic functions like deposits or staking. OKX feels built for professionals, whereas exchanges like eToro or Coinbase cater better to first-time users.

Are Withdrawal Fees and Limits an Issue?

Withdrawal costs depend on the network, often higher for coins like ETH or BTC. Fiat withdrawals are limited, with no full GBP support. These small frictions can become frustrating, especially for UK users looking for seamless cash-out options.

How Helpful Is Customer Support?

Customer support is average at best. Live chat exists, but replies often take hours, and resolution times can drag on. There’s no UK helpline, and email responses feel scripted — a notable weakness compared to more responsive platforms.

Where Does OKX Need to Improve Next?

OKX should prioritise UK licensing, simpler onboarding, and better educational resources. Its platform is powerful but inaccessible for many casual investors. A clearer, more regulated presence would help build trust among new and cautious users.

Pros and Cons Table

| Pros | Cons |

|---|---|

| Low fees | Not FCA-registered |

| Advanced trading tools | Complex for beginners |

| Strong security | Limited GBP support |

| Good staking options | Average customer support |

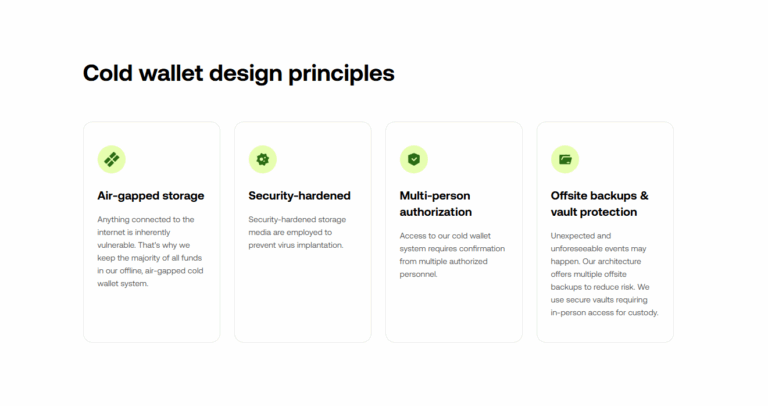

Is OKX Safe and Trustworthy in 2025?

OKX maintains strong security standards, including encryption, cold storage, and multi-factor authentication. It’s considered secure from a technical standpoint, but the absence of FCA regulation means UK users lack the same consumer protections offered by exchanges like Crypto.com or Coinbase.

What Security Features Protect Your Assets?

OKX secures over 95% of client funds in offline cold storage, minimising exposure to hacks. Users can enable two-factor authentication, withdrawal whitelisting, and anti-phishing codes. The exchange also provides proof of reserves, allowing anyone to verify asset backing transparently.

Security Feature Checklist

| Security Element | OKX | Description |

|---|---|---|

| 2FA | Yes | Protects logins |

| Cold Storage | Yes | 95%+ of assets offline |

| Insurance Fund | Yes | Covers losses in case of breach |

| Proof of Reserves | Yes | Publicly verifiable holdings |

How Does OKX Compare to Other Top Exchanges in 2025?

OKX offers excellent trading tools and low fees, but it trails competitors in accessibility and regulation. While professional traders may enjoy its depth, UK users often prefer simpler, FCA-registered exchanges like Crypto.com or Bitpanda for everyday crypto investing.

OKX vs Bitpanda: Which Is Better for Active Traders?

OKX edges ahead on fees and product range, offering advanced features like futures and APIs. Bitpanda, however, is far more transparent and compliant, with a cleaner interface. For active UK traders, Bitpanda’s mix of usability and trust feels like the smarter choice.

OKX vs Crypto.com: Which Is More Beginner-Friendly?

Crypto.com wins easily for beginners. It’s FCA-registered, supports full GBP integration, and offers clear app navigation. OKX feels like a professional exchange built for traders, not learners — making Crypto.com the safer and simpler entry point for most UK users.

Comparison Table: OKX vs Major Competitors

| Platform | Best For | Regulation | Ease of Use | Fees |

|---|---|---|---|---|

| OKX | Pro traders | Offshore | Moderate | Low |

| Bitpanda | Advanced users | Partial UK access | Moderate | Low |

| Crypto.com | Beginners | FCA-Registered | Easy | Fair |

Final Verdict: Is OKX Worth Using in 2025?

OKX is a capable but imperfect exchange. It’s fast, secure, and affordable but not ideal for UK retail users due to limited support and regulatory uncertainty. Overall rating: 3.4/5 — good for experienced traders, but others have better options.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fees

- Multi-Asset Platform

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

Is OKX beginner-friendly?

Yes, OKX is beginner-friendly with its intuitive interface and OKX Academy, which offers educational resources to help new traders learn the ropes. The platform also provides a demo trading feature for practice.

What are the fees on OKX?

OKX has some of the lowest fees in the market, with spot trading fees starting at 0.08% (maker) and 0.1% (taker). Futures trading fees are even lower at 0.02% (maker) and 0.05% (taker).

What security measures does OKX have in place?

OKX prioritizes security with features like cold wallet storage, two-factor authentication (2FA), anti-phishing tools, and an insurance fund to protect against unforeseen losses.

Can I stake crypto on OKX?

Yes, OKX offers staking for a variety of cryptocurrencies with competitive APY rates. Staking rewards can go up to 25%, making it a great platform for earning passive income.

Does OKX support fiat deposits and withdrawals?

Yes, OKX supports fiat deposits and withdrawals via bank transfer and credit cards. However, fees for fiat withdrawals can be higher compared to competitors, so keep that in mind.