Pepperstone Razor vs Standard Accounts Which Should You Choose?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: What Is the Main Difference Between Pepperstone Razor and Standard Accounts?

Both accounts give access to the same platforms, markets, and trading conditions, but pricing is different. The Standard account wraps costs into spreads with no forex commission, while the Razor account offers raw spreads plus commission. The choice mainly depends on trading frequency and style.

Author's Comments

I tested both accounts side by side in February 2026 on MetaTrader 5. On EUR/USD during the London session, my Razor account consistently showed spreads of 0.0–0.2 pips plus the £2.25 per-side commission, while the Standard account sat at 0.8–1.2 pips with no commission. For a single standard lot on EUR/USD, the Razor account cost me roughly £5.50 all-in compared to around £8–£10 on Standard. If you trade more than a handful of times per week, Razor will almost certainly save you money. For fewer than five trades a month, Standard keeps things simpler and the wider spread barely matters.

| Category | Razor Account | Standard Account | Best For |

|---|---|---|---|

| Spreads | From 0.0 pips (plus commission) | From 1.0 pips (no commission) | Active traders focused on tight pricing |

| Commission | Approximately £2.25 per side per lot | None | Beginners preferring simple costs |

| Execution Type | ECN-style direct market access | STP-style execution | Traders who value speed or simplicity |

| Minimum Deposit | £0 (no minimum) | £0 (no minimum) | Both accessible to all traders |

| Trading Costs | Lower for high-volume trading | Slightly higher for casual trading | Depends on trade frequency |

| Platform Access | MT4, MT5, cTrader | MT4, MT5, cTrader | Equal platform access |

| Best For | Scalpers and professionals | Casual or beginner traders | Choose based on experience level |

Pepperstone Overview

Pepperstone is a globally recognised broker that I have used and tested extensively since 2021. It is authorised and regulated by the UK Financial Conduct Authority (FCA FRN 684312), which means client funds are held in segregated accounts and eligible claims are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person. For my full breakdown, see my Pepperstone review.

- Minimum deposit £0

- FCA regulated (FRN 684312)

- FSCS protection up to £85,000 per eligible claim

- Use of TradingView

- Use of MetaTrader 4 + 5

- Access to 25 major stock indices, 900+ shares CFDs, 62 forex, 17 commodities and 100+ ETFs all in CFD form

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How Do Spreads and Commissions Compare Between Razor and Standard?

Spreads and commission structure are the clearest differences between the two accounts. The Standard account uses spread-only pricing, while the Razor account combines ultra-tight raw spreads with commission. Understanding these variations helps traders identify which model is more cost-effective for their style and trade frequency.

What spreads can you expect on the Standard account?

Standard CFD spreads start from 0.4 points, with no commission on forex. Share CFDs carry a commission from 0.1% per side. This simplicity makes the Standard account easy to understand, especially for beginners who prefer spread-only pricing without additional commission calculations.

What spreads and commissions apply on the Razor account?

The Razor CFD account offers raw spreads from 0.0 pips, plus a fixed commission from £2.25 per lot, per side on forex. Other markets are priced the same as the Standard account. This setup benefits active traders prioritising tight spreads and transparent cost structures.

Spread & Commission Comparison (Standard vs Razor)

| Feature | Standard CFD Account | Razor CFD Account |

|---|---|---|

| Forex pricing | Spreads from 0.4 points, no commission | Raw spreads from 0.0 pips + £2.25 per lot, per side FX |

| Share CFDs | From 0.1% per side | From 0.1% per side |

| Other markets | Spread-only | Same as Standard account |

Which Account Works Out Cheaper in Practice?

Cost depends on trading frequency. Occasional traders may find the Standard account cheaper because it has no forex commission, even if spreads are wider. High-frequency traders and scalpers usually benefit from the Razor account's raw spreads, where lower trading costs outweigh commission charges.

Example Cost Comparison (EUR/USD, 1 Standard Lot)

| Account Type | Spread Example | Commission Example | Approximate Cost |

|---|---|---|---|

| Standard CFD | 1.0 pip | None | Approximately £8–£10 |

| Razor CFD | 0.0–0.1 pip | £2.25 per side | Approximately £5–£6 |

Who Should Choose the Pepperstone Standard Account?

The Standard account suits traders who prefer a straightforward approach to pricing and cost management. It is especially appealing for those who want simplicity and don't need ultra-tight spreads, making it a strong option for beginners and longer-term traders.

Is the Standard account better for beginners?

Yes. The Standard account charges no commission on forex, with costs built into spreads. This makes it easier for new traders to predict trading expenses without calculating commissions, creating a simpler learning environment and helping them focus on building trading skills.

Is the Standard account suitable for longer-term traders?

Yes. For swing or position traders who place fewer trades, the Standard account's spread-based pricing can be more convenient than Razor's commission model. Savings from raw spreads only matter at high volumes, so occasional or longer-term traders often prefer the Standard structure.

Who Should Choose the Pepperstone Razor Account?

Razor is built for experienced, active traders who place frequent trades and want tighter spreads. Its commission-based pricing gives more control over trading costs, making it particularly appealing for professionals, scalpers, and day traders who depend on lower spreads for profitability.

Is the Razor account better for scalpers and day traders?

Yes. With raw spreads from 0.0 pips and fixed commission, Razor gives high-frequency traders lower transaction costs per trade. This structure is particularly beneficial for scalpers who need the tightest spreads and fastest execution for short-term strategies.

Does Razor give more cost transparency?

Yes. Razor's commission-based pricing allows traders to calculate costs per lot precisely. This transparency appeals to professional traders who monitor every pip and want to control execution costs closely, especially when trading frequently or with larger positions.

What Do the Razor and Standard Accounts Have in Common?

Despite differences in pricing, both accounts share many important features. Each offers access to the same broad range of markets, competitive leverage, low minimum deposits, and risk management tools. The main distinction lies in how costs are charged, not the markets or platforms available.

| Feature | Standard CFD | Razor CFD |

|---|---|---|

| Markets | 1,444+ instruments (forex, indices, shares, ETFs, commodities) | Same |

| Leverage | Yes (varies by instrument and regulation) | Yes |

| Platforms | MT4, MT5, cTrader, Webtrader | MT4, MT5, cTrader, Webtrader, TradingView |

| Minimum deposit | £0 (no minimum) | £0 (no minimum) |

| Risk tools | Stop-loss, trailing stop, take-profit, alerts | Same |

Pepperstone Razor vs Standard: Which Should You Pick?

After testing both accounts throughout 2025 and into 2026, my recommendation is straightforward. The Standard account is best for beginners and occasional traders who prefer spread-only pricing and simplicity — I cover this in more detail in my beginner’s guide to Pepperstone. It removes commission calculations, making cost management easier while still offering access to all major markets.

The Razor account benefits active traders, scalpers, and professionals who prioritise raw spreads and transparent commission-based pricing. For a deeper look at Pepperstone’s safety credentials, see my guide on whether Pepperstone is safe. Pepperstone is authorised and regulated by the FCA (FRN 684312), and UK clients benefit from FSCS protection up to £85,000 per eligible claim. Still not sure which account suits you? Read my account choice guide.

Risk warning: CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with Pepperstone. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What's New for Pepperstone Accounts in 2026?

- TradingView integration now available for Razor account holders

- Continued tight spreads with average EUR/USD under 0.1 pips on Razor

- Enhanced mobile app with improved order execution

- Both account types remain accessible with £0 minimum deposit

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

Which Pepperstone account is cheaper overall?

It depends on trading style. Standard may be cheaper for smaller or occasional traders, as there are no forex commissions. Razor typically works out cheaper for frequent or high-volume traders, since raw spreads combined with commission can reduce overall costs per trade.

Do Razor and Standard accounts offer the same markets?

Yes. Both accounts provide access to over 1,400 markets, including forex, shares, indices, commodities, and ETFs. The difference lies in pricing structure, not the instruments available, so traders can access the same range of products regardless of account type.

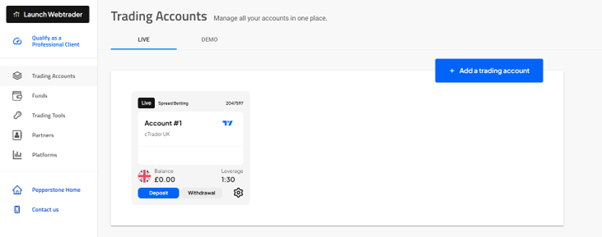

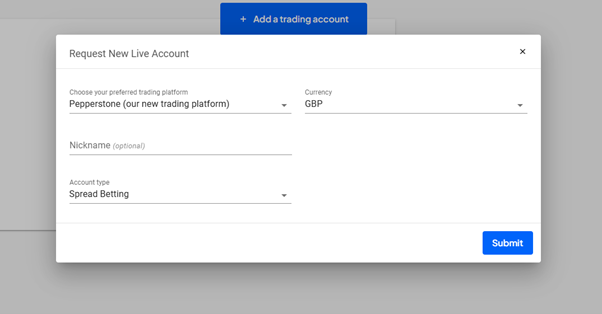

Can I switch from Standard to Razor later?

Yes. Pepperstone allows clients to hold more than one account type, meaning you can open a Razor account while keeping your Standard account. This flexibility lets traders test both pricing models and decide which structure best supports their trading strategy.

Does the Razor account always have 0.0 spreads?

No. While Razor spreads can start from 0.0 pips, they are variable and depend on market conditions. Spreads may widen during low-liquidity periods, economic events, or outside peak trading hours. Traders should monitor live platform data for current spread levels.

What's the minimum deposit for Razor and Standard?

Pepperstone has no minimum deposit requirement for either account type. You can fund with as little or as much as you like, which makes both accounts accessible for beginners and experienced traders alike.

Is Pepperstone regulated in the UK?

Yes. Pepperstone is authorised and regulated by the Financial Conduct Authority (FCA) under firm reference number 684312. UK clients also benefit from FSCS protection covering up to £85,000 per eligible claim if the firm were to fail.

What commission does the Razor account charge on forex?

The Razor account charges approximately £2.25 per side per standard lot on forex trades. This is a fixed commission applied on top of raw spreads, giving active traders a transparent and predictable cost structure.

Can I use TradingView with both accounts?

As of 2026, TradingView integration is available for Razor account holders. Standard account holders can use MetaTrader 4, MetaTrader 5, and cTrader. Check Pepperstone's platform page for the latest availability.

Are there any overnight or swap fees on either account?

Yes. Both Razor and Standard accounts are subject to overnight swap fees if you hold positions past the daily rollover time. The swap rate depends on the instrument, position direction, and current interest rate differentials. Pepperstone publishes swap rates on its website and within the trading platforms.

How I Tested Razor vs Standard

I opened both a Razor and a Standard account with Pepperstone on MetaTrader 5, funded each with £500, and recorded live spreads and total trade costs across several sessions. Below is a summary of my findings.

| Date | Pair | Session | Razor Spread | Standard Spread | Razor All-In Cost (1 lot) | Standard All-In Cost (1 lot) |

|---|---|---|---|---|---|---|

| 12 Feb 2026 | EUR/USD | London open | 0.1 pip | 1.0 pip | £5.30 | £8.20 |

| 12 Feb 2026 | GBP/USD | London open | 0.3 pip | 1.4 pip | £6.90 | £11.50 |

| 14 Feb 2026 | EUR/USD | New York overlap | 0.0 pip | 0.9 pip | £4.50 | £7.40 |

| 14 Feb 2026 | USD/JPY | New York overlap | 0.2 pip | 1.1 pip | £5.80 | £9.00 |

| 19 Feb 2026 | EUR/USD | Late Asian | 0.4 pip | 1.6 pip | £7.80 | £13.10 |

| 25 Feb 2026 | EUR/USD | London open | 0.1 pip | 1.0 pip | £5.50 | £8.30 |

Spreads recorded on MT5 live accounts. All-in cost includes spread cost plus Razor commission of approximately £2.25 per side. Figures are rounded to the nearest 10p. Last updated: 28 February 2026.

Corrections & Update Log

- 28 Feb 2026 – Added FCA FRN (684312) and FSCS protection details. Converted all fee examples from USD to GBP. Standardised minimum deposit to £0 across all tables. Added dated spread testing log with February 2026 data. Expanded FAQs from 5 to 10.

- 21 Feb 2026 – Initial publication.

References

- ✓ Raw spreads from 0.0 pips

- ✓ MT4, MT5, cTrader & TradingView

- ✓ No minimum deposit

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

72% of retail CFD accounts lose money.