Trading 212 Stocks and Shares ISA Review – 2026 Update

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Summary: Is Trading 212's Stocks and Shares ISA Any Good?

The Trading 212 Stocks and Shares ISA provides commission-free trading with no platform fees.* It offers access to over 13,000 global stocks and ETFs, fractional shares, automated investing ("Pies"), and daily interest on uninvested cash. It's regulated by the UK Financial Conduct Authority (FCA).

*Other fees may apply. See terms and fees.

Author's Comments

From my experience, Trading 212's Stocks and Shares ISA offers one of the smoothest investing journeys for UK users. It's affordable, intuitive, and reliable — ideal for new investors. While seasoned traders might crave more tools, the simplicity and cost efficiency make it a standout ISA choice in 2026. – Thomas Drury

| Category | Rating | Verdict |

|---|---|---|

| Ease of Use | 4.6/5 | Excellent mobile app and onboarding |

| Fees | 4.8/5 | Zero commission and no platform fee* |

| Safety | 4.7/5 | FCA regulated and FSCS protected |

| Features | 4.4/5 | Fractional shares and auto-invest tools |

| Overall | 4.6/5 | Ideal for beginner and long-term ISA investors |

*Other fees may apply. See terms and fees.

Introduction

The Trading 212 Stocks and Shares ISA offers a commission-free* platform to invest in stocks, ETFs, and more, with low fees and a user-friendly interface. It's suitable for beginner and experienced investors alike. This review covers the features, costs, and overall experience of using this ISA.

*Other fees may apply. See terms and fees.

What is a Stocks and Shares ISA?

A Stocks and Shares ISA is a UK tax-efficient account that lets you invest in assets like shares, ETFs, funds, and bonds without paying income tax or capital gains tax on your returns. You can invest up to the annual ISA allowance, making it a popular choice for long-term investing and wealth building.

How does a Stocks and Shares ISA differ from a Cash ISA?

A Stocks and Shares ISA allows you to invest in assets like stocks and ETFs, offering the potential for higher returns. In contrast, a Cash ISA is a savings account with interest but minimal growth potential. Both provide tax advantages, such as no capital gains tax.

What are the tax advantages of using a Stocks and Shares ISA?

A Stocks and Shares ISA allows you to earn capital gains and dividends without paying tax. The £20,000 annual contribution limit ensures tax-free growth within the ISA, making it a great choice for long-term investors looking to maximise returns without the burden of taxation.

How can Stocks and Shares ISAs help build wealth over time?

Stocks and Shares ISAs help build wealth by allowing investors to grow their savings in tax-free environments. The potential for capital appreciation and dividends can significantly increase long-term wealth, particularly when reinvested into further stocks, compounding returns over time.

Recent Performance of Stocks and Shares ISAs

Between February 2024 and February 2025, the average Stocks and Shares ISA fund saw a significant growth of 11.86%. In contrast, cash ISAs only achieved a return of 3.80% during the same period. This performance highlights the superior growth potential of stocks and shares ISAs compared to traditional savings accounts, particularly for long-term investors. (moneyfactsgroup.co.uk)

Overview of the Stocks and Shares ISA

How does the Stocks and Shares ISA work with Trading 212?

The Trading 212 Stocks and Shares ISA allows users to invest in stocks, ETFs, and fractional shares with no commission or account fees.* You can open and manage your ISA directly via the Trading 212 app or website, and all investments are held within the tax-free wrapper.

What features make the Trading 212 ISA stand out?

Trading 212 offers commission-free trading,* fractional shares, and access to over 12,000 global stocks and ETFs. It also provides ready-made portfolios ("Pies") for automatic investing. The platform is intuitive, with advanced tools for tracking investments, making it ideal for both beginners and experienced traders.

Is the Trading 212 Stocks and Shares ISA suitable for beginners?

Yes, the Stocks and Shares ISA from Trading 212 is suitable for beginners. The platform's user-friendly interface, commission-free trades,* and educational resources make it easy for new investors to start. Fractional shares also allow for lower-cost entry into a diverse range of stocks and ETFs.

Which assets can you invest in using the ISA account?

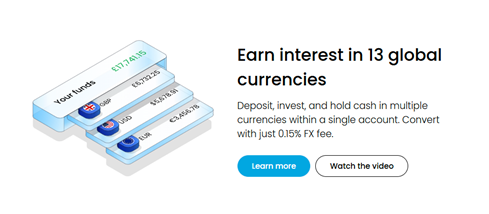

With the Trading 212 Stocks and Shares ISA, you can invest in global stocks, ETFs, and hold uninvested cash that earns 4.05% AER interest. The platform offers over 12,000 assets, allowing for diversified, tax-efficient investments without incurring capital gains or dividend tax.

How does this account compare to the other accounts available on Trading 212?

The Stocks and Shares ISA offers tax-free investing up to £20,000 annually. The Invest account provides flexible investing without tax advantages. The CFD account enables leveraged trading across various instruments but involves higher risk and is not eligible for ISA tax benefits.

*Other fees may apply. See terms and fees.

How to Open and Use a Stocks and Shares ISA on Trading 212

To open a Stocks and Shares ISA with Trading 212 you'll need to:

- Sign Up: Create an account on the Trading 212 platform via their website or mobile app.

- Verify Your Identity: Provide required identification documents to verify your account.

- Select ISA Option: Choose the Stocks and Shares ISA option during account setup.

- Fund Your Account: Deposit funds into your ISA using bank transfer or card.

- Start Investing: Choose assets to invest in and begin managing your portfolio.

What steps are involved in managing your ISA on the Trading 212 platform?

Managing your ISA on Trading 212 involves adding funds, selecting investments, and monitoring your portfolio through the app or website. You can adjust your investments, set up automatic contributions, and track performance via detailed analytics and reports.

How do you begin investing within the Stocks and Shares ISA on Trading 212?

Once your ISA is open, you can deposit funds into the account. From there, you can select individual stocks, ETFs, or use ready-made portfolios ("Pies") to start investing. Fractional shares allow for more flexibility in allocating your funds across various assets.

Detailed Breakdown of Costs and Fees for Stocks and Shares ISAs

| Fee Type | Details |

|---|---|

| Trading Commission | £0 (Commission-free trading)* |

| Platform/Custody Fees | £0 (No account or custody fees) |

| Foreign Exchange Fee | 0.15% per trade when trading in a currency different from the account's base currency |

| Deposit Fees | Free via bank transfer; 0.7% fee applies on card deposits over £2,000 cumulative |

| Withdrawal Fees | Free; £15 fee may apply on some withdrawals |

| Dividend Reinvestment | Free; dividends automatically reinvested once they reach £10 per holding |

| Stamp Duty Reserve Tax | 0.5% on share purchases made for stocks listed on the London Stock Exchange |

| PTM Levy | £1.50 per trade for orders over £10,000 on the London Stock Exchange |

| Transaction Fees (US) | $0.0000278 per share sold (SEC fee) + $0.000166 per share sold (FINRA fee) |

| Transaction Fees (France) | 0.4% French Financial Transaction Tax on purchases of large French companies |

*Other fees may apply. See terms and fees.

If Their Fees Are So Low, How Do They Make Money?

Trading 212 generates revenue through foreign exchange fees (0.15% per trade), interest on uninvested cash, share lending programs, and spreads on CFD trades. The low direct fees attract a large user base, allowing the platform to profit indirectly through these channels without charging commission or account fees.

How Does the Stocks and Shares ISA Compare to Other Providers?

How does the Stocks and Shares ISA with Trading 212 compare to others in the market?

Trading 212 offers commission-free trading with no platform fees,* setting it apart from many other providers like Interactive Investor (II) and Hargreaves Lansdown, which charge for trades or account maintenance. Additionally, Trading 212 provides access to over 12,000 global stocks and ETFs, unlike some competitors with limited options.

Is Trading 212's ISA more affordable compared to traditional brokers?

Yes, Trading 212's ISA is significantly more affordable than traditional brokers. While platforms like Hargreaves Lansdown charge 0.45% annually in fees, Trading 212 offers no platform fees or commissions, making it one of the most cost-effective choices for investors seeking lower-cost investment options.

What are the pros and cons of using this ISA provider?

Pros:

- Commission-free trades*

- No platform fees

- Fractional shares

- Easy-to-use interface

Cons:

- Limited customer support

- 0.15% currency conversion fee

*Other fees may apply. See terms and fees.

Security and Regulation of the Stocks and Shares ISA

Is Trading 212 regulated in the UK?

Yes, Trading 212 is regulated by the Financial Conduct Authority (FCA) in the UK. This ensures that the platform adheres to strict financial standards, offering transparency and investor protection in line with UK regulations, which guarantees a secure and trustworthy investing experience.

What protections are in place for investors' funds?

Investor funds with Trading 212 are protected under the Financial Services Compensation Scheme (FSCS), offering protection up to £85,000 per person. Furthermore, client funds are kept in segregated accounts, ensuring that your investments remain secure and separate from Trading 212's operating funds.

Final Thoughts

Trading 212's Stocks and Shares ISA is a cost-effective option for investors seeking a user-friendly, commission-free platform with no account fees.* While it may lack certain advanced features, it offers excellent value for beginners and long-term investors looking to grow their wealth in a tax-efficient manner.

UK Stocks and Shares ISA 2026 Update

In 2026, UK Stocks and Shares ISAs remain a cornerstone of tax-efficient investing, with the annual ISA allowance unchanged and strong demand from long-term savers. Platforms continue enhancing ISA user experiences with lower fees, faster settlement, and improved insights. Many providers now offer fractional shares and broader ETF access, making it easier for investors of all sizes to diversify within an ISA wrapper.

*Other fees may apply. See terms and fees.

FAQs

Can I transfer my existing ISA to Trading 212?

Yes, you can transfer your existing ISA to Trading 212. The transfer process typically takes up to 15 working days, and there are no charges for transferring funds. However, ensure that you follow the correct transfer procedure to avoid losing your tax benefits.

What is the minimum deposit required to open an ISA with Trading 212?

There is no minimum deposit required to open a Stocks and Shares ISA with Trading 212. This makes it accessible for investors with small or limited amounts to invest, allowing for greater flexibility when starting your investment journey.

Can I withdraw funds from my Stocks and Shares ISA anytime?

Yes, you can withdraw funds from your Stocks and Shares ISA at any time without penalty. However, withdrawing funds will count towards your £20,000 annual ISA contribution limit, which may affect future deposits and tax benefits.

How many ISAs can I have with Trading 212?

You can only have one Stocks and Shares ISA in any given tax year. However, you can open different types of ISAs, such as a Cash ISA or an Innovative Finance ISA, as long as you don't exceed the £20,000 overall contribution limit for the year.

References

- ✓ Deposit £500–£999 → Get £40

- ✓ Deposit £1k–£4,999 → Get £100

- ✓ Deposit £5k–£9,999 → Get £300

- ✓ Deposit £10,000+ → Get £500

61% of retail CFD accounts lose money when trading CFDs with this provider.

61% of retail CFD accounts lose money when trading CFDs with this provider.