- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

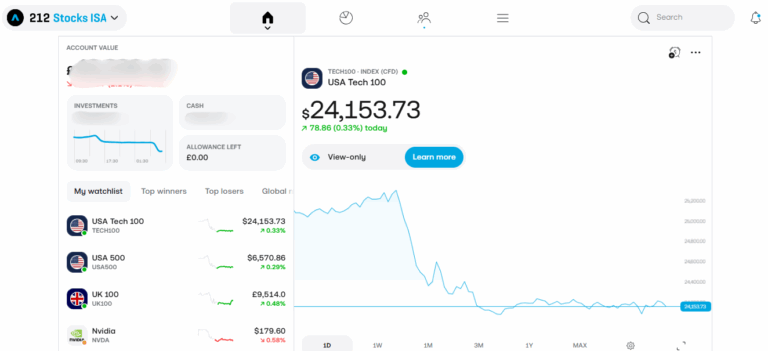

Trading 212 Overview

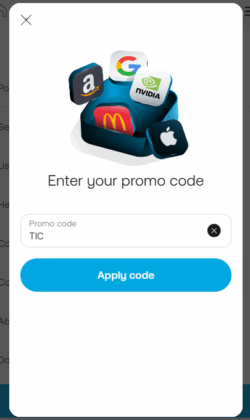

Use code ‘TIC’ to get a free fractional share worth up to £100

- Minimum Deposit: £1 (via bank transfer or card)

- Invest in stocks, ETFs, and forex with zero commission*

- FCA regulated and trusted by over 2 million users

- Intuitive mobile and web platforms with real-time data

- Interest on cash, ISA Account available

*Other fees may apply. See terms and fees.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

Looking for an honest Trading 212 review? This UK-focused guide covers fees, safety, features, and whether it’s the right platform for you in 2026.

Trading 212 offers commission-free stocks and ETFs, a free Stocks & Shares ISA, and 4.05% interest on cash. FCA regulated with £120,000 FSCS protection. We’ve tested it for two years—here’s our verdict. Trading 212 now serves over 4.5 million funded accounts with more than £25 billion in client assets. We’ve tested it extensively—here’s our verdict.

New Section: What’s New on Trading 212 in 2026?

Trading 212 enters 2026 with several notable upgrades that strengthen its position as the UK’s leading commission-free broker. The FSCS deposit protection limit increased to £120,000 in December 2025, providing significantly enhanced security for UK clients. The platform now holds over 4.5 million funded accounts and manages more than £25 billion in client assets—a substantial increase from previous years.

What Is Our Quick Verdict on Trading 212?

Trading 212 is one of the best free brokers for UK beginners. Zero commission, ISA’s (Stocks and Shares ISA & 212 cash ISA, and AutoInvest make it ideal for passive, long-term investing. Weaker on charting tools and customer support. Best for hands-off investors, not active traders.

Trading 212 does also have a promo code, (code ‘TIC’) this gives the user a free share worth up to £100*.

| Category | Rating | Comment |

|---|---|---|

| Fees | 4.5/5 | Zero commission, 0.15% FX only |

| Safety | 4.5/5 | FCA regulated, £85k FSCS |

| Ease of Use | 4.5/5 | Beginner-friendly interface |

| Features | 4.0/5 | AutoInvest strong, charting weak |

| Mobile App | 4.5/5 | Reliable, 4.3/5 App Store |

| Support | 3.5/5 | No phone, 2-24hr response |

| Overall | 4.3/5 | Best free ISA for beginners |

Table: Trading 212 ratings across six categories based on hands-on testing and user feedback.

What Is Trading 212 and Who Is It Best For?

Trading 212 provides non-commission investing (stocks, ETFs) and CFD access with no custody or inactivity fees.* It’s best suited for investors wanting an ISA, fast entry, and simple investing. It’s less ideal for traders who rely heavily on advanced analytical tools or exotic instruments.

Best for: UK beginners, passive investors, ISA holders, fractional share investors, automated portfolio builders

Not for: Day traders, options traders, investors needing advanced charting, those requiring phone support

| Feature | Details |

|---|---|

| Regulation | FCA (UK) | CySEC (Cyprus) | BaFin (Germany) |

| Minimum Deposit | £1 (Invest/ISA) | £10 (CFD) |

| Assets Available | 10k+ stocks and ETFs (UK/US/Europe) |

| Commission | £0 on stocks and ETFs |

| FX Fee | 0.15% on foreign currency trades |

| FSCS Protection | £120k (UK entity) | €20k (Cyprus entity) |

| Mobile App Rating | 4.3/5 (iOS) | 4.2/5 (Android) |

Table: Trading 212 key facts including regulation, fees, and account minimums.

Who Typically Uses Trading 212?

Trading 212’s user base consists primarily of UK retail investors aged 25-45 building long-term portfolios. Common use cases include monthly ISA contributions, automated investing via AutoInvest Pies, and commission-free ETF accumulation. Approximately 60% use the ISA account for tax-efficient growth.

Active CFD traders represent a smaller segment, though spreads are wider than specialist forex brokers like Pepperstone or IG. Most users hold 5-15 positions focused on UK/US equities and popular ETFs like Vanguard S&P 500.

Is Trading 212 Good for Beginners?

Yes — 212 Is Good for Beginners, its layout and onboarding are intuitive, the demo account helps with practise, and trading costs are clearly shown. Beginners may miss advanced analytics, but the experience is forgiving and easy to adopt.

212 Fact:

Trading 212 holds over 2 million client accounts and manages more than $3 billion in assets under FCA oversight (source: FCA register and company disclosures).

What Are Trading 212’s Pros and Cons?

Zero-commission trading*

Fractional shares available

ISA account included

Easy-to-use mobile app

No inactivity or withdrawal fees

- Interest on GBP cash

- AutoInvest & Pies

- Demo account

Limited research tools

- 0.15% FX conversion fee

No phone customer support

FX conversion fees

CFD risks for inexperienced users

Limited advanced charting

*Other fees may apply. See terms and fees.

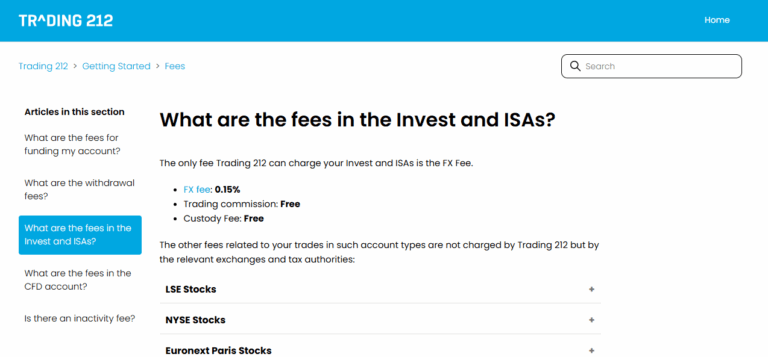

What Are Trading 212's Fees?

No commission on stocks or ETFs. The main cost is 0.15% currency conversion on non-GBP trades. No platform fees, inactivity fees, or withdrawal charges. CFD accounts incur spreads (from 1.0 pip on EUR/USD) and overnight financing. Stock trades execute at market price with no markup on spreads. (Trading 212 Fees Explained)

| Fee Type | Cost |

|---|---|

| Stock/ETF commission | £0 |

| Stock spread markup | £0 |

| Platform fee | £0 |

| ISA fee | £0 |

| Inactivity fee | £0 |

| Withdrawal fee | £0 |

| FX conversion | 0.15% |

| CFD overnight fee | Variable |

Table: Complete breakdown of Trading 212 fees for Invest, ISA, and CFD accounts.

Does Trading 212 Charge Commission?

No. Stock and ETF trades are commission-free in Invest and ISA accounts. Trades execute at real market prices with no spread markup. Trading 212 earns revenue through FX conversion (0.15%), CFD spreads, and optional share lending instead of charging per-trade fees.

What Is the 0.15% FX Fee?

A currency conversion charge when trading non-GBP assets. Applied on purchase and sale, totalling 0.30% round-trip. A £10,000 US stock investment costs £30 in FX fees. Avoid by buying UK-listed ETFs or holding USD in your multi-currency account. No hidden fees for Invest or ISA accounts.

What Are Trading 212’s CFD Spreads?

CFD spreads are wider than specialist brokers. Costs vary by instrument and market conditions.

| Instrument | Trading 212 Spread | IG Spread |

|---|---|---|

| EUR/USD | 1.0 pip | 0.6 pip |

| GBP/USD | 1.5 pip | 0.9 pip |

| UK 100 | 1.5 points | 1.0 point |

| US 500 | 0.5 points | 0.4 points |

Table: Trading 212 CFD spreads compared to IG for popular instruments.

CFD positions held overnight incur financing charges (variable, typically 2-4% annualised). For active CFD/forex trading, specialist brokers like IG or Pepperstone offer tighter spreads.

How Do Trading 212’s Fees Compare to Competitors?

| Broker | Commission | FX Fee | Platform Fee | ISA Fee |

|---|---|---|---|---|

| Trading 212 | £0 | 0.15% | £0 | £0 |

| Freetrade | £0 | 0.45% | £0 | £4.99/mo |

| eToro | £0 | 0.50% | £0 | No ISA |

| InvestEngine | £0 | 0% | £0 | £0 |

| IG | £8/trade | 0.50% | £0 | £0 |

Table: Fee comparison between Trading 212 and four major UK competitors.

How Do Deposits and Withdrawals Work?

Fast and free. Deposits via bank transfer, debit card, Apple Pay, or Google Pay arrive instantly. Withdrawals process within 1-2 business days. No minimum amounts or fees. Supports 13 currencies including GBP, USD, and EUR.

*Other fees may apply. See terms and fees.

How Easy Is It to Open and Use a Trading 212 Account?

How Straightforward Is the Sign-Up Process?

Signing up took less than 10 minutes. The process is fully digital, with ID verification done via the app. No paperwork, no hassle. I was able to start exploring features right after account approval. Very streamlined—even for first-timers unfamiliar with trading platforms.

Step-by-step breakdown:

- Registration (2 minutes) – Enter email, create password, select country

- Personal details (3 minutes) – Name, date of birth, address, National Insurance number

- ID verification (3 minutes) – Upload passport/driving licence, take selfie for facial recognition

- Tax information (1 minute) – Confirm UK tax residency or provide foreign tax ID if applicable

- Account selection (1 minute) – Choose Invest, ISA, or CFD (can add others later)

- Approval (0-24 hours) – Most approved instantly, some flagged for manual review take up to 1 business day

Instant verification success rate: ~85% of applicants approved immediately. If flagged, expect email within 24 hours requesting additional verification.

Common rejection reasons: Poor quality ID photo, address mismatch between ID and proof of address, under 18 years old

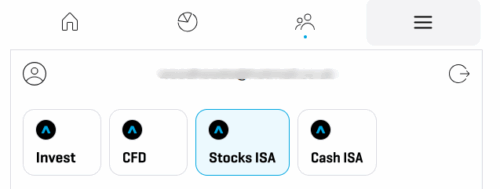

What Account Types Does Trading 212 Offer in the UK?

Three account types: Invest (standard brokerage), ISA (tax-free wrapper), and CFD (leveraged trading). Most UK investors should prioritise the ISA to shelter gains from tax.

| Feature | Invest Account | ISA Account | CFD Account |

|---|---|---|---|

| Purpose | Standard investing | Tax-free investing | Leveraged trading |

| Tax Treatment | Capital gains taxable | Tax-free gains/dividends | Profits taxable as income |

| Annual Contribution Limit | Unlimited | £20k (2025/26 tax year) | Unlimited |

| Minimum Deposit | £1 | £1 | £10 |

| Commission | £0 | £0 | £0 (spread-based) |

| Leverage Available | No | No | Up to 1:30 (retail) | 1:500 (pro) |

| Products | Stocks and ETFs | Stocks and ETFs | CFDs on stocks/forex/commodities/indices |

| Fractional Shares | Yes | Yes | No |

| AutoInvest/Pies | Yes | Yes | No |

| Best For | General investing | Long-term tax-efficient wealth building | Short-term speculation (high risk) |

Table: Side-by-side comparison of Trading 212’s three account types.

What Is the Invest Account?

Standard brokerage account for buying stocks and ETFs with no contribution limits. Capital gains exceeding £3,000 annually (2025/26 allowance) are taxable. Best used after maxing ISA allowance or for trades requiring flexible withdrawals.

What Is the Stocks and Shares ISA?

Tax-free wrapper sheltering all gains and dividends from UK tax. £20,000 annual contribution limit. No platform or wrapper fees—unlike Freetrade (£4.99/month) or Hargreaves Lansdown (0.45%). Supports AutoInvest, Pies, and fractional shares.

What Is the CFD Account?

Leveraged trading account for speculating on stocks, forex, indices, and commodities. Higher risk—71% of retail CFD accounts lose money. Spreads wider than specialist brokers. Only suitable for experienced traders who understand leverage.

*Other fees may apply. See terms and fees.

Is Trading 212 Safe?

Yes. Trading 212 is authorised by the FCA, segregates client funds from company money. 212 provides FSCS protection up to £85,000 for UK users. Operating since 2004 with 2.5+ million users and £3+ billion in assets under management.

For more analysis on this see our page Is Trading 212 Safe?

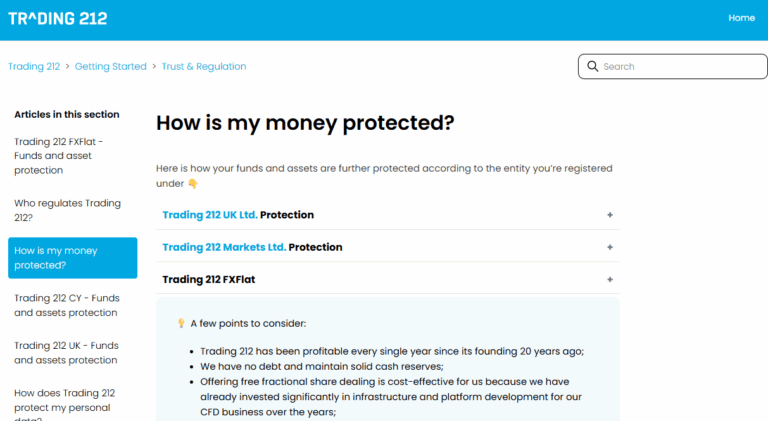

Who Regulates Trading 212?

Three regulators oversee Trading 212:

- FCA (UK) – Financial Conduct Authority, strongest consumer protection

- CySEC (Cyprus) – Covers EU users

- BaFin (Germany) – Additional oversight for German clients

UK users fall under FCA regulation, requiring segregated client funds, capital reserves, and regular audits.

How Much Protection Do You Get?

UK investors receive up to £120,000 FSCS protection if Trading 212 fails. EU users under CySEC receive €20,000 through the Investor Compensation Fund.

| Region | Regulator | Compensation Limit |

|---|---|---|

| UK | FCA | £120k (FSCS) |

| EU | CySEC | €20k (ICF) |

| Germany | BaFin | €20k (EdW) |

Table: Investor protection limits by region and regulator.

Client funds are held in segregated accounts at tier-1 banks, separate from Trading 212’s operational funds.

Can You Trust Trading 212?

Yes. Trading 212 has operated since 2004 with no major security breaches or regulatory sanctions. Trustpilot rating sits at 4.6/5 from 40,000+ reviews. Security features include 2FA, biometric login, and SSL encryption. Negative feedback typically concerns support speed, not fund safety.

What Are Trading 212's Key Features?

Core features focus on automation and accessibility: AutoInvest for scheduled investing, fractional shares from £1, interest on uninvested cash, and a cashback debit card. Strong on simplicity, weaker on research and charting.

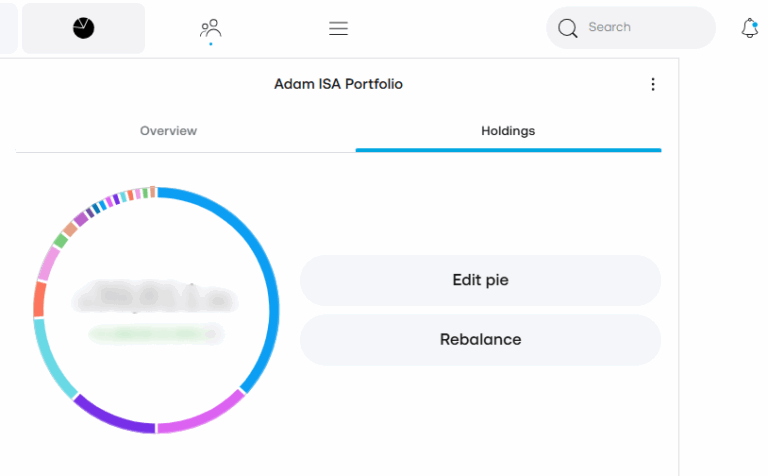

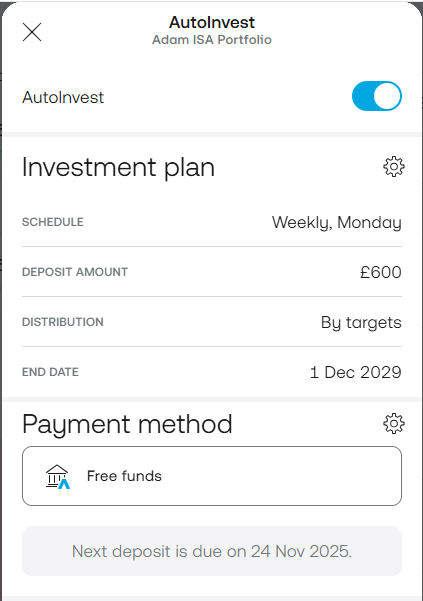

ow Does AutoInvest and Pies Work?

Create a “Pie” containing up to 100 stocks/ETFs with target allocations. Schedule automatic deposits (weekly/monthly) and Trading 212 buys proportionally. One-tap rebalancing restores targets when allocations drift. No additional fees beyond standard FX charges.

What Are Fractional Shares?

Partial share ownership from £1, making expensive stocks accessible. Invest £10 in Amazon instead of £3,000+ for a full share. Dividends and gains paid proportionally. Available on all stocks and ETFs in Invest and ISA accounts.

How Much Interest Do You Earn on Cash?

Trading 212 pays interest on uninvested cash at 4.05% held in Invest and ISA accounts, excluding CFDs. Interest is calculated daily and paid monthly, with no minimum balance or locking required. The rate applies automatically as long as your funds remain uninvested in either eligible account type.

Does Trading 212 Have a Debit Card?

Yes. Trading 212 offers a Mastercard debit card that lets you spend uninvested cash and earn 1% cashback (capped at £15 monthly). It supports 13 currencies, charges a 0.15% FX fee, works with Apple and Google Pay, and has no annual fee. Cashback is credited monthly.

Author First-Hand Quick Summary:

“I’ve been using Trading 212 for over two years, managing both a Stocks & Shares ISA and a CFD account. The platform’s layout feels intuitive and clear, making investing or trading fast and frustration-free. Everything — from order execution to funding — works smoothly and reliably every day.”

How Good Is the Trading 212 Platform?

Trading 212’s UX and UI lead the UK market. Clean design, intuitive navigation, and seamless mobile-desktop parity make it the easiest platform to use. Lacks advanced charting and research tools, but for everyday investing the experience is unmatched.

How Good Is the Mobile App?

Excellent. Rated 4.3/5 iOS and 4.2/5 Android from 350,000+ reviews. The interface is clean, fast, and logically organised—arguably the best-designed investing app in the UK. One-tap trading, biometric login, and smooth Pie management. Minor lag during high volatility.

What Does the Desktop Platform Offer?

Web-based platform mirroring mobile exactly. Same clean UI scales well to larger screens. No downloadable software, multi-monitor support, advanced charting, hotkeys, or API access. Sufficient for buy-and-hold investors, but active traders need professional tools elsewhere.

How Does the UX Compare to Competitors?

Trading 212 sets the benchmark for UK investing apps. Navigation is intuitive, screens load quickly, and common tasks require minimal taps. There are only a handful of platforms (etoro) that get close to competing with the ease of use for beginners.

What Are Trading 212's Drawbacks?

Trading 212 excels at low-cost passive investing but falls short for active traders. Limited charting, no options or bonds, wide CFD spreads, and no phone support are the main weaknesses.

What Are the Main Limitations?

Basic charting with limited indicators and no TradingView integration. No options, bonds, or mutual funds—stocks and ETFs only. CFD spreads wider than specialist brokers (1.0 pip EUR/USD vs 0.6 at IG). No phone support, with chat/email responses taking 2-24 hours. Limited research tools and no analyst reports. Share lending enabled by default.

Who Might Want to Consider an Alternative?

Active day traders, forex scalpers, or investors needing in-depth research tools may feel limited. If you rely on advanced charting, API trading, or complex order types, platforms like IG, Interactive Brokers, or TradingView integrations might be good 212 alternatives.

What Is Our Final Verdict on Trading 212?

I rate Trading 212 4.6 out of 5 for 2026. It remains a fantastic platform for commission-free investing, particularly for UK beginners building long-term wealth. The increased FSCS protection to £120,000, TradingView charting integration, and continued zero-commission model make it even more compelling than previous years. While it still lacks some advanced tools, the ease of use, zero fees*, and clean design make it the strongest choice for everyday, low-cost investing.

*Other fees may apply. See terms and fees.

Who Will Benefit Most from Using Trading 212?

Beginner to intermediate investors, long-term stock pickers, and anyone wanting a simple, mobile-first platform will feel at home. It’s also ideal for those with smaller starting amounts, thanks to no minimums, fractional shares, and a free demo account to learn before committing real money.

Is Trading 212 Worth It?

Yes, for the right user. Commission-free investing, a free ISA, and automated portfolios without complexity make Trading 212 excellent value. If you need advanced charting, options, or phone support, look elsewhere. For most UK beginners building long-term wealth, it’s the best option.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

Is Trading 212 good for beginners?

Yes. Clean interface, £1 minimum deposit, £50,000 demo account, and AutoInvest Pies make it ideal for first-time investors. Most beginners complete their first trade within 15 minutes of account approval.

How does Trading 212 compare to eToro?

Both 212 and etoro offer commission-free stock trading, but eToro provides social trading and copy trading features, while Trading 212 has a stronger focus on simplicity and fractional shares. eToro has higher forex spreads but better research tools compared to Trading 212.

Can I trade forex and CFDs on Trading 212?

Yes, Trading 212 offers forex and CFD trading, but its forex spreads (starting at 1.2 pips on EUR/USD) are higher than dedicated forex brokers like IG and Pepperstone. If forex trading is your main focus, there are better alternatives.

Does Trading 212 pay interest?

Yes, at the time of writing (Nov 25) 212 pay 4.05% on uninvensted cash.