Best Spread Betting Broker for MT4 in the UK (2026)

Looking for the best MT4 spread betting broker in the UK? I've tested Capital.com, IG, Pepperstone, and three other FCA-regulated brokers to find which delivers the best execution, tightest spreads, and most reliable MetaTrader 4 integration for tax-free spread betting.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Which MT4 spread betting broker should I choose?

Quick answer: Capital.com wins for most UK traders wanting MT4 spread betting. Pepperstone if minimising costs is your priority. IG if you need guaranteed stops or markets the others don't offer.

All three are FCA-regulated spread betting brokers with segregated client funds and FSCS protection. Your choice depends on whether you prioritise platform flexibility, trading costs, or market access.

| Broker | Best For | EUR/USD Spread | MT4 Markets | Guaranteed Stops | Minimum Deposit |

|---|---|---|---|---|---|

| Capital.com | Most traders | 0.6 pips | 2,500+ | No | £20 |

| Pepperstone | Lowest costs | 0.1 pips (Razor) | 1,200+ | No | None |

| IG | Market range & protection | 0.85 pips | Subset of 17,000+ | Yes | None |

60% of Retail CFD Accounts Lose Money

72% of retail CFD accounts lose money.

68% of Retail CFD Accounts Lose Money

MT4 Spread Betting Broker Comparison

How did I test these brokers?

I opened live spread betting accounts with six FCA-regulated brokers offering MT4 in early January 2026. Testing ran through to mid-February, focusing on the three that performed best.

This isn't a scientific study with thousands of data points. It's enough to identify which brokers deliver on their promises and which fall short.

| Detail | Approach |

|---|---|

| Brokers tested | Capital.com, Pepperstone, IG, CMC Markets, City Index, FXCM |

| Final recommendations | Capital.com, Pepperstone, IG |

| Account types | Standard spread betting accounts |

| Position sizes | £1-2 per point |

| Total trades | ~60 across the top three accounts |

| EA testing | Moving average crossover on EUR/USD |

| Volatility testing | Manual trades around BoE rate decision, 6 February 2026 |

| Tracked metrics | Actual spreads, execution speed, slippage, platform stability |

Our Top 3 MT4 Spread Betting Brokers

1. Capital.com – Best for most traders

2. Pepperstone – Best for lowest costs

3. IG – Best for market range & protection

Capital.com – Best for most traders

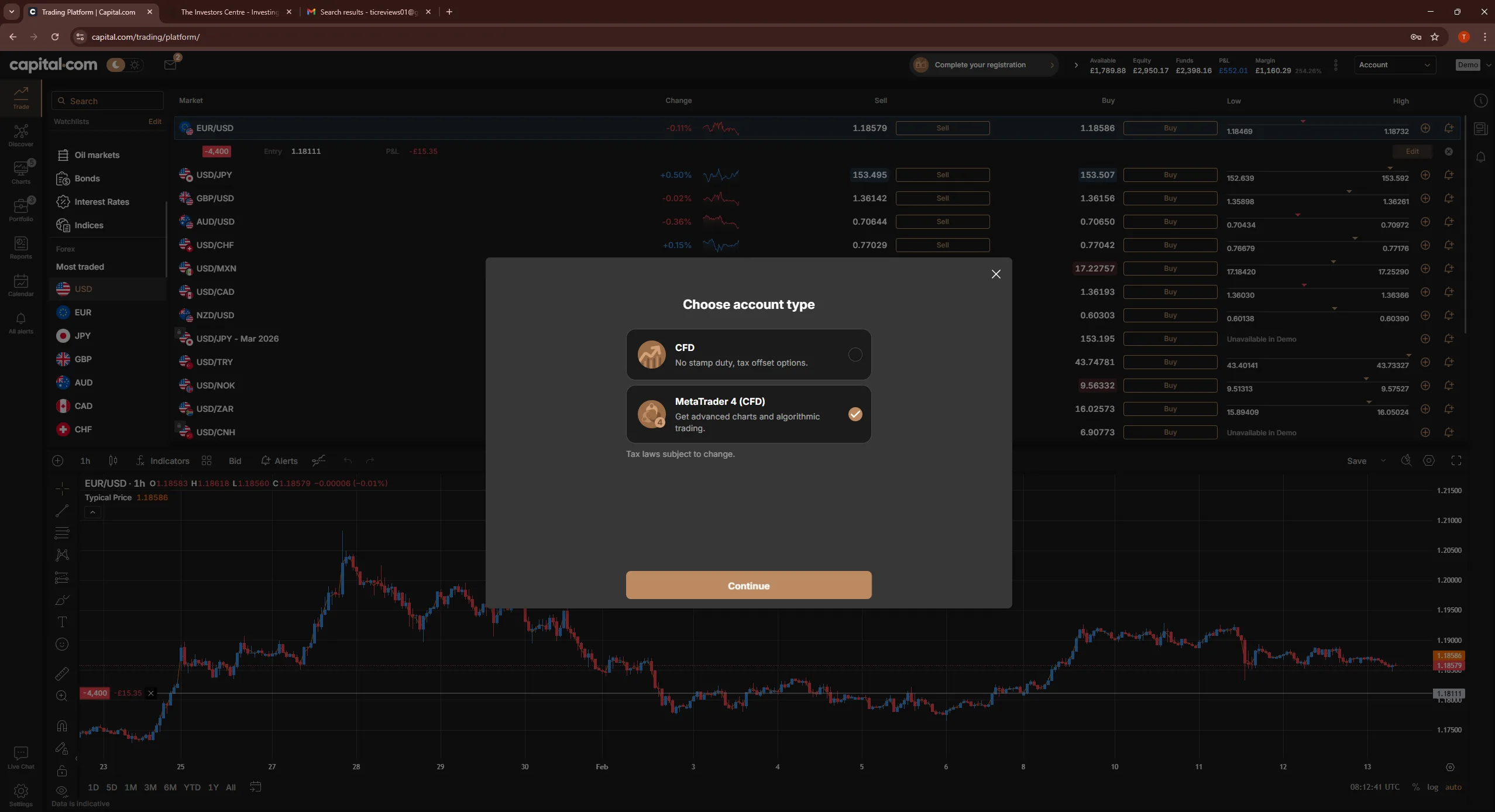

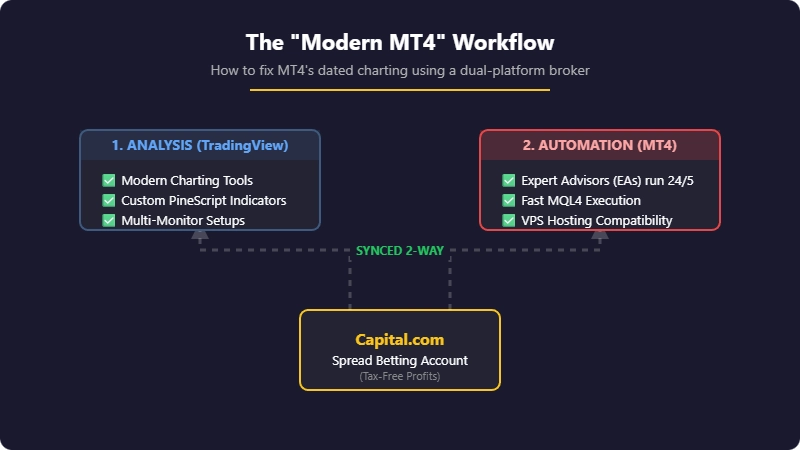

Capital.com is my top pick for most UK traders wanting MT4 spread betting. The main reason: it's the only broker offering proper TradingView integration alongside MetaTrader 4, giving you modern charting without abandoning your EA setup.

Pros

- TradingView integration alongside MT4

- Tight spreads (0.6 pips EUR/USD average)

- Consistent execution – no rejected orders in testing

- Excellent mobile app for position monitoring

Cons

- No guaranteed stop-loss orders

- MT4 market range smaller than proprietary platform

- No MT5 support currently

What does Capital.com charge for MT4 spread betting?

Spreads matched what Capital.com advertises. I recorded EUR/USD between 0.5 and 0.8 pips across different sessions, averaging close to their published 0.6 pips. FTSE 100 sat at 1 point consistently. These costs compare favourably with other low-spread forex brokers.

| Specification | Detail |

|---|---|

| FCA Registration | 793714 |

| EUR/USD Spread | 0.6 pips average |

| GBP/USD Spread | 1.0 pips average |

| FTSE 100 Spread | 1 point |

| Gold Spread | 0.3 points |

| Overnight Financing | Yes (except 1:1 leverage) |

| Minimum Deposit | £20 (card), £50 (bank transfer) |

| Commission | None |

| Inactivity Fee | None (UK) |

How does Capital.com's MT4 execution compare?

Execution was the most consistent of the three brokers I'm recommending. My EA placed 23 trades over three weeks without a single rejected order. Slippage was minimal, though I did see one fill about 0.3 pips worse than expected during the BoE announcement. Not unreasonable given the volatility.

The dual-platform workflow proved genuinely useful. I analysed charts on TradingView (better drawing tools, cleaner interface) and executed through MT4 where my EA runs. Capital.com is one of few brokers making this seamless.

The Capital.com mobile app also deserves mention. MT4's mobile version is clunky regardless of broker. Capital.com's own app let me monitor positions and close manually without frustration. Useful when you need to exit a trade away from your desk.

What are Capital.com's limitations for MT4 traders?

No guaranteed stop-loss orders. If gap protection matters to your strategy, this is a real limitation. Standard stops work fine, and negative balance protection means you can't lose more than your deposit, but an overnight gap on a volatile instrument could still hurt. If guaranteed stops matter, IG offers them.

Market range through MT4 covers 2,500+ instruments including 120 forex pairs, but you won't find UK small-caps or some exotic indices. Capital.com's proprietary platform has more markets than their MT4 offering.

Capital.com also lacks MT5 support currently. If you're considering upgrading from MT4 to MetaTrader 5 in future, Pepperstone offers both.

Pepperstone – Best for lowest costs

Pepperstone wins on trading costs. Their Razor account pricing delivers the tightest spreads I recorded. If you trade frequently, the savings compound.

Pros

- Tightest spreads (0.1 pips EUR/USD on Razor)

- Smart Trader Tools – 28 exclusive indicators and EAs

- Widest platform choice: MT4, MT5, cTrader, TradingView

- No minimum deposit

Cons

- Smaller MT4 market range (1,200+ instruments)

- No guaranteed stops

- Razor commission adds up for small position sizes

What does Pepperstone charge for MT4 spread betting?

The Razor account delivered EUR/USD at 0.1 to 0.2 pips during London hours, though you pay commission on top (£4.50 per standard lot round-trip on forex). The Standard account bakes costs into the spread instead, averaging around 0.6 pips, matching Capital.com.

For high-frequency traders or scalpers, Razor's raw pricing makes Pepperstone one of the lowest-cost spread betting brokers available.

| Specification | Detail |

|---|---|

| FCA Registration | 684312 |

| EUR/USD Spread | 0.1 pips (Razor) / 0.6 pips (Standard) |

| GBP/USD Spread | 0.3 pips (Razor) / 1.0 pips (Standard) |

| FTSE 100 Spread | 1 point |

| Gold Spread | 0.1 points (Razor) / 0.3 points (Standard) |

| Overnight Financing | Yes |

| Minimum Deposit | None |

| Commission | Razor: £2.25 per side (£4.50 round turn) / Standard: none |

| Inactivity Fee | None |

How does Pepperstone's MT4 execution compare?

Execution matched Capital.com: fast, consistent, no issues with my EA. One disconnection during testing, lasting about 40 seconds on a Sunday evening. Not ideal, but it happened outside market hours and reconnected automatically.

The Smart Trader Tools package adds 28 indicators and EAs exclusive to Pepperstone clients. I found the session map and sentiment indicator useful for manual trading. If you're building automation, this library saves development time.

Pepperstone also offers the widest platform choice: MT4, MT5, cTrader, and TradingView. If you outgrow MT4, the upgrade path exists without switching brokers. Useful if you're considering cTrader for spread betting later.

What are Pepperstone's limitations for MT4 traders?

Market range is noticeably smaller than alternatives. Pepperstone covers 1,200+ instruments through MT4, adequate for forex, major indices, and commodities, but limited if you want FTSE small-caps, exotic indices, or niche commodities.

No guaranteed stops, same as Capital.com. If gap protection is essential, you'll need IG.

The tightest spreads require the Razor account with its commission structure. For smaller position sizes or less frequent trading, do the maths. Standard might actually cost less depending on your volume.

IG – Best for market range & protection

IG invented spread betting in 1974. That heritage shows in their market coverage. If you need an instrument and can't find it elsewhere, IG probably has it.

Pros

- Guaranteed stop-loss orders on most markets

- Unmatched market range (subset of 17,000+)

- LSE-listed – added transparency

- ProRealTime for advanced charting

Cons

- Wider spreads than Capital.com and Pepperstone

- MT4 doesn't access full 17,000+ market range

- £250 minimum for card deposits

What does IG charge for MT4 spread betting?

Spreads run wider than both Capital.com and Pepperstone. I recorded EUR/USD averaging 0.8 to 0.9 pips, slightly above their published 0.85 average. Not expensive in absolute terms, but noticeable if you're comparing costs closely across different spread betting platforms.

| Specification | Detail |

|---|---|

| FCA Registration | 195355 |

| EUR/USD Spread | 0.85 pips average |

| GBP/USD Spread | 1.4 pips average |

| FTSE 100 Spread | 1 point |

| Gold Spread | 0.3 points |

| Overnight Financing | Yes |

| Minimum Deposit | £250 (card), none (bank transfer) |

| Commission | None |

| Inactivity Fee | None |

How does IG's MT4 execution compare?

Execution was solid throughout testing. No issues during the BoE volatility on 6 February, which impressed me given how busy that session was. IG's infrastructure handles volume that smaller brokers struggle with.

The key differentiator: guaranteed stop-loss orders on most markets. These cost a small premium but eliminate gap risk entirely. If you hold positions overnight or trade through high-impact news events, this protection has genuine value. Neither Capital.com nor Pepperstone offers guaranteed stops.

IG also provides ProRealTime for advanced charting, offering institutional-grade analysis tools if you need more than MT4 or TradingView offer. Access costs extra for frequent use but is free if you trade enough.

What are IG's limitations for MT4 traders?

IG's MT4 doesn't access their full 17,000+ market range. Forex, major indices, and popular commodities work fine through MetaTrader, but some instruments require their proprietary platform or ProRealTime. If you need a specific market through MT4, verify it's available before committing.

The wider spreads add up for frequent traders. If you're placing dozens of trades weekly, Pepperstone's Razor pricing or Capital.com's tighter spreads will save meaningful money over time. For occasional trading, the difference is negligible.

Card deposits require a minimum of £250, though bank transfers have no minimum at all.

Do I actually need MT4 for spread betting?

MetaTrader 4 is twenty years old. Before comparing brokers, consider whether you actually need it, or whether a modern spread betting platform would serve you better.

When MT4 makes sense

You run Expert Advisors. MT4's MQL4 language supports automation that most proprietary spread betting platforms don't allow. If you've built EAs, you're probably stuck with MT4.

Your indicators don't exist elsewhere. Thousands of custom MT4 indicators are available. Rebuilding your setup on a broker's own platform means starting over.

You trade with multiple brokers. One MT4 installation connects to multiple accounts. If you're comparing execution across different forex brokers or spreading risk, this consistency helps.

When to skip MT4

You don't automate. Modern broker platforms execute just as fast, have better charting, and offer more markets. Without EAs, MT4's advantages disappear. Consider the broker's native platform instead.

You need obscure markets. Every broker offers fewer instruments through MT4 than their own platform. Small-cap shares and exotic indices often aren't available via MetaTrader.

You want modern charting. MT4's charts are functional but dated. TradingView integration (which Capital.com offers) provides a workaround, but if charting matters more than automation, you might prefer a broker with TradingView as the primary platform.

How do I connect MT4 to a spread betting account?

Setting up MT4 for spread betting catches some traders out. A few things to know:

Download MT4 from your broker, not MetaQuotes. Broker-specific builds include the right server connections and any proprietary indicators. Generic MT4 from the MetaQuotes website won't connect to spread betting accounts.

Spread betting prices display in £ per point. Position sizing looks different from standard forex lots. A "1.0" position means £1 per point movement, not one standard lot. If you're adapting an EA designed for CFD trading, check it calculates position sizes correctly.

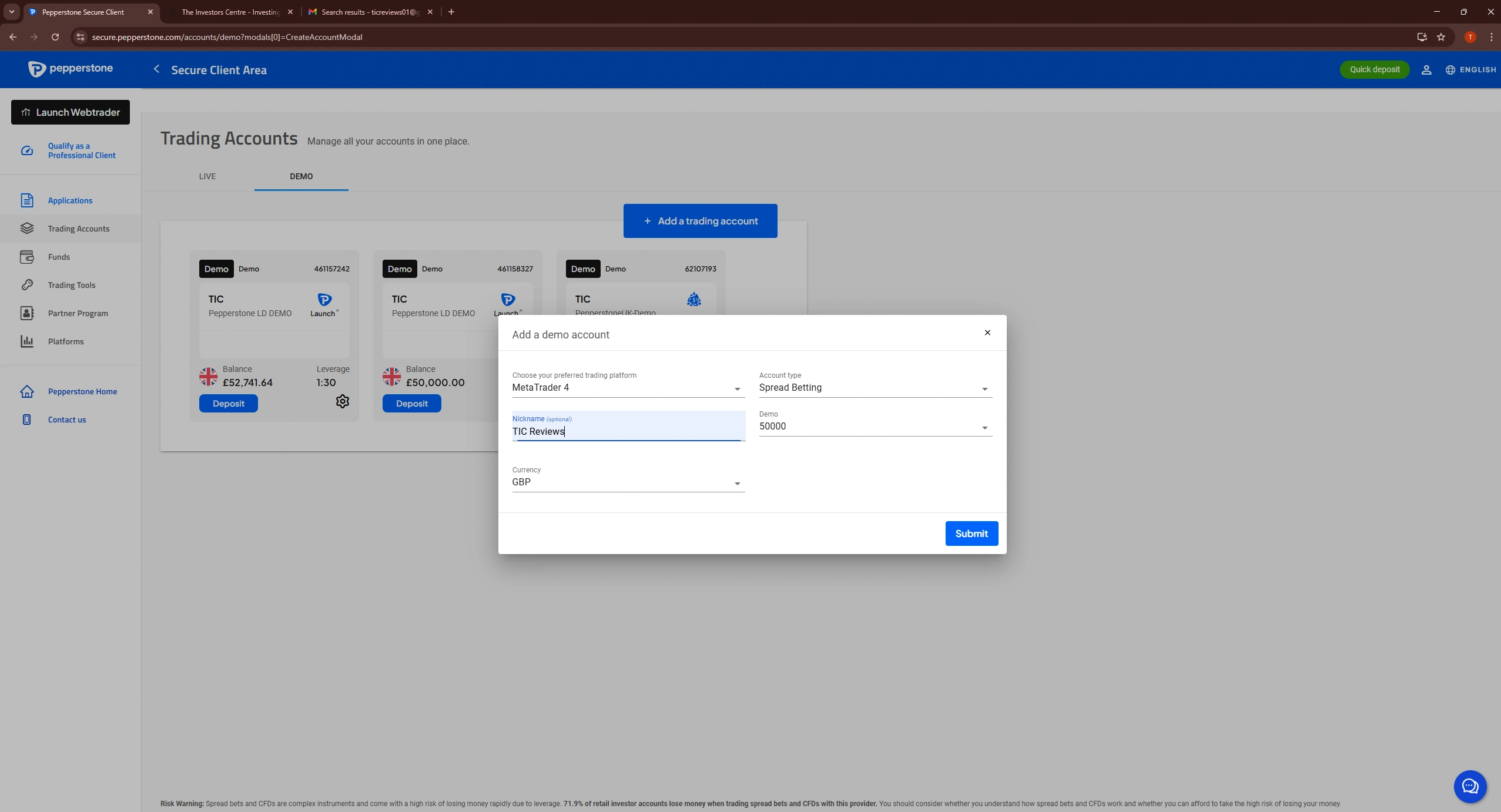

Test on demo first. All three recommended brokers offer MT4 demo accounts. Five minutes verifying your setup works correctly beats discovering problems with real money on the line.

Check which markets are available. Not everything on the broker's main platform appears in MT4. Log into a demo account and browse the market list before committing.

What happens if my spread betting broker fails?

All three recommended brokers hold FCA authorisation, which requires them to segregate client funds from company money. If a broker becomes insolvent, your funds should be identifiable and returnable.

FSCS protection covers up to £85,000 per person if segregation fails for any reason. This applies to all three brokers for UK clients.

| Broker | FCA Registration | FSCS Protected | Segregated Funds |

|---|---|---|---|

| Capital.com | 793714 | Yes, up to £85,000 | Yes |

| Pepperstone | 684312 | Yes, up to £85,000 | Yes |

| IG | 195355 | Yes, up to £85,000 | Yes |

IG is publicly listed on the London Stock Exchange, adding transparency through published accounts. Capital.com and Pepperstone are privately held but maintain FCA-required capital adequacy.

What about CMC Markets, City Index, and other brokers?

I tested six FCA-regulated brokers offering MT4 spread betting. Three didn't make my final recommendations:

CMC Markets – Excellent proprietary platform, but their MT4 integration felt like an afterthought. Spread betting markets available through MT4 are limited compared to their main platform. If you're committed to MT4, other options serve you better. CMC is worth considering if you'd use their Next Generation platform instead.

City Index – Solid broker with competitive spreads, but MT4 market range was restrictive during testing. City Index works well for traders using their native platform; less so for MT4 purists.

FXCM – Decent MT4 integration but spreads ran wider than Capital.com and Pepperstone in my testing. The Trading Station platform is good, but that's not what you're looking for if you want MT4.

None of these are bad brokers. They're simply not the best choice for someone specifically wanting MT4 spread betting in the UK.

The bottom line on MT4 spread betting brokers

Capital.com delivers the best overall MT4 spread betting experience for most UK traders. The TradingView integration alongside MetaTrader 4 solves the dated-charting problem, execution is fast and consistent, and spreads compete with anyone except Pepperstone's Razor pricing. Start here unless you have specific reasons to choose alternatives.

Pepperstone wins on raw costs for traders running sufficient volume. If spread minimisation drives your strategy and you're committed to MT4 automation, the Razor account's 0.1 pip EUR/USD pricing is unmatched. The Smart Trader Tools add genuine value for EA developers.

IG makes sense when you need markets or features others don't offer. Guaranteed stops, unmatched instrument range, and institutional-grade execution justify the slightly wider spreads, if you actually need what they provide.

All three hold FCA authorisation and provide FSCS protection up to £85,000. For tax-free spread betting through MetaTrader 4 in the UK, these are the brokers that deliver.

Frequently Asked Questions

Is MT4 spread betting tax-free in the UK?

Yes. Spread betting profits are exempt from Capital Gains Tax in the UK regardless of which platform you use. The tax treatment applies to the product (spread bet), not the platform (MetaTrader 4). Tax rules depend on individual circumstances and can change. If you're unsure, consult a tax professional.

Can I use my existing MT4 indicators and EAs for spread betting?

Yes, but test them first. Most indicators work identically. EAs that calculate position sizes based on lot values may need adjustment for spread betting's £-per-point structure. Run your automation on a demo account before going live.

What leverage can I use for MT4 spread betting?

FCA rules cap leverage for UK retail clients: 30:1 on major forex pairs, 20:1 on minor forex and major indices, 10:1 on commodities, 5:1 on individual shares. All three recommended brokers apply these limits. Professional clients can access higher leverage but lose some regulatory protections including negative balance protection.

Why don't all spread betting markets appear in MT4?

Brokers limit MT4's market range for technical reasons. Maintaining real-time pricing across thousands of instruments strains the platform. Forex, major indices, and popular commodities typically have MT4 access; individual shares, small-caps, and exotic instruments often require the broker's proprietary platform.

How quickly can I open an MT4 spread betting account?

Capital.com and Pepperstone can verify accounts within hours if your documents are clear. IG sometimes takes 1-2 business days. All three require ID verification (passport or driving licence) and proof of address before you can deposit and trade live.

Which is better for spread betting: MT4 or MT5?

MT4 has broader EA compatibility since most existing Expert Advisors are written in MQL4. MT5 offers more timeframes, order types, and a newer codebase, but requires MQL5 which isn't backward-compatible. If your automation relies on existing MQL4 code, stick with MT4. If you're starting fresh, MT5 may be worth considering. Pepperstone offers both.