Best (and Worst) Trading Platforms for Beginners 2026

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Picking a trading platform when you've never traded before feels like choosing a bank in a foreign country. The logos all look professional, the marketing all says "zero commission," and every comparison guide recommends roughly the same handful of names. The reality is more complicated than that.

I've deposited real money into each of the platforms covered here, placed real trades, timed the onboarding from start to first execution, and measured the actual costs — not just the advertised ones. Some platforms that market themselves to beginners are genuinely excellent. A few are so complicated or so poorly regulated that they'll cost you money before you've placed a single trade. This guide covers both: who I'd recommend, and who I'd actively steer you away from.

If you're past the beginner stage and want the full ranked platform comparison, that's here.

The Best Trading Platforms for Beginners at a Glance

| Platform | Best For | Min Deposit | Cost: £250 UK Share | Cost: £250 US Share | ISA | Demo | Trustpilot |

|---|---|---|---|---|---|---|---|

| eToro | Copy trading & multi-asset | $50 (~£40) | £0 (spread applies) | £0 (1.5–3.0% FX fee) | Yes (eToro Money) | Yes ($100k virtual) | 4.2 / 5 (30,459) |

| Trading 212 | All-round low-cost starter | £1 | £0 | £0 (0.15% FX fee) | Yes (free) | Yes (lifetime) | 4.6 / 5 (78,507) |

| Capital.com | Learning CFD trading | £20 | CFDs only (spread) | CFDs only (no FX fee) | No — CFD only | Yes (unlimited) | 4.6 / 5 (13,841) |

| Bitpanda | Crypto beginners | £10 | From 0.99% crypto fee | N/A | No | Unconfirmed | 3.9 / 5 (14,551) |

FCA FRNs — eToro: 583263 · Trading 212: 609146 · Capital.com: 793714 · Bitpanda: 925234 (cryptoasset activities only). All fees verified February 2026.

The table tells a clear story. Trading 212 is the cheapest option for a beginner buying real shares — genuinely zero commission with only a 0.15% FX conversion fee on US stocks. When I bought £250 of a US-listed ETF on Trading 212, the total conversion cost came to 38p. The same trade on eToro cost me £4.87 in FX conversion — nearly thirteen times more — because eToro's FX fee ranges from 1.5% to 3.0% depending on the currency pair, not the flat 0.5% you'll see quoted in most comparison articles. Both advertise "zero commission," but the real cost to a beginner is materially different.

Capital.com deserves a specific caveat: you cannot buy and own real shares on this platform. Every position is a CFD — a contract for difference — which means you're speculating on price movements rather than building a portfolio. That's not inherently wrong, but a beginner needs to understand the distinction before depositing. Bitpanda's FCA registration is specifically for cryptoasset activities, not the same full-scope authorisation that eToro and Trading 212 hold. If crypto is your starting point, that's fine. If you want shares and ETFs, the other two are stronger choices.

Why Did These Four Make the Cut?

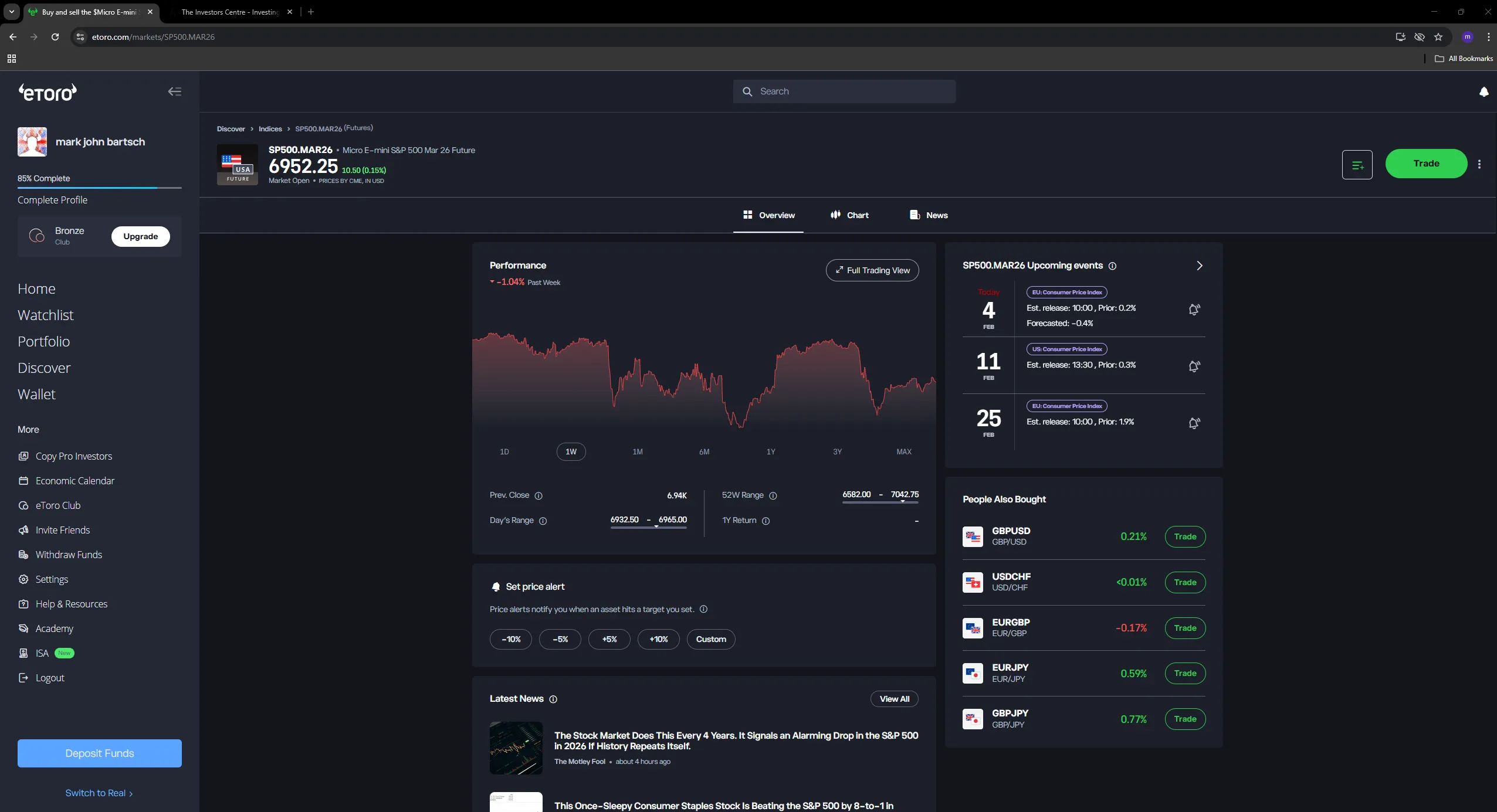

eToro

The one that lets you learn by watching

eToro's CopyTrader feature is the single most useful tool I've found for a complete beginner who wants to invest but doesn't know where to start. You pick a trader whose strategy and risk profile you like, allocate a portion of your capital, and your account automatically mirrors their trades in real time. It's not a gimmick — it's a structured way to learn by observing what experienced investors actually do with real money, rather than reading theory. The social feed adds context: you can see what the community is trading, why, and whether sentiment is shifting before you commit. I went from downloading the app to copying my first trader in about 14 minutes — verification was near-instant using photo ID, though eToro warns it can take up to 24 hours during busy periods.

The downsides are real and worth flagging. eToro's FX conversion fee is not the flat 0.5% you'll see quoted in most comparison articles — it varies from 1.5% to 3.0% depending on the currency pair, which adds up quickly on US trades. There's a $5 fee on every withdrawal, which I confirmed when I moved funds back to my bank. The ISA is offered through eToro Money, which is a separate FCA-regulated entity (FRN 900923), not through the main trading platform — it requires a separate sign-up process. And if you stop using the account, a $10/month inactivity fee kicks in after 12 months. Despite those caveats, for a beginner who wants multi-asset access and a built-in way to learn, it remains a strong starting point. You can open an account with eToro here.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

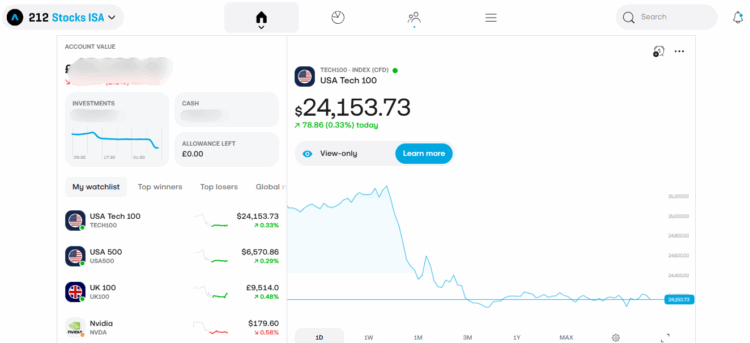

Trading 212

The closest thing to a free lunch

If the goal is to buy real shares and ETFs with the absolute minimum friction and cost, Trading 212 is the answer. Commission is genuinely zero — not "zero but with a catch," just zero. I bought £10 of the Vanguard FTSE 100 UCITS ETF (VUKE) as a test and the confirmation showed no commission, no platform fee, nothing taken off the top — the entire £10 went into the position. The Stocks & Shares ISA has no annual charge, which is remarkable given that most ISA providers charge 0.25% to 0.45% per year. Fractional shares start from £1, so you can build a diversified portfolio even with small deposits. The Pie and AutoInvest features let you set up automatic investing into a basket of your chosen stocks and ETFs — set it, forget it, check quarterly. Interest on uninvested cash in the ISA is around 4.05%, though this rate is variable and subject to conditions.

Where Trading 212 falls short is customer support — it's primarily app-based with no phone line, and response times can lag during market volatility. The CFD side of the platform carries a 75% retail loss rate, which is higher than average, so if you're tempted to switch from investing to trading, tread carefully. But for a beginner who wants to buy and hold real shares in a tax-free wrapper, this is as good as it gets in the UK right now. You can open an account with Trading 212 here.

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results. 75% of retail investor accounts lose money when trading CFDs with this provider.

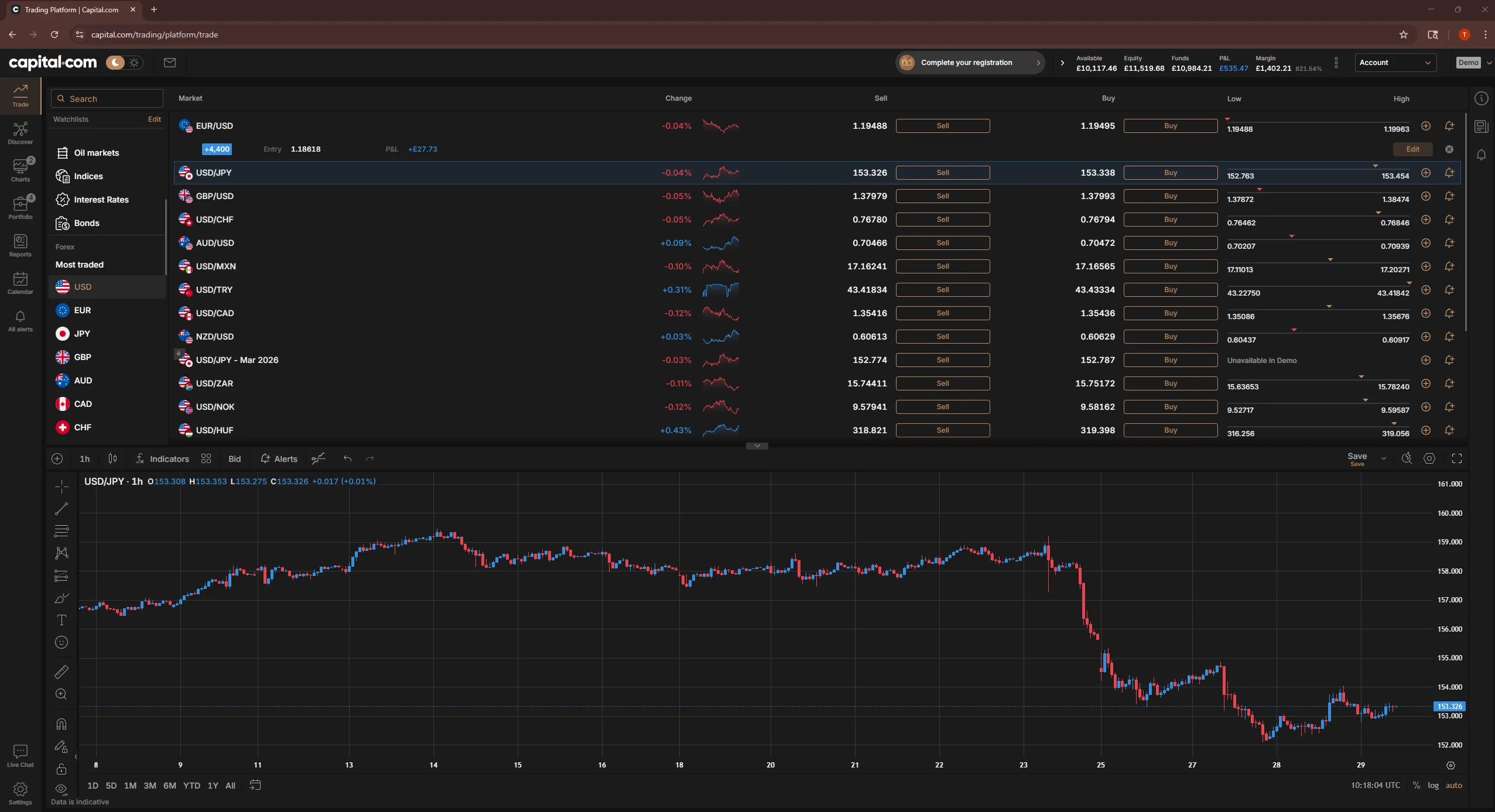

Capital.com

Best mobile app for learning to trade CFDs

Capital.com's mobile app is the best trading interface I've tested for someone learning how CFDs work. The design is clean without being patronising — it surfaces AI-driven insights about your trading behaviour, flags when you're about to take on unusual risk, and integrates educational content directly into the trading flow rather than burying it in a separate section. When I opened a demo position on EUR/USD, the app immediately surfaced a tooltip explaining what the spread cost me in real terms. That kind of contextual education is rare. From opening the app to placing my first demo trade took four taps and under 90 seconds — faster than any other platform I tested. There's no FX conversion fee, which is unusual for a CFD platform and makes it cheaper than most competitors for forex and international index trades. The minimum deposit is just £20.

The critical caveat: this is a CFD and spread betting platform only. You cannot buy and own real shares. Every position is leveraged by default (though you can set leverage to 1x on certain instruments), and 62% of retail investor accounts lose money when trading CFDs with Capital.com. That's their own figure, prominently displayed. If you're interested in learning to trade — as in actively speculating on price movements — rather than investing for the long term, Capital.com offers the best mobile experience. But it's the wrong choice entirely if you want to build a portfolio. You can open an account with Capital.com here.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

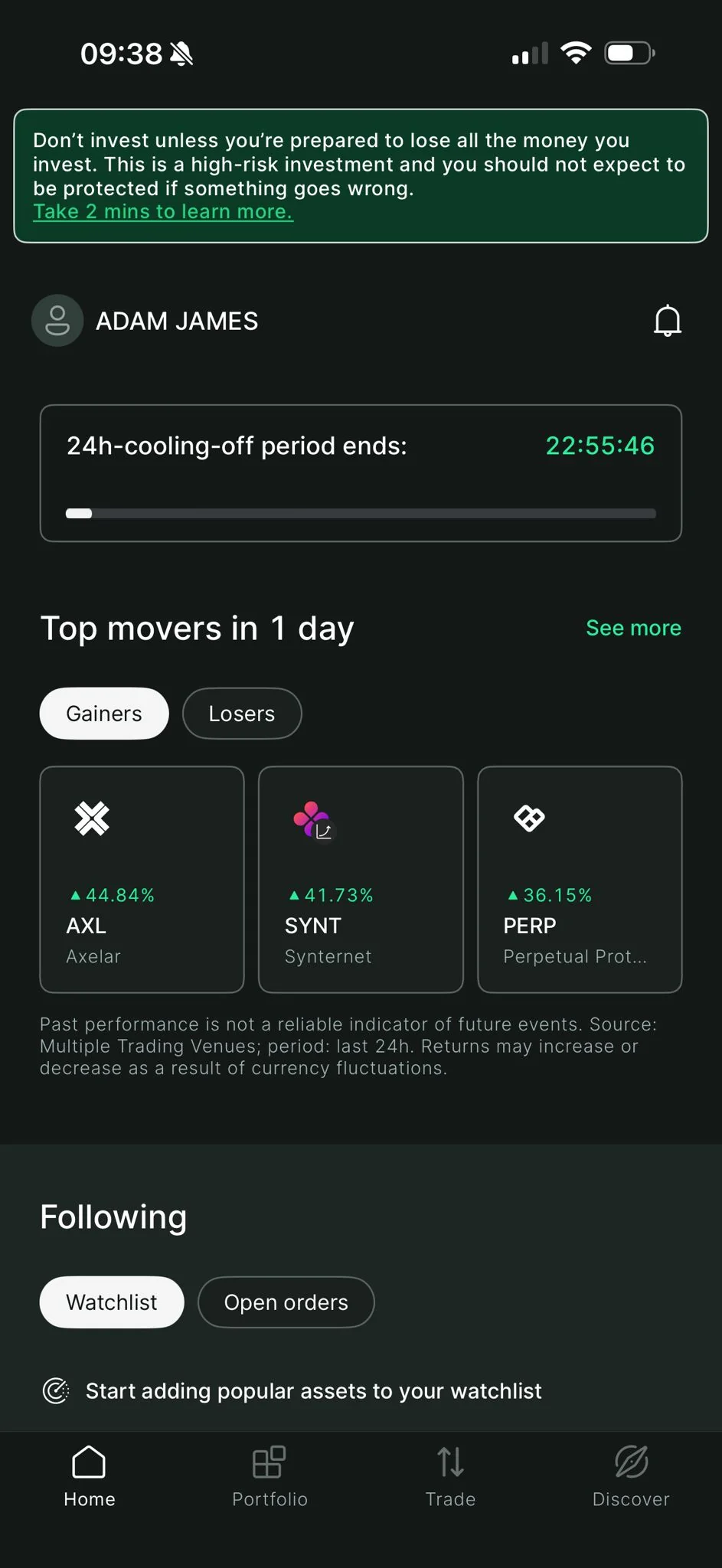

Bitpanda

If you're starting with crypto

For a UK beginner whose primary interest is cryptocurrency rather than stocks, Bitpanda is the strongest regulated option. It's registered with the FCA specifically for cryptoasset activities (FRN 925234), which means it meets UK anti-money-laundering standards — a bar that many popular crypto exchanges fail to clear. The app is clean, supports 600+ cryptocurrencies with fractional purchases from £1, and accepts GBP deposits via bank transfer, card, or PayPal at no charge. I tested the onboarding in January 2026 and two things stood out: ID verification completed in under six minutes using photo ID, and Bitpanda enforces a 24-hour cooling-off period on new accounts before you can trade — a genuine safeguard for impulsive beginners that you can see in the screenshot above.

The trading fee starts from 0.99% per transaction (via the premium/spread model), which is higher than you'd pay on a dedicated exchange like Kraken or Coinbase Pro — but the trade-off is simplicity and regulatory standing. Bitpanda also offers stocks and ETFs, though the range and pricing are less competitive than Trading 212 for that purpose. It's worth noting that the FCA registration for cryptoasset activities is not the same as full broker authorisation — Bitpanda isn't covered by the FSCS for crypto holdings, because no UK crypto platform is. But having FCA registration means there's a regulatory framework around how the business operates, which is more than can be said for several of the alternatives. You can open an account with Bitpanda here.

Investing in cryptoassets is high-risk. The value of cryptoassets can go down as well as up and you may lose all the money you invest. Cryptoassets are not protected by the FSCS. Bitpanda is registered with the FCA for cryptoasset activities under FRN 925234.

Which Platforms Should Beginners Avoid?

Not every platform that appears in Google ads or gets recommended on Reddit is suitable for a first-time trader. Some are built for professionals and will overwhelm you. Others operate in regulatory grey areas that put your money at genuine risk. I've tested all three of the platforms below, and while each has a legitimate audience, none of them should be your first.

Interactive Brokers

Avoid for beginners

I rate Interactive Brokers highly in my main platform rankings — for experienced traders, it's exceptional. For beginners, it's a different story entirely. The Trader Workstation interface looks and feels like a Bloomberg terminal: powerful, dense, and completely unintuitive if you don't already know what you're looking for. When I logged into Trader Workstation for this review, I counted 63 menu items on the main dashboard before giving up trying to find a simple "buy shares" button. The fee structure offers both "fixed" and "tiered" pricing models, and even after years of testing brokers, I had to read the documentation twice to work out which model would cost me less on a £250 UK share purchase.

The ISA carries a £3/month minimum commission charge — which means if you're a buy-and-hold beginner who trades infrequently, you're paying £36/year just for the privilege of having an account that Trading 212 and eToro offer for free. The Broker account requires a $10,000 upfront deposit (applied against commissions over 8 months). And the support data speaks for itself: a Trustpilot rating of 3.6/5 — the lowest of any platform in this article — with only 55% of negative reviews receiving a reply, typically taking over a month. If you don't know the difference between a limit order and a market order yet, this platform will punish you for it.

Admiral Markets

Avoid for beginners

Admiral Markets (now branded as Admirals) has a similar problem to Interactive Brokers — complexity — but without the depth of markets to justify it. The platform is built around MetaTrader 4 and MetaTrader 5, which are powerful professional tools but present a steep learning curve for someone placing their first trade. When I went through the onboarding, the first decision I was asked to make was choosing between two account types — Trade (commission-free, wider spreads) and Zero ($3/lot, tighter spreads). That's a decision no beginner should need to make on day one, and the platform gives you almost no guidance on which to pick.

The FCA register entry for Admiral Markets UK (FRN 595450) includes an unusual note: "Some activities by this firm may not be protected." That's a flag worth paying attention to. App engagement in the UK is vanishingly low — the iOS App Store shows between 2 and 79 ratings depending on the app version, compared to 336,000 for Trading 212. The minimum deposit ranges from £100 to £250 depending on your account type. For a new trader, there is simply no reason to choose Admiral Markets over Capital.com or Trading 212 — you get access to the same asset classes with a fraction of the friction.

MEXC

Avoid entirely — not FCA regulated

MEXC is not authorised or regulated by the FCA. The FCA added MEXC to its Warning List on 22 March 2024 as an unauthorised firm targeting UK consumers. That means no FSCS protection (your first £85,000 of eligible deposits is not covered), no access to the Financial Ombudsman Service, and no regulatory recourse if something goes wrong with your funds.

There is no direct GBP fiat deposit option — you cannot deposit pounds into your account, which forces you through additional conversion steps and fees before you've even placed a trade. When I tested the sign-up flow from a UK IP address in February 2026, the platform accepted my registration without any warning that it lacks FCA authorisation — no disclaimer, no pop-up, no redirect. It markets aggressively to UK users despite having no UK regulatory standing. The Trustpilot rating tells the real story: 1.6/5, rated "Bad" from 1,269 reviews. The contrast with the iOS App Store rating (4.7/5 globally) is itself instructive — app store ratings capture ease of download and first impressions, not what happens when you try to withdraw money or resolve a dispute. For a beginner interested in crypto, Bitpanda offers FCA-registered access to the same major cryptocurrencies without the regulatory risk.

How Do Beginner Fees Actually Compare?

| Platform | Our View | UK Shares | US Shares | FX Fee | Inactivity | Withdrawal |

|---|---|---|---|---|---|---|

| Trading 212 | Recommended | £0 | £0 | 0.15% | None | Free |

| eToro | Recommended | £0 | £0 | 1.5–3.0% | $10/mo (12mo) | $5 |

| Capital.com | Recommended | CFDs only | CFDs only | Free | None listed | Free |

| Bitpanda | Recommended | 0% stocks | N/A | Built in | None | Free (fiat) |

| Interactive Brokers | Avoid for beginners | £3 (fixed) / tiered | $0.005/share (tiered) | Variable | None | 1 free/mo, then $10 |

| Admiral Markets | Avoid for beginners | £0 (Trade) / $3/lot (Zero) | £0 (Trade) / $3/lot (Zero) | 0.3% | Verify | 1 free/mo |

| MEXC | Avoid entirely | N/A | N/A | No GBP fiat | None | Network fees |

All fees verified against platform fee pages, February 2026. Admiral Markets inactivity fee not listed publicly — requires direct verification.

The pattern is clear. The beginner-friendly platforms have simpler, more predictable fee structures. Trading 212 and Capital.com are both transparent — I can calculate the cost of any trade in seconds. eToro's FX conversion adds a layer of complexity that catches many new users off guard, and the real rate is significantly higher than what most comparison sites report. Interactive Brokers' dual pricing model (fixed vs. tiered) genuinely requires a spreadsheet to compare properly — I've been doing this for years and I still have to check.

At the other end of the spectrum, MEXC doesn't even support direct GBP deposits, which means you're paying conversion costs before you've entered the platform — and doing so without any FCA regulatory protection. A new trader shouldn't need to study a fee schedule to work out what a trade costs. If the pricing isn't immediately obvious, that's a signal the platform wasn't designed with you in mind.

What Actually Makes a Platform "Beginner-Friendly"?

There's an important difference between a platform that's simple and one that's been dumbed down. Capital.com simplifies the CFD trading interface without removing the tools you'll eventually need — it guides you without limiting you. Trading 212 gives you access to real shares and ETFs through a clean interface that doesn't assume you know what a stop-loss order is. eToro gamifies the experience, which is a double-edged sword: the social feed and copy trading are powerful learning tools, but the app's design can encourage over-trading in beginners who find it hard to distinguish between investing and entertainment.

Demo accounts are worth using, but with realistic expectations. The psychological difference between trading £10,000 of virtual money and £200 of real money is enormous. In a demo, you'll take risks you'd never take with your own capital, and you'll feel nothing when a position goes against you. I've watched my own behaviour change between demo and live — the strategies that feel bold and clever on paper become genuinely stressful with real money on the line. Use a demo to learn the interface and mechanics, not to develop a strategy you'll then deploy at the same sizing with real capital.

Educational resources vary wildly. Capital.com integrates learning into the trading workflow. Trading 212 has a community-driven knowledge base. eToro's Academy covers the basics well. What matters more than volume of content is structure — a beginner needs a clear path from "what is a share" to "how do I build a portfolio," not 300 scattered blog posts. And regulation is non-negotiable. If a platform isn't authorised by the FCA, you have no protection under the FSCS (up to £85,000 for eligible deposits) and no access to the Financial Ombudsman. That's not a nice-to-have — it's the minimum baseline.

What Are the Mistakes New Traders Make in Their First 90 Days?

The most common mistake is using leverage before understanding it. If you're depositing your first £200 into a CFD account with 30:1 leverage because someone on TikTok told you to trade forex, you are going to lose that money. Leverage amplifies losses exactly as much as it amplifies gains, and the FCA's data consistently shows that the majority of retail CFD accounts are unprofitable. Start with 1:1 exposure until you genuinely understand what you're risking.

Not using a Stocks & Shares ISA when one is available is the second most expensive error. If you're buying real shares on Trading 212 or eToro and not doing it inside an ISA, you're volunteering to pay capital gains tax on profits above the £3,000 annual allowance. The ISA is free on Trading 212 and available through eToro Money. There is no reason not to use one.

Treating a demo account the same as real money is a fantasy that every beginner indulges and every experienced trader has abandoned. The emotions are completely different. Your demo strategy will not survive contact with real losses. Depositing more than you can afford because the app makes it frictionless is closely related — when adding £500 is as easy as tapping a button, the psychological weight of that money evaporates. Set a budget before you open the account, not after.

And finally, chasing volatile meme stocks or crypto tokens because they're trending on social media is the fastest way to learn a very expensive lesson. By the time a ticker is being shared on Reddit or TikTok, the early move has already happened. You're not getting in early — you're providing exit liquidity for someone who did.

Our Verdict — Where Should a Beginner Actually Start?

If you want to buy real shares and ETFs with the lowest possible friction and zero commission, Trading 212 is the clear starting point — especially within its free Stocks & Shares ISA. If you want to learn by watching experienced traders and want multi-asset access from a single account, eToro's CopyTrader feature is genuinely valuable, though be mindful of the FX conversion costs. If your interest is specifically in learning to trade CFDs or forex and you want the best mobile experience, Capital.com offers the most intuitive interface — just understand that you'll never own the underlying asset. And if crypto is your entry point, Bitpanda gives you FCA-registered access without the risks of unregulated exchanges.

Whatever you do, don't start with a platform built for professionals or one that isn't regulated in the UK. The learning curve will cost you money, or the lack of protection will cost you sleep. Neither is a good outcome for someone placing their first trade.

For the full scored rankings across all experience levels, see my main best trading platforms guide.

FAQs

What is the easiest trading platform to use for beginners?

Trading 212 has the simplest interface for buying real shares and ETFs — you can go from account opening to your first trade in minutes. For CFD trading specifically, Capital.com's mobile app is the most intuitive I've tested. Both are FCA regulated and have no minimum deposit barriers that would block a first-time user.

Can I lose more than I deposit?

If you're buying real shares (on Trading 212 or eToro's Invest account), the maximum you can lose is the amount you invested — a share can go to zero, but not below. If you're trading CFDs with leverage, FCA-regulated platforms are required to offer negative balance protection, which means your account cannot go below zero. However, you can still lose your entire deposit very quickly with leveraged products.

Is £100 enough to start trading?

Yes. Trading 212 lets you start with £1 and buy fractional shares. eToro's first deposit minimum is $50 (~£40). Capital.com requires £20. You won't build significant wealth with £100, but it's enough to learn the mechanics of placing trades, building a watchlist, and understanding how markets move — with real money rather than a demo.

Should I start with a demo account or real money?

Use a demo account to learn the platform interface and practice placing different order types. But don't spend months in a demo thinking it prepares you for real trading — the psychological difference is enormous. I'd suggest a few days in demo mode to learn the buttons, then switching to a small real-money deposit (£50–£100) to experience the emotional reality of gains and losses.

What's the difference between buying a share and trading a CFD?

When you buy a share (on Trading 212 or eToro's Invest account), you own a piece of the company. You can hold it indefinitely, receive dividends, and it sits in your ISA. A CFD (contract for difference) is a bet on price movement — you don't own the underlying asset, positions can be leveraged, and you'll pay overnight funding charges if you hold beyond a day. Capital.com and eToro's CFD account are CFD platforms. For beginners who want to invest long-term, buying real shares is almost always the better starting point.

How do I check if a broker is FCA regulated?

Go to the FCA Register and search for the broker's name or Firm Reference Number (FRN). Every legitimately regulated platform will display their FRN on their website, usually in the footer. If a platform doesn't appear on the register — like MEXC — it is not authorised to operate in the UK and your money has no FSCS protection.

Are "zero commission" platforms really free?

They're free of trading commission, but that doesn't mean there are no costs. Trading 212 charges a 0.15% FX conversion fee on non-GBP trades. eToro's FX fee ranges from 1.5% to 3.0% and includes a $5 withdrawal fee. Capital.com makes money through the spread — the difference between the buy and sell price on CFDs. No platform operates as a charity; the question is whether the revenue model is transparent and the costs are predictable for your trading pattern.

References

- FCA Register — eToro (UK) Ltd, FRN 583263 – FCA Register

- FCA Register — eToro Money UK Ltd, FRN 900923 – FCA Register

- FCA Register — Trading 212 UK Limited, FRN 609146 – FCA Register

- FCA Register — Capital Com (UK) Limited, FRN 793714 – FCA Register

- FCA Register — Bitpanda Broker UK Ltd, FRN 925234 – FCA Register

- FCA Register — Interactive Brokers (U.K.) Limited, FRN 208159 – FCA Register

- FCA Register — Admiral Markets UK Ltd, FRN 595450 – FCA Register

- FCA Warning List — MEXC, added 22 March 2024 – FCA Unauthorised Firms

- Financial Services Compensation Scheme — Protection Limits – FSCS

- eToro Fees & Charges – eToro

- Trading 212 Trading Terms – Trading 212

- Capital.com Fees & Charges – Capital.com

- Bitpanda Fees – Bitpanda

- Interactive Brokers Pricing – IBKR