- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

I bought my first Bitcoin in 2019 when it was trading around £6,000. Back then, the process was already smoother than the early days, but I still made plenty of mistakes — leaving coins on exchanges, panic-checking prices at 2am, and once nearly sending BTC to the wrong address. Those lessons shaped how I approach crypto today: secure your keys properly, ignore the daily noise, and never invest more than you can genuinely afford to lose.

The landscape has improved dramatically since then. UK investors now have FCA-registered exchanges, hardware wallets that cost less than a night out, and even regulated ETPs on the London Stock Exchange. Here’s exactly how to buy Bitcoin in 2026, based on six years of holding and trading it.

Quick Answer: How to Buy Bitcoin

How to Buy Bitcoin in the UK for Beginners - Quick Steps

- Select an Exchange – Choose platforms like eToro, Coinbase, or Bitpanda with strong security and low fees.

- Register & Verify – Sign up and complete KYC with ID and proof of address.

- Deposit Funds – Use bank transfer (low fees, slow) or card (instant, higher fees).

- Select and Buy Bitcoin (BTC) – Place a market or limit order, confirm, and complete.

- Secure Your Bitcoin – Transfer to a wallet

- Monitor Your Investment

How to buy Bitcoin in the UK (Step-by-Step Guide)

Step 1: Select a Reputable Exchange

Prioritise platforms that offer strong security, keep a look out for two-factor authentication (2FA), cold storage for crypto, and FCA registration for peace of mind.

Fees matter too. Some exchanges charge as much as 1.5% per trade, while others offer far lower rates for experienced users. Consider deposit, trading, and withdrawal fees before committing.

Ease of use is another key factor—especially if you’re just getting started. A clean interface and responsive support can make a big difference.

Here’s a quick comparison of the best exchanges for UK users:

| Feature | Bitpanda | eToro | Coinbase | Coinbase Advanced Trade |

|---|---|---|---|---|

| Ease of Use | Simple interface, ideal for beginners | Beginner-friendly, social trading features | Simple interface, ideal for beginners | Advanced tools, suited for experienced traders |

| Fees | 1.49% transaction fee | 1% trading fee | 1.49% transaction fee | Lower fees (0.4% maker, 0.6% taker) |

| Funding Options | Bank transfer, debit/credit card, PayPal, Skrill, Neteller | Bank transfer, debit/credit card | Bank transfer, debit/credit card, PayPal | Bank transfer, debit/credit card |

| Crypto Selection | 400+ cryptocurrencies | 75+ cryptocurrencies | 240+ cryptocurrencies | 240+ cryptocurrencies |

| Security | FCA-registered, insured funds, 2FA, cold storage | FCA-regulated, 2FA, cold storage | Insured funds, 2FA, cold storage | Insured funds, 2FA, cold storage |

| Extras | Staking, savings plans, multi-asset platform | CopyTrading, multi-asset platform | Educational tools, staking | Advanced charting, order types, lower fees |

Alternatively you can check our our more in depth analysis on the best crypto exchanges available in the UK.

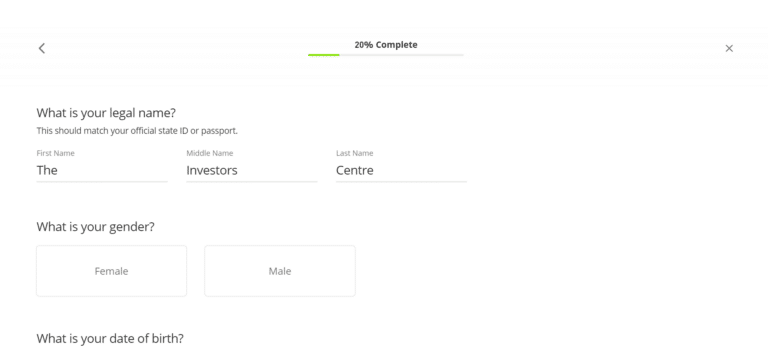

Step 2: Register and Verify Your Account

The next step is to sign up and verify your identity. Start by creating an account with your email and a strong password, then accept the platform’s terms.

To comply with UK regulations, you’ll need to complete the KYC (Know Your Customer) process. This involves submitting your full name, date of birth, and address—along with a photo ID (passport or driver’s licence) and proof of address (like a utility bill).

Verification times vary—some platforms approve accounts in minutes, others may take a few hours. This step is crucial for both compliance and security, helping protect your account from fraud and ensuring the exchange meets AML (Anti-Money Laundering) standards.

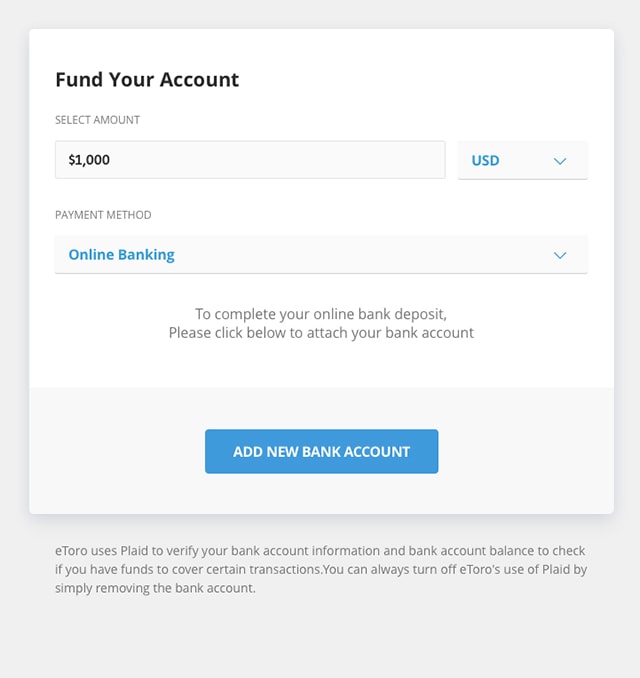

Step 3: Deposit Funds into Your Exchange Account

With your account verified, it’s time to fund it. Most UK exchanges accept bank transfers and credit/debit cards.

- Bank Transfer – Lower fees, but processing can take 1–3 days.

- Credit/Debit Card – Instant deposits, but expect higher fees (typically 2–4%).

Our January 2026 Testing

- Bitpanda: £500 via Faster Payments — arrived in 47 minutes

- eToro: £500 card deposit — instant. Bank transfer took 4 hours.

- Coinbase: £500 via Faster Payments — 12 minutes. Fastest we tested.

- Kraken: £2,000 deposit cleared in 11 minutes. Verification took 40 minutes beforehand.

Card deposits are instant but cost 2-4% in fees. Bank transfers are slower but cheaper.

Watch for deposit fees—some platforms charge, others don’t. Ensure the exchange supports GBP to avoid hidden currency conversion fees. Always double-check your payment details before confirming the transaction to avoid any unnecessary errors or delays.

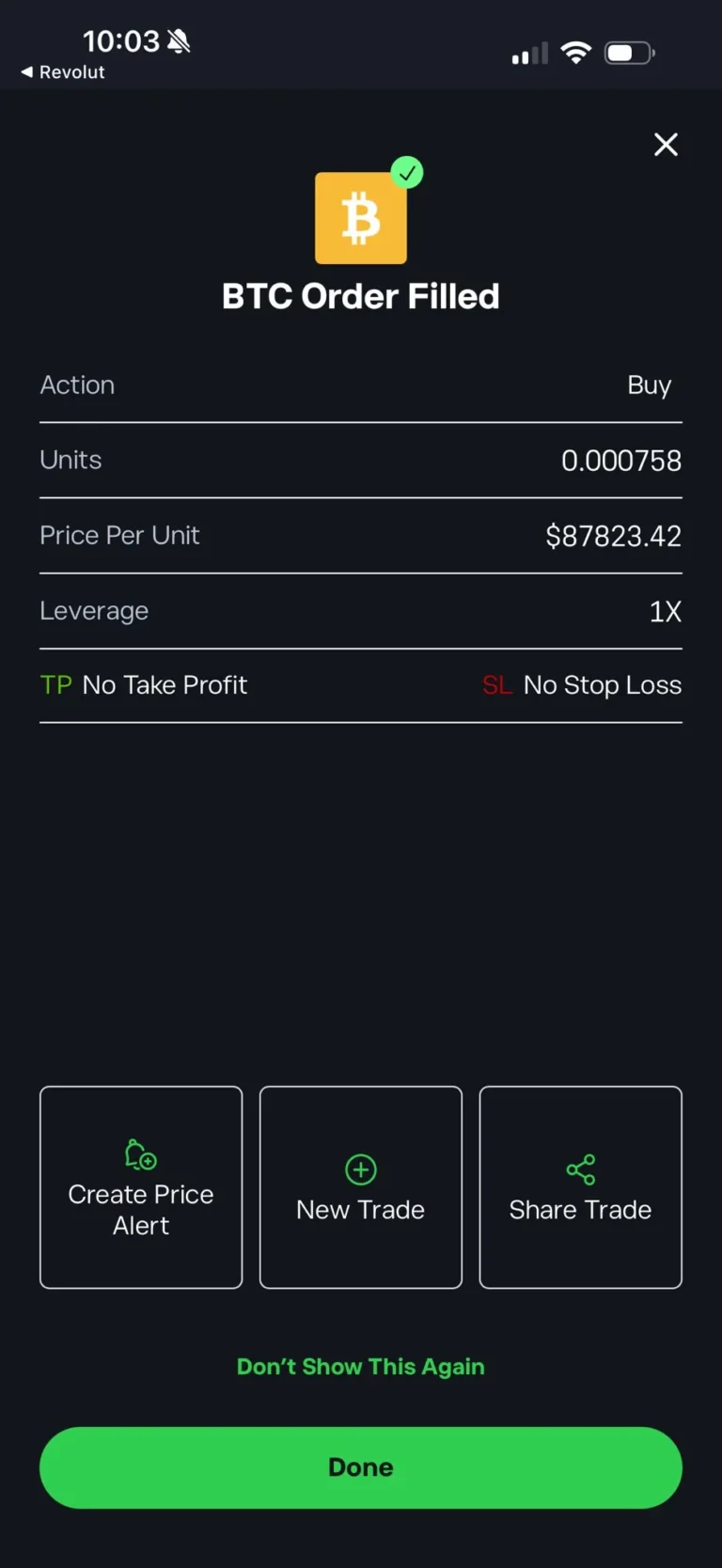

Step 4: Purchase Bitcoin

Now that your account is funded, you can buy Bitcoin. Head to the “Markets” or “Trade” section, search for BTC, and choose how much you want to buy.

You’ll usually see two order types:

- Market Order – Buys instantly at the current price. Fast and beginner-friendly, but may experience slight price fluctuations (slippage) during volatility.

- Limit Order – Lets you set a target price. The trade executes only when the market hits that price—ideal if you want more control.

Before confirming, check the total cost, including trading fees (usually 0.1%–2%). Once submitted, your purchase should appear in your account within minutes.

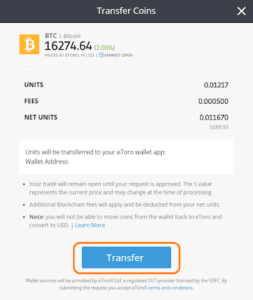

Step 5: Secure Your Bitcoin

After making your bitcoin purchase, don’t leave it sitting on the exchange—it’s safer to transfer it to a personal wallet. Exchanges can be hacked, and securing your crypto is your responsibility.

You’ve got two main wallet options:

- Hardware Wallets – Physical devices that store your new coins offline. Best for long-term security.

- Software Wallets – Mobile or desktop apps, Convenient, but connected to the internet, so slightly less secure.

Quick Steps to Transfer Your Bitcoin Securely:

- Choose a Secure Crypto Wallet – Select a hardware or software wallet that suits your needs.

- Set It Up – Install the app or follow your hardware wallet’s setup guide.

- Secure It – Use a strong password and write down your recovery phrase. Store it offline.

- Transfer Funds – Go to your exchange, hit “Withdraw,” paste your wallet’s public address, and send your Bitcoin.

| Wallet Type | Examples | Best For | Pros | Cons |

|---|---|---|---|---|

| Hot Wallets | Trust Wallet, MetaMask | Frequent trading | Easy access, free to use | Vulnerable to hacking |

| Cold Wallets | Ledger, Trezor | Long-term storage | Maximum security, offline | Requires initial purchase |

Step 6: Monitor and Manage Your Investment

Once your new purchase is secure, keep a close eye on it. Use the tools on your exchange’s dashboard to track price movements and portfolio performance in real time.

Set price alerts to stay ahead of market swings, and follow reliable crypto news sources to stay informed on trends, regulations, and major events. Staying proactive in the industry will help you decide when to buy, sell, or hold—based on data, not emotion.

How to Buy Bitcoin Through an ETP in the UK

Since October 2025, UK retail investors can buy Bitcoin ETPs on the London Stock Exchange. Before that, they were restricted to professional investors only.

What’s a Bitcoin ETP?

An ETP tracks the price of Bitcoin. You buy it through a stockbroker — same as shares. You don’t own actual Bitcoin. You own a financial product backed by Bitcoin held in custody.

ETF vs ETP — what’s the difference? The US approved spot Bitcoin ETFs in 2024 (BlackRock’s IBIT, Fidelity, etc.). In the UK, what’s listed on the LSE are ETPs — specifically ETNs (Exchange Traded Notes). They’re structured as debt securities, not funds. For most retail investors, the practical difference is minimal.

| Term | What It Means | UK Status |

|---|---|---|

| ETF | Exchange Traded Fund — regulated as UCITS in UK/EU | No Bitcoin ETFs for UK retail |

| ETP | Exchange Traded Product — umbrella term for ETFs, ETNs, ETCs | Bitcoin ETPs available on LSE |

| ETN | Exchange Traded Note — debt instrument tracking an asset | This is what 21Shares, WisdomTree etc. actually are |

Why Buy an ETP Instead of Bitcoin Directly?

- Regulated: Listed on the LSE, issued by established asset managers

- No wallet: You don’t manage private keys or worry about exchange hacks

- Tax wrapper potential: Some ETPs may be ISA or SIPP eligible — check with your provider

- Familiar process: Buy through your existing broker alongside shares

Bitcoin ETPs on the London Stock Exchange

- 21Shares — Bitcoin ETP (ticker: 21XB)

- WisdomTree — Physical Bitcoin (ticker: BTCW)

- CoinShares — Physical Bitcoin (ticker: BITC)

- Invesco — Physical Bitcoin (ticker: BTIC)

These are physically backed — the issuers hold actual Bitcoin to match outstanding shares.

ETP vs Direct Purchase

| Factor | Bitcoin ETP | Buying Bitcoin Directly |

|---|---|---|

| Ownership | Shares in a product | Actual Bitcoin |

| Custody | Issuer handles it | Your problem |

| Fees | Annual management fee (0.5-1.5%) | One-time trading fee |

| Tax wrapper | Potentially ISA/SIPP eligible | Not eligible |

| Withdrawals | Sell for cash only | Move to your own wallet |

| Trading hours | LSE hours (8am-4:30pm) | 24/7 |

How to Buy a Bitcoin ETP

- Open an account with a UK broker that offers LSE ETPs — Hargreaves Lansdown, AJ Bell, Interactive Investor, IG

- Search for the ETP by ticker (e.g. “21XB” or “BTCW”)

- Place your order during LSE hours

- Done — it sits in your account alongside your other investments

Which Should You Choose?

Go with an ETP if: You want regulated exposure through your broker, you’re interested in ISA/SIPP eligibility, or you don’t want to deal with wallets and keys.

Buy Bitcoin directly if: You want to own and control your coins, you might use it for payments, or you want to avoid ongoing management fees.

For long-term price exposure with minimal hassle, ETPs now make sense. If you care about self-custody and Bitcoin’s original point — being your own bank — buy it directly.

What Is Bitcoin?

Bitcoin is a decentralised digital currency that allows peer-to-peer transactions without banks or intermediaries. Unlike traditional money, it exists solely online and is powered by blockchain technology.

Bitcoin uses cryptography to secure payments and control the creation of new coins. It’s called a “cryptocurrency” for this reason and is often seen as an alternative to fiat currencies.

What Is Blockchain?

Blockchain is a decentralised, tamper-proof ledger where each transaction is grouped into a “block” and added to a continuous “chain.” Once recorded, data on the blockchain can’t be altered—making it transparent, secure, and resistant to fraud.

Since no single party controls it, blockchain is considered censorship-resistant and trustworthy. Everyone on the network holds a copy, enhancing integrity and decentralisation.

Why Do Traders Buy Bitcoin?

Bitcoin has a few standout features that make it unique:

- Limited Supply – Only 21 million Bitcoins will ever exist, making it scarce—like digital gold.

- Decentralised – No central authority or government controls it.

- Pseudonymous – Users don’t need to link identities to crypto wallets, offering a degree of privacy.

Thanks to these properties—and growing global acceptance—Bitcoin is seen as a revolutionary asset, both as a store of value and a medium of exchange.

Is Bitcoin a Good Investment in 2026?

Bitcoin’s investment case strengthened considerably through 2024-2025. The approval of spot ETFs brought institutional credibility, while the halving reduced new supply entering the market. With prices now established above $100,000 and major asset managers like BlackRock offering regulated exposure, Bitcoin has transitioned from speculative asset to recognised store of value. However, volatility remains significant—prices can swing 20-30% within weeks.

Curious how many Brits invest in crypto? Our cryptocurrency statistics for the UK reveal the latest ownership trends and demographics.

If you’re not sure whether Bitcoin fits your situation — risk tolerance, tax position, other investments — talk to a financial adviser. This guide is educational. It’s not personal advice.

What Risks do I need to Consider?

Investing in any cryptocurrency cannot be considered risk-free. Key concerns include:

- Volatility – Prices can swing dramatically in short periods.

- Regulatory Risk – Governments are still working out how to regulate crypto, which could impact future access.

- Security – If not stored properly, your crypto can be lost or stolen.

You’ll need to weigh these risks against potential rewards. A diversified approach will help you effectively manage exposure.

I learned this in 2022. Portfolio down 60%+ in a few months. I came close to selling at the bottom. The only reason I didn’t was because I’d followed my own rule: never put in more than you can afford to lose. That’s not a cliché — it’s the thing that stops you panic-selling at the worst possible moment.

What is the Long-Term Outlook for Bitcoin?

Many traders believe Bitcoin could become a global digital currency and a reliable store of value. Institutional interest, limited supply, and decentralised infrastructure support its long-term potential.

However, success depends on how Bitcoin navigates future regulation, technology upgrades, and market adoption. Most experts recommend making it part of a broader, balanced portfolio rather than going all in.

How does Bitcoin compare to Altcoins?

“Altcoins” are any cryptocurrencies that are not Bitcoin. This includes popular examples such as Ethereum, Solana, XRP, Dogecoin and Cardano. They often offer faster transactions, lower fees, or different use cases. Alt and meme coins can diversify your crypto portfolio, but they also carry higher risk.

KEY 2026 UPDATES SUMMARY

- Bitcoin $100k milestone — First crossed December 2024, ATH $125k+ October 2025

- UK crypto ETPs — FCA lifted retail ban October 2025, BlackRock/21Shares/WisdomTree on LSE

- US spot ETFs — Approved January 2024, $50bn+ net inflows, BlackRock IBIT ~$100bn AUM

- April 2024 halving — Block reward reduced 6.25 → 3.125 BTC

- eToro IPO — Nasdaq listing May 2025, ticker ETOR, $5bn+ valuation

- ISA/SIPP eligibility — Crypto ETPs potentially eligible, IFISA reclassification April 2026

- Market cap — Bitcoin exceeded $2 trillion during 2025 peaks

January 2026: HMRC now gets your data automatically. Under the Crypto-Asset Reporting Framework (CARF), every FCA-registered exchange reports your trades directly to HMRC. Buys, sells, swaps — all of it. Keep your own records. See HMRC’s Cryptoasset Manual for the full breakdown.

Bitcoin — February 2026

- Price: ~$97,000 / £77,000

- All-time high: $125,000+ (October 2025)

- Market cap: ~$1.9 trillion

- Circulating supply: 19.8m of 21m max

Prices move. Check your exchange for live rates.

Final Thoughts

Bitcoin has evolved dramatically since its early days, now established above $100,000 with institutional backing from the world’s largest asset managers. UK investors can access Bitcoin through FCA-registered exchanges like eToro and Coinbase, or through newly available ETPs on the London Stock Exchange.

Start with an amount you can afford to lose, secure your holdings appropriately, and stay informed on regulatory developments. Bitcoin remains volatile, but its place in the financial landscape is now firmly established.

Top 5 Exchanges

1

Bitpanda

Don’t invest unless you’re prepared to lose all the money you invest.

2

eToro

Investing in crypto carries a high level of risk.

3

Coinbase

Investing in crypto carries a high level of risk.

4

IG

Don’t invest unless you’re prepared to lose all the money you invest.

5

Uphold

Investing in crypto carries a high level of risk.

Get free stock worth up to $500 when you deposit and verify your account. The more you deposit, the bigger your bonus!

⚠️ Important: Only your first deposit counts toward bonus eligibility. Choose your stock from NVIDIA, Tesla, Microsoft, Netflix, or Vanguard ETFs during registration. Must hold for 90 days.

Don't invest unless you're prepared to lose all the money you invest. Not available for ISA deposits. New customers only. First deposit only. Minimum 90-day holding period. eToro fees apply – final bonus value may be lower. T&Cs apply.

Get a free $50 stock when you sign up, verify your account, and make your first deposit of just $50!

- Sign up for a new eToro account

- Verify your account with ID verification

- Deposit $50 to qualify for your free stock

- Choose your stock from 6 select assets: NVIDIA, Tesla, Microsoft, Netflix, or Vanguard ETFs (VOO, VEU)

- Your $50 free stock is credited automatically within 7 days

💡 Perfect For Beginners: Low barrier to entry with just a $50 deposit. Join 40M+ users worldwide and start building your portfolio with a free stock. Must hold for 90 days.

Don't invest unless you're prepared to lose all the money you invest. Not available for ISA deposits. New customers only. Minimum 90-day holding period. eToro fees apply. T&Cs apply.

Get FREE access to an exclusive trading course worth $2,000 when you sign up to eToro. Learn advanced trading strategies from industry experts!

- Advanced Trading Aspects – Professional-level course content

- CopyTrading Masterclass – Learn to follow top investors

- Multi-Asset Strategy – Stocks, ETFs, crypto, forex

- Risk Management – Protect your capital effectively

- Market Analysis Tools – Technical & fundamental analysis

- Portfolio Diversification – Build balanced investments

🎓 Perfect For: New traders looking to build a solid foundation, or experienced investors wanting to refine their strategy. Join 40M+ users worldwide on eToro's trusted platform. No deposit required!

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. New customers only. T&Cs apply.

FAQs

Is it legal to buy Bitcoin in the UK?

Yes, buying and holding Bitcoin is completely legal in the UK. Exchanges must register with the FCA under anti-money laundering regulations. Since October 2025, UK retail investors can also access regulated Bitcoin ETPs on the London Stock Exchange, providing an additional route to Bitcoin exposure through traditional investment accounts.

Do I have to pay tax on Bitcoin in the UK?

Yes, HMRC treats Bitcoin as an asset. You may owe Capital Gains Tax when you sell it for a profit. It’s important to keep records of all transactions for tax reporting.

How much does it cost to buy Bitcoin in the UK?

Costs vary by platform. Expect trading fees between 0.1% and 2%, plus potential deposit or withdrawal charges. Credit card purchases usually come with higher fees than bank transfers.

Can I buy a fraction of a Bitcoin?

Absolutely. Bitcoin is divisible, so you can buy as little as £10 worth. You don’t need to purchase a full coin.

How do I store Bitcoin securely?

Use a hardware wallet, which keeps your private keys offline. Alternatively, use a reputable software wallet with strong security features. Avoid keeping large amounts on exchanges for extended periods.

Can I buy Bitcoin with GBP?

Yes, most UK exchanges support GBP deposits. Using GBP avoids foreign exchange fees, making it the most efficient option for UK residents.

Do I need ID to buy Bitcoin in the UK?

Yes, UK regulations require ID verification (KYC) for most reputable exchanges. You’ll need to submit a photo ID and proof of address before trading.

References

- Financial Conduct Authority (FCA) – Cryptoassets: What you need to know

- HM Revenue & Customs (HMRC) – Cryptoassets Manual

- Bank of England – Cryptoassets and Stablecoins

- Coinbase Help Centre – How to Buy Bitcoin

- eToro Academy – Bitcoin Explained

- Ledger Blog – How to Store Bitcoin Securely

- CryptoUK – Industry Association for Crypto in the UK