Coinbase vs Crypto.com - 2026 UK Comparison

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Coinbase or Crypto.com – Which Suits You Best in 2026?

For most UK users, Coinbase remains the stronger all-round choice. It’s FCA-registered, incredibly beginner-friendly, and widely trusted for reliability and transparency. Crypto.com, while more feature-packed, can feel complex and occasionally costly due to spreads. Coinbase is ideal for everyday investors seeking simplicity and safety.

| Feature / Category | Coinbase | Crypto.com | Verdict |

|---|---|---|---|

| Ease of Use | Very beginner-friendly; clean interface | Feature-rich but busy app | Coinbase – simpler and clearer |

| Regulation | Fully FCA-registered and transparent | FCA-registered but more complex terms | Coinbase – stronger UK trust |

| Trading Fees | ~1.49% per trade | 0.075%–0.4% (lower, but spreads apply) | Crypto.com – cheaper for active users |

| Features | Basic buy/sell, staking, education | Visa card, DeFi, staking, NFTs | Crypto.com – wider ecosystem |

| Mobile Experience | Smooth and intuitive | Advanced but can overwhelm | Coinbase – best for ease of use |

| Customer Support | Reliable email & live help | Slower response times | Coinbase – faster, more consistent |

| Overall Suitability for UK Users | Ideal for beginners and casual investors | Better for tech-savvy, rewards-driven users | Coinbase – best all-round for simplicity and trust |

Trusted Exchange

Trusted Exchange

Platform Overview

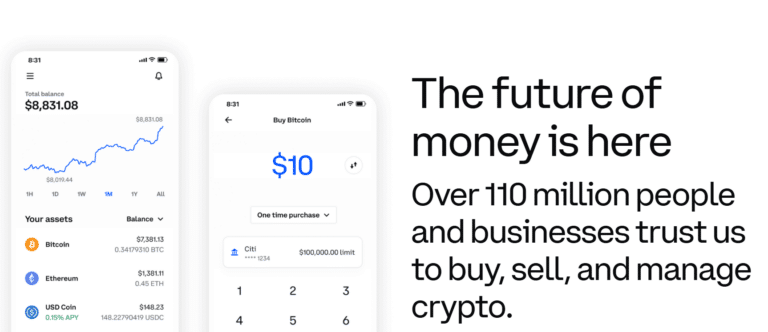

One of the world's most trusted crypto platforms. Buy, sell, earn and stake 250+ cryptocurrencies with GBP support.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Coinbase – Overview

Coinbase is one of the most recognised crypto exchanges globally, trusted by over 100 million users. Its intuitive interface, clear pricing, and educational tools make it perfect for first-time investors. FCA registration gives UK users an extra layer of trust, while deposits and withdrawals are smooth via Faster Payments.

Author’s Comments

From personal experience, Coinbase feels like the safest entry point into crypto for UK investors. It’s transparent, heavily regulated, and easy to navigate. While the fees aren’t the lowest, the platform’s clarity and security justify the premium – particularly for those starting their crypto journey. – Thomas Drury

Coinbase Offering 2026 Update

In 2026, Coinbase continues to expand its UK offerings with broader asset support, improved fiat on-ramp options, and enhanced security features. The platform now includes more regulated stablecoins and advanced educational resources. Fee transparency has improved, and wallet integration makes crypto storage and transfers easier for both new and experienced users. Coinbase remains a top choice for secure, regulated crypto access in the UK.

Coinbase Pros & Cons

Pros:

- User-Friendly Interface

- Regulated & Trusted in the U.S.

- Secure Custody & Insurance

Cons:

- High Fees on Standard Platform

- Limited Altcoin Selection (Compared to Binance)

- Occasional Service Disruptions

| Category | Details |

|---|---|

| Minimum Deposit | No fixed minimum (from ~£2 with card) |

| Trading Fees | Included in spread (no fixed trading commission) |

| Available Account Types | Standard, Coinbase Advanced, Custody |

| Regulatory Status | Registered as a cryptoasset business with the FCA |

Note: Coinbase supports GBP deposits and withdrawals via Faster Payments, and offers linked PayPal withdrawals for added convenience.

Crypto.com – Overview

Crypto.com is a feature-rich platform offering 250+ coins, an integrated Visa card, and access to DeFi and staking. It’s also FCA-registered in the UK, providing credibility. However, its app-centric design, while powerful, can feel overwhelming for new users and less intuitive than Coinbase’s clean layout.

Author’s Comments

Crypto.com offers impressive rewards and a polished ecosystem, but it takes time to master. For a deeper dive into the platform, see our full Crypto.com review. For experienced users, it’s versatile and rewarding. For beginners, the complexity and variable spreads may feel daunting – especially when compared to Coinbase’s straightforward setup and transparent pricing.

Crypto.com Pros & Cons

Pros:

- All-in-One Crypto Ecosystem

- Competitive Fees with Advanced Trading

- Extensive Token Support

Cons:

- Customer Support Can Be Slow

- User Interface May Overwhelm Beginners

- Strict Staking Requirements for Card Perks

| Category | Details |

|---|---|

| Minimum Deposit | No fixed minimum (from ~£20 depending on payment method) |

| Trading Fees | From 0.075% on Crypto.com Exchange (lower with CRO staking) |

| Available Account Types | Crypto.com App, Exchange, DeFi Wallet, Crypto Earn |

| Regulatory Status | Registered as a cryptoasset business with the FCA |

What Are the Main Differences Between Coinbase and Crypto.com?

Coinbase focuses on simplicity, reliability, and regulatory trust – making it perfect for those new to crypto. In contrast, Crypto.com offers a wider ecosystem with DeFi access, staking, and Visa card rewards. While Crypto.com is more versatile, Coinbase delivers a cleaner and more transparent trading experience.

Who Is Each Platform Best Suited For?

Coinbase is best for beginners who want a safe, easy, and regulated way to buy or hold crypto without dealing with complex features. Crypto.com suits active users who enjoy earning rewards or managing multiple crypto tools in one app. For pure simplicity, Coinbase clearly wins.

Which Exchange Offers the Better User Experience?

Coinbase makes onboarding effortless – identity verification takes minutes, and GBP deposits via Faster Payments are usually instant. Crypto.com also offers quick KYC checks but requires more setup steps for full functionality. For UK users seeking a frictionless start, Coinbase feels smoother and faster.

Which Is Simpler for Everyday Trading?

Coinbase’s interface is built for clarity: buying, selling, and tracking your portfolio take just a few taps. Crypto.com’s app, while feature-packed, can feel overwhelming with its various options and tabs. For straightforward crypto management, Coinbase offers the better daily trading experience.

Are There Tax Differences for UK Users?

Both Coinbase and Crypto.com require users to report crypto gains and staking rewards under HMRC’s capital gains and income tax rules. Coinbase provides clearer transaction history and downloadable tax reports, making compliance easier. Crypto.com offers similar tools but with more manual tracking required.

Which Platform Has More Markets and Products?

When it comes to market range, Coinbase focuses on quality and simplicity, while Crypto.com aims for breadth and functionality. Coinbase limits itself to the most trusted cryptocurrencies and learning resources, whereas Crypto.com adds layers of earning, spending, and DeFi access.

| Feature / Product | Coinbase | Crypto.com | Verdict |

|---|---|---|---|

| Supported Coins | 250+ mainstream assets | 250+ including niche and DeFi tokens | Draw – both broad but different focus |

| Staking Options | Limited, easy to use | Extensive, higher rewards | Crypto.com – better for earning |

| Learning Tools | Coinbase Learn, earn-as-you-go quizzes | Blog and tutorials | Coinbase – more beginner-friendly |

| Visa Card | Not offered | Cashback Visa card | Crypto.com – strong spending perks |

| DeFi Access | Minimal, via Coinbase Wallet | Full DeFi app and wallet | Crypto.com – more advanced |

| Overall Experience | Simple, secure trading | Comprehensive, feature-rich ecosystem | Coinbase for ease, Crypto.com for versatility |

Crypto.com wins on flexibility and earning potential, but Coinbase’s focused simplicity makes it the smarter choice for those who just want to buy, hold, or stake crypto without juggling multiple features.

Which Exchange Is Cheaper for UK Traders?

When comparing overall costs, Crypto.com offers lower trading fees, but Coinbase provides greater transparency and fewer hidden spreads. For occasional traders, the difference may be minimal – but active users will notice Crypto.com’s savings, especially when staking or using its exchange rather than the app.

Fee Comparison Table: Coinbase vs Crypto.com

| Fee Type | Coinbase | Crypto.com |

|---|---|---|

| Spot Trading | 1.49% | 0.075%–0.4% |

| Card Purchases | 3.99% | 0–2.99% |

| GBP Bank Transfers | Free | Free |

| Staking Fees | Limited | Tiered CRO system |

Key Costs to Consider

Both platforms include spreads on instant app purchases, meaning the actual buy price may differ from the market rate. Crypto.com’s staking rewards require locking up CRO tokens for higher returns, while Coinbase keeps things flexible but less rewarding. Withdrawal fees depend on the blockchain network, with Crypto.com’s network costs sometimes higher for popular coins like ETH.

Can You Trust Coinbase and Crypto.com in Terms of Safety and Regulation?

Both Coinbase and Crypto.com are FCA-registered, meaning they comply with UK KYC/AML standards. They use cold storage, two-factor authentication, and insurance for custodial funds. Coinbase has never experienced a major hack, while Crypto.com’s 2022 breach prompted major upgrades to security and transparency.

| Feature | Coinbase | Crypto.com | Verdict |

|---|---|---|---|

| FCA Registration | Yes (UK-registered) | Yes (UK-registered) | Tie – both regulated |

| KYC / AML Compliance | Full verification required | Full verification required | Tie – compliant under UK rules |

| Insurance Coverage | Yes – custodial asset insurance | Yes – partial coverage on held assets | Draw – both offer protection |

| Cold Storage | 98%+ of assets offline | 95%+ of assets offline | Coinbase – slightly stronger |

| Hack History | None reported | Yes (2022, fully reimbursed) | Coinbase – stronger trust record |

| Transparency | Regular public audits | Proof-of-Reserves system | Crypto.com – more transparent holdings |

How Do the Mobile Apps Compare for UK Users?

| Feature | Coinbase | Crypto.com | Verdict |

|---|---|---|---|

| App Rating (iOS / Android) | 4.7 / 4.6 | 4.5 / 4.4 | Coinbase – slightly higher ratings |

| Ease of Navigation | Very beginner-friendly | Feature-packed but complex | Coinbase – easier for casual use |

| Performance | Stable and responsive | High performance but heavier app | Tie – both perform well |

| Features Available | Buy/sell, earn, alerts | Trading, staking, Visa card | Crypto.com – more complete ecosystem |

| Interface Design | Minimal and clean | Rich but busy layout | Coinbase – clearer design |

How Do the Desktop Platforms Differ?

Coinbase’s web interface is clean and minimal, built for fast, simple transactions. Crypto.com’s desktop exchange, on the other hand, offers advanced order types, charting, and pro trading features, making it better suited for experienced users.

| Feature | Coinbase | Crypto.com | Verdict |

|---|---|---|---|

| Interface Style | Simple and uncluttered | Advanced with more tools | Crypto.com – more for pros |

| Order Types | Basic (market & limit) | Full range (limit, stop, futures) | Crypto.com – better flexibility |

| Charting Tools | Limited analytics | Customisable advanced charts | Crypto.com – superior analysis tools |

| Speed & Stability | Fast for casual use | Stable but heavier | Tie – both reliable |

| Learning Curve | Very low | Moderate to high | Coinbase – more accessible |

Final Verdict: Coinbase vs Crypto.com – Which Should You Choose in 2026?

| Category | Winner | Why |

|---|---|---|

| Ease of Use | Coinbase | Simpler and clearer layout for everyday users |

| Fees | Crypto.com | Lower trading fees and card flexibility |

| Regulation | Tie | Both FCA-registered and compliant |

| Features | Crypto.com | DeFi, Visa card, and staking rewards |

| Beginners | Coinbase | User-friendly and intuitive interface |

| Security | Coinbase | No hack history and strong cold storage practices |

| Overall Winner | Coinbase | Best for UK investors prioritising safety and ease |

Our Top Pick: Coinbase – Best for UK investors prioritising safety and ease of use.

Best for Active Traders: Crypto.com – Lower fees and a wider ecosystem for experienced users.

FAQs

Is Crypto.com better than Coinbase for UK investors?

It depends. Coinbase is easier to use and FCA-regulated, while Crypto.com has lower fees and more earning opportunities.

Does Coinbase or Crypto.com have lower fees?

Crypto.com has significantly lower trading fees (0.075% vs. Coinbase’s 1.49%). Coinbase charges higher spreads and transaction fees.

Which platform is safer: Coinbase or Crypto.com?

Coinbase has never been hacked, while Crypto.com had a breach in 2022 but refunded users. Both have strong security, but Coinbase has a stronger regulatory track record.

Can I earn interest on my crypto with Coinbase or Crypto.com?

Crypto.com offers crypto staking (up to 8% APY), while Coinbase does not have staking rewards.

Does Crypto.com offer a debit card in the UK?

Yes, Crypto.com’s Visa card is available in the UK and offers cashback rewards on purchases.