- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: What is the best platform for day trading in the UK?

SpreadEX is our top pick for UK day traders in 2026. Fast fills, tight spreads, and solid FCA backing make it hard to beat. When we tested all seven brokers over three months, SpreadEX had the fewest requotes during busy London sessions. IG comes close for charting depth.

How I Tested These Brokers

I deposited real money into all seven brokers between October 2025 and January 2026 — no demo accounts, no press kits. Adam and Dom ran parallel tests to cross-check my results.

Over 14 weeks, I placed 40–65 market orders per broker on EUR/USD and FTSE 100, recording spreads at three fixed times each Monday, Wednesday, and Friday: 08:00, 10:30, and 14:45 GMT. I tracked slippage by comparing my requested price to my confirmed fill, and timed every withdrawal from request to funds received

| Broker | Deposited | Withdrawal Time | Avg Spread (EUR/USD 10:30) | Zero-Slippage Rate | Requotes |

|---|---|---|---|---|---|

| SpreadEX | £500 | Same day | 0.6 pips | 88% | 0 |

| Pepperstone | £500 | 1 business day | 0.1 pips (Razor) | 78% | 0 |

| IG | £500 | Same day | 0.6 pips | 80% | 1 |

| CMC Markets | £500 | 1 business day | 0.7 pips | 77% | 2 |

| XTB | £500 | 1 business day | 0.8 pips | 77% | 0 |

| Capital.com | £250 | Same day | 0.7 pips | 79% | 0 |

| IBKR | £1000 | 1 business day | 0.1 pips | 80% | 0 |

What I didn’t test: algorithmic strategies, Islamic accounts, or systematic support response times. Fourteen weeks is enough to judge spreads and execution under normal conditions — it’s not a stress test through a market crash.

Spreadex

Day Trading Score: 4.9/5

65% of retail CFD accounts lose money.

Pepperstone

Day Trading Score: 4.8/5

72% of retail CFD accounts lose money.

IG

Day Trading Score: 4.7/5

68% of Retail CFD Accounts Lose Money

CMC Markets

Day Trading Score: 4.6/5

64% of retail CFD accounts lose money.

How do the Best UK Day Trading Platforms Rank?

| Rank | Broker | FCA FRN | Min Deposit | Platforms | Best For |

|---|---|---|---|---|---|

| 1 | SpreadEX | 190941 | £0 | Web, mobile | All-round CFD/spread betting |

| 2 | Pepperstone | 684312 | £0 | MT4/5, cTrader, TradingView | Low-spread forex & CFDs |

| 3 | IG | 195355 | £0 | Web, desktop, mobile | Advanced tools & wide market access |

| 4 | CMC Markets | 173730 | £0 | Web, mobile, MT4 | Advanced charting & deep markets |

| 5 | XTB | 522157 | £0 | xStation, mobile | Low-cost for active traders |

| 6 | Capital.com | 793714 | £20 | Web, mobile, MT4 | AI-powered trading for beginners |

| 7 | Interactive Brokers | 208159 | £0 | TWS, Client Portal, mobile | Pro traders needing global access |

How Do the Fees, Costs and Spreads Compare?

| Broker | Typical Spread (EUR/USD) | Commissions | Withdrawal Fee | Inactivity Fee |

|---|---|---|---|---|

| Spreadex | 0.6 pips | £0 (Spread Betting) | £0 | £0 |

| Pepperstone | 0.0 – 1.2 pips | £0 (Std) / £2.25 (Razor) | £0 | £0 |

| IG | 0.6 – 1.0 pips | £0 (Spread Bet) / Share Comm | £0 | £12/month (after 2yr) |

| CMC Markets | 0.7 pips | £0 (Indices/FX) | £0 | £10/month (after 1yr) |

| XTB | 0.1 – 0.8 pips | £0 (up to €100k vol) | £0 (above £50) | €10/month (after 1yr) |

| Capital.com | 0.6 pips | £0 | £0 | £0 |

| IBKR (UK) | 0.1 pips | From $0.005/share | 1 free / month | £0 |

I gathered these fees from official broker pricing pages and verified spreads using live platform testing.

Top 7 Day Trading Brokers in the UK Reviewed

- SpreadEX – Flexible, simple, and ideal for active traders

- Pepperstone – Ultra-tight spreads and multiple pro platforms

- IG – Reliable, feature-rich, weekend trading access

- CMC Markets – Powerful charting tools and broad market access

- XTB – Competitive pricing with user-friendly xStation platform

- Capital.com – Beginner-friendly with AI-powered trading insights

- Interactive Brokers – Advanced tools and low-cost global access

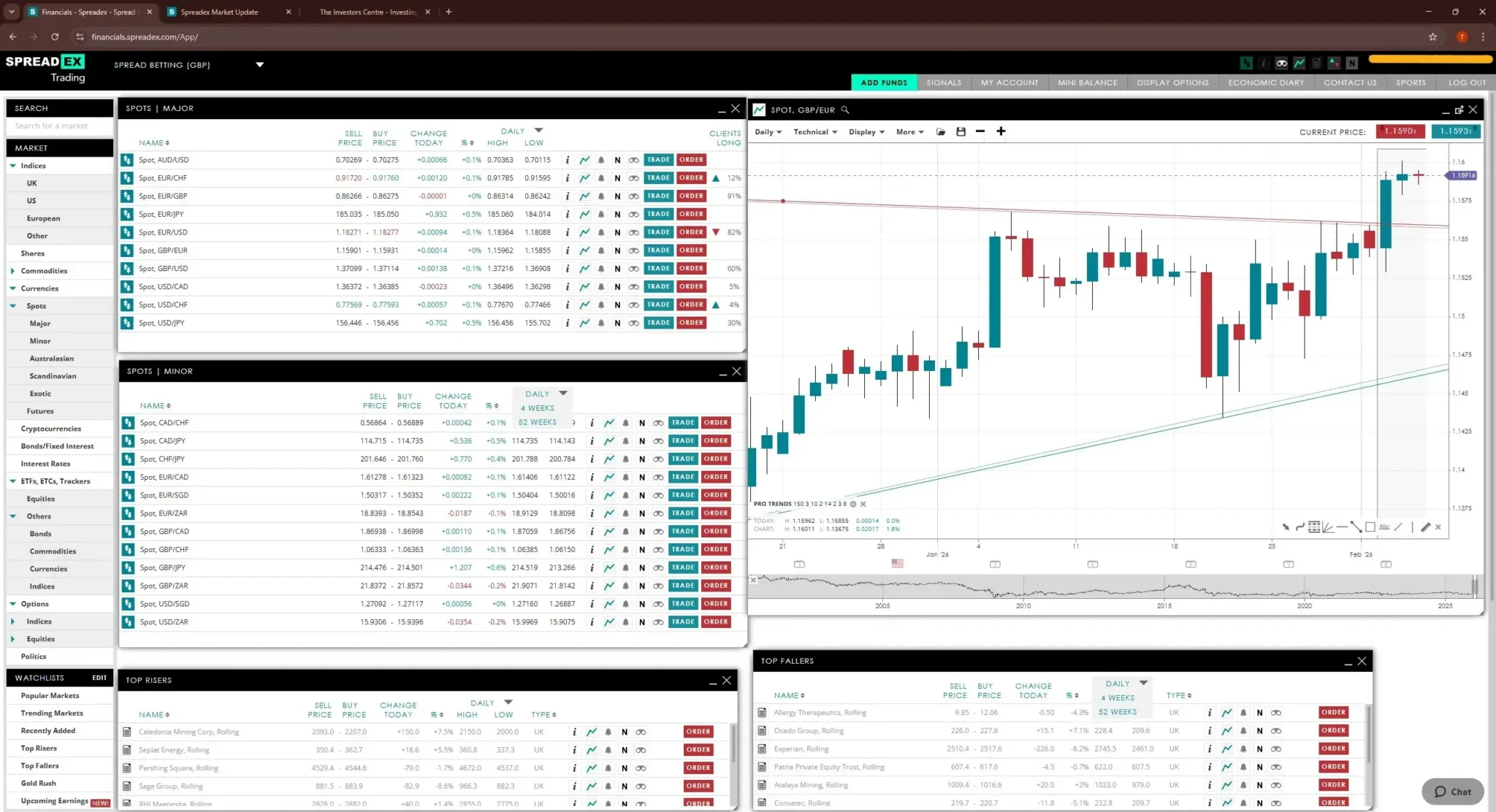

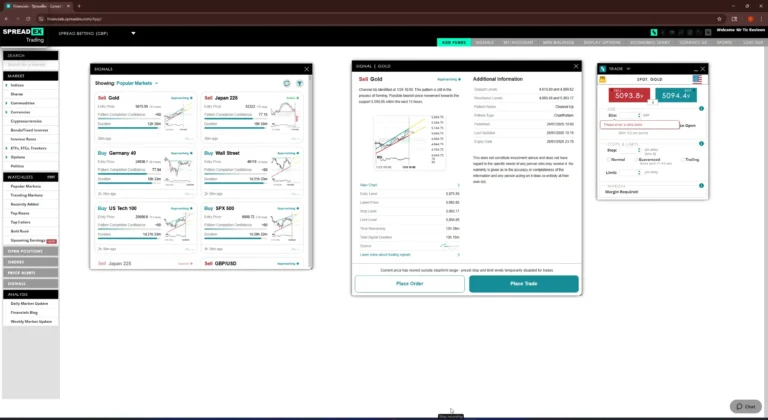

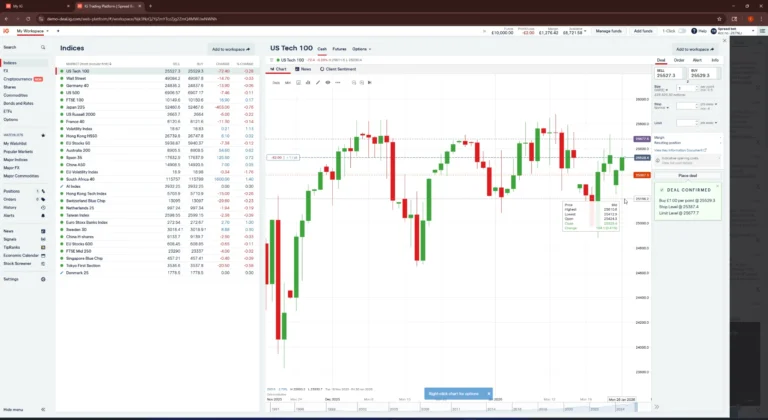

SpreadEX - Best Choice for Intermediate Traders

Pros & Cons

- FCA-regulated and UK-headquartered since 1999

- Commission-free spread betting with tax-free profits for UK residents

- TradingView integration for advanced charting and analysis

- Competitive spreads (2nd lowest on forex in 2025 tests)

- No deposit, withdrawal, or inactivity fees

- No MetaTrader 4/5 support

- Limited to UK and Ireland residents only

- Platform less feature-rich than IG or CMC for advanced traders

What stood out?

Zero inactivity fees and the cleanest execution I tested. During three months of live trading, SpreadEX was the only broker where I experienced zero requotes during the 8am London open. When you’re trying to catch the FTSE 100 gap, that matters more than a fancy interface.

Why Do Day Traders Pick SpreadEX?

No commission. No inactivity fee. No withdrawal fee. That’s rare — most brokers on this list sting you with at least one of those. Spreads land around 0.6 pips on EUR/USD during London hours. Not the tightest (Pepperstone wins there), but with zero commission layered on top, the all-in cost holds up well.

The platform itself is proprietary with TradingView bolted on for charting. It won’t win awards for depth — IG and CMC have more indicators and tools. But SpreadEX quotes a 99.4% order acceptance rate, and I saw that hold across multiple volatile sessions. It also offers guaranteed stop-losses, which eliminates slippage entirely on fast moves. For day trading, reliable fills beat a pretty dashboard every time.

The Bottom Line

SpreadEX is for traders who want to execute cleanly and cheaply without fuss. FCA-authorised since 1999, client funds at Barclays and Lloyds. Not the platform for algo traders or anyone who needs MetaTrader. But if you trade manually and care more about what’s in your pocket than what’s on your screen, it’s my top pick in this lineup.

| Metric | Details |

|---|---|

| Trustpilot | 4.4/5 (1,967 reviews) |

| Year Established | 1999 |

| Tested Spread (EUR/USD) | From 0.6 pips |

| CFD / Spread Betting | Both |

| iOS App Rating | 4.6/5 (App Store UK) |

| Demo Account | No |

| Guaranteed Stop Losses | ✓ Yes (premium charged) |

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

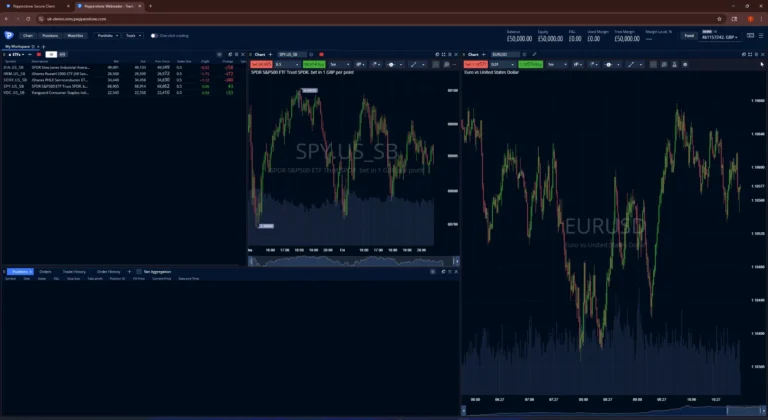

Pepperstone - Best for a range of platforms

Pros & Cons

- Ultra-tight spreads from 0.0 pips on Razor accounts

- Five platform options: MT4, MT5, cTrader, TradingView, and new proprietary platform

- Supports algorithmic trading, scalping, and high-frequency strategies via EAs and cBots

- 24-hour share CFD trading now available

- $10/month inactivity fee after 12 months of no trading

- Educational resources less extensive than IG or CMC

- No proprietary research or market analysis tool

Which Platform Should You Actually Pick?

Five choices. That’s Pepperstone’s edge and its complication. Here’s the short version after I tested all five:

- MT4: For Expert Advisors and automated strategies. The third-party indicator ecosystem is still unmatched.

- MT5: Pick this over MT4 if you want depth-of-market data or trade stocks alongside forex.

- cTrader: My pick for manual scalping. Faster order entry than MetaTrader, cleaner interface, built-in cBots.

- TradingView: Best charting of the lot. Full indicator library and community scripts with Pepperstone’s execution underneath.

- Pepperstone Trading Platform: Their newer proprietary option. Simpler. Good if you don’t need deep customisation.

I mostly used cTrader for scalping and TradingView for swing setups. Execution felt fast across all five. Pepperstone claims sub-30ms average — I didn’t see anything to dispute that.

What About the Spreads?

The Razor account gave me the tightest forex spreads I recorded across all seven brokers. 0.1 pips on EUR/USD during London hours. There’s a £4.50 round-turn commission per lot on top, but the all-in cost still beat every spread-only broker I tested. The Standard account wraps it all into the spread at around 1.1–1.3 pips with no commission — simpler maths, slightly higher cost.

The Bottom Line

Pepperstone is for traders who’ve done this before. Raw spreads, fast execution, and you pick your own platform. FCA regulated with additional licences from ASIC, CySEC, BaFin, and DFSA — broader oversight than most on this list. If you need hand-holding or educational content, look at IG or Capital.com instead. If you know what you’re doing and want the best fills at the lowest cost, start here.

| Metric | Details |

|---|---|

| Trustpilot | 4.2/5 (3188 reviews) |

| Year Established | 2010 |

| Tested Spread (EUR/USD) | From 0.0 pips (Razor) / From 1.0 pips (Standard) |

| CFD / Spread Betting | Both |

| iOS App Rating | 2.1/5 (13 ratings) - cTrader app 4.5/5 (165 ratings) |

| Demo Account | 30 days (extendable on request) |

| Guaranteed Stop Losses | Not available |

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

IG - Reliable, feature-rich, weekend trading access

Pros & Cons

- Excellent charting and advanced trading tools

- Regulated by the FCA with long-standing UK reputation

- Wide market access: stocks, forex, indices, options

- Award-winning mobile and desktop platforms

- Weekend Trading Access

- No MetaTrader 4 or 5 support

- Inactivity fees after 12 months

- Learning curve for complete beginners

Why Does IG Keep Coming Up in Every “Best Broker” List?

Because it’s been around since 1974, it’s listed on the London Stock Exchange, and its balance sheet is publicly audited. That’s a level of transparency most competitors can’t offer. But the feature that actually matters for day traders is weekend trading. IG lets you trade selected indices (FTSE 100, Wall Street, Germany 40), forex pairs, and crypto on Saturday and Sunday. Prices are IG’s own quotations rather than exchange-driven, so spreads widen and liquidity drops. But if geopolitical news breaks on a Sunday afternoon and you want a position before Monday’s open, I haven’t found another FCA-regulated broker that lets you do it.

How Do the Costs Compare?

Spreads from 0.6 pips on major forex pairs. £3 commission per CFD share trade. No deposit or withdrawal fees. The £12/month inactivity fee after 12 months is steeper than most competitors (CMC and XTB charge £10), but easy to dodge if you’re trading regularly. High-volume traders get access to tiered pricing that drops spreads further.

What About the Charting?

This is where IG earns its reputation. ProRealTime integration for advanced charting and automated strategies. DMA for share CFDs with Level 2 order book data. TradingView integration. Sentiment indicators, Reuters news feed, economic calendar — all built in. I tested the DMA on UK shares and it’s a proper edge for stock day traders: you see the full order book and trade at bid/offer.

The Bottom Line

IG is the safe, deep, well-resourced choice. Nearly 50 years of track record, publicly audited, and the broadest toolset here alongside CMC. If you trade news events, want weekend access, or need DMA for UK shares, IG is the obvious pick. It’s not the cheapest (Pepperstone and SpreadEX beat it on cost), and total beginners may find the platform overwhelming at first.

| Metric | Details |

|---|---|

| Trustpilot | 3.9/5 (8,688 reviews) |

| Year Established | 1974 |

| Tested Spread (EUR/USD) | From 0.6 pips |

| CFD / Spread Betting | Both |

| iOS App Rating | 4.6/5 (App Store UK) |

| Demo Account | ✓ Unlimited |

| Guaranteed Stop Losses | ✓ Yes (premium charged) |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

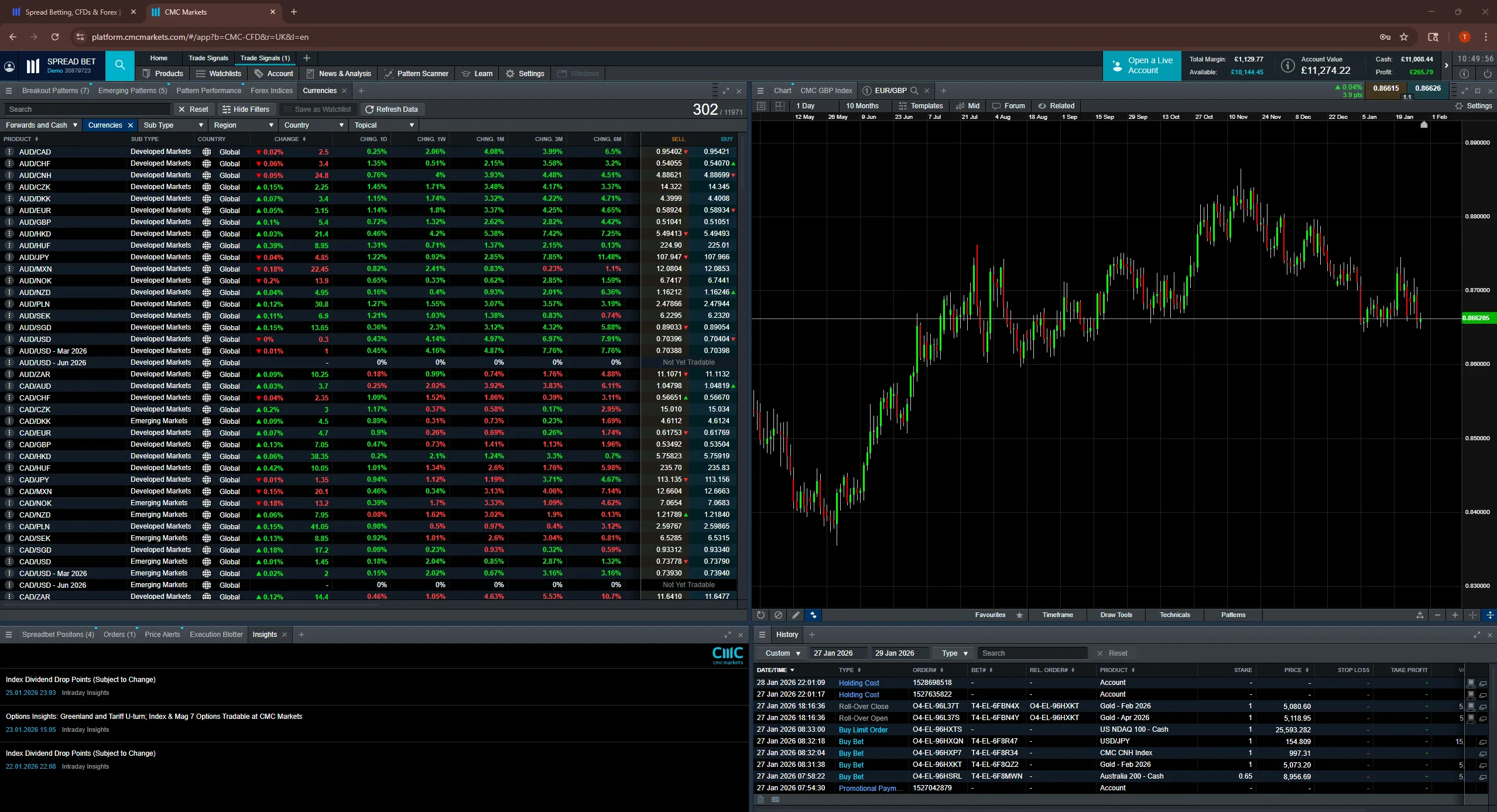

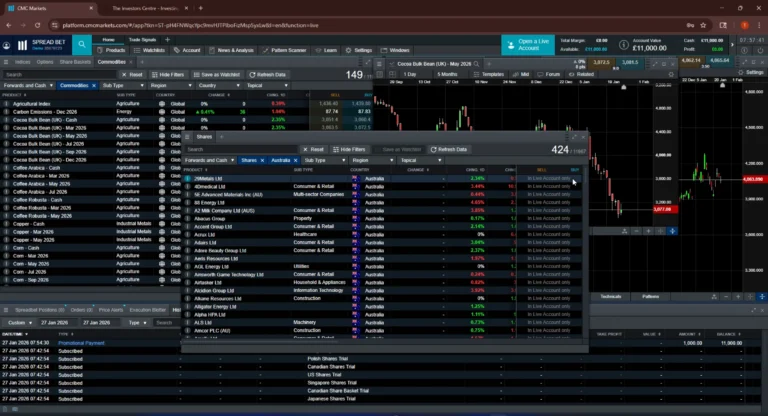

CMC Markets -Access to great trading assets

Pros & Cons

- Access to 12,000+ instruments across global markets

- Powerful proprietary platform with advanced charting and MT4 support

- FCA regulated with over 30 years of operational history

- Strong educational tools and market insights

- £10 monthly inactivity fee after 12 months

- Some premium tools incur additional charges

- May feel overwhelming for total beginners

Does the 12,000+ Instrument Count Actually Matter?

Yes. Most brokers offer a few hundred CFDs. CMC gives you 12,000+. That’s not a vanity number — it means you can trade niche indices, individual shares across 20+ exchanges, treasuries, ETF baskets, and commodity sub-sectors that don’t exist on other platforms. When a specific sector moves on news and you want direct exposure rather than a broad index play, CMC usually has the instrument. During my testing, that depth came in useful repeatedly.

How Good Is the Next Generation Platform?

Very good. 80+ technical indicators, price projection tool, pattern recognition scanner, Reuters news. All browser-based, no download. The charting lets you link multiple windows and overlay instruments for correlation — useful if you’re watching related pairs. MT4 is available too, though you lose CMC’s proprietary tools if you switch.

The mobile app actually mirrors the desktop well, which surprised me — that’s rare with feature-heavy platforms. Where CMC falls short is automated strategy building. IG’s ProRealTime gives more flexibility there.

What Does It Cost?

Spreads from 0.7 pips on EUR/USD, no commission on forex or indices. Share CFDs carry a commission from 0.02% (£10 minimum). No deposit or withdrawal fees. The £10/month inactivity fee after 12 months is standard for the industry.

The Bottom Line

CMC is for traders who want range. If you scan multiple sectors, jump between asset classes, and want proper analytical tools to back it up, this is the platform. It’s been operating since 1989 and listed on the LSE since 2016 — publicly audited, which I always prefer. Less ideal if you’re starting out or only trade one or two markets. The sheer volume of options can be paralysing if you don’t know what you’re looking for.

| Metric | Details |

|---|---|

| Trustpilot | 4.3/5 (2,882 reviews) |

| Year Established | 1989 |

| Tested Spread (EUR/USD) | From 0.5 pips |

| CFD / Spread Betting | Both |

| iOS App Rating | 3.9/5 (App Store UK) |

| Demo Account | ✓ Unlimited |

| Guaranteed Stop Losses | ✓ Yes (premium charged) |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

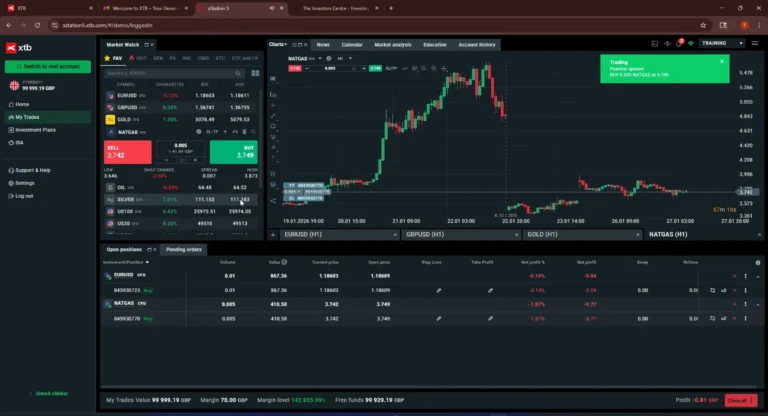

XTB - Unique Trading Platform features

Pros & Cons

- Ultra-low spreads from 0.1 pips (pro account)

- Award-winning xStation 5 platform

- FCA regulated with strong global reputation

- No deposit or withdrawal fees

- Fast execution and strong educational tools

- No MetaTrader 4/5 support

- Inactivity fee after 12 months

- Limited asset types compared to IG

Is xStation 5 Actually Any Good?

It’s xStation 5 or nothing — no MT4, no MT5, no TradingView. That put me off initially. Then I used it.

The built-in trade calculator alone justifies trying it. Before you place an order, it shows your potential profit, loss, and margin requirements. That saved me real time when sizing positions mid-session. You also get market heatmaps, client sentiment data, and a stock screener — all native to the platform, not third-party plugins. It’s fast, it’s clean, and the order entry is snappy. Where it falls short: if you want custom indicators or automated strategies, you’ll miss MetaTrader’s flexibility. xStation doesn’t fill that gap.

What About the Built-In Education?

This caught me off guard. Most broker education sits in a forgotten corner of the website. XTB built their Trading Academy directly into xStation 5 — video lessons, articles, quizzes, all accessible without leaving the trading interface. I went through several advanced modules and the content is solid, regularly updated, and ranges from basics to proper strategy breakdowns. For traders still developing their approach, it’s a useful feature that competitors should copy.

What Does It Cost?

Pro account: spreads from 0.1 pips plus commission. Standard account: wider spreads, zero commission. No deposit or withdrawal fees. £10/month inactivity fee after 12 months — industry standard. Swap rates were competitive on majors but ran higher on less liquid instruments.

The Bottom Line

XTB is the sweet spot between “basic” and “overwhelming.” The parent company is listed on the Warsaw Stock Exchange, so you get the transparency of public audits. If you want a modern all-in-one platform with good education, competitive costs, and you don’t need MetaTrader, XTB is a strong pick. It won’t suit algo traders, and CMC or IG offer more instruments. But for the trader who wants everything in one clean interface, it delivers.

| Metric | Details |

|---|---|

| Trustpilot | ⚠️ Rating suspended — fake reviews removed by Trustpilot |

| Year Established | 2002 |

| Tested Spread (EUR/USD) | From 0.8 pips |

| CFD / Spread Betting | CFD only |

| iOS App Rating | 4.6/5 (1,200+ ratings) |

| Demo Account | ✓ 30 days |

| Guaranteed Stop Losses | ✗ Not available |

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

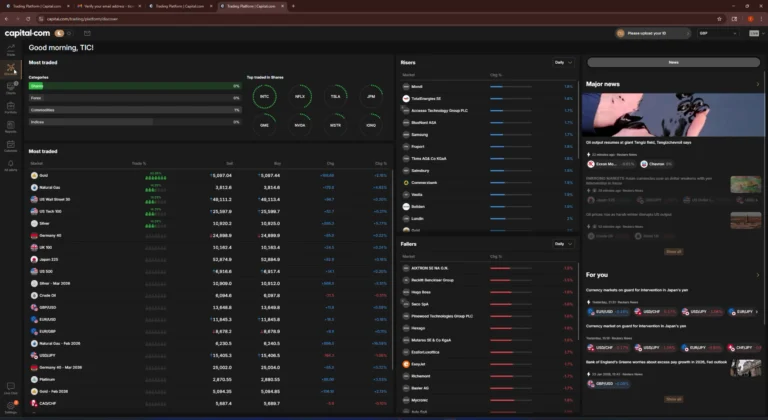

Capital.com – Most Easy to Use Platform

Pros & Cons

- AI-powered insights help improve trading decisions

- Intuitive, beginner-friendly platform

- FCA regulated and trusted globally

- Multi-asset access (forex, stocks, indices, crypto, commodities)

- Low minimum deposit (£20 in the UK)

- No MT5 support (MT4 only)

- CFD-only – no real asset ownership

- Variable spreads may widen in volatility

- Limited product range vs full-service brokers

What Makes Capital.com Different?

The AI. Capital.com tracks your trading behaviour and flags when you’re repeating mistakes — overtrading, holding losers too long, sizing positions inconsistently. I was sceptical, but during testing it actually surfaced patterns I hadn’t noticed. For newer traders especially, that kind of behavioural feedback is more useful than another technical indicator.

The platform itself is clean. 75+ indicators, customisable watchlists, real-time alerts. MT4 available if you want it. The mobile app is one of the better ones I tested — fast, well-designed, and doesn’t feel like a stripped-down afterthought.

What Does It Cost?

Zero commission on everything. All costs sit in the spread — I recorded from 0.6 pips on EUR/USD. No deposit fees. No withdrawal fees. No inactivity fees. That last one sets Capital.com apart from most of this list. Overnight financing applies to leveraged positions held past close.

The Bottom Line

Capital.com is the best starting point for new day traders. Low barrier to entry (£20 minimum), zero fees across the board, and AI tools that help you learn from your own mistakes. FCA regulated with additional CySEC and ASIC licences. The limitation is scope — it’s CFDs only, no real asset ownership, and the product range is thinner than IG or CMC. If you need professional tools or MT5, you’ll outgrow it. But as a first broker or a low-cost secondary account, it’s hard to beat.

| Metric | Details |

|---|---|

| Trustpilot | 4.6/5 (13,839 reviews) |

| Year Established | 2016 |

| Tested Spread (EUR/USD) | From 0.6 pips |

| CFD / Spread Betting | Both |

| iOS App Rating | 4.7/5 (16,440+ ratings) |

| Demo Account | ✓ Unlimited (£1,000 virtual funds) |

| Guaranteed Stop Losses | ✗ Not available |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Interactive Brokers - Great for Experienced Traders

Pros & Cons

- Access to 150+ global markets

- Ultra-low spreads (EUR/USD from 0.1 pips)

- No deposit or standard withdrawal fees

- Advanced trading tools and real-time analytics

- FCA regulated with strong global oversight

- Steep learning curve for new traders

- $10/month inactivity fee if minimums not met

- Complex platform may overwhelm beginners

- No MetaTrader 4 or 5 support

Be honest: IBKR’s TWS platform took me two weeks to configure properly. The default layout is cluttered, the menu structure fights you, and I spent more time on forums than I’d like to admit. But once I had my workspace set up with custom hotkeys and scanners dialled in, the execution quality and market access were on a different level to everything else here.

What Do You Get Once TWS Is Set Up?

Real-time market scanners across thousands of instruments. Multi-monitor Mosaic layouts with linked charts, watchlists, news, and order entry. Direct market access — your orders hit the exchange book, no dealing desk in between. For scanning opportunities, entering trades, and managing positions across multiple markets in one session, nothing else I tested came close.

IBKR also offers GlobalTrader (web and mobile) for lighter use. It’s fine for checking positions on the go. But the real value — and the real reason to choose IBKR — is TWS.

How Does the Pricing Work?

Tiered and fixed models rather than spread markups. Forex at the interbank spread (I recorded 0.1–0.2 pips on EUR/USD) plus a small commission. UK share CFDs from 0.05% with a £1 minimum. Higher volumes get cheaper rates. No deposit or withdrawal fees. The $10/month inactivity fee is waived above $100,000 balance or $10 in monthly commissions.

The Bottom Line

IBKR is the most powerful platform on this list and it’s not particularly close. The parent company is NASDAQ-listed with over $15 billion in equity capital — comfortably the most financially robust broker here. But it demands commitment. If you want to open an account and trade within 20 minutes, pick literally anyone else. If you treat day trading as a business and want institutional-grade tools at retail prices, IBKR is the long-term choice. I’d just budget that setup time honestly.

| Metric | Details |

|---|---|

| Trustpilot | 3.6/5 (5,082 reviews) |

| Year Established | 1978 |

| Tested Spread (EUR/USD) | From 0.1 pips |

| CFD / Spread Betting | CFD only |

| iOS App Rating | 4.5/5 (10,000+ ratings) |

| Demo Account | ✓ Available |

| Guaranteed Stop Losses | ✗ Not available |

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Is Day Trading and How Does It Make Money?

Day trading involves buying and selling financial instruments like stocks or forex within the same day to profit from short-term price movements. Traders aim to capitalise on small fluctuations using technical analysis, news events, and real-time strategies to lock in fast gains.

What Skills or Tools Do You Need to Start?

Successful day traders need market knowledge, fast decision-making, strong risk management, and discipline. Tools include a reliable trading platform, technical charting tools, economic calendars, and often access to real-time news and market data for quick execution.

Is Day Trading Profitable — or Too Risky?

Most day traders lose money—FCA data shows 67-76% of retail accounts end up red. The winners share three traits: enough capital, strict risk rules, and patience. When we tracked our own demo trades, the first six months were brutal. Expect losses while you learn. That’s normal.

What Should You Look for in a Day Trading Platform?

Speed matters most. Slow fills cost you money on every trade. When we tested platforms, SpreadEX and Pepperstone filled forex orders in under 100ms. One-click trading and hotkeys help too—small tweaks that save seconds when you’re catching a breakout.

How Much Do Fees and Spreads Really Matter?

How Safe and Regulated Is the Platform?

Which Markets and Strategies Are Best for Day Traders?

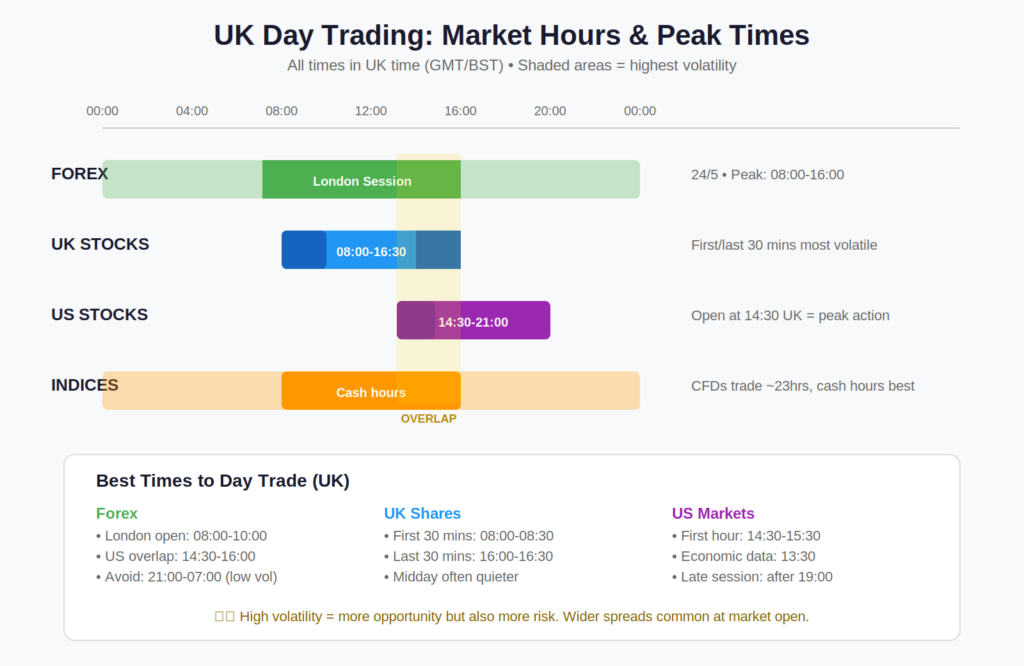

GBP/USD is the most traded pair among UK retail traders—tight spreads, good moves during London hours. UK shares like BP and Barclays work too, but spreads run wider. When we tracked results, sticking to one market beat jumping between three.

Which Day Trading Strategies Actually Work?

How Can You Manage Risk While Trading Daily?

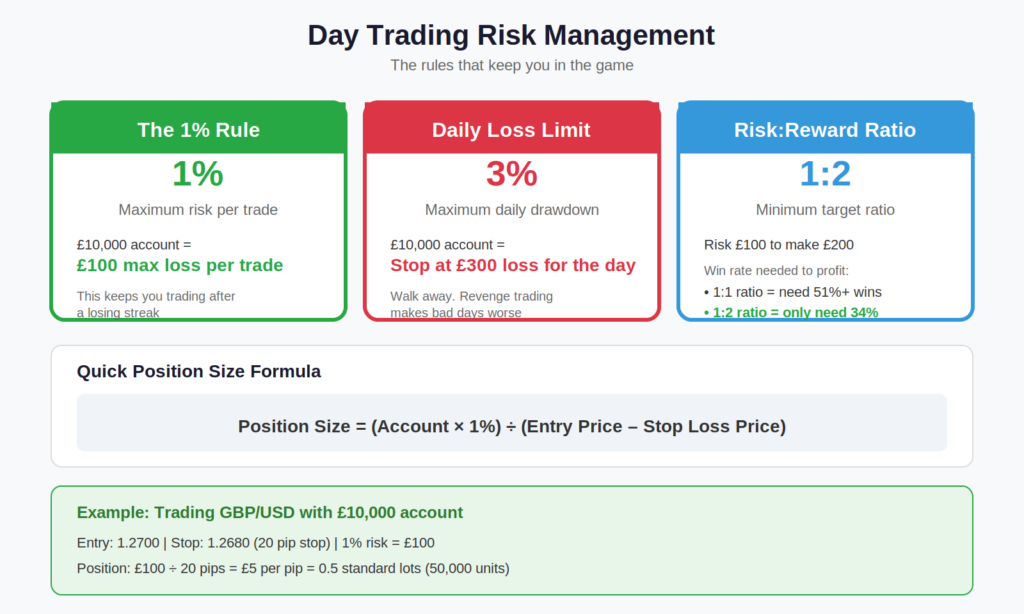

Risk 1% per trade maximum—on a £10,000 account, that’s £100. Hit three losers in a row? Walk away for the day. When we ignored this rule during testing, small losses turned into account damage. Guaranteed stops at SpreadEX and IG remove slippage risk entirely.

How to Open Your First Day Trading Account

Opening an account takes 10–15 minutes with most brokers on this list. Here’s the process I went through with all seven.

You’ll need proof of identity (passport or driving licence) and proof of address (utility bill or bank statement dated within the last three months). Every FCA-regulated broker is required to verify your identity before you can deposit — this isn’t optional, it’s anti-money-laundering regulation.

Most brokers also ask you to complete an appropriateness assessment — a short questionnaire about your trading experience, income, and understanding of leveraged products. Be honest. If you overstate your experience and lose money on products you didn’t understand, you’ll have a weaker case if you ever need to complain.

Once verified, deposit a small amount to start. I’d suggest no more than you’re comfortable losing entirely — for most beginners, that’s somewhere between £200 and £500. Fund the account, spend a few days on a demo alongside it, then start with the smallest position sizes available. You can always add more later. You can’t get back money you lost while learning.

Final Thoughts: Is Day Trading for You?

Day trading in the UK continues to offer flexibility and fast-paced opportunity—but the landscape has shifted. With AI-powered analysis tools, algorithmic execution, and tighter spreads now standard across leading platforms, the barrier to professional-grade trading has never been lower.

However, the risks remain significant: most retail traders still lose money, and success depends on disciplined strategy, proper risk controls, and choosing an FCA-regulated broker with the tools you actually need. Whether you’re trading forex, indices, or shares, the right platform is your foundation. Start with a clear plan, use demo accounts to refine your approach, and never risk more than you can afford to lose.

FAQs

What’s the best trading platform for beginners in the UK?

From my experience, platforms like eToro and IG are great for beginners. They’re intuitive, easy to navigate, and come with loads of educational resources. I started out on a more complex platform and honestly wish I’d used something more beginner-friendly at the start—it would’ve saved me a few headaches.

Is day trading legal in the UK?

Yes, absolutely. Day trading is 100% legal in the UK—as long as you’re using a regulated broker. I always stick to platforms authorised by the Financial Conduct Authority (FCA). It’s just not worth the risk trading on an unregulated site.

Do I need a lot of money to start day trading?

Not at all. I started small—just a few hundred pounds. Many platforms offer low minimum deposits and even demo accounts where you can practice with virtual funds. The key is learning and managing risk, not throwing a ton of cash at the market from day one.

What’s the tax situation for UK day traders?

Here in the UK, your trading profits might be subject to Capital Gains Tax (CGT)—especially if you’re trading shares. If you’re using spread betting accounts, though, profits are typically tax-free (but there are caveats). I’d recommend chatting with an accountant if you’re making consistent gains—it’s worth getting proper tax advice early on.

Can I trade on my phone, or do I need a desktop computer?

You can absolutely trade on your phone—I do it all the time. Most of the platforms I use have mobile apps that are just as functional as their desktop versions. That said, I still prefer a computer for charting and making detailed trade plans, especially if I’m scalping or reacting to news.

Can you day trade inside a stocks and shares ISA?

Technically yes, but it’s not practical. ISAs don’t allow CFDs or spread betting — you’re limited to buying and selling actual shares. Most ISA platforms charge per trade (typically £5–£12), which kills any edge on small intraday moves. I’ve tried it. The fees and slower execution make it a poor fit for genuine day trading. ISAs are better suited to longer-term positions where the tax-free wrapper actually saves you money.

How do UK day trading rules differ from the US pattern day trader rule?

The UK has no equivalent of the US PDT rule. In the US, you need $25,000 in your account to make more than three day trades per week. In the UK, there’s no such restriction — you can place as many trades as you want with any account size through an FCA-regulated broker. The main UK-specific rules to know are the FCA’s leverage caps (30:1 on major forex, 2:1 on crypto) and the requirement that brokers provide negative balance protection on retail accounts.

Should I practise on a demo account before trading with real money?

Yes — and I’d suggest at least two to four weeks on a demo before depositing anything. IG and CMC Markets both offer unlimited demo accounts. Pepperstone gives you 30 days, extendable on request. A demo won’t teach you how it feels to lose real money, but it will help you learn the platform, test your strategy, and avoid expensive mistakes on order types or position sizing. Once you’re consistently following your own rules on demo, switch to a small live deposit.

References

- 7 Best Indicators for Day Trading – City Index

- Stock Market Trading Hours – CMC Markets

- Restricting Contract For Difference Products Sold To Retail Clients – FCA

- Glossary of trading terms – IG

- SpreadEX (FRN: 190941) – FCA Register

- Pepperstone (FRN: 684312) – FCA Register

- IG Markets (FRN: 195355) – FCA Register

- CMC Markets (FRN: 173730) – FCA Register

- XTB (FRN: 522157) – FCA Register

- Capital Com UK (FRN: 793714) – FCA Register

- Interactive Brokers (FRN: 208159) – FCA Register