Best Platform for Trading Indices UK 2026 — Tested With Real Money

We placed over 50 index trades across 8 FCA-regulated platforms between December 2025 and February 2026, recording live spreads on the FTSE 100, S&P 500 and DAX 40 at fixed timestamps each trading day. Index trading is the second most popular form of leveraged trading in the UK, and the spread differences between brokers compound quickly over dozens of trades. Here's how every platform performed when we tested them with real money.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: What Is the Best Platform for Trading Indices?

Capital.com is the best platform for trading indices in the UK for 2026. It combines tight spreads on the FTSE 100, zero commission, FCA regulation (FRN 793714) and spread betting — so index profits are currently tax-free. IG is best for breadth, Pepperstone for execution speed and Spreadex for fixed spreads.

| If You Want | Choose | Why |

|---|---|---|

| Best overall for indices | Capital.com | Tight spreads, zero commission, clean interface |

| Widest index selection + weekends | IG | 80+ indices, weekend trading, ProRealTime |

| Fastest execution + raw spreads | Pepperstone | Sub-50ms fills, Razor account pricing |

| Fixed spreads on indices | Spreadex | Predictable costs during news events |

60% of Retail CFD Accounts Lose Money

72% of retail CFD accounts lose money.

68% of Retail CFD Accounts Lose Money

65% of retail CFD accounts lose money.

64% of retail CFD accounts lose money.

68% of retail CFD accounts lose money.

71% of Retail CFD Accounts Lose Money

64% of retail CFD accounts lose money.

How Do the Best Platforms Compare?

| # | Platform | TIC Rating | Best For | FTSE 100 Spread* | S&P 500 Spread* | Spread Betting | Trustpilot | Get Started |

|---|---|---|---|---|---|---|---|---|

| 1 | Capital.com | 4.7/5 | Overall / Beginners | ~1.0 pts | ~0.7 pts | Yes | 4.6/5 | Visit |

| 2 | Pepperstone | 4.6/5 | Execution speed / Raw spreads | ~1.2 pts | ~0.4 pts | Yes | 4.2/5 | Visit |

| 3 | IG | 4.5/5 | Market breadth / Weekend trading | ~1.0 pts | ~0.4 pts | Yes | 3.9/5 | Visit |

| 4 | Spreadex | 4.4/5 | Fixed spreads / UK support | ~1.0 pts (fixed) | ~0.6 pts (fixed) | Yes | 4.5/5 | Visit |

| 5 | CMC Markets | 4.3/5 | Advanced charting | ~1.0 pts | ~0.5 pts | Yes | 4.1/5 | Visit |

| 6 | City Index | 4.2/5 | Beginners / Trading signals | ~1.0 pts | ~0.5 pts | Yes | 4.2/5 | Visit |

| 7 | XTB | 4.2/5 | Low-cost entry | ~1.3 pts | ~0.5 pts | No | 3.8/5 | Visit |

| 8 | Saxo Markets | 4.1/5 | Professional / DMA futures | ~1.0 pts | ~0.3 pts | No | 3.5/5 | Visit |

*Spreads are approximate based on our live testing during London trading hours, February 2026. Variable spreads fluctuate — expect wider during news events and off-peak sessions.

How We Tested These Index Trading Platforms

Every platform on this page was tested with a real-money funded account between December 2025 and February 2026. No demo data. No spec sheets copied from broker websites.

I opened spread betting and CFD accounts on all eight platforms, deposited real funds, and placed index trades across the FTSE 100, S&P 500 and DAX 40. Spreads were recorded at three fixed timestamps each trading day — 08:00, 14:30 and 21:00 GMT — to capture the London open, the US open and the late session. Market orders were timed during the London and New York opens to measure execution speed under genuine volatility.

For positions held overnight, I logged the financing charges across 1-day, 3-day and 5-day holds to calculate the real total cost of holding index positions beyond intraday. I also contacted each platform's support team with an index-specific margin query and timed the response.

This testing forms part of our broader trading platforms and strategies coverage, and the methodology is consistent across all our platform comparisons. A caveat worth stating upfront: spreads vary by session and volatility. Our data reflects testing-period conditions, not guarantees of what you'll see on any given day.

Some of the platforms listed on this page are affiliate partners, meaning we may earn a commission if you open an account through our links. This does not influence our rankings or ratings — every platform was tested with real money using the same methodology. Platforms that are not affiliate partners are included where they meet our testing criteria.

Index Trading Platform Reviews

1. Capital.com — Best Overall Platform for Trading Indices

2. IG — Best for Index Market Breadth and Weekend Trading

3. Pepperstone — Best for Execution Speed on Index Trades

4. Spreadex — Best for Fixed Spreads on Index Trades

Capital.com — Best Overall Platform for Trading Indices

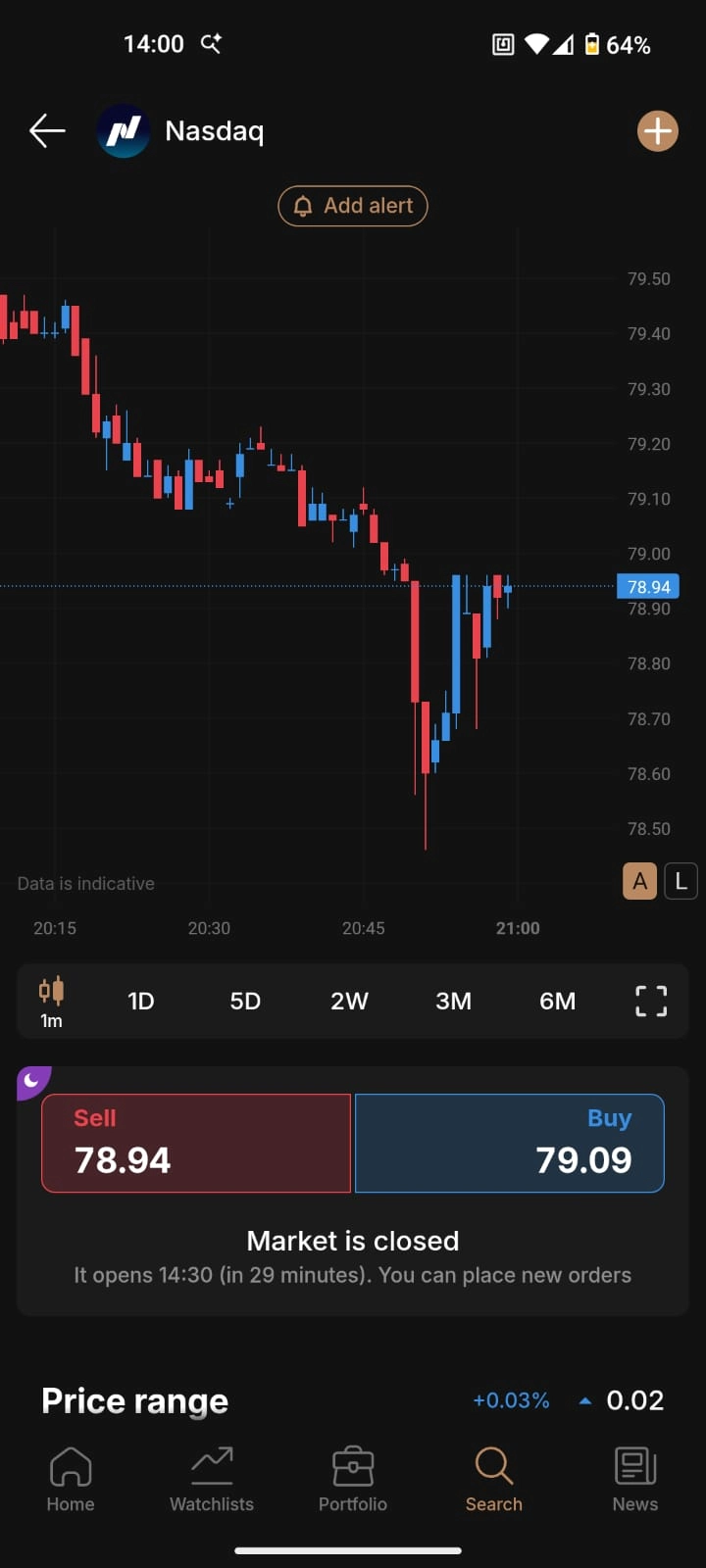

Capital.com's proprietary platform is the most intuitive on this list for finding, charting and trading indices. The index category is clearly separated in the left sidebar, and opening a position takes two taps on mobile or two clicks on desktop. There's no digging through nested menus.

Pros

- Tight FTSE 100 spreads (~1.0 pts) with zero commission

- Most intuitive interface for index trading on this list

- AI behavioural insights flagged genuine overtrading patterns

- £20 minimum deposit — lowest barrier to entry

Cons

- Only ~25 indices available — doesn't match IG or CMC breadth

- No MT5 support — limited to proprietary, MT4 or TradingView

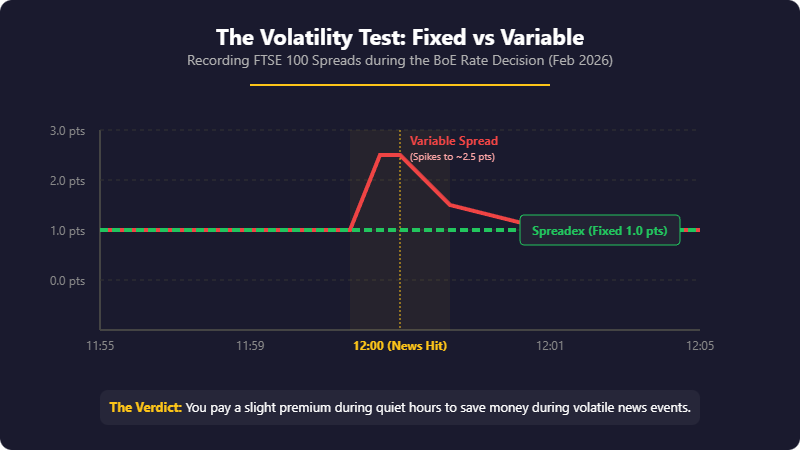

- Spreads widened during BoE rate decision (~2.5 pts for ~45 seconds)

What Does It Actually Cost to Trade Indices on Capital.com?

Capital.com charges zero commission on index trades. The cost sits entirely in the spread. Here's what a typical trade looked like during our testing: a £10/point spread bet on the FTSE 100 at 8,200. The spread was 1.0 point, meaning the cost to open and close was £10. I held that position for five trading days, and overnight financing added approximately £18. Total round-trip cost for a 5-day hold: roughly £28.

There are no deposit fees, no withdrawal fees and no inactivity charges. Capital.com is one of the cleanest fee structures for index trading in the UK.

The honest limitation: spreads widened during high-impact releases. During the BoE rate decision in our testing window, the FTSE 100 spread expanded to approximately 2.5 points for around 45 seconds before settling back. That's normal for variable-spread brokers, but it's worth factoring in if you trade around news events. Capital.com also doesn't support MT5 — you're limited to the proprietary platform, MT4 or TradingView.

| Detail | Capital.com |

|---|---|

| FCA FRN | 793714 |

| Also regulated by | CySEC, ASIC, SCA, SCB |

| Indices available | ~25 |

| FTSE 100 spread (our test) | ~1.0 pts |

| S&P 500 spread (our test) | ~0.7 pts |

| Spread betting | Yes |

| Platforms | Proprietary, MT4, TradingView |

| Min. deposit | £20 |

| Retail loss rate | 60% |

Our Experience With the Interface

I tested the mobile app alongside the web platform for two weeks, primarily monitoring FTSE 100 positions. The mobile experience is close to desktop — price alerts, chart indicators and order modifications all work without frustration. That's not something I can say for every platform here.

The AI-powered behavioural insights feature flagged that I was overtrading during the US open on three separate occasions. Whether that's useful depends on the trader, but it caught a real pattern in my behaviour that I wouldn't have noticed from the P&L alone. The charting tools are adequate for standard technical analysis — moving averages, RSI, MACD and Bollinger Bands are all there — but active traders who rely on multi-timeframe layouts or custom indicators will want to connect TradingView alongside.

Order execution was clean throughout testing. I recorded zero requotes on market orders during the London open, and limit orders on the FTSE 100 filled at the requested price every time during our testing window.

Who Should Use Capital.com for Index Trading — and Who Shouldn't?

Capital.com is the best starting point for beginner to intermediate index traders. The interface is clean, the fee structure is simple, the mobile app works properly, and the £20 minimum deposit means you're not committing serious capital to test it.

Avoid Capital.com if you need MT5, algorithmic trading capabilities, DMA access to exchange-traded index futures, or the widest possible index selection. With around 25 indices available, it covers the major markets but doesn't match IG or CMC's breadth.

If you're placing your first index trades and want a platform that won't overwhelm you, this is where I'd start.

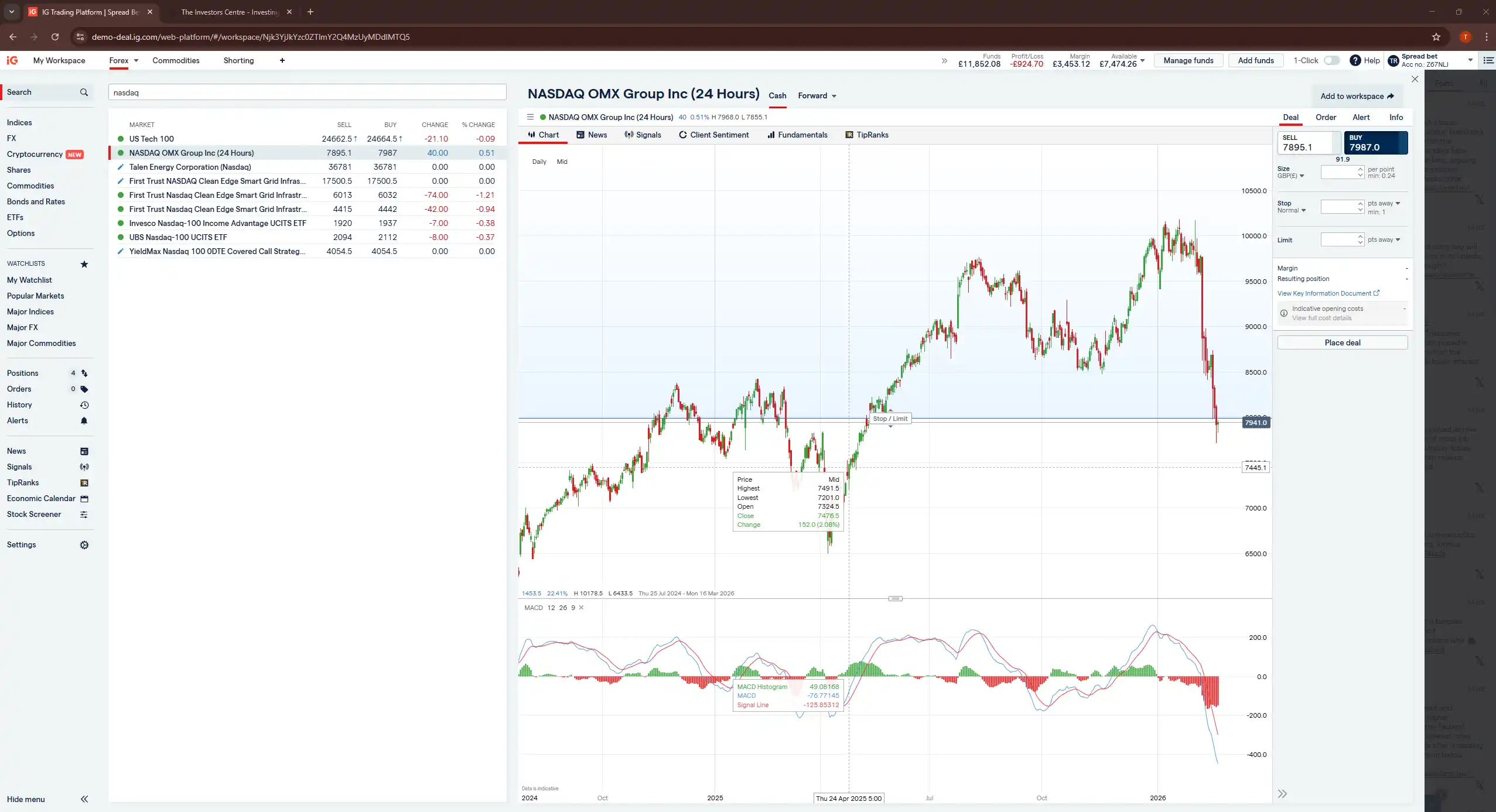

IG — Best for Index Market Breadth and Weekend Trading

IG offers over 80 indices — comfortably the widest selection on this list. That includes standard cash and forward contracts on the majors, plus regional and sector-specific indices that none of the other platforms here provide. If you want to trade the Hang Seng, the VIX or the Russell 2000 from a single UK account, IG is essentially your only option among these eight.

Pros

- 80+ indices — widest selection on this list by far

- Weekend trading on UK 100, Wall Street and Germany 40

- ProRealTime charting with pattern recognition and screening

- S&P 500 spreads among the tightest tested (~0.4 pts)

Cons

- Complex interface — steeper learning curve for beginners

- £250 minimum deposit — higher barrier than competitors

- ProRealTime premium features carry monthly fee unless activity thresholds met

What Does It Actually Cost to Trade Indices on IG?

IG's spread betting on indices is commission-free — costs are embedded in the spread. On the S&P 500, we recorded some of the tightest spreads in our testing at approximately 0.4 points during US trading hours. The FTSE 100 averaged around 1.0 point.

A worked comparison: the same £10/point FTSE 100 spread bet that cost £28 over five days on Capital.com cost approximately £30 on IG, owing to marginally higher overnight financing rates. The difference is small on individual trades but adds up if you're holding index positions regularly.

The honest limitation: IG's index spreads are competitive but not the tightest in calm conditions — Pepperstone's Razor account undercuts IG on most major indices during standard London hours. IG's real advantage is breadth and weekend access, not raw pricing.

| Detail | IG |

|---|---|

| FCA FRN | 195355 |

| FTSE 250 listed | Yes |

| Indices available | 80+ |

| FTSE 100 spread (our test) | ~1.0 pts |

| S&P 500 spread (our test) | ~0.4 pts |

| Spread betting | Yes |

| Weekend indices | Yes |

| Platforms | Proprietary, MT4, ProRealTime, L2 Dealer |

| Min. deposit | £250 |

| Retail loss rate | 68% |

Our Experience With the Interface

I placed weekend trades on the UK 100 and Wall Street markets during our testing period. The spreads were wider than weekday sessions, as expected — roughly double — but fills were reliable and there were no issues with order execution. IG also tops our weekend trading platforms compared ranking for this reason.

ProRealTime charting is a genuine differentiator for technical analysis on indices. The pattern recognition, automated screening and multi-timeframe layouts go beyond what you'll get on Capital.com or Spreadex's proprietary platforms. The catch is that premium ProRealTime features carry a monthly fee unless you meet activity thresholds.

The downside is complexity. IG's interface serves spread bettors, CFD traders, options traders, share dealers and ISA investors from the same dashboard. If you're new to index trading, the initial learning curve is steeper than Capital.com. The platform doesn't always make it obvious which product type you're trading, and I've seen beginners accidentally open CFD positions when they intended to spread bet.

Who Should Use IG for Index Trading — and Who Shouldn't?

IG is the best choice for experienced traders who want the widest global index selection from a single UK account, traders who want to trade indices at weekends, and anyone who values ProRealTime's advanced charting.

Avoid IG if you're a complete beginner wanting the simplest possible platform, or if you exclusively trade the FTSE 100 and S&P 500 and want the absolute tightest raw spreads — Pepperstone is cheaper on those specific markets.

Pepperstone — Best for Execution Speed on Index Trades

Pepperstone gives you five platforms to choose from for index trading: MT4, MT5, cTrader, TradingView and their newer proprietary platform. I tested all five during our review window, and TradingView integration was the standout — you can place index trades directly from TradingView charts with no switching between windows.

Pros

- Sub-50ms execution on index market orders — fastest tested

- Five platform choices including MT5 and cTrader

- Razor account raw spreads tighter than IG and Capital.com

- No minimum deposit and no inactivity fee

Cons

- Only ~23 indices — IG offers roughly four times as many

- No guided experience for beginners — built for experienced traders

- Razor account commission adds complexity to cost calculations

What Does It Actually Cost to Trade Indices on Pepperstone?

Pepperstone offers two account types, and the cost difference matters for index traders. The Razor account charges raw spreads plus a £2.25 per side commission. On a £10/point S&P 500 trade during our testing, the raw spread was approximately 0.4 points (£4 cost) plus £4.50 commission round-trip, totalling roughly £8.50 for an intraday trade. That's cheaper than every other platform on this list for the S&P 500.

The Standard account wraps the commission into the spread — the same trade with approximately 1.0 point spread costs around £10. At higher volumes, the Razor account saves money. Below roughly five standard lots per month, the Standard account is simpler and the cost difference is marginal.

There's no minimum deposit and no inactivity fee. If speed matters across asset classes, see our top derivative trading brokers comparison for broader context.

| Detail | Pepperstone |

|---|---|

| FCA FRN | 684312 |

| Indices available | ~23 |

| FTSE 100 spread (our test) | ~1.2 pts (Standard) / ~0.8 pts + comm (Razor) |

| S&P 500 spread (our test) | ~0.4 pts (Razor) |

| Spread betting | Yes |

| Platforms | MT4, MT5, cTrader, TradingView, Proprietary |

| Min. deposit | None |

| Retail loss rate | 72% |

Our Experience With the Interface

Execution speed is where Pepperstone separates itself. I recorded sub-50ms fills on FTSE 100 and S&P 500 market orders during the London open — consistently the fastest on this list. For day traders who need to enter and exit index positions quickly during volatile opens, that speed advantage is tangible. Pepperstone also features in our best day trading platforms UK ranking for the same reason.

The Razor account raw spread on the FTSE 100 hovered between 0.8 and 1.2 points during calm London sessions — tighter than IG and Capital.com during the same windows. On the S&P 500, Razor spreads averaged approximately 0.4 points.

The trade-off is that Pepperstone's interface, while clean and fast, lacks the guided experience beginners get on Capital.com. There's no AI-powered insight tool, no built-in trading signals, and no hand-holding for new traders. It's built for people who already know what they're doing.

Who Should Use Pepperstone for Index Trading — and Who Shouldn't?

Pepperstone is the best choice for active index day traders who want the tightest possible spreads, algorithmic traders using MT5 or cTrader, and anyone who values execution speed above all else.

Avoid Pepperstone if you want the widest index selection — IG offers roughly four times as many markets — or if you're a beginner who needs platform guidance and a simpler onboarding experience.

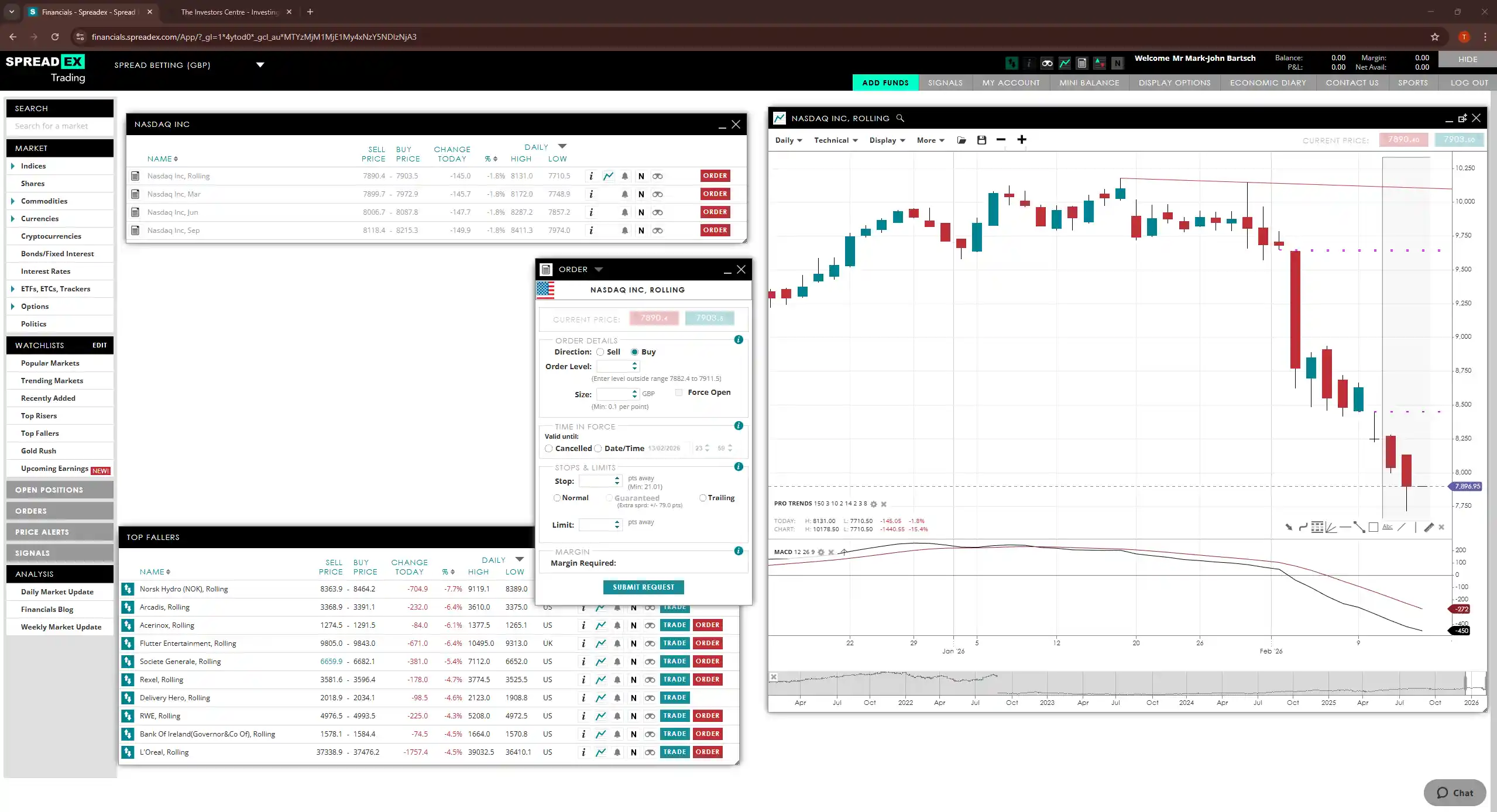

Spreadex — Best for Fixed Spreads on Index Trades

Spreadex is the only platform on this list offering fixed spreads on indices as standard, and during our testing that distinction proved genuinely useful. The FTSE 100 spread held at approximately 1.0 point throughout our testing period, including during a BoE rate decision where variable-spread platforms widened significantly.

Pros

- Fixed spreads on indices — predictable costs during news events

- UK-based phone support — reached a human within 3 minutes

- Zero commission, no inactivity fee, no withdrawal fees

- TradingView integration for advanced charting

Cons

- No MT4/MT5 — limited to proprietary platform and TradingView

- Fixed spreads marginally wider than variable during calm sessions

- No algorithmic trading capabilities

What Does It Actually Cost to Trade Indices on Spreadex?

Spreadex charges zero commission, has no inactivity fee and no withdrawal fees. That combination is uncommon. The fixed spread on the FTSE 100 is approximately 1.0 point. During calm London sessions, that's marginally wider than Pepperstone's Razor account. But during volatile sessions — which is when costs actually matter most — the fixed spread consistently undercut the variable-spread platforms.

A £10/point FTSE 100 trade during the BoE decision cost £10 in spread on Spreadex versus an estimated £20–£25 on platforms where the spread temporarily doubled. Over a month of mixed trading conditions, our total spread costs on Spreadex were comparable to Capital.com — the savings during news events roughly offset the premium during calm sessions.

| Detail | Spreadex |

|---|---|

| FCA FRN | 190941 |

| Operating since | 1999 |

| Indices available | ~30 |

| FTSE 100 spread (our test) | ~1.0 pts (fixed) |

| S&P 500 spread (our test) | ~0.6 pts (fixed) |

| Spread betting | Yes |

| Platforms | Proprietary + TradingView |

| Min. deposit | None (credit facility option) |

| Retail loss rate | 61% |

Our Experience With the Interface

TradingView integration is available for charting, which brings Spreadex's analysis capabilities closer to Pepperstone and IG. The proprietary platform itself is simpler and more straightforward than the others here. It won't overwhelm beginners, but it lacks the depth and customisation that active technical analysts will want.

I tested the UK-based phone support with an index margin query on a Wednesday afternoon and reached a human within three minutes. That's noticeably faster than Capital.com's live chat and IG's phone queue during the same week. Spreadex also holds a UK Gambling Commission licence alongside its FCA authorisation — a legacy of its origins in sports spread betting, which it still offers alongside financial markets.

Who Should Use Spreadex for Index Trading — and Who Shouldn't?

Spreadex suits news-event traders, anyone wanting predictable index trading costs, and traders who value fast UK-based phone support.

Avoid Spreadex if you need MT4 or MT5, if you want algorithmic trading capabilities, or if you exclusively trade during calm London hours and want the absolute tightest variable spreads.

CMC Markets, City Index, XTB and Saxo — Other Platforms Worth Considering

The four platforms above are our top picks for different types of index trader. The following four are strong alternatives for specific use cases.

CMC Markets — Best for Advanced Index Charting (FRN 173730)

CMC Markets matches IG with over 80 indices and pairs them with one of the most powerful charting platforms available to UK retail traders. The Next Generation platform offers 115+ technical indicators and an automated pattern recognition scanner. I tested it on the DAX 40, and it flagged a head-and-shoulders formation that I'd missed on my TradingView chart — a genuine value-add for technical analysts.

FTSE 100 spreads were competitive at approximately 1.0 point during London hours. The platform's depth is its strength and its weakness: it's overwhelming for beginners, but for experienced chart-based index traders, it's excellent. 67% of retail accounts lose money with CMC Markets.

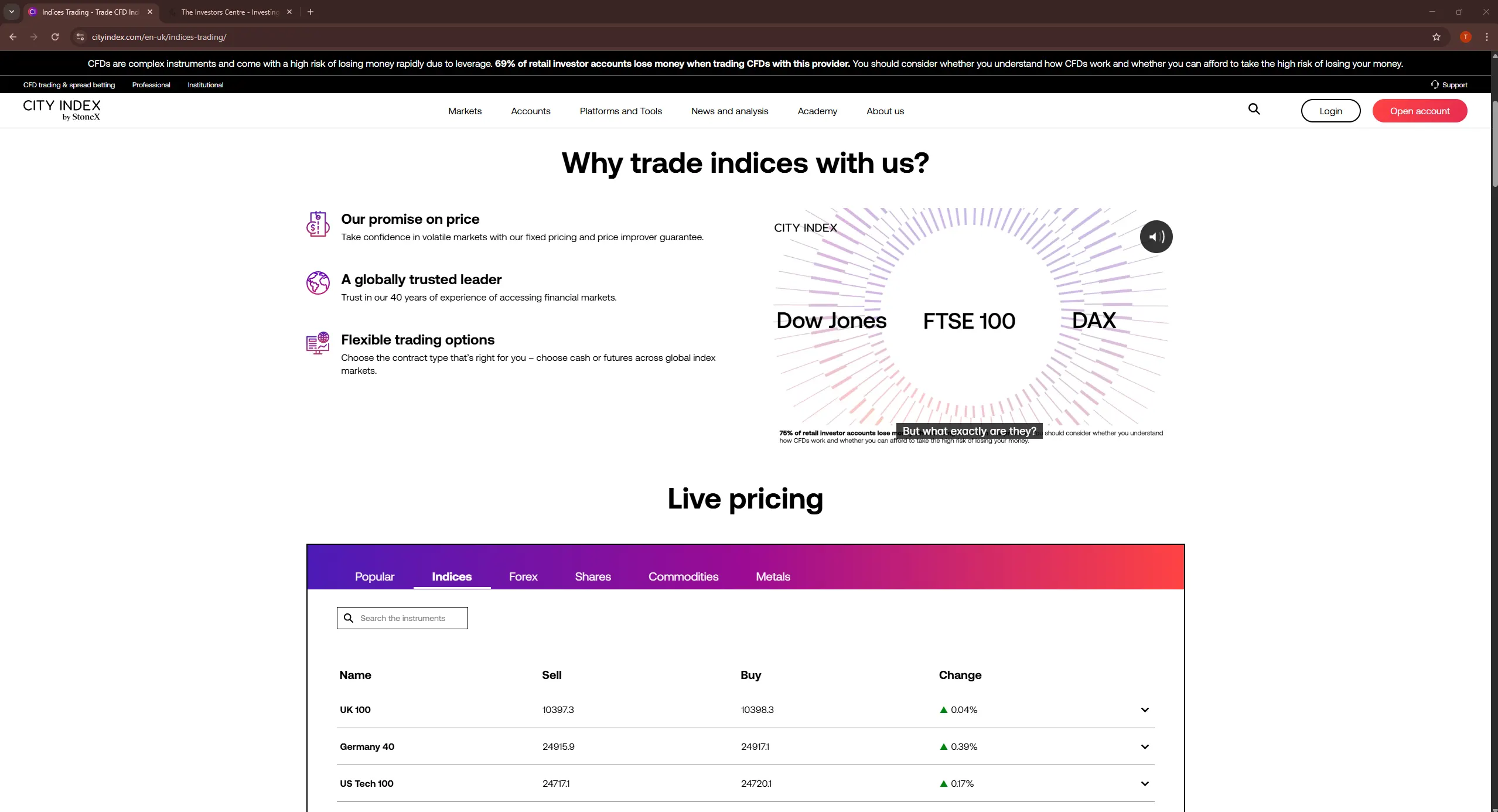

City Index — Best for Index Trading Beginners (FRN 446717)

City Index offers around 40 indices via spread bets and CFDs, backed by StoneX Group (Nasdaq-listed). The standout for newer traders is the built-in trading signals from two external providers — I tested them on the FTSE 100 and S&P 500, and while they're a useful starting point, they shouldn't replace your own analysis.

The Performance Analytics tool is genuinely helpful for beginners tracking what's working and what isn't. If you prefer to own index-tracking shares rather than trade derivatives, see our best UK stock trading platforms instead. 69% of retail accounts lose money with City Index.

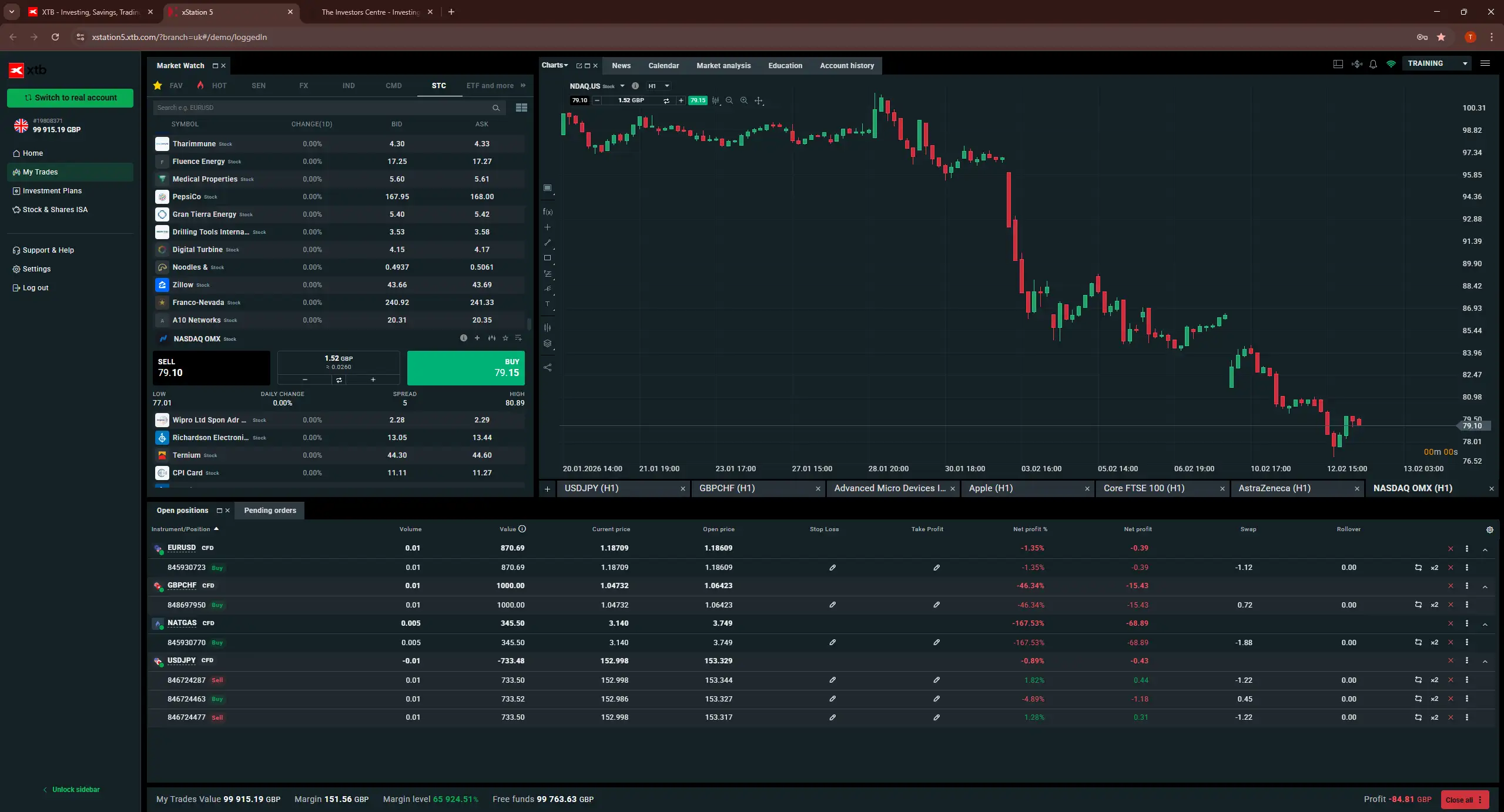

XTB — Competitive Pricing on xStation 5 (FRN 522157)

XTB offers approximately 35 indices on xStation 5, a fast and visually modern platform with decent charting but fewer indicators than CMC or TradingView. Zero commission on standard accounts and tight spreads make it a cost-effective option.

The significant limitation for UK traders: XTB doesn't currently offer spread betting on indices. That means index profits are subject to Capital Gains Tax — a meaningful disadvantage compared to the spread betting platforms above. 74% of retail accounts lose money with XTB.

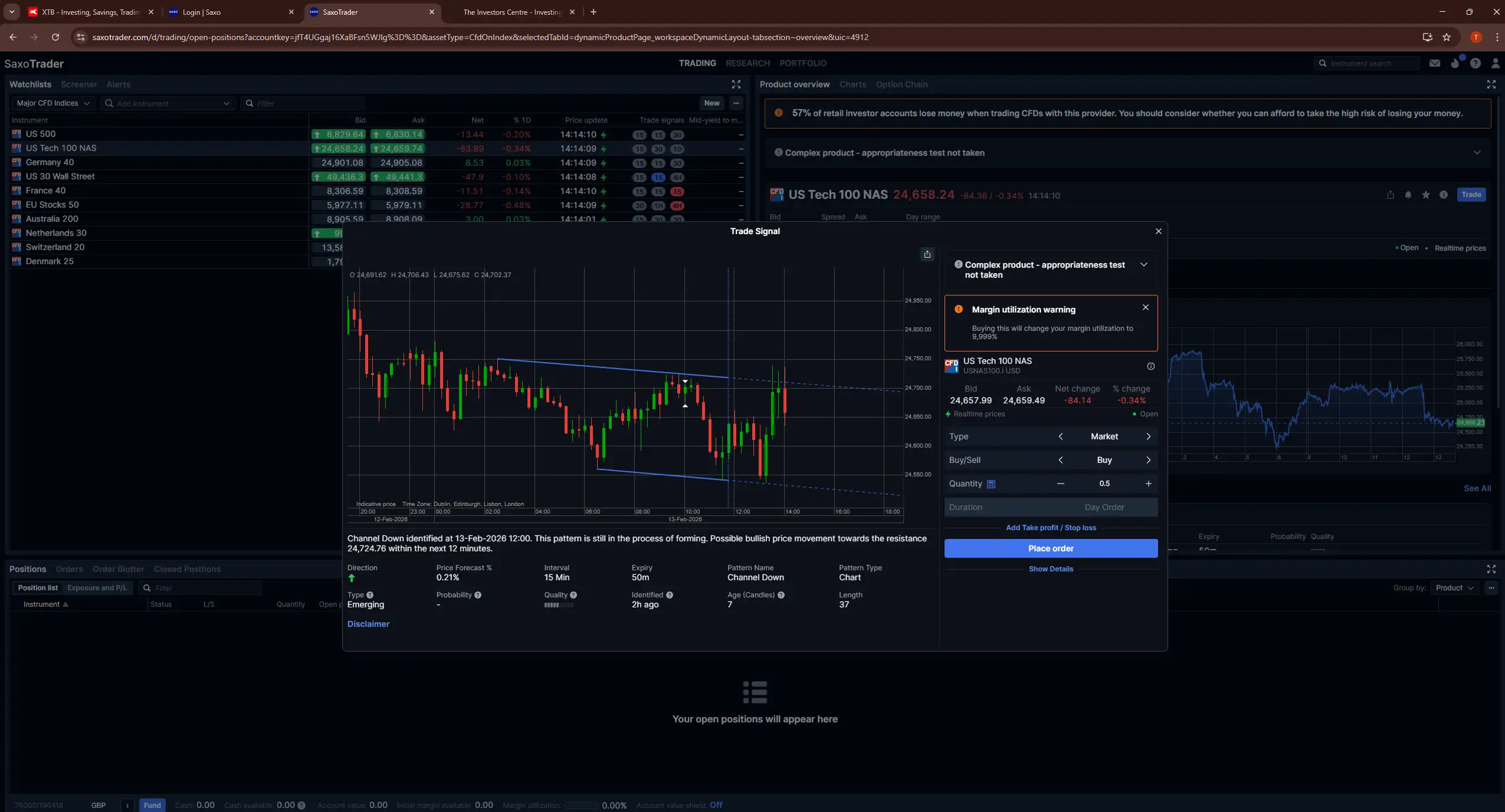

Saxo Markets — Best for Professional Index Traders (FRN 551422)

Saxo is the only platform on this list offering DMA access to exchange-traded index futures and options. If you want to trade S&P 500 E-mini futures or options on the FTSE 100 with direct exchange access, Saxo is essentially the only FCA-regulated option here. We recorded the tightest S&P 500 spread in our entire testing at approximately 0.3 points.

SaxoTraderPRO is built for institutional-style order flow, and the minimum account expectations reflect that. Saxo also features in our UK options trading platforms guide for the same reasons. Not ideal for retail traders with smaller accounts. 65% of retail accounts lose money with Saxo Markets.

What Does It Actually Cost to Trade Indices in the UK?

The main costs of trading indices in the UK are the spread, overnight financing charges and — on non-GBP indices — currency conversion fees. Most competing pages list the spread and move on. The reality is that overnight financing is the hidden cost that makes index trading expensive for anyone holding beyond intraday.

Across all eight platforms, overnight financing on a £10/point FTSE 100 position averaged £3–£4 per night. That doesn't sound significant until you scale it: hold that position for 20 trading days and financing alone adds approximately £60–£70, regardless of which broker you're using. That's six to seven times the opening spread cost — and it's the figure most brokers don't emphasise in their marketing.

| Holding Period | Capital.com (SB) | IG (SB) | Pepperstone Razor (CFD) |

|---|---|---|---|

| Intraday (no financing) | ~£10 | ~£10 | ~£8.50 |

| 1 day | ~£13 | ~£13 | ~£12 |

| 5 days | ~£28 | ~£30 | ~£26 |

| 20 days | ~£70 | ~£80 | ~£75 |

*Based on a £10/point FTSE 100 trade. Overnight financing rates vary and are subject to change. Spread betting costs assume no commission. Pepperstone Razor includes £2.25/side commission.

The tax difference is equally important. On £5,000 of annual index trading profit, a spread bettor pays £0 in Capital Gains Tax. A CFD trader on the same profit pays approximately £500–£1,000 depending on their tax band and whether they've used their annual CGT allowance. Over multiple years, that difference compounds significantly.

Costs work differently if you're trading commodities — see our gold trading platforms we tested for a breakdown.

Spread Betting vs CFDs for Index Trading — Which Is Better?

For most UK index traders, spread betting is the better option. Profits are currently free from Capital Gains Tax, and the trading experience is virtually identical to CFDs. You're still trading on margin, using the same leverage limits, on the same platforms.

The practical difference shows up in the numbers. On £5,000 of index trading profit over a year, spread betting saves £500–£1,000 in CGT depending on your tax band. For profitable UK retail traders, this is the single biggest reason to default to spread betting over CFDs.

| Feature | Spread Betting | CFDs |

|---|---|---|

| Tax on profits | Currently tax-free (CGT exempt) | Subject to CGT |

| Loss offset | No — cannot offset against other gains | Yes — can offset against gains |

| Commission | Usually none (cost in spread) | Varies (some charge commission) |

| DMA / Exchange access | No | Yes — via some brokers (Saxo) |

| FCA leverage limit (major indices) | 20:1 | 20:1 |

| Best for | UK retail traders trading profitably | Hedgers, professionals, loss-offset strategy |

There are situations where CFDs make more sense. If you want DMA access to exchange-traded index futures, only CFD brokers like Saxo offer that. If you're hedging a physical equity portfolio with index short positions, CFDs allow you to offset trading losses against capital gains elsewhere — spread betting losses can't be used this way. And if you expect a losing year, CFD losses can reduce your overall CGT liability.

We cover the broader product differences in our top derivative trading brokers guide.

How to Choose the Right Indices Trading Platform

The best platform depends entirely on how you trade. Rather than listing generic criteria, here's what I'd recommend based on the 50+ trades I placed during testing:

If you're new to index trading, start with Capital.com or City Index. Both have clean interfaces, low minimum deposits and enough hand-holding to prevent expensive mistakes.

If you're an active day trader who values execution speed and tight raw spreads, Pepperstone's Razor account is the best option on this list.

If you want access to the widest range of global indices from a single UK account, IG is the clear winner with 80+ markets.

If you trade around scheduled news events and want predictable costs, Spreadex's fixed spreads remove the variable-spread anxiety.

If advanced technical analysis drives your index trading, CMC Markets' Next Generation platform is the most powerful charting tool here.

If you're a professional trader wanting DMA exchange access to index futures and options, Saxo Markets is built for that.

One thing is non-negotiable regardless of which platform you choose: FCA regulation. Every platform on this list has it, but always verify for yourself on the FCA Register before depositing a single pound. We'd always recommend starting on a demo account for practice before trading indices with real money.

What Are the Most Popular Indices to Trade in the UK?

The most popular indices among UK traders are the FTSE 100, S&P 500, NASDAQ 100, DAX 40 and Dow Jones 30. These five offer the tightest spreads, highest liquidity and the widest availability across every FCA-regulated platform on this list.

The FTSE 100 and S&P 500 dominate because they combine deep liquidity with tight spreads and GBP-denominated spread bets on most platforms, eliminating currency conversion costs. The best trading window for US indices from the UK is the London–New York session overlap between 2:30pm and 4:30pm GMT, when both markets are open simultaneously and spreads tend to be tightest.

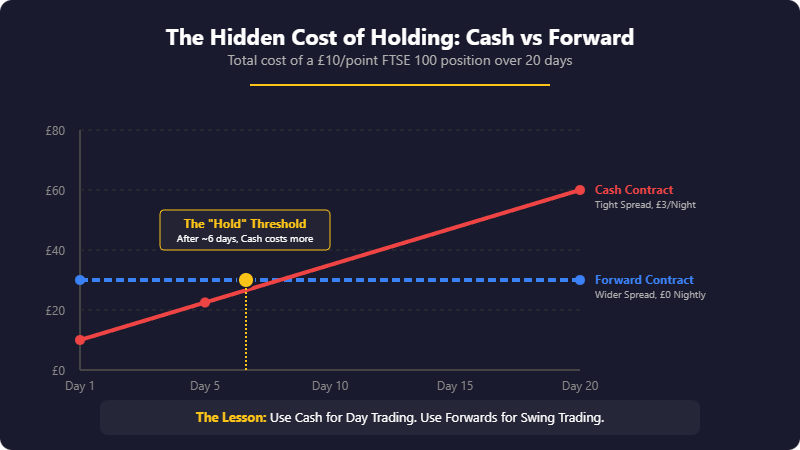

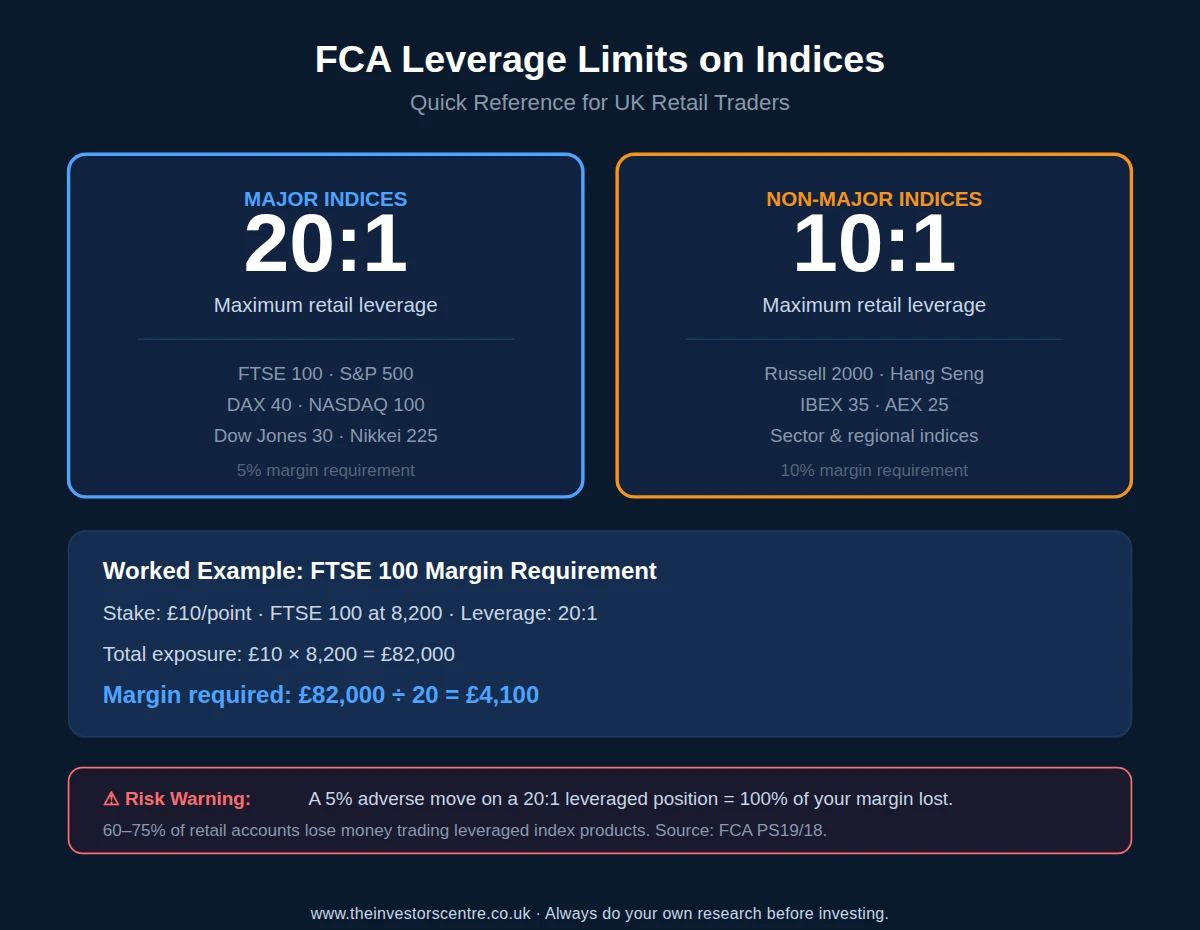

FCA regulations cap retail leverage at 20:1 on major indices — that includes the FTSE 100, S&P 500 and DAX 40 — and 10:1 on non-major equity indices. It's worth understanding the difference between cash and forward index contracts: cash indices track the spot price with tighter spreads but overnight financing applies, while forward contracts carry wider spreads but no overnight financing, making them better suited to trades held over several days. IG, CMC Markets and Saxo all offer both.

Asian and exotic indices are available on IG and CMC but come with noticeably wider spreads and lower liquidity. If you're starting out, stick with the major five. We cover S&P 500 exposure through ETFs in a separate guide for investors wanting a passive rather than leveraged approach.

Final Thoughts

After 50+ trades across all eight platforms, the clearest takeaway is that no single broker is best for every type of index trader. Capital.com earned the top spot because it gets the fundamentals right for the widest range of users — tight spreads, zero commission, a clean interface and spread betting as standard. But IG, Pepperstone and Spreadex each outperformed it in their specific areas.

The more useful finding from our testing was how much total costs diverge once you factor in overnight financing. The spread is the headline number every broker wants you to compare, and it matters for day traders. But if you're holding index positions for days or weeks, financing charges doubled or tripled the actual cost of the trade on every platform we tested. That's something worth modelling before you commit to a strategy.

Every platform on this list is FCA-regulated, and we verified each FRN on the register. Beyond that, the right choice comes down to how you trade, how often you trade and whether you value breadth, speed, cost predictability or platform depth. Test two or three on demo before depositing real money — the differences are easier to feel than to read about.

FAQs

Can you trade indices tax-free in the UK?

Yes. Spread betting on indices is currently exempt from Capital Gains Tax and Stamp Duty for UK residents. This applies across all FCA-regulated spread betting platforms on this list. If you trade indices via CFDs instead, profits are subject to CGT. Tax laws can change and depend on your individual circumstances.

What is the minimum deposit to start trading indices?

It varies by platform. Capital.com requires just £20. Pepperstone has no minimum deposit. IG asks for £250, and Spreadex has no set minimum but recommends depositing enough to cover margin requirements comfortably. We'd suggest starting with at least £200–£500 to give yourself enough margin headroom on index positions.

Is trading indices risky?

Yes. Index trading via CFDs and spread bets uses leverage, which magnifies both profits and losses. FCA rules cap retail leverage on major indices at 20:1, meaning a 5% adverse move wipes out your entire position. Between 60% and 75% of retail accounts lose money with the providers on this page. Never trade with money you can't afford to lose.

What leverage can UK traders get on indices?

FCA regulations cap retail leverage at 20:1 on major indices and 10:1 on non-major equity indices. In practical terms, a £10/point FTSE 100 position at 8,200 requires approximately £4,100 in margin. Professional clients can apply for higher leverage but must demonstrate a portfolio exceeding €500,000, significant trading frequency and relevant industry experience.

Can you trade indices on weekends?

Some platforms offer weekend index markets. IG provides weekend trading on UK 100, Wall Street and Germany 40 with adjusted spreads that are wider than weekday sessions. Most other platforms close index markets from Friday evening to Sunday evening. Weekend liquidity is lower, so consider reducing your position size.

What is the difference between cash and forward indices?

Cash indices track the spot price with tighter spreads, while forward indices are based on futures contracts with wider spreads. The key practical difference is cost over time: cash indices charge overnight financing (approximately £3–£4 per night on a £10/point FTSE 100 position), while forwards roll that cost into a wider upfront spread with no nightly charge. As a rough guide, if you plan to hold an index position for less than three days, cash is usually cheaper. Beyond three to five days, forwards often work out cheaper because you avoid the compounding financing. IG, CMC Markets and Saxo offer both contract types — most other platforms on this list only offer cash indices.

References

- FCA Register — Capital Com (UK) Limited, FRN 793714

- FCA Register — IG Markets Limited, FRN 195355

- FCA Register — Pepperstone Limited, FRN 684312

- FCA Register — Spreadex Limited, FRN 190941

- FCA Register — CMC Markets UK Plc, FRN 173730

- FCA Register — StoneX Financial Ltd (City Index), FRN 446717

- FCA Policy Statement PS19/18 — Restricting contract for difference products sold to retail clients

- HMRC — Capital Gains Tax guidance: spread betting tax treatment

- Capital.com — Indices trading

- IG — Indices trading UK