- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

View our independently selected range of trusted crypto platforms for 2026, all tested hands-on using real capital. Every exchange listed is available to users based in the United Kingdom.

To Buy Kaspa in the UK, you'll need to:

- Select a reputable crypto exchange that lists Kaspa (KAS) like Bitpanda.

- Register and complete KYC verification.

- Deposit funds using a bank account or fiat currency.

- Search for Kaspa trading pairs and place your order.

- Securely store Kaspa in a crypto wallet.

Where to Buy Kaspa (KAS)

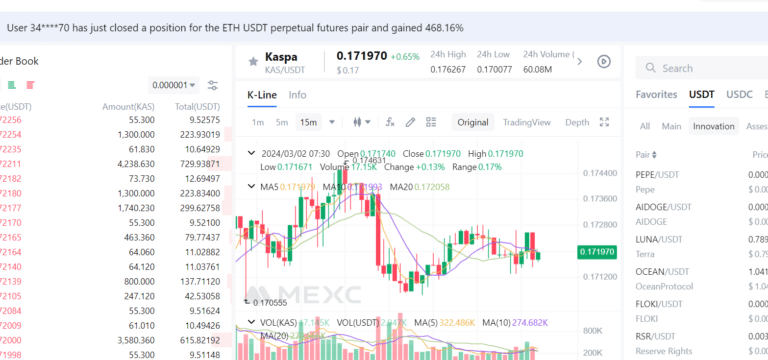

When it comes to buying Kaspa (KAS) in the UK, selecting the right platform is crucial. Two popular choices among UK investors are MEXC and Bitpanda.

Here’s a comparison based on fees, security, user-friendliness, and Kaspa’s price and support, including pros and cons for each.

Registration and Verification Processes

Both MEXC and Bitpanda follow a standard signup process that emphasizes security and compliance with regulatory standards. Here’s a brief overview:

- Step 1: Sign Up: Provide basic information like your email address and create a secure password.

- Step 2: Verification: Both platforms require identity verification to comply with KYC regulations. This involves submitting a government-issued ID and, in some cases, a proof of address.

- Step 3: Security Setup: It’s recommended to set up two-factor authentication (2FA) for an added layer of security.

- Step 4: Deposit Funds: Once verified, you can deposit funds using your preferred payment method.

- Step 5: Start Trading: With funds in your account, you’re ready to buy Kaspa or other cryptocurrencies.

Both platforms strive to make the registration and verification process as smooth as possible, balancing the need for security with user convenience.

Whether you’re a beginner or a seasoned trader, choosing a platform that aligns with your trading habits, security expectations, and support for Kaspa is key to a successful investment experience.

Pros & Cons

- Zero deposit and withdrawal fees

- £1 minimum investment

- FCA-registered with enterprise-grade security (ISO 27001 certified)

- Staking available on 50+ cryptos with up to 30% APY

- Crypto indices for easy diversification

- Clean, beginner-friendly interface

- Trading spread of ~1.49% (can reach 2.49%) – higher than some competitors

- No stocks, ETFs, or metals for UK users (EU only)

- No margin trading or leverage

- Customer support can be slow during peak periods

- Savings plans not currently available in the UK

-

What are the Fees?

-

What Cryptocurrencies are Available?

-

How Safe is the Broker?

-

Who Is It Best For?

| Fee Type | Cost |

|---|---|

| Trading Spread | ~1.49% (ranges 0.99% – 2.49%) |

| Deposits | £0 (all methods) |

| Withdrawals | £0 (all methods) |

| Inactivity Fee | £0 |

| Account Fee | £0 |

UK users can deposit via Faster Payments, credit/debit card, or PayPal – all fee-free from Bitpanda’s side. Card issuers may charge around 1.5% on their end.

Bitpanda offers 600+ cryptocurrencies – the largest selection available to UK investors. This includes major coins like Bitcoin, Ethereum, and Solana, plus a huge range of altcoins and emerging low-cap tokens. The platform also features crypto indices, allowing users to invest in themed baskets of assets for easy diversification. Staking is available on 50+ cryptocurrencies including Cardano (ADA), Solana (SOL), and Polkadot (DOT), with rewards up to 30% APY.

Bitpanda is FCA-registered for cryptoasset activities in the UK and holds MiCA licensing across the EU. Security features include ISO 27001 and ISO 27018 certification, cold wallet storage for the majority of user funds, two-factor authentication, and external reserve audits. As of January 2026, there have been no publicly reported security breaches. Note that crypto is unregulated in the UK, so FSCS protection does not apply.

Bitpanda is ideal for:

- Beginners seeking an easy-to-use platform with low barriers to entry

- Low-cap hunters wanting access to emerging and niche tokens

- Long-term holders looking for staking rewards and a secure place to accumulate crypto

- Casual investors who value zero fees on deposits and withdrawals

It’s less suited to active day traders needing advanced charting tools, margin trading, or the lowest possible spreads.

DON’T INVEST UNLESS YOU’RE PREPARED TO LOSE ALL THE MONEY YOU INVEST. THIS IS A HIGH-RISK INVESTMENT AND YOU SHOULD NOT EXPECT TO BE PROTECTED IF SOMETHING GOES WRONG.

Pros & Cons

- Very low trading fees (as low as 0%)

- Huge range of cryptocurrencies (1,000+ listed)

- High liquidity, especially for altcoins

- Offers futures, margin, staking, and launchpad features

- Not FCA-registered (operates offshore)

- Limited fiat on-ramp options for UK users

- Interface may be overwhelming for beginners

-

What are the Fees?

-

What Cryptocurrencies are Available?

-

How Safe is the Exchange?

-

Who Is It Best For?

MEXC offers highly competitive fees. Spot trading fees start at 0.1%, with frequent promotions reducing fees to 0%. Futures trading can be as low as 0% maker and 0.01% taker. However, UK users may face higher costs using third-party services for GBP deposits and withdrawals, as MEXC does not directly support Faster Payments.

MEXC is known for its extensive selection, listing over 1,000 cryptocurrencies, including major tokens like Bitcoin, Ethereum, and Solana, as well as a wide array of emerging altcoins. It’s one of the best platforms for discovering new tokens early.

While MEXC employs security features like two-factor authentication and withdrawal whitelists, it is not regulated by the FCA or a major Western financial authority. That said, it has a solid track record with no major hacks reported, and it holds user funds in cold storage. Caution is advised due to the lack of UK regulatory oversight.

MEXC is ideal for experienced traders and altcoin enthusiasts who want access to a broad range of assets and advanced tools. It’s less suited for UK beginners due to its complex interface and lack of direct GBP support, but great for those who prioritize selection and low fees.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What is Kaspa (KAS)?

Kaspa (KAS) is a cutting-edge cryptocurrency that stands out for its speed, scalability, and security.

It’s designed to solve common issues in blockchain transactions through its “GHOSTDAG” protocol, enabling near-instantaneous transactions.

This makes Kaspa an appealing choice for investors worldwide, including those in the UK.

Unique Features for UK Investors

- Rapid Transactions: Kaspa processes transactions quickly, ideal for efficient trading and investing.

- Scalability: It’s built to handle growth without slowing down or becoming expensive, making it a solid choice for sustainable investment.

- Energy Efficiency: Kaspa’s energy-efficient design appeals to environmentally conscious investors.

- Decentralization and Security: Its decentralized nature ensures security and transparency.

- Community and Accessibility: Supported by a vibrant community and widely accessible through various exchanges, Kaspa is positioned as a valuable addition to any investment portfolio.

In summary, the Kaspa coin offers UK investors a promising cryptocurrency option, combining innovative technology with practical benefits for a sustainable and potentially lucrative investment.

Kaspa is one of many emerging altcoins attracting UK investor attention. For a broader look at the space, see our guides on where to buy altcoins in the UK and the best low cap crypto gems currently on our radar.

Is Kaspa Secure and Legal in the UK?

Legal Framework

Investing in Kaspa (KAS) is legal in the UK, falling under the evolving cryptocurrency regulations aimed at anti-money laundering and financial terrorism.

Compliance with KYC (Know Your Customer) processes and understanding tax implications is essential.

Ensure any exchange or broker you use is registered with the Financial Conduct Authority (FCA) for added reassurance. For a full overview of UK crypto law, see our guide: is Bitcoin legal in the UK.

Security Measures

To safeguard your Kaspa investments, prioritize security:

- Choose Reputable Exchanges: Opt for exchanges with robust security features like two-factor authentication, encryption, and cold storage.

- Secure Wallets: Prefer hardware wallets for maximum security or select software wallets with a strong security track record.

- Be Informed: Stay updated on security practices and scams. Use strong, unique passwords and enable 2FA where available.

Investment Considerations

Before investing in Kaspa, keep these points in mind:

- Market Volatility: Be prepared for price fluctuations and assess how these align with your risk tolerance and investment goals.

- Define Your Goals: Identify whether you’re seeking short-term gains or long-term investment, and strategize accordingly.

- Risk Management: Diversify your investments and only invest what you can afford to lose to mitigate potential risks.

In short, while Kaspa presents exciting investment opportunities, understanding its legal standing, ensuring security, and aligning with your financial objectives are key steps for a safe and informed investment journey in the UK.

If you’re also weighing up other cryptocurrencies, our guide to the best crypto to invest in compares the strongest options for UK investors right now. You may also want to ensure your bank supports crypto transactions — see our list of crypto-friendly banks in the UK.

Step-by-Step Guide to Buying KAS

Step 1: Choose a Cryptocurrency Exchange

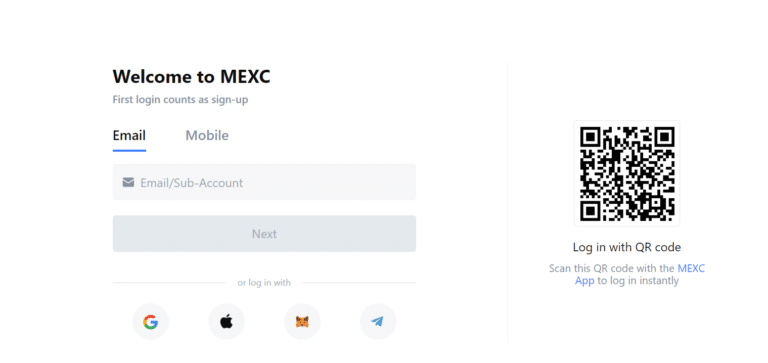

Step 2: Create an Account

Navigate to the chosen exchange’s website.

Click on the “Sign Up” or “Register” button.

Enter your email address and create a secure password. Agree to the terms and conditions, then submit your registration.

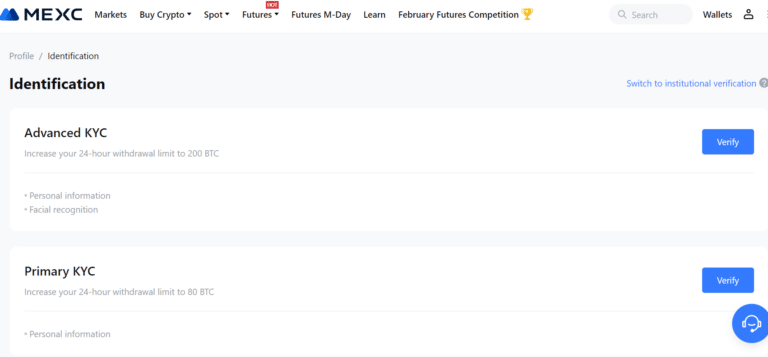

Step 3: Verify Your Identity (KYC Process)

Upon registration, you’ll be prompted to complete the Know Your Customer (KYC) process.

Provide personal information, including your full name, address, and date of birth.

Upload a government-issued ID (passport, driver’s license) and possibly a proof of address (utility bill, bank statement).

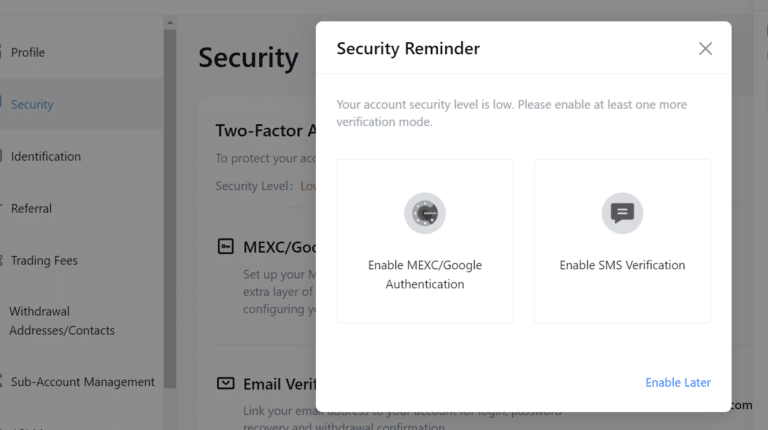

Step 4: Secure Your Account

- Enable two-factor authentication (2FA) from the security settings of your account for an added layer of protection.

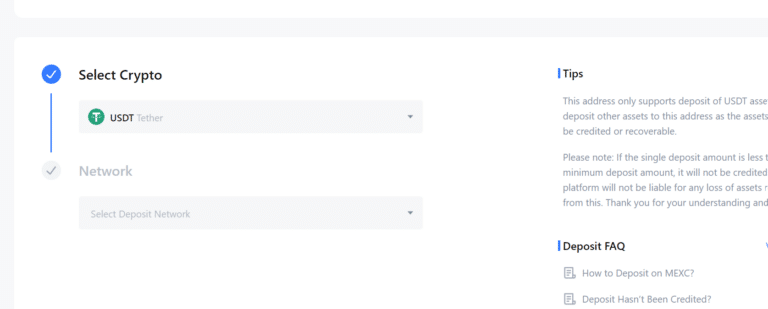

Step 5: Deposit Funds

Go to the “Deposit” section and select your preferred method of depositing funds (bank transfer, credit card, etc.).

Follow the instructions to complete the deposit, noting any fees or minimum deposit amounts.

Step 6: Buy Kaspa (KAS)

Once your funds are deposited, navigate to the trading section of the platform.

Search for Kaspa (KAS) and select the pair you wish to trade (e.g., KAS/GBP).

Enter the amount of KAS you want to buy or the amount of GBP you want to spend.

Review your transaction details, then confirm your purchase.

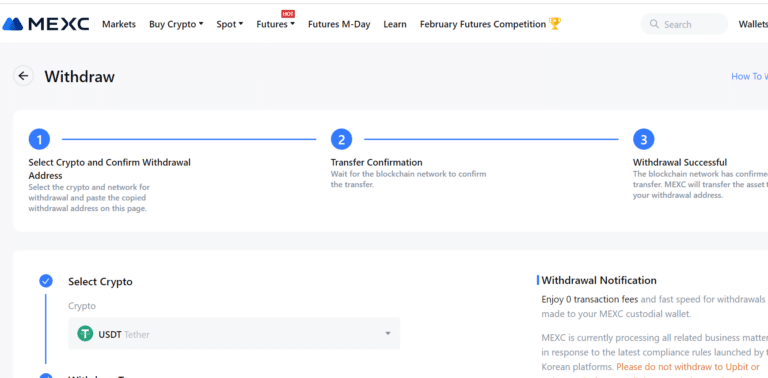

Step 7: Transfer Kaspa to a Secure Wallet (Optional)

For added security, transfer your Kaspa holdings from the exchange to a personal wallet. Choose between hardware (most secure) and software wallets.

Navigate to the “Withdraw” section on the exchange, select Kaspa (KAS) as the currency to withdraw, and enter your wallet address.

Confirm the transaction, taking note of any withdrawal fees.

Storing Your Kaspa Safely

When storing Kaspa (KAS) or any other cryptocurrency, choosing the right wallet is an important step in protecting your funds. Different storage options offer varying levels of security, control, and convenience.

The three main wallet categories to consider are hardware wallets, software wallets, and exchange-based wallets. Each comes with its own benefits and trade-offs, depending on how you plan to use your crypto and how much security you require.

For maximum security, a hardware wallet is recommended. Our Ledger vs Trezor comparison breaks down the two most popular options for UK investors.

When Crypto, Then Bitpanda

- Access to 600+ Cryptoassets

- Certified Platform Security

- Zero-Fee Fiat Funding

DON’T INVEST UNLESS YOU’RE PREPARED TO LOSE ALL THE MONEY YOU INVEST. THIS IS A HIGH-RISK INVESTMENT AND YOU SHOULD NOT EXPECT TO BE PROTECTED IF SOMETHING GOES WRONG.

FAQs

How can I start trading Kaspa on most crypto exchanges?

To start trading Kaspa on most crypto exchanges, first, create an account on a platform that lists Kaspa. Complete the verification process to comply with KYC regulations. Then, deposit funds using a bank account or fiat currency, search for Kaspa trading pairs (e.g., KAS/USD, KAS/BTC), and begin trading. For a full walkthrough, see our guide on how to buy cryptocurrency in the UK.

What should I look for in a crypto wallet to store Kaspa safely?

When choosing a crypto wallet to store Kaspa, consider security features like private key storage, backup options, and two-factor authentication (2FA). Decide between hardware wallets for maximum security and software wallets for convenience. Ensure the wallet supports Kaspa and evaluate user reviews and the wallet’s track record in the crypto ecosystem.

Can I buy Kaspa with fiat currency on crypto exchanges?

Yes, you can buy Kaspa with fiat currency on several crypto exchanges. Look for exchanges that offer direct fiat to Kaspa pairs for easier transactions. Platforms with the lowest crypto fees will help you keep more of your investment when buying with GBP.

How do I sell Kaspa and withdraw to my bank account?

To sell Kaspa and withdraw the proceeds to your bank account, log into the crypto exchange where you hold Kaspa. Trade your Kaspa for a fiat-compatible digital asset or directly for fiat currency, if available. Then, request a withdrawal to your linked bank account, adhering to the exchange’s withdrawal process and limits.

What are the benefits of instant transaction confirmation in the Kaspa ecosystem?

Instant transaction confirmation in the Kaspa ecosystem significantly reduces waiting times for transaction finality, enhancing the user experience. This feature makes Kaspa ideal for real-time applications and fast-paced trading environments, increasing the asset’s utility and appeal as a digital asset for both daily transactions and investment purposes.