How to Buy Kaspa in the UK

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder and of TIC. A passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management.My goal is to empower individuals to make informed investment decisions through informative and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please keep in mind that Crypto assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Quick Answer: How to Get Kaspa in the UK (2024)

- Select a reputable crypto exchange that lists Kaspa (KAS).

- Register and complete KYC verification.

- Deposit funds using a bank account or fiat currency.

- Search for Kaspa trading pairs and place your order.

- Securely store Kaspa in a crypto wallet.

Featured Broker

eToro - Best for Beginners

- Copy Trading

- Competitive Fees

- Diverse Asset Range

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What is Kaspa (KAS)?

Kaspa (KAS) is a cutting-edge cryptocurrency that stands out for its speed, scalability, and security.

It’s designed to solve common issues in blockchain transactions through its “GHOSTDAG” protocol, enabling near-instantaneous transactions.

This makes Kaspa an appealing choice for investors worldwide, including those in the UK.

Unique Features for UK Investors

Rapid Transactions: Kaspa processes transactions quickly, ideal for efficient trading and investing.

Scalability: It’s built to handle growth without slowing down or becoming expensive, making it a solid choice for sustainable investment.

Energy Efficiency: Kaspa’s energy-efficient design appeals to environmentally conscious investors.

Decentralization and Security: Its decentralized nature ensures security and transparency.

Community and Accessibility: Supported by a vibrant community and widely accessible through various exchanges, Kaspa is positioned as a valuable addition to any investment portfolio.

In summary, the Kaspa coin offers UK investors a promising cryptocurrency option, combining innovative technology with practical benefits for a sustainable and potentially lucrative investment.

Is Kaspa Secure and Legal in the UK?

Legal Framework

Investing in Kaspa (KAS) is legal in the UK, falling under the evolving cryptocurrency regulations aimed at anti-money laundering and financial terrorism.

Compliance with KYC (Know Your Customer) processes and understanding tax implications is essential.

Ensure any exchange or broker used to buy crypto here is registered with the Financial Conduct Authority (FCA) for added reassurance.

Security Measures

To safeguard your Kaspa investments, prioritize security:

Choose Reputable Exchanges: Opt for exchanges with robust security features like two-factor authentication, encryption, and cold storage.

Secure Wallets: Prefer hardware wallets for maximum security or select software wallets with a strong security track record.

Be Informed: Stay updated on security practices and scams. Use strong, unique passwords and enable 2FA where available.

Investment Considerations

Before investing in Kaspa, keep these points in mind:

Market Volatility: Be prepared for price fluctuations and assess how these align with your risk tolerance and investment goals.

Define Your Goals: Identify whether you’re seeking short-term gains or long-term investment, and strategize accordingly.

Risk Management: Diversify your investments and only invest what you can afford to lose to mitigate potential risks.

In short, while Kaspa presents exciting investment opportunities, understanding its legal standing, ensuring security, and aligning with your financial objectives are key steps for a safe and informed investment journey in the UK.

Choosing a Platform to Buy Kaspa

When it comes to buying Kaspa (KAS) in the UK, selecting the right platform is crucial. Two popular choices among UK investors are MEXC and Bitpanda.

Here’s a comparison based on fees, security, user-friendliness, and Kaspa’s price and support, including pros and cons for each.

Registration and Verification Processes

Both MEXC and Bitpanda follow a standard signup process that emphasizes security and compliance with regulatory standards. Here’s a brief overview:

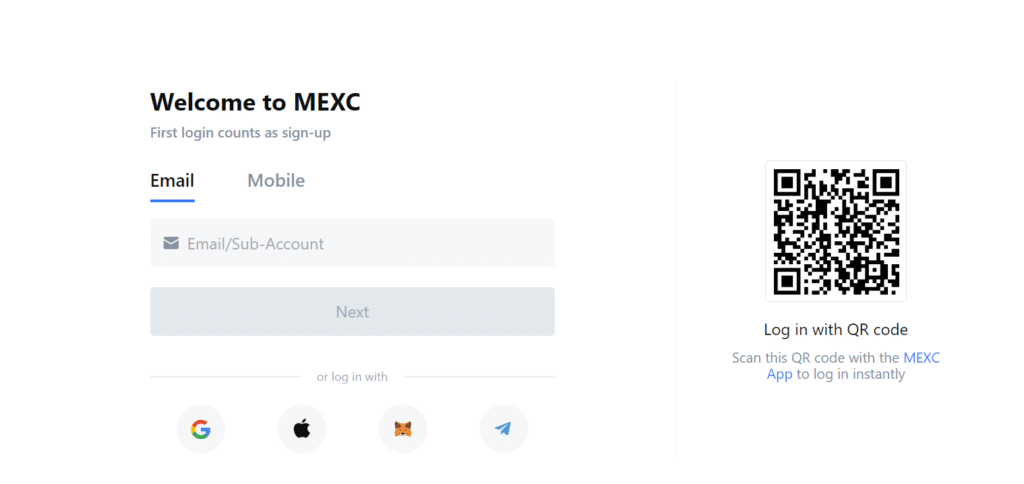

Step 1: Sign Up: Provide basic information like your email address and create a secure password.

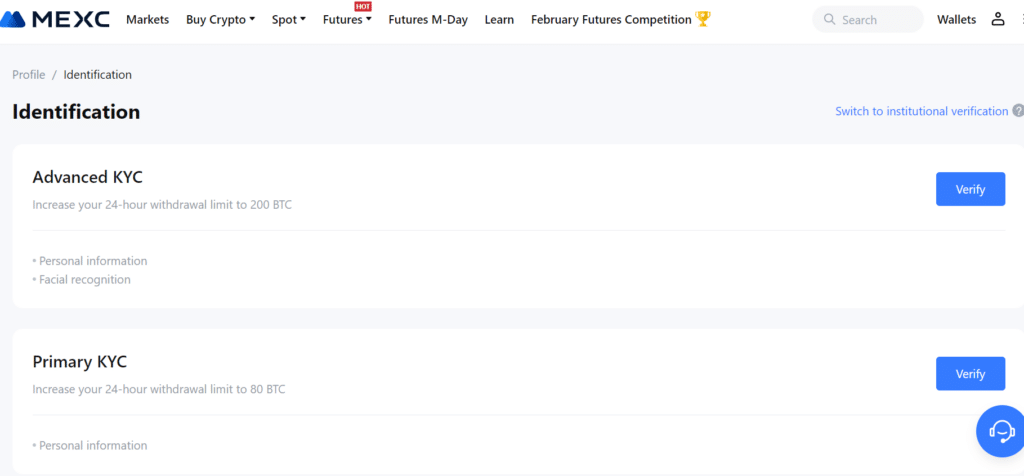

Step 2: Verification: Both platforms require identity verification to comply with KYC regulations. This involves submitting a government-issued ID and, in some cases, a proof of address.

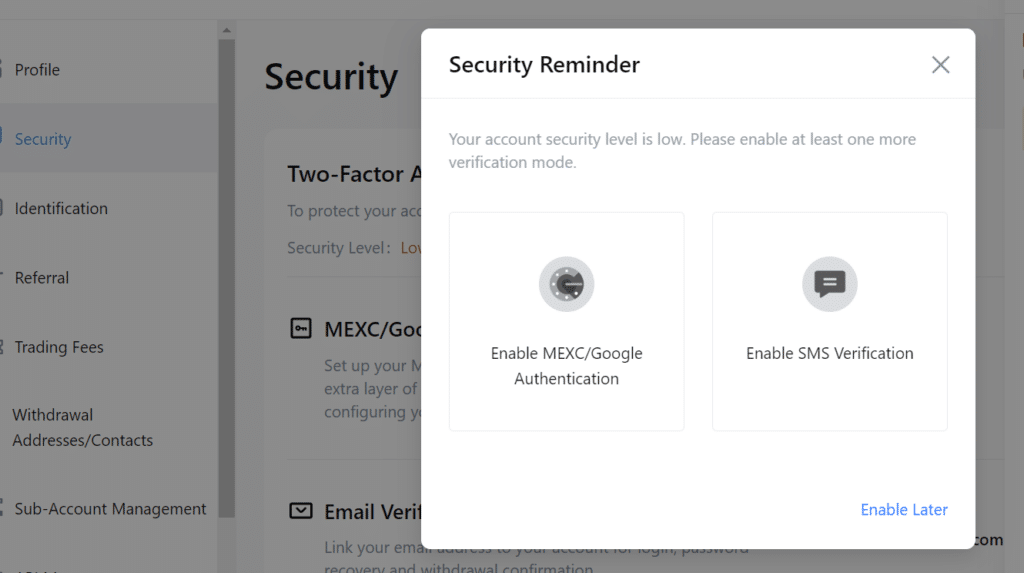

Step 3: Security Setup: It’s recommended to set up two-factor authentication (2FA) for an added layer of security.

Step 4: Deposit Funds: Once verified, you can deposit funds using your preferred payment method.

Step 5: Start Trading: With funds in your account, you’re ready to buy Kaspa or other cryptocurrencies.

Both platforms strive to make the registration and verification process as smooth as possible, balancing the need for security with user convenience.

Whether you’re a beginner or a seasoned trader, choosing a platform that aligns with your trading habits, security expectations, and support for Kaspa is key to a successful investment experience.

TIC Score 4.5/5

MEXC - Great choice to Trade Kaspa with low fees and a variety of other digital assets

Pros

Cons

- Low Fees: MEXC offers competitive trading fees, making it an attractive option for frequent traders.

- Robust Security: Implements advanced security measures, including multi-tier and multi-cluster system architecture.

- Complex Interface: New users may find MEXC's platform overwhelming due to its comprehensive features and tools.

- Variable Liquidity: For less popular assets like Kaspa, liquidity can sometimes fluctuate, impacting trade execution.

TIC Score 4/5

Bitpanda - Good choice to purchase Kaspa with detailed price analysis

Pros

Cons

- User-Friendly: Bitpanda is known for its intuitive interface, ideal for beginners.

- Multiple Payment Options: Offers a variety of payment methods, including bank transfer and credit cards, enhancing accessibility.

- Higher Fees: Compared to some competitors, Bitpanda's fees can be higher, especially for small transactions.

- Limited Advanced Tools: More experienced traders might find Bitpanda's trading tools and features less comprehensive.

Step-by-Step Guide to Buying KAS

Step 1: Choose a Cryptocurrency Exchange

Select a cryptocurrency exchange that supports Kaspa (KAS) transactions. For UK investors, platforms and currencies like MEXC and Bitpanda are popular choices due to their reliability, security, and user-friendly interfaces.

Step 2: Create an Account

Navigate to the chosen exchange’s website.

Click on the “Sign Up” or “Register” button.

Enter your email address and create a secure password. Agree to the terms and conditions, then submit your registration.

Step 3: Verify Your Identity (KYC Process)

Upon registration, you’ll be prompted to complete the Know Your Customer (KYC) process.

Provide personal information, including your full name, address, and date of birth.

Upload a government-issued ID (passport, driver’s license) and possibly a proof of address (utility bill, bank statement).

Step 4: Secure Your Account

Enable two-factor authentication (2FA) from the security settings of your account for an added layer of protection.

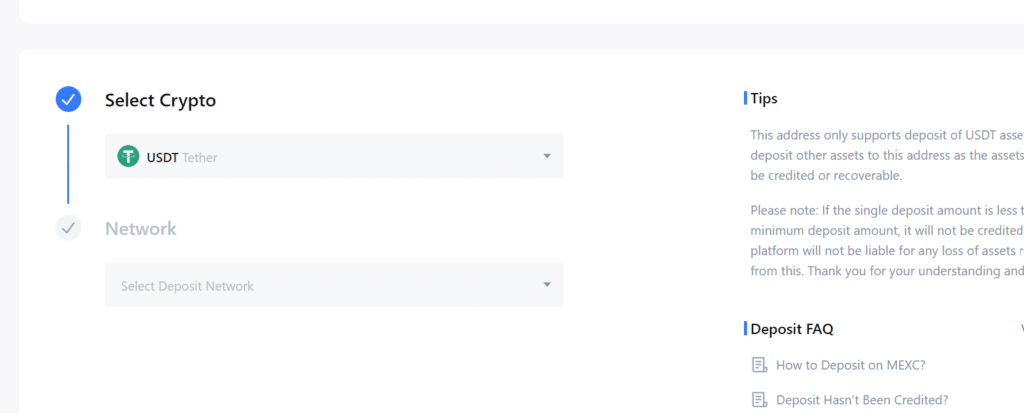

Step 5: Deposit Funds

Go to the “Deposit” section and select your preferred method of depositing funds (bank transfer, credit card, etc.).

Follow the instructions to complete the deposit, noting any fees or minimum deposit amounts.

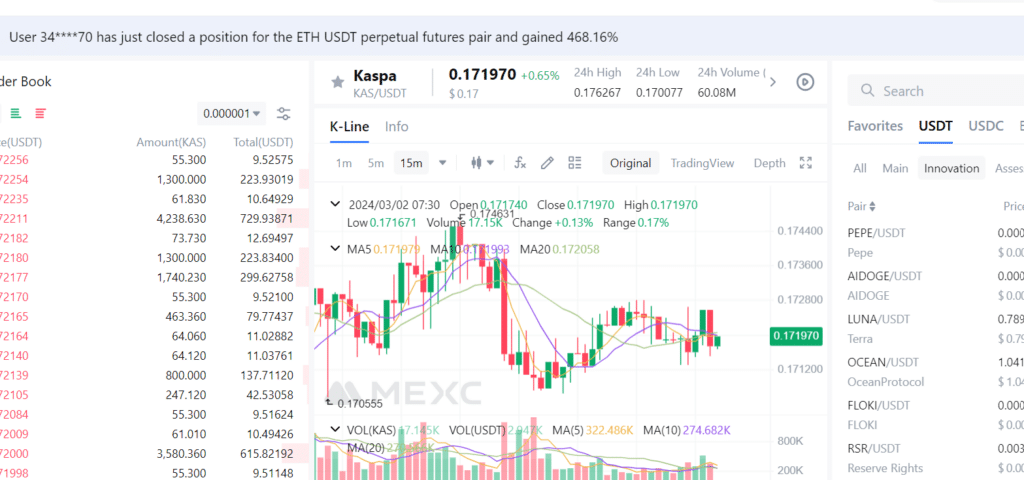

Step 6: Buy Kaspa (KAS)

Once your funds are deposited, navigate to the trading section of the platform.

Search for Kaspa (KAS) and select the pair you wish to trade (e.g., KAS/GBP).

Enter the amount of KAS you want to buy or the amount of GBP you want to spend.

Review your transaction details, then confirm your purchase.

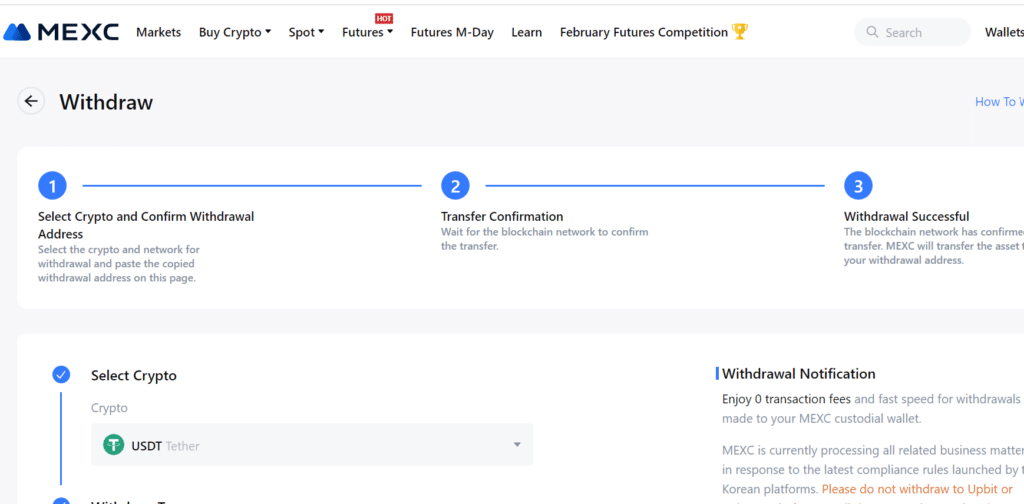

Step 7: Transfer Kaspa to a Secure Wallet (Optional)

For added security, transfer your Kaspa holdings from the exchange to a personal wallet. Choose between hardware (most secure) and software wallets.

Navigate to the “Withdraw” section on the exchange, select Kaspa (KAS) as the currency to withdraw, and enter your wallet address.

Confirm the transaction, taking note of any withdrawal fees.

Storing Your Kaspa Safely

When it comes to holding Kaspa (KAS) or any cryptocurrency, selecting the right storage option is crucial for ensuring the safety of your assets.

There are three primary types of wallets to consider: hardware wallets, software wallets, and exchange wallets.

Each has its advantages and considerations, depending on your needs and security preferences.

Exchange Wallets

Description

Wallets provided by the cryptocurrency exchange where you buy Kaspa, allowing for easy access and trading.

Pros

Convenient for active traders; no need for transferring between wallets for transactions.

Cons

Exposed to risks if the exchange is hacked; not recommended for long-term storage or for large amounts.

Considerations

Ensure the exchange has robust security measures in place.

Software Wallets

Description

Applications or software installed on your computer or smartphone, providing convenient access to your assets.

Pros

Free and easy to use; offers quick access to your Kaspa for trading or spending.

Cons

Vulnerable to online threats like viruses and hacking if your device is compromised.

Popular Choices

Exodus, Trust Wallet, and MetaMask (if there’s Kaspa support).

Hardware Wallets

Description

Physical devices that store cryptocurrencies offline, making them immune to online hacking attempts.

Pros

Offer the highest level of security for your Kaspa holdings; ideal for long-term investors or those holding significant amounts of cryptocurrencies.

Cons

Can be more expensive than other options; requires physical handling and can be lost or damaged.

Popular Choices

Trezor Model T, Cypherock & Ledger

Choosing the Right Wallet

Selecting the best wallet for your Kaspa depends on balancing convenience with security:

For Active Trading: If you’re actively trading Kaspa, an exchange wallet provides the convenience you need, though it’s wise to transfer funds not needed for immediate trading to a more secure wallet.

For Everyday Use: Software wallets are suitable for those who use Kaspa for regular transactions, offering a good mix of accessibility and security.

For Long-term Holding: Hardware wallets are the best choice for long-term investors looking to “hodl” their Kaspa. They provide the highest security level, protecting your investment from online threats.

Security Practices: Regardless of the wallet type, practice good security hygiene. This includes using strong, unique passwords, enabling two-factor authentication when available, and regularly backing up your wallet (especially for software wallets).

Research and Reviews: Before choosing a wallet, research and read reviews to ensure it supports Kaspa, meets your security needs, and is user-friendly.

In summary, the right storage solution for your Kaspa holdings should align with your investment strategy, usage patterns, and security expectations.

By carefully considering your options and adopting robust security practices, you can ensure the safety of all time high on your Kaspa investments.

FAQs

To start trading Kaspa on most crypto exchanges, first, create an account on a platform that lists Kaspa. Complete the verification process to comply with KYC regulations. Then, deposit funds using a bank account or fiat currency, search for Kaspa trading pairs (e.g., KAS/USD, KAS/BTC), and begin trading by setting buy or sell orders based on your trading strategy.

When choosing a crypto wallet to store Kaspa, consider security features like private key storage, backup options, and two-factor authentication (2FA). Decide between hardware wallets for maximum security and software wallets for convenience. Ensure the wallet supports Kaspa and evaluate user reviews and the wallet’s track record in the crypto ecosystem.

Yes, you can buy Kaspa with fiat currency on several crypto exchanges. Look for exchanges that offer direct fiat to Kaspa pairs (e.g., KAS/GBP, KAS/EUR). You may need to link your bank account or use a credit/debit card to make the purchase. Verify the exchange supports your preferred method of payment and check for any associated fees.

To sell Kaspa and withdraw the proceeds to your bank account, log into the crypto exchange where you hold Kaspa. Trade your Kaspa for a fiat-compatible digital asset or directly for fiat currency, if available. Then, request a withdrawal to your linked bank account, adhering to the exchange’s withdrawal process and limits.

Instant transaction confirmation in the Kaspa ecosystem significantly reduces waiting times for transaction finality, enhancing the user experience. This feature makes Kaspa ideal for real-time applications and fast-paced trading environments, increasing the asset’s utility and appeal as a digital asset for both daily transactions and investment purposes.