- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Discover the most promising low market cap cryptocurrencies set to surge in the next bull cycle. We’ve handpicked 10 high-upside altcoins based on fundamentals, utility, and token performance — all under the radar but packed with potential.

Explore our curated list of our top 3 reputable exchanges for purchasing cryptoassets, each rigorously tested with real funds. All brokers are accessible to traders in the United Kingdom.

Quick List – Best Low Cap Crypto to Watch in 2026

• Render (RNDR)

• Synapse (SYN)

• Aergo (AERGO)

• Golem (GLM)

• Highstreet (HIGH)

• Quantstamp (QSP)

• ZetaChain (ZETA)

• Status Network (SNT)

• Ethernity Chain (ERN)

• AIOZ Network (AIOZ)

Best Centralised Low Cap Crypto Brokers to Use

| Platform | FCA Regulated | Fees | Token Access | User Rating | Best For |

|---|---|---|---|---|---|

| Bitpanda | Yes | From ~1.49% | 5+ tokens | 4.3/5 | EU & UK compliance-focused investing |

| eToro | Yes | 1% buy/sell | 5+ tokens | 4.2/5 | Simplicity and UI |

| Crypto.com | Yes | From ~0.075% | 8+ tokens | 4.4/5 | Mobile-first trading & rewards |

| Coinbase | Yes | From ~0.6% | 6+ tokens | 4.5/5 | Beginner-friendly crypto access |

| Uphold | Yes | Spread-based | 5+ tokens | 4.1/5 | Multi-asset & transparency |

Low Cap Crypto Gem Rankings Table

| Coin | Symbol | Market Cap (USD) | Sector | Key Strength | Where to Buy |

|---|---|---|---|---|---|

| Render | RNDR | $690.8M | AI / GPU Rendering | AI demand & GPU utility | eToro; Coinbase; Binance |

| Synapse | SYN | $11.3M | Cross-chain Bridge | Interoperability & liquidity protocol | Coinbase; Binance; Kraken |

| Aergo | AERGO | $29.8M | Enterprise Blockchain | Enterprise-ready hybrid blockchain | KuCoin; HTX; Bithumb |

| Golem | GLM | $206.4M | Decentralised Compute | Shared compute marketplace | Binance; Pionex; WEEX |

| Highstreet | HIGH | $17.1M | Metaverse / VR | Retail metaverse & virtual experiences | Coinbase; Binance |

| Quantstamp | QSP | ~$0.6M | Security Audits | Smart contract security protocol | Gate.io; CoinEx |

| ZetaChain | ZETA | $83.7M | Omnichain Interoperability | Native cross-chain transfers & swaps | OKX; XT.COM |

| Status Network | SNT | $55.9M | Messaging & Communication | Mobile-first privacy network | Huobi; Binance; HTX |

Top 10 Low Cap Crypto Gems – Full Analysis

Render (RNDR)

What Does the Project Do?

Render delivers decentralized GPU rendering power for 3D artists, game creators, and AI workflows by matching idle GPU resources with those needing them—making rendering scalable and cost‑effective.

Current Market Cap and Price Trends

RNDR currently has a market cap of approximately $2.34–$2.37 billion. The price hovers around $4.50, showing solid momentum driven by interest in AI and metaverse graphics.

Why This Crypto Made the List

With tangible utility, growing adoption in AI and 3D sectors, strong tokenomics, and institutional backing, RNDR scored high in project fundamentals, real‑use case relevance, and tech innovation.

If you’re looking for a user‑friendly way to gain exposure to tokens like RNDR, check out the best crypto apps in the UK — several support altcoin trading directly from your phone.

Don’t invest unless you’re prepared to lose all the money you invest.

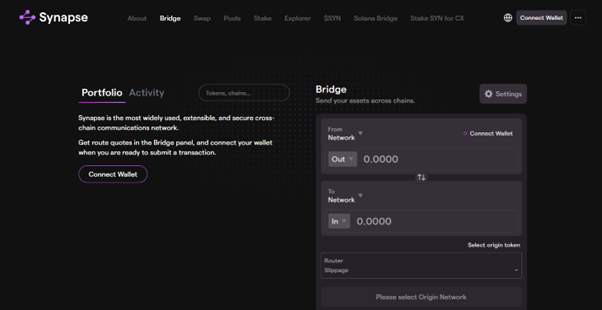

Synapse (SYN)

What Does the Project Do?

Synapse is a cross‑chain liquidity protocol that enables transfers, swaps, and messaging across multiple blockchains—it acts as a bridge and decentralized exchange across diverse ecosystems.

Current Market Cap and Price Trends

SYN’s market cap sits between approximately $35 million and $45 million today. Its price recently surged ~50% in a week, showing strong volatility and renewed interest in interoperability solutions.

Why This Crypto Made the List

Synapse’s inclusion is based on its cross‑chain utility, booming interoperability demand, robust growth patterns, and strong ecosystem use—even at a relatively small market cap it shows promising momentum.

Don’t invest unless you’re prepared to lose all the money you invest.

Aergo (AERGO)

What Does the Project Do?

Aergo is a hybrid blockchain designed for enterprises, offering both permissioned and permissionless blockchain solutions. It aims to bring flexibility and scalability to organisations building decentralised apps or integrating blockchain into business systems.

Current Market Cap and Price Trends

AERGO’s market cap sits around $76.9 million, with moderate trading volume and a stable price range. It has shown periodic growth aligned with regional enterprise adoption, particularly in South Korea.

Why This Crypto Made the List

Aergo scores well for strong partnerships (e.g. Blocko), enterprise readiness, and real-world use. It offers a compelling use case in the B2B space and stands out from purely consumer-driven projects.

Don’t invest unless you’re prepared to lose all the money you invest.

Golem (GLM)

What Does the Project Do?

Golem enables decentralised computing power sharing, allowing users to rent out their unused CPU/GPU capacity for others to perform tasks like scientific simulations or rendering.

Current Market Cap and Price Trends

With a market cap of approximately $284 million, GLM is one of the more established low-cap projects. It saw strong recovery in 2024 and remains fairly volatile due to broader compute/AI narratives.

Why This Crypto Made the List

Golem is a legacy project with solid fundamentals. Its longevity, consistent development, and fit within the decentralised AI narrative give it strong relevance for the 2025 bull cycle.

Golem’s compute‑sharing model shares the AI narrative with larger assets like Bitcoin. If you’re considering a position in the original cryptocurrency alongside small caps, our guide explains how to invest in Bitcoin in the UK.

Don’t invest unless you’re prepared to lose all the money you invest.

Highstreet (HIGH)

What Does the Project Do?

Highstreet blends e-commerce and gaming within a VR metaverse. It allows users to buy physical items as NFTs and experience them in-game, merging real-world shopping with virtual environments.

Current Market Cap and Price Trends

HIGH has a market cap of around $50.95 million. It’s prone to volatility but has benefited from the rebound of metaverse-focused narratives and Shopify-related integrations.

Why This Crypto Made the List

Highstreet combines commerce and gaming in a way few projects do. Its functional VR world, NFT marketplace, and early strategic partnerships make it a unique metaverse play worth watching.

Don’t invest unless you’re prepared to lose all the money you invest.

Quantstamp (QSP)

What Does the Project Do?

Quantstamp provides security audits for smart contracts and blockchain protocols. It aims to prevent costly bugs and exploits in decentralised applications by offering automated and manual code review services.

Current Market Cap and Price Trends

QSP’s market cap sits at around $13.3 million, reflecting its niche appeal. Though growth has been modest, its price responds well to increased DeFi and security-related activity.

Why This Crypto Made the List

Quantstamp addresses one of crypto’s biggest pain points: security. Its specialised utility, real client base, and regulatory alignment with audit standards make it a hidden gem in the low-cap space.

Don’t invest unless you’re prepared to lose all the money you invest.

ZetaChain (ZETA)

What Does the Project Do?

ZetaChain is a Layer 1 blockchain focused on cross-chain interoperability. It enables smart contracts that can access data and assets from any connected chain — even Bitcoin — without wrapping.

Current Market Cap and Price Trends

ZETA currently has a market cap of around $183 million. It gained momentum after its 2024 launch and remains actively traded due to its novel cross-chain architecture.

Why This Crypto Made the List

ZetaChain scored high for innovation and developer interest. Its native support for omnichain dApps sets it apart in a sector that continues to prioritise interoperability and scalability.

Cross‑chain tokens like ZETA are gaining attention alongside established altcoins. If you’re weighing up the best crypto to invest in right now, interoperability projects are worth serious consideration.

Don’t invest unless you’re prepared to lose all the money you invest.

Status Network (SNT)

What Does the Project Do?

Status is a private, decentralised messaging platform and crypto wallet. Built on Ethereum, it empowers users with censorship-resistant chat, secure crypto transactions, and dApp access in one mobile interface.

Current Market Cap and Price Trends

SNT’s market cap hovers around $41 million. It has remained under the radar but maintains an active development cycle and loyal community.

Why This Crypto Made the List

Status supports the Web3 ethos of privacy and user sovereignty. Its unique mobile-first approach and multi-functionality make it a valuable contender as decentralised communication grows.

Don’t invest unless you’re prepared to lose all the money you invest.

Ethernity Chain (ERN)

What Does the Project Do?

Ethernity Chain creates authenticated NFTs (aNFTs), collaborating with sports teams, brands, and celebrities to mint officially licensed digital collectibles.

Current Market Cap and Price Trends

ERN’s market cap is roughly $31.6 million. It spiked during NFT peaks but has since stabilised, with periodic resurgences tied to new drops or partnerships.

Why This Crypto Made the List

Its real-world brand integrations and licensed content differentiate ERN from other NFT plays. As NFTs mature, Ethernity is well-positioned for mainstream collector interest.

Don’t invest unless you’re prepared to lose all the money you invest.

Aioz Network (AIOZ)

What Does the Project Do?

Aioz is a decentralised content delivery network (dCDN), enabling users to share bandwidth and storage to power media streaming, file delivery, and decentralised apps.

Current Market Cap and Price Trends

AIOZ’s market cap is about $108 million, reflecting renewed attention to decentralised infrastructure. Price trends follow media/tech sentiment and CDN usage shifts.

Why This Crypto Made the List

Aioz taps into real-world demand for scalable streaming and content services. Its dCDN model, strong testnet performance, and live integrations make it a future-facing pick for Web3 infrastructure.

Decentralised infrastructure tokens like AIOZ can be paired with privacy‑focused banking. If your current bank restricts crypto purchases, our guide to the best crypto‑friendly banks in the UK can help you find a suitable alternative.

Don’t invest unless you’re prepared to lose all the money you invest.

How Did We Choose These Low Cap Gems?

What Is Our Project Scoring System?

We assessed each project based on real utility, active community engagement, roadmap clarity, team credibility, tokenomics, and market traction. Projects scoring highly across these criteria made the list, as they show strong fundamentals and genuine long-term potential beyond hype or speculation.

Why Do Market Cap and Growth Potential Matter?

Smaller‑cap cryptocurrencies offer significant upside during bull markets, as early entry can compound gains dramatically. While they carry greater risk, solid fundamentals combined with low valuations allow room for rapid price expansion—making them attractive for high‑reward, speculative portfolio additions.

What Are Low Cap Cryptos—and Why Do They Boom in Bull Markets?

What Are the Benefits of Small Cap Crypto Investing?

Early adoption of small‑cap projects can lead to outsized returns if the technology gains traction. These coins often fuel innovation and attract enthusiastic communities. If multiple success factors align—utility, partnerships, adoption—they can surge significantly during bullish cycles. If you’re exploring the wider altcoin market, our guide on where to buy altcoins covers the best platforms available to UK investors.

What Are the Risks and Volatility Factors?

Low‑cap projects often suffer from limited liquidity, making their prices prone to large swings. Weak development teams, unclear roadmaps, and susceptibility to pump‑and‑dump schemes increase risk. Smart investors must weigh volatility against potential reward and invest cautiously. Understanding whether Bitcoin is a good investment can help you benchmark risk across different market cap tiers.

What Are Examples from Past Bull Markets?

Several former low‑caps—like Ethereum in 2016 or Chainlink in 2017—surged dramatically during bull runs, transitioning into top crypto assets. Their growth illustrates how early-stage coins with real use cases and strong networks can transform into mainstream success stories over time. Today, Ethereum remains one of the most accessible large‑cap tokens — our guide explains how to buy Ethereum in the UK.

How Can You Buy Low Cap Cryptos in 2025?

- Choose a reliable exchange offering these tokens — the best crypto exchanges in the UK include Bitpanda, eToro, and Coinbase.

- Set up a secure non‑custodial wallet compatible with ERC‑20 or native chains. Our best crypto wallets UK guide covers the top options.

- Transfer funds, place limit or market orders cautiously. Compare crypto platforms with the lowest fees to minimise trading costs.

- Store major holdings offline in hardware wallets — see our Ledger vs Trezor comparison for the leading choices.

Final Thoughts – Are Low Cap Cryptos Worth It?

Low‑cap crypto investing can be highly rewarding—but only with careful research, robust risk management, and a readiness to absorb losses. They are speculative by nature. Allocate only what you’re prepared to lose, and balance them with more established assets for a safer portfolio. If you’re just getting started, our step‑by‑step guide on how to buy cryptocurrency walks you through the entire process.

Top 5 Exchanges

1

Bitpanda

Don’t invest unless you’re prepared to lose all the money you invest.

2

eToro

Investing in crypto carries a high level of risk.

3

Coinbase

Investing in crypto carries a high level of risk.

4

IG

Don’t invest unless you’re prepared to lose all the money you invest.

5

Uphold

Investing in crypto carries a high level of risk.

Get free stock worth up to $500 when you deposit and verify your account. The more you deposit, the bigger your bonus!

⚠️ Important: Only your first deposit counts toward bonus eligibility. Choose your stock from NVIDIA, Tesla, Microsoft, Netflix, or Vanguard ETFs during registration. Must hold for 90 days.

Don't invest unless you're prepared to lose all the money you invest. Not available for ISA deposits. New customers only. First deposit only. Minimum 90-day holding period. eToro fees apply – final bonus value may be lower. T&Cs apply.

Get a free $50 stock when you sign up, verify your account, and make your first deposit of just $50!

- Sign up for a new eToro account

- Verify your account with ID verification

- Deposit $50 to qualify for your free stock

- Choose your stock from 6 select assets: NVIDIA, Tesla, Microsoft, Netflix, or Vanguard ETFs (VOO, VEU)

- Your $50 free stock is credited automatically within 7 days

💡 Perfect For Beginners: Low barrier to entry with just a $50 deposit. Join 40M+ users worldwide and start building your portfolio with a free stock. Must hold for 90 days.

Don't invest unless you're prepared to lose all the money you invest. Not available for ISA deposits. New customers only. Minimum 90-day holding period. eToro fees apply. T&Cs apply.

Get FREE access to an exclusive trading course worth $2,000 when you sign up to eToro. Learn advanced trading strategies from industry experts!

- Advanced Trading Aspects – Professional-level course content

- CopyTrading Masterclass – Learn to follow top investors

- Multi-Asset Strategy – Stocks, ETFs, crypto, forex

- Risk Management – Protect your capital effectively

- Market Analysis Tools – Technical & fundamental analysis

- Portfolio Diversification – Build balanced investments

🎓 Perfect For: New traders looking to build a solid foundation, or experienced investors wanting to refine their strategy. Join 40M+ users worldwide on eToro's trusted platform. No deposit required!

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. New customers only. T&Cs apply.

FAQs

What Is Considered a Low Cap Crypto?

A low cap crypto typically has a market capitalisation under $300 million. These projects are early stage or niche, offering higher growth potential but also increased volatility and risk compared to mid or large-cap cryptocurrencies.

Can Low Cap Coins Really 10x?

Yes, it’s possible. Many low cap coins have delivered 10x or higher returns in past bull markets, especially when driven by new technology, strong narratives, or viral adoption. However, gains are never guaranteed and come with heightened risk.

Where Can I Buy Low Cap Gems Safely?

Bitpanda is one of the best options for buying low cap crypto safely — it’s FCA‑registered and offers a wide altcoin selection. Alternatively, platforms like eToro and Coinbase provide solid access. For users leaving centralised platforms, our best Binance alternatives UK guide covers the top regulated options. Always store long‑term holdings in a secure, non‑custodial wallet and verify token contract addresses carefully.

Are Low Cap Cryptos Riskier Than Large Cap Ones?

Yes. Low caps often lack liquidity, have smaller teams, and can be more easily manipulated. While they offer greater upside, they also carry a much higher chance of failure or price collapse. You can review the latest UK cryptocurrency statistics to understand how adoption and market trends affect different cap tiers. Diversification and proper research are essential.