How to Buy Tesla Shares in the UK

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder and of TIC. A passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management.My goal is to empower individuals to make informed investment decisions through informative and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please bear in mind that the value of investments can decrease in addition to increasing, which means there is a possibility of receiving an amount lower than your initial investment. It is generally advisable to retain your investments for a minimum of five years in order to maximize the likelihood of achieving your desired returns. Capital at risk.

Quick Answer: To Buy Tesla Shares, you'll need to:

- Choose a Platform: Select from our recommended share trading platforms for beginners.

- Open an Account: Sign up by providing personal information.

- Fund Your Account: Use bank transfer, debit, or credit card.

- Search for TSLA: Access stock information.

- Buy Shares: Execute a market or limit order.

Featured Broker

eToro - Best for Beginners

- Copy Trading

- Competitive Fees

- Diverse Asset Range

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

A Step-by-Step Detailed Guide on Investing in Tesla

Invest in Tesla, a leader in electric vehicles and sustainable energy. This guide provides a detailed approach to purchasing Tesla shares, suitable for investors using any trading platform. Tesla’s innovative business model and growth potential make it an attractive option for many investors.

Choosing the Right Trading Platform

Select a platform that suits your trading needs. Consider factors like user interface, fees, accessibility, and whether it supports the specific markets and stock exchanges where Tesla shares are traded. Platforms like Robinhood, TD Ameritrade, and Fidelity offer varied functionalities that cater to different investor needs, from beginners to experienced traders. Review each platform’s features, such as real-time data, trading tools, and educational resources, to make an informed decision.

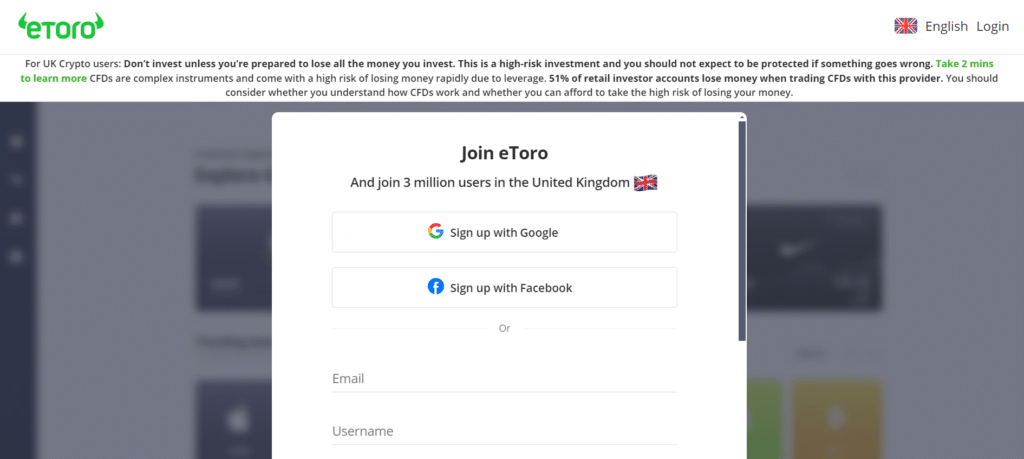

Registering and Setting Up Your Account

Create and set up your trading account. This involves registering with your chosen platform by providing personal information such as your name, address, and social security number, and setting up login credentials. The next step is verification, where you’ll need to provide identification documents like a passport or driver’s license. This is crucial for security and to comply with financial regulations.

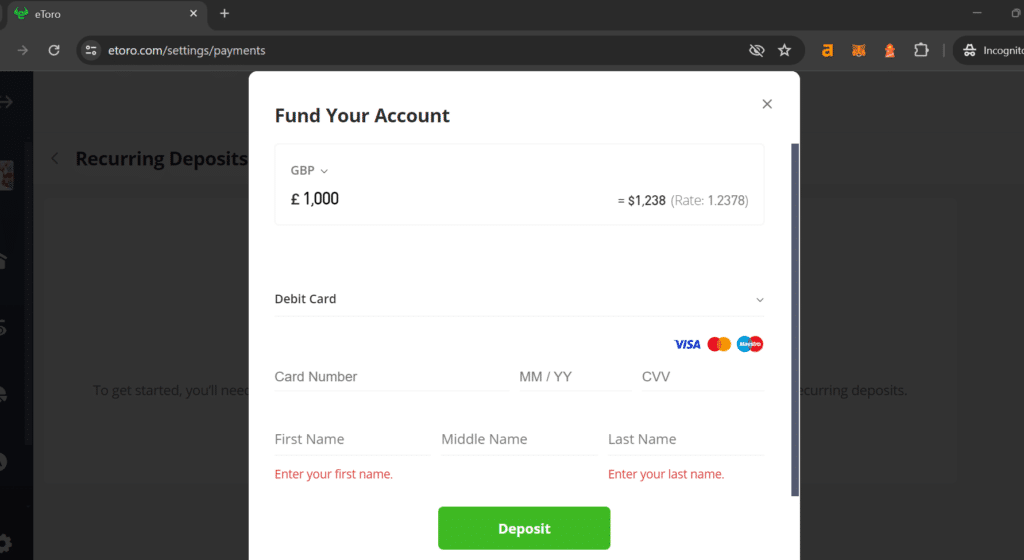

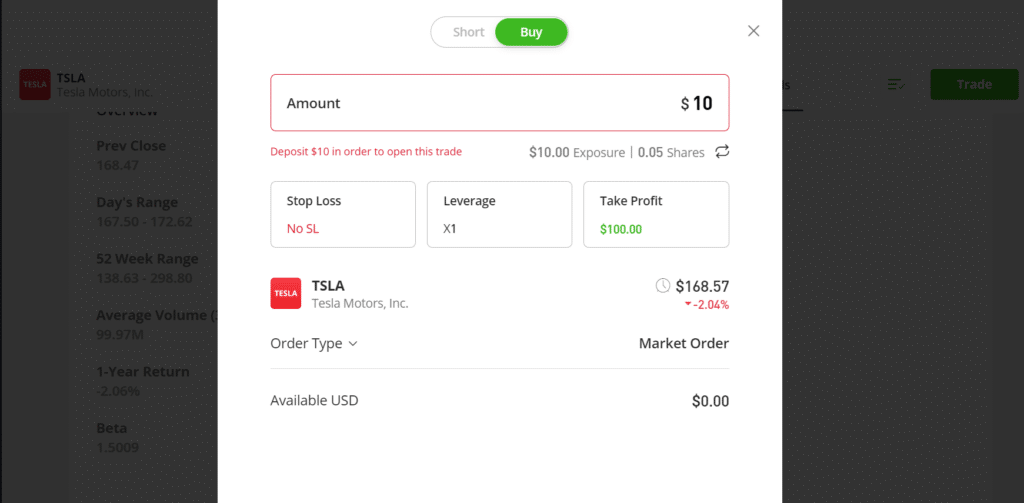

Funding Your Account

Deposit funds to start trading. Most platforms allow various funding methods, including bank transfers, debit cards, and electronic wallets. Check for minimum deposit requirements and processing times, which vary across platforms. It’s important to consider any fees associated with these transactions, as they can affect your investment budget.

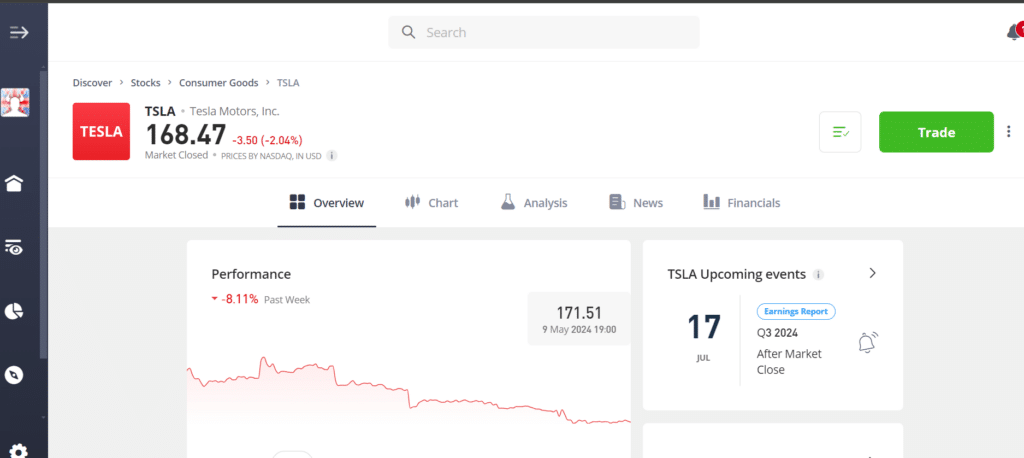

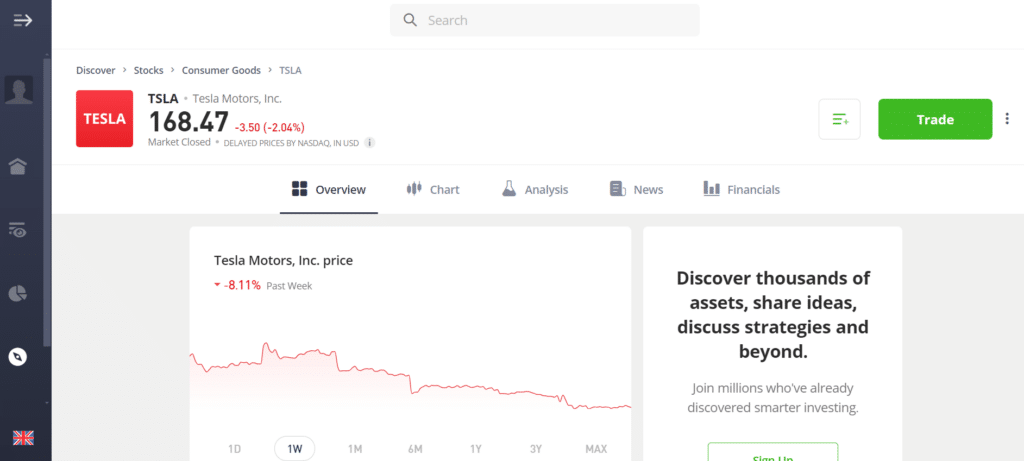

Searching for Tesla Shares

Navigate to the stock search feature on your platform. Enter “Tesla” or its stock ticker “TSLA” into the search bar. Access Tesla’s stock page to view current pricing, trading volumes, and additional stock information. Familiarize yourself with the platform’s layout and tools to monitor stock performance and news updates effectively.

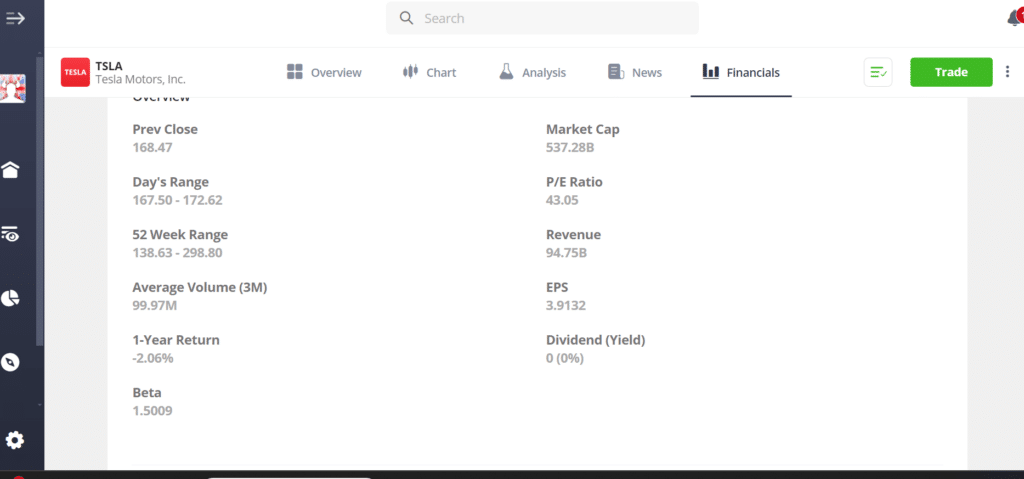

Researching Tesla Shares

Conduct thorough research before investing. Analyze Tesla’s past performance, read up on recent news and industry trends, and consider consulting financial analysts’ ratings. Many platforms offer tools for technical analysis and real-time news feeds to aid in your research. Make an informed decision based on your financial goals and risk tolerance.

Buying Tesla Shares

Purchase shares through your platform. Decide on the number of shares you want to buy and choose between a market order (buy at the current price) or a limit order (buy at a predetermined lower price). Review your order, confirm the details, and execute the purchase. Monitor your investment to make adjustments as needed based on market conditions and your investment strategy.

Where to Buy Tesla Shares

eToro – Best Overall Platform

Pros

Cons

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

- Social trading capabilities: eToro is a leader in social trading, allowing users to copy trades of successful investors, which is great for beginners.

- Wide range of assets: Offers trading in a broad array of assets including stocks, cryptocurrencies, forex, and commodities.

- Regulatory compliance: eToro is heavily regulated, which offers a high level of security and peace of mind for investors.

- Withdrawal fees: eToro charges a flat fee for withdrawals, which can be a downside for those moving small amounts of money.

- Spreads can be high: The spread fees on eToro can be higher than some other platforms, particularly for cryptocurrencies and less common assets.

- Complex fee structure: The pricing structure can be complex and may be confusing for new traders, especially when dealing with CFDs.

Your capital is at risk.

Pros and Cons

- Extensive Stock Market Access: IG offers access to over 12,000 global stocks, allowing investors to buy shares from major exchanges worldwide.

- Advanced Research Tools: The platform provides sophisticated research and analysis tools, including real-time data and technical indicators, helping investors make informed stock purchase decisions.

- Low Commission Rates: IG offers competitive commission rates for stock trading, reducing the cost of buying shares.

- Educational Resources: IG provides a wide range of educational materials, such as tutorials and market analysis, supporting investors in improving their stock trading skills.

- Complex Interface for Beginners: The platform’s advanced features and tools may be difficult for novice stock investors to navigate, leading to a steeper learning curve.

- Inactivity Fees: IG charges an inactivity fee if there are no trades for a certain period, which could be a drawback for those who buy and hold stocks infrequently.

- High Minimum Deposit: The platform requires a higher minimum deposit compared to some competitors, which might deter new investors from getting started.

What is Tesla?

Tesla, Inc. is an American electric vehicle (EV) and clean energy company founded in 2003 by a group including Elon Musk, JB Straubel, Martin Eberhard, Marc Tarpenning, and Ian Wright. The company is based in Austin, Texas, and its mission is to accelerate the world’s transition to sustainable energy. Tesla is best known for its electric cars, but its product line also includes battery energy storage from home to grid-scale, solar panels, and solar roof tiles.

Tesla’s Impact on the Automotive Industry

Tesla has significantly impacted the automotive industry by proving that electric vehicles can be desirable and commercially viable. Tesla’s Model S, launched in 2012, was a turning point in the acceptance of electric cars, combining high performance with luxury and innovative technology, such as autopilot features. The company’s approach to software updates, direct sales, and emphasis on sustainability have set new standards in the automotive industry.

Tesla’s Energy Products

Beyond vehicles, Tesla’s energy products aim to reduce global reliance on fossil fuels. The company manufactures the Powerwall, a home battery storage device that stores electricity for residential use, backup power, and load-shifting. Tesla’s larger-scale battery products, Powerpack and Megapack, are designed for commercial and utility-scale projects, helping businesses and energy providers increase renewable energy consumption and enhance grid reliability. Tesla also produces solar products, including solar panels and Solar Roof, which integrate seamlessly into a home’s design to generate renewable energy.

Is Tesla a Good Investment?

Investing in Tesla, Inc. involves evaluating both its market performance and its potential for future growth within the electric vehicle and renewable energy industries. Here are some considerations to determine if Tesla is a good investment for you.

Market Performance

Tesla’s stock has shown impressive growth, especially evident during significant market rallies. The company has become one of the most valuable car manufacturers globally by market capitalization, despite producing a fraction of the vehicles that traditional carmakers do. Tesla’s aggressive growth strategy, ambitious production targets, and its expansion into new markets and technologies continue to attract investor interest.

Innovation and Industry Leadership

Tesla is at the forefront of innovation in both the automotive and energy sectors. With its continuous improvements in battery technology, electric powertrains, and autonomous driving capabilities, Tesla maintains a competitive edge. The company’s commitment to innovation not only in electric vehicles but also in energy storage solutions positions it well within the rapidly growing renewable energy market.

Volatility and Risks

Tesla’s stock is known for its volatility, influenced by market trends, regulatory news, and Elon Musk’s public statements. Potential investors should be prepared for significant swings in stock price, which are common. Additionally, Tesla faces intense competition as traditional automakers ramp up their electric vehicle offerings.

Environmental Impact and Sustainability Goals

For investors prioritizing sustainability, Tesla’s focus on reducing dependency on fossil fuels aligns with a broader global shift towards environmental responsibility. Investing in Tesla can be seen not only as a financial decision but also as a support for sustainable technology development. This aspect can be particularly appealing to ESG (Environmental, Social, and Governance) investors.

In conclusion, whether Tesla is a good investment depends on your financial goals, risk tolerance, and investment timeframe. It’s essential to conduct thorough research and consider both the potential rewards and risks associated with Tesla’s ambitious but sometimes unpredictable business model.

What are the Risks of Buying Tesla Shares?

Investing in Tesla shares, like any investment in individual stocks, carries certain risks that should be considered before making a decision. Below are some specific risks associated with investing in Tesla.

Market Volatility

Tesla’s stock is known for its high volatility. The price can swing widely based on market conditions, investor sentiment, and external factors like changes in government policies affecting electric vehicles. This volatility can be driven by news about the company, fluctuations in the automotive and technology sectors, or tweets and public statements by CEO Elon Musk, which have historically impacted the stock price.

Competitive Industry

The electric vehicle (EV) industry is becoming increasingly competitive as more traditional automakers introduce their own EVs. Companies like Ford, Volkswagen, and General Motors are investing heavily in electric technology and may leverage their existing manufacturing capabilities and customer base to compete directly with Tesla. This increasing competition could impact Tesla’s market share and profitability.

Production Challenges

Tesla has faced challenges in scaling up production to meet demand without compromising quality. These include issues like production bottlenecks, supply chain disruptions, and quality control problems with new models. Any delays or problems in manufacturing can affect company revenues and the stock price.

Regulatory and Legal Risks

Tesla operates in a highly regulated industry, where changes in government policies regarding electric vehicles, renewable energy, and autonomous driving technology can significantly impact its business. Additionally, Tesla has been involved in several high-profile legal issues, including investigations by regulatory bodies, which could pose financial and reputational risks.

Considering these factors, potential investors should weigh these risks against their personal investment goals and risk tolerance. It’s important to have a diversified investment portfolio to mitigate potential losses from any single investment, including Tesla.

References

FAQs

Before investing in Tesla, consider the company’s market position, financial health, and growth potential in the electric vehicle and renewable energy sectors. Also, assess external factors such as competitive market landscape, regulatory environment, and technological advancements. Your own financial goals and risk tolerance are crucial in deciding whether Tesla fits into your investment portfolio.

Tesla is unique in the automotive sector due to its focus on electric vehicles and high rate of innovation. While it doesn’t produce as many vehicles as traditional automakers, its market capitalization has often surpassed those of established players due to its growth potential and investor enthusiasm for renewable technologies. However, its stock tends to be more volatile than those of traditional automakers.

Yes, Tesla can be considered a strong candidate for ESG (Environmental, Social, and Governance) investors due to its commitment to reducing reliance on fossil fuels and advancing sustainable energy solutions. However, investors should also consider the company’s corporate governance and social practices when evaluating its overall ESG impact.

Short-term investments in Tesla can be risky due to the stock’s high volatility. Price swings can be prompted by various factors, including media reports, technological breakthroughs, and Elon Musk’s public statements. Short-term traders need to be prepared for potentially significant fluctuations in stock value.

To invest in Tesla, you’ll first need to open a brokerage account if you don’t already have one. Once your account is set up and funded, you can buy Tesla shares through the trading platform provided by your broker. It’s advisable to start with thorough research and consider starting with a smaller investment to mitigate risk, especially if you are new to the stock market.

Related Articles

Capital at Risk.