How to Buy Litecoin in the UK

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please keep in mind that Crypto assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Quick Answer: How to Buy Litecoin?

To buy Litecoin, you can sign up for an account on a cryptocurrency exchange such as OKX, which offers a variety of cryptocurrencies including Litecoin (LTC). Once registered, you can deposit funds using your preferred payment method, search for Litecoin on the platform, and proceed to buy LTC by placing a buy order.

Introduction to Buying Litecoin in the UK

Litecoin, often referred to as “Bitcoin’s gold,” has been gaining traction as one of the most popular cryptocurrencies in recent times. If you’re from the UK and wondering how to buy Litecoin UK specifically, you’re not alone. Many investors are eager to dive into the world of crypto, especially with the surge in Litecoin’s market cap and its promise as a reliable digital asset. This guide will walk you through the step by step guide to making your purchase and ensuring your investment is safe and sound.

Page Contents:

Litecoin Exchange Comparison Table

Cryptocurrencies Available | 4.7/5 | 4/5 | 4.7/5 | 4.3/5 | 4.8/5 |

User Experience | 4.1/5 | 4.3/5 | 4.3/5 | 4.5/5 | 4.1/5 |

Fees | 4.4/5 | 3.7/5 | 4.2/5 | 3.5/5 | 4.6/5 |

Mobile App | 4.5/5 | 4.2/5 | 4.4/5 | 4.4/5 | 4.3/5 |

Community | 4.2/5 | 4.6/5 | 4.1/5 | 3.9/5 | 4.45 |

Staking | 4.4/5 | 3.9/5 | 4.2/5 | 4.0/5 | 4.9/5 |

Transparency | 4.3/5 | 4.8/5 | 4.5/5 | 4.2/5 | 4/5 |

Advanced Trading Tools | 4.6/5 | 4.7/5 | 4.4/5 | 4.1/5 | 4.7/5 |

UK Accessibility | 3.5/5 | 4.6/5 | 4.3/5 | 3.9/5 | 4.0/5 |

Overall Review Score | 4.35/5 | 4.7/5 | 4.3/5 | 4.1/5 | 4.5/5 |

Where to Buy Litecoin in the UK 2024?

Pros

Cons

- User-Friendly Interface: Easy navigation for traders of all levels.

- Diverse Cryptocurrency Selection: Offers a wide array of digital assets for portfolio diversification.

- Social Trading Features: Enables interaction and trade mirroring.

- Regulated Platform: Operates in compliance with regulatory standards.

- Educational Resources: Provides learning materials for informed decision-making.

- Limited Cryptocurrency Offerings: Some desired coins may not be available for trading.

- Higher Fees: Fees may exceed those of competitors.

- Geographical Restrictions: Availability varies depending on location.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

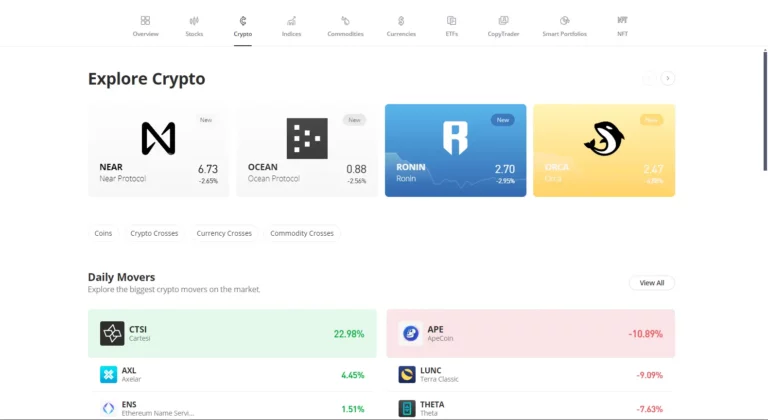

OKX - Best Exchange Overall

OKX Exchange, established in 2017 and headquartered in Seychelles, is a dynamic player in the global cryptocurrency market, offering a wide array of trading options and advanced security measures.

Pros

Cons

- Over 300 Cryptocurrencies Available

- Advanced Trading Tools: Such as real-time charts, technical analysis tools & more.

- High Liquidity

- Robust Security Protocols

- Highly Functional Mobile App

- Competitive Fee Structure: Loyalty and higher volume trading rewarded

- Global Compliance and KYC Standards

- DeFi OKX Wallet

- Limited Services for UK Users: Restrictions on services like Derivatives, OKX Earn, and Crypto Loans in the UK market.

- Higher Fees for Low-Volume Traders: The tiered fee structure may be less favourable for users with lower trading volumes.

- Credit & Debit Card Purchase Fees Higher fees compared the bank transfers.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Coinbase - Best for Beginners

Coinbase is renowned for its user-friendly interface, making it an ideal choice for beginners entering the cryptocurrency space. It also offers a robust security framework and a wide range of cryptocurrencies, ensuring a secure and diverse trading experience.

Pros

Cons

- User-Friendly Interface: Ideal for beginners, with an intuitive design that simplifies navigating the crypto market.

- Strong Security Measures: Includes two-factor authentication and insurance against security breaches.

- Wide Range of Cryptocurrencies

- Educational Resources

- Reputation and Trust: Well-established in the industry with a strong track record and regulatory compliance.

- Staking Options: Enables users to earn rewards by staking certain cryptocurrencies.

- Reliable Mobile App

- Higher Fees for Some Transactions: Can be more expensive compared to other exchanges, especially for small transactions.

- Limited Advanced Trading Features: May not cater to the needs of advanced traders seeking complex trading tools.

- Bank Withdrawal Restrictions: Sometimes faces delays or limitations on large bank withdrawals.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

CoinJar - Easiest to Use

CoinJar is celebrated for its simplicity and ease of use, making it an excellent choice for those new to cryptocurrency trading. It offers a streamlined interface and a straightforward fee structure, catering well to casual investors and beginners.

Pros

Cons

- User-Friendly Interface

- Simple Fee Structure Transparent and uncomplicated fees, making it easy for users to understand their costs.

- Mobile App Efficiency

- Fiat Currency Support

- Speedy Transactions

- Bundled Investments: Provides a unique feature of bundled cryptocurrency investments for diversification.

- Limited Cryptocurrency Selection: Offers fewer cryptocurrencies compared to larger exchanges.

- Higher Fees for Convenience: While user-friendly, fees can be higher compared to more complex platforms.

- Limited Advanced Features: Not as feature-rich for experienced traders looking for advanced trading tools.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Understanding Litecoin: Bitcoin's Silver to Bitcoin's Gold

Litecoin (often denoted as LTC) was created by Charlie Lee, a former Google engineer. While Bitcoin has widely been accepted as digital gold, Litecoin has been dubbed as “Bitcoin’s silver.” The primary reason for this comparison is due to the simpler algorithm that Litecoin employs, allowing for faster and low cost payments.

Buying Litecoin means investing in a crypto that’s suited for everyday transactions compared to other cryptocurrencies. Whether you’re looking to invest, trade, or use it for daily expenses, understanding the past performance and potential future results can help you make an informed decision about adding Litecoin or other crypto to your digital assets portfolio.

Setting Up Your Litecoin Wallet: Securing Your Investment

Before you proceed to buy Litecoin or buy LTC, it’s crucial to have a secure place to store your coins. This is where a Litecoin wallet comes into play. A wallet is essentially a digital tool that allows you to manage your crypto.

There are several types of wallets available for Litecoin LTC, such as:

Hardware wallets: These are physical devices that store your private keys offline. They are considered one of the most secure options because they are immune to online hacks. Examples include cold storage devices and USB-type wallets.

Paper wallets: These are physical documents that contain your private key and public addresses. It’s vital to keep them safe from physical damage or theft.

Digital or Crypto Wallets: These are software-based, and they store your private keys on your device or online. They’re suitable for those who engage in frequent cryptocurrency transactions but require good security practices.

Remember, losing access to your wallet means you lose your Litecoin. Hence, always backup and ensure you have multiple copies of your private keys in secure locations. If you’re planning to make large purchases, consider splitting your LTC between a cold wallet for savings and a mobile or desktop wallet for everyday transactions.

Choosing the Right Cryptocurrency Exchange: Where to Buy Litecoin LTC in the UK

To buy Litecoin in the UK, the most common method is through a cryptocurrency exchange. Not all exchanges are created equal, and selecting the right one is pivotal for a smooth purchase experience and ensuring your funds’ security.

When considering an exchange, focus on the following:

Fees

Every exchange will have transaction fees associated with buying and selling. It’s essential to find a balance between low fees and platform reliability.

Payment Method

Different exchanges offer varied payment options, including bank transfer, debit card, credit, and cash deposits. Choose an exchange that aligns with your preferred payment method.

Security

Ensure the platform implements strong security measures. Look for features like two-factor authentication, withdrawal whitelist, and cold storage for funds. Check if they are covered under the Financial Services Compensation Scheme, which can offer additional peace of mind.

User Experience

Especially for beginners, a straightforward and intuitive interface can make the buying Litecoin process much smoother. Some exchanges cater more to experienced traders with advanced charting tools, while others are more beginner-friendly.

Trading Volume

An exchange with a high trading volume for Litecoin LTC indicates a lot of trading activity, which can offer better price accuracy and liquidity.

Bank Account Integration

Some platforms allow direct bank linkage, streamlining the purchase Litecoin process.

Once you’ve selected an exchange and set up an account, you can deposit your fiat currency, such as GBP, and proceed to buy Litecoin LTC. Many platforms offer both market and limit orders, enabling you to buy at the current price or set your purchase price.

Alternative Methods to Acquire Litecoin in the UK

While cryptocurrency exchanges are the most common platforms for buying Litecoin, they aren’t the only options. Several alternative methods cater to different preferences and needs. Here’s a closer look:

Peer-to-Peer (P2P) Trading

This method involves buying Litecoin directly from another person. Platforms that facilitate P2P trading often use an escrow service to hold the LTC until the payment has been verified. The purchase price is typically agreed upon between the buyer and seller.

Litecoin ATMs

Similar to regular ATMs, Litecoin ATMs allow you to buy LTC using cash. Insert your cash, provide your Litecoin wallet address, and the LTC will be transferred to you. Remember to factor in the ATM fees and ensure the current price offered is competitive.

Using a Debit or Credit Card

Some platforms, apart from traditional exchanges, allow users to buy Litecoin using their debit card or credit. While this method offers convenience, it might come with higher transaction fees.

Bank Transfers

Some services specialize in facilitating Litecoin purchases solely through bank transfers. These services might offer better rates or low fees, especially for larger amounts.

Over-the-Counter (OTC) Services

Ideal for those looking to buy or sell large amounts of Litecoin, OTC services offer a more personalized trading experience. These services connect big buyers with big sellers, ensuring large trades don’t drastically move the market price.

Each method has its pros and cons. Consider factors like fees, price, security, and convenience before deciding which method best suits your buy Litecoin needs in the UK.

Safe Storage and Management of Litecoin Assets

Once you’ve made the decision to buy Litecoin and have successfully acquired some, the next vital step is ensuring your crypto is stored securely. Here’s how to manage and keep your Litecoin safe:

Understanding Private Keys

At the heart of every crypto wallet is a private key. This alphanumeric code gives you access to your Litecoin and allows you to authorize transactions. Never share your private keys with anyone, and store them securely. Loss of your private key can mean loss of your Litecoin.

Cold vs. Hot Storage

Cold Storage: This refers to storing your crypto offline, away from internet access. Methods include hardware wallets, paper wallets, and cold wallets. They’re considered the safest options as they’re resistant to online hacking attempts.

Hot Storage: These are wallets connected to the internet, like mobile, desktop, or online wallets. They’re convenient for regular transactions but are susceptible to cyber threats.

Backup, Backup, Backup: Ensure you have multiple backups of your wallet and private keys. For physical backups like paper wallets, consider using a safe deposit box or a home safe.

Updates & Security

Regularly update your wallet software to benefit from the latest security patches. Use strong, unique passwords and consider using two-factor authentication (2FA) for added protection.

Beware of Phishing & Scams

Always double-check website URLs, especially of crypto exchanges or wallet providers. Be wary of unsolicited communication asking for your credentials or private keys.

Is Litecoin Safe?

It’s not just about the safety of the asset but also how you manage and store it. While Litecoin is a secure cryptocurrency, the safety of your investment largely depends on how you handle and store it.

Remember, while Litecoin and other cryptocurrencies present opportunities for growth, always be informed and cautious. The investment world has its risks, and past performance doesn’t guarantee future results.

The Tax Implications of Buying Litecoin in the UK

As with any financial transaction, buying Litecoin in the UK may have tax implications that you should be aware of. While cryptocurrency tax regulations can be complex and subject to change, it’s essential to understand the basics:

Capital Gains Tax (CGT): In the UK, CGT may apply when you sell or exchange Litecoin for a profit. You are allowed an annual tax-free allowance (known as the Annual Exempt Amount), and any gains above this threshold are subject to CGT. Keep records of your crypto transactions to calculate your tax liability accurately.

Income Tax: If you’re mining Litecoin or receiving it as payment for goods or services, it may be considered income and subject to income tax. The exact rules can vary depending on your specific circumstances, so it’s advisable to consult a tax professional.

Trading and VAT: Trading cryptocurrencies is generally exempt from Value Added Tax (VAT) in the UK. However, if you provide goods or services in exchange for Litecoin, VAT may apply as it would in regular fiat currency transactions.

Reporting and Compliance: HM Revenue and Customs (HMRC) in the UK has issued guidance on how to report your cryptocurrency transactions for tax purposes. It’s crucial to stay compliant with tax regulations and accurately report your crypto activities.

Remember that tax regulations can change, and it’s essential to keep yourself informed about the latest developments. Consulting with a tax professional who specializes in cryptocurrency can provide you with personalized advice and ensure you meet your tax obligations.

Conclusion & Final Thoughts on Buying Litecoin in the UK

In conclusion, buying Litecoin in the UK can be a rewarding venture, offering exposure to the world of cryptocurrencies and the potential for long-term investment growth. Here are some key takeaways to keep in mind:

Security: Prioritize the safety of your Litecoin assets by using secure wallets, keeping backups of your private keys, and being vigilant about potential scams.

Diversification: While Litecoin may be a part of your investment portfolio, consider diversifying across other cryptocurrencies and traditional assets like stocks and fiat currencies to spread risk.

Tax Considerations: Stay informed about the tax implications of your crypto transactions and ensure compliance with UK tax regulations.

Stay Informed: The cryptocurrency market is dynamic, and staying informed about market conditions, current prices, and news developments can help you make informed decisions.

Seek Professional Advice: If you’re uncertain about any aspect of buying Litecoin or managing your cryptocurrency investments, consider seeking advice from financial professionals or tax experts.

Remember that investing in cryptocurrencies carries inherent risks, and past performance is not indicative of future results. It’s crucial to conduct thorough research, manage your investments wisely, and only invest what you can afford to lose.

FAQs

A: The amount of Litecoin you should purchase depends on your investment strategy and how much you’re willing to allocate towards this digital currency. It’s recommended to start small and only invest what you can afford to lose.

A: For storing Litecoin, both hardware and software crypto wallets work well. Hardware wallets are more secure as they store your Litecoin offline, while software wallets provide convenience for easy access and trading.

A: As with any investment, there are risks involved. However, Litecoin is one of the more established digital currencies with a track record of stability and is widely supported by various trading platforms.

A: Trading Litecoin, like any form of trading, carries risk, and it should not be relied upon as a primary source of income, especially for those who are not professional traders. It’s important to gain experience and understand market trends before considering trading Litecoin as a significant income stream.

Exchanges in the UK typically charge a trading fee, withdrawal fees per trading fee, and sometimes deposit fees and withdrawal fees. The specific amounts per trading fee can vary between platforms.

Featured Blogs

Who Created This Content: This guide was authored by Thomas Drury is an experienced financial trader in leverage intruments, crypto and general investing.

He has over a decade experience in finance and holds Chartered Status in the financial industry, Thomas’s specialty is trading CFDs, Forex and Day Trading.

His crypto portfolio is heavily weighted towards BTC and Eth, but enjoys trading low cap crypto’s with higher volatility. Thomas’s favourite trading strategy is break out Trading.

How This Content Was Created: Our assessment of the purchasing Litecoin in the United Kingdom is rooted in rigorous research and firsthand experience. Here’s our methodology:

Platform Testing: We actively tested multiple platforms over a span of six months, analysing their functionalities, ease of use, and reliability.

Fee Analysis: Each platform’s fee structure was dissected to ascertain its competitiveness in the market.

User Feedback: We engaged with real users and considered their reviews and experiences, lending a holistic perspective to our evaluation.

Market Dynamics: Regular updates from industry news, changing regulations, and market dynamics ensure the guide remains current and reliable.

AI-Assistance: While human judgment and expertise are at the core of our assessments, we utilized AI tools to improve structure, critique our work.

Note: Our use of AI tools is strictly for data gathering and content assistance. All conclusions drawn and recommendations made are based on human analysis and judgment.

Why This Content Was Created: Our primary objective in creating this guide is to empower traders, both seasoned and novices, with impartial, comprehensive, and actionable information to make informed decisions.

We understand the complexity of the stock trading world and aim to simplify it for our readers.

While we hope our content is discoverable by those seeking insights, our main priority is to provide genuine value to our visitors.

We staunchly oppose content creation practices that manipulate search rankings or violate any standards of integrity.

Our #1 Recommended Trading Platform in the UK - Including Crypto

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.