Quick Answer: To Buy Amazon Inc. Shares You Will Need To:

- Choose a reputable broker

- Open and fund your account

- Search for the ticker AMZN

- Place a buy order

- Confirm and monitor your investment

Introduction

Amazon (AMZN) is one of the world’s largest and most influential companies, renowned for its e-commerce dominance, cloud computing services (AWS), and diverse business ventures. For UK investors, buying Amazon shares presents an opportunity to invest in a tech giant with substantial growth potential.

Over the past decade, Amazon’s stock has shown impressive performance, driven by its continuous innovation and market expansion. Recent trends, such as increased online shopping and cloud service adoption, further boost Amazon’s growth prospects. This guide aims to help UK investors navigate the process of buying Amazon shares, ensuring they make informed decisions based on current market conditions and investment goals.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be construed as financial or investment advice. Investing in stocks, including Amazon (AMZN), involves risks, and it is possible to lose some or all of your investment.

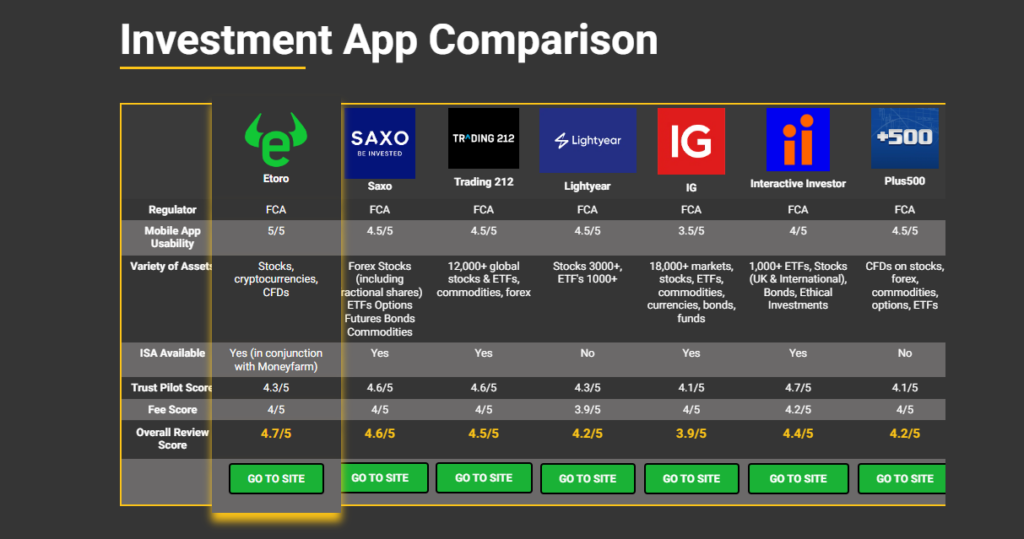

Step 1: Select a Broker

Choosing the right broker is crucial for a smooth investment experience. Look for brokers that offer competitive fees, user-friendly platforms, and strong regulatory compliance. Some popular brokers in the UK include Hargreaves Lansdown, Interactive Investor, and eToro. Each of these brokers provides various features suitable for different investor needs. Ensure the broker is FCA-regulated, offers access to US markets, and has a reliable customer support system. Comparing fees and services can help you select the best broker for your Amazon share purchases.

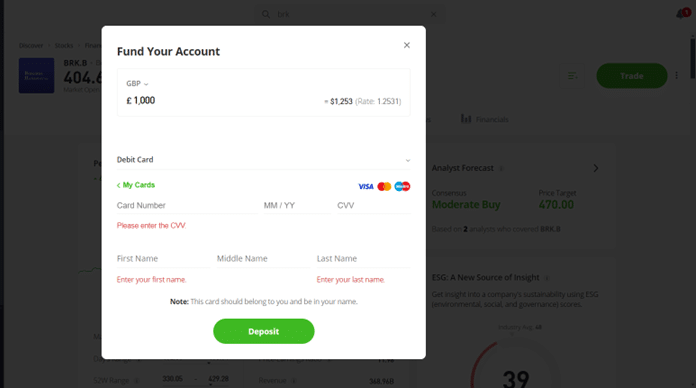

Step 2: Open and Fund Your Account

Opening a brokerage account involves providing personal information, including your name, address, and identification documents. This process typically takes a few days, depending on the broker’s requirements. Once your account is set up, you need to fund it. This can be done via bank transfer, debit card, or other payment methods accepted by your broker. Ensure you deposit sufficient funds to cover the purchase of Amazon shares and any associated fees.

Step 3: Find Ticker

To buy Amazon shares, you need to locate its ticker symbol, AMZN, on your broker’s platform. Most brokers have a search function where you can enter the company’s name or ticker symbol. Ensure you select Amazon Inc. and verify the stock details to avoid purchasing the wrong security. This step is crucial to ensure your investment is accurately placed.

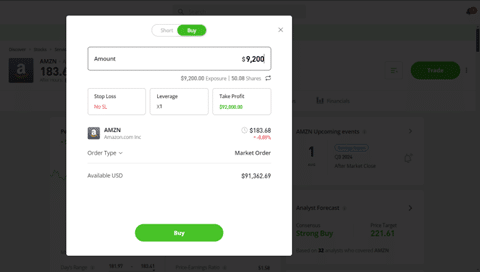

Step 4: Place Buy Order

When placing a buy order, you can choose between different order types, such as market orders or limit orders. A market order buys the shares at the current market price, while a limit order allows you to specify the price you are willing to pay. Carefully review the order details before submitting to avoid any mistakes. Understanding the differences between order types can help you execute your investment strategy effectively.

Step 5: Confirm and Monitor

After placing your order, confirm the transaction through your broker’s platform. Monitoring your investment is essential to track its performance and make informed decisions. Use the tools and resources provided by your broker to analyse stock performance, set alerts, and review any relevant news or market trends affecting Amazon. Regular monitoring helps you stay informed and adjust your strategy as needed.

Where to Trade Amazon Inc. Shares

Best for Beginners - Etoro

- 5,000+ Tradable assets

- Beginner friendly platform

- Copy trading feature

Your capital is at risk.

Best for Intermediates - Saxo

- 71,000 Trading instruments

- Advanced tools, research & expert tips

- Fees lowered in 2024

Your capital is at risk.

Etoro is an excellent choice for beginners due to its user-friendly interface and extensive educational resources. The platform offers a social trading feature, allowing users to follow and copy experienced traders. Additionally, Etoro provides a wealth of tutorials, webinars, and articles designed to help novice investors understand the basics of trading and investing. Its commission-free trading structure also makes it a cost-effective option for those just starting out.

Saxo is a great choice for intermediate investors, offering advanced tools and comprehensive research resources. The platform provides access to a wide range of markets and financial instruments, including stocks, bonds, ETFs, and derivatives. Saxo’s sophisticated trading tools, such as advanced charting and risk management features, cater to more experienced traders looking to execute complex strategies. Additionally, Saxo offers detailed market analysis and insights, helping investors make informed decisions.

AvaTrade

- Diverse Trading Options

- Educational Resources

Capital at risk.

Trading 212

- Commission-Free Trading

- User-Friendly Interface

Capital at risk.

What is the Cheapest Way to Buy Amazon Inc. Shares?

To buy Amazon shares cost-effectively, compare broker fees and look for any available discounts or promotions. Some brokers, like Etoro, offer commission-free trading, which can significantly reduce costs. It’s also wise to consider brokers that provide fractional shares, allowing you to invest smaller amounts without having to purchase a full share. Another strategy is to use brokers that offer low foreign exchange fees, as Amazon shares are traded in USD. Regularly reviewing and comparing brokers’ fee structures can help you find the most economical option for your investments.

Pros and Cons of Investing in Super Micro Computer, Inc (SMCI) Shares

Pros

- Strong growth potential

- Market dominance in e-commerce and cloud computing

- Diverse revenue streams

- Consistent innovation and expansion

- Strong financial performance

Cons

- High valuation

- Market volatility

- Regulatory risks

- Competitive pressures

- Dependency on key personnel

How to Sell Amazon Inc. Shares

To sell Amazon shares, follow these steps:

- Log in to your brokerage account.

- Locate your Amazon holdings.

- Choose the type of sell order (market or limit).

- Enter the number of shares you wish to sell.

- Review and submit the order. Consider the timing of your sell order to maximize returns and be aware of potential tax implications. Capital gains tax may apply, so consult with a tax advisor to understand your liabilities.

Buying Amazon Stock vs Shares?

Buying Amazon shares and stock essentially refer to the same investment, as both terms represent ownership in Amazon Inc. However, “shares” typically refer to the individual units of ownership, while “stock” is a more general term describing your equity stake in the company. Whether you buy shares or stock, you are purchasing a portion of Amazon Inc., entitling you to potential dividends, voting rights, and a share of the company’s growth and profits. The key distinction lies in the context and terminology used, not in the nature of the investment itself.

How to Invest in AMZN via a Fund

Investing in Amazon through mutual funds or ETFs allows for diversified exposure to the company without purchasing individual shares. These funds pool investors’ money to buy a range of stocks, including Amazon, spreading risk across multiple assets. This approach can be more cost-effective and less volatile, ideal for those seeking a balanced investment strategy. Mutual funds and ETFs often come with professional management and lower individual transaction costs, making them accessible for both beginners and experienced investors.

Which Funds Contain AMZN Stock?

Popular funds that hold Amazon stock include:

- Vanguard S&P 500 ETF (VOO)

- Fidelity Contrafund (FCNTX)

- iShares Core S&P 500 ETF (IVV)

Is Amazon Inc. Stock Over-Valued?

Amazon’s valuation metrics indicate a high price-to-earnings (P/E) ratio compared to industry averages, suggesting a premium valuation. Experts have mixed opinions; some believe Amazon’s continuous growth and market dominance justify its valuation, while others caution about potential overvaluation risks. Factors like future earnings potential, market expansion, and innovation in areas such as cloud computing and AI support bullish perspectives. Conversely, economic uncertainties and increased competition raise concerns about sustaining such high valuations. Investors should consider both optimistic growth forecasts and potential headwinds when evaluating Amazon’s stock price.

Risks of Buying Amazon Stock

Investing in Amazon stock comes with several risks. Market risk affects all stocks and can lead to significant price fluctuations. Amazon’s high valuation poses a risk if the company’s growth fails to meet expectations, potentially resulting in sharp declines. Regulatory risks are significant, as increased government scrutiny could impact operations and profitability. Additionally, intense competition from other tech giants and market sectors can affect Amazon’s market share and earnings. Investors should carefully evaluate these risks and consider diversifying their portfolios to mitigate potential losses.

Important Note: Always refer to the latest information and specific instructions directly from the relevant platform. These platforms might update their processes or requirements over time.

Conclusion

Investing in Amazon shares offers significant growth potential due to the company’s market leadership and continuous innovation. However, investors should carefully consider the high valuation, potential market volatility, and regulatory risks. Selecting a reputable broker, understanding order types, and monitoring investments are crucial steps in the investment process. Diversifying through funds or ETFs can also balance risk and reward. By conducting thorough research and staying informed about market trends, investors can make well-informed decisions regarding Amazon shares.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

UK investors may be subject to capital gains tax (CGT) on profits from selling Amazon shares. Additionally, dividend income is subject to dividend tax. It’s advisable to consult a tax professional for personalized advice and to stay updated on tax regulations.

No, Amazon does not currently pay dividends to its shareholders. The company reinvests its profits into business growth and expansion, focusing on long-term value creation rather than immediate dividend payouts.

Since Amazon shares are traded in USD, UK investors face currency exchange risks. Fluctuations in the GBP/USD exchange rate can impact the value of your investment and returns. It’s important to monitor exchange rates and consider this risk when investing.

Yes, many UK brokers offer access to US markets, allowing you to buy Amazon shares. Ensure the broker is FCA-regulated and provides a platform that supports trading in international stocks, including those listed on US exchanges.

UK residents need a brokerage account with access to US markets, which typically involves providing identification and financial information for regulatory compliance. Additionally, it’s important to understand and comply with both UK and US tax obligations related to foreign investments.

Gain Access to Our #1 Recommended Investment Platform in the UK

Your capital is at risk.

References

Berkshire Hathaway Inc. – Official Website

Yahoo Finance – Berkshire Hathaway Inc. (BRK.A and BRK.B) Stock Prices and Financial Information