Quick Summary

- Automate Your Investing: Mimic the trades of experienced traders, saving time on research and analysis.

- Learn from the Pros: Gain valuable insights by observing successful traders’ strategies.

- Diversify Your Portfolio: Gain exposure to various assets and sectors through copied traders’ portfolios.

Important Considerations:

- Past Performance Isn’t a Guarantee: Research thoroughly; historical results don’t predict future success.

- Manage Risk Wisely: Understand copied traders’ risk tolerance and utilize stop-loss orders.

- Fees Apply: Standard trading fees apply to each executed trade within your copied portfolio.

What is Copy Trading?

Imagine having a team of investment gurus constantly monitoring the market and making winning trades for you. That’s the basic idea behind copy trading. It allows you to automatically replicate the investment decisions of experienced traders.

Think of it like following a recipe for financial success. You start copying an investor with a track record you admire, and their investment “recipe” (the assets they buy and sell) gets applied to your own portfolio, proportionally based on your available funds.

This approach can be particularly appealing to new investors who might feel overwhelmed by the complexities of the financial markets. By copying experienced traders, you gain exposure to potentially lucrative strategies and learn from their expertise in a hands-off way. It’s like having a mentor guiding your investment journey without the need for constant, active management on your part.

How Does eToro Copy Trading Work on a technical level?

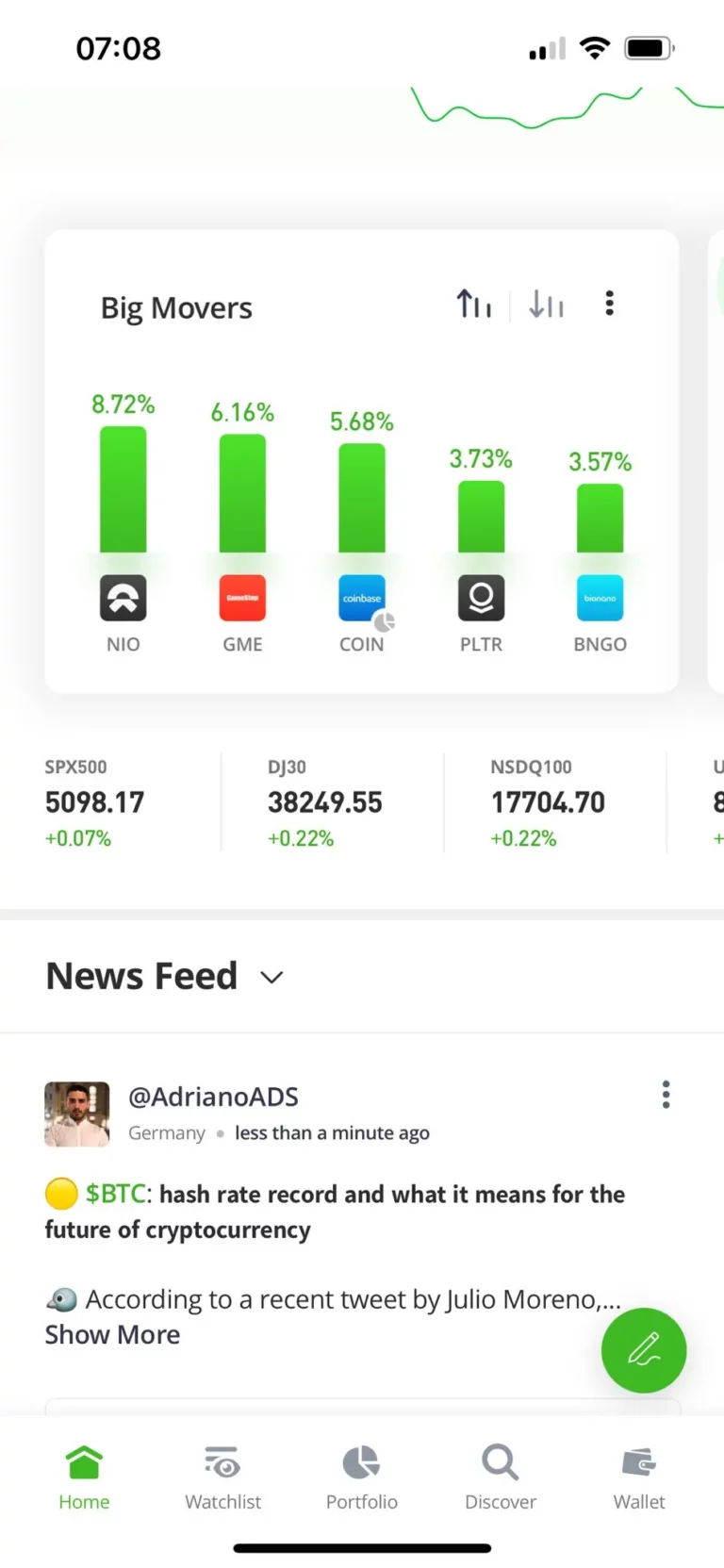

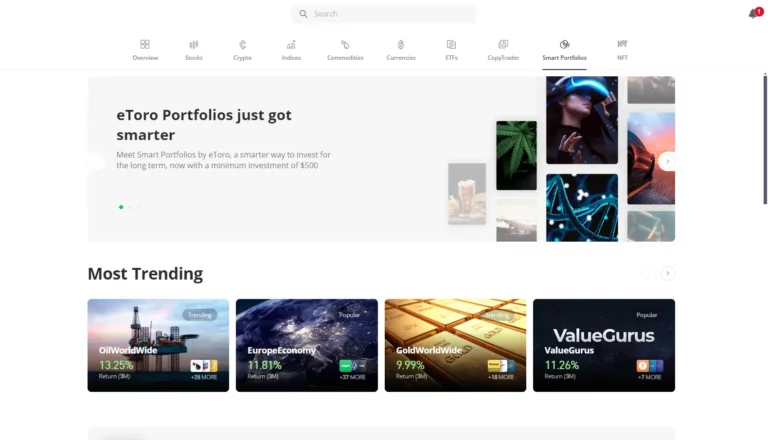

Finding the perfect trader to copy is crucial for your eToro copy trading experience. Here’s how to navigate the Trader Marketplace:

Performance vs. Risk: Don’t just chase the highest returns. Analyze the trader’s risk tolerance and investment style. Do they align with your goals?

Track Record & Consistency: Look beyond short-term gains. Consistent performance over a longer period is a better indicator of skill.

Diversification: Consider copying multiple traders with different strategies to spread your risk and exposure to various market sectors.

Setting Up Your Copy

Once you’ve chosen your trader, eToro makes setting up your copy trade a breeze:

Browse the Trader Marketplace: Find your chosen trader.

Review Statistics & Performance: Analyze their risk profile, strategy, and track record.

Set Investment Amount: Decide how much capital to allocate to copying this trader.

Click “Copy”: Activate the CopyTrader™ feature and eToro will automatically mirror the trader’s portfolio adjustments in your account.

Additionally, users have the option to ‘remove funds’ that have not been invested, moving them back to their available cash.

Managing Your Copied Portfolio

While copy trading automates some aspects, staying informed is crucial:

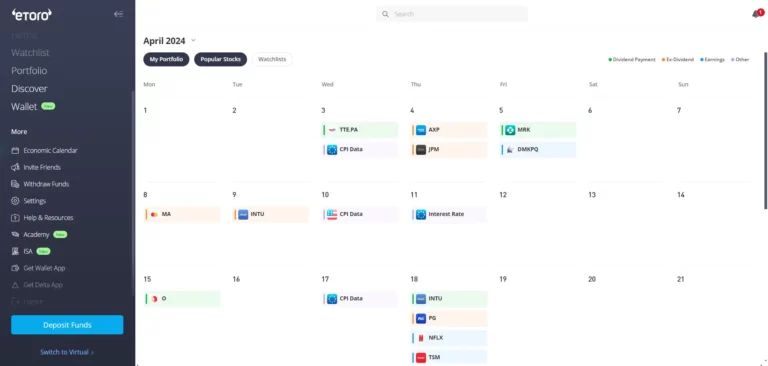

Monitor Performance: Track your copied portfolio’s performance alongside the copied trader.

Understand the “Why” Behind Trades: While eToro provides some insights, research the rationale behind the copied trader’s decisions to gain valuable knowledge.

Adjustments & Risk Management: You can pause or stop copying at any time. Utilize stop-loss orders to manage risk within your copied positions.

Important Considerations:

Past performance is not indicative of future results. Copying a trader with a strong historical track record doesn’t guarantee success.

Stay engaged and monitor your copied portfolio regularly. Don’t blindly follow the copied trader. Understand their strategy and adjust your investment approach as needed.

Copy trading carries inherent risks. You’ll experience the same level of risk and potential reward as the copied trader, including the use of margin and leverage if applicable.

Selecting a Trader to Copy

Finding the perfect trader to copy is crucial for your eToro copy trading experience. Here’s how to navigate the Trader Marketplace:

- Performance vs. Risk: Don’t just chase the highest returns. Analyze the trader’s risk tolerance and investment style. Do they align with your goals?

- Track Record & Consistency: Look beyond short-term gains. Consistent performance over a longer period is a better indicator of skill.

- Diversification: Consider copying multiple traders with different strategies to spread your risk and exposure to various market sectors.

Setting Up Your Copy

Once you’ve chosen your trader, eToro makes setting up your copy trade a breeze:

- Browse the Trader Marketplace: Find your chosen trader.

- Review Statistics & Performance: Analyze their risk profile, strategy, and track record.

- Set Investment Amount: Decide how much capital to allocate to copying this trader.

- Click “Copy”: Activate the CopyTrader™ feature and eToro will automatically mirror the trader’s portfolio adjustments in your account.

- Additionally, users have the option to ‘remove funds’ that have not been invested, moving them back to their available cash.

Managing Your Copied Portfolio

While copy trading automates some aspects, staying informed is crucial:

Monitor Performance: Track your copied portfolio’s performance alongside the copied trader.

Understand the “Why” Behind Trades: While eToro provides some insights, research the rationale behind the copied trader’s decisions to gain valuable knowledge.

Adjustments & Risk Management: You can pause or stop copying at any time. Utilize stop-loss orders to manage risk within your copied positions.

Benefits of Copy Trade on eToro

Copy trading on eToro offers several advantages that can be particularly appealing to new investors or those seeking a more hands-off approach:

Automate Your Investing

Imagine delegating your investment decisions to a team of seasoned professionals. With copy trading, you can do just that. By mimicking the trades of experienced traders, you automate your investment strategy and save valuable time on researching and analyzing the market. This allows you to focus on other aspects of your life while your portfolio potentially grows alongside the copied trader’s.

Learn from Experienced Traders

Even the most dedicated research can’t replace real-world experience. Copy trading provides a unique opportunity to learn from successful traders in a practical way. By observing their portfolio allocations, asset selections, and trading strategies, you gain valuable insights that can enhance your overall investment knowledge. Over time, you can develop your own investment skills and potentially become more confident in making independent decisions.

Diversify Your Portfolio

Diversification is a cornerstone of any sound investment strategy. Copy trading allows you to gain exposure to a variety of assets and sectors through the copied trader’s portfolio. This can help mitigate risk by reducing the impact of any single asset’s performance on your overall portfolio health. Additionally, you can diversify further by copying multiple traders with different investment styles, creating a more balanced and potentially more resilient investment portfolio.

Things to Consider Before Copy Trading on eToro

While copy trading offers attractive benefits, there are important factors to consider before diving in:

Past Performance is not a Guarantee of Future Results

A common pitfall for new investors is chasing past returns. Just because a trader has a stellar historical track record doesn’t guarantee future success. Market conditions can change rapidly, and strategies that worked in the past might not translate well to the present or future.

Focus on a trader’s overall approach, risk management practices, and consistency over a longer period. Don’t be swayed solely by impressive short-term gains.

Risk Management and Stop-Loss Orders

Copy trading inherits the risk profile of the copied trader. If they utilize leverage or engage in high-risk strategies, your portfolio will be exposed to those same risks.

Always understand the copied trader’s risk tolerance and investment style. Utilize stop-loss orders within your copied positions to manage risk and potentially minimize potential losses. Remember, you can also pause or stop copying a trader at any time.

Fees Associated with Copy Trading

There are no additional fees specifically for using eToro’s copy trading feature (CopyTrader™). However, standard trading fees apply to each trade executed within your copied portfolio. These fees can vary depending on the asset being traded.

Conclusion: Is Copy Trading on eToro Right for You?

Copy trading on eToro can be a valuable tool, particularly for new investors or those seeking a more automated approach. It offers benefits like automation, potential for learning from experienced traders, and diversification opportunities. However, it’s crucial to understand the limitations and potential risks involved.

Here’s a quick checklist to help you decide if copy trading on eToro aligns with your investment goals:

Do you have a limited amount of time for active investment management?

Are you comfortable with a hands-off approach and delegating some investment decisions?

Do you have a moderate risk tolerance and understand that past performance doesn’t guarantee future results?

Are you willing to conduct thorough research and select traders whose strategies align with your goals?

If you answered yes to most of these questions, copy trading could be a viable option for you. However, if you have a very low-risk tolerance, limited investment experience, or prefer a more hands-on approach, alternative investment strategies might be more suitable.

Remember, copy trading is a tool, and like any tool, it requires responsible use.

Key Takeaways

- Copy trading on eToro lets you automate your investing by mimicking experienced traders.

- Benefits include saving time, learning from pros, and potentially diversifying your portfolio.

- Crucial to understand the risks: past performance isn’t guaranteed, manage risk with stop-loss orders, and fees apply.

- Carefully research and choose traders whose strategies align with your goals and risk tolerance.

- Copy trading is a tool; use it responsibly with thorough research and a well-defined investment strategy.

Copy trading does not amount to investment advice. Your investments may go up or down.

Your capital is at risk.

Frequently Asked Questions

Here are some frequently asked questions about eToro’s copy trading platform (CopyTrader™):

Who can Use Copy Trading on eToro?

Copy trading on eToro is generally accessible to most users who meet the platform’s eligibility requirements. These can vary depending on your location and regulations. It’s important to check eToro’s website for specific requirements in your country.

What is the Minimum Investment Amount for Copy Trading?

The minimum investment amount required to copy a trader on eToro is currently $200. However, there’s also a minimum trade amount of $1. This means that if the copied trader makes a trade for an amount smaller than $1 for your proportional allocation, that specific trade won’t be mirrored in your account.

Consider the minimums when determining how much capital to allocate to copying a particular trader.

Does eToro Guarantee Profits with Copy Trading?

No, eToro does not guarantee profits with copy trading.

The performance of your copied portfolio will directly reflect the performance of the copied trader. There is inherent risk involved in any form of investing, and copy trading is no exception.

It’s crucial to remember that past performance is not indicative of future results. Conduct thorough research and choose traders whose strategies align with your goals and risk tolerance.

What Happens When a Copied Trader Closes a Position?

When a copied trader closes a position, your corresponding copied position will also be closed automatically. This ensures your portfolio remains aligned with the copied trader’s strategy.

Can I Copy Multiple Traders on eToro?

Yes, you can copy multiple traders on eToro. This can be a great way to diversify your portfolio and gain exposure to various investment approaches. However, it’s important to carefully manage the number of traders you copy and ensure their strategies don’t conflict or create excessive risk.

Gain Access to Our #1 Recommended Investment Platform in the UK

Copy trading does not amount to investment advice. Your investments may go up or down. Your capital is at risk.

More From eToro

References

eToro CopyTrader™ Platform Guide: https://www.etoro.com/copytrader/ (Official eToro guide on CopyTrader™)