Quick Answer: How to Buy TSMC Stock?

To invest in Intuitive Surgical AI, follow these streamlined steps:

- Research: Dive into Intuitive Surgical’s market performance, technological advancements, and potential for growth. Focus on evaluating financial indicators and the impact of AI innovations in surgery.

- Investment Decision: Determine the investment amount by assessing your financial situation and investment objectives.

- Broker Selection: Choose a brokerage offering NASDAQ access, where Intuitive Surgical is traded. Consider the brokerage fees, platform usability, and services offered.

- Account Setup and Funding: Create an account with your selected broker, complete the necessary verifications, and deposit your investment capital.

- Purchase Shares: Find Intuitive Surgical by its ticker symbol ISRG, check the latest stock price, and buy shares according to your investment strategy.

Make sure this investment complements your overall portfolio strategy, and stay updated on industry and market trends to guide your investment decisions.

Trading 212 is a fintech company that offers a user-friendly, accessible platform for trading in a wide variety of financial instruments including stocks, Forex, commodities, and more. Known for its commission-free trades and minimal fees, Trading 212 makes investing accessible to both novice and experienced traders. Its intuitive app and web platform provide a seamless trading experience, featuring real-time market data, analysis tools, and educational resources to help users make informed trading decisions. Trading 212 has grown to become a popular choice among traders looking for an efficient and cost-effective way to invest in the global markets.

TIC Trading 212 Score 4.5/5

Use code TIC to get a free share worth up to £100

Understanding Intuitive Surgical

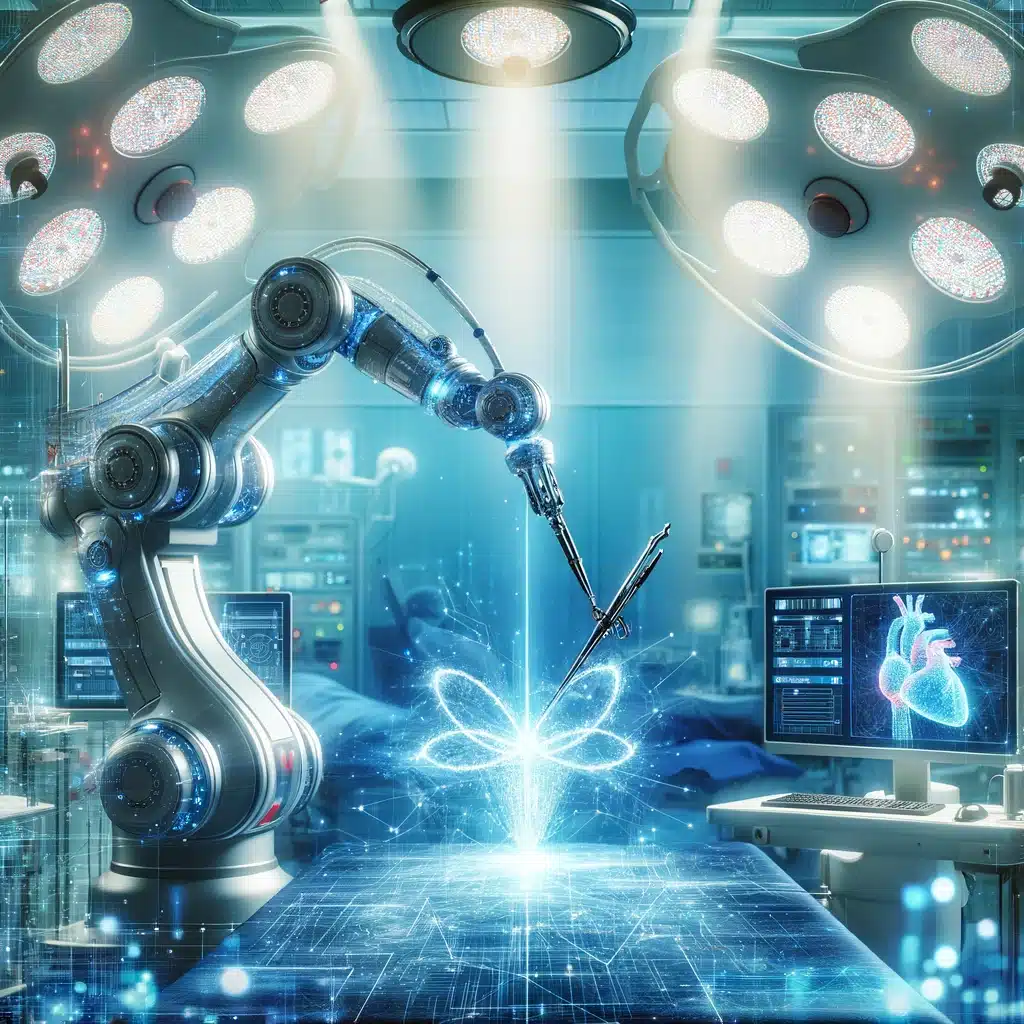

Intuitive Surgical Inc., the mastermind behind the pioneering da Vinci Surgical Systems, has set the standard for robotic-assisted, minimally invasive surgery. This innovative company’s technology is a game-changer in the medical field, allowing for precision and flexibility that traditional surgical approaches can’t match. The da Vinci Surgical System, the cornerstone of Intuitive Surgical’s offering, has been instrumental in advancing minimally invasive surgery across various medical disciplines, making surgeries less daunting for patients and more precise for surgeons.

The company’s technology enables physicians to perform delicate and complex procedures through tiny incisions, which translates to less patient trauma, reduced hospital stays, and quicker recovery times. This leap in surgical technology is not just about improving surgical outcomes; it’s also about revolutionizing patient care, positioning Intuitive Surgical at the forefront of healthcare innovation.

With a robust portfolio that extends beyond the da Vinci systems to include the Ion Endoluminal System, designed for performing minimally invasive biopsies, Intuitive Surgical demonstrates its capacity for diversification within the medical instruments sector. These advancements are central to the company’s growth, underscoring its commitment to developing technologies that push the boundaries of minimally invasive care.

The Case for Buying Intuitive Surgical Stock

Why buy Intuitive Surgical stock? The answer lies in the company’s relentless pursuit of innovation, its dominant market position, and the increasing global demand for minimally invasive surgeries. As healthcare providers continue to seek out surgical solutions that offer better outcomes with lower risks, Intuitive Surgical’s da Vinci Surgical Systems and related services find themselves in a growing market with expanding opportunities.

The financial health of Intuitive Surgical is another compelling reason for investors. With a market cap that mirrors its leading role in the healthcare technology sector, the company boasts a strong financial foundation characterized by robust earnings per share (EPS) growth and a high gross margin. These financial metrics are indicative of Intuitive Surgical’s efficient operations, profitable business model, and the high demand for its minimally invasive surgical solutions.

Intuitive Surgical’s stock performance has garnered attention from investors and analysts alike, many of whom see the company as a strong buy. The stock’s liquidity, measured by its shares traded volume, and its price resilience reflect investor confidence and the company’s stable market position. Additionally, the continuous innovation and expansion into new clinical applications bolster the case for Intuitive Surgical as a valuable addition to investment portfolios.

Financial Performance and Market Presence

Intuitive Surgical’s stock price history offers a narrative of resilience and growth, appealing to investors looking for stability and potential in the healthcare sector. The company’s strategic initiatives, focused on enhancing its commercial offerings and expanding service agreements, have cultivated a recurring revenue model that bolsters its financial stability and attractiveness to investors.

The global markets have been responsive to Intuitive Surgical’s advancements, with shares traded actively reflecting the investment community’s interest. Analysts closely watch the company’s share price movements, earnings projections, and market trends to provide investment advice and forecasts. This attention from the financial community underscores the significance of Intuitive Surgical in the investment landscape, particularly for those interested in the burgeoning field of medical technology.

Investment Considerations

Intuitive Surgical presents a nuanced investment profile that requires careful consideration of several factors. The price-to-earnings (P/E) ratio, analyst ratings, and stock price history are critical metrics for assessing the company’s valuation and growth potential. Investors should weigh these factors against the broader market risks, including regulatory changes, competition, and technology adoption rates among healthcare providers.

Investing in Intuitive Surgical, or any company for that matter, entails understanding the market dynamics and the company’s position within its industry. The healthcare sector, characterized by rapid technological advancements and stringent regulatory environments, presents unique challenges and opportunities for companies like Intuitive Surgical. Investors must navigate these waters carefully, balancing the potential for high returns with the inherent risks of the market.

How to Buy Intuitive Surgical Stock

For those considering an investment in Intuitive Surgical, the process begins with selecting a reputable brokerage account that offers access to NASDAQ, where ISRG shares are traded. Conducting thorough research is paramount, utilizing financial news, analysts’ reports, and investment advice to gauge the stock’s potential. Understanding market trends, the company’s performance, and the broader healthcare sector’s direction can inform investment decisions, helping investors determine the right time to buy shares.

Placing a market order or a limit order through your brokerage account allows you to specify the price point at which you’re willing to buy the stock, offering control over your investment. As with any investment, diversification is key. Including Intuitive Surgical in a portfolio alongside other stocks, bonds, and financial instruments can spread risk and enhance potential returns.

The Future of Intuitive Surgical

Looking ahead, Intuitive Surgical’s prospects appear bright, driven by its commitment to innovation, expansion into new markets, and the ongoing shift towards minimally invasive surgical procedures. The company’s development pipeline promises new technologies and applications that could further solidify its market dominance and disrupt the healthcare industry.

The adoption of da Vinci Surgical Systems by healthcare providers worldwide is a testament to the technology’s value and effectiveness. As Intuitive Surgical continues to develop and market products that meet the evolving needs of the medical community, its market cap and share price are expected to reflect the company’s growth trajectory and investment potential.

Innovations and Roadmap: Charting Intuitive Surgical's Future

Without the original header, I’m interpreting “header 11” as focusing on upcoming innovations, strategic initiatives, and the company’s vision for the future. Here is content that could fit such a header:

Intuitive Surgical, a beacon of innovation in the field of robotic-assisted surgery, continues to push the boundaries of what’s possible in minimally invasive procedures. The company’s roadmap is paved with ambitious plans to expand its technological repertoire, enhance surgical outcomes, and democratize access to advanced surgical care worldwide.

Advancing Surgical Precision

At the heart of Intuitive Surgical’s ongoing success is its commitment to continuously improving the da Vinci Surgical Systems. The company invests heavily in research and development to introduce new features, enhance system capabilities, and improve the intuitiveness of its robotic platforms. This dedication ensures that surgeons have access to the most advanced tools, enabling even greater surgical precision and patient safety.

Expanding Clinical Applications

Intuitive Surgical is not content with resting on its laurels. The company actively explores new clinical applications for its technology, venturing beyond its established domains into areas where robotic assistance could revolutionize patient care. By conducting rigorous clinical trials and collaborating closely with medical professionals, Intuitive Surgical aims to unlock new possibilities in surgery, from complex cardiac procedures to delicate pediatric operations.

Global Accessibility and Training

Understanding that innovation is most impactful when widely accessible, Intuitive Surgical is committed to expanding its global footprint. This includes not just selling systems in new markets but also ensuring that surgeons around the world are proficient in using its technology. To this end, the company has ramped up its efforts in providing comprehensive training programs, online learning modules, and simulation-based learning environments. These initiatives are crucial in building a global community of skilled practitioners who can leverage the da Vinci systems to the fullest.

Sustainability and Ethical Innovation

As Intuitive Surgical looks to the future, it also recognizes the importance of sustainability and ethical considerations in its operations and innovations. The company is increasingly focused on reducing the environmental impact of its products and operations, ensuring that its contributions to healthcare are not just revolutionary but also responsible. This commitment extends to ethical considerations in the deployment of its technology, ensuring equitable access and addressing disparities in healthcare outcomes.

Collaborative Partnerships for Broader Impact

Recognizing the power of collaboration, Intuitive Surgical actively seeks partnerships with healthcare institutions, academic centers, and technology companies. These collaborations are aimed at accelerating the pace of innovation, sharing knowledge and best practices, and integrating complementary technologies to enhance the capabilities of the da Vinci systems. Through these partnerships, Intuitive Surgical aims to create a more interconnected ecosystem of surgical care, where technology and human expertise combine to improve patient outcomes on a global scale.

As Intuitive Surgical charts its course into the future, it remains steadfast in its mission to transform surgery through innovation, training, and accessibility. With a clear vision and a roadmap geared towards expanding the impact of robotic-assisted surgery, the company is poised to continue its leadership in the field, improving the lives of patients around the world while pushing the boundaries of medical technology.

Final Thoughts on Investment

Intuitive Surgical represents a compelling investment opportunity, particularly for those intrigued by the intersection of technology and healthcare. With its innovative surgical systems, a proven track record of financial performance, and a strong market presence, Intuitive Surgical is well-positioned for continued growth and success.

Investors interested in Intuitive Surgical should conduct comprehensive research, consider the market’s volatility, and seek professional investment advice. As the healthcare landscape continues to evolve, Intuitive Surgical’s innovations and contributions are likely to remain at the forefront, offering investors a stake in the future of medical technology and patient care.

In conclusion, Intuitive Surgical stands as a beacon of innovation and growth in the healthcare sector. With its pioneering technology, robust financials, and strategic market positioning, Intuitive Surgical offers a promising investment opportunity for those looking to capitalize on the advancements in minimally invasive surgery. As always, potential investors should approach this opportunity with diligence, informed by thorough research and a clear understanding of their investment goals and risk tolerance.

References

Intuitive Surgical AI Homepage – Intuitive Surgical AI

How to Invest in Intuitive Surgical – Finder.com

Intuitive Surgical Inc. – Market Watch

FAQs

Intuitive Surgical AI refers to the artificial intelligence innovations used in Intuitive Surgical’s robotic-assisted surgical systems, like the da Vinci systems. These technologies enhance surgical precision, efficiency, and outcomes. Investing in Intuitive Surgical AI is attractive due to the company’s leading position in the rapidly growing field of robotic-assisted surgery, continuous innovation, and expansion into new surgical applications.

To purchase Intuitive Surgical AI shares from the UK, you’ll need to open a brokerage account with a platform that offers access to US stocks, as Intuitive Surgical is listed on the NASDAQ. Look for brokers that support international trading and compare their fees, exchange rates, and services. Once your account is set up and funded, you can search for Intuitive Surgical’s ticker (ISRG) and place a buy order.

Yes, international investors should be aware of currency exchange risk, as fluctuations in the GBP/USD exchange rate can affect the sterling value of your investment. Additionally, there are market risks associated with the healthcare and technology sectors, including regulatory changes and competition. It’s important to research and consider these factors thoroughly before investing.

Diversification is a key strategy; consider balancing your portfolio across different sectors and geographies to mitigate risk. Keeping an eye on long-term trends in healthcare technology and robotic surgery can also guide your investment decisions. Monitoring the company’s performance, including earnings reports and industry developments, will help you make informed decisions about when to buy, hold, or sell.

Yes, UK investors can hold US stocks like Intuitive Surgical AI in tax-efficient accounts such as a Stocks and Shares ISA or a Self-Invested Personal Pension (SIPP), subject to the specific rules and limits of those accounts. This can offer tax advantages on dividends and capital gains. However, not all brokerage platforms offer the ability to include international stocks in these accounts, so you’ll need to confirm this capability with your broker.