Quick Summary

Bitcoin: A decentralized digital currency introduced in 2009 by the pseudonymous Satoshi Nakamoto. It operates without a central bank, with transactions verified via cryptography on a public ledger called the blockchain.

Bitcoin Mining: Essential for creating new Bitcoins and validating transactions. Miners solve complex mathematical problems; successful solutions allow them to add blocks to the blockchain and earn new Bitcoins. Over time, the technology for mining (like ASICs and GPU rigs) has evolved, becoming more energy-intensive.

Energy Consumption: Bitcoin mining is energy-hungry, with its energy use comparable to entire countries like Argentina or the Netherlands. The more complex the mining puzzles become, the more power is required.

Environmental Impact: Bitcoin mining’s extensive energy use has significant carbon emissions, especially if powered by coal or other non-renewables. This contributes to global warming and other environmental issues.

E-Waste: The short lifespan of mining hardware due to constant technological advancements results in substantial electronic waste, which, if improperly disposed of, can harm the environment.

Key Mining Regions:

China: Formerly dominant, but banned cryptocurrency mining in 2021.

U.S. (especially Texas): Gained prominence after China’s crackdown due to favorable conditions.

Iceland: Known as a green mining hub due to its renewable energy sources.

Russia & Eastern Europe: Emerging players thanks to cold climates and affordable power.

Economic vs. Environmental: While Bitcoin mining offers economic benefits like job creation and investment opportunities, it poses severe environmental challenges, from massive energy use to carbon emissions and e-waste.

Greening Bitcoin: Solutions include transitioning to renewable energy, using energy-efficient consensus mechanisms like PoS, carbon offsetting, sustainable hardware, and global collaborative efforts. Some real-world examples of green practices include geothermal-powered mining farms in Iceland and Norway.

In essence, while Bitcoin presents transformative economic potential, its environmental challenges need urgent addressing. The key lies in finding a balance to harness its benefits while minimizing its ecological footprint.

As one of the largest and oldest Bitcoin exchanges in the world, Kraken is consistently named one of the best places to buy and sell crypto online, thanks to our excellent service, low fees, versatile funding options and rigorous security standards.“ Kraken.com

228 Cryptocurrencies

Over 9 Million Users

Top Trading Features for advanced traders – Low Spreads & High Liquidity

Capital at risk

Introduction to Bitcoin and its Global Rise

In the digital era, one name has continuously echoed louder than most when it comes to revolutionary financial change: Bitcoin. Born out of a desire to decentralize currency and give power back to the people, Bitcoin, a form of cryptocurrency, emerged in 2009 as the brainchild of an anonymous entity known as Satoshi Nakamoto.

So, what exactly is Bitcoin? At its core, Bitcoin is a decentralized digital currency, operating without a central bank or single administrator. Transactions occur directly between users, without intermediaries, and are verified through network nodes by cryptography. These transactions are then recorded on a public ledger called a blockchain. This decentralization offers a freedom that traditional currencies bound by regulatory bodies cannot.

In today’s dynamic financial ecosystem, Bitcoin’s relevance is ever-growing. Once brushed off as a fleeting trend, it has now cemented its position as a major player in global finance. With the increasing acceptance of digital currencies by businesses and investors alike, Bitcoin has not only demonstrated its potential to transform traditional financial systems but has also highlighted the necessity of understanding the technologies and infrastructures powering it. Now widely available through Crypto Exchanges like Kraken and Coinbase.

The rise of Bitcoin has brought with it undeniable economic opportunities. Yet, like all innovations, it comes with its set of challenges. As we delve deeper into its workings, especially the mining process, a pressing concern emerges about its environmental implications, stirring debates worldwide.

What is Bitcoin Mining?

Bitcoin mining is a fundamental component of the cryptocurrency’s infrastructure. It plays a pivotal role in the creation of new Bitcoins and the validation of transactions.

Bitcoin mining is a computational process where miners use powerful computers to solve complex mathematical problems. These problems, known as cryptographic puzzles, are essential for maintaining the security and integrity of the Bitcoin network. When these puzzles are successfully solved, the miner has the authority to add a new block to the blockchain. The blockchain serves as a decentralized ledger, documenting all Bitcoin transactions. As a reward for this service, miners receive newly minted Bitcoins. This incentive ensures the continuous operation, security, and update of the network.

Over time, the machinery used for Bitcoin mining has advanced to meet the increasing complexities of the cryptographic puzzles. Initially, standard desktop computers were adequate for mining purposes. However, as the puzzles’ intricacies grew, more robust equipment became necessary. Application-Specific Integrated Circuits (ASICs) were introduced, which are machines tailored exclusively for Bitcoin mining. They are designed to perform a specific computation with high efficiency. Alongside ASICs, GPU (Graphics Processing Unit) rigs have also been employed, using multiple graphics cards collectively to augment computational power. While these machines are highly effective, their significant energy consumption has led to growing environmental concerns.

Bitcoin mining is a vital process that ensures the cryptocurrency’s functionality and security. However, the technological demands of mining, particularly the energy requirements, have given rise to environmental challenges.

The Energy Consumption of Bitcoin Mining

One of the most significant concerns emerging from the rapid expansion of Bitcoin mining is its immense energy consumption. The sheer magnitude of electricity required by mining operations has placed Bitcoin’s energy use in the spotlight, raising pertinent questions about its environmental sustainability.

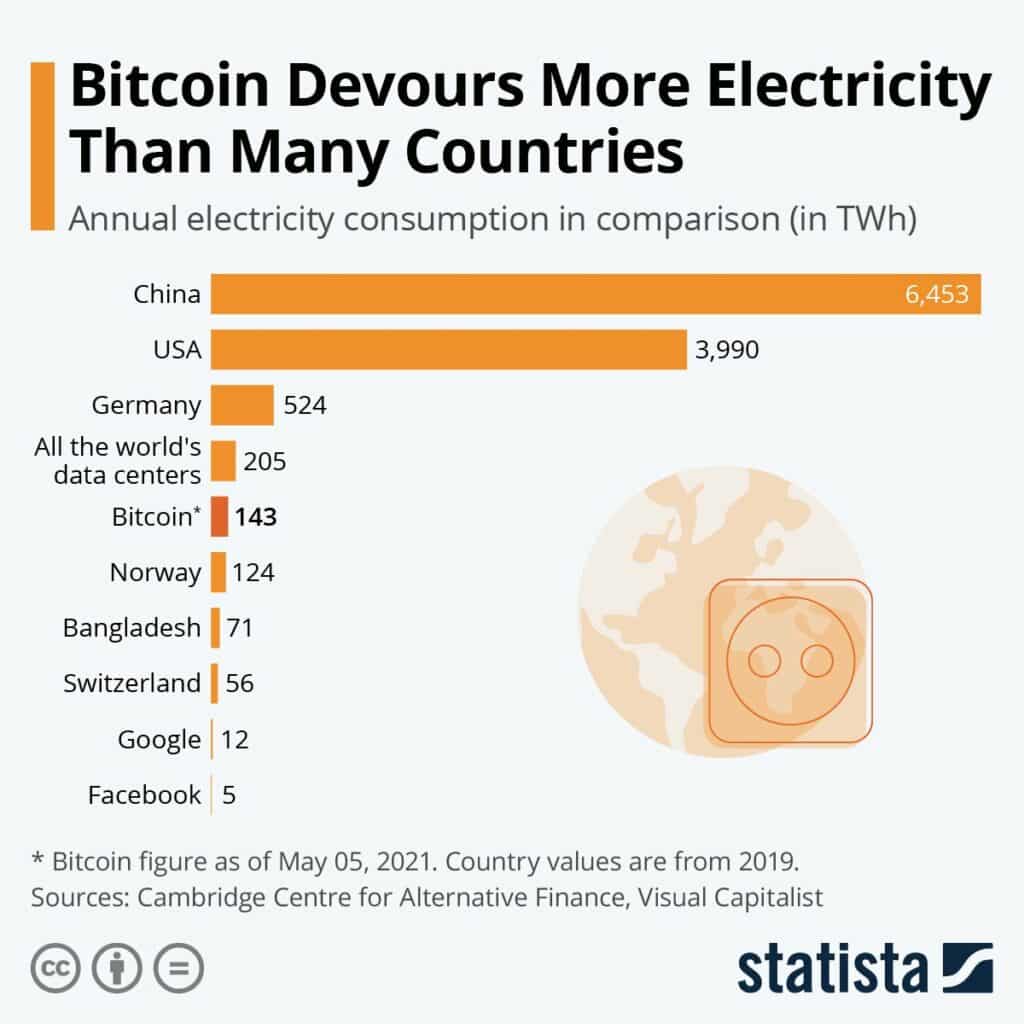

Comparing Bitcoin’s Energy Use to Countries and Industries: To put the scale of Bitcoin’s energy consumption into perspective, analysts have compared it to the energy usage of entire countries, see the below infographic from statista which provides a useful reference point. According to research, the Bitcoin network’s annual electricity consumption rivals or even surpasses that of medium-sized nations. For instance, as of recent data, Bitcoin’s energy consumption was akin to countries like Argentina or the Netherlands. When juxtaposed with various industries, the energy requirements of Bitcoin mining can often exceed those of traditional sectors, underlining the environmental challenges associated with its growth.

Highlighting the Intensity of Power Used in Mining Operations: The core reason behind this vast energy consumption lies in the nature of the mining process. Miners across the globe deploy powerful machinery, like ASICs and GPU rigs, in a race against time and competition to solve cryptographic puzzles. As the Bitcoin network has been designed to produce a new block every ten minutes, regardless of the number of miners, the puzzles’ complexity adjusts accordingly. This ensures the timeline remains consistent, but it also means that as more miners join the network, the computational challenges grow more demanding. To address these evolving complexities, mining operations are continually ramping up their computational power, resulting in the corresponding spike in electricity usage.

Comparing Bitcoin’s Energy Use to Countries and Industries: To put the scale of Bitcoin’s energy consumption into perspective, analysts have compared it to the energy usage of entire countries, see the below infographic from statista which provides a useful reference point. According to research, the Bitcoin network’s annual electricity consumption rivals or even surpasses that of medium-sized nations. For instance, as of recent data, Bitcoin’s energy consumption was akin to countries like Argentina or the Netherlands. When juxtaposed with various industries, the energy requirements of Bitcoin mining can often exceed those of traditional sectors, underlining the environmental challenges associated with its growth.

How Bitcoin Mining Affects the Atmosphere

Detailed Analysis of CO2 Emissions Resulting from Mining:

The carbon footprint of Bitcoin mining depends on the source of electricity. In regions where coal or other non-renewable resources primarily generate power, the CO2 emissions per mined Bitcoin are significantly high. Coal-fired power plants, which remain the primary energy source in several major Bitcoin mining hubs, emit massive quantities of carbon dioxide. Considering the immense energy demands of mining operations, this translates to a considerable volume of CO2 being released into the atmosphere. Current estimates suggest that Bitcoin mining contributes to millions of tons of CO2 emissions annually, a figure comparable to the annual emissions of some industrialized cities or even entire countries.

Real-world Implications of These Emissions on Global Warming:

The substantial CO2 emissions from Bitcoin mining are not an isolated concern. They feed into the larger global challenge of climate change. Elevated levels of carbon dioxide in the atmosphere contribute to the greenhouse effect. This phenomenon leads to global temperature rises, causing a myriad of environmental challenges such as melting ice caps, rising sea levels, and adverse weather events. The carbon footprint from Bitcoin mining amplifies the broader environmental challenges the world is grappling with. The integration of such a sizable new source of CO2 emissions necessitates urgent attention, especially when global efforts are focused on reducing carbon footprints to combat climate change.

E-Waste: The Hidden Environmental Culprit

When discussing the environmental repercussions of Bitcoin mining, energy consumption often takes centre stage. However, an equally pressing yet less highlighted concern is the mounting e-waste from the industry. As the technological demands of Bitcoin mining surge, the life span of mining hardware shrinks, leading to significant electronic waste.

Overview of Electronic Waste Generated from Outdated Mining Hardware:

The world of Bitcoin mining is in a perpetual race to achieve higher computational power, driven by the escalating difficulty of cryptographic puzzles. To remain profitable and competitive, miners frequently update their equipment. This constant turnover results in vast amounts of outdated hardware. ASICs and GPU rigs, once the pinnacle of mining efficiency, quickly become obsolete as newer models emerge. Given the scale of global mining operations, this equates to thousands of tons of electronic waste annually. This waste, laden with metals and toxic compounds, requires proper handling and disposal.

Environmental Consequences of Improper E-Waste Disposal:

E-waste poses a multitude of environmental threats when not managed correctly. Improper disposal means that harmful elements like lead, mercury, and cadmium can leach into the ground, contaminating water sources and the surrounding environment. Furthermore, e-waste in landfills contributes to air pollution as toxic chemicals are released when the waste degrades or is incinerated. These pollutants have been linked to a host of health issues in humans, from respiratory diseases to developmental problems. On a broader scale, the improper recycling or disposal of e-waste also represents a missed opportunity to reclaim valuable metals and reduce the environmental impact of mining for new materials.

Regions Most Impacted by Bitcoin Mining

When discussing the environmental repercussions of Bitcoin mining, energy consumption often takes centre stage. However, an equally pressing yet less highlighted concern is the mounting e-waste from the industry. As the technological demands of Bitcoin mining surge, the life span of mining hardware shrinks, leading to significant electronic waste.

Overview of Electronic Waste Generated from Outdated Mining Hardware:

The world of Bitcoin mining is in a perpetual race to achieve higher computational power, driven by the escalating difficulty of cryptographic puzzles. To remain profitable and competitive, miners frequently update their equipment. This constant turnover results in vast amounts of outdated hardware. ASICs and GPU rigs, once the pinnacle of mining efficiency, quickly become obsolete as newer models emerge. Given the scale of global mining operations, this equates to thousands of tons of electronic waste annually. This waste, laden with metals and toxic compounds, requires proper handling and disposal.

Environmental Consequences of Improper E-Waste Disposal:

E-waste poses a multitude of environmental threats when not managed correctly. Improper disposal means that harmful elements like lead, mercury, and cadmium can leach into the ground, contaminating water sources and the surrounding environment. Furthermore, e-waste in landfills contributes to air pollution as toxic chemicals are released when the waste degrades or is incinerated. These pollutants have been linked to a host of health issues in humans, from respiratory diseases to developmental problems. On a broader scale, the improper recycling or disposal of e-waste also represents a missed opportunity to reclaim valuable metals and reduce the environmental impact of mining for new materials.

Economic Gains vs. Environmental Costs

The rise of Bitcoin and the cryptocurrency market has been nothing short of meteoric. As an innovative decentralized financial system, it offers unprecedented economic opportunities. However, this is juxtaposed against a backdrop of pressing environmental concerns. Here is a closer look at the tug of war between Bitcoin’s economic gains and its environmental costs.

The Allure of Economic Benefits:

Job Creation: The burgeoning Bitcoin mining industry has led to significant job creation. From the actual miners to those in ancillary roles, such as hardware manufacturing, software development, and maintenance, the industry has generated employment opportunities globally.

Stimulating Local Economies: Regions with large-scale mining operations often see an influx of economic activity. These operations require substantial infrastructure, thereby boosting local businesses and services.

Investment Opportunities: Bitcoin’s exponential rise in value has garnered substantial interest from individual and institutional investors alike. Its decentralized nature offers an alternative investment vehicle, often uncorrelated to traditional financial markets.

The Environmental Toll:

Massive Energy Consumption: Bitcoin mining is notoriously energy intensive. With the increasing difficulty of the cryptographic puzzles involved in mining, the energy required has skyrocketed, leading to environmental concerns, especially in regions relying on non-renewable energy sources.

Carbon Emissions: As discussed earlier, the carbon footprint of Bitcoin mining, particularly in coal-reliant regions, is immense. These emissions contribute to global warming and climate change, pressing global issues that require immediate attention.

E-Waste: The rapid technological turnover in the mining industry leads to significant amounts of electronic waste. Improper disposal can lead to soil, water, and air pollution, further straining the environment.

Striking a Balance: The challenge lies in harnessing the economic potential of Bitcoin while mitigating its environmental repercussions. Solutions like transitioning to renewable energy sources for mining operations, promoting sustainable hardware practices, and leveraging energy-efficient consensus algorithms can help strike a balance.

Can Bitcoin Go Green?

As the clamour for sustainable solutions intensifies, the question arises: Can Bitcoin truly go green?

Understanding the Current Scenario:

Energy Intensity: Bitcoin mining relies on proof-of-work (PoW) to validate transactions. This process is incredibly energy-intensive, as miners compete to solve complex mathematical problems and earn the coveted block rewards.

Dependence on Fossil Fuels: Many mining operations, especially in regions with cheap electricity, rely heavily on coal and other non-renewable energy sources, exacerbating carbon emissions.

Steps Towards a Greener Bitcoin:

Shift to Renewable Energy: Mining operations can transition to cleaner energy sources. For instance, harnessing solar, wind, hydro, or geothermal energy can significantly reduce the carbon footprint of mining activities.

Energy-Efficient Consensus Mechanisms: While PoW is the backbone of Bitcoin, other consensus mechanisms, like proof-of-stake (PoS) or delegated proof-of-stake (DPoS), are more energy-efficient. Though transitioning Bitcoin from PoW is a complex endeavour, other cryptocurrencies have shown that greener mechanisms are viable.

Carbon Offsetting: Miners and cryptocurrency organizations can invest in carbon offset projects to neutralize their emissions. These could include afforestation initiatives or funding renewable energy ventures.

Sustainable Mining Hardware: Promoting the production and use of energy-efficient mining rigs, and ensuring proper recycling and disposal practices for obsolete equipment, can curb the e-waste challenge.

Global Collaborative Efforts: Several global initiatives and collaborations are pushing for greener crypto practices. The Crypto Climate Accord, inspired by the Paris Climate Agreement, aims to decarbonize the cryptocurrency industry. Such efforts underscore the growing recognition and commitment to ensuring a sustainable future for digital currencies.

Real-World Adoption of Green Practices: Companies and individual miners are already taking strides toward sustainability. For instance, some mining farms in Iceland and Norway leverage abundant geothermal and hydroelectric energy. Similarly, various cryptocurrency platforms are exploring PoS and other energy-efficient mechanisms.

Conclusion

As Bitcoin continues its journey from a ground-breaking decentralized currency to a focal point in environmental debates, it underscores the larger challenge of harmonizing technological advancement with ecological responsibility. Bitcoin mining, with its substantial energy demands and carbon footprint, serves as a stark reminder that every innovation carries with it unintended consequences. While the potential economic benefits are undeniable, the global community must prioritize sustainable practices to ensure that the promise of digital currencies does not come at the expense of our planet’s well-being. By seeking solutions and fostering dialogue, we can navigate the crossroads of innovation and sustainability, ensuring a brighter future for both the digital economy and our environment. For more on Bitcoin check out how to invest in Bitcoin.