Quick Answer: The Best Day Trading Strategies are…

The best day trading strategies are trend following, pullback trading, and breakout trading. Each is designed to capitalise on market movements, whether by riding trends, buying during pullbacks, or entering after breakouts, making them effective for beginners and experienced traders alike.

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Trend Following | Trading in the direction of an existing trend | Simple, effective in trending markets | Can be late to enter, susceptible to trend reversals |

| Pullback Trading | Buying after a price dip or selling after a rally | Lower-risk entry, potential for higher returns | Requires patience, might miss out on big moves |

| Breakout Trading | Trading after a price breaks through a support or resistance level | Potential for large profits, clear entry signals | High volatility, false breakouts can occur |

| Moving Average Crossover | Buying when a short-term moving average crosses above a long-term one, and vice versa | Easy to implement, clear signals | Lagging indicator, can produce false signals |

| Support and Resistance Trading | Buying at support levels, selling at resistance levels | Identifiable levels, potential for consistent profits | Ranges can break, requires accurate level identification |

| Scalping | Making multiple small profits on rapid price fluctuations | Potential for high returns, fast-paced | Requires quick reflexes, high transaction costs |

| Range Trading | Buying and selling within a defined price range | Low-risk, consistent profits in ranging markets | Limited profit potential, difficult to predict range breaks |

| Reversal Trading | Betting on a price reversal after a strong move | High potential rewards if correct | High risk, requires precise timing |

| News Trading | Trading based on market reactions to news events | Potential for large, quick profits | High volatility, requires fast decision-making |

| Fading | Trading against the market after a sharp price move | Potential for quick profits if correct | High risk, requires accurate timing |

What Is Day Trading and Why Should You Care?

| Trading Style | Time Horizon | Focus | Risk |

|---|---|---|---|

| Day Trading | Intraday | Short-term price movements | High |

| Swing Trading | Days to weeks | Intermediate-term price swings | Medium |

| Long-Term Investing | Months to years | Fundamental analysis, company growth | Low |

Day trading is a strategy where traders buy and sell financial instruments like stocks or currencies within the same day. The goal is to profit from short-term price movements. Instead of holding positions overnight, day traders close all trades by the end of the trading day, aiming to capitalize on even small fluctuations in price.

Why should you care about day trading? It offers the potential for quick profits and the flexibility to work from anywhere with an internet connection. Unlike traditional investing, which requires long-term commitments, day trading allows you to be actively involved in the market on a daily basis. For those who enjoy analysing data and making fast decisions, it can be a rewarding challenge.

However, day trading requires more than just interest—it demands dedication, discipline, and a solid strategy. If approached correctly, it can be a pathway to financial independence, but without the right mindset, it can lead to significant losses.

How Does Day Trading Differ From Other Trading Styles?

Day trading differs from other trading styles mainly in its time frame. Day traders open and close positions within the same day, often making multiple trades to capitalize on short-term price movements. This contrasts with swing trading, where traders hold positions for several days or weeks, waiting for a larger price move.

Long-term investing, on the other hand, involves holding assets for months or years, focusing on the fundamentals of a company or market trends. Day traders, however, focus on technical analysis, using charts and patterns to predict short-term price changes. They are less concerned with the long-term growth of an asset and more focused on how it moves within the day.

Another major difference is the level of attention required. Day trading is highly hands-on—you need to be constantly monitoring the market. This is in contrast to longer-term trading strategies, where you can step back and review your portfolio periodically rather than constantly.

What Are the Risks and Rewards of Day Trading?

Day trading offers the reward of potentially making quick profits. For some, it’s the excitement of seeing immediate results from their trades that draws them in. There’s also the flexibility of setting your own schedule and trading from anywhere, which is a huge appeal for those looking to escape the traditional 9-to-5 grind.

But with these rewards come significant risks. The most obvious risk is financial loss. Since day trading involves making quick decisions in volatile markets, it’s easy to lose money—especially if you’re using leverage, which can amplify both gains and losses. Beginners are particularly vulnerable to these risks, often losing substantial amounts before they develop the necessary skills.

Emotional and psychological stress is another risk. Day trading can be mentally taxing, requiring intense focus and the ability to stay calm under pressure. It’s easy to let emotions, such as fear or greed, influence your decisions, which can lead to costly mistakes. Discipline is key, but maintaining it in the heat of the moment can be incredibly challenging.

Time commitment is also a significant factor. Day trading isn’t something you can do on the side or casually. It requires you to be fully engaged and constantly monitoring the market. If you don’t have the time to dedicate to it, the risks may outweigh the rewards.

In short, day trading can be profitable and offer a unique lifestyle, but it comes with high risks. Success requires careful planning, emotional control, and a willingness to learn from mistakes.

How Can You Get Started With Day Trading?

Getting started with day trading can seem overwhelming at first, but breaking it down into clear steps makes the process more manageable. The key is preparation—knowing the fundamentals, selecting the right tools, and understanding the financial commitment required. Here’s what you need to know to begin your day trading journey.

What Basic Knowledge Should You Have Before You Begin?

Before you start day trading, you need a solid foundation of knowledge. First, it’s essential to understand the basic principles of trading, including how markets operate, how to read price charts, and how different financial instruments work. Day traders typically rely heavily on technical analysis, so becoming familiar with chart patterns, indicators, and trading signals is crucial.

It’s also important to grasp trading psychology. This means understanding the emotional aspects of trading—how fear and greed can influence your decisions—and learning how to manage those emotions. Successful day traders are disciplined and unemotional, sticking to their strategy regardless of short-term outcomes.

Risk management is another critical area of knowledge. You need to understand concepts like stop-loss orders, position sizing, and the risk/reward ratio. Without proper risk management, even a few bad trades can wipe out your account. Educating yourself on these basics before you dive into live trading is key to long-term success.

What Tools and Platforms Are Essential for Day Trading?

To be a successful day trader, you need the right tools and platforms. A reliable trading platform is your primary tool, so choose one that offers real-time data, fast order execution, and robust charting tools. Popular platforms like eToro, IG, and Spreadex provide these features and cater specifically to active traders.

In addition to a trading platform, you’ll need a solid internet connection. Day trading requires quick responses to market movements, so a lagging connection could mean missing out on critical opportunities. Ensure your setup is fast and reliable.

Many day traders also use news feeds and financial analysis tools. Real-time news services, such as Benzinga Pro or Bloomberg, can alert you to breaking news that could impact the markets. Economic calendars are useful for tracking important events like earnings reports or Federal Reserve announcements, which can cause market volatility.

Lastly, many traders use simulators or paper trading accounts before trading with real money. These allow you to practice your strategies in real-time without the risk of losing capital. Practicing with a simulator helps you gain confidence and refine your techniques before going live.

How Much Capital Do You Need to Start Day Trading?

The amount of capital needed to start day trading depends on several factors, including the market you’re trading in and your risk tolerance. For those trading U.S. stocks, the Financial Industry Regulatory Authority (FINRA) requires a minimum account balance of $25,000 if you’re classified as a pattern day trader (making four or more day trades within five business days). This is just a starting point—you’ll want to have more than the minimum to comfortably manage your trades and cover potential losses.

If you’re trading other markets, such as forex or futures, the capital requirements can be lower. Some brokers allow you to start trading forex with as little as $500, though a larger account gives you more flexibility and reduces the psychological pressure of trading with a smaller cushion.

When determining your starting capital, consider not just the minimum required but also how much you can afford to lose. Day trading is risky, and there’s always the possibility of losing your entire investment. It’s crucial to trade with money you can afford to lose without impacting your financial stability.

What Are the Top 10 Day Trading Strategies for Beginners?

Mastering day trading starts with understanding proven strategies. Below is a ranked list of my top 10 favourite strategies for beginners, ordered by their effectiveness and accessibility. Each strategy is explained with actionable insights to help you get started.

1. Trend Following Strategy

Trend following is the best place to start for beginners. The idea is simple: identify an existing trend and trade in the direction of that trend. For example, if a stock is consistently moving upward, you buy in and ride the trend as long as it continues.

Why it’s great: It’s straightforward, relies on clear visual cues (like moving averages or trend lines), and can be very profitable in trending markets. The key to success is learning to spot the trend early and exit before it reverses

2. Pullback Trading Strategy

The pullback strategy is all about patience. It involves waiting for a temporary price dip (in an uptrend) or a small rally (in a downtrend) and entering the trade when the price resumes its original trend. This allows you to enter at a better price and improve your risk/reward ratio.

Why it’s great: It offers a lower-risk entry point compared to jumping into the trend immediately. This strategy is particularly effective in strong trends, where pullbacks are often followed by further price movements in the trend’s direction.

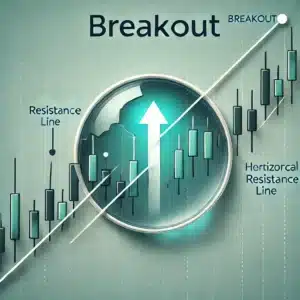

3. Breakout Trading Strategy

Breakout trading focuses on identifying when the price of an asset breaks through a key support or resistance level. When a price “breaks out” of a defined range, it often leads to significant moves in the direction of the breakout, providing profitable opportunities.

Why it’s great: This strategy is powerful in markets that have been trading within a range for a while. It’s especially effective when combined with high volume, signalling a strong potential move. Beginners can use this strategy to capture large moves when the market gains momentum.

4. Moving Average Crossover Strategy

This strategy uses two moving averages—a short-term and a long-term one. When the short-term moving average crosses above the long-term average, it signals a buy. When it crosses below, it signals a sell.

Why it’s great: It’s easy to implement and provides clear entry and exit signals. The moving average crossover strategy works best in trending markets, helping beginners avoid false signals and focus on real opportunities. It’s a classic and reliable strategy that stands the test of time.

5. Support and Resistance Trading Strategy

This strategy involves trading around key support and resistance levels. Support is a price level where an asset tends to stop falling, and resistance is where it tends to stop rising. By identifying these levels, you can buy at support and sell at resistance.

Why it’s great: This strategy helps you capitalize on predictable price movements between established levels. It’s an effective way to trade within a range and provides clear entry and exit points. The key is to confirm these levels using volume or other indicators.

6. Scalping Strategy

Scalping is a fast-paced strategy where traders make many small trades throughout the day, capturing tiny price movements. Scalpers hold positions for only a few seconds or minutes and aim for small, consistent gains that add up over time.

Why it’s great: Scalping is ideal for traders who enjoy rapid decision-making and high activity levels. While it requires focus and discipline, the frequent opportunities for small profits can be appealing for those who thrive in fast-paced environments.

7. Range Trading Strategy

Range trading involves buying at the bottom of a price range (support) and selling at the top (resistance). This strategy works best in markets that aren’t trending strongly in one direction but are instead moving sideways within a defined range.

Why it’s great: Range trading is an excellent choice when markets are stable and not exhibiting clear trends. It allows you to profit from predictable price movements without the need for significant market shifts. Just be cautious of breakouts that can disrupt the range.

8. Reversal Trading Strategy

Reversal trading involves betting against the current trend, expecting it to reverse. Traders using this strategy look for signs that the trend is losing strength and is about to change direction. Reversal traders often rely on candlestick patterns and momentum indicators to time their entries.

Why it’s great: When done correctly, reversal trading can be highly profitable. It allows you to catch large moves at the very beginning of a new trend. However, it requires precise timing and is riskier than trend following, making it better suited for traders with some experience.

9. News Trading Strategy

News trading is all about capitalizing on market volatility following significant news events. Traders monitor breaking news—such as earnings reports, economic data releases, or geopolitical events—and quickly enter trades to profit from the market’s reaction.

Why it’s great: News trading can lead to large price movements in a short amount of time. This strategy is ideal for those who can react quickly to news and are comfortable with high volatility. However, it requires access to real-time news and a deep understanding of how different news impacts markets.

10. Fading Strategy

Fading involves trading against the prevailing market sentiment after sharp price movements. For example, if a stock has surged quickly, a fading strategy might involve shorting the stock, expecting it to “fade” or pull back after the surge.

Why it’s great: Fading takes advantage of overreactions in the market, offering the potential for quick profits as the price corrects. It’s a contrarian strategy, which can be rewarding, but it requires careful timing and the ability to manage risk effectively, as going against the trend can be dangerous.

What Common Mistakes Should You Avoid in Day Trading?

Day trading can be rewarding, but it’s also fraught with potential pitfalls. Many new traders fall into common traps that can quickly lead to losses. By being aware of these mistakes, you can better position yourself for long-term success. Let’s explore three critical mistakes to avoid and how to sidestep them.

How Can You Control Emotions While Trading?

One of the biggest challenges in day trading is controlling your emotions. The markets can be unpredictable, and it’s easy to let fear or greed influence your decisions. Fear can cause you to exit a winning trade too early, while greed can push you to hold onto a losing position for too long, hoping for a reversal.

To avoid emotional trading, it’s essential to have a well-defined strategy and stick to it, no matter what. This means setting clear entry and exit points for every trade and using stop-loss orders to protect yourself from major losses. Mindfulness practices, like taking deep breaths or stepping away from the screen during stressful moments, can also help keep your emotions in check.

Remember, successful day traders stay calm under pressure and make decisions based on logic and analysis, not on gut feelings or emotions.

Why Is Overtrading Dangerous and How Can You Prevent It?

Overtrading is a common mistake, especially for beginners who feel the need to always be in the market. The temptation to make more trades can come from a fear of missing out (FOMO) or a desire to quickly recover from a losing streak. However, overtrading can lead to increased transaction costs, higher exposure to risk, and ultimately, greater losses.

To prevent overtrading, set a daily limit for the number of trades you’ll execute. Stick to your trading plan and avoid impulsive trades that don’t fit your strategy. It’s also helpful to schedule breaks throughout your trading day. Stepping away from the screen allows you to reset and approach the market with a clear mind, reducing the urge to overtrade.

Quality over quantity is key in day trading. Focus on making a few well-executed trades rather than chasing every opportunity that comes your way.

What Are the Risks of Ignoring a Trading Plan?

A solid trading plan is your roadmap to success in day trading. It outlines your strategy, risk management rules, and goals. Ignoring this plan can lead to haphazard decision-making and significant losses. Without a plan, you might enter trades based on emotion or market noise rather than sound analysis, which can quickly spiral out of control.

The risk of ignoring your trading plan is that you lose consistency. When you abandon your plan, you’re more likely to make emotional decisions, overtrade, or take on excessive risk. This can result in erratic performance, where one big loss wipes out several small gains.

To avoid this, always stick to your plan, even when the market seems unpredictable. If you find that your plan isn’t working, refine it rather than abandoning it. The most successful day traders have a well-defined plan and the discipline to follow it, no matter what the market throws at them.

How Can You Evaluate and Improve Your Day Trading Performance?

Success in day trading isn’t just about executing trades—it’s also about continuously evaluating and refining your performance. To become a better trader, you need to consistently review your results, analyse your behaviour, and adapt your strategies. Here’s how you can do just that.

What Tools Can You Use to Track and Analyse Your Trades?

Tracking and analysing your trades is crucial for identifying patterns in your performance. One of the best ways to do this is by keeping a trading journal. A good trading journal should include detailed records of each trade, such as entry and exit points, position sizes, and the rationale behind each trade. Over time, this journal will reveal your strengths, weaknesses, and areas for improvement.

In addition to a journal, many traders use software tools that automatically track and analyse their trades. Platforms like TradeStation or MetaTrader 4 allow you to generate reports that provide insights into your performance metrics, such as win/loss ratios, average profit per trade, and drawdowns. These tools make it easier to spot trends and make data-driven decisions on how to improve your strategy.

By regularly reviewing your trading history with these tools, you can identify which strategies are working and which need adjustment, helping you refine your approach over time.

How Can You Reflect on Your Trading Behaviour to Enhance Success?

Reflection is a powerful tool for improving your trading performance. Beyond analysing the numbers, it’s essential to reflect on your behaviour and mindset during trades. Ask yourself questions like: Did I stick to my trading plan? How did I handle stressful situations? Was I influenced by emotions?

One method for reflection is to set aside time at the end of each trading day to review your decisions. Write down your thoughts on what went well and what didn’t. Over time, these reflections will help you recognize patterns in your behaviour that could be impacting your success. For instance, you may notice that you tend to overtrade after a losing streak or that you struggle with holding onto winning trades.

By reflecting on your behaviour, you can work on building better habits, such as maintaining discipline and staying calm under pressure—two critical components of long-term success in day trading.

What Should You Do If Your Strategy Isn’t Working?

Even the best strategies won’t work all the time. If you find that your strategy isn’t delivering the results you expected, it’s essential to stay calm and take a step back to reassess. Start by reviewing your trading journal or performance reports to pinpoint where things are going wrong. Is your strategy flawed, or are you deviating from it? Are market conditions changing, making your strategy less effective?

If your analysis shows that the strategy itself is flawed, it may be time to adjust or change it. However, don’t make changes impulsively. Test any new or modified strategies in a demo account or with smaller position sizes before committing significant capital.

On the other hand, if your strategy has been historically successful and only recently started underperforming, consider external factors. Market conditions can shift, and strategies that work in one environment might struggle in another. In this case, you might need to tweak your approach or sit out until conditions improve.

Remember, the key is to adapt without overreacting. Consistent evaluation and measured adjustments are what will help you recover from setbacks and continue improving as a trader.

Is Day Trading Worth It for You?

Day trading offers the potential for quick profits, flexibility, and a dynamic work environment. But it’s also demanding, requiring time, effort, and emotional resilience. Deciding whether day trading is worth it for you depends on your personal circumstances, goals, and risk tolerance. Here’s how to assess whether this trading style fits your life.

What Are the Potential Long-Term Benefits of Day Trading?

The long-term benefits of day trading can be significant for those who master the craft. One of the biggest advantages is the potential for financial independence. Successful day traders can earn a full-time income from trading, giving them the freedom to work from anywhere and set their own schedule. This flexibility is appealing to many, especially those looking to escape the constraints of a traditional 9-to-5 job.

Another benefit is the opportunity to continually refine your skills and strategies. Day trading can be intellectually stimulating for those who enjoy analysing markets and data. As you gain experience, you can improve your decision-making, adapt to changing market conditions, and potentially increase your profits over time.

For some, the thrill of day trading—the excitement of making quick decisions and seeing immediate results—is a major benefit. The fast-paced nature of day trading can be highly rewarding for individuals who thrive in dynamic environments.

However, it’s important to recognize that these benefits are not guaranteed. Day trading requires discipline, education, and consistent effort. For those willing to invest the time to develop their skills, the long-term rewards can be substantial, but they don’t come without significant challenges.

How Do You Determine If Day Trading Aligns With Your Financial Goals?

Before diving into day trading, it’s crucial to assess whether it aligns with your financial goals and risk tolerance. Ask yourself what you hope to achieve through trading. Are you looking to supplement your income, or do you aim to make day trading your primary source of earnings? Understanding your objectives will help you decide if the time and effort required for day trading are worth it.

Next, consider your risk tolerance. Day trading is inherently risky, and not everyone is comfortable with the potential for significant losses. If you prefer stable, predictable returns and dislike taking financial risks, long-term investing may be a better fit. On the other hand, if you’re comfortable with market volatility and enjoy actively managing your investments, day trading could be aligned with your financial personality.

It’s also essential to evaluate the time commitment. Day trading isn’t a passive activity—you’ll need to dedicate significant time each day to analysing markets and executing trades. Consider whether you have the time and energy to commit to this level of involvement without it negatively impacting other areas of your life.

Ultimately, determining whether day trading is worth it for you comes down to a clear understanding of your financial goals, risk tolerance, and willingness to invest time and effort. If these factors align, day trading can be a rewarding pursuit. If not, you may want to explore other investment strategies that better suit your lifestyle.

References

FAQs

Day trading is a strategy where traders buy and sell financial instruments within the same day, aiming to profit from short-term price movements.

The required capital depends on the market, but U.S. stock day traders typically need a minimum of $25,000 to meet regulatory requirements.

Yes, day trading is inherently risky due to the fast-paced nature of the market, and traders can experience significant gains or losses quickly.

Day traders need a reliable trading platform, real-time data, technical analysis tools, and fast internet connectivity to execute trades efficiently.

Yes, beginners can succeed with proper education, practice, and discipline. However, it’s essential to manage risks and avoid emotional decision-making.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.