Quick Answer: Trading 212 vs eToro - Which is Better?

eToro emerges as the preferred platform over Trading 212, thanks to its innovative social trading features, which enable users to follow and replicate the strategies of successful investors. This unique approach fosters a supportive trading community and provides valuable insights for traders at all levels, making eToro the superior choice for those seeking a dynamic and interactive investment experience.

eToro

eToro redefines investing with its intuitive platform and social trading network. Connect with millions of traders worldwide, learn from the best, and trade confidently across diverse asset classes. Experience innovation and opportunity in one place, making investing accessible and empowering for all.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Introduction

In the dynamic world of online trading, two platforms stand out for their popularity and innovative features: Trading 212 and eToro.

Both offer unique opportunities for retail investors, but how do they compare in terms of costs, investment options, and overall user experience?

This article delves into a comprehensive comparison to help you decide which platform suits your trading and investing needs best.

Regulation | FCA, CySEC, FSC Regulated | FCA Regulated |

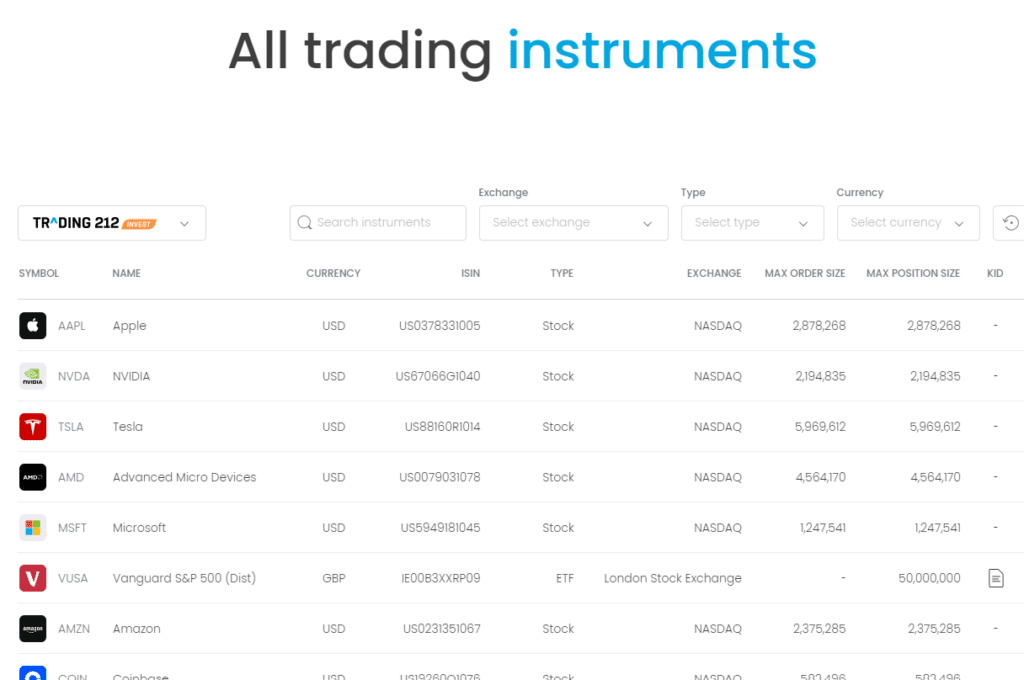

Tradable Assets | UK, US, Germany stocks, ETFs, CFDs on various assets | US, Europe, Asia-Pacific stocks, ETFs, Crypto (CFDs only) |

Account Types | Invest, CFD, ISA | Invest, CopyTrader, CopyPortfolio |

Fees | No dealing fees, No FX fees on international | No commission on stock and ETF trading, 0.1% currency conversion fee |

Minimum Deposit | £1 | $10 (USD) |

Minimum Trade | 0.01 Lots | $10 (USD) |

Demo Account | Yes | Yes |

Mobile App | iOS & Android | iOS & Android |

User Experience | Simple, intuitive, great for beginners | User-friendly, good for beginners with social features |

Additional Features | Commission-free CFD trading, intuitive mobile app | Copy trading, CopyPortfolios, Social investing features |

Payment Methods | Apple Pay, Credit/Debit Card, Google Pay, PayPal, Skrill, Wire Transfer | Credit/Debit Card, Wire Transfer (other options may vary) |

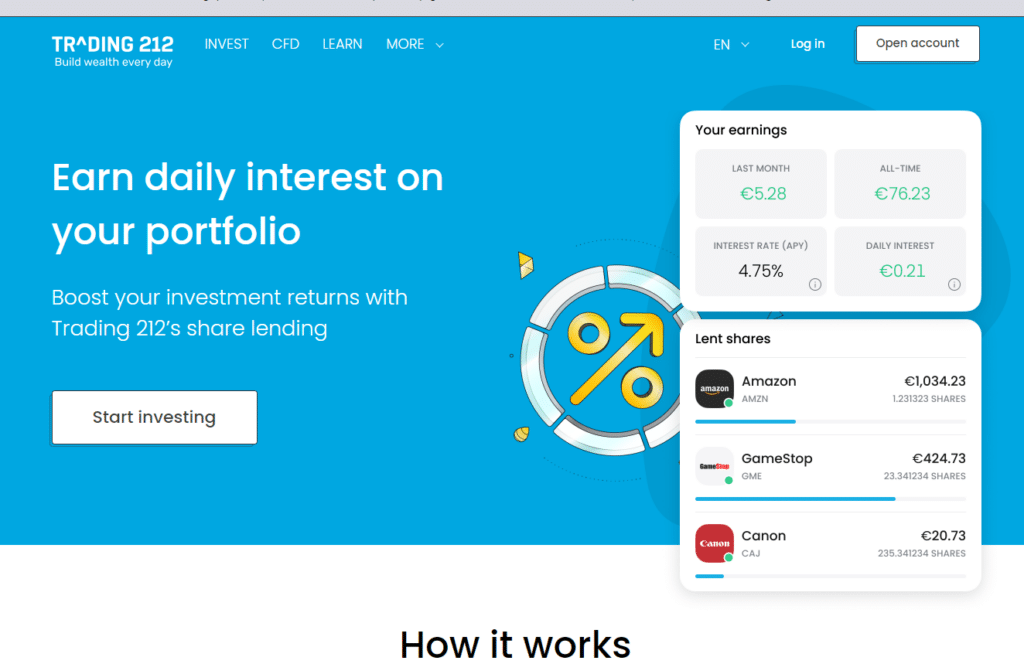

Interest on Uninvested Cash | Up to 5.1% | No |

Leveraged Trading | Yes | Yes (on CFDs only) |

Social Trading | Yes | Yes (core feature) |

Ethical Investing | Yes | Limited options |

Comparing Costs

Account Opening Fees:

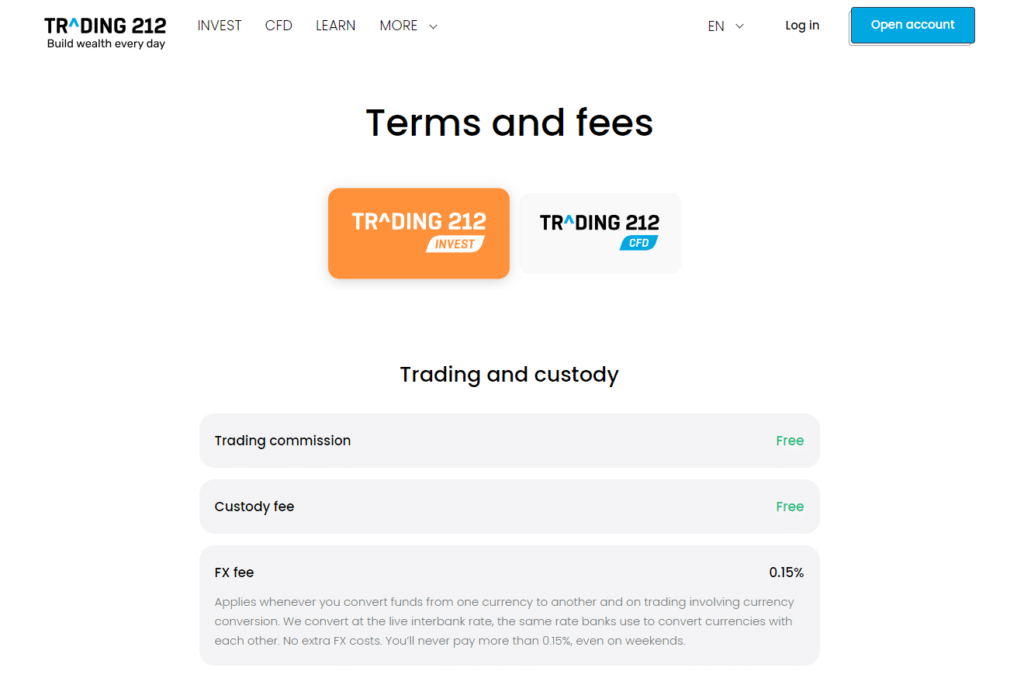

Trading 212: Zero fees to open an account, making it accessible for beginners.

eToro: Also offers free account opening, welcoming users with varying investment sizes.

Trading Fees and Commissions:

Trading 212: Boasts commission-free trading for stocks and ETFs, appealing to cost-conscious investors.

eToro: Similarly offers commission-free trades but with a caveat; a spread fee applies, which can vary depending on market conditions.

Non-Trading Fees (Withdrawal, Inactivity):

Trading 212: Charges no inactivity fees, but withdrawal fees are something to watch out for.

eToro: Imposes a $5 withdrawal fee and a $10 monthly inactivity fee after 12 months, which might deter less active investors.

Available Markets and Instruments:

Both platforms offer a wide range of investment opportunities, from stocks and ETFs to forex and commodities. The choice between Trading 212 and eToro may come down to specific market interests.

Stocks & Shares ISA Comparison:

Trading 212: Provides a tax-efficient ISA wrapper, allowing UK investors to make the most of their annual allowance.

eToro: Does not currently offer a Stocks & Shares ISA, which could be a deciding factor for UK-based investors focused on long-term savings.

Cryptocurrency Trading:

eToro: Stands out for its cryptocurrency offerings, with a broad range of digital assets compared to Trading 212. Its social trading features also enable users to follow and copy the trades of successful crypto investors.

Trading 212: Offers a more limited selection of cryptocurrencies but is catching up as the market grows.

CFD Trading:

Both platforms provide CFD trading, allowing users to speculate on the price movement of assets without owning them. However, it’s crucial to understand the high risk involved with CFD trading and how retail cfd accounts generally lose money, as it may not be suitable for all investors.

In summary, while Trading 212 and eToro have much in common, including commission-free trades and a wide range of investment options, they cater to different investor needs through their unique features such as Stocks & Shares ISAs and cryptocurrency trading options.

Your choice between Trading 212 and eToro will depend on your specific investment goals, preferred assets, and whether you value features like social trading.

User Experience and Platform Features

Both Trading 212 and eToro pride themselves on offering user-friendly interfaces designed for both beginners and experienced traders. Trading 212 offers a streamlined approach, with an intuitive design that makes navigation and executing trades straightforward.

eToro, on the other hand, distinguishes itself with its social trading platform, allowing users to copy the trades of successful investors, adding a unique dimension to crypto trading with its ease of use.

Mobile App Functionality

The mobile experiences of Trading 212 and eToro are robust, catering to the modern investor who prefers to manage investments on the go. Trading 212’s app provides a seamless transition from desktop to mobile, offering full functionality.

eToro’s app also maintains its former share trading platform’s social features, ensuring users can follow, copy, and execute trades from their mobile devices.

Tools and Resources for Investors

Trading 212: Offers a range of educational resources, including articles, tutorials, and a demo account that allows users to practice trading with virtual money.

eToro: Besides its social trading features, eToro provides an extensive array of research tools and insights, making it easier for investors to make informed decisions based on market trends and expert opinions.

Customer Support and Reviews

Trading 212: Provides support through email and a comprehensive FAQ section. However, some users may miss live chat or phone support.

eToro: Offers a more varied range of customer service options, including a live chat feature, which many users find convenient for quick and direct responses.

Feedback for both platforms varies, with users praising the ease of use and learning resources of Trading 212, while eToro receives accolades for its social trading environment and community engagement.

Nonetheless, both platforms face criticism over customer service responsiveness during peak times.

Professional Reviews and Ratings

Financial experts and professional reviewers often highlight the competitive fee structures and range of services of both platforms.

Trading 212 is noted for its no-commission trading options, while eToro’s social trading capabilities are a frequent point of praise.

Customer Support and User Reviews

Valuable insights into the quality of a trading platform’s services can be gleaned from customer support and user reviews. Trading 212 receives higher Trustpilot ratings than eToro, suggesting greater overall user satisfaction. Additionally, Trading 212 offers more responsive customer service compared to eToro.

Examining user reviews and customer support responsiveness can help potential users make an informed decision when choosing between Trading 212 and eToro. These factors can also provide insights into the platform’s commitment to user satisfaction and ongoing support.

Customer Service Channels

Customer service is a crucial aspect of any trading platform, as users may require assistance or encounter issues while trading. Trading 212 offers email and telephone support, ensuring users can receive timely help when needed.

eToro also provides multiple customer service channels, including email, telephone, and live chat support. Although both platforms offer various support options, Trading 212’s more responsive customer service sets it apart, ensuring users can focus on trading without worrying about potential issues.

Trustpilot Ratings

Trustpilot ratings offer an additional perspective on user satisfaction and experiences with trading platforms. Trading 212 boasts a higher Trustpilot rating of 4.6 out of 5, indicating greater user satisfaction compared to eToro’s rating of 4.3 out of 5.

These ratings provide valuable insights into the experiences of real users, helping potential traders make an informed decision when comparing Trading 212 and eToro. A higher Trustpilot rating suggests that Trading 212 may be the better choice for those seeking a platform with a proven track record of user satisfaction.

Security and Regulation

Both Trading 212 and eToro offers trading and are highly regulated, ensuring they adhere to stringent financial standards.

Trading 212 is regulated by the UK’s Financial Conduct Authority (FCA), among other bodies, while eToro is regulated by several authorities all the money, including the FCA and CySEC, ensuring a high level of trust and security.

To protect user data and funds, both platforms employ advanced security measures, including SSL encryption, two-factor authentication (2FA), and segregation of client funds from company funds.

Fund Protection Schemes

Both platforms offer protection under financial services compensation schemes.

For instance, Trading 212 and eToro UK users are covered by the Financial Services Compensation Scheme (FSCS), providing an additional layer of security for investors.

Pros and Cons Summary

Advantages of Trading 212

No commission fees for stocks and ETFs.

Access to a free demo account for practice trading.

Stocks & Shares ISA available for UK investors.

Advantages of eToro

Unique copy trading platform allowing users to copy trades.

Wide range of cryptocurrencies available.

Diverse customer service options including live chat.

Limitations of Trading 212

Limited cryptocurrency trading options.

No social trading features.

Customer support options could be expanded.

Limitations of eToro

Spread fees can be higher, especially in cryptocurrency trading for eToro Customers

$5 withdrawal fee and inactivity fees may deter some users.

No Stocks & Shares ISA option for UK investors.

While both Trading 212 and eToro have their unique advantages, the choice between them depends on your own investments, trading style, preferred assets, and the value you place on community engagement and learning from others’ trading strategies.

Conclusion and Overall Winner

After a thorough comparison of Trading 212 and eToro across various facets including costs, investment options, user experience, customer support, and security measures, it’s clear that both platforms have their distinct strengths and cater to different investor needs.

Choosing an overall winner high risk investment, is not straightforward as it largely depends on what you prioritize in your trading and investment journey.

eToro vs Trading 212 Final Thoughts

Trading 212 shines with its commission-free trading model for stocks and ETFs, making it an attractive option for cost-conscious investors and beginners looking to dip their toes into the world of investing without incurring high fees.

Its provision of a Stocks & Shares ISA is also a significant advantage for UK investors focusing on tax-efficient savings.

On the other hand, eToro stands out for its unique social trading platform, offering investors the opportunity to copy the trades of successful investors, which can be particularly appealing to those new to investing or those looking to leverage the knowledge and strategies of experienced traders.

Additionally, eToro’s broader range of cryptocurrencies appeals to investors interested in digital assets.

Both eToro and Trading 212 offer a wide range of trading options, from stock trading to major currency pairs, catering to retail investor accounts and those interested in CFDs. They operate under strict regulatory oversight by reputable bodies such as the Australian Securities and Investments Commission and the Bulgarian Financial Supervision Commission, ensuring a secure and reliable trading environment. This global regulatory compliance not only adds a layer of security but also opens up diverse investment opportunities for traders around the world.

Recommendations for Different Types of Investors

For Beginner Investors: eToro’s social trading platform provides a valuable learning opportunity by observing and copying the trades of experienced investors, making it a fantastic choice start trading with for those new to the investment world.

For Cost-Conscious Investors: Trading 212’s no-commission model for stocks and ETFs presents an excellent low cost, option, especially for those looking to invest small amounts frequently.

For Crypto Enthusiasts: eToro offers a wider selection of cryptocurrencies and the social trading feature, which can be particularly useful for navigating the volatile crypto markets by following the strategies of seasoned crypto traders.

For UK Investors Seeking Tax Efficiency: Trading 212’s Stocks & Shares ISA is an unbeatable option for those looking to maximize their investments in a tax-efficient manner.

In summary, there is no one-size-fits-all answer when choosing between Trading 212 and eToro. Your decision should be guided by your investment goals, preferred assets, and whether the unique features of social trading or the appeal of a tax-efficient account like a Stocks & Shares ISA align with your investment strategy.

FAQs

eToro USA LLC or eToro USA Securities inc is a registered brokerage that offers a platform for trading various financial assets, including stocks, cryptocurrencies, and more. It operates under the regulatory oversight of the United States’ financial authorities, providing a secure environment for US-based investors.

Yes, both eToro and Trading 212 may charge currency conversion fees for transactions involving assets in a currency different from your account’s base currency. These foreign exchange fees vary by platform and should be considered when trading international assets.

Trading platforms eToro and Trading 212 differ primarily in their features and offerings. eToro is renowned for its social trading capabilities and wide range of cryptocurrencies, while Trading 212 is favored for its commission-free stock free share, and ETF trades, as well as its provision of a Stocks & Shares ISA for UK investors.

Yes, forex traders can use both eToro and Trading 212. These platforms offer access to major, minor, and exotic currency pairs, catering to traders with various levels of experience in the forex market.

Trading CFDs (Contracts for Difference) on eToro and Trading 212 allows investors to speculate on the price movement of various assets without owning them. It’s important to note that CFD trading carries a high level of risk and can result in losses that exceed your initial investment. Both platforms offer tools and resources to help manage this risk.

Gain Access to Our #1 Recommended Investment Platform in the UK

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.