How to Trade Crypto Futures in the UK

Dom Farnell

Co-Founder

Dom is a Co-Founder and of TIC. A passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management.My goal is to empower individuals to make informed investment decisions through informative and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please keep in mind that Crypto assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law. We do not recommend trading crypto futures in the UK as you will not find legally a UK regulated exchange. Off shore exchanges may offer these services but they will not be FCA regulated so please act with caution.

Quick Answer: How can you Trade Crypto Futures in the UK?

In the UK, for example, while the FCA bans retail consumers from trading crypto derivatives, platforms like MEXC offer these services globally, including to UK users, from their offshore bases, bypassing the ban and direct FCA oversight. Users should tread carefully, considering the regulatory landscape.

Page Contents:

- Crypto Futures Trading Platform Comparison Chart

- Top 3 Crypto Trading Platforms in 2024

- Introduction to Crypto Futures

- Regulatory Landscape in the UK

- Trading Stategies and Risk Management

- Understanding Leverage and Its Risks

- Exploring Market Trends

- Platform Setup and Usage for UK Crypto Futures Trading

- Conclusion

- References

- FAQs

Crypto Futures Trading Platform Comparison Chart

Spot Trading Fees | 0.1% for some pairs, Zero fees for selected pairs | 0.08% for makers, 0.10% for takers | Varied fees based on pricing tiers |

Futures Trading Fees | 0.01% for makers, 0.05% for takers | 0.02% for makers, 0.05% for takers | Not applicable |

Leverage | Up to 200x | Up to 100x on futures, 10x on spot trades | No |

Number of Coins | 1,520+ cryptocurrencies | 320+ tradable cryptocurrencies | Extensive range, exact number varies |

User Base | Info not found | Over 20 million users worldwide | Large global presence |

Deposit Methods | Crypto, Visa/Mastercard, Bank Transfer, etc. | Crypto deposits; Fiat not supported directly | Bank transfers, Debit/Credit cards |

Withdrawal Fees | No fiat withdrawals | Competitive crypto withdrawal fees | Varies by asset and method |

Security | High, with cold storage for assets | Proof of Reserves (PoR) report, $14.5 billion in assets | High, adheres to U.S. regulations |

Regulation | Unregulated in most jurisdictions | Largely unregulated in major markets | Heavily regulated, U.S.-based |

User Experience | Versatile platform for all levels | User-friendly, suitable for beginners and pros | Known for trustworthiness, user ed. |

Special Features | Copy Trading, Token Launchpad | Spot Copy Trading across 120 spot pairs, Smart Account feature | Crypto educational courses |

Geographical Availability | Almost every country | 160+ countries, not available in North America | Global, focus on the U.S. market |

Top 3 Crypto Trading Platforms in 2024

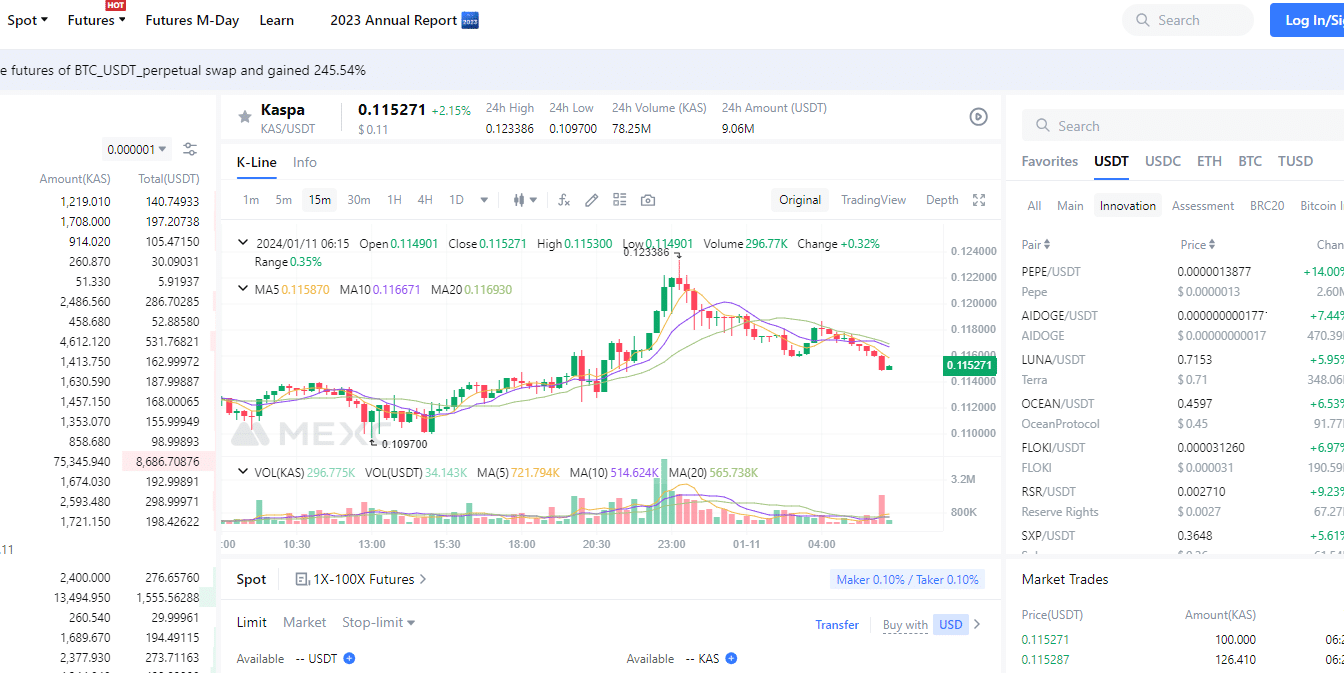

MEXC Futures - Best Exchange for Pro Traders

Pros

Cons

- Wide Range of Cryptocurrencies

- User-Friendly Interface: The platform is designed to be intuitive, catering to both beginners and experienced traders. This includes easy navigation, clear market data, and straightforward trading processes.

- Robust Security Measures: MEXC implements high-level security protocols, including SSL encryption, two-factor authentication (2FA), and multi-signature wallets, to ensure the safety of users' funds and personal information.

- Competitive Fees: The exchange offers reasonable transaction fees, which is an important consideration for traders concerned about cost efficiency.

- Complexity for Absolute Beginners: Despite its user-friendly design, absolute beginners might still find the world of cryptocurrency trading overwhelming, including navigating various trading tools and understanding market dynamics.

- Limited Educational Resources: Compared to some other platforms, MEXC may offer fewer resources for educating new traders about the complexities of cryptocurrency trading and investment strategies.

- Regulatory Uncertainties: As with many cryptocurrency exchanges, evolving regulations in different countries could impact the platform’s operations or the availability of certain features in the future.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

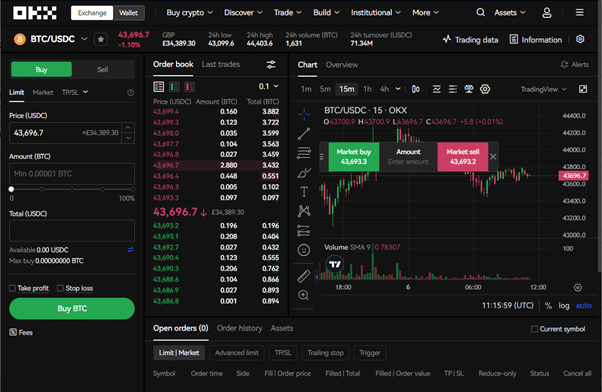

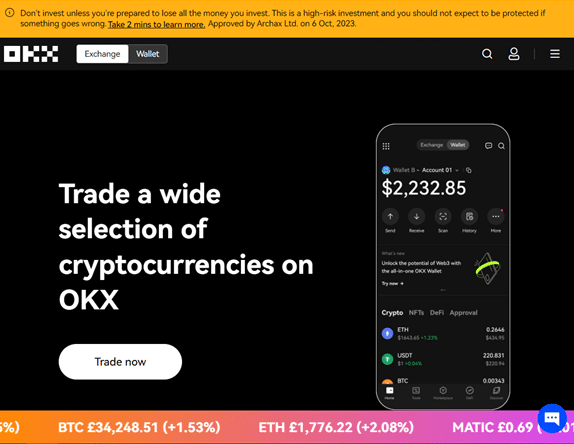

OKX - Best Exchange Overall

Pros

Cons

- Over 300 Cryptocurrencies Available

- Advanced Trading Tools: Such as real-time charts, technical analysis tools & more.

- High Liquidity

- Robust Security Protocols

- Highly Functional Mobile App

- Competitive Fee Structure: Loyalty and higher volume trading rewarded

- Global Compliance and KYC Standards

- DeFi OKX Wallet

- Limited Services for UK Users: Restrictions on services like Derivatives, OKX Earn, and Crypto Loans in the UK market.

- Higher Fees for Low-Volume Traders: The tiered fee structure may be less favourable for users with lower trading volumes.

- Credit & Debit Card Purchase Fees Higher fees compared the bank transfers.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

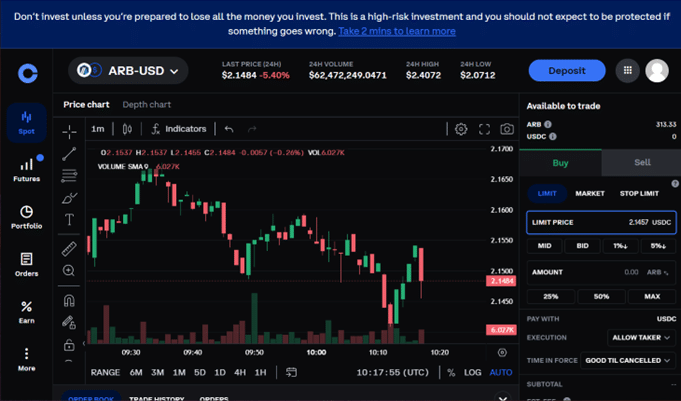

Coinbase - Best for Beginners

Pros

Cons

- User-Friendly Interface: Ideal for beginners, with an intuitive design that simplifies navigating the crypto market.

- Strong Security Measures: Includes two-factor authentication and insurance against security breaches.

- Wide Range of Cryptocurrencies

- Educational Resources

- Reputation and Trust: Well-established in the industry with a strong track record and regulatory compliance.

- Staking Options: Enables users to earn rewards by staking certain cryptocurrencies.

- Reliable Mobile App

- Higher Fees for Some Transactions: Can be more expensive compared to other exchanges, especially for small transactions.

- Limited Advanced Trading Features: May not cater to the needs of advanced traders seeking complex trading tools.

- Bank Withdrawal Restrictions: Sometimes faces delays or limitations on large bank withdrawals.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Introduction to Crypto Futures

Crypto futures represent a cornerstone in the dynamic world of cryptocurrency trading, enabling traders to predict and bet on future price movements of digital currencies without the need to possess the actual asset.

Essentially, these contracts are agreements to buy or sell a particular cryptocurrency at a specified price on a future date, serving both speculative purposes and as a hedge against market volatility.

Particularly, Bitcoin futures stand out for their potential to diversify trading strategies, allowing investors to gain exposure to Bitcoin’s price movements while managing risks more effectively.

This mechanism not only broadens the scope and limits the availability of investment opportunities but also introduces a strategic layer to trading in the digital asset markets.

Regulatory Landscape in the UK

In the UK, the Financial Conduct Authority (FCA) has taken a firm stance on crypto derivatives, imposing a ban on the sale of such products to retail clients. This prohibition stems from concerns over high risks and volatility associated with these instruments, which could lead to significant losses for retail investors.

The regulatory landscape for bitcoin futures is nuanced, with the FCA’s decision highlighting the need for investor protection. However, this has also created a complex environment where traders seek platforms outside FCA jurisdiction to access these markets, emphasising the global and decentralised nature of cryptocurrency trading.

Trading Stategies and Risk Management

To delve deeper into trading strategies and risk management in the volatile crypto market, it’s essential to adopt a multifaceted approach that balances potential profits against the costs and the risks of significant losses. Key strategies to explore include:

Technical Analysis: Utilizing chart patterns and indicators to predict future price movements and identify entry and exit points.

Fundamental Analysis: Assessing the intrinsic value of a cryptocurrency based on news, developments, and financial metrics.

Position Sizing: Calculating the appropriate amount to invest in a trade based on your risk tolerance and overall portfolio size.

Diversification: Spreading investments across various assets or sectors to reduce the impact of a single loss.

Stop-Loss and Take-Profit Orders: Automatically closing trades at predetermined price levels to lock in profits and limit losses.

Hedging: Using derivative instruments like futures contracts to offset potential losses in spot market positions.

Understanding exposure is crucial. It refers to the degree of risk associated with your investments. Setting appropriate limits—such as how much of your portfolio is exposed to a single asset—helps in managing this exposure and ensuring that potential losses don’t exceed your risk tolerance. Regularly reviewing these parameters in light of evolving market conditions and personal financial goals is vital for maintaining a robust risk management strategy.

Understanding Leverage and Its Risks

Understanding Leverage in Futures Trading:

Leverage allows traders to control larger positions with a smaller capital investment.

It magnifies both potential profits and losses in proportion to the chosen leverage level.

Potential Benefits of Leverage:

Leverage can amplify profits, offering the opportunity for significant gains.

It allows traders to access larger positions than they could with their own capital alone.

Risks Associated with Leverage:

On the flip side, leverage can lead to substantial losses, and even a small adverse price movement can wipe out an entire investment.

It amplifies the impact of market volatility, making risk management paramount.

Essential Aspects of Risk Management:

Setting stop-loss orders at predefined price levels helps limit potential losses.

Diversifying a portfolio across different assets spreads risk.

Proper position sizing ensures that traders don’t overcommit to a single trade.

Significance of Regulated Platforms:

Trading on regulated platforms ensures adherence to financial standards and operational integrity.

Regulated platforms prioritize client protection and provide a safer environment for leveraging trading strategies in the volatile crypto market.

Exploring Market Trends

When it comes to exploring market trends in cryptocurrency futures, it’s essential to consider the broader landscape beyond Bitcoin. Here’s an analysis:

Diverse Cryptocurrency Futures: While Bitcoin futures remain a focal point, there’s a growing interest in futures contracts for other cryptocurrencies like Ethereum, Ripple, and Litecoin. These offer traders opportunities beyond the Bitcoin market.

Rising Popularity of Altcoins: Altcoins (alternative cryptocurrencies to Bitcoin) are gaining traction in the futures market. Traders are exploring futures contracts on assets like Ethereum (ETH), which has seen significant growth.

Emergence of Crypto ETFs: Exchange-traded funds (ETFs) tracking cryptocurrency indices have become increasingly popular. These ETFs provide exposure to a basket of cryptocurrencies, simplifying diversification.

Commodities and Stocks in Futures: Some platforms offer futures contracts tied to traditional assets like commodities (e.g., gold) and stocks (e.g., tech companies). These contracts enable traders to diversify their portfolios further.

Leveraging Traditional Assets: futures can serve as a hedge against traditional market movements. Traders may turn to futures during stock market volatility or economic uncertainty.

Overall, the futures market is evolving, with traders exploring a more extensive range of assets and investment opportunities, including ETFs, commodities, and stocks, to diversify, increase their exposure and adapt to changing market conditions.

Conclusion

In conclusion, the state of futures contract trading in the UK reflects a dynamic landscape shaped by regulatory decisions and market trends. The ban on certain crypto derivatives for retail clients by the Financial Conduct Authority (FCA) underscores the importance of investor protection. However, this has led to a complex environment where traders seek platforms in jurisdictions outside FCA jurisdiction to access these markets.

The future outlook for futures trading in the UK remains uncertain. Potential developments may include:

Regulatory Evolutions: Ongoing regulatory changes may influence the accessibility and types of crypto futures available to UK traders.

Market Expansion: As the crypto market continues to grow, new assets and trading opportunities may emerge, further diversifying the futures market.

Innovative Products: Platforms may introduce innovative products, such as crypto ETF futures, to cater to evolving investor preferences.

It’s paramount for readers to stay informed and exercise caution when considering futures trading. Due diligence, risk management, and choosing regulated platforms are vital for both profit while navigating this dynamic and evolving market. By staying informed and making informed decisions, traders can potentially benefit from the opportunities while minimizing risks.

References

FAQs

To trade futures in the UK, you will not find legally a UK regulated exchange. Off shore exchanges may offer these services but they will not be FCA regulated so please act with caution.

Futures contracts are agreements to buy or sell cryptocurrencies at a specified price on a future date. They enable traders to speculate on price movements without owning the underlying assets.

Yes, Bitcoin futures are accessible in the UK through unregulated platforms. These bitcoin futures allow traders to bet on the future price of Bitcoin.

Effective trading strategies can optimise profits and minimize losses in futures trading. Strategies like technical analysis, diversification, and risk management play a vital role.

The appropriate leverage level varies based on your risk tolerance. It’s crucial to choose a level that allows you to maximize potential profits while managing risks effectively. Leverage will cause greater losses.

Protect your account by setting stop-loss orders, diversifying your portfolio, and sizing your positions correctly. These risk management techniques help limit potential losses.

Some platforms offer futures contracts tied to traditional assets like commodities and stocks. This allows traders to diversify their exposure beyond cryptocurrencies.

Regulation ensures the protection of traders and the integrity of the trading environment. Regulated exchange platforms adhere to financial standards and provide a safer trading experience.

ETFs (Exchange-Traded Funds) tracking cryptocurrency indices offer a convenient way to gain exposure to a basket of cryptocurrencies, simplifying diversification in futures contract trading.

To stay informed, regularly follow reputable financial news sources, explore and join online communities, and monitor official announcements from regulatory bodies. Additionally, consider subscribing to newsletters or joining forums dedicated to futures trading.