Is MoonPay Safe? A Full Security Breakdown for UK Users

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Updated 17/02/2025

When I first heard about MoonPay, I was intrigued. A platform that allows you to buy crypto instantly using a credit card, bank transfer, or even Apple Pay? That sounded like a game-changer. But, as with anything in the crypto space, the big question is: Is MoonPay safe?

Crypto transactions come with risks—hacks, scams, and fraud are all too common. Whether you’re a seasoned investor or just getting started, knowing how secure a platform is before using it is crucial.

In this guide, I’ll break down MoonPay’s security measures, regulatory compliance, and potential risks. If you’re a UK-based user wondering whether MoonPay is a reliable way to buy crypto, this article will give you the clarity you need.

Final Rating: ⭐4.3/5 – Ideal for beginners and casual crypto buyers, but fees and customer support could be improved

Quick Answer: Is MoonPay Safe?

Yes, MoonPay is a secure and regulated crypto payment processor. It uses encryption, fraud prevention tools, and KYC verification to protect users. However, fees can be high, and as a custodial platform, it doesn’t offer wallets—meaning you’ll need to store your crypto externally.

What Is MoonPay? A Quick Overview

MoonPay is essentially a fiat-to-crypto on-ramp, meaning it allows users to buy cryptocurrencies using traditional payment methods like debit/credit cards, bank transfers, and Apple Pay. Unlike full-fledged exchanges like Binance or Coinbase, MoonPay does not hold funds for users—instead, it acts as a bridge between fiat currency and crypto.

The platform was founded in 2019 in London and has quickly expanded to serve over 5 million users globally. It partners with major exchanges, wallets, and NFT platforms, making it a popular choice for those who want a quick and easy way to buy crypto without signing up for a dedicated exchange.

One of MoonPay’s biggest selling points is its regulatory compliance. In the UK, it follows anti-money laundering (AML) and know-your-customer (KYC) rules, requiring users to verify their identity before making a purchase

📌 Key Facts About MoonPay

| Feature | Details |

|---|---|

| Founded | 2019 |

| Headquarters | London, UK |

| Regulatory Status | Complies with UK AML & KYC rules |

| Services | Crypto purchases via card, bank transfer, Apple Pay |

| User Base | 5M+ users globally |

How Secure Is MoonPay? Breaking Down Its Safety Features

When dealing with crypto payments, security is non-negotiable. Since MoonPay processes transactions involving real money and digital assets, it has implemented several safety measures to protect users. Let’s dive into the key security aspects that make MoonPay a reliable payment processor.

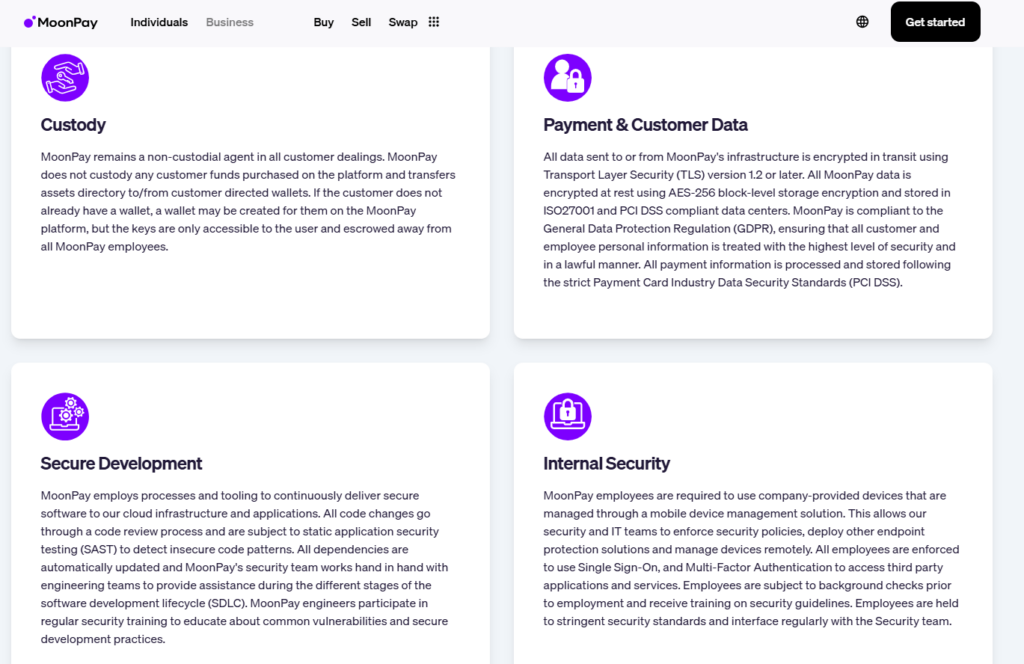

Platform Security

MoonPay prioritizes security through end-to-end encryption, ensuring that all sensitive data—such as payment details and personal information—is protected from cyber threats. The platform is PCI DSS compliant, meaning it meets the same security standards as major financial institutions and banks.

One crucial security feature is that MoonPay does not store your card details. Instead, it processes payments through third-party banking partners, reducing the risk of fraud or data leaks.

To further safeguard transactions, MoonPay uses AI-driven fraud detection and transaction monitoring. Suspicious activities—such as unusual purchase patterns or login attempts from different locations—are flagged and can trigger additional verification steps to prevent unauthorized use.

Account Protection

To protect user accounts, MoonPay requires ID verification (KYC) before making a purchase. This ensures that only legitimate users can access the platform, reducing the risk of fraudulent activity.

MoonPay also implements two-factor authentication (2FA) for certain transactions, adding an extra layer of security when logging in or making payments.

Additionally, MoonPay’s anti-fraud systems work behind the scenes to block suspicious transactions in real time. If a transaction appears risky, it may be delayed or rejected until further verification is completed.

Regulatory Compliance & Transparency

Unlike traditional crypto exchanges, MoonPay functions as a payment processor rather than a trading platform. This means it doesn’t hold funds or provide wallets but simply facilitates the purchase of crypto.

MoonPay follows UK anti-money laundering (AML) and know-your-customer (KYC) regulations, ensuring that all transactions are monitored for suspicious activity. While it is not directly regulated by the Financial Conduct Authority (FCA), it complies with financial laws to operate within the UK.

By adhering to these regulatory measures, MoonPay maintains a transparent and secure process for users who want to buy crypto safely.

📌 MoonPay's Security Features

| Security Feature | Details |

|---|---|

| Encryption | End-to-end encryption for data security |

| PCI DSS Compliance | Meets industry standards for secure payments |

| KYC & AML Compliance | Follows UK regulations for identity verification |

| Fraud Prevention | AI-driven monitoring for suspicious activity |

Risks and Limitations of Using MoonPay

While MoonPay offers a secure and convenient way to buy crypto, there are some downsides that users should be aware of. Let’s break down the key risks and limitations.

High Fees and Exchange Rate Markups

One of the biggest concerns with MoonPay is its high transaction fees. Unlike traditional exchanges like Binance or Coinbase, which offer lower trading fees, MoonPay charges spread fees on each purchase. These can vary based on payment method, market conditions, and the cryptocurrency being bought.

Additionally, exchange rate markups can make purchases more expensive than directly buying on an exchange. Since MoonPay acts as an intermediary, the price you pay for crypto may not always match real-time market rates, leading to higher overall costs.

Customer Support Challenges

Many users have reported frustrations with MoonPay’s customer support. The platform does not offer live chat or phone support, meaning users must rely on email-based support, which can be slow.

Issues such as failed transactions, delays in KYC verification, or account restrictions can take time to resolve, leading to frustration—especially for first-time users trying to complete their crypto purchases.

No Wallet Services

Unlike exchanges that provide built-in wallets, MoonPay does not store or manage your crypto. Users must provide an external wallet address before making a purchase.

This means:

✔️ You have full control over your assets, but

⚠️ If you enter the wrong wallet address, the transaction is irreversible.

For beginners, this adds an extra layer of responsibility when using MoonPay.

📌 Potential Risks of Using MoonPay

| Risk | Details |

|---|---|

| High Fees | Higher than most crypto exchanges |

| Exchange Rate Markups | Users may pay more than market rates |

| Support Issues | No live chat; slow response times |

| No Wallet | Users must provide their own wallet for transactions |

Is MoonPay Safe for Beginners?

For anyone new to crypto, MoonPay offers a simple and intuitive way to buy digital assets. The platform’s user-friendly interface, quick transactions, and multiple payment options make it an appealing choice for beginners who want a hassle-free experience.

One of the biggest advantages is that MoonPay doesn’t require users to sign up for an exchange—you can buy crypto directly using a debit card, bank transfer, or even Apple Pay. This eliminates the often-confusing process of navigating full-fledged trading platforms.

Security is another strong point. MoonPay uses encryption, fraud monitoring, and KYC verification to protect users and prevent unauthorized transactions. However, high fees and the lack of a built-in wallet may be drawbacks for beginners. Since MoonPay only processes payments, users must ensure they have a secure external wallet before making a purchase.

📌 Why MoonPay Appeals to Beginners

| Feature | Why It’s Beginner-Friendly |

|---|---|

| Simple Interface | Easy-to-use for crypto purchases |

| Payment Methods | Supports bank transfers, credit cards, Apple Pay |

| Security Measures | KYC, fraud prevention, and encryption |

| No Exchange Needed | Buy crypto directly without an exchange account |

Tips to Maximize Your Security on MoonPay

While MoonPay is secure, users should take additional precautions to protect their crypto transactions.

- Use a strong, unique password and enable two-factor authentication (2FA) where possible.

- Verify the recipient wallet address before making a purchase—crypto transactions are irreversible.

- Compare exchange rates before buying to avoid overpaying.

- Transfer purchased crypto to a private wallet for long-term safety.

📌 Security Best Practices for MoonPay Users

| Security Tip | How It Helps |

|---|---|

| Strong Password & 2FA | Reduces the risk of account hacking |

| Verify Wallet Address | Prevents sending crypto to the wrong destination |

| Compare Rates | Avoids overpaying for crypto purchases |

| Use a Secure Wallet | Ensures safe storage of purchased crypto |

Conclusion: Should You Use MoonPay?

MoonPay offers a secure and convenient way to buy crypto, especially for beginners looking for a quick fiat-to-crypto solution. Its strong encryption, KYC verification, and fraud prevention measures make it a safe platform for transactions.

However, it’s important to consider the drawbacks. High fees, potential customer support delays, and the lack of a built-in wallet may make it less appealing for some users. If cost is a major concern, comparing MoonPay’s rates with other exchanges is a smart move.

Final Recommendation

MoonPay is a reliable and safe payment processor, but users should compare fees, use a secure external wallet, and double-check all transaction details before making a purchase.

Trade Smarter, not Harder

- Instant Crypto Purchases

- Exchange-Free Purchases

- Fast Registration

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

FAQs

Yes, MoonPay follows UK AML and KYC regulations but is not FCA-registered.

No, MoonPay is a payment processor, not an exchange or wallet service.

No, once a transaction is processed, it cannot be reversed.

MoonPay charges for convenience, security, and fiat payment processing.

Always use a trusted wallet and verify details before confirming payments.