How to Buy Meta Shares in the UK – Step-by-Step Guide

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Some of the links on this website are affiliate links, meaning we may earn a commission if you click through and make a purchase or investment, at no extra cost to you. This helps support our website and allows us to continue providing quality content.

Updated 02/01/2025

Quick Answer: How to buy META (facebook) Shares

2️⃣ Open an Account – Register and verify your ID.

3️⃣ Deposit Funds – Bank transfer, card, or PayPal.

4️⃣ Search for META – Locate Meta Platforms Inc.

5️⃣ Select Order Type – Market, limit, or stop-loss order.

6️⃣ Buy Shares – Confirm and execute the trade.

7️⃣ Monitor & Manage – Track performance and adjust strategy.

Featured Platform: eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Meta Platforms (NASDAQ: META), the parent company of Facebook, Instagram, and WhatsApp, is one of the world’s most valuable technology companies. With a market cap of over \$1 trillion and strong revenue growth, Meta remains a top choice for UK investors looking to buy tech stocks.

But how do you buy Meta shares in the UK, and what are the best platforms to use? This guide walks you through the process step by step, comparing brokers, fees, and investment strategies.

How to Buy Meta Shares in the UK – Step-by-Step Guide

Investing in Meta (META) shares is straightforward, but each step requires careful consideration. Below is a detailed guide covering everything from choosing the right broker to placing your first order.

1. Choose a Broker to Buy Meta Shares

Before investing, you need to select a trusted UK brokerage that offers Meta (META) shares. Each broker differs in fees, platform features, and user experience.

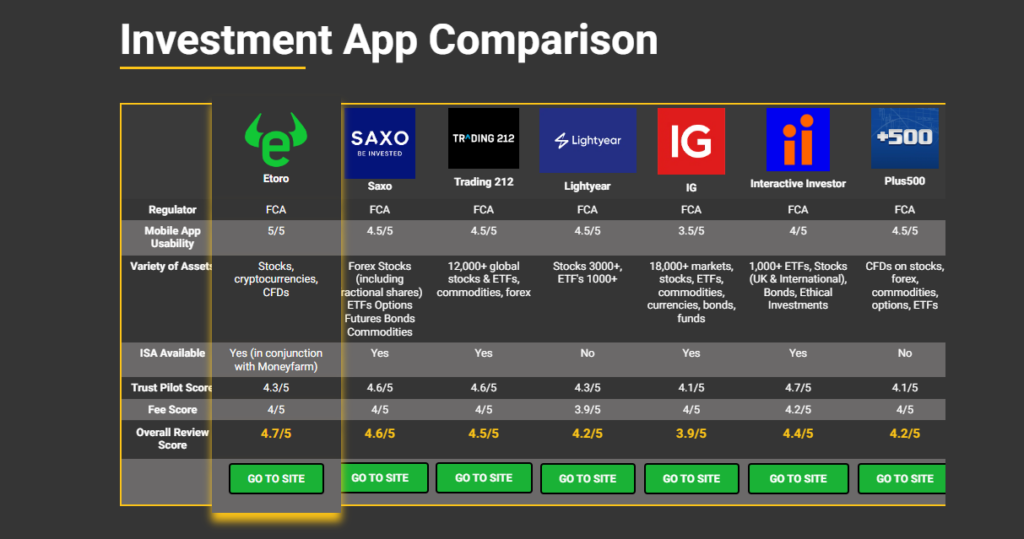

Top 3 Brokers for Buying Meta Shares in the UK

| Broker | Commission | Minimum Deposit | FSCS Protection? | Key Features |

|---|---|---|---|---|

| eToro | £0 | £50 | ✅ Yes | Social trading, CopyTrader, fractional shares |

| IG | £10 per trade | £250 | ✅ Yes | Advanced trading tools, real-time data, leverage options |

| Saxo Markets | £5 per trade | £500 | ✅ Yes | Professional trading platform, low FX fees |

💡 Best for Beginners: eToro – Easy-to-use, commission-free, and offers fractional shares (invest from £10).

💡 Best for Advanced Traders: IG – Offers detailed market insights, leverage, and stop-loss orders.

💡 Best for Large Investments: Saxo Markets – Competitive pricing for high-volume investors.

2. Open an Account & Verify Your Identity

Once you’ve chosen a broker, you need to register for an account. The process is regulated by the Financial Conduct Authority (FCA) to prevent fraud and ensure security.

How to Sign Up with a Broker

1️⃣ Go to the Broker’s Website – Visit eToro, IG, or Saxo Markets and click “Sign Up”.

2️⃣ Enter Your Personal Details – Provide name, email, and phone number.

3️⃣ Verify Your Identity – Upload a copy of your passport or driving licence (FCA regulation).

4️⃣ Complete a Suitability Assessment – Some brokers ask about your trading experience to match you with suitable investment options.

💡 Approval Time: Most brokers verify accounts within 24 hours, but some may take 1-3 business days.

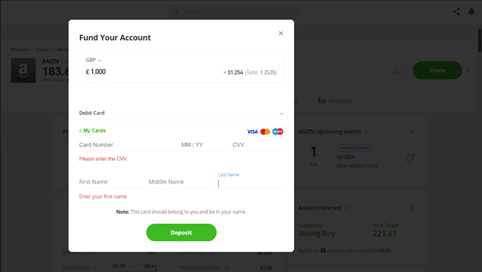

3. Deposit Funds into Your Account

To buy Meta shares, you need to fund your account. Brokers support multiple deposit methods, but fees and processing times vary.

Deposit Methods & Fees

| Deposit Method | eToro | IG | Saxo Markets | Processing Time |

|---|---|---|---|---|

| Bank Transfer | ✅ Free | ✅ Free | ✅ Free | 1-3 business days |

| Credit/Debit Card | ✅ 0.5% FX fee | ❌ Not available | ✅ 0.5% FX fee | Instant |

| PayPal/Skrill | ✅ 1% fee | ❌ Not available | ❌ Not available | Instant |

💡 Avoid Extra Fees: Since Meta shares trade in USD, UK investors pay FX conversion fees when depositing GBP. Use a multi-currency account (Wise or Revolut) to deposit in USD and bypass conversion charges.

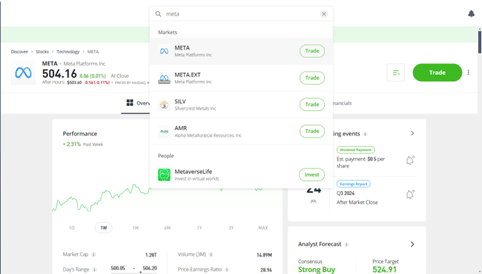

4. Search for Meta Shares (Ticker: META)

Once your funds are available, search for Meta Platforms Inc. (META) on your broker’s trading platform.

How to Find Meta Shares on Your Trading Platform

1️⃣ Log in to your broker account (eToro, IG, or Saxo).

2️⃣ Use the search bar and enter “META” (Meta Platforms Inc.).

3️⃣ Select Meta (META) from the results and open its trading page.

4️⃣ Review key stock information, including live price, market cap, and trading volume.

💡 Check Market Hours: Meta shares trade on the NASDAQ exchange (9:30 AM – 4:00 PM ET). UK investors can trade during pre-market and after-hours through some brokers like IG and Saxo.

5. Choose Your Order Type

Before placing your trade, you need to select an order type based on your investment strategy.

Types of Orders & When to Use Them

| Order Type | How It Works |

|---|---|

| Market Order | Buys the stock instantly at the current price. |

| Limit Order | Sets a target price, and the trade executes only if META reaches that price. |

| Stop-Loss Order | Automatically sells shares if the price drops to a pre-set level, reducing risk. |

💡 Pro Tip: If you expect short-term price drops, use a limit order to buy Meta shares at a lower price.

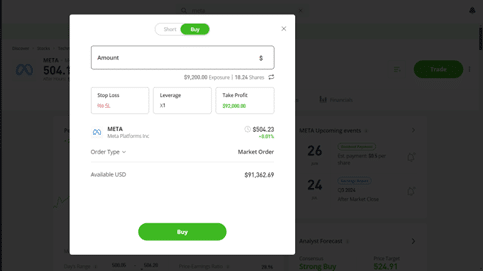

6. Confirm Your Order & Buy Meta Shares

Once you’ve selected your order type, it’s time to execute the trade.

How to Buy Meta Shares

1️⃣ Enter the Number of Shares – Choose how many META shares you want to buy. Fractional shares allow investing from as little as £10.

2️⃣ Review the Trade Summary – Check the total cost, fees, and FX conversion (if applicable).

3️⃣ Click “Buy” to Complete the Purchase – The trade is executed, and Meta shares are added to your portfolio.

💡 Tracking Your Investment: Brokers like eToro, IG, and Saxo offer real-time portfolio tracking and performance charts.

7. Monitor Your Investment & Plan an Exit Strategy

After purchasing Meta shares, monitor your investment and decide on an exit strategy.

Investment Monitoring Tips

✅ Track Market News – Follow Meta’s earnings reports, new product launches, and AI/metaverse developments.

✅ Use Price Alerts – Set notifications for price changes to buy more or take profits.

✅ Consider Dividend Potential – Meta does not currently pay dividends, but this could change in the future.

💡 Selling Your Shares:

- If you’re a long-term investor, hold Meta shares for capital appreciation.

- If you’re a trader, set profit targets and use stop-loss orders.

What is the Cheapest Way to Buy Meta Platforms Shares?

Investing in Meta (META) can be expensive if you don’t choose the right broker. Some platforms charge commission fees, FX conversion costs, and inactivity fees, which eat into profits.

How to Buy Meta Shares at the Lowest Cost

✅ Use a Zero-Commission Broker – eToro offers £0 commission on US stocks.

✅ Deposit in USD – Brokers like IG and Saxo charge currency conversion fees for GBP deposits. Using a multi-currency account (Wise or Revolut) can reduce this cost.

✅ Avoid Inactivity & Withdrawal Fees – Some brokers charge $5 per withdrawal or £10/month inactivity fees.

More here on the Best Investment Platforms

💡 Best Low-Cost Option: eToro is cheapest for beginners if depositing in USD. IG and Saxo charge commissions but offer advanced trading features.

Pros and Cons of Investing in Meta Shares

Before investing, consider the key advantages and risks of owning Meta (META) stock.

Pros of Investing in Meta Shares

✅ Strong Revenue Growth – Meta generated $116.6 billion in 2023, a 16% YoY increase.

✅ Market Leader in Social Media – Owns Facebook, Instagram, WhatsApp with nearly 4 billion users.

✅ Expanding into AI & Metaverse – Investing over $36 billion in VR, AI, and advertising technology.

✅ Profitable Business Model – High-profit margins due to advertising dominance.

✅ Stock Buybacks – Meta has repurchased billions in shares, increasing shareholder value.

Cons of Investing in Meta Shares

❌ Regulatory Risks – Ongoing EU and US antitrust investigations into Meta’s ad business.

❌ High Competition – Faces strong rivals like TikTok, Google, and Apple in digital advertising.

❌ Stock Price Volatility – META dropped 75% in 2022 before recovering in 2023.

❌ No Dividends – Unlike Apple or Microsoft, Meta reinvests profits instead of paying shareholders.

❌ Metaverse Uncertainty – Heavy investment in VR & AI, but profitability remains uncertain.

💡 Key Takeaway: Meta is a strong long-term investment, but competition, regulation, and metaverse spending are risks to watch.

How to Sell META Shares

If you already own Meta shares, you may want to sell them to take profits or cut losses.

Steps to Sell Meta Shares

1️⃣ Log in to Your Broker Account – Go to eToro, IG, or Saxo.

2️⃣ Locate Your Meta Shares – Open your portfolio or holdings section.

3️⃣ Select Sell Order Type:

- Market Order – Sells instantly at the current price.

- Limit Order – Sets a price target; shares sell only if that price is reached.

4️⃣ Confirm the Sale – Review details, then click “Sell”.

5️⃣ Withdraw Your Funds – If needed, transfer funds to your bank or reinvest.

💡 Best Exit Strategy: If the stock is volatile, use a limit order instead of selling at market price.

How to Invest in META via a Fund

Instead of buying individual shares, you can invest in funds that hold Meta stock. This provides diversification and reduces risk.

Which Funds Contain META Stock?

Meta is a top holding in many S&P 500 and Nasdaq ETFs.

| Fund Name | META % of Fund | Fund Type |

|---|---|---|

| Vanguard S&P 500 ETF (VOO) | 2.20% | Index ETF |

| Invesco QQQ Trust (QQQ) | 3.80% | NASDAQ 100 ETF |

| iShares US Technology ETF | 4.50% | Tech-focused ETF |

| Fidelity Contrafund (FCNTX) | 10% | Mutual Fund |

💡 Best for Passive Investors: VOO or QQQ ETFs (low fees, high diversification).

Is Meta Overpriced?

✅ Strong revenue growth suggests Meta is fairly valued.

❌ P/E ratio is higher than industry average, meaning the stock may be expensive.

✅ AI & Metaverse investments could fuel future earnings growth.

💡 Expert Opinion: “Meta remains a solid long-term investment, but short-term risks exist due to high valuation.” – www.nasdaq.com/market-activity/stocks/meta

Final Thoughts

✅ 1. Diversify Your Portfolio

Don’t invest everything in Meta—spread risk by holdingS&P 500 ETFs, Nasdaq ETFs, or other tech stocks like Apple & Microsoft.

✅ 2. Be Aware of FX Fees

UK investors pay conversion fees when buying US stocks in GBP. Use a multi-currency account (Wise or Revolut) to avoid extra costs.

✅ 3. Use a Stop-Loss to Protect Your Investment

Set a stop-loss at 10-15% below your buy price to reduce downside risk in volatile markets.

✅ 4. Monitor Market Trends & Meta’s Financial Reports

Track earnings reports, AI investments, and regulatory news to stay informed about Meta’s stock performance.

✅ 5. Invest in Meta via ETFs for Lower Risk

If you’re risk-averse, consider ETFs like VOO or QQQ, which hold Meta alongside other leading tech stocks.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs

Capital gains tax may apply to profits from selling shares. Consult with a tax advisor for specific advice.

As of now, Meta Platforms does not pay dividends, reinvesting profits into growth initiatives.

Investments in US stocks involve currency exchange risk. Fluctuations in the GBP/USD exchange rate can impact returns.

This depends on the broker. Some platforms offer fractional shares, allowing investments as low as £1.

Yes, many brokers allow you to hold US stocks like Meta Platforms in ISAs and SIPPs, providing tax advantages.

You May Also Like:

References:

- eToro Official Website – www.etoro.com

- IG Trading Platform – www.ig.com/uk

- Saxo Markets UK – www.home.saxo

- Meta Investor Relations – investor.fb.com

- Yahoo Finance: META Stock Data – finance.yahoo.com/quote/META

- Nasdaq: META Stock Overview – www.nasdaq.com/market-activity/stocks/meta

- Statista: Social Media Market Share – www.statista.com