How to Short the FTSE: A Beginner's Guide

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 08/01/2025

Do you think the FTSE 100 is on the verge of a downturn? I’ve been there, watching the market wobble and wondering if there’s a way to turn that uncertainty into an opportunity. The truth is, markets don’t always go up—and when they fall, traders like us can still find ways to profit. Shorting the FTSE 100 is one such strategy, letting you potentially benefit from falling prices instead of fearing them.

I’ve found shorting particularly useful during times of economic uncertainty or when market sentiment takes a bearish turn. It’s not just about making money—it’s also a way to protect other investments or take advantage of corrections in a volatile market.

In this guide, I’ll share everything you need to know about shorting the FTSE, from what it means to how it works. I’ll walk you through the steps, the tools I use, the platforms I trust, and the risks I’ve learned to manage. Whether you’re just starting out or looking to sharpen your skills, I’ve got you covered. Let’s dive in together.

Quick Answer: How to Short the FTSE…

To short the FTSE, you’ll need to use a trading platform offering CFDs, spread betting, or inverse ETFs. Open an account, search for FTSE assets, place a sell trade, and monitor your position carefully. Ensure you manage risks with stop-loss orders.

What Does It Mean to Short the FTSE?

Short selling is a trading strategy where you profit from falling prices by selling first and buying back later. It involves:

- Borrowing an Asset: Traders borrow an index (like the FTSE 100) or its equivalent from a broker.

- Selling It at the Current Price: The trader sells the borrowed asset, expecting the price to drop.

- Buying It Back at a Lower Price: Once the price has fallen, the trader repurchases the asset at the reduced price and returns it to the broker, pocketing the difference as profit.

For the FTSE 100, traders typically use instruments like:

- CFDs (Contracts for Difference): Allow you to speculate on the FTSE 100’s movements without owning it.

- Spread Betting: Tax-free in the UK and enables you to profit from price declines.

- Inverse ETFs: Track the FTSE 100’s movements in reverse, making them a longer-term option for bearish trades.

Why Short the FTSE?

There are several reasons traders might short the FTSE 100:

- Economic Downturns: If you expect the UK economy to face challenges, you might anticipate the FTSE 100 will decline as companies lose value.

- Bearish Sentiment: Traders often short indices when market sentiment turns negative, driven by geopolitical events, rising interest rates, or poor earnings reports.

- Speculation and Hedging: Shorting is a way to hedge long-term portfolios or speculate on short-term market drops.

However, shorting is inherently speculative. While it can be lucrative, the risks, especially with leveraged products, must be carefully managed.

Different Ways to Short the FTSE 100

Shorting the FTSE 100 can be done using various instruments, each with unique features and advantages. Here are the three most common methods:

CFDs (Contracts for Difference)

CFDs are one of the most popular tools for shorting the FTSE 100. They allow traders to speculate on the price movement of an asset, including indices like the FTSE, without actually owning it.

How It Works:

- You open a CFD position by selecting the FTSE 100 or its equivalent on your trading platform.

- To short, you place a “sell” order, betting that the price of the FTSE will decline.

- If the FTSE 100 drops, you can close your position at the lower price and profit from the difference.

Advantages of Using CFDs:

- Leverage: CFDs allow you to trade larger positions than your initial capital, potentially increasing your profits (but also your risks).

- Flexibility: CFDs are ideal for both short-term and long-term trades, offering a range of trading tools like stop-loss orders.

- Margin Trading: You only need to deposit a fraction of the total trade value, freeing up capital for other trades.

Spread Betting

Spread betting is another popular method for shorting the FTSE 100, particularly in the UK, where profits are exempt from capital gains tax.

How It Works:

- Instead of buying or selling the FTSE, you bet on the index’s movement.

- You “sell” (go short) by wagering a certain amount per point of movement, profiting when the FTSE drops.

Why Spread Betting is Ideal for Shorting:

- Tax-Free Profits: Unlike other trading methods, profits from spread betting are not subject to capital gains tax in the UK.

- Short-Term Focus: Spread betting is particularly suitable for short-term trades, such as intraday or swing trading.

- Low Costs: Many platforms offer commission-free spread betting with competitive spreads.

Inverse ETFs (Exchange-Traded Funds)

For those looking for a more passive approach to shorting the FTSE, inverse ETFs are a great option. These funds are designed to move in the opposite direction of the index they track.

How It Works:

- You purchase shares of an inverse ETF that tracks the FTSE 100.

- When the FTSE falls, the value of the inverse ETF rises, allowing you to profit from the decline.

Why Use Inverse ETFs?

- Longer-Term Strategy: Inverse ETFs are best suited for longer-term bearish positions.

- No Leverage Risk: Unlike CFDs or spread betting, inverse ETFs don’t use leverage, reducing the risk of significant losses.

- Simplicity: Buying and holding an inverse ETF is straightforward and doesn’t require active monitoring.

Each method offers unique benefits and suits different trading styles. Choose the one that aligns with your financial goals, trading experience, and risk tolerance.

How to Short the FTSE: Step-by-Step Guide

Shorting the FTSE 100 may seem complex at first, but by breaking it down into clear steps, you can approach it with confidence. Here’s a guide to help you get started:

Step 1: Choose the Right Instrument

Before you can short the FTSE, you need to decide which trading instrument best suits your goals and style. The three most common options are CFDs, spread betting, and inverse ETFs.

| Instrument | Best For | Advantages | Considerations |

|---|---|---|---|

| CFDs | Active traders; short-term trades | Leverage, flexibility | Higher risk due to leverage |

| Spread Betting | UK traders seeking tax-free profits | Tax-free, ideal for short-term trades | Requires active involvement |

| Inverse ETFs | Long-term bearish positions | Simplicity, no leverage risk | Limited to available ETF options |

Before you can short the FTSE, you need to decide which trading instrument best suits your goals and style. The three most common options are CFDs, spread betting, and inverse ETFs.

Step 2: Select a Platform

Choosing the right trading platform is critical to your success. Look for platforms that offer:

- FTSE Availability: Ensure the platform provides access to the FTSE 100 via your chosen instrument.

- Low Fees: Compare spreads, commissions, and overnight charges.

- User-Friendly Interface: A clear, intuitive interface helps you focus on trading, not navigating tools.

- Regulation: Make sure the platform is regulated by the FCA for a secure trading environment.

- Tools and Features: Look for stop-loss options, real-time data, and market analysis tools.

Popular platforms for shorting the FTSE include:

- eToro: Beginner-friendly with access to CFDs.

- IG: Offers both CFDs and spread betting, with advanced charting tools.

- Plus500: Simple, commission-free platform suitable for straightforward trading.

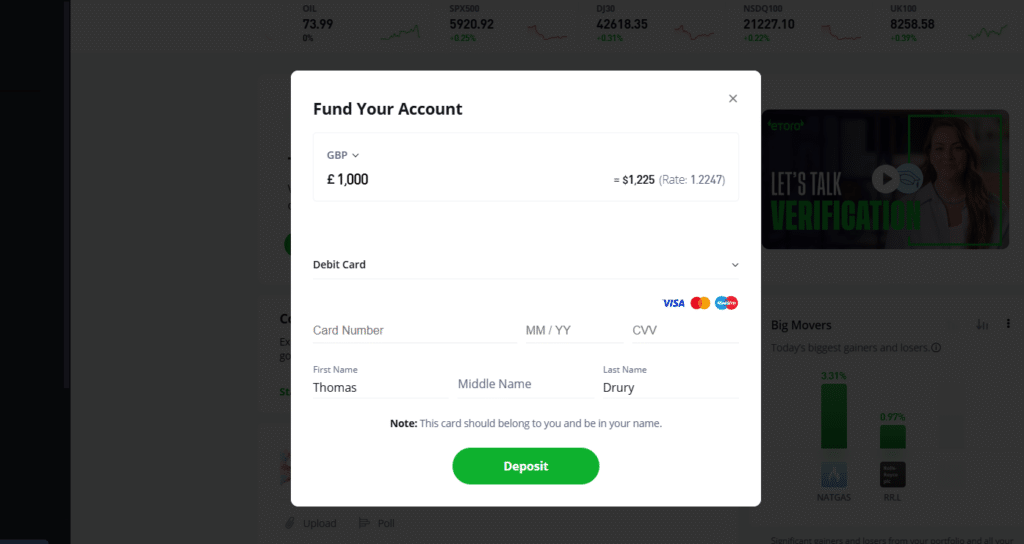

Step 3: Open and Fund Your Account

Once you’ve chosen your instrument and platform, it’s time to set up your trading account.

- Register on the Platform:

- Provide your personal information and verify your identity with documents like a passport or driver’s license.

- Complete a risk assessment questionnaire (common for FCA-regulated platforms).

- Fund Your Account:

- Deposit funds using bank transfer, debit card, or other supported payment methods.

- Ensure you meet the platform’s minimum deposit requirement (e.g., £100 for many platforms).

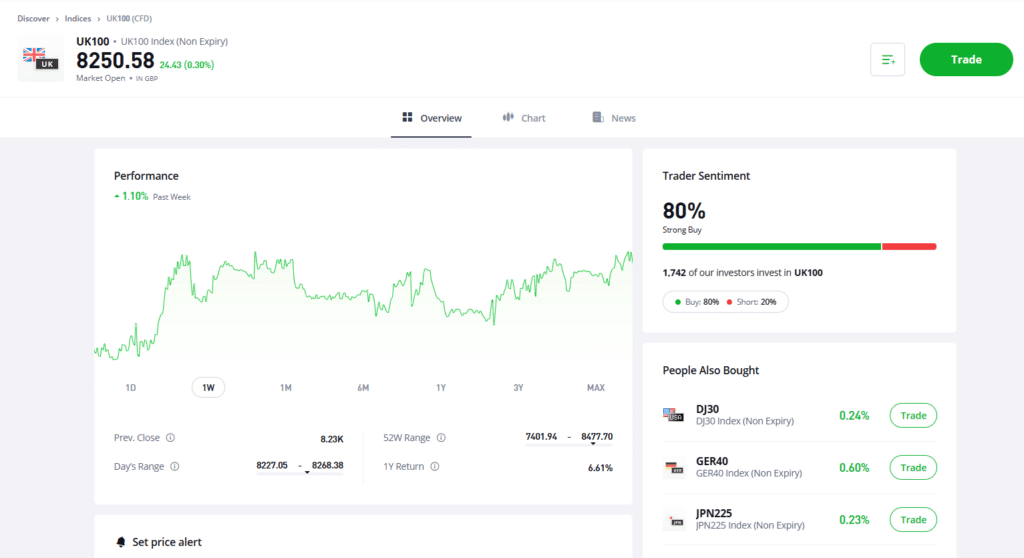

Step 4: Execute Your Short Trade

Now that your account is ready, it’s time to place your first short trade on the FTSE 100.

- Find the FTSE Asset:

- Search for the FTSE 100 or its equivalent (e.g., UK100 for CFDs or an inverse ETF).

- Platforms often have a search bar to locate the specific asset.

- Set Your Trade Parameters:

- Choose the amount you want to trade or bet (for spread betting).

- Set Stop-Loss and Take-Profit Levels:

- Stop-Loss: Automatically closes your trade if the price moves against you, limiting your losses.

- Take-Profit: Locks in your profits when the FTSE reaches your target price.

- Place the Short Trade:

- Select “Sell” or “Short” to open your position.

- Confirm your trade, and it will be executed immediately based on current market conditions.

Step 5: Monitor Your Position

Shorting the FTSE requires active monitoring to ensure your strategy stays on track.

- Track Market Movements:

- Stay updated on market news, as macroeconomic factors like interest rate changes, political events, and corporate earnings reports can impact the FTSE 100.

- Manage Your Risk:

- Adjust your stop-loss and take-profit levels as needed. For example, tighten your stop-loss if the trade moves in your favour to secure profits.

- Be cautious with leveraged trades, as they can amplify both gains and losses.

- Close the Trade Strategically:

- When the FTSE 100 falls to your expected level, close the trade to realize your profits.

- Alternatively, close the trade early if market conditions shift against your analysis.

By following these steps, you’ll have a structured approach to shorting the FTSE. Always remember to use risk management tools and trade responsibly, especially when dealing with leveraged instruments like CFDs or spread betting.

Risks and Considerations When Shorting the FTSE

Rewards of Shorting the FTSE

Shorting the FTSE offers significant opportunities for traders, especially during market downturns:

- Profiting in Bearish Markets: When the FTSE 100 declines, shorting enables traders to turn falling prices into profits, a valuable strategy during recessions or market corrections.

- Hedging Existing Investments: Shorting can act as a hedge for portfolios dominated by UK equities. For instance, if the FTSE 100 falls, gains from shorting can offset losses in long positions.

Risks of Shorting

Despite its potential rewards, shorting the FTSE carries notable risks:

- Unlimited Loss Potential: When shorting, losses can theoretically be infinite if the FTSE 100’s price rises instead of falling. This makes proper risk management essential.

- Margin Calls and Leverage Risks: Most instruments for shorting, like CFDs or spread betting, use leverage. This amplifies both profits and losses, and if the market moves against your position, you may face margin calls requiring additional funds to maintain the trade.

- Market Volatility: The FTSE 100 is influenced by external factors such as political events, economic data releases, and geopolitical developments. These factors can lead to sudden and unpredictable price swings, increasing risk for traders.

By combining tools like stop-loss orders and careful position sizing, traders can better manage these risks and protect their capital.

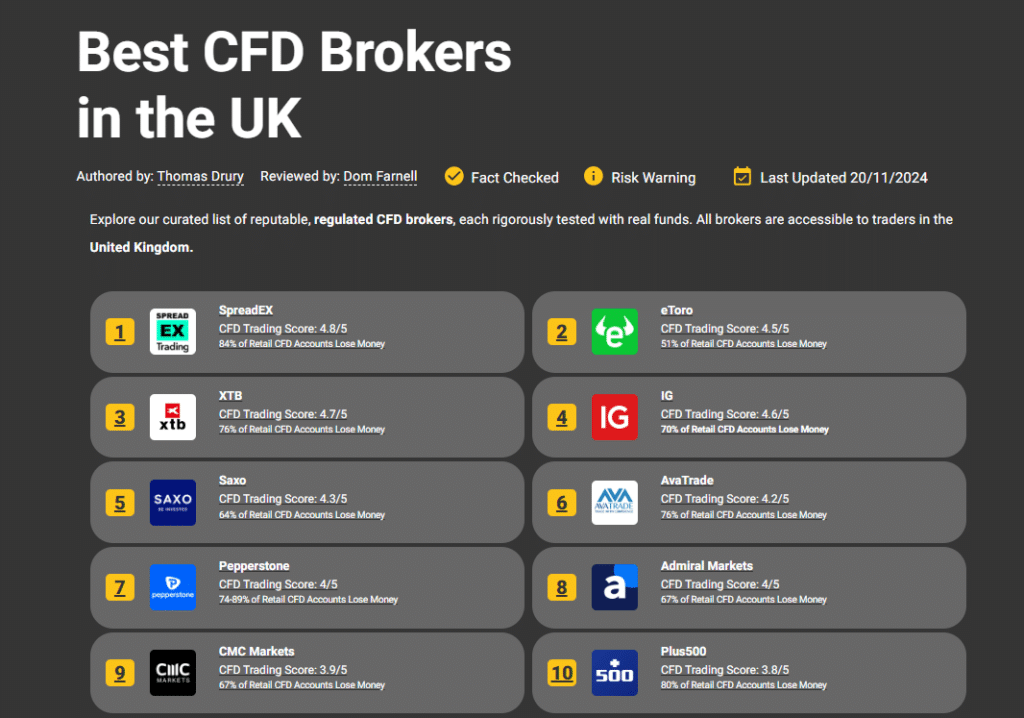

Best Platforms to Short the FTSE

When shorting the FTSE, choosing a reliable platform can make all the difference. Below is a comparison of three top platforms for UK traders:

| Platform | Fees | Ease of Use | CFD/Spread Betting Availability |

|---|---|---|---|

| eToro | Low spreads | Beginner-friendly | ✅ Yes (CFDs only) |

| IG | Competitive fees | Advanced tools | ✅ Yes (CFDs and spread betting) |

| Plus500 | No commission | Intuitive | ✅ Yes (CFDs only) |

- eToro: Known for its social trading features, eToro is an excellent choice for beginners looking to short the FTSE through CFDs.

- IG: Offering both CFDs and spread betting, IG is ideal for experienced traders who need access to advanced tools and a wide range of markets.

- Plus500: A simple, commission-free platform, Plus500 is perfect for traders seeking a no-frills experience.

Each platform is regulated by the FCA, ensuring a secure trading environment.

Final Thoughts: Should You Short the FTSE?

Shorting the FTSE 100 can be a powerful strategy to profit from falling markets or hedge existing investments. With tools like CFDs, spread betting, and inverse ETFs, traders have multiple methods to match their style and goals.

However, it’s vital to understand the risks, particularly with leveraged instruments like CFDs. Losses can exceed your initial investment, and external factors like political and economic developments can amplify volatility.

If you’re confident in your market analysis and prepared to manage risks, shorting the FTSE could be a rewarding strategy. But always trade responsibly, set stop-loss levels, and stay informed to protect your capital.

FAQs

The easiest way to short the FTSE is through CFDs (Contracts for Difference) or spread betting on a user-friendly trading platform like eToro or IG. These methods allow you to place a “sell” trade on the FTSE 100 without owning the asset.

Yes, beginners can short the FTSE 100, but it’s essential to start with a risk-free demo account to practice. Platforms like eToro and Plus500 offer beginner-friendly interfaces and resources to help new traders learn the basics before trading with real money.

Yes, shorting the FTSE is legal in the UK. FCA-regulated platforms, such as IG and Plus500, provide secure environments for retail traders to short indices like the FTSE 100 through CFDs, spread betting, or ETFs.

The tax implications depend on the method used:

- Spread Betting: Profits are tax-free in the UK.

- CFDs and ETFs: Profits are subject to capital gains tax (CGT). It’s always best to consult a tax advisor to understand your specific obligations.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.