How to Buy Stellar (XLM) in the UK

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Updated 26/11/2024

Explore our curated list of reputable exchanges for buying Stellar, each rigorously tested with real funds. All brokers are accessible to traders in the United Kingdom.

To Buy Stellar XLM in the UK, you'll need to:

- Choose a trusted exchange Like eToro or Coinbase).

- Create and verify an account with photo ID.

- Deposit GBP via bank transfer, PayPal, or card.

- Search for Stellar (XLM) and place your buy order.

- Store your Stellar securely in a wallet.

Featured Partner - eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Top 5 Exchanges

1

eToro

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

2

Coinbase

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

3

Uphold

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

4

MEXC

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

5

OKX

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

If you’re looking to buy Stellar (XLM) in the UK, you’re not alone. In the month of November 2024 the coin value is up over 450%.

Stellar has gained significant attention as a cryptocurrency focused on fast, low-cost cross-border payments and financial inclusion.

I first discovered Stellar while exploring blockchain projects designed to bridge gaps in the global financial system, and its practical use cases immediately stood out to me.

In this guide, I’ll walk you through my step-by-step process for buying Stellar in the UK, along with insights on the best platforms to use and how to store it securely.

Step-by-Step How to Guide

Step 1 – Choosing the Right Crypto Exchange

Focus on platforms with strong security features like two-factor authentication (2FA) and cold storage to protect your assets.

Fees can vary significantly, so be sure to review transaction, deposit, and withdrawal costs to avoid unexpected charges. While some exchanges offer low fees, they may have higher spreads, so compare your options carefully.

Here’s a quick comparison of popular exchanges for buying Stellar (XLM):

- eToro: Best for beginners, offering commission-free trading and a user-friendly interface.

- Coinbase: Provides simple tools and robust security, perfect for first-time users.

- Coinbase Advanced Trade: Features advanced charting, lower fees (0.4% maker, 0.6% taker), and order types suited for experienced traders.

- Uphold: Offers versatile multi-asset trading with no transaction fees, though it has higher spreads.

For ease of use and regulatory compliance, eToro is a solid choice for users in the UK. Meanwhile, Coinbase Advanced Trade is excellent for those who want more features and reduced trading costs.

| Feature | eToro | Coinbase | Coinbase Advanced Trade | Best Wallet |

|---|---|---|---|---|

| Ease of Use | Beginner-friendly, social trading features | Simple interface, ideal for beginners | Advanced tools, suited for experienced traders | User-friendly, simple interface for multi-asset trading |

| Fees | 1% trading fee | 1.49% transaction fee | Lower fees (0.4% maker, 0.6% taker) | Low fees (0.08% maker, 0.10% taker) or spread-based pricing (0.8-1.2%) |

| Funding Options | Bank transfer, debit/credit card | Bank transfer, debit/credit card, PayPal | Bank transfer, debit/credit card | Bank transfer, debit/credit card |

| Crypto Selection | 75+ cryptocurrencies | 240+ cryptocurrencies | 240+ cryptocurrencies | 350+ cryptocurrencies |

| Security | FCA-regulated, 2FA, cold storage | Insured funds, 2FA, cold storage | Insured funds, 2FA, cold storage | Strong security, cold storage, 2FA |

| Extras | CopyTrading, multi-asset platform | Educational tools, staking | Advanced charting, order types, lower fees | Multi-asset trading, competitive spreads |

Step 2 – Creating and Securing an Account

After selecting your preferred exchange, the next step is to create and secure your account. This process typically involves registering with your email, setting a strong password, and completing identity verification as required by Know Your Customer (KYC) regulations in the UK. These steps ensure compliance with legal standards and protect your account from fraud.

Steps to Create and Secure Your Account:

- Register Your Account: Sign up using your email address and set a robust, unique password.

- Verify Your Identity: Upload a valid photo ID (passport or driving licence) to meet KYC requirements. Some platforms may also require proof of address.

- Enable Two-Factor Authentication (2FA): Activate 2FA to add an extra layer of protection. This ensures that even if your password is compromised, a hacker cannot access your account without the secondary authentication method.

I cannot stress enough the importance of 2FA—it’s simple to set up and protects your account from unauthorised access.

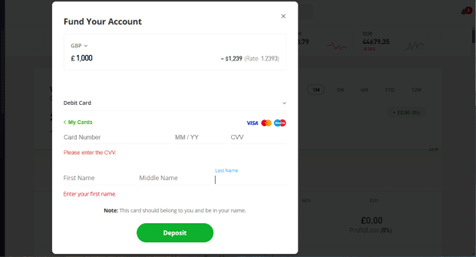

Step 3 – Depositing Funds

To buy Stellar (XLM), you’ll first need to deposit GBP into your exchange account. Most UK exchanges offer several funding options, including bank transfers, debit/credit cards, and PayPal. Each method has its pros and cons regarding fees and processing times.

Common Funding Methods:

- Bank Transfers: Often low-cost or free, but processing can take 1–2 business days.

- Debit/Credit Cards: Instant deposits but typically come with fees of up to 3%.

- PayPal: A quick and convenient option, though not supported by all exchanges.

For first-time buyers, starting with a smaller deposit (e.g., £50–£100) is a smart approach. This allows you to familiarize yourself with the platform before committing larger amounts. Always double-check deposit fees to avoid unexpected charges.

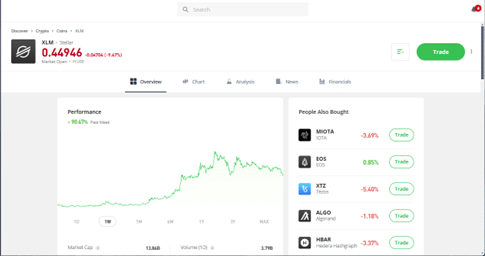

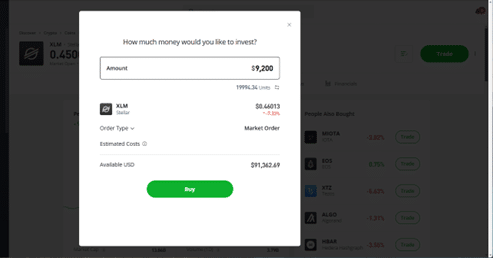

Step 4 – Find and Place a Buy Order for Stellar

Once your funds are in your account, you’re ready to purchase Stellar (XLM). Most exchanges have a search bar or a dedicated section for cryptocurrencies, making it easy to locate XLM.

Steps to Buy Stellar (XLM):

- Navigate to the “Trade” or “Markets” section of your platform.

- Search for XLM/GBP to find the relevant trading pair.

- Enter the amount of GBP you wish to invest or the number of XLM you want to buy.

- Choose an order type:

- Market Order: Buys instantly at the current market price.

- Limit Order: Lets you set a specific price at which you want to buy XLM.

- Confirm your order. Your Stellar will typically appear in your account within minutes.

While market orders are convenient for quick purchases, limit orders can be a better option if you’re aiming to buy at a specific price point.

Step 5 – Store Your Stellar Securely

After purchasing Stellar, it’s essential to move your coins to a secure wallet. Leaving them on an exchange exposes you to potential hacks.

Wallet Options:

- Hot Wallets: Software wallets like eToro Wallet are convenient but connected to the internet.

- Cold Wallets: Hardware wallets like Ledger Nano X or Trezor store Litecoin offline for maximum security.

Always back up your wallet’s recovery phrase and keep it safe.

For more on the best Crypto wallets Click here.

Bonus Step – Selling or Using Stellar

Selling Stellar is simple on most exchanges. Navigate to the Sell section, select XLM, and choose your preferred currency (e.g., GBP). You can then withdraw your funds to your bank account.

You can also use Stellar for:

- Low-cost international transfers: XLM’s network excels at fast and affordable cross-border payments.

- Trading other cryptocurrencies: Exchange XLM for Bitcoin, Ethereum, or other assets.

I’ve also used Stellar to explore decentralised finance (DeFi) tools, which further highlight its utility.

Where to Buy Stellar XLM

#1 eToro - Best in class for ease of use, simplicity and quick sign up

eToro stands out for its beginner-friendly interface and FCA regulation. It’s ideal if you’re new to cryptocurrency trading and want a seamless experience. eTopo’s real strength is in it’s multi asset platfrom.

Pros & Cons

- Multi-asset platform

- Zero commission on crypto trades.

- Supports GBP deposits via bank transfer, cards, and PayPal.

- Limited advanced trading features.

- Withdrawal fees (£5 per transaction).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

#2 Coinbase - The go-to platform for beginners

Coinbase is ideal for newcomers, thanks to its intuitive app and educational resources. It was my first exchange, and I found the process straightforward. However, fees can be higher compared to competitors for quick buys.

We recommend utilising their free Coinbase Advanced Trade platform for lower fees.

Pros & Cons

- Higher fees on basic platform (1.49% per trade).

- Bank deposits incur additional charges in the UK.

- Beginner-friendly with easy navigation.

- Coinbased Advanced Trade option for more features and lower fees.

- Excellent mobile app for trading on the go.

- Educational content to help users learn about Stellar and crypto in general.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

#3 Uphold - Multi-Asset, Low Minimums

Uphold is great for small investors and those looking to diversify. Its multi-asset functionality allows you to trade Stellar alongside stocks, metals, and other cryptocurrencies.

Pros & Cons

- No minimum deposit, great for beginners.

- Supports multiple assets beyond crypto.

- Low trading fees.

- Less user-friendly than eToro or Coinbase.

- Limited staking and earning options for Stellar.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What is Stellar?

Stellar is a blockchain-based platform designed to facilitate fast and low-cost cross-border payments. Its native token, XLM, is used to power transactions on its network. Created in 2014, Stellar focuses on connecting banks, payment systems, and individuals to create a unified financial ecosystem.

What sets Stellar apart is its focus on accessibility and affordability. With transaction fees as low as fractions of a penny, it’s particularly valuable for international money transfers and microtransactions.

How Does Stellar Work?

Stellar uses a unique Stellar Consensus Protocol (SCP) to validate transactions instead of traditional proof-of-work or proof-of-stake models. This makes transactions faster and more energy-efficient.

The platform operates on two key features:

- Anchor System: Allows fiat currencies to be represented on the blockchain for seamless transfers.

- Decentralised Exchange (DEX): Enables users to trade XLM and other assets directly.

Online forms are quick to comment on Stellar’s speed and efficiency , with transactions completing in just 2–5 seconds.

Is Stellar a Good Investment?

Stellar has several advantages as an investment, including its focus on real-world use cases like global payments. Its partnerships with major financial institutions make it a promising long-term asset.

However, as with all cryptocurrencies, XLM is subject to market volatility. I view Stellar as a mid-term investment—it has solid fundamentals, but its price is closely tied to adoption in the financial industry. Always do your research before investing.

Final Thoughts on Buying Litecoin

Buying Stellar in the UK is highly accessible when you follow the right steps. From picking a reliable exchange to securing your funds in a wallet, these steps will ensure your investment is safe. Stellar’s potential as a global payment solution makes it an exciting opportunity.

Ready to start? Platforms like eToro or Coinbase make it easy to invest in Stellar today.

Always invest responsibly, and never risk more than you can afford to lose.

FAQs

What is the minimum amount I can invest in Cardano?

Most platforms allow you to start with as little as £10–£50, depending on the exchange.

Can I buy Stellar with GBP in the UK?

Yes, many exchanges like Coinbase and eToro support GBP deposits via bank transfer or card.

Do I need a wallet for Stellar?

While not mandatory, using a wallet (hot or cold) is recommended for better security and long-term storage.

You May Also Like:

References:

Investopedia: “Talking to Clients About Crypto Risks: A Guide for Financial Advisors”

https://www.investopedia.com/risks-of-cryptocurrencies-8401477BBC News: “FTX: Cryptocurrency market rocked by near-collapse of exchange”

https://www.bbc.com/news/business-63564364Investopedia: “10 Rules of Investing in Crypto”

https://www.investopedia.com/investing-in-crypto-6502543Investopedia: “Crypto Due Diligence and the Fiduciary Responsibility for Financial Advisors”

https://www.investopedia.com/financial-responsibility-and-crypto-due-diligence-8385090The Times: “A user’s guide to all you need to know about cryptocurrency”

https://www.thetimes.co.uk/article/a-users-guide-to-crypto-3k5q77p90

Our #1 Recommended Crypto Wallet & Exchange Platform in the UK