Plus500 Review 2026

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Review Summary

Plus500 is a highly-rated trading platform, earning 4.5 stars for its intuitive design, diverse CFD offerings, and robust risk management tools. While it lacks advanced research features, its ease of use and transparency make it a strong choice for many traders.

Quick Review Summary

| Feature | Description |

|---|---|

| Platform | User-friendly interface with intuitive design |

| Instruments | CFDs on stocks, indices, forex, ETFs, commodities |

| Costs | No commissions, tight spreads, inactivity fee after 3 months |

| Tools | Advanced risk management features including GSLO |

| Education | Trading Academy, webinars, and market insights |

| Support | Multiple contact channels available |

| Security | SSL-protected platform with FSCS protection |

Best CFD & Spread Betting

Best CFD & Spread Betting

Capital.com offers a user-friendly interface with access to over 5,000 global markets via CFDs and spread betting. With tight spreads and an intuitive proprietary platform, it's a strong choice for both new and experienced traders.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

What is Plus500?

Founded in 2008 and headquartered in Israel, Plus500 has built a solid reputation in the trading world. It is publicly listed on the London Stock Exchange, making it part of the FTSE 250 Index. It's clean, responsive, and works just as well on mobile as it does on desktop. Setting up watchlists, managing trades, and tracking positions is completely seamless.

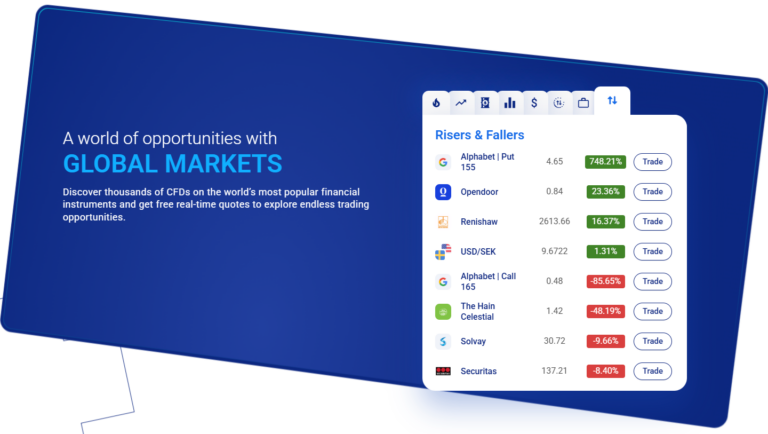

The platform is proprietary, offering a streamlined and intuitive trading experience that doesn't rely on third-party tools. With access to over 2,800 CFDs spanning forex, stocks and indices, Plus500 caters to diverse trading interests.

Plus 500's Key features include:

- Guaranteed Stop-Loss Orders to manage market risks.

- Negative Balance Protection ensuring traders never lose more than their deposited funds.

- Responsive mobile and desktop interfaces, which are easy to navigate and consistent across devices

Who Should Use Plus500?

Plus500 is designed for traders who value an easy-to-use platform, transparency, and access to a broad range of CFDs. It is particularly suited for:

- Casual traders who prefer a user-friendly experience

- Active traders seeking risk management tools such as stop-loss orders

Note: CFDs are complex instruments and carry the risk of losing money rapidly due to leverage. Beginners should consider starting with a demo account and Plus500's educational resources.

Is Plus500 Available in the UK?

Yes, Plus500 operates legally in the UK and is fully regulated by the Financial Conduct Authority (FCA). That kind of oversight offers peace of mind, especially when you're trusting a platform with your money. What's more,

Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909). This oversight provides reassurance for traders using the platform. In addition, UK clients are covered by the FSCS (Financial Services Compensation Scheme), which protects up to £85,000 in the event the broker were to fail.

For UK users, deposits and withdrawals can be made in GBP, helping to avoid currency conversion fees that might otherwise reduce your balance.

For UK users, you can deposit and withdraw in GBP, which means there are no annoying currency conversion fees cutting into your balance.

What markets are available to UK traders?

UK traders can access a wide variety of CFDs, including:

- Forex: Major, minor, and exotic currency pairs.

- Indices: Global indices like FTSE 100 and S&P 500.

- Stocks: Leading UK and international equities.

- Commodities: Trade gold, crude oil, and other key assets.

This broad market range makes Plus500 versatile for different trading strategies.

What is the difference between live trading and a demo account?

One thing I really like about Plus500 is its demo account. It mirrors real market conditions but uses virtual funds, so you can test-drive the platform, practice strategies, and get comfortable, without risking a penny.

When you're ready, switching to a live account means trading with real money and real-time market movements. But remember: emotions come into play with real cash on the line, so having proper risk management tools is key.

How Do You Fund a Live Account?

Funding your Plus500 account is pretty straightforward. The minimum deposit is £50, and if you're trading in anything other than GBP, there's a 0.7% currency conversion fee. Still, the variety of payment methods gives traders plenty of flexibility. You can use:

- Debit/Credit cards (Visa or MasterCard)

- PayPal or Skrill for fast e-wallet deposits

- Bank transfers for direct deposits

What Fees Does Plus500 Charge?

Plus500 keeps things straightforward with no commissions and no withdrawal fees. Instead, costs come from spreads, overnight funding, a currency conversion fee, and an inactivity fee. Optional tools such as guaranteed stop-loss orders (GSLOs) may also carry a charge. Full details are available on the Plus500 Fees & Charges page

| Fee Type | Details |

|---|---|

| Spreads | No commissions on FX trades. EUR/USD spread averages around 1.1-1.2 pips, though it can vary depending on market conditions. |

| Overnight Funding | Charged for holding positions overnight; varies depending on the asset and market. |

| Currency Conversion Fee | Applied when trading in a currency different from your account currency. Up to ~0.70% depending on the trade's currency difference. |

| Inactivity Fee | Up to USD 10 per month will be charged if there is no login to the account for at least 3 months. |

| Guaranteed Stop Loss Order (GSLO) | Available; if you use it the spread is guaranteed but will be wider than standard. |

| Withdrawal Fees | None charged by Plus500. (Note: your bank or payment provider may impose external fees.) |

| Deposit Fees | None charged by Plus500 in general. External/payment provider fees may apply. |

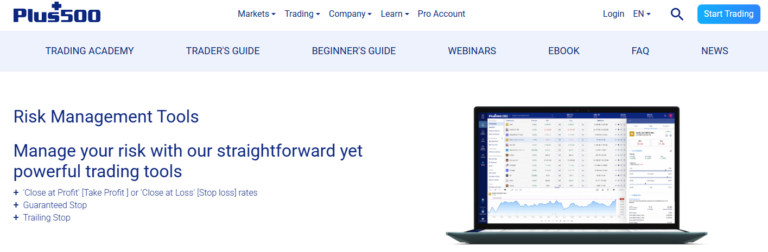

How Does Plus500 Help You Manage Risk?

Risk is part of trading, but Plus500 offers solid tools to help keep things under control. The standout feature? Negative balance protection, so you'll never lose more than what's in your account. It's a safety net that all brokers should have, and thankfully, Plus500 does.

You'll also get access to risk management tools like guaranteed stop-loss orders (GSLOs) to lock in your limits even in fast-moving markets. These tools make Plus500 a solid option if you're day trading riskier assets or just want extra control over your exposure.

| Feature | What It Does |

|---|---|

| Negative Balance Protection | Stops your balance from going below zero—required by ESMA rules |

| GSLOs (Guaranteed Stop-Loss Orders) | Closes trades at your exact price, no matter how volatile the market gets |

Quick Tips for Reliable Trading

Want to manage risk effectively when trading on Plus500? Here are a few smart habits to keep in mind:

- Always set stop-loss orders – they help you define a clear exit point and limit potential losses.

- Use leverage responsibly – Plus500 provides built-in limits to prevent overleveraging, but it's still important to choose position sizes that match your risk tolerance.

- Diversify your portfolio – spreading trades across different asset classes or sectors can reduce the impact of a single losing position.

These strategies can help smooth out the bumps, because even experienced traders don't make a profit with every trade.

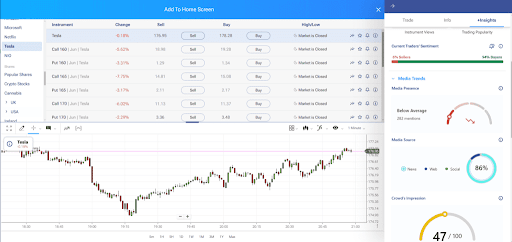

Does Plus500 Offer any Learning Tools?

Yes—Plus500 but the focus is more on quick tips and tools rather than deep educational content. The Insights Tool is quite useful, giving you a snapshot of trending assets and showing what other traders are keeping an eye on. Their Trading Academy includes a series of short videos and articles designed to help you grasp the basics, which is great if you're a beginner or new to trading. And if you ever need help, customer support is available via email or WhatsApp to assist you.

It's not the most in-depth learning hub compared to other platforms, but these features are still helpful for building a solid foundation and staying informed.

Is My Money Secure with Plus500?

Yes — Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909). The platform uses SSL encryption and other safeguards to provide a secure trading environment. However, trading CFDs is inherently risky, and market volatility means losses can occur at any time.

| Safety Feature | What It Means for You |

|---|---|

| Top-Tier Regulation | Regulated by FCA (UK), ASIC (Australia), CySEC (Cyprus) |

| Segregated Accounts | Your money is kept separate from company funds |

| FSCS Protection | UK users are covered up to £85,000 if the broker becomes insolvent |

| Public Company | Listed on the London Stock Exchange, so they follow strict financial standards |

How To Start Trading with Plus500

First, explore their demo account to practise strategies, then transition to live trading with a small deposit. The platform's tools and intuitive interface support efficient trading and risk management.

Step-by-Step Guide

- Create a Demo Account — Register for free on Plus500's platform and gain access to virtual funds. Use this account to practise and explore available trading tools risk-free.

- Understand the Markets — Familiarise yourself with the range of CFDs, including forex, stocks and commodities. Leverage the +Insights Tool to identify trends and market sentiment.

- Set Clear Goals — Define your trading objectives and risk tolerance. Plan a strategy before transitioning to live trading.

- Fund Your Live Account — Deposit a minimum of £50 via debit/credit card, PayPal, Skrill, or bank transfer. Monitor currency conversion fees if trading in non-GBP assets.

What are the Pros & Cons of trading with Plus500?

The CFD offering is massive—over 2,800 instruments covering forex, stocks and indices. As someone who likes to dip into different markets, that variety was a real highlight for me.

Risk management is another win. Having features like guaranteed stop-loss orders and negative balance protection gave me confidence, especially when testing high-volatility trades.

What Could Be Better?

- Limited research tools – If you're into advanced market analysis, you might find it a bit light.

- No social or copy trading – Unlike eToro, there's no way to follow other traders.

- Education lacks depth – The Trading Academy is fine, but it doesn't go beyond the basics like others do.

If these limitations matter to you, it’s worth comparing Plus500 with a more feature-rich CFD broker — see my City Index vs Plus500 comparison to see how they stack up on tools, spreads, and platforms.

| What's Offered | Considerations |

|---|---|

| User-friendly platform interface on desktop and mobile | Platform-specific trading only (no MT4/TradingView) |

| CFDs on 2,800+ instruments (stocks, indices, forex, ETFs, commodities) | No social or copy trading features |

| No commissions with tight spreads | Inactivity fee of $10/month after 3 months |

| Advanced risk management tools including GSLO | Research tools focus on essential analysis |

| No deposit or withdrawal fees | Trading Academy and educational resources cover fundamentals |

| SSL-secured platform with FSCS protection | Single platform option without third-party integrations |

Final Verdict

Plus500 earns a strong 4.5-star rating thanks to its intuitive interface, broad CFD market coverage, and integrated risk management features. Its simplicity makes it easy to get started, though the lack of advanced research tools and social trading options may be a drawback for some users.

For traders looking for a straightforward CFD platform with solid built-in risk controls, Plus500 is a compelling option. New traders are best served by using the demo account first and taking advantage of the Trading Academy, webinars, and market insights before committing real capital.

- User Friendly

- Diverse CFD Offerings

- Transparent Fee Structure

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

Is Plus500 suitable for experienced traders?

Yes, Plus500 offers a wide range of CFDs, competitive spreads, and risk management tools like guaranteed stop-loss orders, making it appealing for traders with some experience.

Does Plus500 work in the UK?

Yes, Plus500 is fully FCA-regulated and offers GBP transactions alongside FSCS protection. UK users can trade a variety of CFDs securely.

Does Plus500 use real money?

Yes, live trading on Plus500 involves real money. However, a demo account is available for practising and exploring the platform risk-free.

What fees does Plus500 charge?

Plus500 charges spreads, overnight funding fees, and inactivity fees but does not charge commissions or withdrawal fees. All costs are transparently displayed.

Can you go into debt with Plus500?

No, negative balance protection ensures that users cannot lose more money than their account balance.

References

- Financial Conduct Authority (FCA) – Plus500 is regulated in the UK by the FCA.

- London Stock Exchange – Plus500 Ltd Company Profile

- Financial Services Compensation Scheme (FSCS) – Details UK protection

- Plus500 Official Website – Fees and Charges

- BBC – Understanding Leverage in Trading

- BBC – What is CFD Trading, and Why Is It So Popular?

- Trustpilot – Plus500 User Reviews

- Finance Magnates – Broker News and Analysis

- ✓ 0% Commission* Other fees may apply

- ✓ MT4 & TradingView integration

- ✓ Free to open · £20 minimum deposit

62% of retail investor accounts lose money when trading CFDs with this provider.

62% of Retail CFD Accounts Lose Money