How to Open a Forex Trading Account (2026)

Want to start forex trading in the UK? This guide shows how to open a forex account step by step—reliably, legally, and quickly—with everything you need to know about regulation, platforms, funding, and your first trade.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: How Can I Open a Forex Trading Account?

You open a forex account by choosing a regulated UK broker, registering online, verifying your ID, funding your account, and downloading the trading platform. Once set up, you can practise on a demo or start trading live with as little as £50–£250.

- ✓ 0% Commission* Other fees may apply

- ✓ MT4 & TradingView integration

- ✓ Free to open · £20 minimum deposit

62% of retail investor accounts lose money when trading CFDs with this provider.

Step-by-Step: How to Open a Forex Trading Account

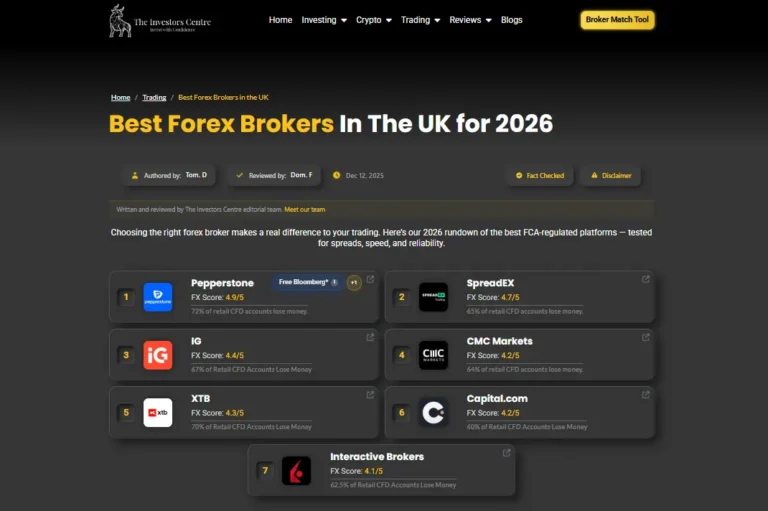

Step 1 – Choose a Regulated Forex Broker

Why is regulation so important when choosing a broker?

FCA regulation ensures your broker keeps client money in segregated accounts, follows anti-money laundering laws, and operates transparently. It provides a strong layer of protection and accountability—crucial when dealing with leveraged products like forex in a high-risk financial environment.

How do you compare forex brokers effectively?

Compare brokers based on key factors like regulation, minimum deposit, spreads, trading platforms, account types, and educational tools. Prioritise those authorised by the FCA and offering a demo account. Look for competitive spreads and reliable, easy-to-use trading software.

Forex Broker Comparison (UK 2026)

| Broker | FCA Regulated | Min Deposit | EUR/USD Spread | Platform | Demo Available |

|---|---|---|---|---|---|

| IG | Yes | £250 | 0.6 pips | MT4/ProReal | Yes |

| eToro | Yes | £50 | 1.0 pips | Web/Mobile | Yes |

| Plus500 | Yes | £50 | 0.8 pips | WebTrader | Yes |

Step 2 – Register and Fill Out the Application

What personal details are needed to open an account?

You'll need to enter your full name, current UK address, mobile number, email, and national insurance number. Brokers also request information about your employment status, annual income, financial background, and previous trading experience to assess suitability and assign appropriate risk warnings.

How long does registration usually take?

The registration process typically takes under 10 minutes. Some platforms offer near-instant account approval through automated systems. If details match verification databases, you can proceed to the next steps—such as funding and downloading the platform—on the same day you sign up.

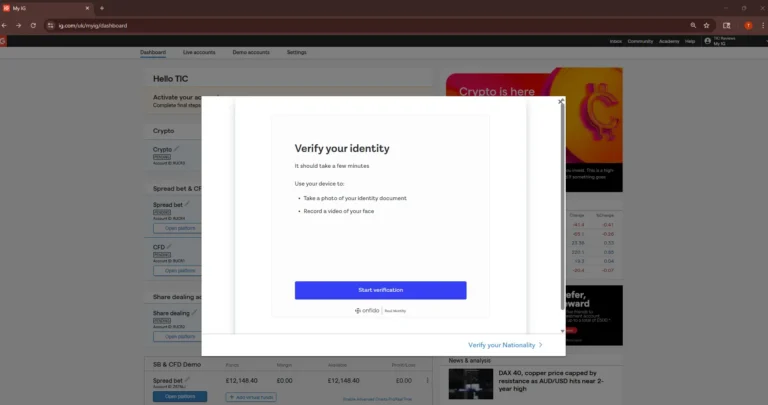

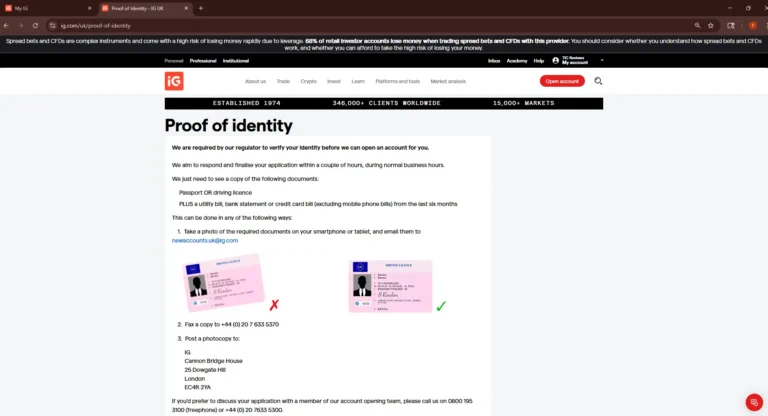

Step 3 – Verify Your Identity

Why do brokers require ID verification?

Forex brokers are legally required to complete Know Your Customer (KYC) checks. These help prevent identity fraud and money laundering. You must complete verification before depositing or withdrawing, ensuring all activity is legally compliant and tied to a real, verified account holder.

What documents do you need to upload?

You'll need to upload one photo ID (passport or driving licence) and one proof of address (bank statement or utility bill dated within three months). Most platforms offer secure, encrypted upload portals, and many verify your documents within a few business hours.

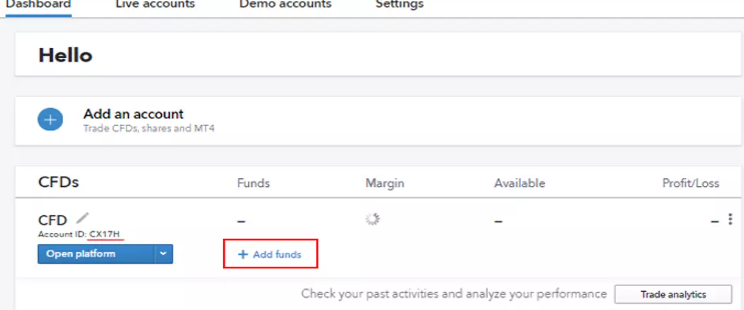

Step 4 – Fund Your Forex Account

What funding methods are accepted?

Most UK brokers support debit and credit cards, standard bank transfers, and e-wallets like PayPal or Skrill. Several offer instant funding via Faster Payments. Choose the method that balances speed, convenience, and cost based on your deposit amount and trading urgency.

Is there a minimum deposit to begin?

Minimum deposits vary by broker, typically ranging from £50 to £250. Always check this before signing up. Starting with a slightly higher amount can help with trade flexibility and effective risk management when opening multiple positions or using stop-loss strategies.

Common UK Deposit Options

| Payment Method | Processing Time | Typical Fees | Notes |

|---|---|---|---|

| Debit Card | Instant | None | Fastest and most popular |

| Bank Transfer | 1–2 days | Low | Ideal for large deposits |

| PayPal / Skrill | Instant | Low fee | Convenient for mobile use |

Step 5 – Download the Trading Platform

Which trading platforms do brokers use?

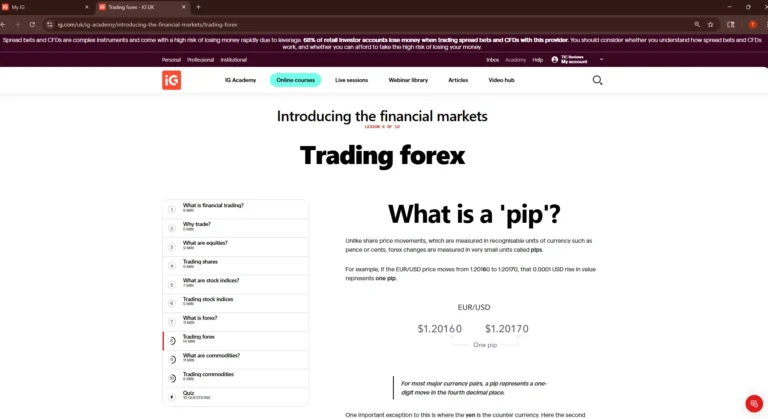

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used due to their reliability and charting tools. Some brokers also offer their own platforms via browser or mobile apps. Choose one that suits your style and is easy to navigate for beginners.

Can you trade using a mobile app?

Yes. Almost all UK brokers offer trading apps for iOS and Android. These apps allow you to place trades, track market movements, manage open positions, and set alerts—all from your smartphone, making them ideal for convenience and trading on the move.

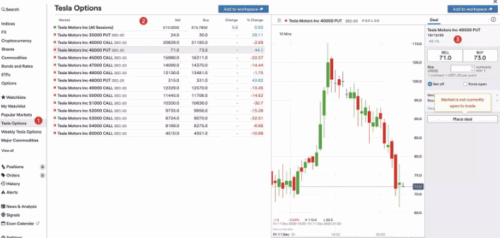

Step 6 – Make Your First Forex Trade

How do you place your first order?

Choose a currency pair, enter your trade size, and select buy or sell. Set stop-loss and take-profit levels to manage risk. Most brokers offer easy one-click order placement and let beginners start small using micro-lots to reduce exposure.

What's a reliable currency pair for beginners?

EUR/USD is the most recommended pair for new traders. It's highly liquid, has tight spreads, and tends to behave predictably compared to exotic or volatile pairs. These features make it ideal for learning market behaviour without facing extreme price fluctuations.

What Do You Need to Start Forex Trading in the UK?

What's the minimum deposit required for UK traders?

While some brokers allow you to start with as little as £50, beginning with £250 or more gives you more flexibility to manage trades and risk. A larger balance also helps with maintaining margin and placing multiple trades without overexposing your account.

Can you start with zero risk?

Yes. Most brokers offer demo accounts with up to £100,000 in virtual funds. This lets you practise trading, test strategies, and become familiar with the platform—all without putting real money at risk. It's the best way to build confidence early on.

Do you need advanced equipment to trade forex?

No advanced setup is necessary. A laptop, tablet, or smartphone with a reliable internet connection is enough. Most brokers support browser-based platforms and mobile apps, so you don't need powerful software or multiple monitors to begin trading effectively.

Is Forex Trading Legal and Safe in the UK?

Is forex trading legal for UK residents in 2026?

Yes. Forex trading is fully legal in the UK and regulated by the Financial Conduct Authority (FCA). Traders can buy and sell currency pairs through licensed brokers that meet strict standards for transparency, client protection, and financial conduct under UK law.

Do you need a licence to trade as an individual?

No licence is needed for personal trading. UK residents can trade forex freely using regulated platforms. A licence is only required if you offer trading advice, manage other people's money, or operate as a financial services provider under FCA rules.

How can you check a broker's regulatory status?

Visit the FCA Register and search the broker's name or firm reference number. The register confirms if a company is authorised to operate in the UK and details their permissions, complaints history, and whether they hold client funds securely.

What safety measures do regulated brokers offer?

FCA-regulated brokers hold client money in segregated accounts, separate from company funds. Many are also covered by the Financial Services Compensation Scheme (FSCS), which can protect up to £85,000 in case of broker insolvency. Secure encryption also protects your data.

Conclusion: Is It Easy to Open a Forex Account in the UK?

Yes. Opening a forex trading account in the UK is now quick, secure, and beginner-friendly. With just a few documents, a small deposit, and the right broker, you can start practising or trading within hours—using a regulated platform designed for safety and ease.

FAQs

Can I open a forex trading account with £100?

Yes. Many UK brokers allow accounts to be opened with as little as £50–£100. However, starting with £250 or more gives you more flexibility to manage positions, control risk effectively, and absorb market fluctuations without quickly breaching margin requirements.

How fast can I start trading after registering?

If your ID is verified instantly and you fund the account immediately, you could start trading within 30 minutes. Most brokers offer same-day activation, especially if you use common payment methods like debit cards or Faster Payments for quick deposits.

Is forex trading income taxed in the UK?

Yes. Forex profits may be subject to Capital Gains Tax or Income Tax depending on how you trade. HMRC rules vary based on whether you're spread betting or trading CFDs, so always keep records and consult a tax adviser if unsure.

Can I practise trading before going live?

Yes. Most brokers offer demo accounts that simulate real market conditions using virtual funds. Practising first lets you learn how to place trades, manage risk, and get comfortable with the platform—without the pressure of losing real money while you learn.

References

- How to check a firm or individual is authorised | FCA

- How To Start Forex Trading: A Guide To Making Money with FX

- Bank of England Market Operations Guide | Bank of England

- Capital Gains Tax: what you pay it on, rates and allowances: Overview | GOV.UK

- What we cover | Check your money is protected | FSCS

62% of Retail CFD Accounts Lose Money