Profile

Co-Founder

Thomas brings extensive experience in financial analysis and investment research. With a strong background in both institutional and retail investment sectors, Thomas ensures all content meets the highest standards of accuracy and relevance.

Follow on Twitter Connect on LinkedIn"Every piece of investment advice should be grounded in solid research and practical application. My role is to ensure our content provides real value to investors at every level."

My Favourite Writes:

Profile

Co-Founder

Dom is an experienced retail investor, learning his craft in what he likes to call the "hard way". Through many of these lessons he has crafted himself a sound investment strategy that has enabled him to make investing into a business not just a hobby.

Follow on Twitter"Financial clarity and integrity are the cornerstones of everything we do. We're here to ensure that your investment journey is built on a solid financial understanding and a sound strategic foundation."

My Favourite Writes:

Profile

Co-founder & Senior Financial Platform Analyst

Adam founded The Investors Centre in 2023 and has personally tested 50+ UK financial platforms. An active investor since 2013, he has authored 200+ platform guides and oversees all testing methodology.

Follow on Twitter Connect on LinkedIn"Investment is about more than just numbers; it's about strategy, research, and the willingness to adapt."

My Favourite Writes:

How We Test

Our Commitment to Accuracy

At The Investors Centre, we maintain the highest standards of accuracy and reliability in all our investment education content. Every article undergoes rigorous fact-checking and review processes.

Our Testing & Verification Process

- Primary Research: We gather data directly from official sources including company reports, regulatory filings, and government databases.

- Platform Testing: Our team personally tests and evaluates investment platforms, creating accounts and documenting real user experiences.

- Expert Analysis: Content is reviewed by experienced investors and financial professionals within our team.

- Data Verification: All statistics, figures, and claims are cross-referenced with multiple authoritative sources.

- Regular Updates: We review and update content quarterly to ensure information remains current and accurate.

Review Standards

- Independence: We maintain editorial independence and disclose any potential conflicts of interest.

- Transparency: Our testing methodology and evaluation criteria are clearly documented.

- Objectivity: Reviews are based on measurable criteria and standardized testing procedures.

Corrections Policy

If errors are identified, we correct them promptly and note significant updates at the bottom of articles. Readers can report inaccuracies to our editorial team at info@theinvestorscentre.co.uk

Last Review Date

This article was last fact-checked and updated on: December 10, 2025

Disclaimer

Educational Purpose Only

All content on The Investors Centre is provided for educational and informational purposes only. It should not be construed as personalised investment advice, financial advice, or a recommendation to buy, sell, or hold any investment or security.

No Financial Advice

We are not authorised by the Financial Conduct Authority (FCA) to provide investment advice. Content on this website does not constitute financial advice, and you should not rely on it as such. Always consult with a qualified financial advisor or professional before making investment decisions.

Investment Risks

Investing carries inherent risks, including the potential loss of principal. Past performance does not guarantee future results. The value of investments can go down as well as up, and you may not get back the amount originally invested.

Accuracy & Completeness

While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained on this website.

Third-Party Content & Links

This website may contain links to third-party websites and references to third-party products or services. We do not endorse, control, or assume responsibility for any third-party content, privacy policies, or practices. Users access third-party sites at their own risk.

Affiliate Disclosure

Some links on this site may be affiliate links. If you click on these links and make a purchase or sign up for a service, we may receive a commission at no additional cost to you. This does not influence our editorial content or reviews.

Personal Responsibility

Any action you take upon the information on this website is strictly at your own risk. We will not be liable for any losses or damages in connection with the use of our website or the information provided.

Regulatory Notice

Investment products and services featured on this website may not be available in all jurisdictions or to all persons. Users are responsible for complying with local laws and regulations.

Contact Information

For questions about this disclaimer or our content, please contact:

Email: info@theinvestorscentre.co.uk

Last Updated

This disclaimer was last updated on: August 2025

We’ve tested, reviewed, and compared top FCA-regulated brokers to help you find the right fit. Whether you’re a beginner or advanced trader, this guide focuses on real tools, transparent fees, and platforms trusted by UK investors today.

Pepperstone

Stocks Trading Score: 4.8/5

72% of retail CFD accounts lose money.

IG

Stocks Trading Score: 4.5/5

67% of Retail CFD Accounts Lose Money

Spreadex

Stocks Trading Score: 4.4/5

65% of retail CFD accounts lose money.

CMC Markets

Stocks Trading Score: 4.4/5

67% of retail CFD accounts lose money.

Quick Answer: Which is the Best?

The Best Trading Platform in the UK is Pepperstone, thanks to its low-cost trading, lightning-fast execution, and access to MetaTrader and cTrader. It’s trusted by thousands of UK traders for forex and CFDs, offering transparency, reliability, and competitive spreads across global markets.

How do the Top UK Trading Platforms Rank?

| Rank | Platform | Best For | Fees | Trading Tools | User Experience |

|---|---|---|---|---|---|

| 1 | Pepperstone | Fast Execution & CFD Traders | Low (0% on Standard; Razor from £2.25 per side) | MT4, MT5, cTrader, TradingView | Fast, built for active traders |

| 2 | IG | Market Access & Research | Medium (Free with 3+ trades, inactivity fees) | Advanced charts, ProRealTime | Advanced, steeper learning |

| 3 | Spreadex | UK-Focused Traders | Low (All fees included in the spread) | Basic tools, simple interface | Very intuitive and simple |

| 4 | CMC Markets | Technical Traders | Medium (No commission, inactivity fees) | Highly customizable, MT4 | Responsive, data-rich |

| 5 | XTB | Beginners & Investors | Low (0% commission*, inactivity fees apply: 10 euro/365 days) | xStation 5, mobile app | Beginner-friendly, clean UI |

| 6 | Interactive Brokers (IBKR) | Professional Traders | Very Low (From $0, market data fees may apply) | Institutional-grade tools | Functional but complex |

| 7 | eToro | Copy & Social Trading | No commission (inactivity & withdrawal fees apply) | CopyTrader, social trading features | Easy-to-use, gamified style |

*Free for ETF and real shares and 0.2% fee for transactions above EUR 100000.

Here are the top 7 Trading Platforms in the UK

- Pepperstone – Fastest Platform for Execution

- IG – Best for Market Access and Research Tools

- Spreadex – Easiest Platform for UK Traders

- CMC Markets – Top Choice for Technical Traders

- XTB – Best For Beginners and Investors

- Interactive Brokers – Best for Pro Traders

- eToro – Best for Copy Trading

Pros & Cons

- Ultra-fast trade execution

- Competitive spreads on Razor account

- Strong platform integrations (MT4, MT5, TradingView)

- No minimum deposit

- CFD-only trading (no real shares)

- Not ideal for long-term investors

- No ISA or SIPP accounts

-

How Much Does It Cost to Trade on Pepperstone?

-

Who Is Pepperstone Best Suited For?

-

Is Pepperstone Regulated and Is My Money Safe?

-

What Features Make Pepperstone Stand Out?

Razor accounts charge £2.25 per side per lot. Standard accounts are commission-free with spreads. No platform or inactivity fees apply.

Best for experienced or high-frequency traders who prioritise speed, tight spreads, and advanced tools for forex and CFD trading.

Yes. Regulated by the FCA in the UK and ASIC in Australia. Client funds are held in segregated accounts for added protection.

High-speed execution, institutional-grade platforms, and access to deep liquidity make Pepperstone ideal for precision-focused trading strategies.

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros & Cons

- Extensive market access across global equities, indices, and forex

- Strong research tools and analysis

- Trusted and long-established UK brand

- FCA regulated with robust investor protections

- Higher fees for infrequent traders

- Steeper learning curve for new investors

-

How Much Does It Cost to Trade on IG?

-

Who Is IG Best Suited For?

-

Is IG Regulated and Is My Money Safe?

-

What Features Make IG Stand Out?

£0 commission on UK/US shares with 3+ trades/month. Otherwise, £8 (UK) and $10 (US). No platform fees for active users. £24/quarter inactivity fee applies.

Ideal for experienced traders and those wanting global market access, deep research, and technical tools. Not recommended for beginners due to complexity.

Yes. IG is authorised and regulated by the FCA, and client funds are held in segregated accounts with FSCS protection up to £85,000.

IG offers a professional-grade trading platform, detailed technical analysis, global market access, and advanced tools for serious retail and professional traders.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Simple, user-friendly interface

- Low minimum deposit (£1)

- No inactivity or platform fees

- Good UK-based customer service

- Limited access to global markets

- Basic toolset may not suit advanced traders

-

How Much Does It Cost to Trade on Spreadex?

-

Who Is Spreadex Best Suited For?

-

Is Spreadex Regulated and Is My Money Safe?

-

What Features Make Spreadex Stand Out?

0% commission. Trading costs are built into the spread. No platform or inactivity fees, making it affordable for casual or occasional users.

Ideal for beginners or UK-focused traders seeking a no-frills experience. Not recommended for those needing advanced tools or international market access.

Yes. Spreadex is FCA regulated and offers client fund segregation and FSCS protection up to £85,000.

Its ease of use, no hidden fees, and UK-focused platform make it a great choice for domestic traders who value simplicity and support.

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros & Cons

- Advanced charting and analysis tools

- Highly customisable trading platform

- No minimum deposit requirement

- Strong reputation with FCA regulation

- Interface can be overwhelming for beginners

- Limited support for long-term investing accounts like ISAs/SIPPs

-

How Much Does It Cost to Trade on CMC Markets?

-

Who Is CMC Markets Best Suited For?

-

Is CMC Markets Regulated and Is My Money Safe?

-

What Features Make CMC Markets Stand Out?

£0 commission on CFD trades. Share trading via CMC Invest may include charges. No platform fees; £10/month inactivity fee after 12 months of no trades.

Best for technically skilled traders who value customisation and analytics. Less suitable for beginners or those seeking traditional long-term investment accounts.

Yes. CMC Markets is FCA regulated. Funds are held in segregated client accounts with FSCS protection up to £85,000.

Its standout features include advanced charting, a wide range of instruments, MT4 support, and a professional-grade trading environment for technical analysis.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Commission-free trading up to monthly limits

- Regulated by the FCA

- Excellent educational content for beginners

- Clean, user-friendly trading platform

- No ISA or SIPP options

- Limited advanced order types for professional traders

-

How Much Does It Cost to Trade on XTB?

-

Who Is XTB Best Suited For?

-

Is XTB Regulated and Is My Money Safe?

-

What Features Make XTB Stand Out?

XTB offers 0% commission on stock and ETF CFDs up to €100,000/month. After that, a 0.2% fee applies. There’s no deposit requirement, but a £10/month inactivity fee kicks in after 12 months of no trading.

XTB is ideal for beginners and casual investors who want a simple platform, low fees, and access to core markets without overwhelming tools or complexity.

Yes. XTB is fully regulated by the UK’s FCA and other top-tier authorities. Client funds are held in segregated accounts, offering strong protection and transparency.

XTB’s standout features include its award-winning xStation 5 platform, commission-free trades (within limits), strong educational content, fast execution, and mobile-optimised design for easy access.

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros & Cons

- Ultra-low trading fees

- Access to global markets

- Advanced trading tools and order types

- Strong reputation among professional investors

- Complex interface with a steep learning curve

- Overwhelming for casual or beginner traders

-

How Much Does It Cost to Trade on Interactive Brokers?

-

Who Is Interactive Brokers Best Suited For?

-

Is Interactive Brokers Regulated and Is My Money Safe?

-

What Features Make Interactive Brokers Stand Out?

From £3 per UK stock trade (IBKR Pro). No platform or inactivity fees. Additional market data subscriptions may apply depending on usage.

Best for experienced traders, institutions, or those needing access to international markets and sophisticated tools. Not ideal for beginners.

Yes. Regulated by the FCA, SEC, and other top-tier regulators. Offers client fund protection and strong compliance practices

It offers unmatched global access, algorithmic trading tools, advanced charting, and some of the lowest costs in the industry.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros & Cons

- 0% commission on real stock trading

- Easy-to-use platform for beginners

- Innovative CopyTrader™ feature

- Strong mobile experience

- Currency conversion and withdrawal fees

- Wider spreads on some trades

- Not suited for advanced strategies

-

How Much Does It Cost to Trade on eToro?

-

Who Is eToro Best Suited For?

-

Is eToro Regulated and Is My Money Safe?

-

What Features Make eToro Stand Out?

Real stock trading is commission-free. However, a $5 withdrawal fee and currency conversion fees apply. Inactivity fee of $10/month after 12 months.

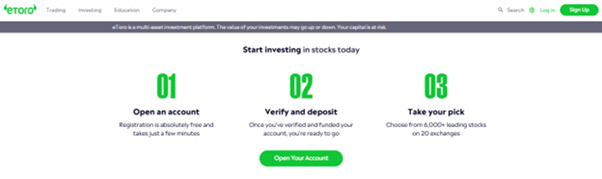

Perfect for beginners or casual investors who want to follow expert traders using the CopyTrader™ feature. Ideal for mobile-focused users.

Yes. eToro is regulated by the FCA in the UK and other global authorities. Client funds are protected and kept in segregated accounts.

Copy trading, a beginner-friendly interface, social trading insights, and access to global stocks—all from an intuitive mobile or web platform.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 61% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What Should You Look for in a Stock Trading Platform?

Why do Fees Matter?

At first glance, a wider spread with no commission might seem cheaper, while a tighter spread with a fixed fee can look costly on smaller trades.

But as position size and trading frequency increase, the balance flips: the low-spread account with a commission becomes more cost-effective, while the higher-spread, no-fee account ends up costing more.

The table below highlights how this difference plays out in practice for Pepperstone’s different account types.

Illustrative round-trip costs

Assumes 1 pip ≈ £10 per £100k notional.

Are the Trading Tools Suitable for Your Style and Strategy?

Whether you’re a casual investor or active trader, tools should match your needs. Beginners may value simplicity, while pros need real-time charts, custom alerts, and market scanners. A strong platform provides the flexibility to grow with your trading knowledge.

Can You Access a Wide Range of Assets for Diversification?

The best platforms support more than just UK stocks. Look for access to ETFs, global equities, bonds, and even crypto or commodities. A wider asset selection means you can diversify your portfolio without needing multiple brokers.

Is the Trading Platform Regulated and Your Money Safe?

Stick to brokers regulated by trusted bodies like the FCA. This ensures higher protection standards, secure fund segregation, and proper dispute processes. Your money and personal data are safer when a platform meets strict UK compliance rules.

What Do Real Traders Say About These Platforms?

What Evaluation Criteria Should You Use to Compare Platforms?

| Factor | Why It Matters | What to Look For |

|---|---|---|

| Fees | Affects long-term profitability | Low spreads, no hidden costs |

| Tools | Enables smarter decisions | Real-time data, screeners, charts |

| Regulation | Protects your capital | FCA, ASIC, SEC licensing |

| User Feedback | Reflects real-life reliability | 4.0+ reviews, responsive support |

Which Platform Features Actually Matter Most?

In 2026, seamless mobile trading, fractional shares, strong analytics, and fast execution are key. Customisable dashboards and risk-management tools are increasingly important. Platforms that blend usability with professional-grade features offer the best long-term experience.

Which Stock Trading Platform Best Matches Your Needs?

XTB and eToro are ideal for beginners. XTB offers great education and no minimum deposit, while eToro features social and copy trading tools that simplify decision-making. Both provide a smooth onboarding experience and user-friendly interfaces for new traders.

Which Platforms Offer the Most Advanced Tools and Assets?

IG and CMC Markets stand out for advanced traders. IG delivers in-depth research tools and broad market access, while CMC offers highly customisable charting and MT4 support. They’re perfect for traders focused on technical analysis and multi-asset exposure.

What’s the Best Choice for Professional or Global Traders?

Interactive Brokers and Pepperstone cater to experienced investors. IBKR offers ultra-low commissions, institutional-grade tools, and global markets. Pepperstone is ideal for fast-paced trading with razor-sharp execution and support for platforms like MT4, MT5, and TradingView.

How Do These Platforms Compare at a Glance?

| Trader Type | Recommended Platforms | Why These Platforms Stand Out |

|---|---|---|

| First-Time Investors | XTB, eToro | Easy onboarding, helpful education, no/low deposit requirements |

| Advanced Traders | IG, CMC Markets | Deep analysis tools, pro-grade charts, wide asset access |

| Professionals & Global Use | Interactive Brokers, Pepperstone | Institutional tools, tight spreads, fast trade execution |

How Do You Open and Manage a Brokerage Account?

Decide between a standard brokerage, ISA, or SIPP account. Taxable accounts suit flexible investing, while ISAs offer tax-free gains and SIPPs help with retirement savings. Your choice depends on your goals, risk profile, and how you plan to manage your investments.

How Should You Compare Brokers Before Signing Up?

Compare fees, supported assets, platform tools, and regulation. Look at user experience, customer service, and reviews. Make sure the broker fits your strategy—whether you’re a passive investor, frequent trader, or want access to global stocks or specific tax wrappers

How Do You Fund Your Account Safely?

Most UK brokers accept bank transfers, debit cards, and sometimes e-wallets. Make sure your name matches the registered account, and avoid third-party payments. Check for any minimum deposit requirements, and always use secure payment channels with two-factor authentication enabled.

How Do You Start Investing Once Funded?

Use the platform’s research tools to explore stocks, ETFs, or other assets. Start small, especially if you’re new. Place your order, review confirmation, and monitor performance. Use watchlists or alerts to stay updated and avoid making impulsive or emotional decisions.

How Should You Monitor and Adjust Your Portfolio?

Review your portfolio regularly to ensure it aligns with your goals. Rebalance if needed, diversify across sectors or regions, and assess performance. Use available tools like portfolio trackers, risk assessments, and market updates to stay informed and proactive.

What’s the Best Stock Trading Platform for You in 2026?

If you’re just starting out, XTB and eToro offer simplicity and learning tools. Advanced traders benefit from IG or CMC’s pro-level features. Global investors and pros favour Interactive Brokers or Pepperstone. Start with a demo account to find your best fit.

What’s Changed in 2026?

Pepperstone remains our top pick for active traders. eToro expanded its UK ISA offering through Moneyfarm. XTB continues to grow its commission-free stock access. All platforms listed remain FCA-regulated with FSCS protection up to £120,000. No major fee changes across the board.

FAQs

What is the best stock trading platform for beginners?

Based on my experience, XTB and eToro are great picks for beginners. They offer simple interfaces, low fees, and strong educational tools to help you get started confidently.

Which trading platform has the lowest fees?

Interactive Brokers consistently offers the lowest fees, especially for high-volume traders. XTB also has commission-free stock trading, making it a solid low-cost option for most investors.

Are these platforms regulated and safe to use?

Yes — all platforms I reviewed, including IG, CMC, and Pepperstone, are regulated by trusted authorities like the FCA, ASIC, or SEC. That means your funds are protected and the platform is held to high standards.

Can I trade international stocks on these platforms?

Absolutely. Platforms like IG, Interactive Brokers, and CMC Markets offer access to global markets including the US, UK, EU, and Asia. Just watch for FX conversion fees.

Should I use a demo account before trading with real money?

Definitely. I always recommend starting with a demo account. It’s the best way to get a feel for the platform’s tools and layout without risking any of your money.

References

- XTB Official Website – Trading Platform & Fees

- IG Group – Share Dealing & Trading Platform

- CMC Markets – Next-Generation Trading Platform

- Spreadex – Spread Betting & CFD Trading

- Interactive Brokers – IBKR Global Trading

- eToro – Investing & Copy Trading Platform

- Pepperstone – Forex and CFD Broker

- FCA Register – Financial Services Register

- Trustpilot – User Reviews for Trading Platforms