How to Short Tesla – Beginners Guide [2025]

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 14/04/2025

Quick Answer: How to Short Tesla in 2025?

To short Tesla, open a margin account with a brokerage, locate Tesla shares to borrow, and execute a sell order. The goal is to buy back the shares at a lower price to turn a profit. Be aware of the risks, as losses can exceed the initial investment.

Overview Of Tesla 2025:

By 2025, Tesla is set to remain a leader in the EV market, driven by innovations in battery technology and autonomous driving. With expanding global factories and new models, Tesla is pushing towards mass adoption of sustainable vehicles while continuing to shape the future of energy and transportation.

Start Shorting Tesla Today with eToro

- Copy Trading Tools

- Competitive Fees

- Trade With Leverage

- User Friendly

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

For a user-friendly platform with competitive rates, consider eToro. With eToro, you can short Tesla with ease, access market insights, and manage your risk effectively. Sign up now and start trading!

What is Short Selling?

Short-selling is a strategy where investors borrow shares of a stock they believe will decrease in value. They then sell these shares at the current market price and aim to buy them back at a lower price. This difference between the selling price and the repurchase price is the investor’s profit. However, if the stock price rises instead, the investor incurs a loss. This strategy is popular for those with a high-risk tolerance and confidence in a stock’s potential decline.

Why Would Investors Want to Short Tesla?

Tesla’s stock is known for its volatility, partly due to its position in a rapidly changing industry and the influence of its CEO, Elon Musk. High-profile news and market sentiment can cause large swings in Tesla’s share price, both up and down. For this reason, some investors find shorting Tesla appealing because it presents opportunities for profit during periods of overvaluation or hype.

For instance, I once shorted Tesla around an earnings report period, expecting a negative reaction due to lower-than-expected delivery numbers. The stock indeed dropped following the announcement, allowing me to close my position for a quick profit. However, there have been other times when unexpected news, like an announcement of a new product, caused the stock to surge, proving the importance of timing and research in this strategy.

Here’s a quick comparison of long and short positions with Tesla:

| Aspect | Long Position (Buying) | Short Position (Short Selling) |

|---|---|---|

| Goal | Profit from price increase | Profit from price decrease |

| Risk | Limited to investment amount | Theoretically unlimited |

| Ownership | Own shares | Borrowed shares |

| Common in Tesla? | Yes, for long-term growth | Yes, due to volatility |

Short-selling Tesla requires an understanding of market trends and the ability to manage risk, as the potential losses can be substantial if the stock doesn’t behave as expected.

How Does Short Selling Work? A Step-by-Step Guide

Short-selling involves multiple steps, each requiring careful attention to detail. If you’re looking to short Tesla, here’s a simplified breakdown of the process.

Step 1: How Do You Open a Margin Account for Short Selling?

To short Tesla, you first need a margin account. This type of account allows you to borrow shares to sell, which is essential for short selling. Opening a margin account usually involves filling out an application with a brokerage, agreeing to their terms, and meeting specific financial requirements. Most brokerages require you to have a minimum balance or meet certain income criteria because short-selling is considered high-risk.

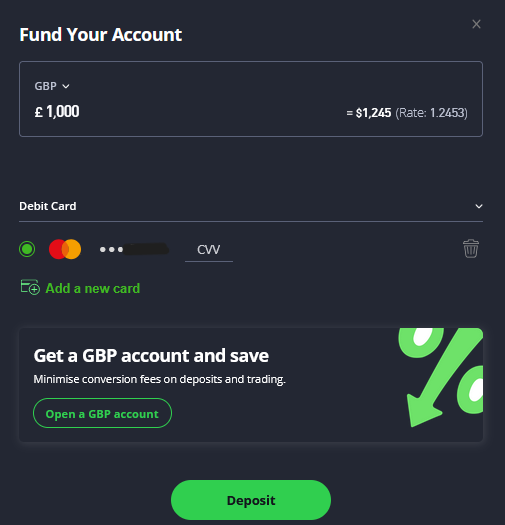

Step 2: Funding Your Margin Account

Once your margin account is open, it’s time to fund it. This funding meets the brokerage’s initial margin requirement, which is a percentage of the total trade value. Additionally, you’ll need to maintain a minimum amount in your account, called the maintenance margin. If the stock moves against your position and your balance falls below this level, you’ll face a margin call and will need to add funds or close the position.

For example, I once funded an account with just the minimum required amount. But a sudden upward spike in the stock price quickly led to a margin call, and I had to scramble to add more funds. Since then, I have always kept a cushion in the account to avoid these stressful situations.

Step 3: Borrowing Tesla Shares to Sell

With a funded account, the next step is to borrow shares. Brokerages typically have a pool of shares available for clients to borrow, and they handle the logistics. Once borrowed, these shares can be sold at the current market price. Be aware that brokerages often charge interest on the borrowed shares, and availability can fluctuate, so it’s best to confirm with your broker before executing a trade.

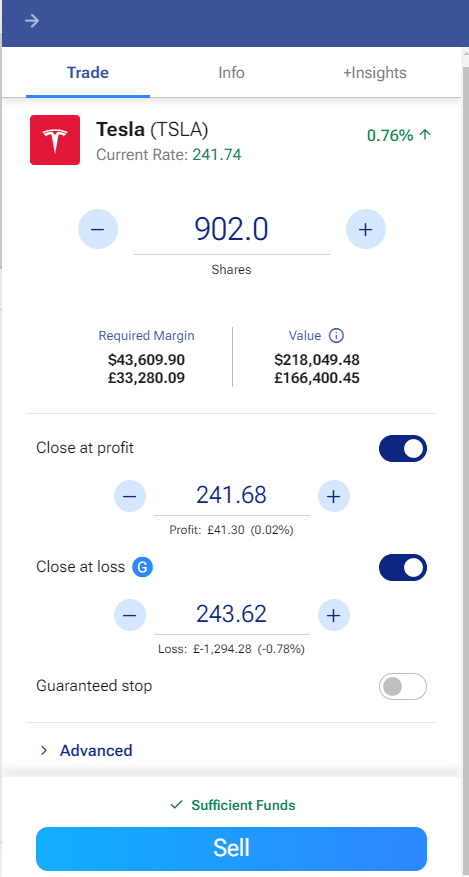

Step 4: Initiating the Short Sale

To initiate the short sale, select the Tesla shares in your trading platform, set the number of shares to short, and place a sell order. Once executed, you’ve officially shorted the stock. At this point, you’re aiming for the price to fall so you can repurchase the shares at a lower price later.

A useful tip: I’ve found that setting stop-loss orders when I open a position can help mitigate risk by automatically closing the trade if Tesla’s price rises unexpectedly.

Step 5: Monitoring and Covering Your Position

The final step is to monitor your position and cover it by buying back the Tesla shares. Keeping an eye on Tesla’s price movements and staying updated on market news is vital. When the stock reaches a lower price that meets your profit target, you’ll place a “buy to cover” order, repurchasing the shares at the lower price and closing the position.

From experience, it’s easy to get caught up in the excitement and hold out for a bigger drop, but I’ve learned that having a clear exit plan ensures you lock in profits and avoid potential losses.

Each step is critical to the short-selling process and managing risk effectively, especially with a volatile stock like Tesla.

| Step | Action | Purpose |

|---|---|---|

| 1. Open a Margin Account | Set up an account for borrowing | Essential to start short selling |

| 2. Fund Account | Deposit funds | Meet margin requirements |

| 3. Borrow Shares | Locate Tesla shares to borrow | Acquire shares to sell short |

| 4. Sell Shares | Initiate the short sale | Sell at current price |

| 5. Buy Back | Repurchase shares at a lower price | Close the short position and make a profit |

What are the Risks of Short Selling Tesla?

Short-selling Tesla carries significant risks, and understanding these risks are crucial before entering a position. Here’s a closer look at some of the major risks involved.

What is the Risk of Unlimited Loss?

When you short a stock, your potential losses can be theoretically unlimited. This is because, unlike buying shares, where the maximum loss is the initial investment, a short position can lead to far greater losses if the stock price rises significantly. If Tesla’s price shoots up, you’ll have to buy back the shares at this new, higher price to close the position. Since there’s no cap on how high a stock can go, this creates an unlimited loss scenario.

I remember a time when I shorted a stock, expecting it to decline. Instead, an unexpected merger announcement sent the stock soaring, and I quickly found myself with a growing loss. With Tesla, a sudden positive announcement or product launch could create a similar situation, underscoring why managing risk is essential.

How Do Margin Calls Work?

A margin call occurs when your account balance falls below the brokerage’s required maintenance margin due to adverse stock price movements. When shorting Tesla, a rise in its stock price can decrease your account’s equity, triggering a margin call. At this point, your broker will ask you to deposit additional funds or close the position to meet the minimum margin requirement.

In my experience, margin calls are a scramble to avoid forced liquidation by the brokerage. I always try to keep extra funds in the account as a buffer. But if you can’t meet the margin call in time, your broker may close the position at a loss, often when the stock price is at a peak, which can lead to even greater losses.

What Company-Specific Risks Does Tesla Present?

Tesla’s stock is exceptionally volatile, driven by high trading volumes, strong market sentiment, and frequent media coverage. Tesla’s CEO, Elon Musk, has also been known to make statements or announcements that can instantly impact the stock’s price. For example, news about new technology, production updates, or even Musk’s tweets can lead to sharp price movements, which makes shorting Tesla particularly risky.

I’ve noticed this firsthand when Musk made unexpected comments on social media about potential developments, causing massive spikes in the stock. Tesla’s volatility, combined with these external factors, means that short sellers need to be constantly vigilant and prepared for the stock to move dramatically in either direction.

Understanding these risks is essential when short-selling, especially with a high-profile stock like Tesla. An effective risk management strategy can help mitigate potential losses, but short-selling always carries the potential for significant financial exposure.

What Are the Different Ways to Short Tesla?

If you’re interested in shorting Tesla, there are several methods available, each with its unique pros, cons, and risk profiles. Here’s an overview of some popular ways to short Tesla.

Can You Short Tesla with Traditional Short Selling?

Traditional short selling involves borrowing Tesla shares from a brokerage, selling them at the current market price, and repurchasing them later when the price has ideally dropped. This is the most direct method of shorting and provides a one-to-one exposure to Tesla’s price movement.

Pros

- Direct Exposure:You gain direct exposure to Tesla’s stock price, making it easier to predict profit and loss.

- Widely Accessible: Most brokerages support traditional short selling, so it’s an easy option if you already have a brokerage account.

Cons

- Unlimited Risk: Since Tesla’s price could rise indefinitely, losses can be theoretically unlimited.

- Interest on Borrowed Shares: : You’ll pay interest on the shares borrowed, which can add up over time, especially if you hold the position for an extended period.

I’ve used traditional short selling in the past for stocks I felt were overvalued. While it provides direct exposure, I quickly learned the importance of setting stop-loss orders to limit potential losses, as stocks can sometimes behave unpredictably, especially with high-profile companies like Tesla.

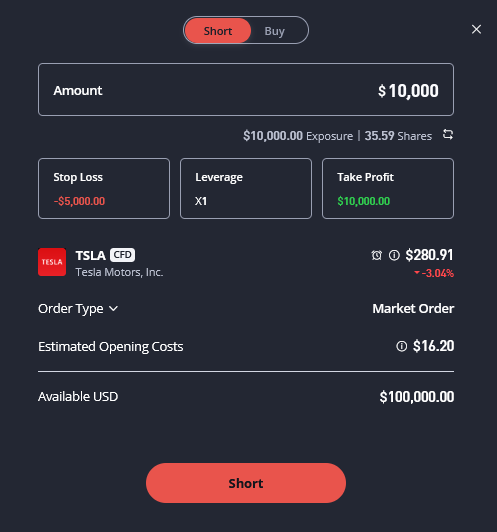

Using CFDs to Short Tesla

Contracts for Difference (CFDs) allow you to speculate on Tesla’s price without owning the actual shares. When you short a CFD, you essentially enter into an agreement with a broker to pay the difference between Tesla’s current price and its future price. If the price drops, you profit; if it rises, you lose.

Pros

- No Need to Borrow Shares: You don’t need to locate and borrow shares, making the process simpler.

- Typically Lower Fees: CFDs often have lower upfront costs compared to traditional shorting.

Cons

- Leverage Risk: CFDs are usually leveraged, which means you can control a larger position with a small amount of capital, increasing both potential profits and potential losses.

- • Not Available in the U.S: CFDs are restricted in some countries, including the United States.

I’ve found CFDs convenient for short-term trades, especially with volatile stocks. However, leverage can be a double-edged sword, so if you’re not prepared for sudden movements, losses can mount quickly.

Using Put Options to Hedge Against Tesla’s Stock

A put option gives you the right, but not the obligation, to sell Tesla shares at a specific price (the strike price) before the option expires. If Tesla’s stock price falls below the strike price, the option becomes profitable.

Pros

- Limited Loss Potential: Unlike traditional shorting, your loss is limited to the cost of the option premium.

- No Borrowing Needed: Since you don’t need to borrow shares, there’s no interest involved.

Cons

- Premium Costs: Buying put options involves paying a premium, which can be costly, especially for a volatile stock like Tesla.

- Expiration Risk: Options have an expiration date, meaning your position is time-bound. If Tesla’s price doesn’t fall as expected within that timeframe, the option could expire worthless.

Put options are a favourite of mine for limiting risk. I can place a calculated bet against Tesla without worrying about margin calls or sudden losses, making it a more flexible tool for bearish positions.

Are Inverse ETFs a Viable Option for Tesla?

Inverse ETFs are funds designed to move in the opposite direction of a particular index or sector. While they don’t directly short Tesla, you can choose ETFs that track indices related to Tesla’s sector. If Tesla declines and drags the sector down, the inverse ETF rises in value.

Pros

- Easy Access: You can trade ETFs like stocks, so they’re simple to buy and sell.

- No Need to Manage Borrowed Shares: Inverse ETFs provide a way to profit from a decline without actively shorting.

Cons

- Non-Tesla Specific: Inverse ETFs don’t track Tesla exclusively, so they may not reflect its price movements perfectly.

- Subject to Decay: Inverse ETFs often experience decay over time, meaning their performance can degrade, especially if held for extended periods.

I find inverse ETFs useful for indirect short exposure, particularly when I want to bet on a sector rather than a specific stock. However, it’s essential to monitor these investments closely, as they’re best suited for short-term positions.

| Method | Description | Pros | Cons |

|---|---|---|---|

| Traditional Short | Borrow and sell shares directly | Direct exposure, widely accessible | Unlimited risk, interest on borrowed shares |

| CFDs | Trade contracts on price movement | No need to borrow, lower fees | Leverage can amplify losses |

| Put Options | Right to sell at a set price | Limited loss potential, no borrowing | Premium costs, expiration risk |

| Inverse ETFs | Opposite performance to index/sector | Easy to access, no need to manage trades | Non-Tesla-specific, subject to decay |

Which Method of Shorting Tesla is Right for You?

When deciding which method to use, consider your risk tolerance, experience, and the costs involved.

- Traditional Short Selling is ideal for those comfortable with direct exposure and willing to manage margin accounts.

- CFDs offer a simpler approach without borrowing, but leverage makes them riskier.

- Put Options are a safer choice for those wanting to limit risk, but they require an understanding of options trading.

- Inverse ETFs provide an indirect, easy-to-access option for those who prefer broader market exposure.

Each method suits different strategies and risk profiles, so choose based on what aligns best with your experience and goals. For instance, I’ve used put options when I wanted to limit my downside and CFDs when I was looking for a quick trade based on a short-term trend. Matching the right tool to your objectives makes all the difference in effective short selling.

Conclusion: Is Shorting Tesla Right for You?

Shorting Tesla can offer profit opportunities but comes with significant risks, including unlimited loss potential, margin calls, and high volatility. If you’re considering shorting Tesla, ensure you fully understand the strategy and have a solid risk management plan in place. Consulting with a financial advisor can be invaluable, especially if you’re new to short-selling or trading high-profile stocks. Ultimately, shorting Tesla requires careful planning, market knowledge, and a readiness for potential losses.

FAQs

Investors may choose to short Tesla if they believe the stock is overvalued or anticipate a drop due to market conditions or company-specific factors. Tesla’s high volatility and rapid price fluctuations can make it attractive to those looking for opportunities to profit from a decline in its value.

Shorting Tesla involves the risk of unlimited losses if the stock price rises. Additionally, you may face margin calls if the position moves against you, requiring additional funds. Other risks include interest on borrowed shares and the potential for Tesla’s volatility to result in unpredictable price movements.

Using put options can limit your potential losses, as they provide the right, not the obligation, to sell Tesla shares at a set price. This approach caps losses at the option’s premium cost. Inverse ETFs can also offer a less direct method of betting against Tesla, though they’re subject to decay and broader market movements.

Bullish investors see Tesla as a pioneering leader in the electric vehicle industry with strong growth potential. Bearish investors, however, may view Tesla as overvalued, emphasizing high competition and potential risks associated with production and market sentiment. These differing perspectives create a dynamic environment for trading Tesla stock.

References:

- Investopedia – Short Selling Explained

- eToro – How to Short Stocks

- U.S. Securities and Exchange Commission (SEC) – Risks of Short Selling

- Yahoo Finance – Tesla Stock Analysis

- Bloomberg – Tesla Inc. Financials

- Reuters – News on Tesla Inc

Featured Blogs

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Stocks, ETFs, crypto, more

- Copy top investors easily

- User & beginner friendly

- 30M+ global users

- Regulated, trusted platform