Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please note that the information provided by The Investors Centre is for educational purposes only and should not be considered financial advice. Always consult a professional before making any investment decisions.

Last Updated 20/01/2025

Quick Answer: IG or Saxo, which is best?

The best broker depends on your needs. IG is ideal for beginners, offering low fees and user-friendly platforms, while Saxo suits experienced traders with its vast market access and advanced tools. Choose IG for simplicity and Saxo for professional-grade features and broader assets.

Why I Chose to Compare IG and Saxo

When I started trading, choosing a broker felt overwhelming. IG and Saxo quickly stood out due to their strong reputations and regulatory backing—IG with the FCA in the UK and ASIC in Australia, and Saxo with FINMA in Switzerland and the FCA.

IG appealed to me with its beginner-friendly tools and lower forex fees, perfect for learning the basics. Saxo, on the other hand, impressed me with its vast market access and professional-grade platforms, though its higher costs gave me pause.

My aim here is simple: to help you decide which broker aligns with your trading needs by blending data and my personal experiences.

A Quick Overview: Who Are IG and Saxo?

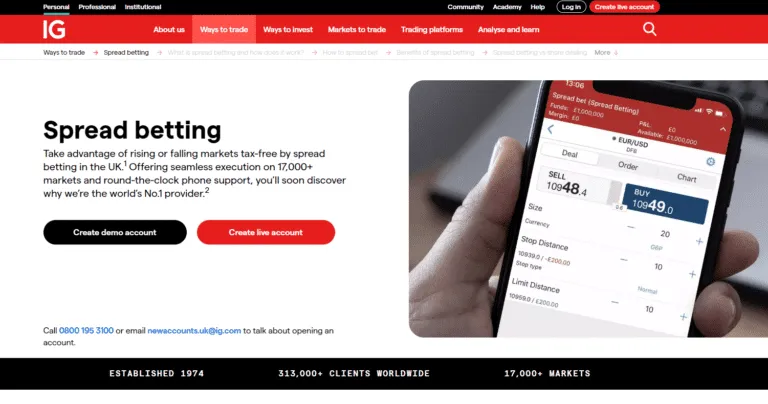

IG: A Pioneer in Online Trading

Established in 1974, IG has grown to serve over 17 countries, bringing financial trading to retail investors. Known for its simplicity and innovation, IG offers a user-friendly platform perfect for beginners. In my early days, I found its clear navigation and accessible tools invaluable.

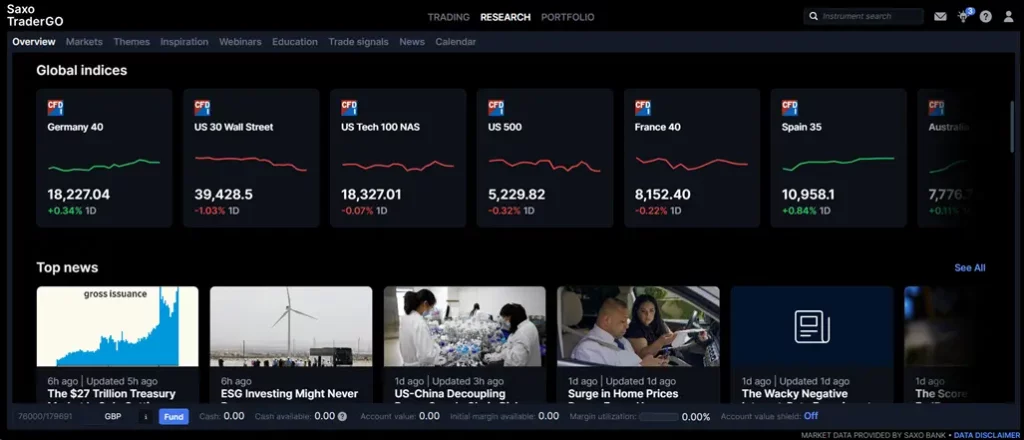

Saxo: A Global Powerhouse for Serious Traders

Founded in 1992 in Copenhagen, Saxo specializes in catering to professional traders and high-net-worth clients. With access to over 25 markets and advanced tools, Saxo excels for those with more experience. While its platform felt overwhelming at first, I saw its value as I gained confidence.

Both brokers have unique strengths, and understanding their offerings is key to finding your best fit.

| Feature | IG | Saxo |

|---|---|---|

| Founded | 1974 | 1992 |

| Headquarters | London, United Kingdom | Copenhagen, Denmark |

| Global Reach | Available in 17+ countries, including the UK, Australia, Singapore, and the US. | Available in 25+ countries, including Switzerland, the UK, Hong Kong, and Australia. |

| Regulated by | FCA (UK), ASIC (Australia), BaFin (Germany), and others. | FCA (UK), FINMA (Switzerland), ASIC (Australia), FSA (Denmark), and others. |

| Key Milestones | - One of the first brokers to introduce CFDs to retail investors. | - Known for its proprietary trading platforms with advanced tools. |

| - Listed on the London Stock Exchange since 2000. | - Among the first brokers to integrate ESG-focused investing options. | |

| Primary Audience | Primarily caters to retail traders, with beginner-friendly tools and resources. | Focuses on professional traders and high-net-worth individuals, offering extensive market access. |

Key Metrics: How IG and Saxo Compare

Fees and Costs

When comparing brokers, fees are often the first thing I look at. Even small differences can add up quickly, especially if you trade frequently. IG and Saxo both offer transparent pricing, but their fee structures cater to different types of traders.

Forex and CFD Fees:

IG has a slight edge here, with a EUR/USD spread of 0.6 pips, compared to 0.9 pips on Saxo. For active forex traders like me, that difference adds up over time. IG’s lower spreads make it a more cost-effective choice for frequent trades.

US Stock Fees:

Saxo charges just $1.60 per US stock trade, which is significantly lower than IG’s $10 per trade. If your focus is stock trading, Saxo’s fee structure is more appealing. However, IG offers discounts for active traders, which can narrow the gap if you’re trading often.

Inactivity Fees:

One area where both brokers shine is the lack of inactivity fees. As someone who doesn’t always trade consistently, I appreciated that neither IG nor Saxo penalized me for periods of downtime.

Additional Fees:

Both brokers offer free deposits and withdrawals for bank transfers, but their support for other payment methods differs. For example, IG supports PayPal, which I found incredibly convenient, while Saxo does not.

My Takeaway on Fees:

If you’re trading forex or CFDs, IG’s lower spreads and straightforward pricing are a win. However, Saxo’s low stock trading fees and access to more markets make it worth considering for equity-focused traders or those with diverse portfolios. The choice ultimately depends on what you trade most.

| Fee Type | IG | Saxo |

|---|---|---|

| US Stock Fee | $10.00 per trade for most accounts, reduced for active traders. | $1.60 per trade but may vary based on trading volume and account type. |

| EUR/USD Spread | 0.6 pips on standard accounts; competitive for forex-focused traders. | 0.9 pips; slightly higher but includes access to a broader range of currency pairs. |

| Inactivity Fee | None; no penalty for dormant accounts. | None, which is advantageous for casual traders or long-term investors. |

| Withdrawal Fee | $0; free withdrawals across most payment methods. | $0 for bank transfers; other methods may incur charges. |

| Deposit Fee | $0; accepts payments via bank transfer, credit/debit cards, PayPal, and more. | $0; supports bank transfers and limited card options but lacks PayPal. |

| S&P 500 CFD Spread | 0.4 points, offering a low-cost entry for CFD trading. | 0.5 points, slightly higher but competitive for its market depth. |

| Account Maintenance Fee | None; no ongoing maintenance charges for standard accounts. | Variable; may include fees for premium or professional accounts. |

Platforms and User Experience

When it comes to trading platforms, IG and Saxo both deliver high-quality options, but their designs cater to different types of traders. Here’s how they compare:

Mobile Platforms

Both brokers excel in mobile trading, with apps that score 5.0/5 for their smooth performance and robust features. IG’s app stands out for its simplicity. When I started trading, I found it intuitive to navigate, and it didn’t overwhelm me with options. Saxo’s app, while powerful, felt more suited to experienced traders, with advanced tools that took me time to fully understand.

Web Platforms

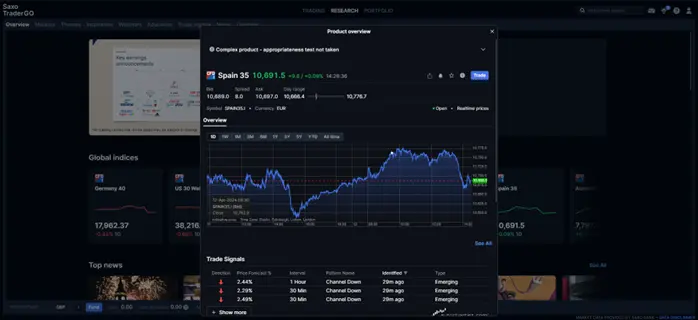

IG’s web platform mirrors its mobile experience: clean, intuitive, and highly customizable. It’s perfect for beginners who want to focus on learning without distractions. On the other hand, Saxo’s SaxoTraderGO platform is packed with features like advanced charting and risk management tools. While it’s a fantastic tool for professionals, I initially found it daunting compared to IG’s straightforward design.

Desktop Platforms

Here’s where Saxo shines with SaxoTraderPRO, a desktop platform tailored for serious traders. It offers deep market data, multiple screens, and advanced analytics. While I appreciate its functionality now, as a beginner, I found it overwhelming and stuck with IG’s web-based approach, which was more approachable for my needs.

Unique Features

- IG: Offers MT4 support, a big win for traders who rely on automated strategies or expert advisors. I used MT4 early on for backtesting strategies, and IG’s seamless integration was a huge plus.

- Saxo: Provides access to advanced tools like trading APIs and customizable dashboards. For professionals, this level of control and data access is invaluable.

My Takeaway on Platforms:

If you’re just starting, IG’s user-friendly platforms make it the better choice. Saxo’s tools, while exceptional, cater more to seasoned traders or those ready to dive into advanced features. It’s a matter of preference: simplicity versus sophistication.

| Platform Feature | IG | Saxo |

|---|---|---|

| Mobile App Score | 5.0/5: Highly intuitive, fast, and reliable; supports trading, charting, and news updates. | 5.0/5: Robust and feature-rich; includes advanced tools like risk management and watchlists. |

| MT4 Support | Yes: Offers full compatibility with MetaTrader 4 (MT4), allowing automated trading and expert advisors (EAs). | No: Proprietary platforms only; lacks support for MT4 but compensates with advanced analytics. |

| Web Platform Score | 5.0/5: Clean interface, customizable layouts, and comprehensive research tools. | 5.0/5: Sleek design with powerful functionalities; tailored for professional traders. |

| Desktop Platform Score | 4.5/5: Available but less emphasized; similar functionality to the web platform. | 5.0/5: Highly advanced desktop software with deep market analysis tools. |

| Ease of Use | Designed with beginners in mind; offers educational resources and simple navigation. | Built for advanced traders, requiring familiarity with complex trading environments. |

| Special Features | - Integrated with ProRealTime for advanced charting. | - Offers SaxoTraderGO for mobile and web and SaxoTraderPRO for desktop, with deep market data access. |

| - Includes Autochartist for pattern recognition. | ||

| Languages Supported | Available in 15+ languages, catering to a global audience. | Supports 25+ languages, emphasizing its international presence. |

Markets and Products

When it comes to the variety of tradable assets, both IG and Saxo offer extensive options, but their focus differs, catering to different types of traders.

Forex

IG provides access to 80+ currency pairs, including majors, minors, and a few exotics. As someone who started with forex, IG’s straightforward approach felt more accessible, with lower spreads and a focus on popular pairs. Saxo, on the other hand, offers an impressive 190+ pairs, making it a dream for traders looking to explore lesser-known or exotic currencies. However, this variety can feel overwhelming if you’re just starting.

CFDs

IG has a robust selection of 17,000+ CFDs, covering indices, commodities, shares, and cryptocurrencies. This range suited my needs as a beginner focusing on diverse but manageable options. Saxo takes it further with 40,000+ CFDs, including niche markets like small-cap stocks and commodities. For experienced traders with specific strategies, Saxo’s broader selection is unmatched.

Equities

Saxo shines in direct stock trading, offering 22,000+ global shares, compared to IG’s 12,000+ shares available mainly as CFDs. If you’re an investor looking for a direct stake in companies, Saxo provides more variety. IG, however, simplifies things with a focus on CFDs, which appealed to me when I prioritized learning over long-term investments.

Other Markets

- ETFs: Saxo offers 3,000+ ETFs, surpassing IG’s 2,000+, making it a better choice for thematic and diversified ETF investing.

- Cryptocurrencies: IG offers 10+ cryptocurrencies, focusing on popular names like Bitcoin and Ethereum, while Saxo’s 50+ crypto assets provide more niche options.

- Bonds and Mutual Funds: Saxo dominates here, offering global bonds and 250+ mutual funds, while IG has limited or no offerings in these areas.

My Takeaway on Markets and Products:

I appreciated Saxo’s broader selection, especially as I grew more confident in trading and wanted to diversify. However, IG’s focus on forex and CFDs felt more beginner-friendly and manageable when I was just starting. Saxo is ideal for traders with experience and a need for niche markets, while IG is perfect for those who want a solid, straightforward range of assets.

| Market/Asset | IG | Saxo Bank |

|---|---|---|

| Forex Pairs | 80+ pairs: Includes major, minor, and some exotic pairs; ideal for most forex traders. | 190+ pairs: Extensive offering, including a wide range of exotic currencies, suitable for global traders. |

| CFDs | 17,000+ CFDs: Covers indices, forex, commodities, shares, and cryptocurrencies. | 40,000+ CFDs: Broader selection, including more niche and international markets. |

| Stocks | 12,000+ shares available as CFDs and direct stock trading on global exchanges. | 22,000+ shares: Access to a wider range of stocks globally, with direct investment options. |

| Indices | 80+ indices: Includes major markets like the S&P 500, FTSE 100, and Nikkei 225. | 100+ indices: Broader market access, including regional and niche indices. |

| Commodities | Includes hard commodities (gold, oil, etc.) and soft commodities (coffee, cotton, etc.). | Offers a comprehensive list of commodity CFDs, including minor commodities like rubber and palladium. |

| Cryptocurrencies | 10+ cryptocurrencies available for CFD trading, including Bitcoin, Ethereum, and Ripple. | 50+ cryptocurrencies: Broader crypto offerings, including niche altcoins and crypto pairs. |

| ETFs | 2,000+ ETFs available for trading and investing. | 3,000+ ETFs: Offers a wider selection, including niche and thematic ETFs. |

| Bonds | Limited options for bond trading, mainly via CFDs. | Extensive range of bonds, including government and corporate bonds across global markets. |

| Mutual Funds | Not available. | Over 250+ mutual funds, catering to long-term investors. |

Safety and Regulation: Are IG and Saxo Trustworthy?

When choosing a broker, safety and regulation are non-negotiable for me. Trusting a platform with your hard-earned money requires knowing it’s properly regulated and adheres to strict standards. Both IG and Saxo excel in this regard.

Regulatory Oversight

IG is regulated by top-tier authorities, including the FCA (UK), ASIC (Australia), and BaFin (Germany). Similarly, Saxo operates under stringent oversight, with licenses from the FCA, FINMA (Switzerland), and ASIC, among others. Knowing that both brokers are held accountable by multiple regulatory bodies gave me peace of mind when I first started trading.

Investor Protection

Both brokers provide robust investor protection schemes. For UK clients, IG and Saxo are part of the FSCS, offering compensation of up to £85,000 in the unlikely event of insolvency. Other regions have similar protections, depending on the broker’s regulatory body.

Fund Security

IG and Saxo ensure client funds are segregated in tier-1 banks, which means your money is kept separate from the broker’s operational funds. For added security, IG offers additional insurance beyond the FSCS limit, covering up to £1 million for eligible accounts—something Saxo doesn’t currently match.

My Takeaway on Safety:

I’ve always prioritized working with brokers who have strong regulatory credentials, and both IG and Saxo meet the mark. IG’s extra insurance gave me added confidence early on, while Saxo’s global presence and strict compliance reassure me that my funds are in safe hands. Whether you’re a beginner or an experienced trader, you can trust both brokers to prioritize client safety.

| Safety Feature | IG | Saxo |

|---|---|---|

| Regulated by | FCA (UK), ASIC (Australia), BaFin (Germany), MAS (Singapore), and more. | FCA (UK), FINMA (Switzerland), ASIC (Australia), FSA (Denmark), and more. |

| Investor Protection | Yes: Coverage includes FSCS protection up to £85,000 in the UK and similar schemes in other regions. | Yes: Provides investor protection, such as FSCS up to £85,000 in the UK and compensation schemes under other jurisdictions. |

| Insurance Coverage | Additional insurance covering excess above standard FSCS limits, up to £1 million. | No additional insurance coverage beyond regulatory schemes. |

| Security of Funds | Segregates client funds in tier-1 banks; ensures funds are separate from company assets. | Follows strict client fund segregation practices, using top-tier banks for fund storage. |

| Transparency | Publicly listed on the London Stock Exchange (LSE), ensuring enhanced disclosure and oversight. | Privately owned, with strong compliance and reporting standards. |

| Operational History | Established in 1974, making it one of the longest-standing brokers in the industry. | Established in 1992, with a reputation for catering to high-net-worth individuals and institutions. |

Conclusion: My Final Thoughts on IG vs Saxo

Both IG and Saxo are excellent brokers, but their strengths cater to different audiences. IG’s low fees and accessible platforms make it ideal for beginners, while Saxo’s comprehensive market range and professional tools are better suited for experienced traders.

My advice? Start with the broker that aligns with your current needs. If you’re new, IG provides a solid foundation. As your trading evolves, you might find Saxo’s extensive offerings and tools more appealing. Ultimately, don’t be afraid to switch brokers as your skills and goals change—what works today may not suit you tomorrow.

| Criteria | IG Score | Saxo Score |

|---|---|---|

| Fees | 3.6/5: Competitive spreads and commissions, particularly for forex and CFDs, but US stock fees are higher compared to Saxo. | 3.1/5: Slightly higher costs across most trading instruments, including forex spreads and US stock fees, which can deter cost-sensitive traders. |

| Platforms | 5.0/5: Intuitive and user-friendly platforms (web, mobile, and MT4). Great for both beginners and experienced traders. | 5.0/5: SaxoTraderGO and SaxoTraderPRO provide advanced features for professional traders, though they may feel overwhelming for novices. |

| Customer Support | 2.4/5: Limited live chat hours and slower response times in some regions; service quality varies depending on location. | 4.5/5: Responsive and helpful, with knowledgeable agents available during trading hours; offers multilingual support. |

| Educational Resources | 4.5/5: Extensive library of webinars, articles, and tutorials tailored for beginners and intermediate traders. | 4.0/5: Comprehensive materials geared toward experienced traders, with less beginner-friendly content. |

| Market Range | 4.0/5: Covers 17,000+ instruments, focusing on forex and CFDs, with limited niche markets like bonds or mutual funds. | 5.0/5: Access to 40,000+ instruments, including a wide array of niche markets such as bonds, mutual funds, and exotic forex pairs. |

| Ease of Use | 4.7/5: Simplified account setup and platform navigation, making it beginner-friendly. | 4.0/5: Professional-grade tools with a steeper learning curve, ideal for experienced traders. |

FAQ

IG generally has lower fees for forex and CFDs, with tighter spreads and no inactivity fees. Saxo’s fees are higher, but it offers competitive pricing for stock trading and access to niche markets.

IG is better for beginners due to its intuitive platform, lower costs, and extensive educational resources. Saxo caters more to experienced traders with its advanced tools and broader product range.

Yes, Saxo provides access to over 40,000 instruments, including niche markets like bonds and mutual funds, compared to IG’s 17,000+ instruments focused on forex and CFDs.