Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice.

Please bear in mind that trading involves the risk of capital loss. 68% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money. CFDs are complex instruments with a high risk of losing money rapidly due to leverage.

Updated 02/02/2025

Quick Answer

Trading 212 is great for beginners with its user-friendly, commission-free trading, while Saxo’s feature rich platform offers advanced tools and diverse products for experienced investors. Both are optimal for UK Investors.

Page Contents

Introduction

Investing in the UK can be exciting, and choosing the right platform in 2025 is a great place to start. This VS Series blog compares Saxo vs. Trading 212, breaking down key differences in fees, features (copy trading, anyone?), and available investment options like stocks, ETFs, and even forex!

For more on investment platforms, check out our Best Investment Apps 2025, Best Day Trading Platforms 2025, or Best CFD Platforms 2025.

Disclaimer: This guide is for informational purposes only and should not be considered financial advice. Always conduct your own research before making any investment decisions.

Trading 212 and Saxo Overview

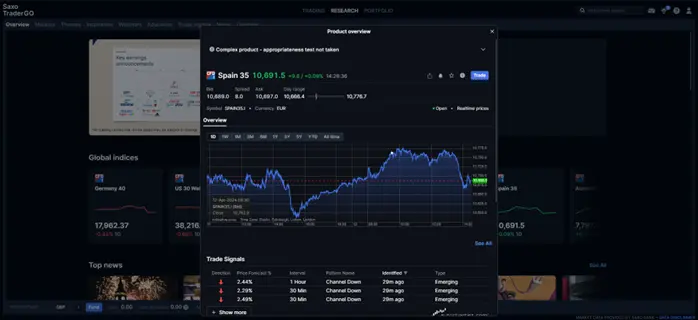

Saxo

Saxo is the online trading arm of Saxo Bank, a Danish investment bank founded in 1992. FCA-regulated in the UK, Saxo offers a wide range of investment products (stocks, ETFs, options, CFDs) and advanced platform features.

Trading 212

Trading 212 is a FCA-regulated UK investment platform known for its user-friendly interface and commission-free stock and ETF trading. They cater to beginners with a focus on ease of use, but offer a limited selection of products compared to more advanced platforms.

Saxo Summary:

- Founded in 1992 in Denmark, Saxo has grown into a leading online trading platform with a global presence.

- FCA-regulated in the UK, ensuring adherence to strict financial regulations.

- Known for catering to a wide range of investors, from beginners to experienced traders.

- Offers a comprehensive selection of investment products and advanced platform features.

Trading 212 Summary:

- Established in 2004 in Bulgaria, Trading 212 has become a popular choice for UK investors in recent years.

- FCA-regulated, providing a safe trading environment for UK users.

- Gained popularity for its user-friendly interface and commission-free stock and ETF trading.

- Primarily targets beginner investors with a focus on ease of use and accessibility.

- Offers a more limited selection of investment products compared to Saxo.

Head to Head Comparison

Investing Options | Stocks, ETFs, Bonds, Forex, CFDs, Mutual Funds | CFDs, Stocks, ETFs |

Interest on Cash | 3.91% £ | 5.2% £ |

FCA Regulated | ||

Founded | 2011 | 2004 |

4.0/5 | 4.8/5 | |

ISA Account | ||

Mobile App | ||

Fractional Shares | ||

Demo Account | ||

Investor Protection | ||

Available in UK | ||

Active Users | 1,000,000+ | 1,000,000+ |

Costs and Fees * * Saxo Fees are based on Classic account tier. Other tiers may have lower prices by comparison. | Costs and Fees | |

Inactivity Fee | ||

Platform Fee | ||

Min Deposit | £0 | £0 |

UK Exchange Fee | 0.08% min £3 | Free |

US Exchange Fee | 0,015 USD/Share | Fx fee applies (typically 0.1%) |

Deposit Fee | £0 | £0 |

Custody Fee Stocks, ETFs & Bonds | 0.12% | £0 |

Custody Fee Funds | 0.4% | £0 |

Withdrawal Fee | £0 | Free for first withdrawal per month, then £10 fee |

Review Scores | Review Scores | |

Investment Options | 4.8/5 | 3.4/5 |

Fees | 4.0/5 | 4.8/5 |

Desktop Platform | 4.7/5 | 3.8/5 |

Mobile Platform | 4.6/5 | 4.5/5 |

Research Tools | 4.7/5 | 3.3/5 |

Customer Support | 4.6/5 | 4.0/5 |

Regulatory Compliance | 4.8/5 | 5/5 |

Performance Tracking | 4.5/5 | 4.1/5 |

Total Score | 4.6/5 | 4.4/5 |

Reviews

Both Saxo and Trading 212 ranked highly in their our reviews. You may want to check out our in-depth reviews for each below:

Key Differences Between Trading 212 and Saxo

Choosing the right online trading platform is crucial for UK investors. Understanding the key differences between Trading 212 and Saxo can help you make an informed decision based on your investment goals and experience level.

Investment Focus

Trading 212 caters primarily to beginner investors. They focus on commission-free stock and ETF investing, making it a cost-effective option for those starting their investment journey. They also offer a limited selection of CFDs. In contrast, Saxo provides a wider range of investment products, including stocks, ETFs, options, CFDs, bonds, and Forex. This caters to both beginners and experienced traders who seek a more comprehensive platform.

Fees & Costs

Trading 212 shines with commission-free stock and ETF trades, making it a very attractive option for those focused on these asset classes. However, they may have fees associated with other products or inactivity. Overall, it’s generally considered a low-cost platform. Saxo, on the other hand, charges fees based on transaction size and asset class. While their fees might be lower for high-volume traders, it’s important to factor in potential account or inactivity fees.

Platform Features

Trading 212 prioritizes user-friendliness. Their platform is simple and easy to navigate, making it ideal for beginners. However, they offer basic charting tools and limited research resources. For experienced traders who require more powerful functionality, Saxo boasts advanced features. Their platform includes sophisticated charting tools, in-depth market research, and even algorithmic trading capabilities.

Investment Accounts

Both platforms offer ISA accounts, including Stocks & Shares ISAs and Lifetime ISAs. However, Trading 212 doesn’t cater to margin trading. Saxo provides a wider range of account options, including ISA accounts, regular investment accounts, and margin trading accounts. This additional feature can be beneficial for experienced investors seeking leverage strategies.

Customer Support

The availability of customer support can be important for UK investors. Trading 212 offers 24/7 support via chat and email, but their phone support might be limited. Saxo goes a step further by providing 24/7 phone, chat, and email support in multiple languages.

Suitability for UK Investors

Trading 212’s commission-free structure, user-friendly interface, and focus on stocks and ETFs make it a compelling option for UK beginners. However, Saxo’s wider range of products, advanced platform features, and comprehensive customer support cater to experienced investors who require a more robust trading environment.

Platform Pros and Cons

Saxo

- Wide range of investment products: Offers stocks, ETFs, options, CFDs, bonds, and Forex, catering to diverse investment strategies.

- Advanced platform features: Boasts sophisticated charting tools, in-depth market research, and algorithmic trading capabilities.

- Comprehensive customer support: Provides 24/7 phone, chat, and email support in multiple languages.

- ISA accounts: Offers both Stocks & Shares ISA and Lifetime ISA accounts for tax-efficient investing.

- Margin trading accounts: Available for experienced investors seeking leverage strategies.

- Fees: Charges fees based on transaction size and asset class, potentially higher costs compared to Trading 212 for some trades.

- Complex platform: Advanced features might be overwhelming for beginners.

- No commission-free trading: Doesn't offer commission-free stock and ETF trades like Trading 212.

Trading 212

- Commission-free stock and ETF trades: Ideal for cost-conscious investors focusing on these asset classes.

- User-friendly platform: Simple and easy to navigate, perfect for beginners.

- Fractional shares: Allows users to invest in portions of shares, making it easier to build a diversified portfolio.

- ISA accounts: Offers both Stocks & Shares ISA and Lifetime ISA accounts for tax-efficient investing

- Mobile app: Provides a convenient and user-friendly mobile app for on-the-go trading.

- Limited investment options: Offers a smaller selection of investment products compared to Saxo.

- Basic research tools: Lacks the in-depth research resources found on more advanced platforms.

- Limited customer support: Phone support might be limited, with primary support via chat and email.

- No margin trading: Not suitable for investors seeking leverage strategies.

Who Should Choose Them?

Saxo

Saxo is the ideal platform for UK investors who:

- Are active traders: They need advanced features for in-depth analysis and strategy execution.

- Seek a wider range of products: They want the flexibility to explore diverse asset classes beyond stocks and ETFs.

- Have experience: They can navigate the platform’s complexity and leverage its advanced features effectively.

- Value global reach: They want access to international markets for broader investment opportunities.

- Demand comprehensive support: Multilingual 24/7 support is important for them.

Trading 212

Trading 212 caters to UK investors who:

- Are beginners: They appreciate the user-friendly interface and easy navigation.

- Prioritize cost-effectiveness: Commission-free stock and ETF trades are a major benefit.

- Want to invest in stocks and ETFs: Their core focus aligns with this investment style.

- Have limited capital: Fractional shares allow them to invest with smaller amounts.

- Value mobile access: They want the convenience of managing their portfolio on the go.

Saxo vs Trading 212: Final Verdict

Choosing the right online trading platform in the UK depends on your investment goals and experience level. Here’s a quick summary to help you decide:

For Beginners:

- Trading 212: Ideal for those starting their investment journey. Offers a user-friendly platform, commission-free stock and ETF trades, and fractional shares for building a diversified portfolio with minimal fees.

For Experienced Investors:

- Saxo: Caters to active traders seeking a powerful platform with advanced features like sophisticated charting tools, in-depth research, and algorithmic trading capabilities. It offers a wider range of products, including options, CFDs, bonds, and Forex, for a more versatile trading experience.

Remember:

- Cost-Effectiveness: Trading 212 excels with commission-free stock and ETF trades. Saxo might be more cost-effective for high-volume traders due to their fee structure.

- Platform Features: Trading 212 prioritizes simplicity, while Saxo provides advanced functionality for experienced users.

- Investment Products: If you focus on stocks and ETFs, Trading 212 might suffice. For a wider range of products, Saxo is the better choice.

Do your research! These are just key takeaways. Explore each platform in detail and consider your investment goals before making a decision.

Trading 212 vs Saxo FAQ

How do Saxo and Trading 212 compare in terms of fees and commissions for UK investors?

Trading 212 attracts with its commission-free trades, whereas Saxo charges a fee but offers access to a wider range of markets and professional trading instruments.

Which platform offers better tools and resources for beginner investors in the UK?

Trading 212 is more suited for beginners with its easy-to-use interface and educational content, whereas Saxo caters to more experienced traders with advanced tools.

Can I trade international stocks on Saxo and Trading 212?

Yes, both platforms allow trading in international markets. Saxo provides broader access across global exchanges, while Trading 212 offers a select but popular range.

How do Saxo and Trading 212 ensure the security of investor funds and data?

Both platforms are regulated and employ advanced security measures such as data encryption and multi-factor authentication to protect user accounts.

What are the mobile trading capabilities of Saxo and Trading 212?

Saxo and Trading 212 both offer robust mobile apps that support full trading capabilities, real-time data, and account management features on-the-go.

What have been the historical performances of Saxo and Trading 212?

Historical data shows both platforms have robust track records with high customer satisfaction, though specific performance can vary by investment type and market conditions.

How responsive is customer service on Saxo and Trading 212?

Both platforms offer customer service with Saxo providing more personalized support, and Trading 212 focusing on efficiency and fast response times through automated solutions.

Bonus Tip: Explore each platform’s features (including copy trading if that interests you) and fees (including potential exit fees) before making your decision.

I hope you have enjoyed our Trading 212 vs Saxo post. If you think there is anything we may have missed, then please get in touch via email and let us know.