Is CMC Invest Safe? | Security, Regulation & Trustworthiness

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Can I Trust CMC Invest for UK Investments?

Yes — CMC Markets is widely regarded as a trustworthy option for UK investors. It's FCA-regulated, has a long track record, and uses strong security measures to protect client funds. As with any broker, understand the fees and risks involved, but CMC Invest generally delivers a secure, reliable trading environment.

Author's Comments: My Experience With CMC Invest

After reviewing CMC Invest thoroughly, I found it to be a secure and trustworthy platform. Its FCA regulation, segregated client funds, and FSCS protection give me confidence. Personally, I felt comfortable investing in an ISA and SIPP here, and I would recommend it for long-term UK investors seeking safety and transparency.

Why Is CMC Invest Considered a Secure Platform for Investors?

Security comes from regulatory oversight, segregated funds, FSCS coverage, and strict operational standards. Personal data is protected via encryption and two-factor authentication. Clear fee structures and professional support ensure investors can confidently manage their long-term investment portfolios in a Stocks & Shares ISA, SIPP, and/or GIA.

Who Is CMC Invest Suitable For?

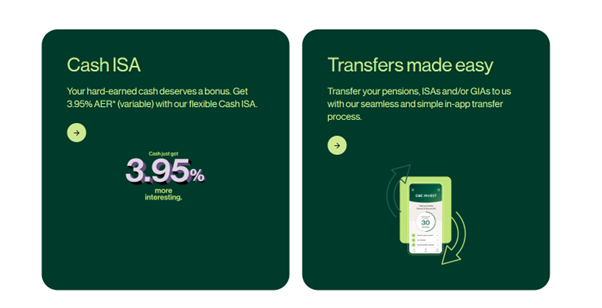

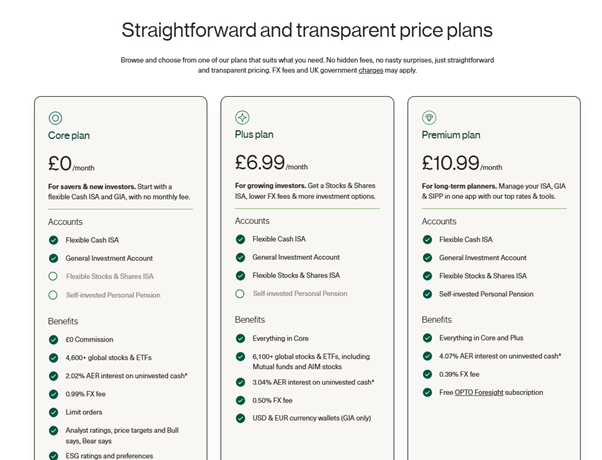

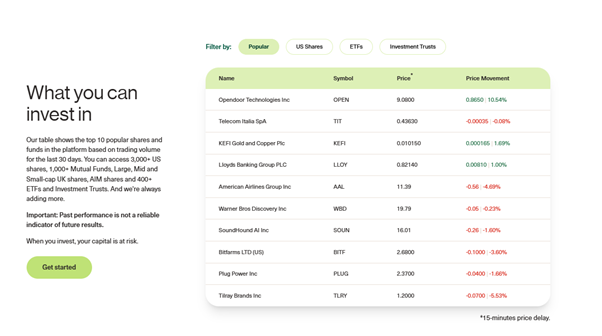

CMC Invest is ideal for UK-based investors looking to invest for the long term (think: five years or more) in domestic and global shares, ETFs, investment trusts and mutual funds via a Stocks & Shares ISA, SIPP or GIA. For savers, CMC Invest also offers Cash ISAs. Beginners benefit from easy-to-use interfaces and educational guides, while experienced investors gain access to advanced portfolio management tools and professional-grade research. Remember, though, that when you invest your capital is at risk.

Safety Snapshot – Licenses, Client Fund Protection, Platform Security

| Feature | Details |

|---|---|

| FCA Regulated | Yes |

| Segregated Client Funds | Yes |

| FSCS Protection | Up to £85,000 per client |

| Invest in | Stocks, ETFs, investment trusts, mutual funds |

| Cybersecurity | Encryption, 2FA, Secure Servers |

Why Should Investors Prioritise Platform Safety?

Choosing a safe investment platform that complies with regulatory standards protects your capital and reduces the risk of loss due to fraud. FCA-regulated brokers like CMC Invest provide transparency, segregation of client funds, and secure management of ISAs, GIAs and SIPPs.

How Can a Safe Platform Protect My ISA or SIPP Investments?

Responsible, regulated platforms are safe because they safeguard client money in segregated accounts, provide FSCS compensation, and adhere to strict capital requirements. They prevent misuse of funds, ensure secure execution of trades and transfers, and allow investors to attempt to build long-term wealth with confidence.

What Risks Exist With Unregulated Investment Platforms?

Unregulated platforms may mismanage funds, freeze accounts, or expose investors to scams, putting customers' capital at risk. Lack of regulatory oversight increases exposure to fraud, hidden fees, and operational failures. In contrast, using a properly regulated platform provides investor protections, legal recourse, and a safe environment for long-term investment.

Is CMC Invest Legitimate and Fully Regulated?

CMC Invest is fully licensed and regulated by the FCA in the UK. FCA oversight ensures compliance with investor protection rules, financial reporting, and operational standards, giving UK investors the confidence that their ISAs, SIPPs and other accounts are handled responsibly.

Which Regulatory Authorities Oversee CMC Markets?

CMC Markets is regulated by the FCA in the UK, ASIC in Australia, and equivalent bodies in other regions. These regulatory bodies monitor compliance, financial health, and risk-management practices, ensuring that financial institutions such as CMC Markets meet the required standards and fulfil their regulatory obligations.

What Licenses Does CMC Invest Hold (FCA, Other International Authorities)?

| Regulator | License Number | Region |

|---|---|---|

| FCA | 173730 | UK |

| ASIC | 238054 | Australia |

| MAS | Not Listed | Singapore |

| IIROC | Not Listed | Canada |

Why Does Regulation Matter for UK Investors?

Regulation ensures brokers follow strict financial and operational rules. Investors benefit from segregated funds, transparent fees, and risk controls. UK law provides legal recourse for disputes, ensuring trading and investing occurs within a secure, well-governed framework.

How Regulation Protects Investors from Fraud and Mismanagement

- Segregated client funds prevent misuse of deposits

- Regular audits ensure compliance with rules and transparency

- Capital requirements reduce insolvency risk

- FCA oversight enforces fair treatment and security for UK investors

How Are Investor Funds Protected at CMC Invest?

Investor money is held in separate accounts from the firm's own money, ensuring that funds can be returned to clients in a timely manner if the company were to become insolvent. Investors' holdings are also protected up to £85,000 per client under the FSCS. These protections ensure that deposits remain safe even if the platform faces insolvency, giving UK investors the confidence to invest with CMC Invest through an ISA, SIPP, or GIA.

What Are Segregated Accounts and How Do They Work?

Segregated accounts separate client funds from the company's own capital. This prevents misuse, ensures accessibility for withdrawals, and protects investments from company financial issues. UK clients benefit from legal safeguards and clear fund separation under FCA rules.

What Happens If CMC Invest Becomes Insolvent?

In insolvency, client funds in segregated accounts remain protected. UK investors may claim up to £85,000 under the FSCS. Segregation ensures that deposits are recoverable, minimising potential losses even in the extreme case of insolvency.

What Security Measures Keep My Investments Safe?

CMC Invest uses advanced security protocols, including data encryption, two-factor authentication (2FA), secure servers, and regular audits. These measures protect personal and financial information, ensure transaction integrity, and provide a secure environment for managing ISAs, SIPPs, and other accounts.

How Is Personal and Financial Data Protected?

All sensitive data is encrypted and stored on secure servers. Two-factor authentication adds an extra login layer. Regular penetration testing, monitoring, and compliance with GDPR prevent unauthorised access, ensuring investor information remains confidential and secure.

How Are Transactions and Portfolio Management Executed Securely?

Trades and investment transactions are processed on regulated infrastructure with encryption and risk monitoring. Portfolio management tools include secure order placement, account updates and regular statements. Investors can review their positions safely and securely.

Overview of Platform Security Tools and Features

| Feature | Description |

|---|---|

| Data Encryption | End-to-end protection of personal and financial information |

| Two-Factor Authentication | Extra security for account access |

| Secure Servers | Protected against cyber threats and unauthorised access |

| Audit and Compliance | Regular internal and FCA audits |

| Transaction Monitoring | Continuous oversight of trading and account activity |

Should I Use CMC Invest for My ISA or SIPP?

CMC Invest is suitable for UK investors seeking regulated, long-term investment accounts such as ISAs and SIPPs. FCA oversight, fund protection, and strong security measures make it safe, while its platform tools support portfolio management, research, and diversified investment strategies.

What Are the Key Takeaways on Safety, Regulation, and Fund Protection?

CMC Invest is FCA-regulated, segregates client funds, and offers FSCS protection up to £85,000. Investors benefit from secure transactions, data protection and regulatory oversight, making it a reliable platform for long-term investing via Stocks & Shares ISAs, SIPPs and GIAs.

Who Is CMC Invest Most Suitable For?

CMC Invest is ideal for UK investors who want a regulated, reliable platform with access to a wide range of assets and solid research tools. It works well for intermediate and experienced traders who value advanced charting and comprehensive market data. Beginners can use it too, but those seeking a simpler, entry-level interface may prefer more streamlined alternatives.

CMC Platform Update January 2026

In January 2026, CMC Markets has continued refining its UK platform with improved charting tools, faster order execution, and enhanced market insights. Fee transparency has been boosted across key instruments, and new educational content helps traders of all levels stay informed. Regulatory protections remain strong, and overall usability improvements make the platform more competitive for active traders.

FAQs

Is CMC Invest FCA-Regulated?

Yes, CMC Invest is fully regulated by the UK's Financial Conduct Authority (FCA), ensuring compliance with investor protection rules, financial transparency, and strict operational standards.

Are Funds in an ISA or SIPP Protected?

Yes. Client funds are held in segregated accounts and covered by FSCS protection up to £85,000, ensuring security for UK investors even in the unlikely event of platform insolvency.

Can I Trust CMC Invest for Long-Term Investment?

Yes. CMC Invest combines regulatory compliance, segregated funds, and professional security measures, making it a reliable choice for building a long-term investment portfolio, whether through a Stocks & Shares ISA, SIPP, or GIA.

How Can I Verify CMC Invest's Regulatory Status?

UK investors can verify CMC Invest's FCA license via the FCA Register. International investors should consult local regulators, such as ASIC in Australia. FCA regulation ensures that a platform is legally authorised and compliant with investor protection standards in the UK.

References

- Straightforward and Transparent Fees | CMC Invest

- How Your Money is Protected | CMC Invest

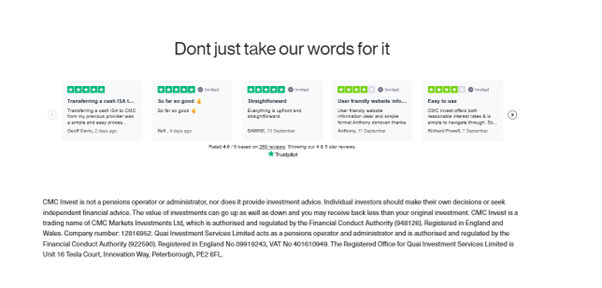

- CMC Invest Reviews | Read Customer Service Reviews of cmcinvest.com

- ✓ Award-winning Next Generation trading platform

- ✓ Spread bet & CFD trading — tax-efficient options

- ✓ Competitive spreads from 0.7 pts on UK 100

- ✓ Advanced charts, pattern recognition & Reuters news

64% of retail investor accounts lose money when trading CFDs with this provider