Trading 212 ISA vs Invest (2026): What’s the Best Choice for You?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Choosing between Trading 212’s ISA and Invest accounts shapes how your money grows and how much tax you pay on returns. With Trading 212 surpassing £25 billion in client assets and 4.5 million funded accounts globally in 2025, the platform has established itself as the UK’s fastest-growing savings and investment platform.

The introduction of the 212 Card, enhanced interest rates on uninvested cash, and upcoming 2027 rule changes make understanding the differences between these account types more important than ever.

Trading 212 Overview

Use code ‘TIC’ to get a free fractional share worth up to £100

- Minimum Deposit: £1 (via bank transfer or card)

- Invest in stocks, ETFs, and forex with zero commission*

- FCA regulated and trusted by over 2 million users

- Intuitive mobile and web platforms with real-time data

- Interest on cash, ISA Account available

*Other fees may apply. See terms and fees.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

Quick Answer: Key Differences Between Trading 212 ISA and Invest

| Feature | Trading 212 ISA | Trading 212 Invest |

|---|---|---|

| Tax-Free Gains | Yes – no capital gains or dividend tax | No – gains may be taxable |

| Annual Contribution Limit | £20,000 (ISA limit for 2026) | No limit |

| Account Flexibility | More restrictions due to ISA rules | Greater freedom to trade, withdraw, deposit |

| Best For | Long-term, tax-efficient investing | Short-term trading or over £20k investing |

| FCA Protection | Yes | Yes |

What Are Trading 212 ISA and Invest Accounts?

Trading 212 is a UK-based investment platform offering commission-free trading.* The ISA account allows tax-free investing up to £20,000 annually. The Invest account offers flexible investing without tax protection. ISAs suit long-term investors, while Invest accounts are ideal for higher-volume or short-term trades.

For a deep dive on their ISA account, check out Trading 212 Stocks and Shares ISA Review

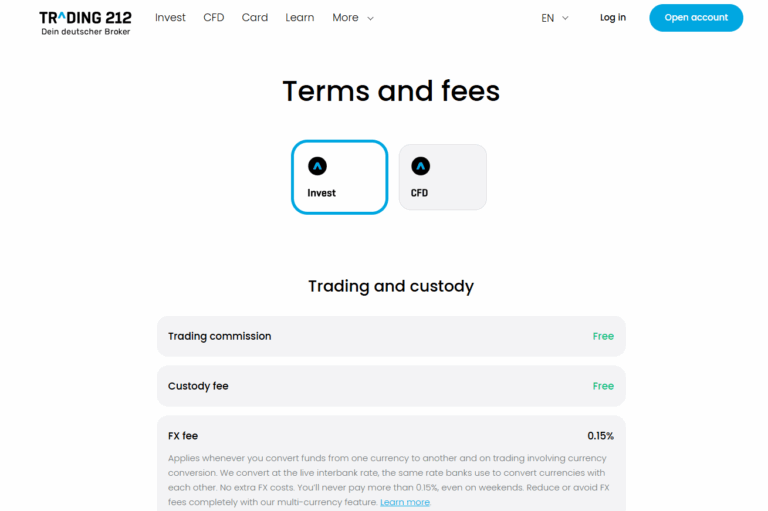

*Other fees may apply. See terms and fees.

Feature-by-Feature Comparison: Trading 212 ISA vs Invest

| Feature | Trading 212 ISA | Trading 212 Invest |

|---|---|---|

| Tax Treatment | Tax-free gains and dividends | Gains and dividends may be taxable |

| Contribution Limits | £20,000 per year (2026 ISA limit) | No deposit limit |

| Withdrawals | Withdrawals don’t reset allowance | Unlimited withdrawals |

| Asset Availability | Stocks, ETFs (within ISA-eligible list) | Wider range, including non-ISA-eligible assets |

| Suitability | Long-term, tax-efficient investing | Short-term or high-volume investing |

| Fees | Commission-free* (standard Trading 212 model) | Same – no commissions |

| Account Restrictions | Subject to ISA rules and HMRC limits | Fewer restrictions |

*Other fees may apply. See terms and fees.

Which Account Is Best for Your Investing Style?

| Investor Type | Recommended Account | Reason |

|---|---|---|

| Beginner investor | ISA | Simple to use, tax-free growth |

| Tax-conscious investor | ISA | Protects gains and dividends from tax |

| High-frequency trader | Invest | No ISA limits or trading restrictions |

| Long-term wealth builder | ISA | Allows compounding gains to grow tax-free |

| Over £20K to invest | Both | Use ISA first, then Invest for remaining capital |

Pros and Cons: Trading 212 ISA vs Invest

Trading 212 ISA

Pros & Cons

Completely tax-free investing (no capital gains or dividend tax)

Ideal for long-term growth and compounding

Simplified tax reporting – no need to declare gains or dividends

Protects your investments from future tax hikes

£20,000 annual contribution limit (as of 2026 stocks & shares)

Limited to eligible ISA assets only

Can only subscribe to one Stocks & Shares ISA per tax year

Withdrawals can’t be re-added unless it’s a flexible ISA

Trading 212 Invest

Pros & Cons

No deposit limits – invest as much as you want

More flexibility for short-term or tactical trading

Access to a broader range of assets

Useful for overflow once ISA allowance is maxed out

Gains and dividends are taxable

Requires manual tax reporting (Self Assessment may apply)

No tax-free wrapper protection

Less efficient for long-term wealth building

Can You Use Both Trading 212 ISA and Invest Accounts?

Yes, Trading 212 allows you to open both an ISA and Invest account simultaneously. Many use the ISA for tax-free investing, while using Invest for amounts over the ISA limit or short-term trades. Transferring funds between them requires selling, withdrawing, and re-depositing manually.

Final Verdict: Trading 212 ISA vs Invest — Which One Should You Choose?

rading 212’s ISA and Invest accounts serve distinct purposes in your investment strategy heading into 2026. The Stocks & Shares ISA offers powerful tax-free compounding for long-term wealth building, protected by FSCS up to £85,000 and earning competitive interest on uninvested cash. With the platform now managing over £25 billion in client assets across 4.5 million accounts, Trading 212 has proven its reliability as the UK’s fastest-growing investment platform.

The Invest account provides essential flexibility for short-term trading, overflow funds exceeding your ISA allowance, and access to 212 Card benefits including cashback and zero-FX spending. For most UK investors, the optimal approach is filling the ISA first (up to £20,000), then using Invest for any additional capital.

The upcoming April 2027 Cash ISA reduction to £12,000 for under-65s makes the Stocks & Shares ISA even more valuable. If you’re building long-term wealth, prioritise your Stocks & Shares ISA allowance now while the rules remain favourable. Those over 65 retain the full £20,000 Cash ISA limit indefinitely under current rules.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

Can I lose ISA status if I sell and rebuy?

No, but selling within your ISA and rebuying doesn’t affect your ISA status. However, withdrawing and redepositing counts toward your annual allowance unless you have a flexible ISA, which Trading 212 does not currently offer. Be cautious with frequent withdrawals and contributions.

What happens if I exceed the ISA limit?

If you deposit more than the £20,000 ISA allowance in 2026 for Stocks & Shares ISAs, HMRC may require the excess to be removed. You could lose tax benefits and face penalties. Always track contributions carefully, especially if using multiple ISA providers within the same tax year.

Can I transfer an existing ISA to Trading 212?

Yes, you can transfer an existing stocks and shares ISA to Trading 212 without losing tax protection. You’ll need to complete a transfer form through the platform. Do not withdraw the funds yourself—this would reset the ISA wrapper and affect your annual limit.

Are both accounts FCA protected?

Yes. Trading 212 is FCA-regulated, and client funds are protected under the FSCS up to £120,000 in the event of broker failure. However, this protection doesn’t cover investment losses. Both ISA and Invest accounts offer the same regulatory and custodial security structure.