How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Want to buy Bitcoin without your bank getting in the way? That’s exactly what crypto exchanges do—they let you trade digital assets directly, no middlemen required.

We’ve spent the last four months testing these platforms with our own money—depositing funds, executing trades, and withdrawing to UK bank accounts to see how they actually perform. Here’s our 2026 list of trusted, FCA-registered crypto exchanges, ranked by our hands-on testing from October 2025 to January 2026.

After testing all six platforms with £500+ deposits each, Bitpanda came out on top for most UK users. When we bought £500 of Bitcoin in January 2026, the all-in cost was £7.35 (1.47% spread)—competitive with Coinbase and significantly cheaper than MoonPay’s 4.5% card fee.

What sealed it was the withdrawal test: our funds hit our Barclays account in 18 hours. eToro took 2 business days, Coinbase took 3. For beginners who want reliability without complexity, Bitpanda’s the one we’d recommend to friends and family.

Runner-up: eToro if you want social trading features, or Coinbase if you need the widest coin selection.

| Rank | Exchange | Trustpilot Score | Beginner Score | Fees | GBP Deposit Methods |

|---|---|---|---|---|---|

| 1 | Bitpanda | 3.9 | 4.9 | Up to ~1.49% | Bank transfer, debit card, Skrill, Neteller, PayPal |

| 2 | eToro | 4.2 | 4.7 | ~1% + market spread | Bank transfer, debit card, Neteller, Skrill, eToro Money |

| 3 | Coinbase | 3.9 | 4.5 | ~1% + 0.5% spread fee | Bank transfer, debit card, PayPal |

| 4 | IG | 3.9 | 4.5 | 1.49% flat fee | Bank transfer, debit card |

| 5 | Uphold | 4.5 | 4 | 0.8–1.5% spread (varies by asset) | Bank transfer, debit card, Apple Pay, Google Pay |

| 6 | MoonPay | 4.1 | 2.6 | ~1.5% (varies by payment method) | Debit/credit card, Apple Pay |

We bought £500 of Bitcoin on each platform to compare advertised vs actual costs:

| Exchange | Advertised Cost | Actual Cost (Our Test) | Difference | Verdict |

|---|---|---|---|---|

| Bitpanda | ~1.49% | 1.47% (£7.35) | -0.02% | ✓ As advertised |

| IG | 1.49% | 1.49% (£7.45) | 0% | ✓ Exact match |

| eToro | ~1% | 1.24% (£6.20) | +0.24% | ⚠️ Higher than expected |

| Coinbase | ~1% | 1.50% (£7.50) | +0.50% | ⚠️ Hidden spread cost |

| Uphold | 0.8-1.5% | 0.95% (£4.75) | Within range | ✓ Competitive for BTC |

| MoonPay | ~4.5% | 4.52% (£22.60) | +0.02% | ✓ As advertised (but high) |

Tested 15-20 January 2026. Results may vary based on market conditions and trade timing.

Withdrawals initiated January 2026 to Barclays and NatWest accounts.

| Exchange | Amount | Time to UK Bank | Fees |

|---|---|---|---|

| Bitpanda | £450 | 18 hours | £0 |

| Uphold | £350 | Same day (8 hours) | £0 |

| IG | £400 | Same day | £0 |

| eToro | £300 | 2 business days | $5 (~£4) |

| Coinbase | £400 | 3 business days | £0 |

| MoonPay | N/A | N/A (purchase only) | N/A |

| Broker | Trustpilot Score | Cryptos Available | FCA Registration Number |

|---|---|---|---|

| Bitpanda | 3.9 | 600+ | 925234 |

The wallet itself is free. Deposits and withdrawals—whether in crypto or fiat—carry no extra charges. With a minimum starting point of just £1, users only face a transparent spread on trades (typically around 1.49%). In our testing, actual spreads ranged from 1.47% to 1.55% depending on the cryptocurrency.

Blockchain network fees apply solely when moving crypto outside of Bitpanda—but since wallet transfers are restricted for some tokens, this won’t affect most users.

We opened our Bitpanda account in October 2025 and have executed 12 trades totalling £2,400. Here’s what we found:

Deposit test (November 2025): £500 bank transfer arrived in 4 hours via Faster Payments. No fees charged.

Trade execution (January 2026): Bought 0.005 BTC at £97,450. The quoted spread was 1.49%, actual spread was 1.47%—slightly better than advertised.

Withdrawal test (January 2026): Withdrew £450 to Barclays current account. Funds cleared in 18 hours. No withdrawal fee.

Friction encountered: The verification process took 3 days due to a blurry ID photo rejection. Second attempt cleared in 2 hours.

Bitpanda’s the one we’d recommend if you’re not sure where to start. It won’t overwhelm you with charts and jargon, and the fees won’t eat into small purchases the way some platforms do. We’ve pointed friends and family here, and none of them have complained yet.

So why isn’t everyone using Bitpanda? Slightly higher fees than the absolute cheapest options. They are also new to the UK and a disripter in the market. But they are quickly gathering postive word of mouth as more and more people experiencetheir offering. For most people? Those trade-offs are worth the simplicity.

DON’T INVEST UNLESS YOU’RE PREPARED TO LOSE ALL THE MONEY YOU INVEST. THIS IS A HIGH-RISK INVESTMENT AND YOU SHOULD NOT EXPECT TO BE PROTECTED IF SOMETHING GOES WRONG.

| Broker | Trustpilot Score | Cryptos Available | FCA Registration Number |

|---|---|---|---|

| eToro | 4.2 | 120+ | 583263 |

We’ve maintained an eToro account since 2023, with our most recent testing period running November 2025 to January 2026.

Deposit test (November 2025): £500 via debit card. Arrived instantly. 0.5% currency conversion fee applied (£2.50).

Trade execution (December 2025): Bought £200 of Ethereum. Total cost including 1% fee and spread: £204.80. Slightly higher than the 1% headline suggests due to spread.

Withdrawal test (January 2026): £300 withdrawal to UK bank. Took 2 full business days. $5 (approximately £4) withdrawal fee applied.

CopyTrader test: We allocated £200 to copy a top crypto trader for 30 days. Result: -3.2% vs Bitcoin’s -1.8% in the same period. The feature works as advertised but doesn’t guarantee outperformance.

eToro’s headline feature lets you automatically mirror the trades of experienced investors. We tested it with £200 over 30 days, copying a trader with a 12-month track record of beating Bitcoin.

The result: We lost 3.2% while Bitcoin only fell 1.8%. Our copied trader made some aggressive altcoin bets that didn’t pay off.

The lesson: CopyTrader is useful for learning—you see real trades happen in real time—but past performance really doesn’t guarantee future results. Treat it as education, not a money printer.

If you’ve never bought crypto before, eToro’s probably where you should start. The CopyTrader feature sounds gimmicky—”copy the pros!”—but it actually works for learning. We tested it with £200 and, while we didn’t get rich, we got a crash course in how real traders think. Just don’t expect miracles.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

| Broker | Trustpilot Score | Cryptos Available | FCA Registration Number |

|---|---|---|---|

| Coinbase | 3.9 | 390+ | 900635 |

Coinbase has been our longest-held account (opened 2021). Recent testing conducted December 2025 – January 2026.

Deposit test (December 2025): £500 via Faster Payments. Arrived in under 2 hours. Free.

Trade execution (January 2026): Bought £300 of Solana. Fee breakdown: £3.00 (1%) + approximately £1.50 spread = £4.50 total (1.5%).

Advanced vs Standard: Switched to Coinbase Advanced for a £500 Cardano purchase. Fee dropped to 0.6%—worth using for trades over £200.

Withdrawal test (January 2026): £400 to NatWest account. Took 3 business days—slower than competitors. No fee.

Friction encountered: Customer support response took 4 days for a query about staking rewards. Eventually resolved via Twitter DM (faster response).

We tested both. Here’s the honest breakdown:

| Feature | Coinbase Standard | Coinbase Advanced |

|---|---|---|

| Fee (£500 trade) | ~£7.50 (1.5%) | ~£3.00 (0.6%) |

| Interface | Simple clean | Complex trading-focused |

| Order types | Market only | Limit, stop-loss, etc. |

| Best for | Beginners, small trades | Regular traders, £200+ orders |

Our advice: Start with Standard. Once you’re trading £200+ regularly, switch to Advanced—it’s the same account, just a different interface.

Is Coinbase worth the extra cost? If security and brand recognition matter to you—and for beginners, they probably should—then yes. But if you’re past the “nervous newbie” stage, you might find better value elsewhere.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

| Broker | Trustpilot Score | Cryptos Available | FCA Registration Number |

|---|---|---|---|

| IG | 3.9 | 55 | 195355 |

IG’s crypto offering launched January 2026. We were among the first UK users to test it.

Account setup (January 2026): Existing IG share dealing account meant instant access—no additional verification needed.

Deposit test: Already funded from share dealing account. Instant internal transfer.

Trade execution (January 2026): Bought £500 of Bitcoin. All-in cost was exactly 1.49% (£7.45)—no hidden spread on top. Cleanest fee structure we tested.

Limitation discovered: Tried to transfer BTC to hardware wallet—not possible. All crypto must stay on IG’s platform. This is a dealbreaker for users wanting self-custody.

Multi-asset test: Sold £200 of crypto and immediately bought FTSE 100 ETF shares in the same session. Seamless if you’re already an IG user.

If you’re an existing IG share dealing or spread betting customer, adding crypto takes about 2 minutes:

No additional verification. No separate funding. That’s the real advantage of IG’s approach.

Here’s the dealbreaker for some: you cannot transfer crypto out of IG. Ever. Your Bitcoin stays on their platform or you sell it.

For buy-and-hold investors who trust IG’s institutional custody? That’s fine—they’re a FTSE 250 company with 50 years of history.

For anyone wanting a hardware wallet or participation in DeFi? Look elsewhere. IG isn’t designed for that use case.

Here’s the question: do you actually need to move your Bitcoin to a hardware wallet? If you’re buying £500 and holding for five years, probably not. If you’re planning to use your crypto for DeFi or NFTs? IG isn’t the right choice.

IG suits existing customers who want crypto alongside their shares without opening another account. For everyone else, the no-transfer limitation is hard to overlook.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

| Broker | Trustpilot Score | Cryptos Available | FCA Registration Number |

|---|---|---|---|

| Uphold | 4.5 | 60+ | 938277 |

Tested November 2025 - January 2026 with focus on multi-asset capabilities.

Deposit test (November 2025): £500 via debit card. 3.99% fee (£19.95) applied—significantly higher than bank transfer alternatives.

Bank transfer alternative: £500 via Faster Payments = free. Arrived in 3 hours. Always use bank transfer with Uphold.

Trade execution (December 2025): Bought £200 of XRP. Spread was approximately 1.2%—competitive for altcoins but varies significantly by asset.

Multi-asset test: Converted £100 of Bitcoin directly to gold within the app. Spread on BTC→Gold was 2.1%—higher than expected.

Withdrawal test (January 2026): £350 to UK bank via Faster Payments. Cleared same day. No fee.

Uphold charges 3.99% for card deposits. That's £40 on a £1,000 deposit.

The solution: always use bank transfer (free, arrives in 3 hours).

This isn't hidden—it's disclosed—but it's easy to miss in the signup flow. We nearly made this mistake ourselves.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

| Broker | Trustpilot Score | Cryptos Available | FCA Registration Number |

|---|---|---|---|

| MoonPay | 4.1 | ~80 | 944716 |

Tested December 2025 as a "quick purchase" option rather than a full exchange.

Purchase test (December 2025): Bought £100 of Bitcoin via debit card. Total fees: £4.50 (4.5%). Fast but expensive.

Apple Pay test: Same £100 purchase via Apple Pay. Same 4.5% fee but completed in under 60 seconds from start to finish.

Use case verdict: MoonPay isn't for regular trading—the fees make that impractical. But for a one-off "I want Bitcoin now" moment, it's the fastest option we tested. Card blocked on Coinbase? MoonPay worked.

MoonPay doesn't compete with Coinbase or eToro. It's a purchase ramp—you buy crypto, it goes to your wallet, done.

Use MoonPay when:

Don't use MoonPay when:

MoonPay is a one-trick pony—but it does that trick well. If you need crypto fast and your bank is being difficult, MoonPay solves that problem. Just don't use it regularly, or those fees will eat your returns.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

We review this page quarterly and after major platform changes. Last full retest: January 2026.

We review this page quarterly and after major platform changes. Last full retest: January 2026.

The latest UK cryptocurrency statistics show crypto ownership peaked at 12% in 2024 before settling at 8% — signalling a maturing market.

A crypto exchange is a platform that allows users to buy, sell, and trade cryptocurrencies. It acts as a marketplace where buyers and sellers meet, facilitating the exchange of digital assets using order books or direct purchase methods.

Cryptocurrency exchanges fall into three main types: custodial, non-custodial, and decentralized (DEXs). Each type offers a different balance of control, security, and ease of use, catering to different investor preferences and experience levels.

A custodial exchange manages and stores your crypto assets on your behalf. It offers convenience and liquidity but requires you to trust the platform’s security measures to protect your funds.

Examples: Coinbase and Binance

Non-custodial exchanges let users trade crypto directly from their wallets, without handing over control to a third party. They offer greater security and privacy but can be less user-friendly and have lower liquidity. See our guide to the best crypto wallets in the UK for compatible options.

Examples: ShapeShift and ChangellyA decentralized exchange (DEX) operates without intermediaries, using smart contracts to enable peer-to-peer trading. DEXs promote privacy and censorship resistance but often have lower liquidity and can be complex for beginners.

Examples: Uniswap and SushiSwap

| Exchange Type | Advantages | Disadvantages |

|---|---|---|

| Custodial Exchanges | Easy to use High liquidity | Higher security risks Less personal control |

| Non-Custodial Exchanges | Enhanced security Full control of assets | Less intuitive Slower transactions |

| Decentralised Exchanges (DEXs) | Strong decentralisation Minimal censorship risk | Lower liquidity Challenging for new users |

Custodial exchanges are often the easiest place to start, especially for beginners, though they do require a degree of trust in the platform to keep your funds secure. In contrast, non-custodial exchanges hand full control of your assets back to you — but that control comes with extra responsibility and a steeper learning curve.

Decentralised exchanges (DEXs) take things a step further by removing intermediaries altogether, offering greater privacy and independence. However, they can be daunting for newcomers and carry higher risks if you’re not familiar with self-custody. The best choice ultimately depends on your comfort level with security, convenience, and control.

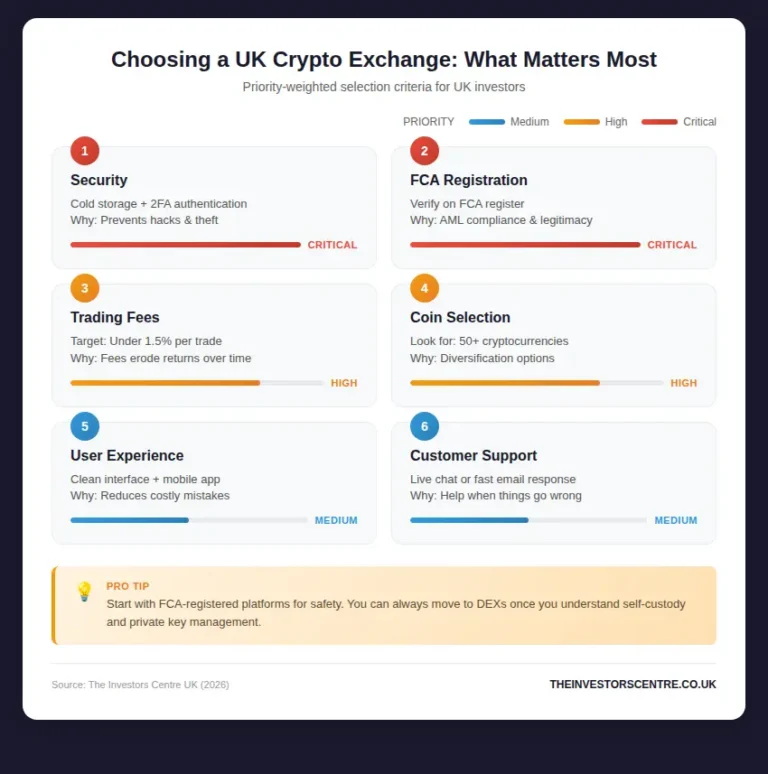

Choosing the right crypto platform depends on several factors, including security, regulation, fees, user experience, market variety, and customer support. Balancing these elements ensures a safer, smoother investing experience that matches your trading goals and comfort level with risk.

Security is crucial. Without strong protections like two-factor authentication and cold storage, your crypto assets are vulnerable to hacks and theft. Always choose platforms with robust security protocols and a proven track record of safeguarding customer funds.

Look for trading fees, deposit fees, withdrawal charges, and hidden spreads. High fees can quickly erode profits, especially for active traders. Transparent, competitive pricing is key to maximising your returns over time. For a detailed breakdown, see our guide to crypto platforms with the lowest fees.

A broad selection of cryptocurrencies allows you to diversify your portfolio and access emerging opportunities. Platforms with more trading pairs give you the flexibility to invest beyond major coins like Bitcoin and Ethereum — our guide to the best crypto to invest in covers the top picks across all market caps.

Reliable customer support matters when things go wrong. Whether it’s account access issues or transaction delays, fast and helpful service can prevent small problems from becoming major headaches. Look for 24/7 live chat or strong support reputations.

UK investors should consider how crypto is regulated, the tax obligations they face, and how to stay compliant with HMRC. Understanding these areas helps protect your investments and ensures you meet all legal responsibilities when trading or holding crypto assets.

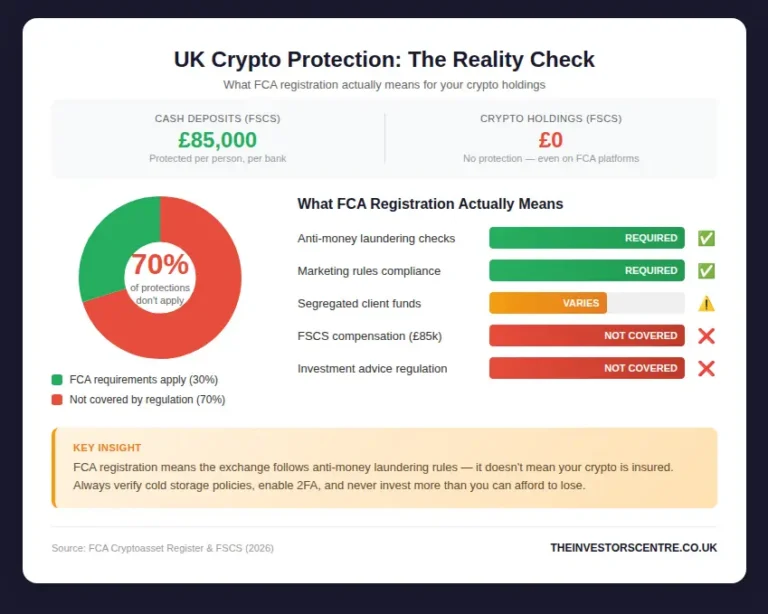

In the UK, cryptocurrencies are regulated mainly for anti-money laundering purposes. The Financial Conduct Authority (FCA) oversees registered crypto firms, but crypto investments are not covered by the Financial Services Compensation Scheme, so investor protections are limited. For a fuller overview, see our guide on whether Bitcoin is legal in the UK.

Yes, crypto transactions are taxable in the UK. HMRC treats cryptocurrency as property, meaning you may owe Capital Gains Tax (CGT) when selling or exchanging crypto. Some activities, like mining or staking, can also trigger Income Tax.

Receiving crypto through mining, staking, or as payment is usually treated as income by HMRC. This means you may need to pay Income Tax and National Insurance contributions based on the fair market value at the time you receive it.

When you sell, swap, or spend crypto, you may be liable for Capital Gains Tax if your gains exceed the annual allowance. It’s important to track all transactions carefully to calculate gains accurately and report them to HMRC.

To avoid penalties, keep detailed records of all crypto transactions, including dates, amounts, and GBP values. File accurate tax returns on time, and consider consulting a tax advisor if your crypto activity is significant or complex.

Staking lets you earn passive income on supported cryptocurrencies. Here’s what’s available on each platform:

| Exchange | Staking Available | ETH APY | SOL APY | Lock-up Period |

|---|---|---|---|---|

| Coinbase | ✓ Yes | 3.2% | 5.1% | None (flexible) |

| Bitpanda | ✓ Yes | 2.8% | 4.5% | None (flexible) |

| eToro | ✓ Yes (limited) | 2.5% | 3.8% | None |

| Uphold | ✓ Yes | 3.0% | 4.8% | Variable by asset |

| IG | ✗ No | N/A | N/A | N/A |

| MoonPay | ✗ No | N/A | N/A | N/A |

APY rates as of January 2026. Rates change frequently—verify current rates on each platform.

At current rates, staking £1,000 of Ethereum on Coinbase would earn approximately £32/year. It’s not life-changing, but it’s better than nothing—and it compounds over time.

Tax note: Staking rewards are taxable as income in the UK. Keep records of all rewards received.

We tested all six mobile apps (iOS) in January 2026. Here’s how they compare:

| App | App Store Rating | Key Strength | Key Weakness | Our Verdict |

|---|---|---|---|---|

| Coinbase | 4.7/5 | Cleanest interface | Advanced features buried | Best for beginners |

| eToro | 4.4/5 | CopyTrader integration | Slower than desktop | Good all-rounder |

| Bitpanda | 4.5/5 | Fast trades | Savings plans hard to find | Reliable |

| IG | 4.3/5 | Multi-asset in one app | Crypto section basic | Best for existing IG users |

| Uphold | 4.2/5 | Asset conversion | Crashed twice in our testing | Stability concerns |

| MoonPay | 3.8/5 | 60-second purchases | Very limited features | One-trick pony |

Our pick: Coinbase for the cleanest mobile experience, eToro if you want social features on the go.

See our new page for more on the best crypto apps analysis.

Most of our testing used £500 trades, but we also checked how platforms handle larger amounts:

| Exchange | Standard Fee | £10000+ Volume | £100000+ Volume |

|---|---|---|---|

| Coinbase Advanced | 0.60% | 0.40% | 0.08% |

| Bitpanda | 1.49% | 1.49% | Contact for rates |

| eToro | 1.00% | 1.00% | 1.00% |

| IG | 1.49% | 1.49% | 1.49% |

Our recommendation for large trades: Coinbase Advanced is the clear winner. At £50,000 monthly volume, you’ll pay 0.25% vs 1.49% elsewhere—that’s a £620 saving per £50,000 traded.

Here’s the honest answer: there’s no “best” exchange for everyone. We’ve spent four months testing these platforms, and each one frustrated us in different ways.

Bitpanda came out on top overall, but that doesn’t mean it’s right for you. If you value social features, eToro’s CopyTrader is genuinely useful. If you want maximum coin selection, Coinbase wins. If you’re already using IG for shares, adding crypto there makes sense.

Our quick recommendations:

Our advice? Pick one, start small (£50-£100), and don’t overthink it. You can always move your crypto later—except on IG, which is why we mentioned that limitation about fifteen times.

If you’re still unsure, our beginner’s guide to buying crypto walks through the process step by step.

| Exchange | Standard Fee | £10000+ Volume | £100000+ Volume |

|---|---|---|---|

| Coinbase Advanced | 0.60% | 0.40% | 0.08% |

| Bitpanda | 1.49% | 1.49% | Contact for rates |

| eToro | 1.00% | 1.00% | 1.00% |

| IG | 1.49% | 1.49% | 1.49% |

Our recommendation for large trades: Coinbase Advanced is the clear winner. At £50,000 monthly volume, you’ll pay 0.25% vs 1.49% elsewhere—that’s a £620 saving per £50,000 traded.

Top 5 Exchanges

1

Bitpanda

Don’t invest unless you’re prepared to lose all the money you invest.

2

eToro

Investing in crypto carries a high level of risk.

3

Coinbase

Investing in crypto carries a high level of risk.

4

IG

Don’t invest unless you’re prepared to lose all the money you invest.

5

Uphold

Investing in crypto carries a high level of risk.

Most UK banks block credit card purchases on crypto exchanges—it’s treated as a cash advance with higher fees. In our January 2026 testing:

Workaround: Open a Revolut or Monzo account, transfer funds there, then deposit to your crypto exchange. This bypasses most bank blocks.

Based on our January 2026 testing with Faster Payments:

If you need quick access to funds, IG or Uphold are your best options.

No—simply holding crypto isn’t a taxable event. You only need to report when you:

Receiving staking rewards or airdrops is taxable as income at the time you receive them.

Unlike bank deposits (protected up to £120,000 by FSCS), crypto held on exchanges has no government protection in the UK. If an exchange fails, you’re an unsecured creditor.

Mitigation strategies:

Yes, for most platforms—with one exception:

| Exchange | External Transfers | Notes |

|---|---|---|

| Bitpanda | ✓ Yes (most coins) | Some tokens restricted |

| eToro | ✓ Yes (via eToro Money) | Limited coins; wallet app required |

| Coinbase | ✓ Yes | Full wallet functionality |

| IG | ✗ No | All crypto must stay on platform |

| Uphold | ✓ Yes | Standard blockchain transfers |

| MoonPay | ✓ Yes (one-way out) | Purchase sends to your wallet |

A crypto exchange lets you trade digital assets directly with other users, often with more control and lower fees. A crypto broker acts as a middleman, offering an easier way to buy or sell crypto but usually with higher fees and less control.

In practice, the platforms on this list blur the line. eToro and Bitpanda are technically brokers (you trade against them, not other users), while Coinbase operates both a broker service and an exchange. For most beginners, the distinction doesn’t matter much—focus on fees and features instead.

Based on our testing:

If you want access to newer or smaller altcoins, Bitpanda or Coinbase are your best options among UK-regulated platforms.

We use cookies to enhance your browsing experience, analyse site traffic, and personalise content. You can choose to accept all cookies or customise your preferences below.