- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

My goal with this guide is to simplify the process for you and review the best UK Investing platforms that make investing in REITs easy, whether you’re a beginner or an experienced investor. Whether you want to invest in REITs collectively or a single REIT, the process is straightforward.

Quick Answer: How to Invest in REITs in the UK?

How to Choose a REIT or Platform (Decision Criteria)

When investing in REITs, focus on regulation and safety, yield history, and diversification across sectors or geographies. Review debt levels, as highly leveraged REITs are riskier. Compare platform fees, minimums, and ISA eligibility to ensure your REIT investment is cost-efficient and tax-advantaged in the UK.

How to Invest in REITs in the UK (Step-By-Step Guide)

Investing in Real Estate Investment Trusts (REITs) can be a smart way to gain exposure to the property market without directly buying property. Here’s a six-step guide tailored to UK investors.

Step 1. Choose a Trading Platform

Start by choosing a UK trading platform that fits your goals. Consider ISA support for tax-free investing, fees, ease of use, and REIT availability. Platforms like eToro suit beginners, while IG, Saxo, and Interactive Brokers offer broader access and advanced tools.

| Platform | ISA Support | Fees | REIT Access | Best For |

|---|---|---|---|---|

| eToro | No | 0% commission | REIT ETFs | Beginners |

| IG | Yes | £3–£8/trade | UK & Global REITs | Experienced traders |

| Interactive Brokers | No | Competitive | Global REITs | Global diversification |

| Saxo Bank | Yes | Higher fees | International REITs | High-net-worth users |

Step 2. Open an Account

After selecting a platform, register by entering your details and verifying your identity with documents like a passport and utility bill. Complete the KYC process to meet UK regulations, then select an account type—either a general account or an ISA for tax efficiency.

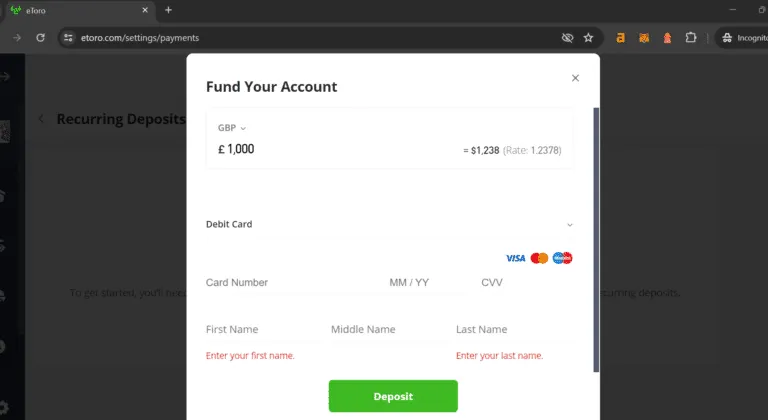

Step 3. Fund Your Account

Before you can buy anything, you need to deposit funds. Common Deposit Methods inlcude Debit/Credit Card, Bank Transfer or Digital Wallet (PayPal, etc.)

| Platform | Minimum Deposit |

|---|---|

| eToro | £42 |

| IG | £50 |

| Saxo Bank | £500 |

Tip: If you’re investing in US REITs (like VNQ), watch for currency conversion fees. Many platforms charge 0.5%–1%.

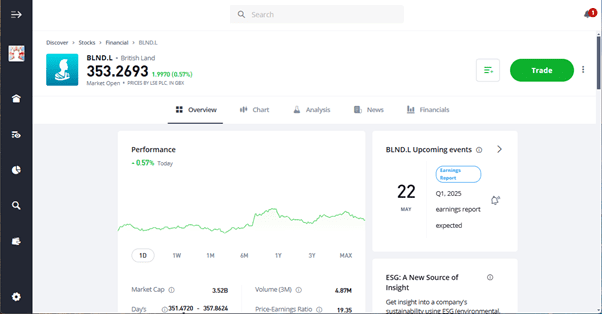

Step 4. Search for REITs or REIT ETFs

Use your platform’s search tool to find REITs or REIT ETFs that align with your goals. Some traders may prefer ETFs like VNQ or IGR for instant diversification. You can also choose individual REITs by sector, such as commercial, healthcare, or logistics and filter by yield or performance.

Evaluate & Select REIT(s)

Before investing, evaluate REITs by reviewing dividend yield, debt ratios, and portfolio diversification. High yields may signal risk if debt is excessive. Look for consistent occupancy rates and stable management. UK investors can choose individual REITs or diversified REIT ETFs, depending on goals and risk tolerance.

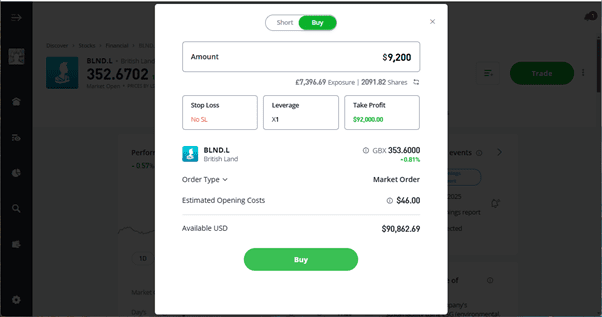

Step 5. Place a Buy Order

Once you’ve chosen a REIT, decide how much to invest—starting with £100 is fine for beginners. Choose a market or limit order, review any fees or stamp duty (0.5% for UK REITs), then place your order to complete the trade.

Step 6. Track and Reinvest

To maximise returns, regularly monitor your REIT investments using platform tools to track prices and yields. Reinvest dividends automatically with a DRIP and rebalance your portfolio by adding exposure to different sectors like logistics or retail to stay aligned with your goals.

Pro Tip: Consider setting quarterly reviews to ensure your portfolio aligns with your goals and risk tolerance.

What is a Real Estate Investment Trust (REIT)?

A Real Estate Investment Trust (REIT) is a company that owns or finances income-generating properties like offices or shopping centres. REITs generate income from rent or property sales and must pay out 90% of profits as dividends, offering investors steady income and stock-like liquidity.

How Does a REIT Work?

REITs pool investor funds to buy, manage, or finance properties like homes or offices. They earn income through rent or interest and must pay out at least 90% of taxable income as dividends. Professionally managed and publicly traded, REITs offer accessible, hands-off property investing.

How Does REIT Investing Work in the UK?

UK REITs offer strong tax advantages—they’re exempt from corporation tax on rental income if they distribute 90% of profits to shareholders. Holding REITs in an ISA boosts these benefits, making dividends and gains tax-free. Though a 0.5% stamp duty applies, the overall appeal remains high.

Can I Invest in REITs Through an ISA?

Investing in REITs through a Stocks and Shares ISA is highly tax-efficient. Dividends and capital gains are completely tax-free. Simply open an ISA with a platform like IG, add REITs or ETFs, deposit up to £20,000, and monitor your portfolio tax-free.

What Types of REITs Can You Invest In?

Each type offers different risks and rewards, allowing investors to align with their goals.

| REIT Type | Description |

|---|---|

| Equity REITs | Own income-producing property (e.g., retail, offices) |

| Mortgage REITs | Invest in mortgages or mortgage-backed securities |

| Hybrid REITs | Combine property ownership and mortgage investments |

| Specialty REITs | Focus on data centres, healthcare, storage, etc. |

What Are the Requirements to Qualify as a UK REIT?

To qualify as a UK REIT, a company must be listed, hold 75% of assets in property, earn 75% from rent, and distribute 90% of profits. It must also meet ownership rules and financial standards, ensuring transparency and continued tax benefits for investors.

What Are the Tax Benefits of REITs in the UK?

REITs offer exceptional tax advantages:

| Benefit | Description |

|---|---|

| No Corporation Tax | REITs don't pay corporation tax on rental income or capital gains |

| Tax-Free in ISAs or SIPPs | Avoids 20% withholding tax on distributions |

| 20% Withholding Tax | Applied to income distributions (outside ISA or pension wrappers) |

Tip: Use a Stocks & Shares ISA to maximise REIT income post-tax.

Final Thoughts

Top 5 Platforms

1

eToro

61% of retail CFD accounts lose money when trading CFD’s with this provider.

2

IG

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

3

IBKR

62.5% of retail investor accounts lose money when trading CFDs with this provider.

4

Saxo

64% of retail investor accounts lose money when trading CFDs with this provider.

5

XTB

71% of Retail CFD Accounts Lose Money

Still not sure which is best for you?

FAQs

How can I buy REITs in the UK?

Open an account. Fund your account and search for REITs or ETFs by ticker symbol. Place a buy order and start your investment journey.

How do beginners invest in REITs?

Beginners should use platforms like eToro for their ease of use. Start small, focus on REIT ETFs for diversification, and gradually build your confidence in the market.

Are UK REITs a good investment?

Yes, UK REITs offer tax efficiency through ISAs, regular dividends, and exposure to the growing UK property market.

Do REITs pay monthly?

Some REITs pay monthly dividends, but most pay quarterly. Check the payment schedule for your chosen REIT.

What kind of dividends can I expect from REITs?

REIT dividend yields vary, but UK REITs typically offer 3%-8%, depending on the sector and performance.

References

- HMRC – Real Estate Investment Trusts (REITs) Guidelines

- London Stock Exchange – List of UK-Listed REITs

- FCA – Register of Regulated Investment Platforms

- London Stock Exchange – REITs

- Morningstar – REIT ETF Analysis and Performance

- Vanguard – Real Estate ETF (VNQ) Product Page

- iShares – Global REIT ETF (IGR) Overview