How to Invest in the S&P 500 in the UK 2026

Invest in the S&P 500 from the UK using ETFs or index funds. Discover the best platforms, tax-efficient options, and how to start investing with confidence.

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: To Start Investing in the S&P 500 You'll Need to:

- Select a broker or investment platform offering US stocks.

- Open a trading account.

- Deposit funds into your account.

- Choose your investment method: individual stocks, ETFs, index funds, or derivatives.

- Execute your investment strategy.

- Consider fees, minimum balances, and account types.

What Is the S&P 500?

The S&P 500 is a major US stock market index that follows the performance of 500 of the largest publicly listed American companies, selected by market capitalisation. Together, these businesses account for around 80% of the total value of the US equity market and span 11 different sectors, from technology to healthcare. Well-known names such as Apple, Microsoft and Amazon all form part of the index. While you can't invest in the S&P 500 directly, UK investors can gain exposure through exchange-traded funds (ETFs) designed to closely track its performance.

Did you know? Only 35% of UK adults hold investments, and 61% with £10k+ keep it in cash. See the full breakdown in our UK Investment Statistics 2026 report.

Top 10 Companies in the S&P 500 by Index Weight (2026)

| Rank | Company | Index Weight (%) |

|---|---|---|

| 1 | Nvidia (NVDA) | 7.4 |

| 2 | Microsoft (MSFT) | 6.7 |

| 3 | Apple (AAPL) | 6.5 |

| 4 | Alphabet (GOOGL & GOOG) | 4.5 |

| 5 | Amazon (AMZN) | 4.0 |

| 6 | Meta Platforms (META) | 3.0 |

| 7 | Broadcom (AVGO) | 2.9 |

| 8 | Tesla (TSLA) | 1.8 |

| 9 | Berkshire Hathaway (BRK.B) | 1.6 |

| 10 | JPMorgan Chase (JPM) | 1.5 |

Can I Invest in the S&P 500 from the UK?

Yes, UK investors can access the S&P 500 through ETFs, mutual funds, or index trackers. These are available via FCA-regulated platforms, including through tax-efficient wrappers like a Stocks & Shares ISA or pension (SIPP), making it legal, safe, and widely accessible.

What returns has the S&P 500 delivered historically?

The S&P 500 has returned an average of 10.26% annually since 1957, including dividends. A £10,000 investment in 2000 would be worth approximately £68,000 today despite two major crashes. That said, past performance doesn't guarantee future results, and UK investors face additional currency risk that can amplify both gains and losses.

Step-by-Step: How to Start Investing Today

Follow these five steps to start investing in the S&P 500 from the UK using a trusted, FCA-regulated platform:

1. Choose an FCA-Regulated UK Investment Platform

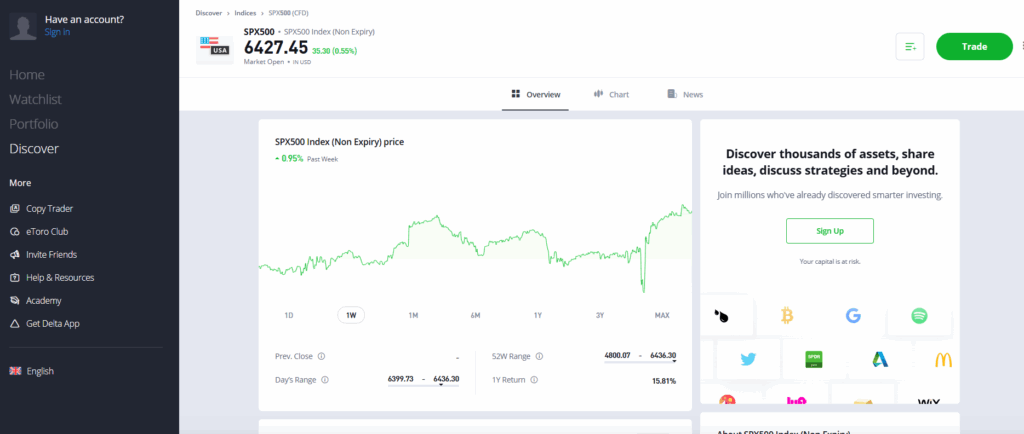

Select a broker or platform that gives access to S&P 500 ETFs or index funds. Top UK options include Trading 212, IG, eToro, and CMC Invest. Make sure the platform is FCA-authorised for investor protection and regulatory compliance.

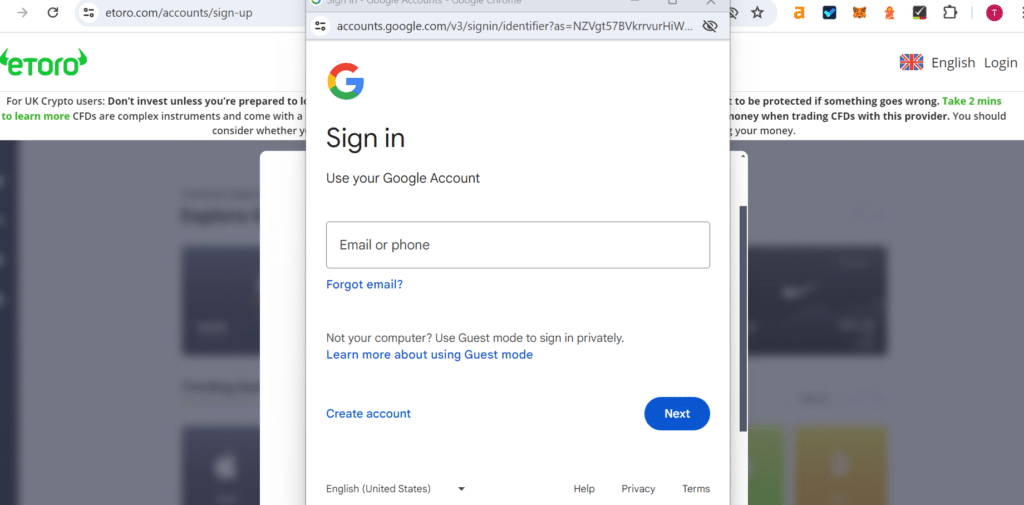

2. Open and Verify Your Account

Begin the account setup process. You'll need to provide basic personal details, submit proof of ID (passport or driving licence), and verify your address. This process ensures compliance with anti-money laundering (AML) rules and usually takes a few minutes.

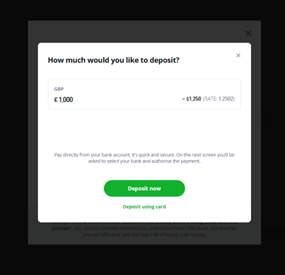

3. Fund Your Account in GBP

Deposit money into your account using a bank transfer, debit card, or other supported method. Most platforms accept GBP, even if the underlying asset is priced in USD. Be aware of currency conversion fees if applicable.

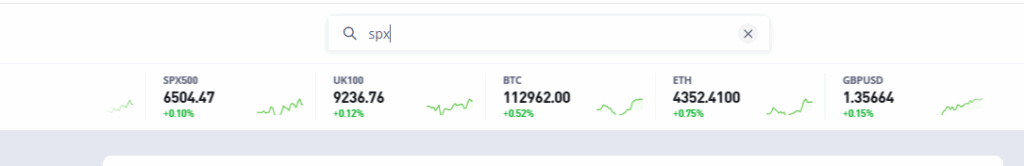

4. Search for an S&P 500 ETF or Index Fund

Use the platform's search bar to find products like:

- Vanguard S&P 500 UCITS ETF (VUSA)

- iShares Core S&P 500 ETF (CSP1 or IUSA)

- Fidelity Index US Fund

Check each fund's fee (ongoing charges figure), performance history, and tracking accuracy before investing.

5. Place Your Buy Order

Choose how much to invest. Some platforms allow fractional shares, so you don't need to buy a full unit. Confirm the fund, double-check fees, and click "Buy." You now own a piece of the S&P 500.

Optional: Set Up a Monthly Investment Plan

Many platforms offer recurring investments. Automating monthly contributions (e.g., £100/month) helps with pound-cost averaging, builds discipline, and avoids timing the market.

What's the Best Way to Invest in the S&P 500 from the UK?

The best way is through low-cost S&P 500 ETFs or index funds available via FCA-regulated platforms. They're ideal for passive investing and can be held in a Stocks & Shares ISA or SIPP for tax efficiency. Choose a fund with low fees and good tracking.

What's the Difference in ETFs and Index Funds?

ETFs trade like shares and offer real-time pricing, while index funds are priced once daily. ETFs are better for active DIY investors, while index funds suit long-term, hands-off strategies. Both track the S&P 500 but differ slightly in fees, flexibility, and platform availability.

Can I Use a Stocks & Shares ISA or SIPP?

Yes, investing through an ISA or SIPP offers major tax benefits. ISAs allow tax-free growth and withdrawals, while SIPPs offer upfront tax relief. Both protect gains and dividends from UK tax, making them ideal for building long-term wealth with S&P 500 investments.

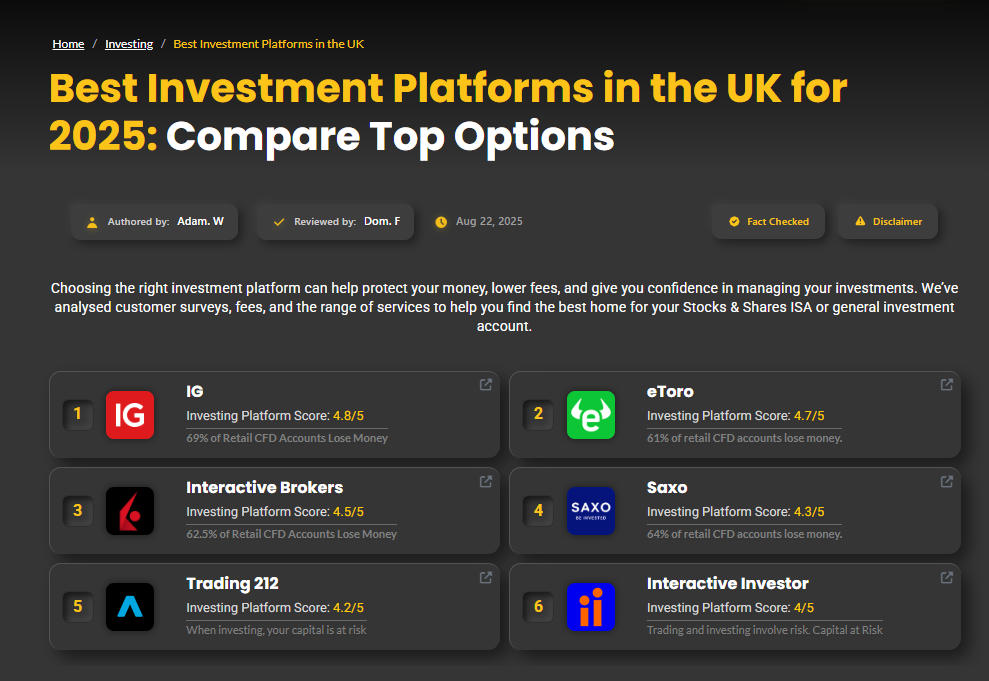

Which UK Platform Is Best for Investing in the S&P 500?

Several FCA-regulated UK platforms offer access to S&P 500 ETFs or index funds. Fees, ISA support, and minimum deposits vary. Compare options carefully to find the right fit for your goals.

| Rank | Platform | Best For | Min Deposit | Dealing Fees | Platform Fees | ISA Available | Total Annual Cost (£10k) |

|---|---|---|---|---|---|---|---|

| #1 | Interactive Investor | ISA investors & large portfolios | £0 | £3.99 | £4.99-£11.99/month | Yes | £108 |

| #2 | eToro | Beginners & social investing | £50 | $0 (FX fees apply) | £0 | No | £77 |

| #3 | IG | Advanced investors & market access | £250 | £8 (£3 frequent) | £0 (FX applies) | Yes | £15 |

| #4 | Saxo | High-net-worth & premium features | £0 | £8 (lower for active) | 0.12% custody (min £1/month) | Yes | £20 |

| #5 | Hargreaves Lansdown | Customer service & research | £1 | £11.95 (£5.95 frequent) | 0.45% (capped at £45/year for shares) | Yes | £57 |

After testing 12 UK investment platforms with real money across 2024–2026, we found that the best option depends on your investing style and priorities rather than one clear winner. As covered in our best investment platform analysis, eToro stands out for beginners interested in social features and copy trading, IG offers advanced tools with full ISA and SIPP support, and Trading 212 remains popular for investors focused on keeping costs to a minimum with zero platform fees.

For ISA investors prioritising tax efficiency alongside professional features, IG offers the most complete package in 2026 despite slightly higher dealing costs. eToro is better suited to complete beginners who value simplicity and community features and are comfortable giving up ISA benefits. Trading 212 appeals to cost-conscious investors who want fee-free investing with ISA availability.

Your ideal platform depends on whether you prioritise fees, features, tax wrappers, or overall user experience. Our best investment platform guide breaks down which providers suit different investor profiles based on extensive testing.

What should I look for in an S&P 500 investment platform?

Start with FCA regulation, which protects eligible funds up to £85,000 under the FSCS if a provider fails. Next, consider total costs, including platform fees, dealing charges, ETF ongoing costs, and currency conversion fees. ISA availability is important for tax-efficient growth, while fractional investing helps if you're investing smaller amounts. Finally, assess platform reliability and performance during periods of market volatility.

Which platform offers the lowest fees for S&P 500 investing?

Trading 212 and XTB both offer zero platform and dealing fees, leaving the ETF's annual charge of around 0.07%—about £7 per £10,000 invested—as the main cost. IG typically charges £8 per trade (or £3 for frequent traders) plus the ETF fee, bringing annual costs to around £15. eToro is generally more expensive, with total costs of roughly £75–£80 once spreads, FX conversion, and withdrawal fees are included.

How Can I Invest in the S&P 500 Tax-Efficiently?

Can I hold S&P 500 investments in a Stocks & Shares ISA?

Yes, you can hold S&P 500 ETFs like VUSA, IUSA, and CSP1 in a Stocks & Shares ISA. These UCITS-compliant ETFs are eligible for ISA wrappers, allowing you to invest up to £20,000 annually tax-free. We've held VUSA in ISAs across multiple platforms and confirmed all gains, dividends, and withdrawals remain completely tax-free regardless of profit size.

What are the tax benefits of investing through an ISA?

ISAs eliminate Capital Gains Tax and dividend tax entirely. Outside an ISA, you'd pay 10-20% CGT on profits above £3,000 and 8.75-39.35% on dividends above £500. A £50,000 portfolio gaining 10% annually would save approximately £1,000-£1,500 in taxes yearly inside an ISA. Over 20 years, this compounds to tens of thousands in additional wealth.

Should I use a SIPP or ISA for S&P 500 investments?

Use an ISA if you want accessible tax-free growth you can withdraw anytime. Use a SIPP if you're investing for retirement and want upfront tax relief—20% for basic-rate taxpayers, 40% for higher-rate. SIPPs lock funds until age 55, but £10,000 invested becomes £12,500 immediately through tax relief. For most people under 50, max your ISA first, then consider a SIPP.

What taxes will I pay on S&P 500 investments outside an ISA?

Outside an ISA, you'll pay Capital Gains Tax at 10% (basic rate) or 20% (higher rate) on profits exceeding £3,000 annually. Dividends from accumulating ETFs face tax when you sell; distributing ETFs trigger dividend tax yearly at 8.75%, 33.75%, or 39.35% depending on your income bracket. Currency gains from GBP/USD movements also count toward CGT calculations, complicating tax reporting.

| Account Type | Tax Treatment | Notes |

|---|---|---|

| Stocks & Shares ISA | Tax-free growth | £20,000 annual allowance |

| SIPP | Tax relief on contributions | Retirement-focused |

| Standard brokerage | CGT & dividend tax apply | Flexible taxable |

What Are the Risks of Investing in the S&P 500?

What is currency risk and how does it affect UK investors?

Currency risk means GBP/USD movements can affect your returns independently of S&P 500 performance. When we invested £10,000 in January 2022 at £1=$1.35, the S&P 500 fell 18% while sterling weakened to around $1.08 later that year. The combined impact pushed our total loss close to 30—significantly worse than the 18% decline experienced by US investors. As markets recovered in subsequent years, renewed dollar strength boosted returns, amplifying gains compared with US-based investors.

How volatile is the S&P 500?

The S&P 500 experiences corrections of 10% or more roughly every 18 months and bear markets of 20%+ every five to seven years. In March 2020, it fell 34% in just over three weeks. In 2022, it dropped around 25% over nine months. Despite this, the index has recovered from every historical crash within five years. Daily moves of 2–3% are common during volatile periods, requiring strong investor discipline.

Is the S&P 500 too concentrated in tech stocks?

The top 10 companies make up roughly 30% of the index, with firms such as Apple, Microsoft and Nvidia dominating performance. This concentration means returns are heavily influenced by big tech trends, which can magnify losses during sector sell-offs. However, with 500 companies across 11 sectors, the index remains more diversified than alternatives like the FTSE 100, which is more concentrated in financials.

What should I do if the S&P 500 crashes?

Do nothing—or invest more if you have spare cash. We held through the 2020 and 2022 crashes without selling and recovered both times. Panic selling locks in losses permanently. History shows every S&P 500 crash has eventually recovered. Set a five-to-ten-year investment horizon before buying, keep emergency savings, and ignore short-term volatility. Market timing consistently underperforms staying invested.

Final Thoughts: Is the S&P 500 Right for You?

The S&P 500 remains well suited to UK investors seeking long-term growth through diversified exposure to America's leading companies. It is not without risk—currency movements, market volatility, and technology concentration can magnify losses during downturns. However, its long-term track record continues to show consistent recovery and growth across multiple economic cycles.

For most UK investors, the most effective approach is combining S&P 500 exposure through low-cost ETFs such as VUSA within a Stocks & Shares ISA, reducing tax drag while steadily building wealth. Whether you choose eToro for its beginner-friendly experience, IG for comprehensive tools, or Trading 212 for zero fees, the most important factor is starting early and remaining invested through market cycles.

The biggest mistake isn't picking the "wrong" platform or mistiming the market—it's not investing at all. Inflation continues to erode cash savings over time, while the S&P 500 has delivered strong long-term returns despite repeated crashes. Start with an amount you're comfortable with, invest consistently, ignore short-term noise, and allow compound growth to work over the years ahead.

FAQs

Can I invest in the S&P 500 from the UK?

Yes, UK investors can easily invest in the S&P 500 through platforms like eToro, Vanguard, AJ Bell, and others. You can invest via ETFs, index funds, or by purchasing individual S&P 500 stocks.

What is the minimum amount needed to invest in the S&P 500?

The minimum amount varies depending on the platform. Some platforms allow you to start with as little as £50, while others may have higher minimum investment requirements. Many platforms offer fractional shares, making it accessible to investors with smaller budgets.

Is investing in the S&P 500 safe?

While the S&P 500 is considered a solid long-term investment due to its diversification across 500 large companies, all investments carry risks, including market volatility. The S&P 500 has a history of recovering from downturns, but past performance is no guarantee of future returns.

How often do S&P 500 companies pay dividends?

Most S&P 500 companies that pay dividends distribute them quarterly. Some companies may pay semi-annually or annually, but quarterly payments are the most common.

Are S&P 500 ETFs or index funds better?

Both S&P 500 ETFs and index funds aim to track the performance of the S&P 500. ETFs are traded throughout the day like stocks, offering more flexibility, while index funds are priced once at the end of the trading day. The best option depends on your trading style and investment goals.

References

- ✓ Deposit £500–£999 → Get £40

- ✓ Deposit £1k–£4,999 → Get £100

- ✓ Deposit £5k–£9,999 → Get £300

- ✓ Deposit £10,000+ → Get £500

50% of retail CFD accounts lose money when trading CFDs with this provider.

50% of retail CFD accounts lose money when trading CFDs with this provider.